U.S. USB Charger Market, By Product (USB-A, USB-C, Micro-USB, Mini-USB, USB-3, and USB-B), Charger Type (Portable Power Bank/Docking System/Alarm Clock, Wall Chargers, Car Chargers, and Others), Port (Single Port and Multi-Port), Distribution Channel (Online and Offline), Power (30W-44W, 45W-59W, 60W-75W, and Others), Connector (Macro Connectors, Micro Connectors, and Others), Functionality (USB 2.0, USB 3.0, and Others), Application (Smartphones, Laptops, Desktop, Tablets, Headsets/Audio Accessories, Smartwatches, Camera/Video Cameras, Game Controllers, E-Readers, Smart Clocks, Music Players, Toys, Printers, Optical Drive and Hard Drive, and Others) - Industry Trends and Forecast to 2030.

U.S. USB Charger Market Analysis and Size

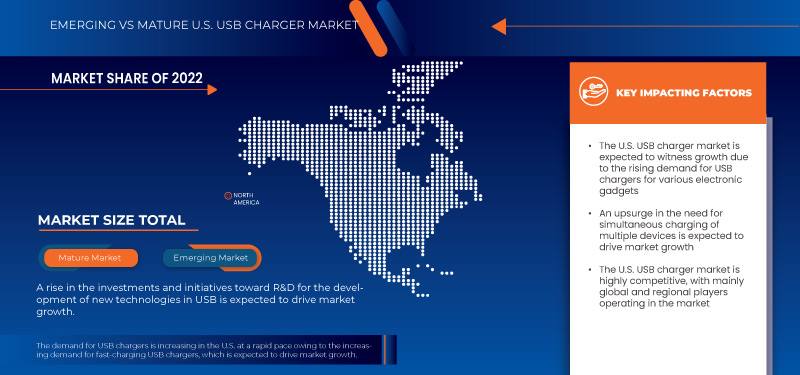

The rise in demand for smartphones is expected to drive market growth. In addition, an upsurge in the need for simultaneous charging of multiple devices and the growing demand for certified USB chargers are expected to further propel market growth. The major restraint that may negatively impact the market is the increase in the presence of counterfeit products. The enhanced R&D activities for a better experience are expected to provide opportunities for market growth. However, device fragmentation and compatibility issues are expected to pose a challenge to market growth.

The U.S. USB charger market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyzes that the market is growing with a CAGR of 6.2% in the forecast period of 2023 to 2030 and is expected to reach USD 11,032.46 million by 2030. The growing demand for certified USB chargers and increasing usage of smartphones is the major factor expected to drive market growth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Product (USB-A, USB-C, Micro-USB, Mini-USB, USB-3, and USB-B), Charger Type (Portable Power Bank/Docking System/Alarm Clock, Wall Chargers, Car Chargers, and Others), Port (Single Port and Multi-Port), Distribution Channel (Online and Offline), Power (30W-44W, 45W-59W, 60W-75W, and Others), Connector (Macro Connectors, Micro Connectors, and Others), Functionality (USB 2.0, USB 3.0, and Others), Application (Smartphones, Laptops, Desktop, Tablets, Headsets/Audio Accessories, Smartwatches, Camera/Video Cameras, Game Controllers, E-Readers, Smart Clocks, Music Players, Toys, Printers, Optical Drive and Hard Drive, and Others) |

|

Countries Covered |

U.S. |

|

Market Players Covered |

Goal Zero, J5create, MIZCO International Limited, myCharge, Nekteck, Ravpower, Spigen, Inc., Native Union, Belkin, ZAGG Inc., Fantasia Trading LLC, Apple Inc., Eaton, SAMSUNG, and AT&T Intellectual Property among others |

Market Definition

A Universal Serial Bus (USB) is a plug-and-play interface that allows computers to communicate with peripherals and other devices. USB-connected devices cover a broad range of keyboards and mice, music players, and flash drives. USB is used to send power to the devices, such as powering smartphones and tablets and charging their batteries. A power adapter that generates the 5-volt DC standard is required by USB. The amperage varies typically from .07A to 2.4A. The charger is plugged into an AC outlet, while a USB cable is plugged into the charger. USB ports on computers have an upper limit of up to 500 milliamps; however, USB chargers that come with cellphones and other devices handle the current of one or more amps.

U.S. USB Charger Market Dynamics

This section deals with understanding the market drivers, restraints, opportunities, and challenges. All of this is discussed in detail below:

Drivers

- Upsurge in the Need for Simultaneous Charging of Multiple Devices

Demand for USB wall chargers is rising very rapidly due to the short battery lives of the electronic devices. Also, people wants to charge all their electronic devices at the same time in order to utilize their time. This has risen the demand of multiport charger market as it is known to be a compact, and a convenient solution and is also very productive in every day’s life. It has also been witnessed that not only traveler but even entertainment, work and others too can use the multiport which helps them to charge its multiple devices at a fast rate. Thus, due to the increase in demand, many companies has come up with different multiport charger. The charger now contains two to seven ports in it which can help the customers to charge all their electronic devices at the same time.

Thus, an increase in the demand for multiport chargers will definitely cater to the need for charging multiple devices such as smartphones, laptops, and others at the same time and at fast rate, which is expected to drive market growth.

- Growing Demand for Certified USB Chargers

People are opting for a certified charger in the market as they are becoming aware of the advantages of certified products over fake chargers. This charger comes not only with good quality but with safety and protection making people opt for certified chargers, which leads to a rise in its demand in the market. Many companies are trying to get the USB IF certification to prove their product is of high quality and safe to use. Also, USB-IF cable certification program aims to provide USB end users with a list of cables that meet the quality standards necessary to operate in a USB environment. Moreover, many companies try for Qi certification as Qi-certified products are tested to international regulatory standards to increase safety, assure quality, reduce risk, prove interoperability, and ensure reliability.

Customers demand certified products to ensure product quality and safety, which is expected to drive market growth.

Opportunity

- Expansion in Demand for Fast Charging Charger in the Market

People nowadays have a fast life due to which they do not have much time to spare charging their devices, which leads to the increase in demand for fast-charging technology in the market. Many new technologies such as USB PD technology, USB 4.0, and others are developing which will help the consumer to charge his device in less time and carry on his work. Many companies are incorporating new and advanced technology in their charging solutions to cater to the rising demand of the market.

Thus, with the advancement in charging technology, companies can provide their consumers with fast chargers which will be safer and more efficient. This is expected to drive market growth.

Restraint

- Increase in the Presence of Counterfeit Products

The rise in the presence of fake products in the USB charger market is a significant concern for consumers, manufacturers, and regulatory bodies alike. Fake or counterfeit USB chargers refer to those products that imitate the appearance and branding of genuine chargers but often do not meet the safety, quality, and performance standards established by regulatory authorities. This issue has become more prevalent with the increasing demand for electronic devices and accessories. The manufacturing and distribution of electronic accessories including USB chargers can be subject to limited regulations and oversight in certain regions. This regulatory gap provides an opportunity for counterfeiters to exploit the market. Many companies are creating structurally similar products and selling them as real ones. But the quality of such product is very low which hamper the consumer and their devices. Fake product also damages the brand image of the company in the market. Counterfeit chargers often lack proper safety mechanisms, leading to a higher risk of electrical accidents, overheating, fires, and even electric shocks. The use of substandard components can result in serious safety issues. Poor-quality chargers can damage electronic devices by delivering incorrect voltage or current levels, leading to reduced battery life, performance issues, or complete device failure. Adding to this, their presence can decrease the total sales of the company.

Manufacturers, governments, and regulatory bodies also play a crucial role in combating the presence of fake products in the market. They can work together to establish and enforce stricter regulations to enhance product traceability and conduct regular market surveillance to make consumers aware of the risks associated with counterfeit products.

Challenge

- Device Fragmentation and Compatibility Issues

Device fragmentation specially refers to the wide range of devices with different charging requirements, connector types, and compatibility issues that manufacturers and consumers have to deal with while manufacturing. Different devices use various types of USB connectors such as USB-A, USB-C, and micro USB. These connectors have varying physical designs and capabilities, leading to the need for different types of chargers and cables. Devices have different battery capacities and power consumption levels. Some devices like smartphones and tablets require less power to charge, while laptops and others need higher wattages for efficient charging. Consumers need to navigate a complex landscape of charging options to find chargers that are compatible with their devices and provide the desired charging speeds.

Recent Developments

- In 2021, Spigen Inc. extended its range of ‘ArcStation Pro’ GaN-based fast chargers and introduced GaNFast 45W ArcStation Pro charger especially for Samsung’s flagship smartphone, the S21 Ultra. GaN, a next-generation semiconductor technology, is used in the charger that runs up to 100x faster than old, slow silicon (Si) and enables up to 3x more power or 3x faster charging in half the size & weight. In addition, it has dual USB-C outputs, which will help charge two devices at the same time. Thus, the company will be able to provide its customers with another fast multi-port charger

- In 2021, Belkin launched two new products SoundForm true wireless earbuds and a MagSafe compatible BoostCharge Pro Wireless charger. This charger has a quick charge feature, which gives 2 hours of playback with just 15 minutes of charging. Thus, the company has brought forward another fast wireless charger for its customers

U.S. USB Charger Market Scope

The U.S. USB charger market is segmented into eight notable segments based on product, charger type, port, distribution channel, power, connector, functionality, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- USB-A

- USB-C

- Micro-USB

- Mini-USB

- USB-3

- USB-B

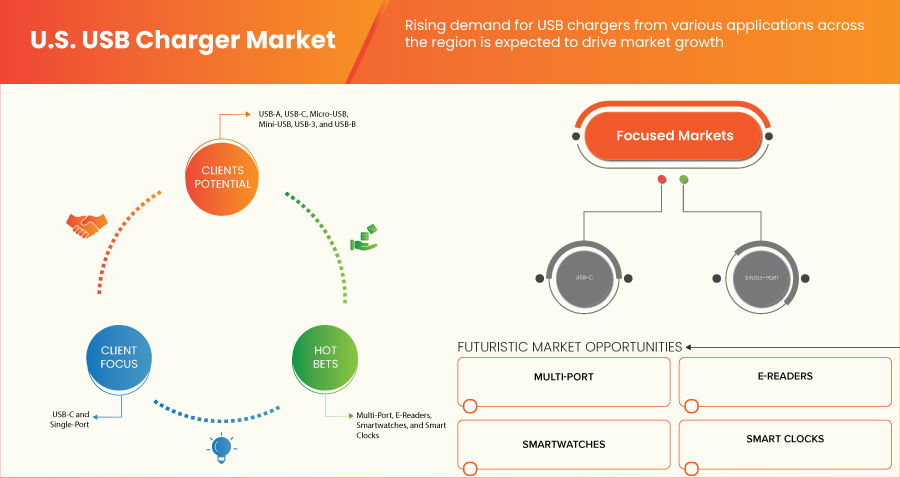

On the basis of product, the market is segmented into USB-A, USB-C, Micro-USB, Mini-USB, USB-3, and USB-B.

Charger Type

- Portable Power Bank/Docking System/Alarm Clock

- Wall Chargers

- Car Chargers

- Others

On the basis of charger type, the market is segmented into portable power bank/docking system/alarm clock, wall chargers, car chargers, and others.

Port

- Single Port

- Multi-Port

On the basis of port, the market is segmented into single port and multi-port.

Distribution Channel

- Online

- Offline

On the basis of distribution channel, the market is segmented into online and offline.

Power

- 30W-44W

- 45W-59W

- 60W-75W

- Others

On the basis of power, the market is segmented into 30W-44W, 45W-59W, 60W-75W, and others.

Connector

- Macro Connectors

- Micro Connectors

- Others

On the basis of connector, the market is segmented into macro connectors, micro connectors, and others.

Functionality

- USB 2.0

- USB 3.0

- Others

On the basis of functionality, the market is segmented into USB 2.0, USB 3.0, and others.

Application

- Smartphones

- Laptops

- Desktop

- Tablets

- Headsets/Audio Accessories

- Smartwatches

- Camera/Video Cameras

- Game Controllers

- E-Readers

- Smart Clocks

- Music Players

- Toys

- Printers

- Optical Drive and Hard Drive

- Others

On the basis of application, the market is segmented into smartphones, laptops, desktop, tablets, headsets/audio accessories, smartwatches, camera/video cameras, game controllers, e-readers, smart clocks, music players, toys, printers, optical drive and hard drive, and others.

Competitive Landscape and U.S. USB Charger Market Share Analysis

The USB charger market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the USB charger market.

Some of the major market players operating in the market are Goal Zero, J5create, MIZCO International Limited, myCharge, Nekteck, Ravpower, Spigen, Inc., Native Union, Belkin, ZAGG Inc., Fantasia Trading LLC, Apple Inc., Eaton, SAMSUNG, and AT&T Intellectual Property among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR APPLICATION COVERAGE GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 ADDITIONAL CUSTOMIZATION

5.1 MARKET SHARE ANALYSIS: BY PRODUCT (2022)

5.2 MARKET SHARE ANALYSIS (2022)

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 UPSURGE IN THE NEED FOR SIMULTANEOUS CHARGING OF MULTIPLE DEVICES

6.1.2 GROWING DEMAND FOR CERTIFIED USB CHARGERS

6.1.3 INCREASING DEMAND FOR SMARTPHONES

6.2 RESTRAINT

6.2.1 INCREASE IN THE PRESENCE OF COUNTERFEIT PRODUCTS

6.3 OPPORTUNITIES

6.3.1 ENHANCED RESEARCH AND DEVELOPMENT ACTIVITIES FOR BETTER PRODUCT EXPERIENCE AND RISING DEMAND FOR WIRELESS CHARGERS

6.3.2 EXPANSION IN DEMAND FOR FAST CHARGING CHARGERS IN THE MARKET

6.4 CHALLENGE

6.4.1 DEVICE FRAGMENTATION AND COMPATIBILITY ISSUES

7 U.S. USB CHARGER MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: U.S.

7.2 NEW PRODUCT LAUNCHES

7.3 PARTNERSHIP

7.4 RECOGNITION

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 APPLE INC.

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENT

9.2 AT&T INTELLECTUAL PROPERTY

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENTS

9.3 SAMSUNG

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENTS

9.4 BELKIN

9.4.1 COMPANY SNAPSHOT

9.4.2 PRODUCT PORTFOLIO

9.4.3 RECENT DEVELOPMENTS

9.5 EATON

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENTS

9.6 FANTASIA TRADING LLC

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENTS

9.7 GOAL ZERO

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENT

9.8 J5CREATE

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENTS

9.9 MIZCO INTERNATIONAL INC

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 RECENT DEVELOPMENTS

9.1 MYCHARGE

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENTS

9.11 NATIVE UNION

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENTS

9.12 NEKTECK

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 RECENT DEVELOPMENT

9.13 RAVPOWER (A SUBSIDIARY OF SUNVALLEYTEK LIMITED)

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENTS

9.14 SPIGEN,INC.

9.14.1 COMPANY SNAPSHOT

9.14.2 PRODUCT PORTFOLIO

9.14.3 RECENT DEVELOPMENTS

9.15 ZAGG INC.

9.15.1 COMPANY SNAPSHOT

9.15.2 PRODUCT PORTFOLIO

9.15.3 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

图片列表

FIGURE 1 U.S. USB CHARGER MARKET: SEGMENTATION

FIGURE 2 U.S. USB CHARGER MARKET: DATA TRIANGULATION

FIGURE 3 U.S. USB CHARGER MARKET: DROC ANALYSIS

FIGURE 4 U.S. USB CHARGER MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. USB CHARGER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. USB CHARGER MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 U.S. USB CHARGER MARKET: MULTIVARIATE MODELLING

FIGURE 8 U.S. USB CHARGER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. USB CHARGER MARKET: DBMR MARKET POSITION GRID

FIGURE 10 U.S. USB CHARGER MARKET: APPLICATION COVERAGE GRID

FIGURE 11 U.S. USB CHARGER MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 U.S. USB CHARGER MARKET: SEGMENTATION

FIGURE 13 THE INCREASING DEMAND FOR SMARTPHONES IS EXPECTED TO DRIVE THE GROWTH OF THE U.S. USB CHARGER MARKET IN THE FORECAST PERIOD

FIGURE 14 THE USB-C SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE U.S. USB CHARGER MARKET IN 2023 AND 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. USB CHARGER MARKET

FIGURE 16 U.S. USB CHARGER MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。