Der globale Markt für Pflanzenschutzmittel umfasst eine breite Palette chemischer, biologischer und natürlicher Wirkstoffe zum Schutz von Nutzpflanzen vor Schädlingen, Krankheiten und Unkraut. Zu diesen Produkten gehören Herbizide, Insektizide, Fungizide und Biopestizide, die eine entscheidende Rolle für die landwirtschaftliche Produktivität und Ernährungssicherheit spielen. Der Markt wird durch die Notwendigkeit angetrieben, die Ernteerträge zu steigern, um den wachsenden globalen Nahrungsmittelbedarf zu decken, insbesondere angesichts von Herausforderungen wie Klimawandel, schrumpfenden Ackerflächen und Schädlingsresistenzen. Landwirte sind auf diese Produkte angewiesen, um ihre Nutzpflanzen zu schützen und ihre Erträge zu optimieren, insbesondere in Regionen mit intensiver Landwirtschaft. Der Markt wird zudem durch strenge Vorschriften für den Einsatz von Pestiziden sowie eine wachsende Nachfrage nach umweltfreundlichen und nachhaltigen Pflanzenschutzlösungen, wie z. B. organischen und biologischen Alternativen, beeinflusst. Wichtige Marktteilnehmer konzentrieren sich auf Innovation und die Entwicklung neuer Formulierungen, die effektiver, umweltfreundlicher und konform mit globalen regulatorischen Standards sind.

Zugriff auf den vollständigen Bericht unter https://www.databridgemarketresearch.com/reports/global-crop-protection-products-market

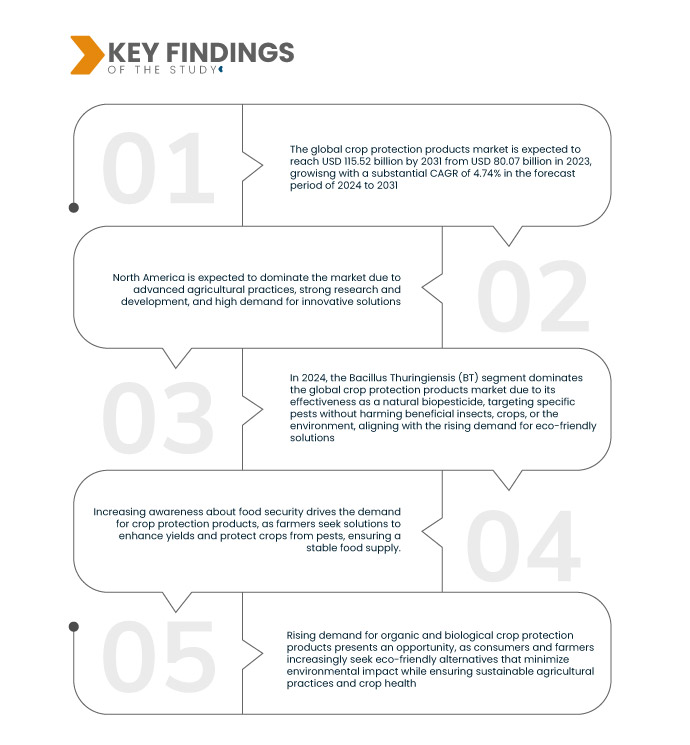

Data Bridge Market Research analysiert, dass der globale Markt für Pflanzenschutzmittel voraussichtlich von 80,07 Millionen US-Dollar im Jahr 2023 auf 115,52 Millionen US-Dollar im Jahr 2031 anwachsen wird, was einem beachtlichen CAGR von 4,74 % im Prognosezeitraum von 2024 bis 2031 entspricht.

Wichtigste Ergebnisse der Studie

Schneller Klimawandel und landwirtschaftliche Praktiken

Schnelle Klimaveränderungen und sich wandelnde landwirtschaftliche Praktiken treiben die Nachfrage nach Pflanzenschutzmitteln deutlich an. Der Klimawandel führt zu unvorhersehbaren Wetterlagen, die zu vermehrten Schädlingsbefällen und Pflanzenkrankheiten führen und die landwirtschaftliche Produktivität weltweit beeinträchtigen. Steigende Temperaturen und veränderte Niederschlagsmuster können Schädlinge und Krankheitserreger in neuen Regionen oder Jahreszeiten gedeihen lassen und bisher unberührte Nutzpflanzen befallen. Dieses Phänomen verstärkt den Bedarf an wirksamen Pflanzenschutzstrategien, um die Ernährungssicherheit zu gewährleisten und Ernteverluste zu minimieren.

Angesichts dieser Herausforderungen setzen Landwirte zunehmend auf Pflanzenschutzmittel wie Herbizide, Fungizide und Insektizide zur Bekämpfung von Schädlingen und Krankheiten. Ohne diese Produkte würden die Ernteerträge stark beeinträchtigt, was die Nahrungsmittelversorgung beeinträchtigen und insbesondere in landwirtschaftlich geprägten Regionen zu wirtschaftlichen Verlusten führen würde. Moderne landwirtschaftliche Praktiken wie Monokulturen können zudem die Anfälligkeit der Nutzpflanzen für Schädlinge und Krankheiten erhöhen. Daher sind Pflanzenschutzlösungen für den Schutz dieser großflächigen landwirtschaftlichen Systeme unverzichtbar.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2024 bis 2031

|

Basisjahr

|

2023

|

Historische Jahre

|

2022 (Anpassbar auf 2016–2021)

|

Quantitative Einheiten

|

Umsatz in Milliarden USD

|

Abgedeckte Segmente

|

Wirkstoff (Bacillus Thuringiensis (BT), Azoxystrobin, Bifenthrin, Fludioxonil, Acephate, Boscalid, Bendiocarb, 1-Methylcyclopropen, Calciumchlorid, Daminozid, Benzyl-Adenin und andere), Produkttyp (Herbizide, Insektizide, Fungizide, Pflanzenwachstumsregulatoren, Akarizide, Begasungsmittel, Nemathisten, Klebstoffe zum Auftragen und andere), Herkunft (synthetische und Biopestizide), Form (flüssig und trocken), Anwendung (Blattspray, Saatgutbehandlung , Bodenbehandlung , Nacherntebehandlung, chemische Behandlung und andere), Pflanzenart (Getreide und Körner, Obst und Gemüse, Ölsaaten und Hülsenfrüchte, Rasen und Zierpflanzen und andere Pflanzen)

|

Abgedeckte Länder

|

USA, Kanada, Mexiko, Deutschland, Großbritannien, Frankreich, Italien, Spanien, Russland, Türkei, Niederlande, Belgien, Schweiz, Dänemark, Schweden, Polen, Norwegen, Finnland, Restliches Europa, China, Indien, Japan, Australien, Südkorea, Indonesien, Thailand, Vietnam, Malaysia, Philippinen, Taiwan, Singapur, Neuseeland, Restlicher Asien-Pazifik-Raum, Brasilien, Argentinien, Restliches Südamerika, Südafrika, Ägypten, Saudi-Arabien, Vereinigte Arabische Emirate, Israel, Oman, Bahrain, Katar, Kuwait und Restlicher Naher Osten und Afrika

|

Abgedeckte Marktteilnehmer

|

Nufarm (Australien), Dow (USA), Bayer AG (Deutschland), Biobest Group NV (Belgien), Koppert (Niederlande), Nissan Chemical Corporation (USA), Sumitomo Chemical Co., Ltd. (Japan), BASF (Deutschland), FMC Corporation (USA), Nutrichem Company Limited (China), Seipasa SA (Spanien), Verdesian Life Sciences (USA), ADAMA (Indien), UPL (Indien), Gowan Company (USA), Bioworks, Inc. (USA), Corteva (USA), Zhejiang Rayfull Chemicals Co., Ltd. (China), Novozymes A/S, Teil der Novonesis Group (Dänemark), Certis USA LLC (USA), Hektaş (Türkei), Valent Biosciences LLC. (USA) und Syngenta Crop Protection AG (Schweiz)

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen der Lieferkette und Nachfrage.

|

Segmentanalyse

Der globale Markt für Pflanzenschutzmittel ist basierend auf Wirkstoff, Produkttyp, Herkunft, Form, Anwendung und Pflanzenart in sechs wichtige Segmente unterteilt.

- Auf der Grundlage des Wirkstoffs ist der Markt in Bacillus Thuringiensis (BT), Azoxystrobin, Bifenthrin, Fludioxonil, Acephat, Boscalid, Bendiocarb, 1-Methylcyclopropen, Calciumchlorid , Daminozid, Benzyladenin und andere unterteilt

Im Jahr 2024 dominiert das Segment Bacillus Thuringiensis (BT) den globalen Markt für Pflanzenschutzmittel

Im Jahr 2024 wird das Segment Bacillus Thuringiensis (BT) voraussichtlich mit einem Marktanteil von 21,24 % den Markt dominieren. Dies ist auf seine Wirksamkeit als natürliches Biopestizid zurückzuführen, das gezielt Schädlinge bekämpft, ohne nützliche Insekten, Nutzpflanzen oder die Umwelt zu schädigen. Dies entspricht der steigenden Nachfrage nach umweltfreundlichen Lösungen.

- Auf der Grundlage des Produkttyps ist der Markt in Herbizide, Insektizide, Fungizide, Pflanzenwachstumsregulatoren, Akarizide, Begasungsmittel, Nemathisten, Streichkleber und andere unterteilt

Im Jahr 2024 dominiert das Segment Herbizide den globalen Markt für Pflanzenschutzmittel

Im Jahr 2024 wird das Segment der Herbizide voraussichtlich mit einem Marktanteil von 43,57 % den Markt dominieren, da sie Unkraut wirksam bekämpfen, Ernteerträge steigern und effiziente landwirtschaftliche Praktiken unterstützen .

- Der Markt wird nach Herkunft in synthetische und Biopestizide unterteilt. Im Jahr 2024 wird das synthetische Segment voraussichtlich mit einem Marktanteil von 92,28 % den Markt dominieren.

- Der Markt wird nach der Form in flüssige und trockene Produkte unterteilt. Im Jahr 2024 wird das flüssige Segment voraussichtlich mit einem Marktanteil von 84,81 % den Markt dominieren.

- Der Markt ist je nach Anwendung in Blattspray, Saatgutbehandlung, Bodenbehandlung, Nacherntebehandlung, Chemigation und weitere Bereiche unterteilt. Im Jahr 2024 wird das Blattspray-Segment voraussichtlich mit einem Marktanteil von 40,24 % den Markt dominieren.

- Der Markt ist nach Anbauarten in Getreide, Obst und Gemüse, Ölsaaten und Hülsenfrüchte, Rasen und Zierpflanzen sowie sonstige Nutzpflanzen unterteilt. Im Jahr 2024 wird das Segment Getreide voraussichtlich mit einem Marktanteil von 41,61 % den Markt dominieren.

Hauptakteure

Data Bridge Market Research analysiert Bayer AG (Deutschland), Syngenta Crop Protection AG (Schweiz), Corteva (USA), Sumitomo Chemical Co., Ltd. (Japan) und FMC Corporation (USA) als wichtige Marktteilnehmer auf diesem Markt.

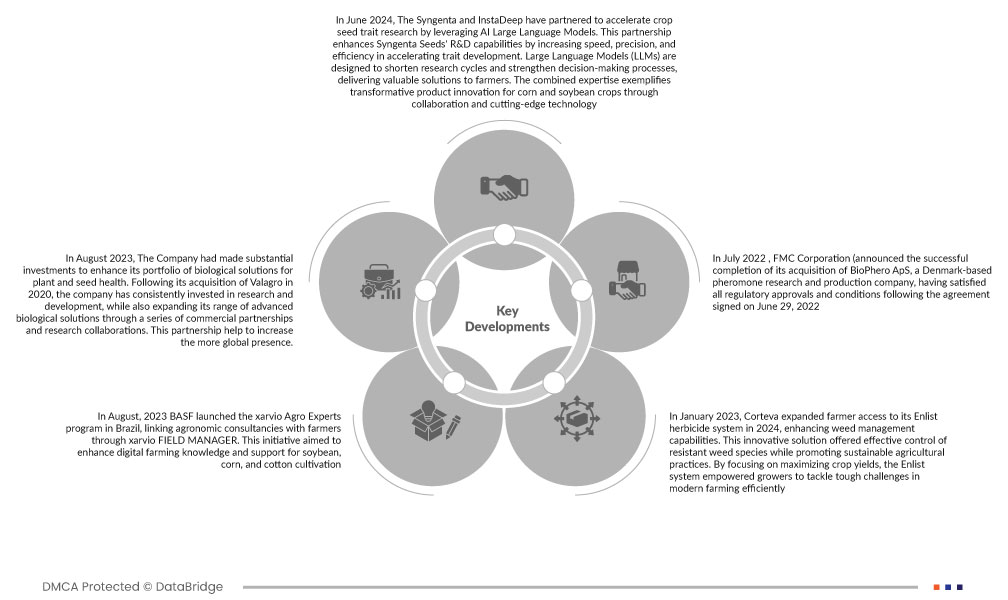

Jüngste Entwicklungen

- Im Juni 2024 haben sich Syngenta und InstaDeep zusammengeschlossen, um die Erforschung von Saatguteigenschaften durch den Einsatz von KI-basierten Large Language Models zu beschleunigen. Diese Partnerschaft stärkt die Forschungs- und Entwicklungskapazitäten von Syngenta Seeds, indem sie Geschwindigkeit, Präzision und Effizienz bei der Entwicklung von Eigenschaften erhöht. Large Language Models (LLMs) verkürzen Forschungszyklen, stärken Entscheidungsprozesse und liefern Landwirten wertvolle Lösungen. Die gebündelte Expertise steht beispielhaft für bahnbrechende Produktinnovationen für Mais- und Sojapflanzen durch Zusammenarbeit und modernste Technologie.

- Im August 2023 hatte das Unternehmen erhebliche Investitionen getätigt, um sein Portfolio an biologischen Lösungen für die Pflanzen- und Saatgutgesundheit zu erweitern. Nach der Übernahme von Valagro im Jahr 2020 investierte das Unternehmen kontinuierlich in Forschung und Entwicklung und erweiterte gleichzeitig sein Angebot an fortschrittlichen biologischen Lösungen durch eine Reihe von kommerziellen Partnerschaften und Forschungskooperationen. Diese Partnerschaft trägt dazu bei, die globale Präsenz zu stärken.

- Im August 2023 startete BASF das Programm xarvio Agro Experts in Brasilien, das agronomische Beratungsunternehmen über den xarvio FIELD MANAGER mit Landwirten verbindet. Ziel dieser Initiative war es, das digitale Wissen und die Unterstützung im Anbau von Sojabohnen, Mais und Baumwolle zu verbessern.

- Im Mai 2023 gaben Kubota und ZEN-NOH eine Zusammenarbeit zur Steigerung der Reisproduktion in Japan bekannt. Sie integrierten den xarvio FIELD MANAGER von BASF in die KSAS-Plattform von Kubota, um den Düngemitteleinsatz zu optimieren und so höhere Erträge und mehr Nachhaltigkeit zu erzielen.

- Im Januar 2023 erweiterte Corteva den Zugang der Landwirte zu seinem Herbizidsystem Enlist und verbesserte damit die Möglichkeiten zur Unkrautbekämpfung. Diese innovative Lösung ermöglichte eine effektive Bekämpfung resistenter Unkrautarten und förderte gleichzeitig nachhaltige landwirtschaftliche Praktiken. Durch die Fokussierung auf die Maximierung der Ernteerträge ermöglichte das Enlist-System den Landwirten, die schwierigen Herausforderungen der modernen Landwirtschaft effizient zu bewältigen.

- Im Juli 2022 gab die FMC Corporation den erfolgreichen Abschluss der Übernahme von BioPhero ApS bekannt, einem in Dänemark ansässigen Unternehmen für Pheromonforschung und -produktion, nachdem alle behördlichen Genehmigungen und Bedingungen nach der am 29. Juni 2022 unterzeichneten Vereinbarung erfüllt worden waren.

Regionale Analyse

Auf der Grundlage der Länder ist der Markt in die USA, Kanada, Mexiko, Deutschland, Großbritannien, Frankreich, Italien, Spanien, Russland, Türkei, Niederlande, Belgien, Schweiz, Dänemark, Schweden, Polen, Norwegen, Finnland, Restliches Europa, China, Indien, Japan, Australien, Südkorea, Indonesien, Thailand, Vietnam, Malaysia, Philippinen, Taiwan, Singapur, Neuseeland, Restlicher Asien-Pazifik-Raum, Brasilien, Argentinien, Restliches Südamerika, Südafrika, Ägypten, Saudi-Arabien, Vereinigte Arabische Emirate, Israel, Oman, Bahrain, Katar, Kuwait und Restlicher Naher Osten und Afrika unterteilt.

Laut Marktforschungsanalyse von Data Bridge:

Nordamerika ist die am schnellsten wachsende Region und wird voraussichtlich die dominierende Region auf dem Markt sein.

Im Jahr 2024 wird Nordamerika voraussichtlich den Markt dominieren, da es dort fortschrittliche landwirtschaftliche Praktiken, intensive Forschung und Entwicklung sowie eine hohe Nachfrage nach innovativen Lösungen gibt.

Für detailliertere Informationen zum globalen Marktbericht für Pflanzenschutzmittel klicken Sie hier – https://www.databridgemarketresearch.com/reports/global-crop-protection-products-market