Us Uk Uae Mexico India And Philippines Gift Card Market

市场规模(十亿美元)

CAGR :

%

| 2024 –2031 | |

| USD 416.20 Billion | |

| USD 1,475.91 Billion | |

|

|

|

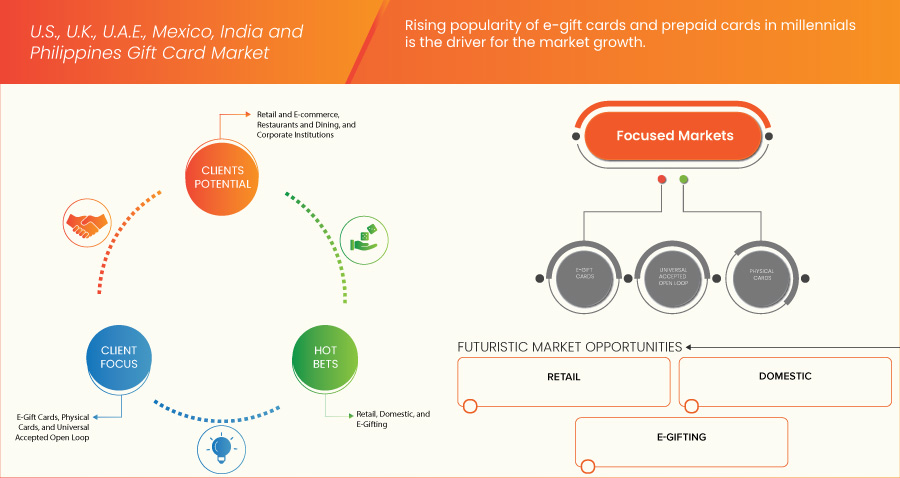

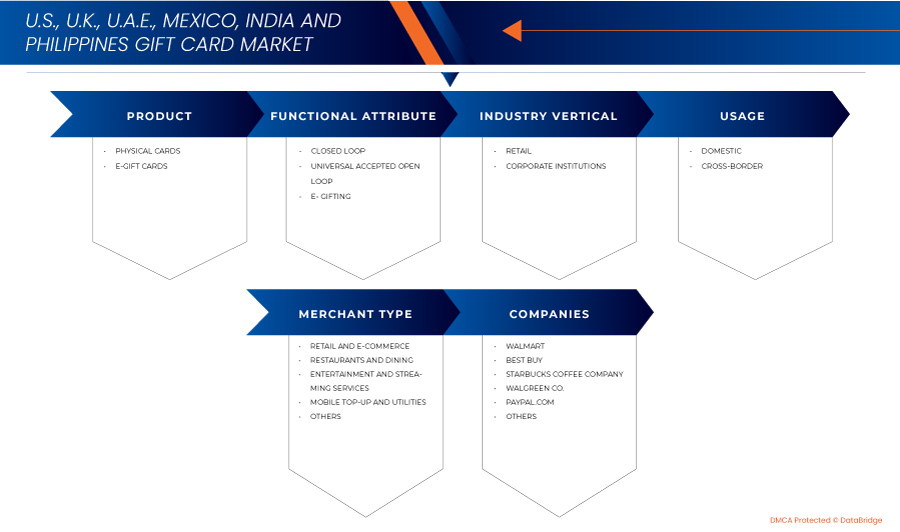

>美国、英国、阿联酋、墨西哥、印度和菲律宾礼品卡市场细分,按产品(实体卡和电子礼品卡)、功能属性(闭环、通用接受开环和电子礼品)、行业垂直(零售和企业机构)、用途(国内和跨境)、商家类型(零售和电子商务、餐厅和餐饮、娱乐和流媒体服务、移动充值和公用事业等) - 行业趋势和预测到 2031 年

礼品卡市场分析

美国、英国、阿联酋、墨西哥、印度和菲律宾的礼品卡市场呈现出多样化的增长趋势,这些趋势受不同消费者偏好和技术进步的影响。在美国和英国,市场受益于实体和数字礼品卡的高采用率,在零售和电子商务领域的使用量很大。由于阿联酋民众精通技术且网上购物文化日益兴起,对数字礼品卡的需求日益增加。墨西哥和印度的市场机会不断扩大,这得益于可支配收入的增加以及礼品卡在零售和企业部门的日益普及。在菲律宾,增长受到中产阶级崛起和电子商务扩张的推动,数字礼品卡越来越受欢迎。总的来说,这些市场反映出数字化、便利性和创新礼品解决方案的趋势。

礼品卡市场规模

美国、英国、阿联酋、墨西哥、印度和菲律宾礼品卡市场预计将从 2023 年的 4162 亿美元增至 2031 年的 14759.1 亿美元,在 2024 年至 2031 年的预测期内,复合年增长率为 17.5%。除了市场价值、增长率、细分市场、地理覆盖范围、市场参与者和市场情景等市场洞察外,Data Bridge 市场研究团队策划的市场报告还包括深入的专家分析、进出口分析、定价分析、生产消费分析和 PESTLE 分析。

礼品卡市场 趋势

“礼品卡在电子商务和数字支付解决方案中日益流行”

礼品卡在电子商务和数字支付解决方案中的日益普及是推动全球市场发展的关键因素。礼品卡为消费者提供了一种方便灵活的支付方式,通过提供无缝和安全的交易来增强在线平台的购物体验。许多电子商务巨头越来越多地加入礼品卡选项来吸引和留住客户,为特殊场合和促销活动提供个性化礼品卡。

此外,数字礼品卡也越来越受欢迎,因为它们提供即时交付和易于使用的功能,与向非接触式和数字支付的转变相一致。企业利用礼品卡进行客户忠诚度计划和员工激励,进一步推动了礼品卡的需求。移动钱包的兴起和数字支付基础设施的扩展预计将推动礼品卡市场的增长,使其成为现代消费者交易中的关键工具。

报告范围和礼品卡市场细分

|

属性 |

礼品卡滚轮关键市场洞察 |

|

涵盖的领域 |

|

|

覆盖国家 |

美国、墨西哥、英国、印度、菲律宾和阿联酋 |

|

主要市场参与者 |

星巴克咖啡公司(美国)、Target Brands, Inc.(美国)、美国运通公司(美国)、PayPal.com(美国)、Blackhawk Network(美国)、苹果公司(美国)、百思买(美国)、丝芙兰美国公司(美国)、Pine Labs(印度)、无印良品菲律宾公司(菲律宾)、Givex Corporation(加拿大)、Gyft, Inc(美国)、Tango Card. Inc(美国)、Plastek Card Solutions, Inc.(美国)、Huuray A/S(丹麦)、Diggecard(挪威)、Duracard Plastic Cards(美国)、Jigsaw Business Solutions(英国)、Stockpile, Inc.(美国)、Card USA, Inc(美国)、TransGate Solutions(美国)、Alltimeprint.com(美国)、沃尔玛(美国)、Under Armour, Inc.(美国)和 Walgreen Co.(美国)等 |

|

市场机会 |

|

|

增值数据信息集 |

除了市场价值、增长率、细分市场、地理覆盖范围、市场参与者和市场情景等市场洞察之外,Data Bridge 市场研究团队策划的市场报告还包括深入的专家分析、进出口分析、定价分析、生产消费分析和 PESTLE 分析。 |

礼品卡市场定义

礼品卡市场涵盖发行、分发和使用预付卡或数字代金券的行业,这些代金券具有特定货币价值,可用作付款或礼物。这些卡可以在指定零售商或在线平台上兑换商品或服务。该市场包括实体卡、数字卡和移动钱包,服务于零售、酒店和娱乐等各个行业。它还涉及卡管理、消费者参与和欺诈预防技术和解决方案的开发。消费者对便捷的送礼选择、企业激励计划和数字支付技术进步的需求推动了市场的发展。

礼品卡市场动态

驱动程序

- 提高预付卡和礼品卡的使用率

预付卡和礼品卡的使用率不断上升,在推动美国、英国、阿联酋、墨西哥、印度和菲律宾等不同地区市场增长方面发挥着关键作用。这些地区的消费者越来越多地转向预付卡和礼品卡,因为它们方便、灵活、用途广泛。此外,随着世界接受数字支付方式并经历电子商务活动的激增,这些卡自然会转向数字格式。在 COVID-19 疫情之后,电子商务销售额大幅增长,原因是由于封锁、社交距离措施和安全问题,消费者行为转向网上购物。此外,亚太地区是一些全球最大电子商务公司的所在地,例如阿里巴巴和亚马逊,它们正在该地区投入巨资。

例如,

- 2023 年 2 月,《福布斯》发表了一篇文章,指出即将到来的 2023 年,电子商务行业将迎来大幅增长,预计增长率为 10.4%。这一预测与更广泛的趋势一致;因为预计同年在线交易将占所有零售购买的 20.8%。因此,电子商务销售额的扩张是这种格局转变的自然结果。

电子礼品卡和预付卡在千禧一代中越来越受欢迎

礼品卡行业与数字世界息息相关。自从礼品卡流行以来,公司就开始使用数字营销策略和数字平台与客户进行虚拟互动。近年来,礼品卡行业通过营销和数字推广改善了与现有消费者的关系,而不是通过地理渠道和商店网络扩张来扩张。

例如,

- 2024 年 3 月,根据 FDRA 发布的文章,与其他世代相比,千禧一代更倾向于在购物中心兑换礼品卡。ICSC 调查显示,58% 的千禧一代更喜欢在购物中心的实体店使用礼品卡,凸显了他们对体验式消费的渴望。这一趋势对美国、英国、阿联酋、墨西哥、印度和菲律宾的礼品卡市场产生了显著影响。千禧一代对电子礼品卡和预付卡的吸引力日益增加,推动了对灵活便捷的兑换方式的需求,推动了市场扩张,并促使零售商改进其数字和店内礼品卡策略,以满足这一人群的偏好。

机会

- 加强市场参与者之间的合作与伙伴关系

市场参与者之间日益增多的合作与伙伴关系为美国、英国、阿联酋、墨西哥、印度和菲律宾的礼品卡市场创造了巨大的机遇。支付服务提供商、零售商、金融科技公司和移动钱包平台之间的战略联盟正在增强礼品卡在这些地区的分销和接受度。这些合作使公司能够利用彼此的优势,扩大其覆盖范围,并提高礼品卡对消费者的便利性和可及性。通过合作,企业可以整合创新技术并提供更全面的解决方案,推动市场的增长和采用。

例如,

- 2024 年 5 月,据《经济时报》报道,Google Wallet 与金融科技公司 Pine Labs 合作,在其印度平台上推出礼品卡服务,允许用户存储、管理和接收礼品卡提醒。此次合作凸显了礼品卡市场合作的上升趋势,有望推动美国、英国、阿联酋、墨西哥、印度和菲律宾的大幅增长。通过将礼品卡管理与领先的数字钱包和金融科技解决方案相结合,此次合作增强了消费者体验、扩大了市场范围并刺激了创新,为这些地区的更广泛采用和市场扩张奠定了基础。

数字经济蓬勃发展

随着美国、英国、阿联酋、墨西哥、印度和菲律宾数字经济的快速扩张,这些地区的礼品卡市场有望实现大幅增长。随着越来越多的消费者接受数字支付和在线购物,对数字礼品卡的需求预计将上升。这种数字化转变为市场参与者扩大产品范围并覆盖更广泛的受众提供了理想的环境。通过将礼品卡整合到流行的数字钱包和电子商务平台中,公司可以满足精通技术的消费者不断变化的偏好,提高便利性和可访问性。

例如,

- 2024 年 2 月,根据首席信息官 Africa Ltd. 发布的文章,非洲的数字礼品卡市场正在迅速扩张,预计 2023 年至 2030 年的复合年增长率 (CAGR) 为 15.3%。这一增长凸显了向更无缝、更安全和更环保的礼品解决方案的转变。蓬勃发展的数字经济为美国、英国、阿联酋、墨西哥、印度和菲律宾的礼品卡市场提供了重要机遇。随着这些地区接受数字化转型,数字礼品卡可以满足消费者对便利性和可持续性的偏好,从而推动市场增长和经济活动。

限制/挑战

- 替代支付渠道的采用率不断上升

消费者越来越多地接受移动钱包、加密货币和数字银行应用程序等新支付方式,而传统的预付卡和礼品卡市场面临着日益激烈的竞争。与实体或数字礼品卡相比,这些替代支付渠道提供了更大的便利性、安全性,而且通常具有更多功能。因此,消费者在金融交易和送礼方面对礼品卡的依赖越来越小。数字礼品卡行业的利益相关者必须创新并适应不断变化的消费者偏好,将这些替代支付选项整合到他们的产品中,同时提供独特的价值主张,使他们在不断发展的金融环境中脱颖而出,保持竞争力。

例如,

- 旧金山联邦储备银行 2021 年的一项研究表明,信用卡占所有支付交易的 28%,创下自 2016 年开展该研究以来的最高水平。该数据表明,消费者的偏好明显转向信用卡作为首选支付方式,超过了传统现金和其他支付方式。值得注意的是,收入水平较高的家庭使用信用卡的普及率更高,收入在 100,000 美元至 149,999 美元之间的家庭使用信用卡的普及率达到 34%,收入超过 150,000 美元的家庭使用信用卡的普及率达到 44%。

本市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入领域的机会、市场法规的变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新。如需获取更多市场信息,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您做出明智的市场决策,实现市场增长。

礼品卡市场范围

根据产品、功能属性、行业垂直、用途和商家类型,市场可分为五个显著的细分市场。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

产品

- 实体卡

- 电子礼品卡

功能属性

- 闭环

- 类型

- 零售闭环

- 餐厅闭环

- 杂项闭环

- 类型

- 通用开环

- 电子礼品

垂直行业

- 零售

- 公司机构

用法

- 国内的

- 跨境

商户类型

- 零售和电子商务

- 产品

- 实体卡

- 电子礼品卡

- 产品

- 餐厅和餐饮

- 产品

- 实体卡

- 电子礼品卡

- 产品

- 娱乐和流媒体服务

- 产品

- 实体卡

- 电子礼品卡

- 产品

- 手机充值和公用事业

- 产品

- 实体卡

- 电子礼品卡

- 产品

- 其他的

- 产品

- 实体卡

- 电子礼品卡

- 产品

礼品卡市场区域分析

根据产品、功能属性、行业垂直、用途和商家类型,市场分为五个显著的部分。

市场报告涵盖的国家包括美国、英国、阿联酋、墨西哥、印度和菲律宾。

美国凭借其庞大的消费群体、高可支配收入以及成熟的零售和电子商务行业,在礼品卡市场占据主导地位。礼品卡深深融入了美国消费文化,在零售、餐饮和娱乐等各个行业都广受欢迎。该国先进的数字基础设施支持电子礼品卡的日益增长的趋势,美国企业经常使用礼品卡进行促销、奖励和企业激励,从而促进了礼品卡的广泛采用和市场领导地位。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了美国、英国、阿联酋、墨西哥、印度和菲律宾品牌的存在和可用性,以及由于来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

礼品卡市场份额

市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对市场的关注有关。

在市场上运营的礼品卡市场领导者有:

- 星巴克咖啡公司(美国)

- Target Brands, Inc.(美国)

- 美国运通公司(美国)

- PayPal.com(美国)

- Blackhawk Network(美国)

- 苹果公司(美国)

- 百思买(美国)

- Sephora USA, Inc.(美国)

- Pine Labs(印度)

- MUJI Philippines Corp.(菲律宾)

- Givex 公司 (加拿大)

- Gyft, Inc(美国)

- Tango Card Inc(美国)

- Plastek Card Solutions, Inc.(美国)

- Huuray A/S(丹麦)

- Diggecard(挪威)

- Duracard 塑料卡(美国)

- Jigsaw 商业解决方案(英国)

- Stockpile, Inc.(美国)

- Card USA, Inc(美国)

- TransGate Solutions(美国)

- Alltimeprint.com(美国)

- 沃尔玛(美国)

- Under Armour, Inc.(美国)

- 沃尔格林公司(美国)

礼品卡市场的最新发展

- 2024 年 2 月,沃尔玛同意以 23 亿美元收购 VIZIO Holding Corp。此次收购使沃尔玛能够利用 VIZIO 的 SmartCast 操作系统来增强客户参与度和广告能力。通过整合 VIZIO 的平台,沃尔玛可以提供个性化的礼品卡选项和有针对性的促销活动,从而改善消费者体验并推动销售

- 2024 年 1 月,百思买 (Best Buy) 强调了其礼品卡的多功能性,让收礼人可以自由选择各种产品,包括电子产品和家用电器。该公司将礼品卡与 My Best Buy 奖励计划整合在一起,让用户可以赚取积分并获得独家促销。百思买还提供季节性和不定期的促销活动,提升了礼品卡的价值。这些卡可在线和店内使用,提供无缝的兑换体验

- 2022 年 5 月,星巴克咖啡公司报告称,未使用的礼品卡余额超过 10 亿美元。首席执行官霍华德·舒尔茨透露,每年有超过 1.2 亿人使用星巴克礼品卡。2021 年,客户为这些卡增加了 110 亿美元,为公司的收入做出了重大贡献

- 2023 年 2 月,沃尔格林收购了 Pharmaca,并将在 2023 年 2 月 25 日之前关闭包括圣达菲店在内的所有 Pharmaca 门店。此次收购使沃尔格林能够访问 Pharmaca 的处方文件和库存,从而有可能提升其药房服务。持有 Pharmaca 礼品卡的客户应核实附近沃尔格林门店的兑换选项

- 2023 年 10 月,PayPal.com 在 Venmo 上推出了一项新功能,允许用户直接通过该应用发送和接收星巴克、亚马逊和塔吉特等知名品牌的礼品卡。此功能为客户提供了一种便捷的数字礼品方式,增强了 Venmo 上的礼品体验。该公司受益于扩大其数字礼品选项,迎合了日益增长的数字交易趋势,并有可能增加平台上的用户参与度

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 DBMR MARKET POSITION GRID

2.8 DBMR MARKET POSITION GRID

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET POSITION GRID

2.11 DBMR MARKET POSITION GRID

2.12 MARKET INDUSTRY VERTICAL COVERAGE GRID

2.13 VENDOR SHARE ANALYSIS

2.14 MULTIVARIATE MODELING

2.15 PRODUCT TIMELINE CURVE

2.16 SECONDARY SOURCES

2.17 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCT ADOPTION SCENARIO

4.1.1 OVERVIEW

4.1.2 PRODUCT AWARENESS

4.1.3 PRODUCT INTEREST

4.1.4 PRODUCT EVALUATION

4.1.5 PRODUCT TRIAL

4.1.6 PRODUCT ADOPTION

4.1.7 CONCLUSION:

4.2 FACTORS AFFECTING BUYING DECISIONS

4.3 CONSUMER BUYING BEHAVIOR

4.3.1 OVERVIEW

4.3.2 RECOMMENDATIONS FROM FAMILY, FRIENDS AND DELEARS

4.3.3 RESEARCH

4.3.4 IMPULSIVE

4.3.5 ADVERTISEMENT

4.3.6 TELEVISION ADVERTISEMENT

4.3.7 ONLINE ADVERTISEMENT

4.3.8 IN-STORE ADVERTISEMENT

4.3.9 OUTDOOR ADVERTISEMENT

4.3.10 CONCLUSION

4.4 REGULATORY FRAMEWORK

4.5 PORTER’S FIVE FORCES ANALYSIS

4.6 BRAND COMPETITIVE ANALYSIS

4.7 SUPPLY CHAIN OF U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET

4.7.1 CARD TYPE

4.7.2 END USER SEGMENTATION

4.7.3 SALES CHANNEL

4.7.4 PRICE RANGE

4.8 DATA ON PLASTIC VS PAPER GIFT CARD MATERIAL

4.8.1 PLASTIC GIFT CARD MATERIAL

4.8.2 PAPER GIFT CARD MATERIAL

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING UTILIZATION OF PREPAID AND GIFT CARDS

5.1.2 RISING POPULARITY OF E-GIFT CARDS AND PREPAID CARDS IN MILLENNIALS

5.1.3 SURGING DEMAND IN E-COMMERCE

5.1.4 RAPID ADOPTION OF MOBILE PAYMENT SOLUTIONS

5.2 RESTRAINT

5.2.1 RISING ADOPTION OF ALTERNATIVE PAYMENT CHANNELS

5.3 OPPORTUNITIES

5.3.1 INCREASING COLLABORATION AND PARTNERSHIP AMONG MARKET PLAYERS

5.3.2 SURGING GROWTH OF THE DIGITAL ECONOMY

5.3.3 EMERGENCE OF ENHANCED FEATURES AND ADVANTAGES IN GIFT AND PREPAID CARDS

5.4 CHALLENGES

5.4.1 CHARGES ASSOCIATED WITH PREPAID AND GIFT CARDS

5.4.2 RISING SECURITY CONCERNS

6 U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 PHYSICAL CARDS

6.3 E-GIFTS CARDS

7 U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET, BY FUNCTIONAL ATTRIBUTE

7.1 OVERVIEW

7.2 CLOSED LOOP

7.2.1 CLOSED LOOP, BY TYPE

7.2.1.1 RETAIL CLOSED LOOP

7.2.1.2 RESTAURANT CLOSED LOOP

7.2.1.3 MISCELLANEOUS CLOSED LOOP

7.3 UNIVERSAL ACCEPTED OPEN LOOP

7.4 E-GIFTING

8 U.S., U.K., U.A.E., MEXICO., INDIA AND PHILIPPINES GIFT CARD MARKET, BY INDUSTRY VERTICAL

8.1 OVERVIEW

8.2 RETAIL

8.3 CORPORATE INSTITUTIONS

9 U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET, BY USAGE

9.1 OVERVIEW

9.2 DOMESTIC

9.3 CROSS-BORDER

10 U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET, BY MERCHANT TYPE

10.1 OVERVIEW

10.2 RETAIL AND E-COMMERCE

10.2.1 RETAIL AND E-COMMERCE, BY TYPE

10.2.1.1 PHYSICAL CARDS

10.2.1.2 E-GIFT CARDS

10.3 RESTAURANTS AND DINING

10.3.1 RESTAURANTS AND DINING, BY TYPE

10.3.1.1 PHYSICAL CARDS

10.3.1.2 E-GIFT CARDS

10.4 ENTERTAINMENT AND STREAMING SERVICES

10.4.1 ENTERTAINMENT AND STREAMING SERVICES, BY TYPE

10.4.1.1 PHYSICAL CARDS

10.4.1.2 E-GIFT CARDS

10.5 MOBILE TOP UP AND UTILITIES

10.5.1 MOBILE TOP UP AND UTILITIES, BY TYPE

10.5.1.1 PHYSICAL CARDS

10.5.1.2 E-GIFT CARDS

10.6 OTHERS

10.6.1 OTHERS, BY TYPE

10.6.1.1 PHYSICAL CARDS

10.6.1.2 E-GIFT CARDS

11 U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: U.S.

11.2 COMPANY SHARE ANALYSIS: MEXICO

11.3 COMPANY SHARE ANALYSIS: U.K.

11.4 COMPANY SHARE ANALYSIS: INDIA

11.5 COMPANY SHARE ANALYSIS: PHILIPPINES

11.6 COMPANY SHARE ANALYSIS: U.A.E.

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 WALMART

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 SERVICE PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 BEST BUY

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 STARBUCKS COFFEE COMPANY

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 WALGREEN CO.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 PAYPAL.COM

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALLTIMEPRINT.COM

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 AMERICAN EXPRESS COMPANY

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 APPLE INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 BLACKHAWK NETWORK

13.9.1 COMPANY SNAPSHOT

13.9.2 SOLUTION PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 CARD USA, INC

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 DIGGECARD

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 DURACARD PLASTIC CARDS

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 GIVEX CORPORATION

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 GYFT, INC.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 HUURAY A/S

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCTS PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 JIGSAW BUSINESS SOLUTIONS

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 MUJI PHILIPPINES CORP.

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 PINE LABS

13.18.1 COMPANY SNAPSHOT

13.18.2 TOOLS PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 PLASTEK CARD SOLUTIONS, INC.

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 SEPHORA USA, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

13.21 STOCKPILE, INC.

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

13.22 TANGO CARD. INC

13.22.1 COMPANY SNAPSHOT

13.22.2 SOLUTION PORTFOLIO

13.22.3 RECENT DEVELOPMENTS

13.23 TARGET BRANDS, INC.

13.23.1 COMPANY SNAPSHOT

13.23.2 REVENUE ANALYSIS

13.23.3 PRODUCT PORTFOLIO

13.23.4 RECENT DEVELOPMENT

13.24 TRANSGATE SOLUTIONS

13.24.1 COMPANY SNAPSHOT

13.24.2 SERVICE PORTFOLIO

13.24.3 RECENT DEVELOPMENTS

13.25 UNDER ARMOUR, INC.

13.25.1 COMPANY SNAPSHOT

13.25.2 REVENUE ANALYSIS

13.25.3 PRODUCT PORTFOLIO

13.25.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 TABLE- BRAND COMPETITIVE ANALYSIS

TABLE 2 LIST OF THE PEOPLE FOR WHOM THE GIFT CARDS ARE PURCHASED IN %

TABLE 3 AVERAGE COSTS ASSOCIATED WITH GIFT CARDS (IN USD)

TABLE 4 U.S. GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 5 MEXICO GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 6 U.K. GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 7 INDIA GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 8 PHILIPPINES GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 9 U.A.E. GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 10 U.S. CLOSED LOOP IN GIFT CARD MARKET, BY FUNCTIONAL ATTRIBUTE, 2022-2031 (USD MILLION)

TABLE 11 MEXICO CLOSED LOOP IN GIFT CARD MARKET, BY FUNCTIONAL ATTRIBUTE, 2022-2031 (USD MILLION)

TABLE 12 U.K. CLOSED LOOP IN GIFT CARD MARKET, BY FUNCTIONAL ATTRIBUTE, 2022-2031 (USD MILLION)

TABLE 13 INDIA CLOSED LOOP IN GIFT CARD MARKET, BY FUNCTIONAL ATTRIBUTE, 2022-2031 (USD MILLION)

TABLE 14 PHILIPPINES CLOSED LOOP IN GIFT CARD MARKET, BY FUNCTIONAL ATTRIBUTE, 2022-2031 (USD MILLION)

TABLE 15 U.A.E. CLOSED LOOP IN GIFT CARD MARKET, BY FUNCTIONAL ATTRIBUTE, 2022-2031 (USD MILLION)

TABLE 16 U.S. CLOSED LOOP IN GIFT CARD MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 17 MEXICO CLOSED LOOP IN GIFT CARD MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 18 U.K. CLOSED LOOP IN GIFT CARD MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 19 INDIA CLOSED LOOP IN GIFT CARD MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 20 PHILIPPINES CLOSED LOOP IN GIFT CARD MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 21 U.A.E. CLOSED LOOP IN GIFT CARD MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 22 U.S. GIFT CARD MARKET, BY INDUSTRY VERTICAL, 2022-2031 (USD MILLION)

TABLE 23 MEXICO GIFT CARD MARKET, BY INDUSTRY VERTICAL, 2022-2031 (USD MILLION)

TABLE 24 U.K. GIFT CARD MARKET, BY INDUSTRY VERTICAL, 2022-2031 (USD MILLION)

TABLE 25 INDIA GIFT CARD MARKET, BY INDUSTRY VERTICAL, 2022-2031 (USD MILLION)

TABLE 26 PHILIPPINES GIFT CARD MARKET, BY INDUSTRY VERTICAL, 2022-2031 (USD MILLION)

TABLE 27 U.A.E. GIFT CARD MARKET, BY INDUSTRY VERTICAL, 2022-2031 (USD MILLION)

TABLE 28 U.S. GIFT CARD MARKET, BY USAGE, 2022-2031 (USD MILLION)

TABLE 29 MEXICO GIFT CARD MARKET, BY USAGE, 2022-2031 (USD MILLION)

TABLE 30 U.K. GIFT CARD MARKET, BY USAGE, 2022-2031 (USD MILLION)

TABLE 31 INDIA GIFT CARD MARKET, BY USAGE, 2022-2031 (USD MILLION)

TABLE 32 PHILIPPINES GIFT CARD MARKET, BY USAGE, 2022-2031 (USD MILLION)

TABLE 33 U.A.E. GIFT CARD MARKET, BY USAGE, 2022-2031 (USD MILLION)

TABLE 34 U.S. GIFT CARD MARKET, BY MERCHANT TYPE, 2022-2031 (USD MILLION)

TABLE 35 MEXICO GIFT CARD MARKET, BY MERCHANT TYPE, 2022-2031 (USD MILLION)

TABLE 36 U.K. GIFT CARD MARKET, BY MERCHANT TYPE, 2022-2031 (USD MILLION)

TABLE 37 INDIA GIFT CARD MARKET, BY MERCHANT TYPE, 2022-2031 (USD MILLION)

TABLE 38 PHILIPPINES GIFT CARD MARKET, BY MERCHANT TYPE, 2022-2031 (USD MILLION)

TABLE 39 U.A.E. GIFT CARD MARKET, BY MERCHANT TYPE, 2022-2031 (USD MILLION)

TABLE 40 U.S. RETAIL AND E-COMMERCE IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 41 MEXICO RETAIL AND E-COMMERCE IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 42 U.K RETAIL AND E-COMMERCE IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 43 INDIA RETAIL AND E-COMMERCE IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 44 PHILIPPINES RETAIL AND E-COMMERCE IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 45 U.A.E. RETAIL AND E-COMMERCE IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 46 U.S. RESTAURANTS AND DINING IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 47 MEXICO RESTAURANTS AND DINING IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 48 U.K. RESTAURANTS AND DINING IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 49 INDIA RESTAURANTS AND DINING IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 50 PHILIPPINES RESTAURANTS AND DINING IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 51 U.A.E. RESTAURANTS AND DINING IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 52 U.S. ENTERTAINMENT AND STREAMING SERVICES IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 53 MEXICO ENTERTAINMENT AND STREAMING SERVICES IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 54 U.K. ENTERTAINMENT AND STREAMING SERVICES IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 55 INDIA ENTERTAINMENT AND STREAMING SERVICES IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 56 PHILIPPINES ENTERTAINMENT AND STREAMING SERVICES IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 57 U.A.E. ENTERTAINMENT AND STREAMING SERVICES IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 58 U.S. MOBILE TOP-UP AND UTILITIES IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 59 MEXICO MOBILE TOP-UP AND UTILITIES IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 60 U.K. MOBILE TOP-UP AND UTILITIES IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 61 INDIA MOBILE TOP-UP AND UTILITIES IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 62 PHILIPPINES MOBILE TOP-UP AND UTILITIES IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 63 U.A.E. MOBILE TOP-UP AND UTILITIES IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 64 U.S. OTHERS IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 65 MEXICO OTHERS IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 66 U.K. OTHERS IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 67 INDIA OTHERS IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 68 PHILIPPINES OTHERS IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 69 U.A.E. OTHERS IN GIFT CARD MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

图片列表

FIGURE 1 U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET: SEGMENTATION

FIGURE 2 U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET: DATA TRIANGULATION

FIGURE 3 U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET: DROC ANALYSIS

FIGURE 4 U.S. GIFT CARD MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 MEXICO GIFT CARD MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 6 U.K. GIFT CARD MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 7 U.A.E. GIFT CARD MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 8 INDIA GIFT CARD MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 9 PHILIPPINES GIFT CARD MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 10 U.S. GIFT CARD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 11 MEXICO GIFT CARD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 12 U.K. GIFT CARD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 13 INDIA GIFT CARD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 14 PHILIPPINES GIFT CARD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 15 U.A.E GIFT CARD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 16 U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 17 U.S. GIFT CARD MARKET: DBMR MARKET POSITION GRID

FIGURE 18 MEXICO GIFT CARD MARKET: DBMR MARKET POSITION GRID

FIGURE 19 U.K. GIFT CARD MARKET: DBMR MARKET POSITION GRID

FIGURE 20 INDIA GIFT CARD MARKET: DBMR MARKET POSITION GRID

FIGURE 21 PHILIPPINES GIFT CARD MARKET: DBMR MARKET POSITION GRID

FIGURE 22 U.A.E. GIFT CARD MARKET: DBMR MARKET POSITION GRID

FIGURE 23 U.S. GIFT CARD MARKET: MARKET INDUSTRY VERTICAL COVERAGE GRID

FIGURE 24 MEXICO GIFT CARD MARKET: MARKET INDUSTRY VERTICAL COVERAGE GRID

FIGURE 25 U.K GIFT CARD MARKET: MARKET INDUSTRY VERTICAL COVERAGE GRID

FIGURE 26 INDIA GIFT CARD MARKET: MARKET INDUSTRY VERTICAL COVERAGE GRID

FIGURE 27 PHILIPPINES GIFT CARD MARKET: MARKET INDUSTRY VERTICAL COVERAGE GRID

FIGURE 28 U.A.E. GIFT CARD MARKET: MARKET END USE COVERAGE GRID

FIGURE 29 U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET : VENDOR SHARE ANALYSIS

FIGURE 30 U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET: MULTIVARIATE MODELING

FIGURE 31 U.S. GIFT CARD MARKET: PRODUCT TIMELINE CURVE

FIGURE 32 U.K. GIFT CARD MARKET: PRODUCT TIMELINE CURVE

FIGURE 33 MEXICO GIFT CARD MARKET: PRODUCT TIMELINE CURVE

FIGURE 34 INDIA GIFT CARD MARKET: PRODUCT TIMELINE CURVE

FIGURE 35 PHILIPPINES GIFT CARD MARKET: PRODUCT TIMELINE CURVE

FIGURE 36 U.A.E. GIFT CARD MARKET: PRODUCT TIMELINE CURVE

FIGURE 37 U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET: SEGMENTATION

FIGURE 38 TWO SEGMENTS COMPRISE THE U.S. GIFT CARD MARKET, BY PRODUCT

FIGURE 39 TWO SEGMENTS COMPRISE THE U.K. GIFT CARD MARKET, BY PRODUCT

FIGURE 40 TWO SEGMENTS COMPRISE THE U.A.E. GIFT CARD MARKET, BY PRODUCT

FIGURE 41 TWO SEGMENTS COMPRISE THE MEXICO GIFT CARD MARKET, BY PRODUCT

FIGURE 42 TWO SEGMENTS COMPRISE THE INDIA GIFT CARD MARKET, BY PRODUCT

FIGURE 43 TWO SEGMENTS COMPRISE THE PHILIPPINES GIFT CARD MARKET, BY PRODUCT

FIGURE 44 U.S. GIFT CARD MARKET EXECUTIVE SUMMARY

FIGURE 45 U.K. GIFT CARD MARKET EXECUTIVE SUMMARY

FIGURE 46 U.A.E. GIFT CARD MARKET EXECUTIVE SUMMARY

FIGURE 47 MEXICO GIFT CARD MARKET EXECUTIVE SUMMARY

FIGURE 48 INDIA GIFT CARD MARKET EXECUTIVE SUMMARY

FIGURE 49 PHILIPPINES GIFT CARD MARKET EXECUTIVE SUMMARY

FIGURE 50 INCREASING UTILIZATION OF PREPAID AND GIFT CARDS IS EXPECTED TO DRIVE THE U.S. GIFT CARD MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 51 INCREASING UTILIZATION OF PREPAID AND GIFT CARDS IS EXPECTED TO DRIVE THE MEXICO GIFT CARD MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 52 INCREASING UTILIZATION OF PREPAID AND GIFT CARDS IS EXPECTED TO DRIVE THE U.K. GIFT CARD MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 53 INCREASING UTILIZATION OF PREPAID AND GIFT CARDS IS EXPECTED TO DRIVE THE INDIA GIFT CARD MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 54 INCREASING UTILIZATION OF PREPAID AND GIFT CARDS IS EXPECTED TO DRIVE THE PHILIPPINES GIFT CARD MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 55 INCREASING UTILIZATION OF PREPAID AND GIFT CARDS IS EXPECTED TO DRIVE THE U.A.E. GIFT CARD MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 56 PHYSICAL CARDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. GIFT CARD MARKET IN 2024 & 2031

FIGURE 57 PHYSICAL CARDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO GIFT CARD MARKET IN 2024 & 2031

FIGURE 58 PHYSICAL CARDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.K. GIFT CARD MARKET IN 2024 & 2031

FIGURE 59 PHYSICAL CARDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA GIFT CARD MARKET IN 2024 & 2031

FIGURE 60 PHYSICAL CARDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE PHILIPPINES GIFT CARD MARKET IN 2024 & 2031

FIGURE 61 PHYSICAL CARDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.A.E. GIFT CARD MARKET IN 2024 & 2031

FIGURE 62 PORTER’S FIVE FORCES ANALYSIS

FIGURE 63 SUPPLY CHAIN OF U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET

FIGURE 64 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S., U.K., U.A.E., MEXICO, INDIA AND PHILIPPINES GIFT CARD MARKET

FIGURE 65 GROWTH OF RETAIL E-COMMERCE SALES (USD TRILLION)

FIGURE 66 U.S. PREPAID CARD TRANSACTION VOLUME (USD)

FIGURE 67 PREFERENCE OF PURCHASING A GIFT CARD IN THE U.S. (IN %)

FIGURE 68 IMPORTANT FEATURES OF PREPAID CARDS ATTRACTING MILLENNIALS

FIGURE 69 CHANGE IN RETAIL TURNOVER YEAR ON YEAR BASIS IN % (JULY 2019 TO JULY 2020)

FIGURE 70 NUMBER OF ANNUAL GLOBAL DIGITAL PAYMENTS

FIGURE 71 TOTAL UPI TRANSACTIONS IN INDIA

FIGURE 72 TOTAL GLOBAL USE OF INTERNET FROM 2005 TO 2019 (IN %)

FIGURE 73 ADVANTAGES OF PREPAID CARDS

FIGURE 74 U.S. GIFT CARD MARKET: BY PRODUCT, 2023

FIGURE 75 MEXICO GIFT CARD MARKET: BY PRODUCT, 2023

FIGURE 76 U.K. GIFT CARD MARKET: BY PRODUCT, 2023

FIGURE 77 INDIA GIFT CARD MARKET: BY PRODUCT, 2023

FIGURE 78 PHILIPPINES GIFT CARD MARKET: BY PRODUCT, 2023

FIGURE 79 U.A.E. GIFT CARD MARKET: BY PRODUCT, 2023

FIGURE 80 U.S. GIFT CARD MARKET: BY FUNCTIONAL ATTRIBUTE, 2023

FIGURE 81 MEXICO GIFT CARD MARKET: BY FUNCTIONAL ATTRIBUTE, 2023

FIGURE 82 U.K. GIFT CARD MARKET: BY FUNCTIONAL ATTRIBUTE, 2023

FIGURE 83 INDIA GIFT CARD MARKET: BY FUNCTIONAL ATTRIBUTE, 2023

FIGURE 84 PHILIPPINES GIFT CARD MARKET: BY FUNCTIONAL ATTRIBUTE, 2023

FIGURE 85 U.A.E. GIFT CARD MARKET: BY FUNCTIONAL ATTRIBUTE, 2023

FIGURE 86 U.S. GIFT CARD MARKET: BY INDUSTRY VERTICAL, 2023

FIGURE 87 MEXICO GIFT CARD MARKET: BY INDUSTRY VERTICAL, 2023

FIGURE 88 U.K. GIFT CARD MARKET: BY INDUSTRY VERTICAL, 2023

FIGURE 89 INDIA GIFT CARD MARKET: BY INDUSTRY VERTICAL, 2023

FIGURE 90 PHILIPPINES GIFT CARD MARKET: BY INDUSTRY VERTICAL, 2023

FIGURE 91 U.A.E. GIFT CARD MARKET: BY INDUSTRY VERTICAL, 2023

FIGURE 92 U.S. GIFT CARD MARKET: BY USAGE, 2023

FIGURE 93 MEXICO GIFT CARD MARKET: BY USAGE, 2023

FIGURE 94 U.K. GIFT CARD MARKET: BY USAGE, 2023

FIGURE 95 INDIA GIFT CARD MARKET: BY USAGE, 2023

FIGURE 96 PHILIPPINES GIFT CARD MARKET: BY USAGE, 2023

FIGURE 97 U.A.E. GIFT CARD MARKET: BY USAGE, 2023

FIGURE 98 U.S. GIFT CARD MARKET: BY MERCHANT TYPE 2023

FIGURE 99 MEXICO GIFT CARD MARKET: BY MERCHANT TYPE 2023

FIGURE 100 U.K. GIFT CARD MARKET: BY MERCHANT TYPE 2023

FIGURE 101 INDIA GIFT CARD MARKET: BY MERCHANT TYPE 2023

FIGURE 102 PHILIPPINES GIFT CARD MARKET: BY MERCHANT TYPE 2023

FIGURE 103 U.A.E. GIFT CARD MARKET: BY MERCHANT TYPE 2023

FIGURE 104 U.S. GIFT CARD MARKET: COMPANY SHARE 2023 (%)

FIGURE 105 MEXICO GIFT CARD MARKET: COMPANY SHARE 2023 (%)

FIGURE 106 U.K. GIFT CARD MARKET: COMPANY SHARE 2023 (%)

FIGURE 107 INDIA GIFT CARD MARKET: COMPANY SHARE 2023 (%)

FIGURE 108 PHILIPPINES GIFT CARD MARKET: COMPANY SHARE 2023 (%)

FIGURE 109 U.A.E. GIFT CARD MARKET: COMPANY SHARE 2023 (%)

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.