برز الطلب المتزايد على إنترنت أسرع كمحرك رئيسي لسوق التكنولوجيا في الولايات المتحدة. ومع الارتفاع الهائل في استهلاك البيانات، مدفوعًا بانتشار خدمات البث، والألعاب الإلكترونية، والعمل عن بُعد ، تبرز حاجة ملحة لبنية تحتية أكثر متانة وسرعة للإنترنت. وقد حفّز هذا الارتفاع في الطلب التطورات التكنولوجية والاستثمارات في تقنيات شبكات الجيل التالي، مثل شبكات الجيل الخامس (5G) وأنظمة الألياف الضوئية، التي تُبشّر بتحسين سرعات الاتصال وموثوقيته.

يمكنك الوصول إلى التقرير الكامل على https://www.databridgemarketresearch.com/reports/us-technology-market

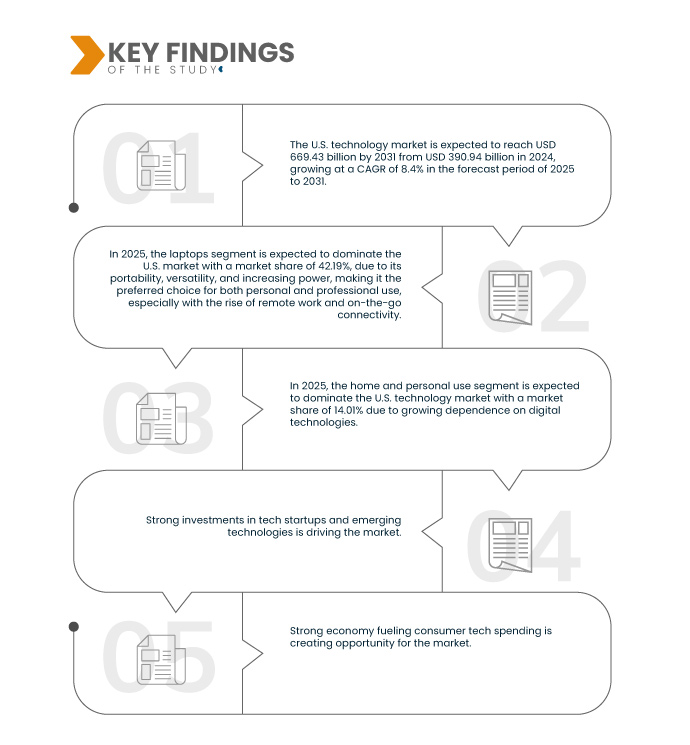

تشير تحليلات Data Bridge Market Research إلى أن سوق التكنولوجيا في الولايات المتحدة من المتوقع أن يصل إلى 669.43 مليار دولار أمريكي بحلول عام 2031 من 390.95 مليار دولار أمريكي في عام 2024، بنمو بمعدل نمو سنوي مركب قدره 8.4٪ في الفترة المتوقعة من 2025 إلى 2031.

النتائج الرئيسية للدراسة

زيادة اعتماد السحابة في الخدمات والبنية التحتية

يُعدّ ازدياد اعتماد الحوسبة السحابية محركًا رئيسيًا للنمو في سوق التكنولوجيا الأمريكية. ومع تزايد تحويل الشركات والمؤسسات عملياتها إلى المنصات السحابية ، ازداد الطلب على الخدمات والبنية التحتية السحابية بشكل كبير. ويعود هذا التوجه إلى قدرة الحوسبة السحابية على توفير موارد قابلة للتوسع، وقدرة حوسبة مرنة، وحلول فعّالة من حيث التكلفة مقارنةً بالأنظمة التقليدية المحلية. ومع تزايد إدراك الشركات لفوائد الحوسبة السحابية، بما في ذلك تحسين التعاون، وتخزين البيانات ، والوصول إلى التحليلات المتقدمة، شهد قطاع التكنولوجيا ارتفاعًا ملحوظًا في الاستثمار والابتكار في تقنيات الحوسبة السحابية.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2025 إلى 2031

|

سنة الأساس

|

2024

|

السنوات التاريخية

|

2023 (قابلة للتخصيص من 2017 إلى 2022)

|

الوحدات الكمية

|

الإيرادات بالمليار دولار أمريكي

|

القطاعات المغطاة

|

التكنولوجيا (أجهزة الكمبيوتر المحمولة، وأجهزة الكمبيوتر المكتبية، والأجهزة اللوحية ، والشاشات، والطابعات، والماسحات الضوئية)، والمستخدم النهائي (الاستخدام المنزلي والشخصي، والرعاية الصحية، والمكاتب، والتعليم، وتجارة التجزئة، والأمن، والتصنيع، والبث الإعلامي والنشر، والعسكرية والدفاع، والخدمات اللوجستية والتحول، والحكومة، والألعاب، والسفر والضيافة، والمكتبات، والقانونية، وإنفاذ القانون، والبناء، وغيرها)

|

الدول المغطاة

|

قملة

|

الجهات الفاعلة في السوق المغطاة

|

Acer (تايوان)، Apple Inc (الولايات المتحدة)، ASUSTeK Computer Inc (تايوان)، Brother (الولايات المتحدة)، Canon Inc. (اليابان)، Dell Inc. (الولايات المتحدة)، DIC CORPORATION (اليابان)، Flint Group (الولايات المتحدة)، Google LLC (الولايات المتحدة)، Honeywell International Inc (الولايات المتحدة)، HP INDIA SALES PRIVATE LIMITED (الولايات المتحدة)، Konica Minolta, Inc. (اليابان)، Lenovo (الصين)، Lexmark International, Inc. (الولايات المتحدة)، Microsoft (الولايات المتحدة)، Panasonic Corporation (اليابان)، Razer Inc (الولايات المتحدة)، SAMSUNG (كوريا الجنوبية)، Seiko Epson Corporation (اليابان)، Xerox Corporation (الولايات المتحدة) وغيرها

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research أيضًا تحليلًا متعمقًا من الخبراء والإنتاج والقدرة التمثيلية الجغرافية للشركة وتخطيطات الشبكة للموزعين والشركاء وتحليل اتجاهات الأسعار التفصيلية والمحدثة وتحليل العجز في سلسلة التوريد والطلب.

|

تحليل القطاعات

يتم تقسيم سوق التكنولوجيا في الولايات المتحدة إلى قطاعين بارزين، يعتمدان على أساس التكنولوجيا والمستخدم النهائي.

- على أساس التكنولوجيا، يتم تقسيم سوق التكنولوجيا في الولايات المتحدة إلى أجهزة الكمبيوتر المحمولة وأجهزة الكمبيوتر المكتبية والأجهزة اللوحية والشاشات والطابعات والماسحات الضوئية

في عام 2025، من المتوقع أن تهيمن شريحة أجهزة الكمبيوتر المحمولة على سوق التكنولوجيا في الولايات المتحدة

ومن المتوقع أن تهيمن شريحة أجهزة الكمبيوتر المحمولة على سوق التكنولوجيا في عام 2025 بحصة سوقية تبلغ 42.19% بسبب قابليتها للنقل وتعدد استخداماتها وقوتها المتزايدة، مما يجعلها الخيار المفضل للاستخدام الشخصي والمهني، خاصة مع صعود العمل عن بعد والاتصال أثناء التنقل.

- على أساس المستخدم النهائي، يتم تقسيم السوق إلى الاستخدام المنزلي والشخصي، والرعاية الصحية، والمكاتب، والتعليم، وتجارة التجزئة، والأمن، والتصنيع، والبث الإعلامي والنشر، والعسكرية والدفاع، والخدمات اللوجستية والتحويل، والحكومة، والألعاب، والسفر والضيافة، والمكتبات، والقانونية، وإنفاذ القانون ، والبناء، وغيرها.

في عام 2025، من المتوقع أن تهيمن شريحة الاستخدام المنزلي والشخصي على سوق التكنولوجيا في الولايات المتحدة

ومن المتوقع أن تهيمن شريحة الاستخدام المنزلي والشخصي على سوق التكنولوجيا في الولايات المتحدة بحلول عام 2025 بحصة سوقية تبلغ 14.01% بسبب زيادة اعتماد السحابة في الخدمات والبنية الأساسية.

اللاعبون الرئيسيون

تقوم شركة Data Bridge Market Research بتحليل شركة Apple Inc. (الولايات المتحدة)، وشركة Microsoft (الولايات المتحدة)، وشركة Lenovo (الصين)، وشركة HP Development Company, LP (الولايات المتحدة)، وشركة LP، وشركة Brother (الولايات المتحدة) باعتبارها اللاعبين الرئيسيين العاملين في سوق التكنولوجيا في الولايات المتحدة.

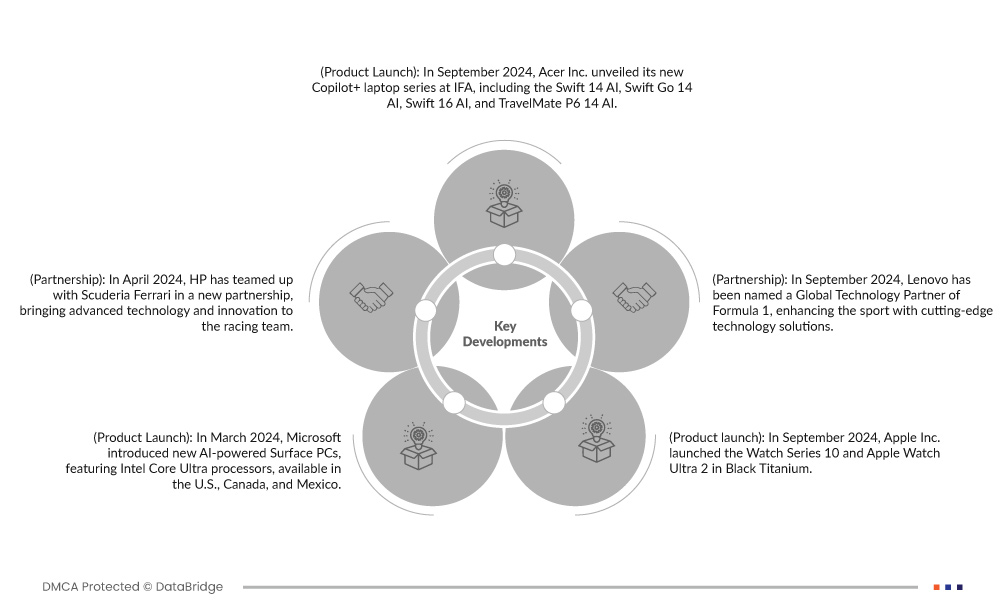

تطوير السوق

- في سبتمبر 2024، أعلنت شركة Apple Inc. عن خططها لإطلاق أجهزة Mac مزودة بمعالج M4 وإصدارات iPad مُحدثة في فعالية عُقدت في أكتوبر. ستشمل الإصدارات الجديدة أجهزة MacBook Pro وiMac وMac Mini المُعاد تصميمه، بالإضافة إلى iPad Mini 7 وiPad من الجيل الحادي عشر. من المتوقع أن يتميز Mac Mini الجديد بتصميم أصغر حجمًا ومنافذ USB-C إضافية. يُفيد هذا الإطلاق Apple من خلال تعزيز مجموعة أجهزة Mac بأداء أسرع واتصالات مُحدثة، مما يجذب المستخدمين الجدد والعملاء الحاليين الذين يبحثون عن أجهزة مُحدثة.

- في مارس 2024، طرحت مايكروسوفت أجهزة Surface PC جديدة مدعمة بالذكاء الاصطناعي، مزودة بمعالجات Intel Core Ultra، ومتوفرة في الولايات المتحدة وكندا والمكسيك. صُممت هذه الأجهزة خصيصًا للشركات، وهي تُعزز منظومة مايكروسوفت، وتدفع عجلة الابتكار من خلال تجارب Copilot المُسرّعة، والميزات المتقدمة، والتنوع لتعزيز المرونة والتفاعل. عزز هذا الإطلاق مكانة مايكروسوفت في سوق أجهزة الكمبيوتر التجارية، مُبرزًا التزامها بالابتكار وتوسيع نطاق منتجاتها.

- في سبتمبر 2024، عُيّنت لينوفو شريكًا تقنيًا عالميًا لسباقات الفورمولا 1، مما يُعزز هذه الرياضة بحلول تكنولوجية متطورة. ستدمج هذه الشراكة قدرات لينوفو المتقدمة في الحوسبة والذكاء الاصطناعي في منظومة سباقات الفورمولا 1، مما يُحسّن تحليل البيانات والهندسة وتفاعل المشجعين. كما تُعزز التزام لينوفو بالابتكار والتكنولوجيا عالية الأداء في الرياضات العالمية.

- في مايو 2024، أعلنت HP وCanva عن شراكة لدمج أدوات تصميم Canva مع تقنية الطباعة من HP. يُسهّل هذا التعاون إنشاء مواد طباعة عالية الجودة ومُخصصة للمستخدمين. كما يُعزز هذا التعاون قيمة HP من خلال تقديم حلول سلسة من التصميم إلى الطباعة، مما يُعزز تفاعل العملاء ونمو أعمالهم.

- في أغسطس 2024، أطلقت شركة Brother 17 طابعة جديدة في نيودلهي، بهدف تحسين الإنتاجية في قطاعات المكاتب الصغيرة والمنزلية (SOHO) والشركات الصغيرة والمتوسطة (SMB) والشركات الكبرى. تميّزت المجموعة الجديدة بسرعات طباعة أعلى، وطباعة مزدوجة تلقائية، واتصال لاسلكي، لتلبية مختلف احتياجات الأعمال. وفرت سلسلة طابعات Brother ذات علبة الحبر والليزر أحادية اللون، منخفضة التكلفة، طباعة بكميات كبيرة بتكلفة منخفضة للصفحة، مما أفاد الشركات من خلال خفض تكاليف التشغيل وتعزيز الكفاءة.

لمزيد من المعلومات التفصيلية حول تقرير سوق التكنولوجيا في الولايات المتحدة، انقر هنا - https://www.databridgemarketresearch.com/reports/us-technology-market