As quoted by Joshua Emerson Smith, "If micro-mobility continues to evolve and gain in popularity, it will raise a host of questions for public officials. The demand for bike lanes could, for example, increase sharply."

Electric vehicles are gaining popularity all across the globe now. With the rising level of awareness and improved horizon of knowledge among people in developed, developing, and under developing economies, the demand for electric vehicles, especially two-wheelers is accelerating. The global aim of governments and regulatory bodies of major economies to reduce carbon emissions coupled with improved infrastructure for faster production of electric vehicles is contributing to this appreciated demand. The concept of micro mobility is just an extension to this evolving automotive infrastructure. The micro mobility wave is sweeping up the economies, especially the developing and developed ones owing to the rising environmental concerns and issues.

For an electric vehicle, charging stations are crucial. Hence, the construction of a charging unit becomes a part of an infrastructure that is required to promote the adoption of electric vehicle. On the similar line, Data Bridge Market Research penned down a report on the global electric vehicle charging stations market. Data Bridge Market Research analyses that the electric vehicle charging stations market was valued at USD 6.97 billion in 2021 and is expected to reach USD 167.52 billion by 2029, registering a CAGR of 48.80% during the forecast period of 2022 to 2029.

To know more about the study, visit: https://www.databridgemarketresearch.com/reports/global-electric-vehicle-charging-stations-market

Micro mobility is the term used to describe a variety of small, lightweight vehicles operated by individual users and travel at speeds typically under 25 km/h. Bicycles, e-bikes, electric scooters, electric skateboards, shared bicycle fleets, and electric pedal-assisted bicycles are some of the examples of micro mobility equipment. As the foundation of a mode of transportation known as micro mobility, electric scooters and motor-assisted bicycles, they have been welcomed as a component of the solution to congested roads and intolerable travel delays. Startups in the micro mobility space have experienced difficulties with profitability, which COVID-19 made worse. But there has been a post-pandemic recovery for these startups. If they haven't already, most city dwellers will soon notice the explosion of shared bikes and scooters that have started to appear all over their city. Existing transportation, including cars, buses, and trains, cannot keep up with the expanding population as city congestion increases. According to the 2019 INRIX National Traffic Scorecard, Americans lose an average of 99 hours a year due to traffic. In 2019, traffic cost Americans almost $88B, or an average of nearly $1,400 per driver. Micro mobility firms are developing as a potent alternative to the present public transit mix as cities struggle to address the transportation dilemma in the face of growing worries about gas-powered emissions, particularly as the COVID-19 crisis affects the industry.

Despite a temporary halt at the start of the epidemic, demand for micro mobility services has increased as a result of COVID-19 for both direct-to-consumer enterprises and sharing platforms. As more people explore for single-rider, open-air transit choices that are environmentally benign, there is an opportunity for micro mobility firms to expand even further. In comparison to public transportation, using a bike or a scooter allows for outdoor mobility, control over social distance, and fewer points of shared touch. Additionally, compared to gas and diesel-powered personal automobiles, they provide a more environmentally-friendly form of transportation. Although there are certain drawbacks to the expanding micro mobility trend, such as a lack of regulation, citywide prohibitions, and theft, this phenomenon can drastically alter the global mobility market. In-depth discussion of the benefits and disadvantages of micro mobility is given as below:

Fig.1: Pros and Cons of Micro Mobility

Benefits/ Pros of micro mobility:

- Road congestion- Road congestion is a severe issue in this metropolis, as it is in every densely populated area. For instance, the Australian Bureau of Infrastructure, Transport, and Regional Economics estimates that if congestion is not solved, it will cost the nation between $27.7 and $37.3 billion by 2030. By encouraging people to utilize micro-mobility devices rather than cars, one of the advantages of micro-mobility is that it helps to relieve traffic congestion. There will be less need for people to drive vehicles, especially for short-distance excursions, as there will be more micro-mobility gadgets on the road. Although some cities have included micro-mobility into their transportation networks, it is debatably still too early to know how it would affect congestion.

- First, fast and last-mile solution- Using personal micro-mobility devices will make it easier for commuters to move around. Commuters can reach neighboring bus and subway stations without using a car by using an e-scooter or an e-bike. The first and last-mile conundrum, or how to get to and from public transportation stops as part of a lengthier journey, is addressed through the usage of micro-mobility devices. The portability of micro mobility devices makes them a practical option for people who need to use public transportation after riding an e-scooter or an e-bike. Overall, using these tools improves the effectiveness of commuting.

- Effective air pollution management- One of the eco-friendly transportation concepts being put out in various locations worldwide involves micro mobility devices. Since they don't emit any pollutants, they assist in lowering the number of emissions that come from cars and other fossil fuel-powered vehicles. According to research by the e-scooter sharing business Lime, for instance, the city of Paris reduced its emissions significantly within a year by adopting shared e-scooter programs. Utilizing micro-mobility devices more frequently will aid in lowering air pollution, particularly in densely populated cities.

- Affordability- Micro mobility devices are relatively inexpensive as compared to purchasing and maintaining an automobile. In addition to having cheaper upfront expenses, these gadgets require little to no maintenance and don't require fuel. Due to the low cost of unlocking and using the vehicles, shared e-scooters and e-bikes are also inexpensive. Shared micro-mobility systems are more affordable than public transportation over short distances. Overall, they offer low-income commuters a cost-effective and effective form of transportation.

Challenges/ hurdles for micro mobility market:

- Safety concerns- Due to serious safety issues, many communities and governments are still unwilling to promote micro mobility technologies. According to a CDC research, 20 people suffer an accident for every 100,000 trips made in an electric scooter. Even though that is a very low number, e-scooter accidents have grown recently. In contrast to a car's airbags, micro-mobility gadgets do not provide protection. Hence some people believe using them is risky. However, safety issues and mishaps might be decreased if organizations and lawmakers can develop appropriate rules and regulations for the usage of micro mobility.

- Unstable regulations- Organizations, politicians, and consumers should anticipate norms and rules to change because micro mobility is a young and rapidly evolving market. When one element changes, other components must also adapt. Manufacturers and customers may need to make adjustments to comply with new requirements, for instance, if the government updates the micro-mobility guidelines. Strong collaboration between organizations and decision-makers is necessary to stay up with advances.

- Complicated communication- Coordination between organizations and users is necessary for implementing a micro mobility plan, as is sound law. Each pertinent organization must collaborate with others to guarantee that rules and regulations are carried out efficiently, whether by laying out recommendations for users or providing high-quality infrastructure for micro mobility devices. Communication between organizations can be difficult as a result. Cities will have to overcome this obstacle to utilize micro mobility technologies properly.

- Competition- There is still a long way to go for the micro mobility market owing to the presence of high and intense competition. This competition is being posed by four-wheelers such as light commercial vehicles (cars) and heavy commercial vehicles (buses and other public transports). The market penetration has already not been easy for the micro mobility solutions. Moreover, to carve down a niche for itself, micro mobility will have to incur costs pertaining to marketing and advertisement.

Urban transportation is starting to use the term "micro-mobility" more frequently. Many think it's the next stage in revolutionizing the transportation industry. In fact, it is predicted that by 2030, the worldwide micro-mobility market will be worth US$195.42 billion. Micro mobility is not a brand-new idea. In actuality, an on-demand bicycle sharing scheme in Europe in 1975 served as the impetus for the concept of micro-mobility. People have rediscovered micro-mobility decades after the modernization of bicycles, kick scooters, and skateboards to their electrical counterparts. Now, among many other things, people think of electric scooters, electric bikes, and electric skateboards when they hear "micro-mobility." The advantages of micro mobility nevertheless remain the same. Its effects on cities and individuals are the only distinction between then and now. Micro mobility is the answer to the growing environmental and road congestion issues as urban populations rise and fuel prices rise. After all, they have demonstrated that they are economical, effective, and eco-friendly to use.

Student, worker, local, and visitor access to possibilities is improved when personal and shared mobility is promoted in urban areas. Particularly for commuters, e-scooters and e-bikes are now more accessible thanks to micro mobility businesses such as Lime, Neuron, and Beam. According to a Lime poll in Washington, DC, 44% of their users used the shared e-scooter to go to their current employment. Additionally, the poll found that 57 percent of respondents utilize shared e-scooters to get to work and school. According to Lime's 2019 Global Rider Survey, 29.3% of tourists use shared e-scooters to access stores in a city. These studies demonstrate how micro-mobility gives people access to opportunities and how communities might better utilize their labor force. A city's entire economic activity would be impacted if more individuals could move around it easily. Since many commuters favor using micro-mobility devices for transportation, it may increase sales for nearby businesses. According to a Lime poll, 72% of e-scooter users use shared e-scooters to explore nearby businesses and attractions. Additionally, a study from Emory University's Goizueta Business School discovered that shared e-scooter programs boost revenues for restaurants and bars by $13.8 million. In general, communities should consider the potential economic effects of micro mobility on people and enterprises.

Residents of densely crowded areas are especially drawn to micro mobility devices because they offer quick and easy access to places like grocery stores, shops, or entertainment venues. In many major cities, you may rent e-scooters, regular bikes, e-bikes, and human- or electric-powered rickshaws for sightseeing and guided excursions. Many locals choose not to own a standard car due to the high cost of vehicle ownership, growing insurance costs, and a lack of suitable parking. The following cities have either carried out large pilot projects or have already seen a significant increase in the micro mobility market:

- Barcelona, Spain

- Chicago, Illionois

- Los Angeles, California

- Minneapolis, Minnesota

- Montreal, Canada

- New York City, New York

- Oakland, California

- San Francisco, California

- Toronto, Canada

In order to promote healthier and more sustainable lives in cities, cities should encourage the use of more electric scooters. Although the majority of cities in the world are currently researching or testing the effects of micro-mobility transportation systems, the findings thus far are encouraging as more communities begin to enact and promote them. So, what does the future of micro mobility look like? Although the pandemic may have impacted the sector, it has nonetheless shown to be robust and helpful in these trying times. Developers of micro mobility who are able to overcome these obstacles will be in a great position to take advantage of this exciting new market. They will be able to have a good influence on metropolitan areas, contributing to the sustainability of cities and generating excellent money. To revise, the following are the major issues and changes facing the micro mobility industry:

Challenges:

- Management of assets and logistics

- Fraud and theft

- Complex design specifications

Opportunities:

- Enter a developing market

- Participate in the development of smart cities.

- Encourage social justice and inclusive mobility

- Encourage carbon reduction and back net zero objectives

Due to its simplicity and cleanliness, more people prefer micro-mobile devices than public transit. People are opting to travel sustainably, and commuters are becoming more aware of their carbon footprint. The core of the micro mobility challenge, as with so many other issues in the future of mobility, typically lies in striking the right balance between protecting the public interest of today while still encouraging innovations that can ultimately benefit customers and the larger transportation system. Given the numerous potential advantages of micro mobility, an equilibrium that favors cities, residents, and service providers is probably already in place.

To get there, everyone involved will probably need to develop trusting connections while still allowing for competition and new entrants. Additionally, there isn't a universal formula that players can use anywhere, just like with many other rising mobility difficulties. To be better prepared for the next mobility breakthrough, such as autonomous vehicles moving people and commodities, everyone can work through the challenging issues now, learn from fresh data, and remember important lessons. The electric scooter trend is unquestionably one of the most significant trends influencing the micro mobility industry. In just a few years, the electric scooter market has experienced substantial growth, and the outlook is promising.

- According to certain predictions for the e-scooter market, the sector will develop at a 7.6 percent compound annual growth rate (CAGR) between 2021 and 2028.

- According to TechCrunch, 2021 was the year of the e-bike, with sales increasing by 240 percent in the 12 months preceding July.

- By 2028, the bike and scooter rental market economy is projected to rise by $11,040 million, according to Vantage Market Research (VMR).

Data Bridge Market Research analyses that the bike and scooter rental market would exhibit a CAGR of 18.0% for the forecast period of 2022-2029 and is likely to reach the USD 11.55 billion by 2029. The bike and scooter rental market is segmented on the basis of operational model, propulsion, service, vehicle type, and application. Some of the major players operating in the bike and scooter rental market are Cityscoot SAS, Uber Technologies Inc., Lime, Bird Rides, Inc., ofo Inc., COUP Mobility GmbH, Mobycy, Vogo rentals, Lyft, Inc., MOTOCRUIZER TECHNOLOGIES INDIA PVT. LTD., Mobike, Spin, eCooltra, Bolt Bikes, Yulu Bikes Pvt Ltd, YEGO Urban Mobility SL, Spinlister , Zoomo, VOI Technology AB, and emmy-sharing, among others.

To know more about the study, visit: https://www.databridgemarketresearch.com/reports/global-bike-and-scooter-rental-market

- Recent estimates indicate that the trend of cargo bikes is poised to increase, with significant environmental advantages. According to a research titled The Promise of Low Carbon Freight, cargo bikes reduced carbon dioxide and nitrogen oxide emissions by a combined 3,896 kilos and 5.5 kilograms over three months.

- As smart cities strive to enhance social fairness, decrease traffic congestion, and enhance air quality, mobility-as-a-service (MaaS) will become an increasingly popular trend. This will allow every resident to have access to inexpensive transportation.

While the e-scooter trend now rules the micro mobility market, a few other devices are also increasing, such as e-bikes for commuters and tourists. Segways, rickshaws, and pedicabs will all see increased use as the world's tourism picks up in a post-pandemic world.

DATA AND STATISTICS RELATED TO MICRO MOBILITY SOLUTIONS

1. North America

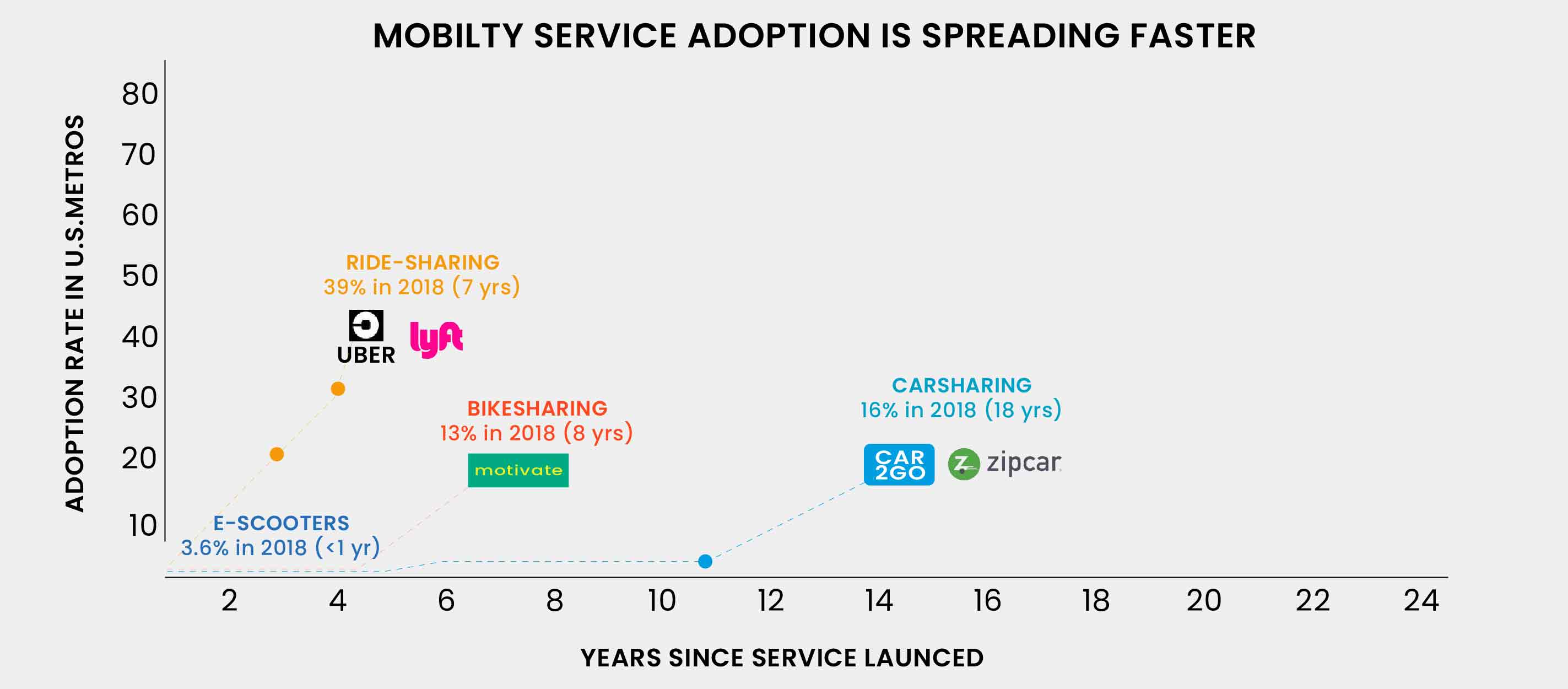

The debut of shared electric scooter services in the spring of 2018 was a major transportation innovation for urban mobility in several American cities. The transportation ecology has undergone tremendous transformation since the original introduction of private ride-hailing services (such as Uber and Lyft). The fast introduction of these new services has taken the public sector by surprise in many respects, leaving it in an awkward position without access to information to help shape policy and planning decisions. Despite the fact that commercial shared electric scooter services have only been offered in American cities for a short period of time—less than 12 months in some markets—a remarkably high percentage of people (3.6%) report having used them. Although there are differences between places, the aggregate number of people who have accepted electric scooters in such a short amount of time is fairly amazing when compared to the adoption of past mobility services. According to analyses and the scant academic research on the use of various mobility services, adoption rates have increased dramatically over the previous ten years (see Fig. 2.).

Fig.2: Comparison of mobility adoption curves in the U.S.

Source: Populus Groundtruth

A more rapid rate of adoption for micro mobility has been made possible by several important variables, including:

- Over the past ten years, the number of GPS-enabled smartphones has more than doubled

- Traffic congestion is on the rise in most American cities; it is faster to travel short distances of 3 miles or less on a bike or scooter

- The amount of private financing for micro-mobility has fueled the supply of these services, accelerating adoption.

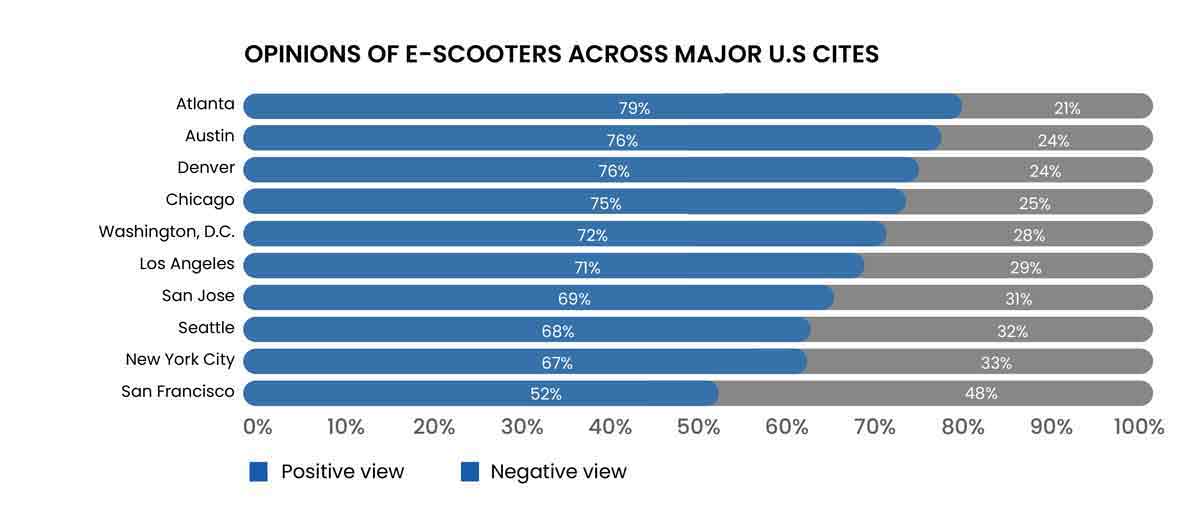

The majority of people (70 percent), according to the report's extensive, representative sampling across the cities featured in the United States, have a favorable opinion of electric scooters. They believe that they increase the number of transportation options, enable a car-free lifestyle, and serve as a convenient alternative to short trips in a personal vehicle. According to preliminary data gathered from the Populus platform, most people demand micro-mobility services in cities, even if further research on this topic is necessary to inform transportation planning and policy decisions.

Fig.3: Public Perception of E-Scooters by U.S.

Source: Populus Groundtruth

The findings showed some diversity in the public's viewpoint. San Francisco in particular stood out as an anomaly with the lowest level of public approval, despite the fact that nationally, most people (52 percent) have a favorable opinion of them. The lower percentages of support in San Francisco could be influenced by a number of intricate factors, most of which have to do with housing and worries about gentrification. An important conclusion from the study is that other American cities might not adopt San Francisco's laws, restrictions, use rates, or attitudes.

This new study implies that electric scooters may be more well-liked and adopted by women than previous station-based, non-electric bike share services, which have historically been utilized primarily by men by a factor of 2 to 3 times. According to the data of publicly available docked bike share data from the United States, men make 75% of the trips, while women make only 25% of them. This is not the fault of the service providers; rather, it reflects America's lack of infrastructure investment for bicycles and pedestrians.

Following the market trends, Data Bridge Market Research prepared an investigative report on the global e-scooter/moped and e-motorcycle market. Data Bridge Market Research shows that the Global E-Scooter/Moped and E-Motorcycle Market was valued at USD 53.59 billion in 2021 and is expected to reach USD 623.59 billion by 2029, registering a CAGR of 8.60% during the forecast period of 2022-2029. The e-scooter/moped and e-motorcycle market is segmented on the basis of type, distance covered, vehicle type, voltage type and technology type.

To know more about the study, visit: https://www.databridgemarketresearch.com/reports/global-e-scooter-moped-and-e-motorcycle-market

2. Asia-Pacific

China was the first nation to introduce a dock less bike-sharing network in 2015, and Asia has been a global leader in micro mobility. Micro mobility firms had the advantage of speedy adoption throughout cities in Asia because there was less regulatory red tape there than in Europe and North America. However, this absence of regulation also led to an oversaturated market, with millions of bicycles building up on city streets. However, it makes sense that cities like Beijing and Shanghai are leading the charge to minimize vehicular mobility and transition to emissions-free solutions in a continent where dangerously high urban pollution levels and extremely clogged streets are common.

By the end of 2017, shared bikes were China's third-most-popular form of public transportation. The micro mobility market is equally successful in other Asian nations such as Singapore, Taiwan, and South Korea. To address transportation concerns, docked bike-sharing municipal schemes were introduced in major Chinese cities as early as 2008.

Hangzhou Public Bicycle, introduced in May 2008 by the Hangzhou Public Transport Corporation, is the country's first and most popular public initiative. After the Hangzhou launch, numerous other Chinese cities, including Beijing, Shanghai, Wenzhou, Kunming, and Guangzhou, also established public bike-sharing programs. These public programs have mostly decreased, but they still exist, as private dock-less bike-sharing businesses started to enter the market. Ofo was the first of these Chinese micromobility firms to reach unicorn status ($1B+ valuations), established in 2014.

Beijing-based bike-sharing corporation deployed more than 10 million bikes globally, including in the US, the UK, Singapore, Australia, France, and other nations. After purchasing the insolvent bike-sharing startup Bluegogo in 2018, Didi Chuxing, China's largest ride-hailing service, has also moved into bike sharing. The division sells both e-bikes and conventional bicycles and raised $1B from SoftBank and Legend Capital in April 2020. As China was getting over Covid-19 in June 2020, Didi Bike declared that daily orders had reached 10M.

A tiny number of firms are competing in India's competitive transportation industry, with mopeds garnering a lot of interest. Congestion and poor road infrastructure present challenging issues, but startups like Bounce, Vogo, and Yulu are tackling them with their micro mobility solutions. According to scooter-sharing startup Bounce, it runs over 20,000 electric and gas-powered dock less bikes and motor scooters around the nation. At a $520M valuation, it raised $105M in a follow-on Series D financing in January 2020. In 2018, after Ofo's China-based business started to experience financial difficulties, it acquired the e-scooter division. Yulu, a platform for renting out electric bikes, is an additional rival that has attracted some noteworthy investors. In 2019, Yulu and Uber signed a collaboration that gives customers access to their bikes via Uber.

3. Europe

- In Europe, micromobility is not a novel idea. In reality, in addition to having high ownership rates, European towns were some of the first to provide shared bicycles as a public utility. For instance, only 56% of people in Denmark possess a car, compared to 90% who own bicycles. Cities in Europe, including Barcelona, Berlin, and Rome, have also restricted access to streets to bikes, scooters, and pedestrians because of the outbreak. The bicycle market in all of Europe was valued at $16.4 billion in 2020, and it is projected to increase at a CAGR of 3.7 percent through 2026. The European Cyclists Federation estimates that until 2024, Europe's auto market will only expand by 1.7 percent yearly.

A surge in the use of electric vehicles appears imminent as European nations get ready to phase out the production of gasoline and diesel automobiles in the near future. According to Berylls, limits on fossil fuel vehicles already influence or will affect 12.6 million cars in Europe. Based on the market share of new car sales, Europe also leads the world in the adoption of electric vehicles. Out of a $2B cycling and walking package, the UK has already contributed £250M ($300M) as an emergency fund to build new bike lanes and larger sidewalks in order to make cities more bicycle and pedestrian-friendly. Additionally, it is experimenting with renting e-scooters.

- In 2018, scooter sharing in Europe started to gain traction, but lately, there have been waves of corporate mergers. In recent years, investors have been aware of the possibilities that e-scooters offer since cities in Europe have more bike lanes and denser populations than most American cities do. In an effort to compete with US-based enterprises that are rushing into the industry, European-based businesses have received finance. Tier Mobility, an e-scooter business based in Berlin, has secured more than $467 million to far, including a $250 million round in which SoftBank participated in November 2020. The business claims to be the first micro mobility provider that is completely climate neutral. In the midst of the pandemic, Tier debuted in 5 new cities. The business was active in 77 cities across 13 nations as of July 2021.

Conclusion

Micro mobility businesses that are providing the globe with the relatively new service of shared or D2C bikes and scooters face various challenges, as with any burgeoning industry. While some businesses may fail along the way, those that do survive will probably prosper in this multibillion-dollar market as they give urbanites a more environmentally friendly alternative to cars and a workable answer to their mobility concerns. COVID-19 has sped up the possibility of the market's consolidation while also boosting demand at a time when single-rider, open-air transportation alternatives are in great demand. Of course, a lot of this depends on geography and how well-suited cities or metropolitan settings are to certain modes of transit. However, one may anticipate seeing an increasing number of bicycles and scooters on the streets of the world's cities as consumer and governmental adoption increases and startups get closer to attaining successful unit economics.