Ein Intermediate Bulk Container (IBC)-Liner ist ein flexibler Beutel oder Liner, der in einen IBC passt. IBC ist ein großer, wiederverwendbarer Behälter für den Transport und die Lagerung von Flüssigkeiten oder Pulvern. Der Liner dient als Barriere zwischen Produkt und Behälter und trägt so zur Hygiene bei, verhindert Verunreinigungen und schützt den Inhalt vor äußeren Einflüssen. Diese Liner bestehen typischerweise aus Materialien wie Polyethylen oder Polypropylen , sind Einweg-Liner und werden häufig in Branchen wie der Lebensmittel-, Getränke-, Pharma- und Chemieindustrie für die effiziente und saubere Handhabung von Schüttgütern eingesetzt.

Vollständigen Bericht abrufen @ https://www.databridgemarketresearch.com/reports/global-ibc-intermediate-bulk-container-liners-market

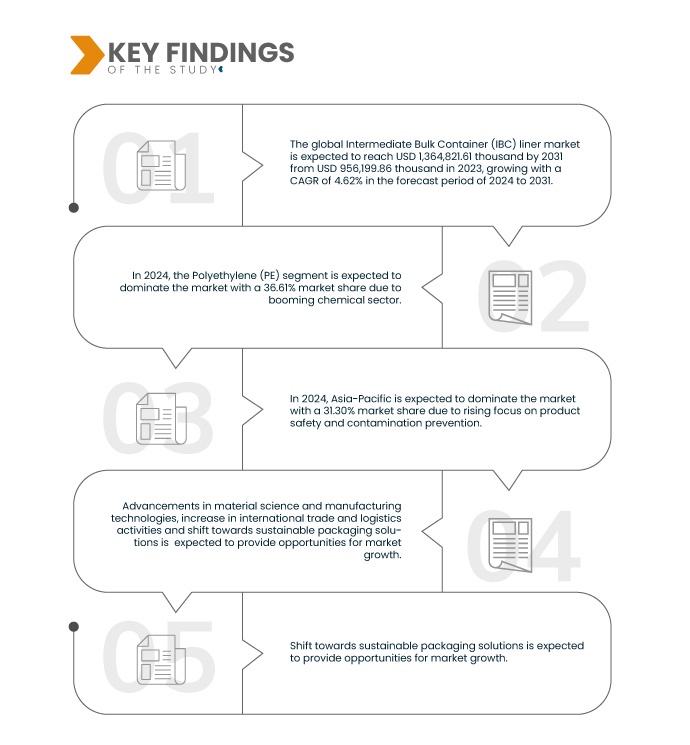

Data Bridge Market Research analysiert, dass der globale Markt für Intermediate Bulk Container (IBC) Liner voraussichtlich von 956.199,86 Tausend USD im Jahr 2023 auf 1.364.821,61 Tausend USD im Jahr 2031 anwachsen wird, was einem CAGR von 4,62 % im Prognosezeitraum von 2024 bis 2031 entspricht.

Wichtigste Ergebnisse der Studie

Boomende Chemiebranche

Die zunehmende Produktion von Chemikalien führt zu einer steigenden Nachfrage nach effektiven, sicheren und kostengünstigen Lager- und Transportlösungen für Chemikalien. IBC-Auskleidungen (Intermediate Bulk Container) bieten Schutzverpackungen für den Transport und die Lagerung von Flüssigkeiten, halbfesten und körnigen Produkten und tragen insbesondere dazu bei, dass Chemikalien mit geringerem Kontaminations- und Leckagerisiko transportiert werden.

Chemiehersteller suchen stets nach Möglichkeiten zur Effizienzsteigerung und Kostenminimierung. Deshalb setzen sie zunehmend auf IBC-Liner. Diese Liner bieten eine zuverlässige Barriere gegen Verunreinigungen, optimieren die Transportraumnutzung und senken gleichzeitig die Reinigungs- und Wartungskosten für Mehrwegbehälter.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2024 bis 2031

|

Basisjahr

|

2023

|

Historische Jahre

|

2022 (Anpassbar auf 2016 – 2021)

|

Quantitative Einheiten

|

Umsatz in Tausend USD

|

Abgedeckte Segmente

|

Material (Polyethylen (PE), EVOH, Aluminiumfolie, Polypropylen (PP), Polyamid (PA), Polymilchsäure (PLA) und andere), Typ (Form Fit Liner, Pillow Liner und andere), Kategorie (Top Fill Container Liner, Open Top Container Liner, Back Fill Container Liner, Thermal Container Liner, Wide Access Container Liner, Barless Container Liner, Fluidizing Container Liner und andere), Abfülltechnologie (aseptisch und nicht aseptisch), Fassungsvermögen (1000–1500 Liter und über 1500 Liter), Dicke (100 bis 150 Mikron, unter 100 Mikron und über 150 Mikron), Endverbrauch (Lebensmittel und Getränke, Industriechemikalien, Gesundheitswesen und Pharmazeutika, Kosmetik und Körperpflege, Landwirtschaft, Öl und Gas, Bauwesen und andere), Vertriebskanal (direkt und indirekt)

|

Abgedeckte Länder

|

USA, Kanada, Mexiko, Deutschland, Frankreich, Italien, Spanien, Niederlande, Belgien, Polen, Schweden, Österreich, Tschechische Republik, Dänemark, Finnland, Portugal, Griechenland, Irland, Rumänien, Ungarn, Slowakei, Bulgarien, Kroatien, Litauen, Luxemburg, Zypern, Estland, Lettland, Malta, Slowenien, Rest der Europäischen Union, China, Indien, Rest des asiatisch-pazifischen Raums, Brasilien, Argentinien, Rest des Südamerikas, Südafrika, Ägypten, Nigeria, Kenia, Äthiopien, Tansania, Sambia, Simbabwe, Algerien, Tunesien, Mauretanien, Rest des Afrikas, Saudi-Arabien, Vereinigte Arabische Emirate, Katar, Kuwait, Oman, Bahrain, Türkei, Israel, Jordanien, Libanon und Rest der Levante

|

Abgedeckte Marktteilnehmer

|

ILC Dover LP (USA), Liquibox (USA), Berry Global Inc. (USA), CDF Corporation (USA), Peak Liquid Packaging (England), International Paper (USA), Amcor plc (Australien), Bulk Lift International, LLC (USA), Arena Products, Inc. (USA), DACO CORPORATION (USA), Freedom Manufacturing LLC (USA), Paper Systems (USA), Qbig Packaging BV (Niederlande), HANGZHOU HANSIN NEW PACKING MATERIAL CO., LTD. (China), Reusable Transport Packaging (USA), TIANJIN UNIPACK PACKAGING MATERIAL (China), MBZ Industries Inc. (USA), TPS Rental Systems Ltd (Großbritannien), Palmetto Industries International Inc. (USA), Composite Containers, LLC (USA), Arlington Packaging Ltd (Großbritannien) und Alccorp.com (Südafrika) unter anderem

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure umfassen die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen.

|

Segmentanalyse:

Der globale Markt für Intermediate Bulk Container (IBC)-Liner ist basierend auf Material, Typ, Kategorie, Fülltechnologie, Kapazität, Dicke, Endverwendung und Vertriebskanal in acht wichtige Segmente unterteilt.

- Auf der Grundlage des Materials ist der Markt in Polyethylen (PE), EVOH, Aluminiumfolie, Polypropylen (PP), Polyamid (PA), Polymilchsäure (PLA) und andere unterteilt

Im Jahr 2024 wird das Segment Polyethylen (PE) voraussichtlich den globalen Markt für Intermediate Bulk Container (IBC) Liner dominieren

Im Jahr 2024 wird das Segment Polyethylen (PE) aufgrund seiner Vielseitigkeit und vorteilhaften Eigenschaften voraussichtlich mit einem Marktanteil von 36,61 % den Markt dominieren. Es ist in verschiedenen Formen erhältlich, darunter Polyethylen hoher Dichte (HDPE) und Polyethylen niedriger Dichte (LDPE).

- Auf der Grundlage des Typs ist der Markt in Formpass-Liner, Kissen-Liner und andere segmentiert

Im Jahr 2024 wird das Segment der Form-Fit-Liner voraussichtlich den globalen Markt für Intermediate Bulk Container (IBC) Liner dominieren

Im Jahr 2024 wird das Segment der Formfit-Liner voraussichtlich mit einem Marktanteil von 36,58 % den Markt dominieren, da der Fokus zunehmend auf Produktsicherheit und Kontaminationsprävention liegt.

- Der Markt ist nach Kategorien segmentiert in Top-Fill-Containerliner, Open-Top-Containerliner, Back-Fill-Containerliner, Thermo-Containerliner, Wide Access-Containerliner, Barless-Containerliner, Fluidizing-Containerliner und weitere. Im Jahr 2024 wird das Segment der Top-Fill-Containerliner voraussichtlich mit einem Marktanteil von 31,83 % den Markt dominieren.

- Auf der Grundlage der Abfülltechnologie wird der Markt in aseptische und nicht-aseptische Abfüllanlagen unterteilt. Im Jahr 2024 wird das aseptische Segment voraussichtlich mit einem Marktanteil von 73,01 % den Markt dominieren.

- Der Markt ist nach Kapazität in 1000–1500 Liter und über 1500 Liter unterteilt. Im Jahr 2024 wird das 1000-1500-Liter-Segment voraussichtlich mit einem Marktanteil von 57,49 % den Markt dominieren.

- Der Markt ist nach Dicke in 100 bis 150 Mikrometer, unter 100 Mikrometer und über 150 Mikrometer unterteilt. Im Jahr 2024 wird das Segment 100 bis 150 Mikrometer voraussichtlich mit einem Marktanteil von 65,18 % den Markt dominieren.

- Der Markt ist nach Endverbrauch segmentiert in Lebensmittel und Getränke, Industriechemikalien, Gesundheitswesen und Pharmazeutika, Kosmetik und Körperpflege, Landwirtschaft, Öl und Gas, Bauwesen und andere. Im Jahr 2024 wird das Segment Lebensmittel und Getränke voraussichtlich mit einem Marktanteil von 36,55 % den Markt dominieren.

- Auf der Grundlage der Vertriebskanäle wird der Markt in direkte und indirekte Vertriebskanäle unterteilt. Im Jahr 2024 wird das direkte Segment voraussichtlich den Markt mit einem Marktanteil von 65,60 % dominieren.

Hauptakteure

Data Bridge Market Research analysiert ILC Dover LP (USA), Liquibox (USA), Berry Global Inc. (USA), CDF Corporation (USA) und Peak Liquid Packaging (England) als wichtige Marktteilnehmer in diesem Markt.

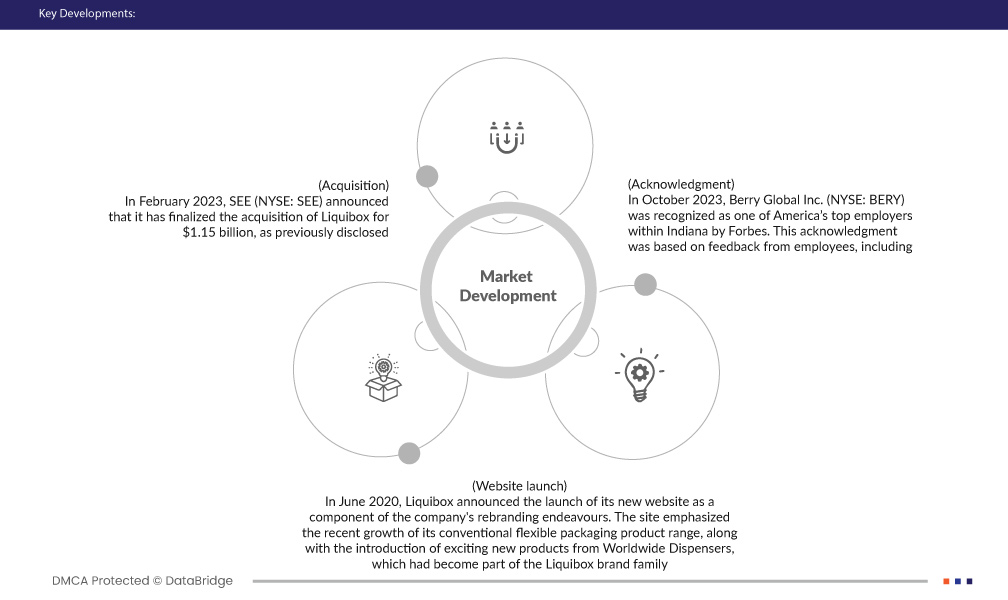

Marktentwicklung

- Im März 2024 wurde Amcor plc, ein weltweit führendes Unternehmen in der Entwicklung und Herstellung verantwortungsvoller Verpackungslösungen, mit acht Flexible Packaging Achievement Awards für innovative und nachhaltige Beiträge zur Branche ausgezeichnet. McCoy Dunnage Free IBC Liner für aseptische Schüttgüter erhielten drei Auszeichnungen: Gold für Nachhaltigkeit und Silber für die Ausweitung des Einsatzes flexibler Verpackungen und technische Innovation. Dies stärkt das Bestreben des Unternehmens, seine Nachhaltigkeitsziele zu erreichen und innovativere Lösungen zu entwickeln.

- Im Februar 2023 gab SEE (NYSE: SEE) bekannt, dass die Übernahme von Liquibox für 1,15 Milliarden US-Dollar abgeschlossen ist. Die Transaktion erfolgte bargeld- und schuldenfrei. Dies stärkt den Kundenstamm und die Marktreichweite des Unternehmens.

- Im Oktober 2023 wurde Berry Global Inc. (NYSE: BERY) von Forbes als einer der besten Arbeitgeber Amerikas in Indiana ausgezeichnet. Diese Anerkennung basierte auf dem Feedback der Mitarbeiter, einschließlich direkter Anregungen und Empfehlungen. Sie trug zum Aufbau des Vertrauens zwischen Arbeitgebern und Arbeitnehmern bei und wirkte sich positiv auf die Kunden aus.

- Im Juni 2020 kündigte Liquibox im Rahmen seiner Rebranding-Bemühungen den Start seiner neuen Website an. Die Website betonte das jüngste Wachstum des Sortiments an konventionellen flexiblen Verpackungen sowie die Einführung spannender neuer Produkte von Worldwide Dispensers, die Teil der Liquibox-Markenfamilie geworden sind. Dies ermöglichte den Kunden einen einfachen Zugang und verbesserte ihr Surferlebnis. Somit ist die Website ein benutzerfreundliches Update.

Regionale Analyse

Geografisch ist der Markt in die USA, Kanada, Mexiko, Deutschland, Frankreich, Italien, Spanien, Niederlande, Belgien, Polen, Schweden, Österreich, Tschechische Republik, Dänemark, Finnland, Portugal, Griechenland, Irland, Rumänien, Ungarn, Slowakei, Bulgarien, Kroatien, Litauen, Luxemburg, Zypern, Estland, Lettland, Malta, Slowenien, Rest der Europäischen Union, China, Indien, Rest des asiatisch-pazifischen Raums, Brasilien, Argentinien, Rest des Südamerikas, Südafrika, Ägypten, Nigeria, Kenia, Äthiopien, Tansania, Sambia, Simbabwe, Algerien, Tunesien, Mauretanien, Rest des Afrikas, Saudi-Arabien, Vereinigte Arabische Emirate, Katar, Kuwait, Oman, Bahrain, Türkei, Israel, Jordanien, Libanon und Rest der Levante-Länder unterteilt.

Laut Marktforschungsanalyse von Data Bridge :

Der asiatisch-pazifische Raum wird voraussichtlich die dominierende und am schnellsten wachsende Region im globalen Markt für Intermediate Bulk Container (IBC) Liner sein.

Aufgrund der Expansion des Lebensmittel- und Getränkegeschäfts, der zunehmenden Besorgnis über Produktsicherheit und -verunreinigung sowie eines boomenden Chemiesektors wird der asiatisch-pazifische Raum voraussichtlich die dominierende und am schnellsten wachsende Marktregion sein.

Für detailliertere Informationen zum globalen Marktbericht für Intermediate Bulk Container (IBC)-Liner klicken Sie hier – https://www.databridgemarketresearch.com/reports/global-ibc-intermediate-bulk-container-liners-market