泰国滑石市场,按矿床类型(滑石碳酸盐、滑石绿泥石等)、最终用途(纸浆和造纸、塑料工业、陶瓷、油漆和涂料、化妆品和个人护理、制药、食品工业、橡胶工业等)划分,行业趋势和预测至 2029 年

市场分析和见解

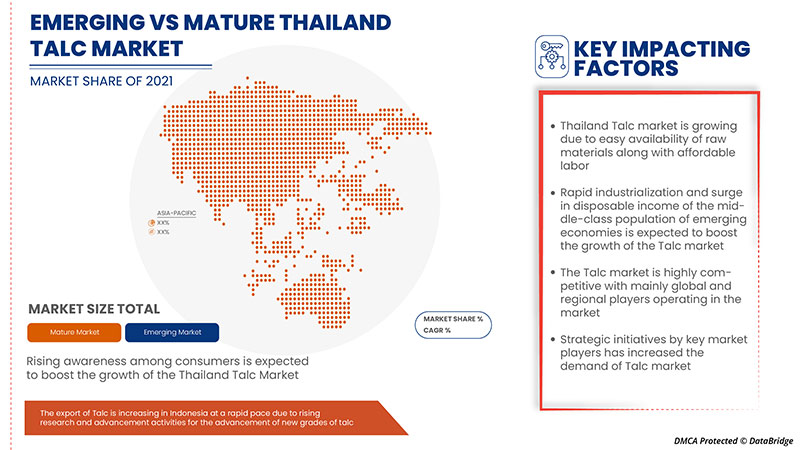

预计泰国滑石市场在 2022 年至 2029 年的预测期内将大幅增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,该市场的复合年增长率为 1.7%。

推动滑石市场增长的主要因素是其在生产汽车零部件轻质塑料方面的广泛应用、新兴经济体的快速工业化和中产阶级人口可支配收入的激增以及原材料的易得性和廉价的劳动力。

滑石因其优异的性能而被广泛应用,例如耐热性、出色的耐电性、耐油性和耐酸性以及油脂吸附性。这种材料用于各种终端行业,以增强使用滑石的产品的性能,包括导热性、刚度、抗冲击性、耐化学性和抗蠕变性,从而推动了泰国滑石市场的增长。

泰国滑石市场报告提供了市场份额、新发展以及国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报。我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史年份 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(千美元) |

|

涵盖的领域 |

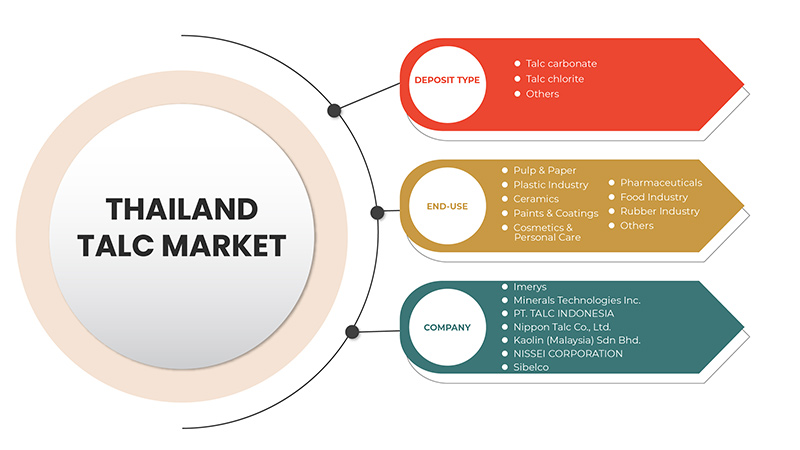

按矿床类型(滑石碳酸盐、滑石绿泥石、其他)、最终用途(纸浆和造纸、塑料工业、陶瓷、油漆和涂料、化妆品和个人护理、制药、食品工业、橡胶工业、其他) |

|

覆盖国家 |

泰国 |

|

涵盖的市场参与者 |

Imerys、Minerals Technologies Inc.、PT. TALC INDONESIA、Nippon Talc Co., Ltd.、Kaolin (Malaysia) Sdn Bhd.、NISSEI CORPORATION 和 Sibelco 等。 |

市场定义

滑石是一种由水合硅酸镁组成的矿物岩石。它用途广泛,最常见的是婴儿爽身粉。由于其耐热、耐电、耐酸、耐油、耐油脂,因此受到各行各业的广泛需求。其特点是矿物柔软、能保留香味、纯度高、颜色洁白。

Talc is an industrial raw material in powdered form. It is the softest mineral with one hardness on the Mohs scale. It is a versatile mineral with various properties and is used in many applications. Talc is chemically inert. It is insoluble in acids and has a platelet-like structure. They have excellent thermal shock and scratch resistance. Talc has low costs and is readily available. It protects from corrosion and good adhesion between surfaces by absorbing moisture.

Thailand Talc Market Dynamics

Drivers

- Extensive applications in producing lightweight plastics for automotive components

There has been increasing demand for talc from the automotive industry due to its growing applications in manufacturing underhood automotive parts. This augmented demand for talc from the automotive industry drives market growth. The lightweight plastic parts used in the automotive industry are produced from talc-reinforced polypropylene, which improves their performance and durability. Moreover, talc extends resistance against abrasion and corrosion. Apart from this, the increasing demand for automotive refinishes and OEM components for the automotive industry are expected to drive the growth of the talc market shortly. In addition, rapid development and industrialization in economies such as Thailand are propelling the demand for more automobiles, which will further boost the growth of the talc market in these regions.

- Rapid industrialization and surge in disposable income of the middle-class population of emerging economies

With the increasing demand from emerging economies, rising industrialization rates, and increasing disposable income, especially in middle-class population, there has been a growing demand for finished products such as automobiles, paints & coatings, and many others. Rapid industrialization in emerging economies such as Thailand and Indonesia is driving the growth of the talc market as talc is used in various end-use industries for several applications. The growing population and increasing disposable income of the middle-class population of emerging economies have led to the increased demand for different consumer products, such as cosmetics, ceramics, automotive plastic parts, and pharmaceuticals, which is, in turn, driving the growth of the talc market.

- Easy availability of raw materials along with affordable labor

Talc is a clay mineral composed of hydrated magnesium silicate and is widely used as a thickening agent, filler, or lubricant in various applications. Talc is a metamorphic mineral in veins, foliated masses, and certain rocks. It is associated with serpentine, tremolite, forsterite, and almost always with carbonates (calcite, dolomite, or magnesite) in the lower metamorphic facies. It also occurs as an alteration product from tremor lite or forsterite. Moreover, the Southeast Asian countries have a substantial cheap workforce compared to other regions and are engaged in mining and synthetic talc manufacturing. Therefore, the easy availability of talc raw materials in these regions and around will help in the growth of the Thailand talc market.

Opportunity

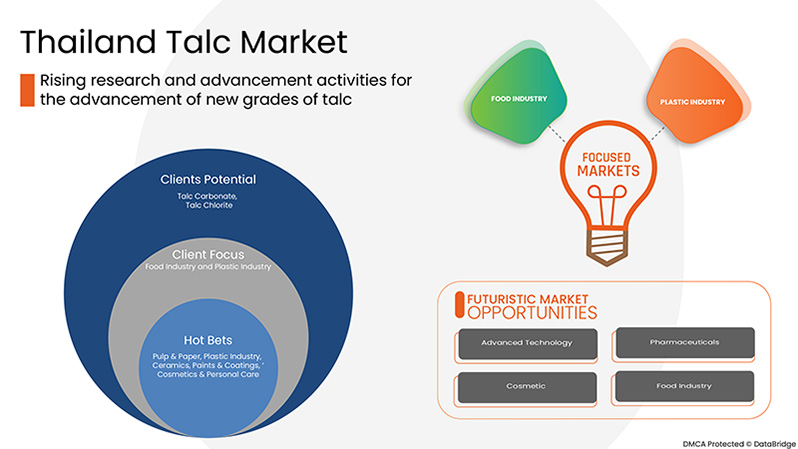

- Rise in research and advancement activities for the advancement of new grades of talc

The potential applications of talc are infinite, and continuous research & development activities in the talc industry are expected to help discover new applications and host a lot of opportunities for the growth of the talc industry. Continuous research & development activities are being carried out in the talc industry for the development of new grades of talc for use in various applications such as in barrier coatings in paperboard food packaging for the food industry and others. There are more emerging trends that have a direct impact on the dynamics of the talc industry. These include growing production of specialty micronized grade talc for plastic and increasing demand for talc in lightweight automotive plastic parts.

Restraints/Challenges

- Guidelines regulating the production as well as usage of talc

Stringent government regulations regarding the use of chemicals during the processing of talc and its usage are the factor that could hamper the growth of the Thailand talc market. There are strict concerns regarding the ill effects of chemicals used in manufacturing talc products. This has resulted in shifting preference from chemicals to green (bio-based) and environment-friendly talc products. Moreover, exposure to talc for a longer duration has serious ill effects on the body functions such as any application of talc on wounds can give rise to scab formation, possible infection, and foreign body granulomas in the dermis. Therefore, owing to these harmful effects created while the production and usage of talc, strict rules and regulations have been enforced, which can hamper the growth in the Thailand talc market.

- Moderate development of the pulp & paper industry due to digitization

由于数字化的发展,纸浆和造纸行业一直以缓慢的速度增长,这减少了造纸和纸浆行业对滑石的需求。在造纸过程中,滑石对产品有很大的好处。滑石用作纸张回收和新纸、纸浆和纸板生产的填料。滑石的特性可防止生产机器内的沥青结块。此外,滑石在造纸行业的主要用途是改善施胶。由于大多数国家向数字媒体和无纸化通信的过渡,纸浆和造纸行业在过去几年略有萎缩。因此,由于数字化,纸浆和造纸行业增长缓慢是短期内限制泰国滑石市场增长的主要因素。

- 容易获得替代品

滑石替代品的可用性是短期内对泰国滑石市场增长造成挑战的主要因素。市场上有各种各样的滑石替代品。在陶瓷应用中,这些滑石替代品包括膨润土、绿泥石、长石、高岭土和叶蜡石。涂料行业中的绿泥石、高岭土和云母。纸浆和造纸行业中的碳酸钙和高岭土。塑料中的膨润土、高岭土、云母和硅灰石以及橡胶制造业中的高岭土和云母。因此,市场上容易获得的各种滑石替代品将极大地挑战泰国滑石市场的增长和发展。

近期发展

- 2022 年,日本滑石株式会社收购了巴基斯坦 FAITH MINERALS (PVT.) LTD.,两公司于 2015 年成立了合资企业。该公司现为日本滑石株式会社的全资子公司。

COVID-19 对泰国滑石市场影响甚微

2020-2021 年,COVID-19 影响了各个制造业,导致工作场所关闭、供应链中断和运输限制。然而,滑石市场受到了重大影响。该国的滑石业务和供应链以及多家制造工厂仍在运营。在后疫情时代,服务提供商在采取卫生和安全措施后继续提供滑石产品。

泰国滑石市场范围

泰国滑石市场根据矿床类型和最终用途进行分类。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

存款类型

- 碳酸滑石

- 滑石绿泥石

- 其他的

根据矿床类型,泰国滑石市场分为碳酸滑石、绿泥石滑石等

最终用途

- 纸浆和造纸

- 塑料工业

- 陶瓷

- 油漆和涂料

- 化妆品和个人护理

- 药品

- 食品工业

- 橡胶工业

- 其他的

根据最终用途,泰国滑石市场分为纸浆和造纸、塑料工业、陶瓷、油漆和涂料、化妆品和个人护理、制药、食品工业、橡胶工业和其他。

竞争格局和泰国滑石市场份额分析

泰国滑石市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对泰国滑石市场的关注有关。

市场上的一些主要参与者包括 Imerys、Minerals Technologies Inc.、PT. TALC INDONESIA、Nippon Talc Co., Ltd.、Kaolin (Malaysia) Sdn Bhd.、NISSEI CORPORATION 和 Sibelco。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、泰国与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THAILAND TALC MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 DEPOSIT TYPE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 IMPORT EXPORT SCENARIO

4.4 RAW MATERIAL PRODUCTION COVERAGE

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 MANUFACTURING AND PACKING

4.5.3 MARKETING AND DISTRIBUTION

4.5.4 END USERS

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7 PRODUCTION CONSUMPTION ANALYSIS- THAILAND TALC MARKET

4.8 VENDOR SELECTION CRITERIA

5 THAILAND TALC MARKET

5.1 REGULATION COVERAGE

6 REGIONAL SUMMARY

6.1 THAILAND

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 EXTENSIVE APPLICATIONS IN PRODUCING LIGHTWEIGHT PLASTICS FOR AUTOMOTIVE COMPONENTS

7.1.2 RAPID INDUSTRIALIZATION AND SURGE IN DISPOSABLE INCOME OF THE MIDDLE-CLASS POPULATION OF EMERGING ECONOMIES

7.1.3 EASY AVAILABILITY OF RAW MATERIALS ALONG WITH AFFORDABLE LABOR

7.2 RESTRAINTS

7.2.1 GUIDELINES REGULATING THE PRODUCTION AS WELL AS USAGE OF TALC

7.2.2 MODERATE DEVELOPMENT OF THE PULP & PAPER INDUSTRY DUE TO DIGITIZATION

7.3 OPPORTUNITIES

7.3.1 RISING RESEARCH AND ADVANCEMENT ACTIVITIES FOR THE ADVANCEMENT OF NEW GRADES OF TALC

7.4 CHALLENGE

7.4.1 EASY ACCESSIBILITY OF SUBSTITUTES

8 THAILAND TALC MARKET, BY DEPOSIT TYPE

8.1 OVERVIEW

8.2 TALC CARBONATE

8.3 TALC CHLORITE

8.4 OTHERS

9 THAILAND TALC MARKET, BY END-USE

9.1 OVERVIEW

9.2 PULP & PAPER

9.2.1 PULP & PAPER, BY TYPE

9.2.1.1 TALC CARBONATE

9.2.1.2 TALC CHLORITE

9.2.1.3 OTHERS

9.3 PLASTIC INDUSTRY

9.3.1 PLASTIC INDUSTRY, BY TYPE

9.3.1.1 TALC CARBONATE

9.3.1.2 TALC CHLORITE

9.3.1.3 OTHERS

9.4 PAINTS & COATINGS

9.4.1 PAINTS & COATINGS, BY TYPE

9.4.1.1 TALC CARBONATE

9.4.1.2 TALC CHLORITE

9.4.1.3 OTHERS

9.5 CERAMICS

9.5.1 CERAMICS, BY TYPE

9.5.1.1 TALC CARBONATE

9.5.1.2 TALC CHLORITE

9.5.1.3 OTHERS

9.6 RUBBER INDUSTRY

9.6.1 RUBBER INDUSTRY, BY TYPE

9.6.1.1 TALC CARBONATE

9.6.1.2 TALC CHLORITE

9.6.1.3 OTHERS

9.7 COSMETICS & PERSONAL CARE

9.7.1 COSMETICS & PERSONAL CARE, BY TYPE

9.7.1.1 TALC CARBONATE

9.7.1.2 TALC CHLORITE

9.7.1.3 OTHERS

9.8 FOOD INDUSTRY

9.8.1 FOOD INDUSTRY, BY TYPE

9.8.1.1 TALC CARBONATE

9.8.1.2 TALC CHLORITE

9.8.1.3 OTHERS

9.9 PHARMACEUTICALS

9.9.1 PHARMACEUTICAL, BY TYPE

9.9.1.1 TALC CARBONATE

9.9.1.2 TALC CHLORITE

9.9.1.3 OTHERS

9.1 OTHERS

9.10.1 OTHERS, BY TYPE

9.10.1.1 TALC CARBONATE

9.10.1.2 TALC CHLORITE

9.10.1.3 OTHERS

10 THAILAND TALC MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 MERGER & ACQUISITION

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 IMERYS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATE

12.2 PT. TALC INDONESIA.

12.2.1 COMPANY SNAPSHOT

12.2.2 PRODUCT PORTFOLIO

12.2.3 RECENT UPDATES

12.3 NISSEI CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 PRODUCT PORTFOLIO

12.3.3 RECENT UPDATES

12.4 NIPPON TALC CO., LTD.

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT UPDATES

12.5 MINERALS TECHNOLOGIES INC. (2021)

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATE

12.6 SIBELCO

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATE

12.7 KAOLIN (MALAYSIA) SDN BHD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF NATURAL STEATITE AND TALC, CRUSHED OR POWDERED; HS CODE - 252620 (USD THOUSAND)

TABLE 2 EXPORT DATA OF NATURAL STEATITE AND TALC, CRUSHED OR POWDERED; HS CODE - 252620 (USD THOUSAND)

TABLE 3 THAILAND TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 THAILAND TALC MARKET, BY DEPOSIT TYPE, 2020-2029 (MILLION TONS)

TABLE 5 THAILAND TALC MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 6 THAILAND TALC MARKET, BY END-USE, 2020-2029 (MILLION TONS)

TABLE 7 THAILAND PULP & PAPER IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 THAILAND PULP & PAPER IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 9 THAILAND PLASTIC INDUSTRY IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 THAILAND PLASTIC INDUSTRY IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 11 THAILAND PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 THAILAND PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 13 THAILAND CERAMICS IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 THAILAND CERAMICS IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 15 THAILAND RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 THAILAND RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 17 THAILAND COSMETICS & PERSONAL CARE IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 THAILAND COSMETICS & PERSONAL CARE IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 19 THAILAND FOOD INDUSTRY IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 THAILAND FOOD INDUSTRY IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 21 THAILAND PHARMACEUTICAL IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 THAILAND PHARMACEUTICAL IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 23 THAILAND OTHERS IN TALC MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 24 THAILAND OTHERS IN TALC MARKET, BY TYPE, 2020-2029 (MILLION TONS)

图片列表

FIGURE 1 THAILAND TALC MARKET: SEGMENTATION

FIGURE 2 THAILAND TALC MARKET: DATA TRIANGULATION

FIGURE 3 THAILAND TALC MARKET: DROC ANALYSIS

FIGURE 4 THAILAND TALC MARKET: THAILAND MARKET ANALYSIS

FIGURE 5 THAILAND TALC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 THAILAND TALC MARKET: DEPOSIT TYPE LIFE LINE CURVE

FIGURE 7 THAILAND TALC MARKET: MULTIVARIATE MODELLING

FIGURE 8 THAILAND TALC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 THAILAND TALC MARKET: DBMR MARKET POSITION GRID

FIGURE 10 THAILAND TALC MARKET: END-USE COVERAGE GRID

FIGURE 11 THAILAND TALC MARKET: CHALLENGE MATRIX

FIGURE 12 THAILAND TALC MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 THAILAND TALC: SEGMENTATION

FIGURE 14 EXTENSIVE APPLICATIONS IN PRODUCING LIGHTWEIGHT PLASTICS FOR AUTOMOTIVE COMPONENTS IS EXPECTED TO DRIVE THE THAILAND TALC MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 TALC CARBONATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDONESIA TALC MARKET IN 2022 & 2029

FIGURE 16 TALC CARBONATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE THAILAND TALC MARKET IN 2022 & 2029

FIGURE 17 TALC CARBONATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE VIETNAM TALC MARKET IN 2022 & 2029

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 SUPPLY CHAIN ANALYSIS – THAILAND TALC MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THAILAND TALC MARKET

FIGURE 21 THAILAND TALC MARKET: BY DEPOSIT TYPE, 2021

FIGURE 22 THAILAND TALC MARKET: BY END-USE, 2021

FIGURE 23 THAILAND TALC MARKET: COMPANY SHARE 2021 (%)

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.