- According to a recent report, the global video entertainment business is expected to rebound after COVID-19 struggles

- During the epidemic, online data usage increased by 30%

- Consumer habits and spending patterns picked up during the pandemic will become deeply ingrained

- Movies and live music are anticipated to recover post-pandemic

One bright spot in an otherwise challenging year for the $2 trillion global entertainment and media sector was the growth in popularity of movie and television programming supplied over the internet, or "over-the-top," or OTT.

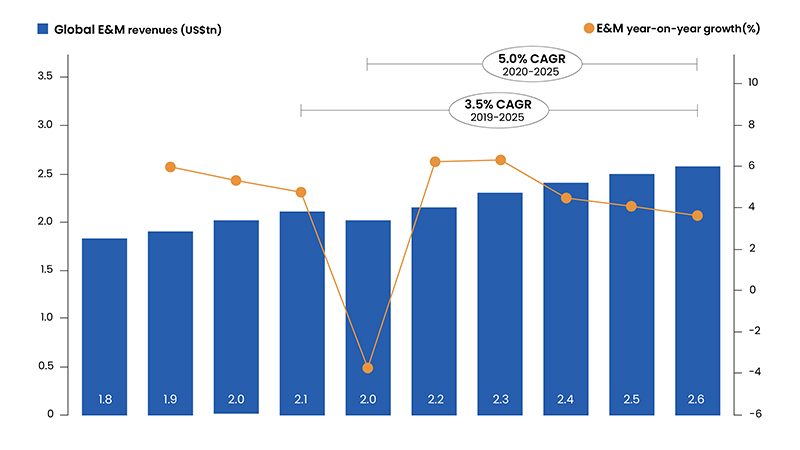

Fig.1: Global Entertainment and Media Industry Revenues

Source: PwC's Global Entertainment and Media Outlook 2021-2025

According to a recent analysis from the international consulting firm PwC, the industry, which experienced a decline in revenues due to the pandemic, is predicted to return quickly and rise by more than a quarter by 2025.

Video entertainment has been around us for a while now. However, as the forecast for the next decade suggests, there will be blurring lines between what we watch and what we play. Say, for example, you are in a movie theatre, and the movie feels more like a game with a narrative wherein the viewer feels himself to be a part and character, this has become the new normal in the video entertainment industry. The coming decade will bring along numerous opportunities for storytellers. The video entertainment will bring to life the creations of many more diverse narrators across various platforms in varying formats. Experts have predicted that the industry is set to transform into a more immersive, personalized, and gamified form. And this should be no shock to anyone as the world has evolved from VHS to virtual reality and from 'bunny ear' antennas to broadband. According to some experts in the field:

- Jonathan Dunn: There will be sensory experiences that alter how people perceive things or help tell a narrative significantly dissimilar from how people currently experience theatre. In the future, storytellers are adopting video games or interactive entertainment as a format. Think about the difficulty levels in a game that are automatically tailored and adjusted to your playstyles in a way that will increase engagement but ultimately make the experience more captivating and persuasive.

- Jacomo Corbo: Augmented reality and haptics enable people to share the same experiences and physical spaces. Everyone in the video feels the power of the explosion or even the wind on their faces if there is an enormous boom. The distinction between what we watch and what we play is one that I believe will become increasingly hazy. Even so, you might be able to influence a story in particular ways. It can read my mood whenever I open a streaming service or turn on my TV. What time is it in the day? And what kind of media do I want to watch right now?

- Terri Tausk: Currently, the scariest part of a horror movie is when a character jumps out off the screen. But what if you can genuinely feel that person standing behind you when you view that video in the future? You participate in it; you see the movie alongside the performers and go through it with them. You could envision using a game console to watch a movie at the theatre, where the first 10 minutes of the film are spent playing games before switching to another form of entertainment. Additionally, it occurs throughout 20 connected theatres, not just in that one. And after that, you can continue playing that game with that group on your video game console at home or in episodes over the following few months. You won't have to go through tens of millions of pieces of content in 2030. An algorithm or artificial intelligence (AI) will conduct the labor-intensive work to make the five highly resonating items you suggest highly.

Why is Microsoft Investing Heavily in the Gaming Arena?

Even though Activision is best known for blockbuster games such as Call of Duty, World of Warcraft, and Candy Crush and not the combination of AR/VR and other technology that forms the foundation of the budding metaverse, Microsoft CEO Satya Nadella framed the company's largest acquisition as a boost to the growing metaverse strategy. Sony and Tencent are currently the two biggest gaming companies, with Microsoft coming in third. Microsoft doesn't intend to invest in a new console as Xbox is doing just fine despite purchasing so many gaming companies. Microsoft is investing heavily in and placing a lot of focus on gaming for a few different reasons. First, Microsoft's goal is to enable everyone and every organization to accomplish more. And the most common and rapidly expanding kind of media worldwide is gaming. And it's the only kind of media that allows you to practically put yourself in someone else's shoes and genuinely experience anything from their point of view. Playing video games gives us the chance to engage in the associated business opportunities while also making a social impact on the world. The other justification is the complete integration of the cloud into gaming's future. The workload associated with gaming is quite complex. Not many people consider it that way. They believe, "Oh, it's only a game." But a technical mishap has genuine repercussions. Restarting a video is necessary if it takes a while to load. You can lose all your game progress, which might take work hours. The limits of computation are pushed by gaming, interactive gaming. It is numerous. A truly fascinating game takes years and years and years to develop.

the Connection Between Video and Social Entertainment

2022 would be the year of amusement and entertainment if 2021 was the year of experimentation and evolution. With the typical individual spending 100 minutes per day watching internet video, social entertainment is quickly displacing other types of entertainment such as TV as the most popular form of leisure. An entirely new age of social entertainment has begun thanks to TikTok (though banned now in India). What started as a lockdown craze of viral dance challenges and beauty hacks has evolved into a rich social entertainment destination that taps into subcultures and touches all facets of society, with over a billion monthly active users and an engagement rate five times higher than other social channels.

Under this new paradigm, consumers are increasingly watching, interacting with, and participating in short-form video content. And it has prompted social media platforms to imitate it. Instagram reels (just expanded to Facebook), YouTube Shorts, Google, LinkedIn, and Pinterest have all increased their short-form offerings to ensure they have a role to play in this era of social innovation. Regardless of their size or industry niche, businesses should strive to establish a presence in short-form video formats and channels to connect with audiences, increase engagement, and improve discoverability.

Top 3 Factors Driving the Growth of the Video and Media Entertainment Industry

Fig.2: Factors Determining the Market Growth in the Coming Decade

- Pandemic Patterns to Prolong

The pandemic hastened trends already present in the media and entertainment sector before COVID-19, such as the growing market domination of digital sales, streaming services, gaming, and user-generated content. Although the industry anticipates a return to some degree of normalcy, the analysis predicts that purchasing patterns and consumer habits developed during the pandemic will persist.

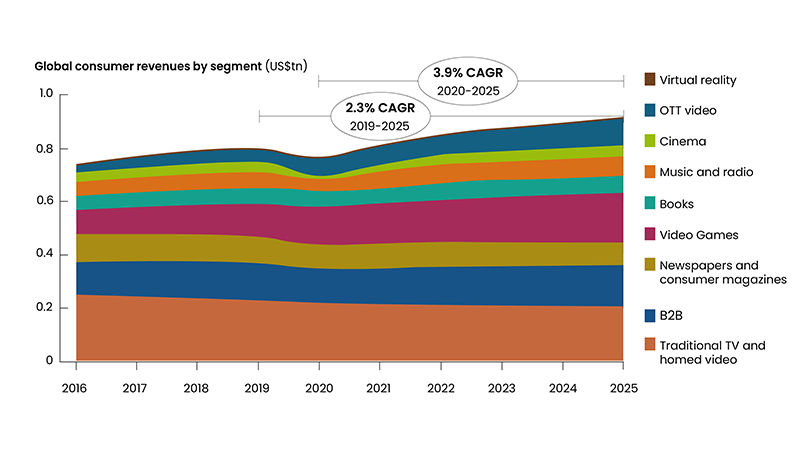

Fig.3: Global Consumer Revenues by Segments

Source: PwC's Global Entertainment and Media Outlook 2021-2025

In the competition for market share, declining industries incurred more significant losses. Print books defied the trend in several markets, including conventional television and home video, newspapers, and consumer magazines. Aside from OTT video, other areas that have shown above-average growth over the past year include video games, internet advertising, and virtual reality, which is expected to experience the highest development over the coming years.

- Long Living Cinema

In 2020, cinema experienced an unprecedented decline of 70.4%, and the epidemic forced the film industry to reconsider its strategy. Disney+'s OTT channel debuted Mulan as a premium digital product while only a few theatres were open. Studios like Warner Brothers followed with simultaneous streaming and theatre debuts for films like the most recent Marvel Film Black Widow. Cinemas were in the business and will stay in business as indicated by the movie revenues pre and post-pandemic, respectively. Yes, the period of pandemic brought drought for the cinema lovers and production houses; however, cinema is evergreen, as indicated by the audience's love. Post-pandemic films such as "Spiderman- No Way Home" starring Tom Holland and "Top Gun: Maverick" and Tom Cruise has managed to surpass the 1 billion mark at the global box office.

- Connectivity Partaking Ahead the Momentum

The statement that internet connectivity is now a fundamental and necessary utility in wealthy and developing countries has almost become commonplace. But it also promotes growth. Due to the high number of consumers who were stranded at home, an increase in downloaded and streamed content resulted in certain internet service providers reporting a 60 percent increase in data usage and a 30 percent increase in overall data consumption.

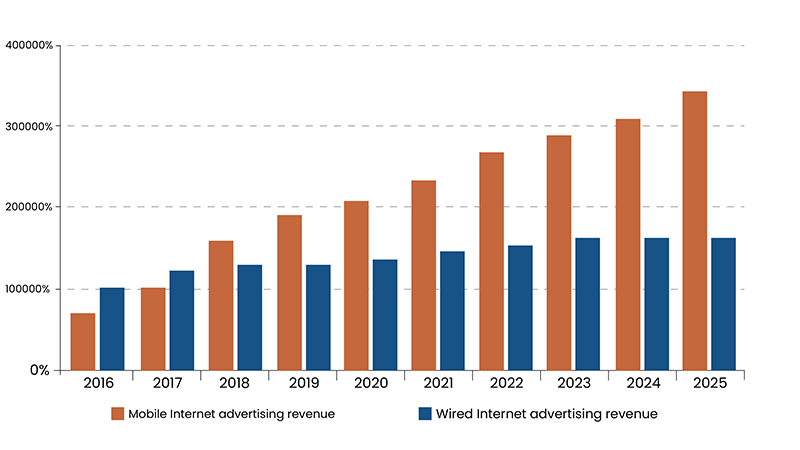

Fig.4: Global Revenue Share of Mobile Internet and Fixed Broadband

Source: PwC's Global Entertainment and Media Outlook 2021-2025

The number of smartphone connections is expected to increase (from 4.6 billion connections in 2020), although, during the year, more customers invested in fixed broadband internet connections, bringing the total to 1.1 billion homes. Given the staggering combined data consumption forecasts of a 26.9% annual increase, updated infrastructure, including the long-promised 5G technology, will probably go from being desired to being necessary for most of the world.

Contribution of Top OTT Platforms

Fig.5: Top OTT Platforms in the World

These three platforms are driving the demand for video entertainment, especially post-pandemic. The battles over TV streaming pit the major media firms against tech giants such as Amazon and Apple are just getting started. But it's not too early to see the next battle lines forming as the current titans aim for an even greater prize: supremacy in all facets of internet entertainment. To dominate audiences' attention for all forms of entertainment in the future, it will be necessary to transcend beyond video. As the most significant businesses employ their ever-expanding digital properties to drive out smaller entertainment competitors, it will also bring "one subscription to rule them all."

However, Netflix is preparing for the broader struggle for attention by going beyond the video streaming arms race. This diversification has one clear objective in mind: audience stickiness. It intends to provide customers in the more than 200 million homes that pay for its service plenty of reasons to keep tuning in by adding more content to watch, listen to, and play. By utilizing video streaming as an additional incentive to entice customers to use its Prime shipping service, Amazon has approached the game of winning customer loyalty from the opposite angle. Netflix is taking a different path, starting with video. According to its leaders, Tik Tok, Instagram, and the newest trending mobile internet service are its actual competitors for audience interest.

Disney, which has long been at the forefront of building a varied media empire around the "intellectual property" of its entertainment holdings, has also been experimenting with brand-new interactive activities that may eventually support its streaming services. These include sports betting, a way to captivate upcoming generations of fans as they stream the most recent game from the comfort of their couches.

While bolstering their video offerings to compete in an industry still in its infancy, strategies like these demonstrate that the streaming behemoths have an eye on the long term. Netflix believes it only has access to a fifth of broadband homes worldwide, excluding China. Disney's acquisition of Fox, Time Warner's purchase of Discovery, and Amazon's bid for MGM are all examples of how urgent these businesses need to build up a better portfolio of video rights to compete in this market.

The purchasing power of the world's population is exponentially increasing. However, the variety of streaming services available to consumers (and the declared intention of E&M corporations to sell them) appears to be expanding exponentially. The launch of Peacock, the introduction of Paramount Plus, and the organic expansion of Disney+ were among the prominent business stories of 2021. (87.6m subscribers and counting). More than 40 other players are active in India, where Disney+Hotstar, Amazon Prime, Netflix, and Zee account for most of OTT's income. As part of its Uma Só Globo (Just One Globo) commitment to bring all brands and channels onto its premium platform, Grupo Globo announced an investment of R$1bn (US$211m) in Globoplay. Global streaming juggernauts battle with local and regional players such as WeTV (Asian drama), GoPlay (local Indonesian content), and Mola TV in the booming OTT streaming market in Indonesia (live sports).

Something needs to give since so many options seem to be available everywhere, and there is competition for a finite amount of consumer spending. And it has during the previous 12 months. By 2026, the OTT video streaming market will continue to expand overall at a CAGR of 7.6%. However, players are now facing the possibility of not having enough individual subscriptions to support their expansion plans. The first decline in a decade, Netflix reported in April 2022 that it had lost 200,000 customers. Just three weeks after CNN+'s pricey launch, Discovery chose to abandon its US$300 million investment due to worries about its capacity to draw huge numbers of members. The landscape is anticipated to shift due to market conflicts in the entertainment and media sector, dropping share values of many of the major firms, and the potential for less investment from private equity and venture capital. It is increasingly questionable if investing a lot of money in content creation to support direct-to-consumer offers would be sufficient to provide significant growth and scaled profits.

Data Bridge Market Research analyses that the over the top (OTT) services market will exhibit a CAGR of 15.66% for the forecast period of 2022-2029. Therefore, the over the top (OTT) services market value would stand tall by USD 293.97 billion by 2029. The over the top (OTT) services market is segmented on the basis of monetization model, type, streaming device, service vertical, content type, platform, service type and user type. Growth and expansion of media and entertainment industry especially in developing economies, will emerge as the major market growth driving factor. Surging demand from the emerging economies, flexibility of the services to offer seamless customer experience, rising mergers with national producers and film studios and strengthening IT industry in developing economies such as India and China will further aggravate the market's growth. Rising industrialization and surging access to mobile applications, social media, and multimedia services are other factors bolstering the market's growth.

To know more about the study, visit: https://www.databridgemarketresearch.com/reports/global-over-the-top-ott-services-market

the 2022 and Beyond Perspective of the Industry

In each market, the entertainment and media industry—and consequently, consumers' attention—was once dominated by a small number of easily recognizable players who had not changed significantly in a long time. These players included broadcasters, film studios, record labels, news organizations, and sizable social media platforms. That previously established order has been completely upended as customers' attention has quickly and unpredictably shifted elsewhere. Apps today can appear and disappear incredibly quickly. 34 million people downloaded the audio chat app Clubhouse during the pandemic's early months, but its popularity dropped off sharply in 2021. And it is now evident, for the first time, that there appears to be a limit to the expansion of dominant platforms or apps such as Facebook and Netflix since they may lose their power to attract and hold attention in a world of quickly changing preferences and shortening attention spans. The younger generation now pays much more attention to fresh platforms. There are roughly 1 billion active users per month on TikTok's infinite and compulsive scroll. TikTok has become a very potent music discovery tool outside of advertising. Over 175 songs that were popular on TikTok in 2021 ended up charting on the Billboard Hot 100. And 30 songs exceeded 1 billion views on TikTok. However, the same are getting more immersed into the virtual worlds of games such as Roblox and Fortnite. The section here will discuss the future of video and media entertainment industry in general:

Regional / Territorial View

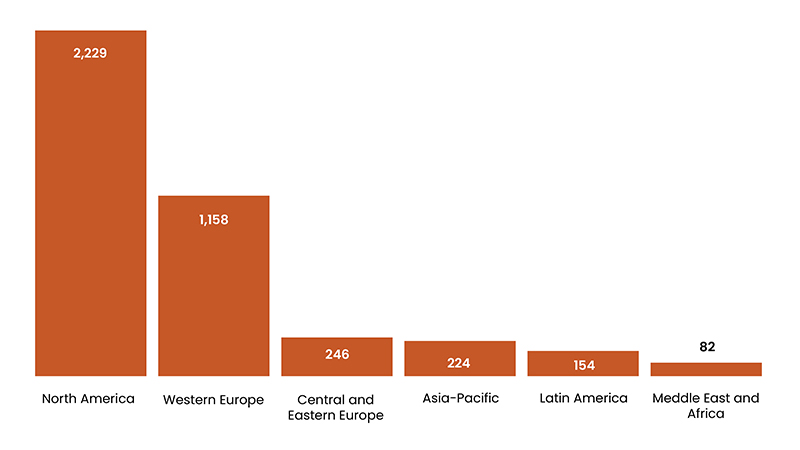

Fig.6: 2021 E&M Spending Per Capita, by Region (US$)

Source: PwC's Global Entertainment and Media Outlook 2022-2026

The disparity between income and access to technology is one of the biggest fault lines in the globe. In 2021, fixed broadband internet access was available in 72.7% of homes, while mobile internet was available to 60.7% of people. This indicates that billions of people worldwide still lack regular access to high-speed internet. North America has by far the biggest E&M expenditure per person, with US$2,229, almost double what Western Europe spends per person in US$1,158. In comparison, Asia-Pacific, which had the most income in E&M in 2021, only spent US$224 per person. The Middle East and Africa have the lowest per capita E&M expenditure, at US$82.

Consumer Outlook

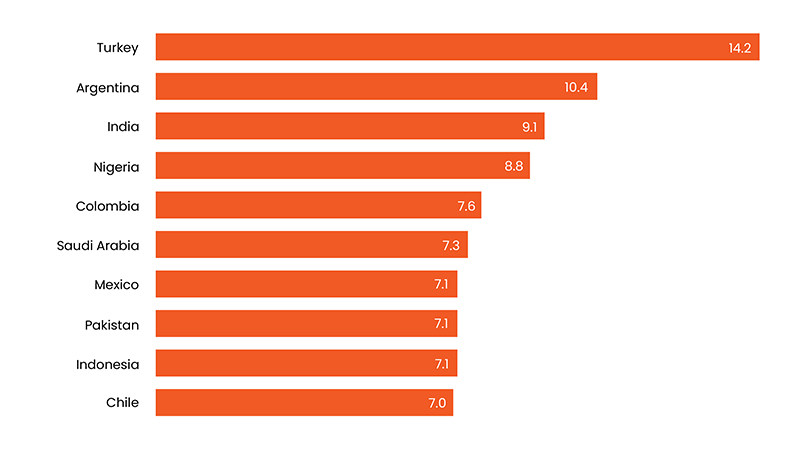

Fig.7: Top Ten Countries by Consumer Growth, 2021−26, CAGR, %

Source: PwC's Global Entertainment and Media Outlook 2022-2026

Turkey has the highest consumer revenue growth rate, with a 14.2 percent CAGR from 2021 to 2026. A significant increase in video games, music, and movies will propel this rate. On the other end of the scale, Japan's population, which is elderly and falling, will only expand at a CAGR of 1.4 percent through 2026. Latin America, the Middle East, Asia, and Africa make up the top ten nations by CAGR, where expenditure is modest but OTT video and video games account for the majority of revenue growth.

Gaming Scenario

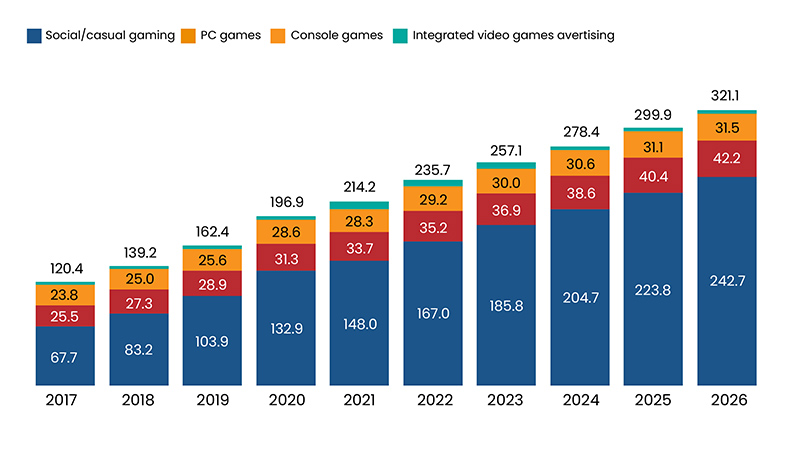

Fig.8: Total Global Video Games Revenue, by Segment (US $ Billion)

Source: PwC's Global Entertainment and Media Outlook 2022-2026

Video games, the medium most popular with young people, are one of the fastest-growing industries. The overall revenue from video games (excluding e-sports) was US$214.2 billion in 2021, and it will increase at a CAGR of 8.4 percent to US$321.1 billion in 2026. (The industry is one of only three to increase its base revenue by more than US$100 billion throughout the projection period; the other two are internet access and online advertising.) In 2017, only 6.1 percent of all E&M expenditures were spent on video games globally. They will represent 10.9 percent of the market by 2026 as the niche gets more popular. The fast rising investment in in-app advertising will boost revenues. In 2021, about half of all gaming and e-sports revenue was generated outside of China and the US. However, many of wealthy but populated nations have a lot of opportunities for expansion. Between 2021 and 2026, Turkey will have the fastest-growing market for video games (with a CAGR of 24.1%), followed by Pakistan (21.9%) and India (18.3 %). The metaverse and the next generation of digital entertainment, brand experiences, and immersive experiences are all being paved over by gaming, with its virtual goods and immersive experiences.

Cinemas Back in the Game

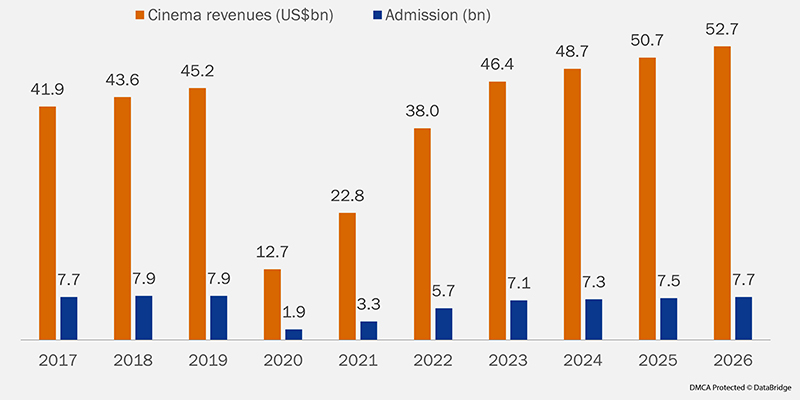

Fig.9: Total Global Cinema Revenues and Admissions (US $ Billion)

Source: PwC's Global Entertainment and Media Outlook 2022-2026

Distributors are putting a greater emphasis on local content and localizing even more in national markets. Growth in developing markets like India is causing a rapid recovery in movie ticket sales. Tollywood movies, produced in the Telugu language and widely spoken in Andhra Pradesh and Telangana, are a tough competitor to Bollywood films in Hindi. Regional films, mainly from South India, have achieved international success. Examples include Kolar Gold Fields (KGF): Chapter 2, Pushpa: The Rise, and RRR. RRR, an action epic with a US$72 million budget, broke the Indian box office record on its first day in March 2022. The emphasis of video entertainment growth is shifting to previously underserved cities and areas in several emerging economies. A significant growth opportunity is emerging outside of the big urban centers as mobile penetration-including 5G service-continues to rise. By the end of 2021, 9 cities in Indonesia would have 5G services. The big urban areas, primarily found in the East, in China have a somewhat saturated OTT market. The main regions for growth are in the West and rural areas, however, OTT providers find it expensive to operate there because to the lower levels of connectivity.

Conclusion

The media and entertainment business will continue to expand and change due to content digitization and technological advancements. Publishers and broadcasters will continue testing new business models to profit from online advertising and digital subscriptions. According to a PricewaterhouseCoopers estimate, the media and entertainment sector as a whole is predicted to climb to $825 billion by 2023 from $717 billion in 2019. (PwC). In 2020, the coronavirus epidemic hindered the expansion of the media and entertainment sector. However, certain media and entertainment industries performed better than others. According to a PwC research, mobile advertising will be three times as big as non-mobile video advertising by 2023, making up roughly 81 percent (or close to $130 billion) of all internet advertising. By 2023, the revenue from television advertising will only grow by about.3 percent, while that of radio advertising will only expand by about.7 percent (to $18.4 billion) in comparison. Due to the proliferation of free online material, the publishing business continues to see a reduction in advertising revenue and a drop in readership.

Data Bridge Market Research analyses that the video streaming market will exhibit a CAGR of 20.0% for the forecast period of 2021-2028. Therefore, the video streaming market value, which was USD 6231.24 million in 2020, would stand tall by USD 26,793.19 million by 2028. The video streaming market is segmented on the basis of type, solution, platform, service, model, deployment type and end user. Asia-Pacific will continue to undergo substantial gains during this period and register the highest CAGR. This is because of the growing adoption of digital technology across numerous industries and growing demand for media content. The major players covered in the video streaming report are Google LLC, Apple Inc., Amazon.in, AT&T Intellectual Property., STAR., Twitter, Inc., Hulu, LLC, Comcast, BT, Cox Communications, Inc., Facebook, Verizon Media., TalkTalk TV Entertainment Limited., Deutsche Telekom AG, Akamai Technologies, Fandango, Snagfilms Inc., iNDIEFLIX Group Inc., Xperi., Crackle, Inc. and Brightcove Inc. among other domestic and global players.

To know more about the study, visit: https://www.databridgemarketresearch.com/reports/global-video-streaming-market