إدارة الأسطول هي ممارسة تُمكّن المؤسسات من إدارة وتنسيق مركبات التوصيل لتحقيق أقصى قدر من الكفاءة وخفض التكاليف. تُستخدم هذه الممارسة لمراقبة وتسجيل سعاة البريد وموظفي التوصيل. تتطلب هذه الممارسة نظامًا تكنولوجيًا يُسهّل على مدير الأسطول تنسيق الأنشطة، من إدارة الوقود إلى تخطيط المسارات، ويمكن إدارتها بسهولة باستخدام برامج إدارة الأسطول. لقد غيّر النمو السريع للتجارة الإلكترونية في المملكة العربية السعودية سلوك المستهلك، مما أدى إلى زيادة كبيرة في الطلب على الخدمات اللوجستية. مع تزايد انتشار التسوق عبر الإنترنت، تحتاج الشركات إلى أنظمة توصيل موثوقة وفعّالة لتلبية توقعات العملاء بشحنات سريعة ودقيقة. يستلزم هذا الطلب المتزايد حلولًا مُحسّنة لإدارة الأسطول لضمان التسليم في الوقت المحدد والكفاءة التشغيلية.

احصل على التقرير الكامل على https://www.databridgemarketresearch.com/reports/saudi-arabia-fleet-management-market

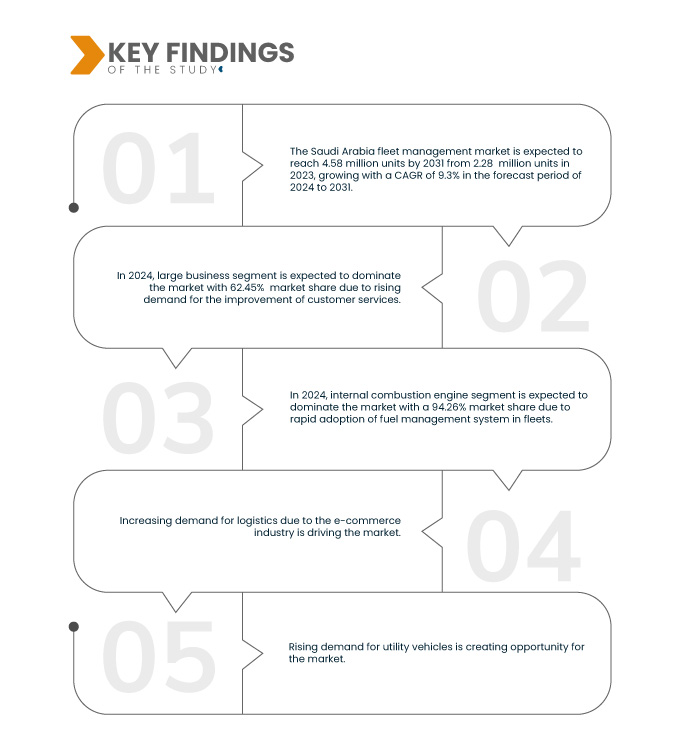

تشير تحليلات أبحاث سوق Data Bridge إلى أن سوق إدارة الأسطول في المملكة العربية السعودية من المتوقع أن يصل إلى 4.58 مليون وحدة بحلول عام 2031 من 2،280.69 مليون وحدة في عام 2023، بنمو بمعدل نمو سنوي مركب قدره 9.3٪ في الفترة المتوقعة من 2024 إلى 2031.

النتائج الرئيسية للدراسة

ارتفاع الطلب على المركبات الخدمية

المركبات متعددة الاستخدامات هي مركبات مصممة ومستخدمة لنقل البضائع أو الركاب. تشمل هذه المركبات الشاحنات والشاحنات الصغيرة والحافلات وغيرها من المركبات المماثلة المستخدمة للأغراض التجارية. يُعد سوق المركبات متعددة الاستخدامات مكونًا أساسيًا في صناعة السيارات في المملكة العربية السعودية وقد شهد نموًا كبيرًا على مدى العقود الماضية. يمكن أن يُعزى ارتفاع الطلب على مركبات الخدمات إلى عدة عوامل، بما في ذلك نمو صناعة التجارة الإلكترونية وزيادة التحضر والحاجة إلى أنظمة نقل فعالة. مع اعتماد المزيد والمزيد من الشركات على مركبات الخدمات لتلبية احتياجات النقل الخاصة بها، من المتوقع أيضًا أن يزداد الطلب على خدمات وبرامج إدارة الأسطول. أحد أسباب ارتفاع الطلب على مركبات الخدمات هو نمو صناعة التجارة الإلكترونية. وقد زاد الطلب على خدمات النقل مع تزايد عدد منصات التسوق عبر الإنترنت. ونتيجة لذلك، أصبح استخدام مركبات الخدمات أكثر شيوعًا، وأصبحت إدارة الأسطول أكثر أهمية.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

السنوات التاريخية

|

2022 (قابلة للتخصيص من 2016 إلى 2021)

|

الوحدات الكمية

|

الإيرادات بالملايين من الوحدات

|

القطاعات المغطاة

|

حجم الأسطول (أساطيل صغيرة (أقل من 100 مركبة)، أساطيل متوسطة (100-500 مركبة)، أساطيل كبيرة وتجارية (500 مركبة فأكثر))، نوع العمل (شركات كبيرة وصغيرة)، نوع المركبة ( محرك احتراق داخلي ومركبة كهربائية)، وسيلة النقل (سيارات ركاب، مركبات تجارية خفيفة، ومركبات تجارية ثقيلة)، المستخدم النهائي (الطاقة والمرافق، السيارات، البناء، التجزئة، النقل والخدمات اللوجستية، التصنيع، الحكومة، التعدين، الرعاية الصحية، الأغذية والمشروبات، الزراعة، وغيرها)

|

الدول المغطاة

|

المملكة العربية السعودية

|

الجهات الفاعلة في السوق المغطاة

|

أوراكل (الولايات المتحدة)، فليت روت (الإمارات العربية المتحدة)، إس إيه بي إس إي (ألمانيا)، زين (المملكة العربية السعودية)، ديتاساد كلاود (المملكة العربية السعودية)، أودوتيك السعودية (المملكة العربية السعودية)، لوكو ناف (الولايات المتحدة)، شركة المقاولات الكهربائية والطاقة (المملكة العربية السعودية)، فالكون فليت مانجمنت (المملكة العربية السعودية)، وتي يو في سود (ألمانيا) وغيرها.

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى رؤى السوق مثل القيمة السوقية ومعدل النمو وشرائح السوق والتغطية الجغرافية والجهات الفاعلة في السوق وسيناريو السوق، فإن تقرير السوق الذي أعده فريق أبحاث السوق في Data Bridge يتضمن تحليلًا متعمقًا من الخبراء وتحليل الاستيراد / التصدير وتحليل التسعير وتحليل استهلاك الإنتاج وتحليل PESTLE.

|

تحليل القطاعات

يتم تقسيم سوق إدارة الأسطول في المملكة العربية السعودية إلى خمسة قطاعات بارزة، والتي تعتمد على أساس حجم الأسطول ونوع العمل ونوع السيارة ووسيلة النقل والمستخدم النهائي.

- على أساس حجم الأسطول، يتم تقسيم السوق إلى أساطيل صغيرة (أقل من 100 مركبة)، وأساطيل متوسطة (100-500 مركبة)، وأساطيل كبيرة ومؤسسية (500 مركبة أو أكثر).

في عام 2024، من المتوقع أن تهيمن الأساطيل الصغيرة (أقل من 100 مركبة) على سوق إدارة الأساطيل في المملكة العربية السعودية

من المتوقع أن تهيمن شريحة الأساطيل الصغيرة (أقل من 100 مركبة) على السوق في عام 2024 بحصة سوقية تبلغ 39.61% بسبب احتياجها المتزايد إلى حلول إدارة متقدمة وتتبع في الوقت الفعلي عبر أساطيل واسعة النطاق لتحسين الكفاءة التشغيلية وضمان الامتثال التنظيمي.

- على أساس نوع العمل، يتم تقسيم السوق إلى أعمال كبيرة وأعمال صغيرة

في عام 2024، من المتوقع أن يستحوذ قطاع الأعمال الكبير على سوق إدارة الأسطول في المملكة العربية السعودية

في عام ٢٠٢٤، من المتوقع أن تهيمن شريحة الأعمال الكبيرة على السوق بحصة سوقية تبلغ ٦٢.٤٥٪، بفضل قدرتها على توفير دقة عالية ومرونة في قياس الأشكال الهندسية المعقدة عبر مختلف الصناعات. كما أن دمجها في عمليات مراقبة الجودة يعزز الكفاءة ويضمن الامتثال لمعايير التصنيع الصارمة.

- بناءً على نوع المركبة، يُقسّم السوق إلى محرك احتراق داخلي وسيارة كهربائية . في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع محركات الاحتراق الداخلي على السوق بحصة سوقية تبلغ ٩٤.٢٦٪.

- بناءً على وسيلة النقل، يُقسّم السوق إلى سيارات ركاب، ومركبات تجارية خفيفة، ومركبات تجارية ثقيلة. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع سيارات الركاب على السوق بحصة سوقية تبلغ ٤٠.٥٧٪.

- بناءً على المستخدم النهائي، يُقسّم السوق إلى قطاعات السيارات، والنقل والخدمات اللوجستية، وتجارة التجزئة، والتصنيع، والأغذية والمشروبات، والطاقة والمرافق، والتعدين، والقطاع الحكومي، والرعاية الصحية، والزراعة، والبناء، وغيرها. ومن المتوقع أن يهيمن قطاع الطاقة والمرافق على السوق بحصة سوقية تبلغ 18.72% في عام 2024.

اللاعبون الرئيسيون

تقوم شركة Data Bridge Market Research بتحليل شركات Zain (الكويت)، وTÜV SÜD (ألمانيا)، وSAP SE (ألمانيا)، وOracle (الولايات المتحدة)، وFleetroot (الإمارات العربية المتحدة) باعتبارها الشركات الرئيسية العاملة في السوق.

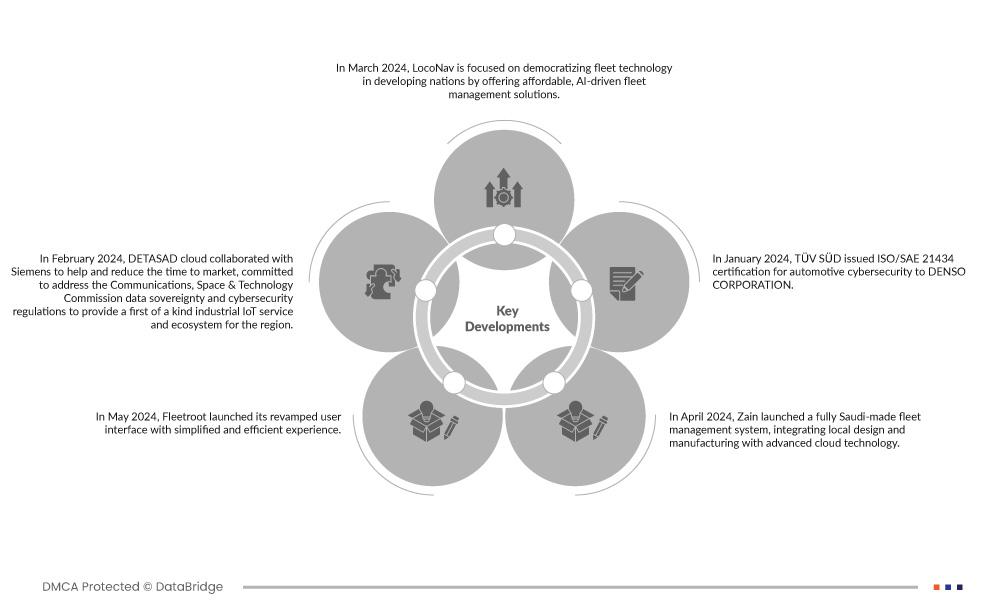

تطوير السوق

- في أبريل 2024، أطلقت زين نظامًا لإدارة الأسطول، مُصنَّعًا بالكامل في السعودية، يجمع بين التصميم والتصنيع المحلي وتقنيات الحوسبة السحابية المتقدمة. وقد كشف هذا النظام عن محفظة منتجات جديدة، ووفّر شريحة جديدة للشركات المتوسعة ذات المنتجات المحلية.

- في يناير 2024، منحت TÜV SÜD شهادة ISO/SAE 21434 للأمن السيبراني للسيارات لشركة DENSO CORPORATION. تؤكد هذه الشهادة أن مكونات وأنظمة مركبات DENSO تلبي معايير الأمن السيبراني الدولية طوال دورة حياتها. بفضل هذه الشهادة، تُثبت DENSO التزامها بتأمين عمليات التطوير، مما يعزز الثقة والامتثال في صناعة السيارات.

- في أبريل 2024، حصلت إدارة النقل من SAP على لقب "رائدة" في تقرير Gartner Magic Quadrant للعام العاشر على التوالي. يوفر هذا الحل تكاملاً شاملاً، يغطي العمليات اللوجستية من المشتريات إلى تسوية الشحنات. ويلتزم SAP بالابتكار المستمر، بما في ذلك الاستفادة من الذكاء الاصطناعي والتعلم الآلي لتحسين العمليات وتعزيز تجارب العملاء. وقد ساعد هذا الشركة على اكتساب قاعدة عملاء أكبر في السوق.

- في يناير 2024، أطلقت شركة أوراكل قدرات لوجستية مُحسّنة، مما ساعد العملاء على خفض التكاليف، وتعزيز الدقة، وأتمتة الامتثال التنظيمي، وزيادة المرونة في سلاسل التوريد العالمية. وقد أثبتت هذه الميزات فعاليتها في نجاح الشركة، حيث حسّنت بشكل كبير الكفاءة التشغيلية والأداء العام.

- في مايو 2024، أطلقت فليت روت واجهة مستخدم مُحسّنة لتجربة مُبسّطة وفعّالة. تتميز بتصميم عصري وبديهي وسهل الاستخدام لضمان الكفاءة. سيساعد هذا الشركة على توسيع قاعدة عملائها من خلال واجهة مستخدم مُبسّطة وسهلة الاستخدام.

لمزيد من المعلومات التفصيلية حول سوق إدارة الأسطول في المملكة العربية السعودية، انقر هنا - https://www.databridgemarketresearch.com/reports/saudi-arabia-fleet-management-market