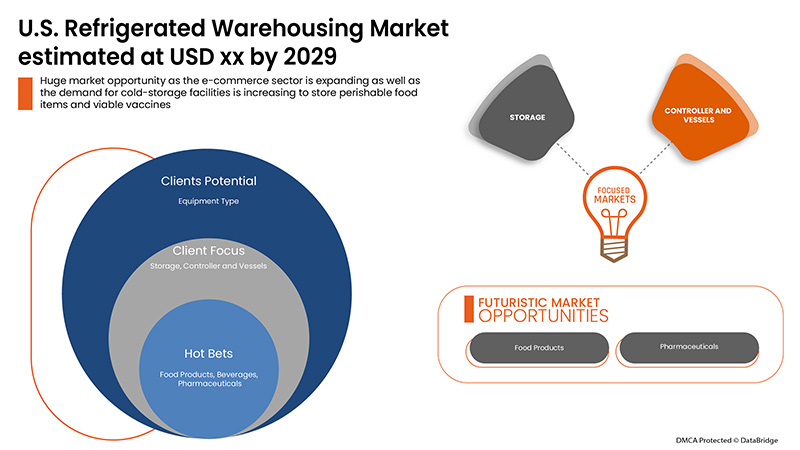

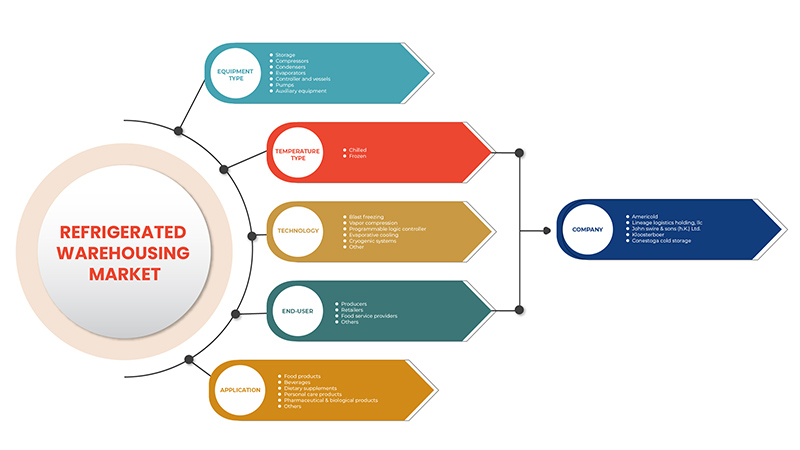

美国冷藏仓储市场,按设备类型(存储、压缩机、冷凝器、蒸发器、控制器和容器、泵和辅助设备)、技术(速冻、蒸汽压缩、可编程逻辑控制器、蒸发冷却、低温系统和其他技术)、温度类型(冷藏和冷冻)、最终用户(生产商、零售商、食品服务提供商等)、应用(食品、饮料、膳食补充剂、个人护理产品、药品和生物制品等)划分 - 行业趋势和预测 2029。

美国冷藏仓储市场分析与洞察

冷藏仓库被称为老年护理,包括满足所有要求。冷藏仓库可以定义为由用于存储易腐烂或温度敏感产品的设施和设备组成的工业综合体。冷藏仓库有助于为各行业的生产商、零售商和食品服务提供商提供温控服务。最新和创新技术用于最大限度地提高效率并在温控环境中存储产品。冷藏仓库用于储存食品、饮料、膳食补充剂、个人护理产品、药品和生物制品以及其他产品。

如今,创新型新型冷藏仓库已面世,并配备了各种新技术,如自动化、速冻、蒸汽压缩机、蒸发冷却等。用于储存易腐食品的冷藏仓库需求不断增长,再加上美国和加拿大零售网络的快速扩张,预计将推动市场需求。然而,冷藏仓库的高运营成本可能会阻碍市场的增长。

技术进步提高效率将为市场增长创造巨大机会,而市场参与者之间的激烈竞争可能会对市场增长带来挑战。

美国冷藏仓储市场预计将在 2022 年至 2029 年的预测期内实现市场增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,该市场以 4.8% 的复合年增长率增长,预计到 2029 年将达到 140.0284 亿美元。

|

报告指标 |

细节 |

|

预测期 |

2021 至 2029 年 |

|

基准年 |

2020 |

|

历史岁月 |

2019(可定制为 2019 - 2014) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按设备类型(储存、压缩机、冷凝器、蒸发器、控制器和容器、泵和辅助设备)、技术(速冻、蒸汽压缩、可编程逻辑控制器、蒸发冷却、低温系统和其他技术)、温度类型(冷藏和冷冻)、最终用户(生产商、零售商、食品服务提供商等)、应用(食品、饮料、膳食补充剂、个人护理产品、药品和生物制品等) |

|

覆盖国家 |

我们 |

|

涵盖的市场参与者 |

特伦顿冷藏公司、LINEAGE LOGISTICS HOLDING, LLC、康尼斯托加冷藏公司、Kloosterboer、Congebec、Americold、英国太古集团(香港)有限公司、Delta Pacific Seafoods、Cold Storage Inc.、Iceberg Cold Storage |

冷藏仓储市场动态

驱动程序

- 用于储存易腐食品的冷藏仓储需求不断增长

随着人们对延长食品保质期和减少食品浪费的需求不断增长,对冷藏设施的需求也随之增加,因为它们可以提供温度控制条件。此外,近年来,美国消费者对可持续和新鲜食品的需求不断增加,这也增加了冷藏设施中新鲜食品的进口量。

- 快速城镇化和零售渠道的扩张

快速的城市化最终带来了零售渠道的需求,以满足终端用户日益增长的需求,而这最终带来了对冷藏的需求。由于许多现有的食品建筑陈旧、低效且不适合处理电子商务,因此对新冷藏能力的需求也随之增加。

机会

- 冷藏仓储的技术进步

自动化处理、库存跟踪和实时温度跟踪方面的技术进步以及多样化举措将通过提供未来市场增长来帮助市场。对新技术的需求不断增长,以降低额外成本并提高冷藏仓储的效率,将为制造商提供有利可图的机会。

限制/挑战

- 冷藏仓库成本高

冷库建设成本高,运营成本高,维护成本高,这对制造商来说是一大难题。此外,建设冷库初期投资也很高。

新冠肺炎疫情对冷藏仓储市场的影响

COVID-19 对市场产生了积极影响,因为疫情增加了网上购物的趋势,尤其是食品杂货。疫情还增加了对可持续、新鲜和冷冻食品的需求,从而增加了对冷藏仓储市场的需求,预计这一趋势将持续更长时间。此外,疫苗运输需求增加,以保持其可行性。

近期发展

- 2022 年 3 月,LINEAGE LOGISTICS HOLDING, LLC 收购了领先的冷链供应商 MTC Logistics,以扩大其在美国和墨西哥湾沿岸港口的覆盖范围。该公司收购了位于马里兰州巴尔的摩、特拉华州威尔明顿和阿拉巴马州莫比尔港口附近的四家工厂。此次收购帮助该公司在美国增加了约 3800 万立方英尺的容量和超过 113,000 个托盘位置

- 2020 年 8 月,Americold 以 2500 万美元收购了佛罗里达州一座 320 万立方英尺的冷藏设施,并以 8250 万美元收购了 AM-C 仓库一座 1380 万立方英尺的冷藏设施。此次收购旨在扩大公司在佛罗里达州和德克萨斯州的影响力。

全球冷藏仓储市场范围

冷藏仓储市场细分为设备类型、技术、温度类型、最终用户和应用。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

设备类型

- 贮存

- 压缩机

- 冷凝器

- 蒸发器

- 控制器和容器

- 泵

- 辅助设备

根据设备类型,美国冷藏仓储市场分为储存、压缩机、冷凝器、蒸发器、控制器和容器、泵和辅助设备。

技术

- 速冻

- 蒸汽压缩

- 可编程逻辑控制器

- 蒸发冷却

- 低温系统

- 其他技术

根据技术,美国冷藏仓储市场细分为速冻、蒸汽压缩、可编程逻辑控制器、蒸发冷却、低温系统和其他技术。

温度类型

- 冷藏

- 冰冻

根据温度类型,美国冷藏仓储市场分为冷藏和冷冻。

最终用户

- 生产者

- 零售商

- 食品服务供应商

- 其他的

根据最终用户,美国冷藏仓储市场分为生产商、零售商、食品服务提供商和其他。

应用

- 食品

- 饮料

- 膳食补充剂

- 个人护理产品

- 药品和生物制品,

- 其他的

根据应用,美国冷藏仓储市场分为食品、饮料、膳食补充剂、个人护理产品、药品和生物制品等。

冷藏仓储市场区域分析/见解

对冷藏仓储市场进行分析,并按国家、设备类型、技术、温度类型、最终用户和应用提供市场规模见解和趋势。

由于大量主要市场参与者的存在,加上市场上冷藏仓库的扩张和收购数量不断增加,美国在预测期内将主导冷藏仓库市场。

报告的国家部分还提供了影响单个市场因素和市场法规变化的信息,这些因素和变化会影响市场的当前和未来趋势。新旧销售、国家人口统计、疾病流行病学和进出口关税等数据点是预测单个国家市场情况的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了全球品牌的存在和可用性以及它们因本土和国内品牌的激烈竞争而面临的挑战以及销售渠道的影响。

竞争格局和冷藏仓储市场份额分析

冷藏仓储市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对冷藏仓储市场的关注有关。

冷藏仓储市场的一些主要参与者包括 Trenton Cold Storage、LINEAGE LOGISTICS HOLDING, LLC、CONESTOGA COLD STORAGE、Kloosterboer、Congebec、Americold、John Swire & Sons (HK) Ltd.、Delta Pacific Seafoods、Cold Storage Inc. 以及 Iceberg Cold Storage 等。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、全球与区域和供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. REFRIGERATED WAREHOUSING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 EQUIPMENT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN OF U.S. REFRIGERATED WAREHOUSING MARKET

4.1.1 COMPONENTS OF REFRIGERATED WAREHOUSE

4.1.2 END-USERS

4.2 VALUE CHAIN OF U.S. REFRIGERATED WAREHOUSING MARKET

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5 TECHNOLOGICAL ADVANCEMENT IN THE REFRIGERATED WAREHOUSING INDUSTRY

4.6 POST-COVID MARKET SCENARIO

4.7 GLOBAL OVERVIEW

5 U.S AND CANADA REFRIGERATED WAREHOUSE MARKET, REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR REFRIGERATED STORAGE TO STORE PERISHABLE FOOD PRODUCTS

6.1.2 RAPID URBANIZATION AND THE EXPANSION OF RETAIL CHANNELS.

6.1.3 INCREASE IN THE NUMBER OF SUPERMARKETS IS FOSTERING THE DEMAND FOR REFRIGERATED WAREHOUSING

6.1.4 INCREASE IN DEMAND FOR REFRIGERATED WAREHOUSING IN THE PHARMACEUTICAL AND PERSONAL CARE INDUSTRY

6.2 RESTRAINS

6.2.1 HIGH COSTS ASSOCIATED WITH REFRIGERATED WAREHOUSING

6.2.2 HIGH INVESTMENT IN RESEARCH AND DEVELOPMENT ACTIVITIES FOR REFRIGERATED WAREHOUSING

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS IN REFRIGERATED WAREHOUSING PROVIDE LUCRATIVE OPPORTUNITIES FOR MARKET GROWTH

6.3.2 EXPANSION OF THE E-COMMERCE INDUSTRY

6.3.3 INCREASE IN NUMBER OF LAUNCHES OF REFRIGERATED WAREHOUSING BY MANUFACTURERS

6.4 CHALLENGES

6.4.1 HIGH OPERATING COST OF REFRIGERATED WAREHOUSE

6.4.2 HIGH COMPETITION AMONG MARKET PLAYERS

7 U.S. REFRIGERATED WAREHOUSING MARKET, BY EQUIPMENT TYPE

7.1 OVERVIEW

7.2 STORAGE

7.3 AUXILIARY EQUIPMENT

7.4 COMPRESSORS

7.5 CONDENSERS

7.6 EVAPORATORS

7.7 CONTROLLER AND VESSELS

7.8 PUMPS

8 U.S. REFRIGERATED WAREHOUSING MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 BLAST FREEZING

8.3 PROGRAMMABLE LOGIC CONTROLLER

8.4 EVAPORATIVE COOLING

8.5 VAPOR COMPRESSION

8.6 CRYOGENIC SYSTEMS

8.7 OTHERS

9 U.S. REFRIGERATED WAREHOUSING MARKET, BY TEMPERATURE TYPE

9.1 OVERVIEW

9.2 FROZEN

9.3 CHILLED

10 U.S. REFRIGERATED WAREHOUSING MARKET, BY END USER

10.1 OVERVIEW

10.2 PRODUCERS

10.3 FOOD SERVICE PROVIDERS

10.4 RETAILERS

10.5 OTHERS

11 U.S. REFRIGERATED WAREHOUSING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD PRODUCTS

11.2.1 FISH, MEAT, SEA FOOD

11.2.2 FUNCTIONAL FOOD

11.2.3 DAIRY PRODUCTS

11.2.3.1 DAIRY PRODUCTS, BY TYPE

11.2.3.1.1 ICE CREAM

11.2.3.1.2 CHEESE

11.2.3.1.3 YOGURT

11.2.3.1.4 OTHERS

11.2.4 PROCESSED FOOD

11.2.4.1 PROCESSED FOOD, BY TYPE

11.2.4.1.1 READY MEALS

11.2.4.1.2 JAMS, PRESERVES & MARMALADES

11.2.4.1.3 SAUCES, DRESSINGS AND CONDIMENTS

11.2.4.1.4 SOUPS

11.2.4.1.5 OTHERS

11.2.5 CONVENIENCE FOOD

11.2.5.1 CONVENIENCE FOOD, BY TYPE

11.2.5.1.1 SNACKS & EXTRUDED SNACKS

11.2.5.1.2 PIZZA & PASTA

11.2.5.1.3 INSTANT NOODLES

11.2.5.1.4 OTHERS

11.2.6 BAKERY

11.2.6.1 BAKERY, BY TYPE

11.2.6.1.1 CAKES, PASTRIES & TRUFFLE

11.2.6.1.2 BISCUIT, COOKIES & CRACKERS

11.2.6.1.3 BREAD & ROLLS

11.2.6.1.4 TART & PIES

11.2.6.1.5 BROWNIES

11.2.6.1.6 OTHERS

11.2.7 INFANT FORMULA

11.2.7.1 INFANT FORMULA, BY TYPE

11.2.7.1.1 FIRST INFANT FORMULA

11.2.7.1.2 COMFORT FORMULA

11.2.7.1.3 HYPOALLERGENIC FORMULA

11.2.7.1.4 ANTI-REFLUX (STAY DOWN) FORMULA

11.2.7.1.5 FOLLOW-ON FORMULA

11.2.7.1.6 OTHERS

11.2.8 CONFECTIONERY

11.2.8.1 CONFECTIONERY, BY TYPE

11.2.8.1.1 CHOCOLATE

11.2.8.1.2 CHOCOLATE SYRUPS

11.2.8.1.3 CARAMELS & TOFFEES

11.2.8.1.4 GUMS & JELLIES

11.2.8.1.5 HARD-BOILED SWEETS

11.2.8.1.6 MINTS

11.2.8.1.7 OTHERS

11.2.9 FROZEN DESSERTS

11.2.9.1 FROZEN DESSERTS, BY TYPE

11.2.9.1.1 GELATO

11.2.9.1.2 CUSTARD

11.2.9.1.3 OTHERS

11.2.10 OTHERS

11.3 PHARMACEUTICALS & BIOLOGICAL PRODUCTS

11.3.1 PHARMACEUTICALS & BIOLOGICAL PRODUCTS, BY TYPE

11.3.1.1 VACCINES

11.3.1.2 BLOOD AND BLOOD COMPONENTS

11.3.1.3 INSULIN

11.3.1.4 CAPSULES

11.3.1.5 TABLETS

11.3.1.6 OTHERS

11.4 BEVERAGES

11.4.1 BEVERAGES, BY TYPE

11.4.1.1 NON-ALCOHOLIC BEVERAGES

11.4.1.1.1 NON-ALCOHOLIC BEVERAGES, BY TYPE

11.4.1.1.1.1 DAIRY BASED DRINKS

11.4.1.1.1.1.1 REGULAR PROCESSED MILK

11.4.1.1.1.1.2 FLAVORED MILK

11.4.1.1.1.1.3 MILK SHAKES

11.4.1.1.1.2 PLANT BASED MILK

11.4.1.1.1.3 JUICES

11.4.1.1.1.4 SPORTS DRINKS

11.4.1.1.1.5 ENERGY DRINKS

11.4.1.1.1.6 SMOOTHIES

11.4.1.1.1.7 OTHERS

11.4.1.2 ALCOHOLIC BEVERAGES

11.4.1.2.1 ALCOHOLIC BEVERAGES, BY TYPE

11.4.1.2.1.1 BEERS

11.4.1.2.1.2 PACKAGED COCKTAIL BEVERAGES

11.4.1.2.1.3 OTHERS

11.5 DIETARY SUPPLEMENTS

11.5.1 DIETARY SUPPLEMENTS, BY TYPE

11.5.1.1 IMMUNITY SUPPLEMENTS

11.5.1.2 OVERALL WELLBEING SUPPLEMENTS

11.5.1.3 BONE AND JOINT HEALTH SUPPLEMENTS

11.5.1.4 SKIN HEALTH SUPPLEMENTS

11.5.1.5 OTHERS

11.6 PERSONAL CARE PRODUCTS

11.6.1 PERSONAL CARE PRODUCTS, BY TYPE

11.6.1.1 SKIN CARE

11.6.1.2 ORAL CARE

11.6.1.3 OTHERS

11.7 OTHERS

12 U.S. REFRIGERATED WAREHOUSING MARKET, BY COUNTRY

12.1 U.S.

13 U.S. REFRIGERATED WAREHOUSING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 LINEAGE LOGISTICS HOLDING, LLC

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENTS

15.2 AMERICOLD

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 JOHN SWIRE & SONS (H.K.) LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 COLD STORAGE INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 CONESTOGA COLD STORAGE

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 CONGEBEC

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DELTA PACIFIC SEAFOODS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ICEBERG COLD STORAGE

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 KLOOSTERBOER

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 TRETON COLD STORAGE

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

16 QUESTIONARE

17 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA MARKET LEADER IN TEMPERATURE-CONTROLLED WAREHOUSING

TABLE 2 GLOBAL MARKET LEADER IN TEMPERATURE-CONTROLLED WAREHOUSING

TABLE 3 STOCKS OF FROZEN AND CHILLED MEATS, DOMESTIC AND IMPORTED, IN COLD STORAGE, QUARTERLY (IN TONNES) (CANADA)

TABLE 4 CANADIAN STOCKS OF FROZEN AND CHILLED MEAT IN COLD STORAGE (IN TONNES)

TABLE 5 CANADIAN STOCKS OF FROZEN AND CHILLED MEAT IN COLD STORAGE (IN TONNES)

TABLE 6 CANADIAN STOCKS OF FROZEN AND CHILLED MEAT IN COLD STORAGE (IN TONNES)

TABLE 7 U.S. REFRIGERATED WAREHOUSING MARKET, BY EQUIPMENT TYPE, 2020-2029 (USD MILLION)

TABLE 8 U.S. REFRIGERATED WAREHOUSING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 9 U.S. REFRIGERATED WAREHOUSING MARKET, BY TEMPERATURE TYPE, 2020-2029 (USD MILLION)

TABLE 10 U.S. REFRIGERATED WAREHOUSING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 11 U.S. REFRIGERATED WAREHOUSING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 12 U.S. FOOD PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.S. DAIRY PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 U.S. PROCESSED FOOD IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 U.S. CONVENIENCE FOOD IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 U.S. BAKERY IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 U.S. INFANT FORMULA IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 U.S. CONFECTIONARY IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 U.S. FROZEN DESSERT IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.S. PHARMACEUTICAL & BIOLOGICAL PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 U.S. BEVERAGES IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 U.S. NON-ALCOHOLIC BEVERAGES IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 U.S. DAIRY BASED DRINKS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 U.S. ALCOHOLIC BEVERAGES IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 U.S. DIETARY SUPPLEMENTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 U.S. PERSONAL CARE PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.S. REFRIGERATED WAREHOUSING MARKET, BY EQUIPMENT TYPE, 2020-2029 (USD MILLION)

TABLE 28 U.S. REFRIGERATED WAREHOUSING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 29 U.S. REFRIGERATED WAREHOUSING MARKET, BY TEMPERATURE TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.S. REFRIGERATED WAREHOUSING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 31 U.S. REFRIGERATED WAREHOUSING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 U.S. FOOD PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. BAKERY IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. DAIRY PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 U.S. PROCESSED FOOD IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 U.S. CONFECTIONARY IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.S. FROZEN DESSERT IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.S. INFANT FORMULA IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.S. CONVENIENCE FOOD IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.S. BEVERAGES IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. NON-ALCOHOLIC BEVERAGES IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. DAIRY BASED DRINKS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. ALCOHOLIC BEVERAGES IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. DIETARY SUPPLEMENTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. PERSONAL CARE PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.S. PHARMACEUTICALS & BIOLOGICAL PRODUCTS IN REFRIGERATED WAREHOUSING MARKET, BY TYPE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 U.S. REFRIGERATED WAREHOUSING MARKET: SEGMENTATION

FIGURE 2 U.S. REFRIGERATED WAREHOUSING MARKET: DATA TRIANGULATION

FIGURE 3 U.S. REFRIGERATED WAREHOUSING MARKET: DROC ANALYSIS

FIGURE 4 U.S. REFRIGERATED WAREHOUSING MARKET: COUNTRY ANALYSIS

FIGURE 5 U.S. REFRIGERATED WAREHOUSING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. REFRIGERATED WAREHOUSING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. REFRIGERATED WAREHOUSING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. REFRIGERATED WAREHOUSING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 U.S. REFRIGERATED WAREHOUSING MARKET: SEGMENTATION

FIGURE 10 RAPID URBANIZATION AND EXPANSION OF RETAIL CHANNELS IS EXPECTED TO DRIVE THE U.S. REFRIGERATED WAREHOUSING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 STORAGE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. REFRIGERATED WAREHOUSING MARKET IN 2022 & 2029

FIGURE 12 VALUE CHAIN OF U.S. REFRIGERATED WAREHOUSING MARKET

FIGURE 13 PERISHABLE FOOD PRODUCTS IMPORTED AND EXPORTED FROM CANADA (CAD BILLIONS)

FIGURE 14 BOVINE PRODUCTS IMPORTED AND EXPORTED FROM CANADA (CAD BILLIONS)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. REFRIGERATED WAREHOUSING MARKET

FIGURE 16 U.S. REFRIGERATED WAREHOUSING MARKET: BY EQUIPMENT TYPE, 2021

FIGURE 17 U.S. REFRIGERATED WAREHOUSING MARKET: BY TECHNOLOGY, 2021

FIGURE 18 U.S. REFRIGERATED WAREHOUSING MARKET: BY TEMPERATURE TYPE, 2021

FIGURE 19 U.S. REFRIGERATED WAREHOUSING MARKET: BY END-USER, 2021

FIGURE 20 U.S. REFRIGERATED WAREHOUSING MARKET: BY APPLICATION, 2021

FIGURE 21 U.S. REFRIGERATED WAREHOUSING MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。