Global Transaction Handling Market

市场规模(十亿美元)

CAGR :

%

USD

15.30 Billion

USD

98.40 Billion

2024

2032

USD

15.30 Billion

USD

98.40 Billion

2024

2032

| 2025 –2032 | |

| USD 15.30 Billion | |

| USD 98.40 Billion | |

|

|

|

|

全球交易處理市場細分,按解決方案(電子簽名、工作流程自動化、身份驗證、文件存檔等)、部署模式(本地和雲端)、組織規模(中小企業和大型公司)、垂直行業(銀行和金融服務、保險、政府和國防、IT 和電信、零售、醫療保健、能源、公用事業、製造業等)– 行業趨勢和預測到 2032 年

交易處理市場分析

在數位技術進步、電子商務興起以及對安全支付解決方案日益增長的需求的推動下,交易處理市場實現了大幅成長。隨著企業和消費者轉向無現金交易,對高效即時處理系統的需求日益加劇。行動錢包、非接觸式支付和加密貨幣等電子支付系統的採用擴大了市場機會。此外,區塊鏈技術和人工智慧(AI)的進步提高了交易處理的安全性、透明度和速度,降低了詐欺風險並改善了客戶體驗。交易處理市場的關鍵趨勢是整合人工智慧和機器學習 (ML) 以進行詐欺偵測和預防。人工智慧演算法可以即時分析交易模式,快速識別潛在威脅。此外,臉部辨識和指紋掃描等生物辨識認證技術的興起進一步加強了安全措施。

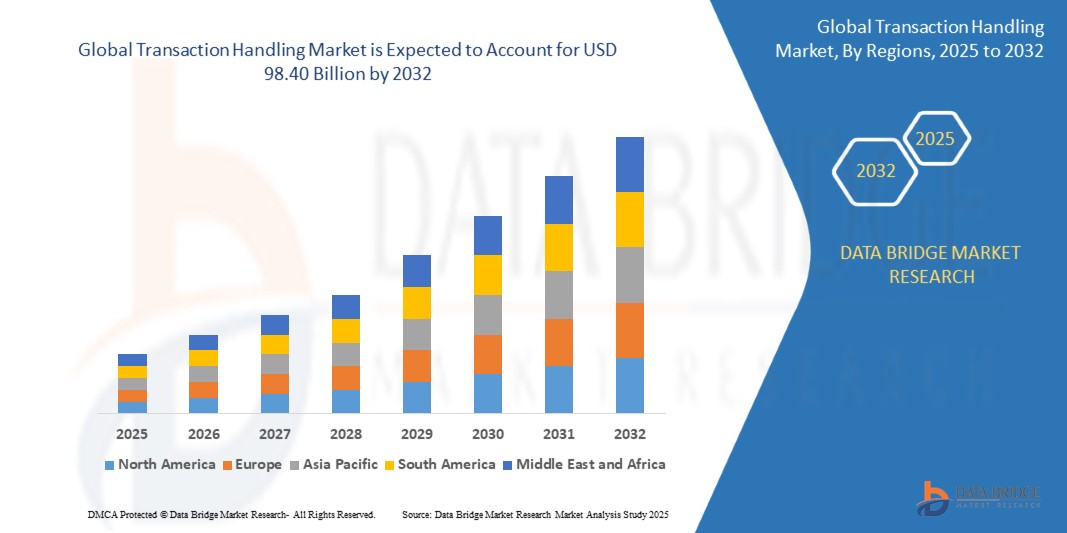

由於數位支付系統的高度採用,北美仍然是主導地區,而亞太地區則正經歷最快的成長,這得益於中國和印度等國家數位交易數量的增加。隨著監管框架的發展和消費者信任的增加,交易處理解決方案市場預計將大幅擴張。

交易處理市場規模

2024 年全球交易處理市場規模價值為 153 億美元,預計到 2032 年將達到 984 億美元,在 2025 年至 2032 年的預測期內複合年增長率為 26.20%。除了市場價值、成長率、市場區隔、地理覆蓋範圍、市場參與者和市場情景等市場洞察外,Data Bridge 市場研究團隊策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 pestle 分析。

交易處理市場趨勢

“人工智慧(AI) 與機器學習 (ML)的日益融合”

交易處理市場正在快速發展,其中一個關鍵趨勢是人工智慧 (AI) 和機器學習 (ML) 的整合,以增強詐欺檢測和即時交易處理。人工智慧演算法越來越多地被應用於監控交易模式、識別異常並預防詐欺活動的發生。例如,PayPal 使用人工智慧系統來偵測可疑交易,從而更快、更準確地預防詐欺。隨著數位交易量的持續成長,這一趨勢至關重要,特別是在北美和亞太等電子商務和行動支付迅速擴張的地區。此外,區塊鏈技術正在獲得越來越大的關注,為處理交易提供了更高的透明度和安全性,特別是在金融服務和供應鏈管理領域。隨著這些技術的不斷成熟,它們透過為企業和消費者提供更安全、更有效率、更透明的解決方案來推動市場成長,確保無縫的交易體驗,同時保持高安全標準。

報告範圍和交易處理市場細分

|

屬性 |

交易處理關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲的美國、加拿大和墨西哥、德國、法國、英國、荷蘭、瑞士、比利時、俄羅斯、義大利、西班牙、土耳其、歐洲其他地區、中國、日本、印度、韓國、新加坡、馬來西亞、澳洲、泰國、印尼、菲律賓、亞太地區 (APAC) 的其他地區、沙烏地阿拉伯、阿聯酋、南非、埃及、以色列、中東和非洲 (MEA) 的其他地區、其他地區、阿根廷地區的巴西地區 |

|

主要市場參與者 |

IDology(美國)、ACI Worldwide(美國)、ACTICO GmbH(德國)、BAE Systems(英國)、Beam Solutions(美國)、Bottomline Technologies, Inc.(美國)、Caseware International Inc.(加拿大)、ComplianceWise(荷蘭)、ComplyAdvantage(英國)、Eastnets(約旦)、Experian(愛爾蘭)、FD、FICO) Inc.(美國)、Infrasoft Technologies(印度)、IdentityMind Global(美國)、NICE(以色列)、Oracle(美國)、LSEG Data & Analytics(英國)、SAS Institute Inc.(美國)和 Software GmbH(德國) |

|

市場機會 |

|

|

加值資料資訊集 |

除了市場價值、成長率、市場區隔、地理覆蓋範圍、市場參與者和市場情景等市場洞察之外,Data Bridge 市場研究團隊策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 pestle 分析。 |

交易處理市場定義

交易處理是指管理、處理和保護各方之間的金融或資料交易的過程,通常涉及商品、服務或資訊的交換。這包括支付授權、詐欺預防、記錄保存以及確保交易資料的完整性和安全性等活動。

交易處理市場動態

驅動程式

- 數位支付的成長

隨著越來越多的消費者和企業接受線上購物、行動錢包使用和非接觸式支付,數位支付的成長已成為交易處理市場的重要驅動力。例如,PayPal 和 Apple Pay 等平台徹底改變了人們的購物方式,推動了向無現金交易的轉變。隨著這些數位支付方式變得越來越普遍,對高效率、安全的交易處理系統的需求也越來越大。快速無縫的支付處理對於滿足消費者對快速交易的期望以及確保防止詐欺的安全至關重要。此外,行動商務和點對點 (P2P) 支付系統(如 Venmo 和支付寶)的興起進一步推動了對能夠安全處理大量交易的強大交易系統的需求。數位支付的日益普及推動著市場向交易處理技術的創新發展,使其成為交易處理市場擴張的主要驅動力。

- 智慧型設備的普及率不斷提高

智慧型設備的日益普及是交易處理市場成長的主要驅動力。隨著智慧揚聲器、智慧型手機和虛擬助理的使用越來越廣泛,消費者越來越依賴這些設備來完成日常任務,包括管理他們的銀行帳戶。亞馬遜 Alexa、Google Assistant 和 Apple Siri 等語音助理都整合了銀行功能,讓用戶可以透過簡單的語音命令查看餘額、轉帳和付款。例如,美國銀行的客戶可以將他們的帳戶連結到 Alexa,並要求更新餘額或查詢最近的交易。這種無需動手即可享受銀行服務的便利,加上家庭和手機上智慧型設備的日益普及,正在鼓勵更多用戶採用交易處理。智慧型設備採用率的上升及其易用性繼續推動市場的發展,使交易處理更容易獲得並對消費者更具吸引力。

機會

- 安全技術的不斷進步

安全技術的進步為交易處理市場帶來了重大機遇,因為網路威脅的日益頻繁地推動了對更強大、更安全的系統的需求。區塊鏈等技術正在整合到支付系統中,透過創建不可變的交易記錄來增強透明度、可追溯性和安全性,從而降低詐欺和篡改的風險。例如,Ripple 利用區塊鏈提供安全、快速的跨境支付,提高交易可靠性。同樣,萬事達卡和維薩卡等公司使用的人工智慧詐欺檢測系統使用機器學習演算法即時監控交易,在詐欺活動發生之前識別並阻止它們。此外,臉部辨識和指紋掃描等生物辨識身分驗證方法也被納入支付解決方案中,以增加額外的安全層,確保只有授權個人才能完成交易。隨著企業和消費者繼續重視安全,這些技術進步提供了不斷增長的市場機會,公司投資於尖端系統來保障交易安全並建立消費者信任。

- 資料隱私和金融交易監管日益嚴格

隨著世界各國政府對資料隱私和金融交易實施更嚴格的監管,監管合規性正日益影響交易處理市場。例如,歐洲的《一般資料保護規範》(GDPR)和《支付服務指令2》(PSD2)等法規要求企業確保交易系統保護客戶資料並提供安全的付款流程。這些法規促使企業投資符合法律標準並增強消費者信任的合規交易處理系統。例如,全球支付處理商 Stripe 透過在其支付系統中整合強客戶身分驗證 (SCA) 等功能,確保同時符合 GDPR 和 PSD2。因此,對安全、合規解決方案的需求為企業創新和開發有助於企業遵守複雜監管框架的系統提供了市場機會。資料隱私法和金融法規的不斷發展進一步刺激了對保證合規的交易處理系統的需求,為市場參與者創造了一個利潤豐厚的成長領域。

限制/挑戰

- 成本管理

Cost management is a significant challenge in the transaction handling market, as the implementation and ongoing maintenance of these systems can be costly. Businesses must invest in the initial setup of transaction processing infrastructure and in continuous updates, security patches, and ensuring compliance with evolving regulations. For instance, the introduction of the General Data Protection Regulation (GDPR) in the European Union required companies to overhaul their data management practices, leading to substantial costs for updating systems and ensuring compliance. In addition, the need for advanced encryption, fraud detection systems, and maintaining high levels of uptime adds to the financial burden. These ongoing expenses, combined with the pressures of meeting customer expectations for security and speed, make cost management a constant challenge for businesses operating in this space, especially for small and medium-sized enterprises with limited budgets.

- Fraud and Security Risks

Fraud and security risks are a major challenge in the transaction handling market, as the increasing frequency and sophistication of cyber threats and fraud attempts can result in significant data breaches, financial losses, and a decline in consumer trust. For instance, in 2017, Equifax, one of the largest credit reporting agencies, suffered a massive data breach exposing the personal data of over 147 million people, leading to financial losses and severe reputational damage. Similarly, in the payment processing sector, fraud attempts, such as credit card skimming and phishing attacks, often compromise transaction data, prompting businesses to invest heavily in encryption technologies, multi-factor authentication, and real-time fraud detection systems. The constant evolution of cyber threats means transaction handling systems must continuously update their security measures, making this a significant and ongoing challenge for businesses in the market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Transaction Handling Market Scope

The market is segmented on the basis of solution, deployment mode, organization size, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Solution

- Electronic Signatures

- Workflow Automation

- Authentication

- Document Archival

- Others

Deployment Mode

- On-premise

- Cloud

Organization Size

- SMEs

- Large Companies

Vertical

- Banking and Financial Services

- Insurance

- Government and Defense

- IT and Telecommunications

- Retail

- Healthcare

- Energy

- Utilities

- Manufacturing

- Others

Transaction Handling Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, solution, deployment mode, organization size, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the transaction handling market, driven by the widespread adoption of advanced digital technologies and the presence of key industry players. The region benefits from robust financial infrastructure and high demand for secure and efficient transaction solutions across various sectors, including banking, retail, and e-commerce. In addition, North America’s emphasis on regulatory compliance and cybersecurity has fueled the adoption of innovative platforms that enhance transaction accuracy and safety. This dominant position is further supported by increased investments in technology and growing consumer preference for seamless digital experiences.

Asia-Pacific is experiencing the fastest growth in the transaction handling market, fueled by rapid digital transformation and the increasing adoption of electronic payment systems. The region's expanding e-commerce sector, coupled with rising smartphone penetration, has driven the demand for efficient and secure transaction solutions. Governments in countries such as India and China are actively promoting cashless economies through initiatives such as digital wallets and unified payment interfaces, further accelerating market growth. In addition, the region's large and growing population presents a vast consumer base, making Asia-Pacific a key area of focus for market players.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Transaction Handling Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Transaction Handling Market Leaders Operating in the Market Are:

- IDology (U.S.)

- ACI Worldwide (U.S.)

- ACTICO GmbH (Germany)

- BAE Systems (U.K.)

- Beam Solutions (U.S.)

- Bottomline Technologies, Inc. (U.S.)

- Caseware International Inc. (Canada)

- ComplianceWise (Netherlands)

- ComplyAdvantage (U.K.)

- Eastnets (Jordan)

- Experian (Ireland)

- FICO (U.S.)

- FIS (U.S.)

- Fiserv, Inc. (U.S.)

- Infrasoft Technologies (India)

- IdentityMind Global (U.S.)

- NICE (Israel)

- Oracle (U.S.)

- LSEG Data & Analytics (U.K.)

- SAS Institute Inc. (U.S.)

- Software GmbH (Germany)

Latest Developments in Transaction Handling Market

- In June 2024, OneSpan Inc. introduced the OneSpan Integration Platform, a solution aimed at simplifying the integration of eSignatures into widely used applications. In the platform enhances efficiency by streamlining the processes of sending, signing, and storing transactions. In with businesses using an average of 342 SaaS applications, the platform addresses challenges faced by IT teams in maintaining security and performance while optimizing business processes

- 2023 年 5 月,DocuSign 推出了 DocuSign Agreement Cloud,這是一個綜合平台,將其電子簽名技術與先進的文件管理和流程自動化功能相結合,使組織能夠有效地簡化其協議工作流程

- 2023 年 11 月,DocuSign 推出了 WhatsApp Delivery,該功能使用戶能夠透過將電子簽章與 WhatsApp 整合來加速交易完成。此功能向簽名者發送即時通知,將他們直接連結到協議,並透過他們首選的通訊平台提供安全且高效的簽名體驗

- 2022 年 9 月,DocuSign 與 Zavvie 合作,將其電子簽名技術與 MoxiEngage CRM 整合。此次合作增強了 Zavvie 的數位交易管理系統,使代理商能夠無縫管理與客戶的交易和協議工作流程

- 2022 年 12 月,Skyslope 宣布與 Weichert, Realtors 合作,為 7,000 多家企業員工提供其數位交易管理解決方案。此次合作擴大了 Skyslope 在美國和加拿大的影響力,為代理商提供領先的房地產交易數位簽名平台

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。