أدى النمو الهائل في التجارة العالمية إلى زيادة ملحوظة في حجم الشحن. ومع تزايد ترابط الاقتصادات حول العالم، يرتفع الطلب على خدمات الشحن تبعًا لذلك. ويعني هذا الارتفاع أن شركات الشحن تعمل على توسيع أساطيلها لاستيعاب حجم أكبر من البضائع. ويترجم ازدياد عدد السفن العاملة إلى حاجة أكبر لخدمات الصيانة والإصلاح الدورية. ومع قطع السفن لأميال أطول، فإنها تواجه التآكل والتلف الذي يستلزم إجراء إصلاحات وصيانة دورية في الحوض الجاف. ولا تضمن هذه الدورة المستمرة من الإصلاحات امتثال السفن للمعايير التشغيلية فحسب، بل تعزز أيضًا من عمرها الافتراضي، وهو أمر بالغ الأهمية لشركات الشحن التي تتطلع إلى تعظيم استثماراتها. ونتيجة لذلك، فإن أحواض بناء السفن الأمريكية التي يمكنها تقديم خدمات صيانة موثوقة وفي الوقت المناسب تجد نفسها في طلب كبير، مما يدفع نمو السوق.

يمكنك الوصول إلى التقرير الكامل على https://www.databridgemarketresearch.com/reports/us-ship-repair-and-maintenance-services-market

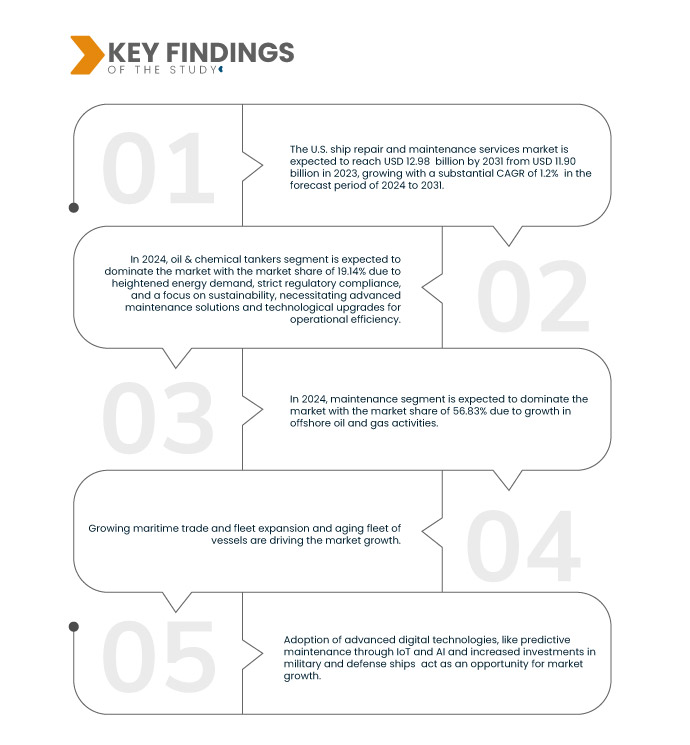

تحلل شركة Data Bridge Market Research حجم سوق خدمات إصلاح وصيانة السفن في الولايات المتحدة والذي قدر بـ 11.90 مليار دولار أمريكي في عام 2023 ومن المتوقع أن يصل إلى 12.98 مليار دولار أمريكي بحلول عام 2031، بمعدل نمو سنوي مركب قدره 1.2٪ خلال الفترة المتوقعة من 2024 إلى 2031.

النتائج الرئيسية للدراسة

- نمو التجارة البحرية وتوسع الأسطول

أدى النمو الهائل في التجارة العالمية إلى زيادة ملحوظة في حجم الشحن. ومع تزايد ترابط الاقتصادات حول العالم، يرتفع الطلب على خدمات الشحن تبعًا لذلك. ويعني هذا الارتفاع أن شركات الشحن تعمل على توسيع أساطيلها لاستيعاب حجم أكبر من البضائع. ويترجم ازدياد عدد السفن العاملة إلى حاجة أكبر لخدمات الصيانة والإصلاح الدورية. ومع قطع السفن لأميال أطول، فإنها تواجه التآكل والتلف الذي يستلزم إجراء إصلاحات وصيانة دورية في الحوض الجاف. ولا تضمن هذه الدورة المستمرة من الإصلاحات امتثال السفن للمعايير التشغيلية فحسب، بل تعزز أيضًا من عمرها الافتراضي، وهو أمر بالغ الأهمية لشركات الشحن التي تتطلع إلى تعظيم استثماراتها. ونتيجة لذلك، فإن أحواض بناء السفن الأمريكية التي يمكنها تقديم خدمات صيانة موثوقة وفي الوقت المناسب تجد نفسها في طلب كبير، مما يدفع نمو السوق.

يخضع قطاع النقل البحري لرقابة صارمة، مع معايير صارمة تُنظّم السلامة والتأثير البيئي والكفاءة التشغيلية. تُلزم هذه اللوائح بإجراء عمليات تفتيش وصيانة دورية لضمان الامتثال. ومع ازدياد صرامة الأطر التنظيمية، يواجه مُشغّلو السفن ضغوطًا للحفاظ على أساطيلهم وفقًا للمبادئ التوجيهية المُتطورة. وهذا يُولّد طلبًا مُستمرًا على خدمات إصلاح وصيانة السفن، إذ إن الامتثال ليس مجرد التزام قانوني، بل عاملٌ حاسم في الحفاظ على تراخيص التشغيل وتجنب العقوبات الباهظة. تُرسّخ أحواض بناء السفن الأمريكية، التي تُثبت خبرتها في الامتثال وسجلها الحافل في تلبية المتطلبات التنظيمية، مكانتها كشركاء أساسيين لشركات الشحن، مما يُحفّز نموًا أكبر في السوق. تلعب الديناميكيات الجيوسياسية دورًا هامًا في التأثير على أنماط التجارة البحرية ومتطلبات الشحن. يُمكن أن تُؤدي التغييرات في السياسات التجارية أو العقوبات أو عدم الاستقرار السياسي إلى تحوّلات في مسارات الشحن وحجم البضائع المنقولة. على سبيل المثال، يُمكن أن تُعطّل النزاعات التجارية المسارات القائمة، مما يُجبر الشركات على التكيف بسرعة وربما توسيع أساطيلها لاستكشاف أسواق جديدة. يتطلب هذا التقلب وجود شبكة إصلاح وصيانة قوية قادرة على الاستجابة للتغيرات السريعة. تُعدّ أحواض بناء السفن الأمريكية التي تُقدّم خدمات مرنة وسريعة الاستجابة أمرًا بالغ الأهمية لضمان جاهزية الأسطول في بيئة متقلبة، مما يُعزز أهميتها في النظام البحري. إن القدرة على التكيف مع التحولات الجيوسياسية لا تضمن تدفقًا ثابتًا لأعمال خدمات الإصلاح فحسب، بل تُعزز أيضًا مرونة القطاع البحري الأمريكي بشكل عام.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

السنوات التاريخية

|

2022 (قابلة للتخصيص حتى 2016 - 2021)

|

الوحدات الكمية

|

الإيرادات بالمليار دولار أمريكي

|

القطاعات المغطاة

|

السفن ( ناقلات النفط والمواد الكيميائية ، سفن الحاويات، ناقلات البضائع السائبة الجافة، البضائع العامة، نقل الغاز، سفن الركاب، سفن التبريد وغيرها)، نوع الخدمة (الصيانة والإصلاح)، التطبيق (الرسو، قطع غيار المحركات، الخدمات العامة، الأعمال الكهربائية والخدمات المساعدة وغيرها)، المستخدم النهائي (الحكومي والدفاعي والتجاري)

|

الدول المغطاة

|

قملة

|

الجهات الفاعلة في السوق المغطاة

|

بي إيه إي سيستمز (المملكة المتحدة)، جنرال ديناميكس ناسكو (الولايات المتحدة)، فينكانتيري مارين جروب (الولايات المتحدة)، فيجور إندستريال ذ.م.م. (الولايات المتحدة)، إبسيلون سيستمز سوليوشنز (الولايات المتحدة)، بلودورث مارين (الولايات المتحدة)، كولونا شيبيارد (الولايات المتحدة)، كونراد شيبياردز (الولايات المتحدة)، ديتينز شيبياردز (الولايات المتحدة)، جلف كوبر آند مانوفاكتشرينغ كوربوريشن (الولايات المتحدة)، إتش إس دي مارين آند شيبريبير بي تي إي المحدودة (سنغافورة) وغيرها.

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى رؤى السوق مثل القيمة السوقية ومعدل النمو وشرائح السوق والتغطية الجغرافية والجهات الفاعلة في السوق وسيناريو السوق، فإن تقرير السوق الذي أعده فريق أبحاث السوق في Data Bridge يتضمن تحليلًا متعمقًا من الخبراء وتحليل الاستيراد / التصدير وتحليل التسعير وتحليل استهلاك الإنتاج وتحليل PESTLE.

|

تحليل القطاعات

يتم تقسيم سوق خدمات إصلاح وصيانة السفن في الولايات المتحدة إلى أربعة قطاعات بارزة بناءً على السفينة ونوع الخدمة والتطبيق والمستخدم النهائي.

- على أساس السفينة، يتم تقسيم السوق إلى ناقلات النفط والمواد الكيميائية، وسفن الحاويات، وناقلات البضائع السائبة الجافة، والبضائع العامة، ونقل الغاز، وسفن الركاب، وسفن التبريد وغيرها

في عام 2024، من المتوقع أن يهيمن قطاع ناقلات النفط والمواد الكيميائية على سوق خدمات إصلاح وصيانة السفن في الولايات المتحدة

في عام 2024، سيقود قطاع ناقلات النفط والمواد الكيميائية سوق خدمات إصلاح وصيانة السفن في الولايات المتحدة بحصة سوقية تبلغ 19.14%، مدفوعًا بالطلب المتزايد على الطاقة والامتثال التنظيمي الصارم والتركيز على الاستدامة، مما يستلزم حلول صيانة متقدمة وترقيات تكنولوجية لتحقيق الكفاءة التشغيلية.

- على أساس نوع الخدمة، يتم تقسيم السوق إلى الصيانة والإصلاح

في عام 2024، من المتوقع أن يهيمن قطاع الصيانة على سوق خدمات إصلاح وصيانة السفن في الولايات المتحدة

ومن المتوقع أن يهيمن قطاع الصيانة على السوق في عام 2024 بنسبة 56.83% بسبب زيادة استخدام السفن، والمتطلبات التنظيمية للسلامة والامتثال البيئي، والحاجة إلى الكفاءة التشغيلية المستمرة، مما يدفع الطلب على خدمات الصيانة الوقائية والروتينية.

- بناءً على التطبيق، يُقسّم السوق إلى: أعمال الإرساء، وقطع غيار المحركات، والخدمات العامة، والأعمال الكهربائية والخدمات المساعدة، وغيرها. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع الإرساء على السوق بحصة سوقية تبلغ ٣٥.٧٣٪.

- بناءً على المستخدم النهائي، يُقسّم السوق إلى قطاعين: حكومي ودفاعي وتجاري. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع الحكومة والدفاع على السوق بحصة سوقية تبلغ ٧٠.٠٧٪.

اللاعبون الرئيسيون

تقوم شركة Data Bridge Market Research بتحليل شركات BAE Systems (المملكة المتحدة)، و Fincantieri Marine Group (الولايات المتحدة)، و General Dynamics NASSCO (الولايات المتحدة)، و Epsilon Systems Solutions Inc (الولايات المتحدة)، و Vigor Industrial LLC. (الولايات المتحدة) باعتبارها اللاعبين الرئيسيين في سوق خدمات إصلاح وصيانة السفن في الولايات المتحدة.

تطورات السوق

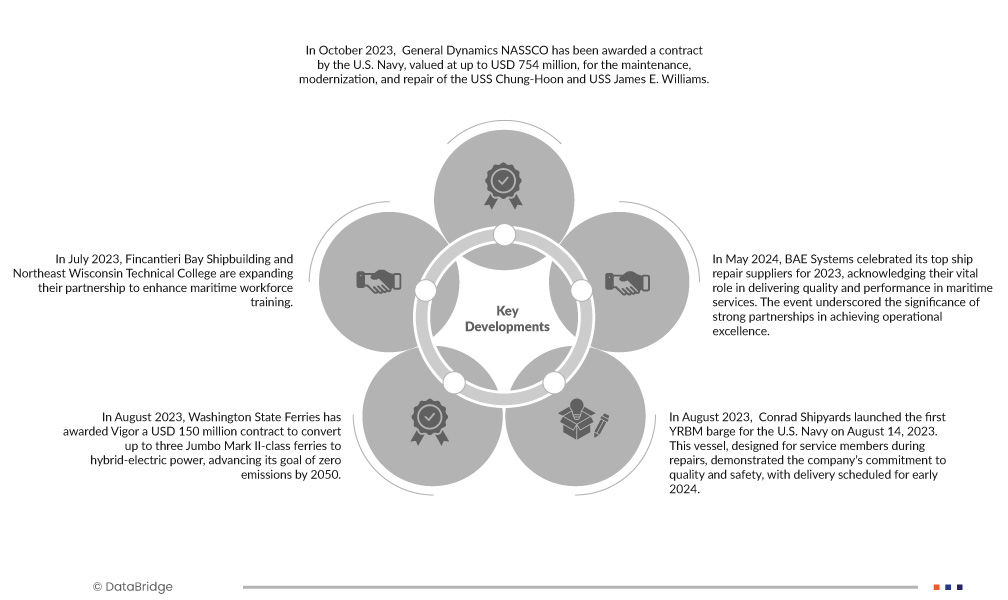

- في أكتوبر 2024، حصلت شركة بي إيه إي سيستمز على عقد بقيمة 92 مليون دولار أمريكي من البحرية الأمريكية لإنتاج محركات دفع للغواصات من فئة فرجينيا. سيعزز هذا العقد قدرات الشركة في تقنيات الغواصات المتقدمة، ويعزز مكانتها في قطاع الدفاع، مساهمًا في النمو والابتكار المستمرين، مع دعم مبادرات الأمن القومي.

- في أكتوبر 2023، حصلت شركة جنرال ديناميكس ناسكو على عقد من البحرية الأمريكية بقيمة تصل إلى 754 مليون دولار أمريكي لصيانة وتحديث وإصلاح السفينتين الحربيتين يو إس إس تشونغ هون وجيمس إي ويليامز. وستُنفذ المرحلة الأولى، التي تبلغ قيمتها 15.6 مليون دولار أمريكي، في نورفولك وسان دييغو، مع إمكانية تمديدها حتى نوفمبر 2030، مما يعزز قدرات ناسكو في مجال خدمات الإصلاح البحري.

- في يونيو 2024، حصلت أحواض بناء السفن التابعة لشركة فينكانتيري في ويسكونسن، فينكانتيري مارينيت مارين وفينكانتيري آي سي إي مارين، على تكريم من منظمة جرين مارين لممارساتها المستدامة. وبقيادة المهندسة البيئية ماكايلا جاكوبس، ارتقت الأحواض إلى المستوى الثالث في إدارة النفايات، مُظهرةً التزامها بحلول بناء السفن الصديقة للبيئة.

- في أغسطس 2023، منحت شركة Washington State Ferries شركة Vigor عقدًا بقيمة 150 مليون دولار أمريكي لتحويل ما يصل إلى ثلاث عبارات من فئة Jumbo Mark II إلى طاقة كهربائية هجينة، مما يعزز هدفها المتمثل في تحقيق انبعاثات صفرية بحلول عام 2050. تهدف هذه المبادرة، وهي جزء من برنامج WSF للكهرباء بقيمة 3.98 مليار دولار أمريكي، إلى تقليل انبعاثات الغازات المسببة للاحتباس الحراري بشكل كبير وتعزيز موثوقية الأسطول القديم.

لمزيد من المعلومات التفصيلية حول تقرير سوق خدمات إصلاح وصيانة السفن في الولايات المتحدة، انقر هنا - https://www.databridgemarketresearch.com/reports/us-ship-repair-and-maintenance-services-market