沙特阿拉伯骨料市场,按产品(沙子、砾石、再生混凝土、碎石)、应用(基础设施、商业、工业、住宅) - 行业趋势和预测到 2030 年。

沙特阿拉伯总体市场分析和见解

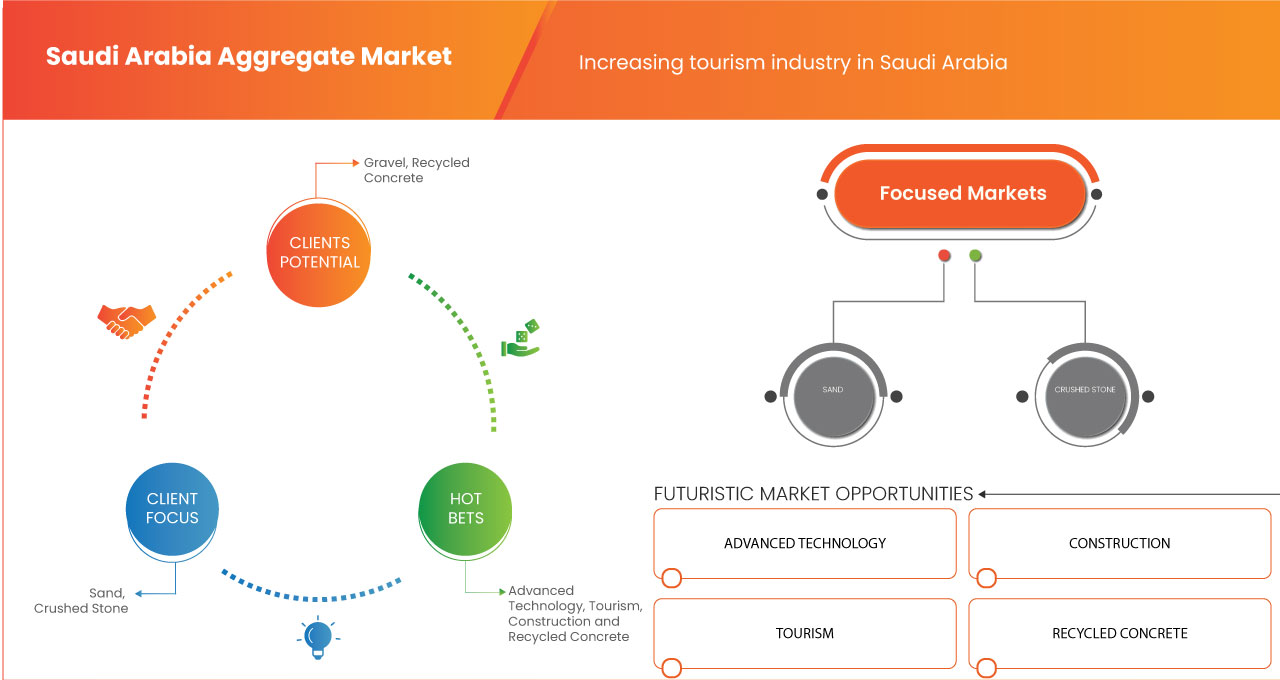

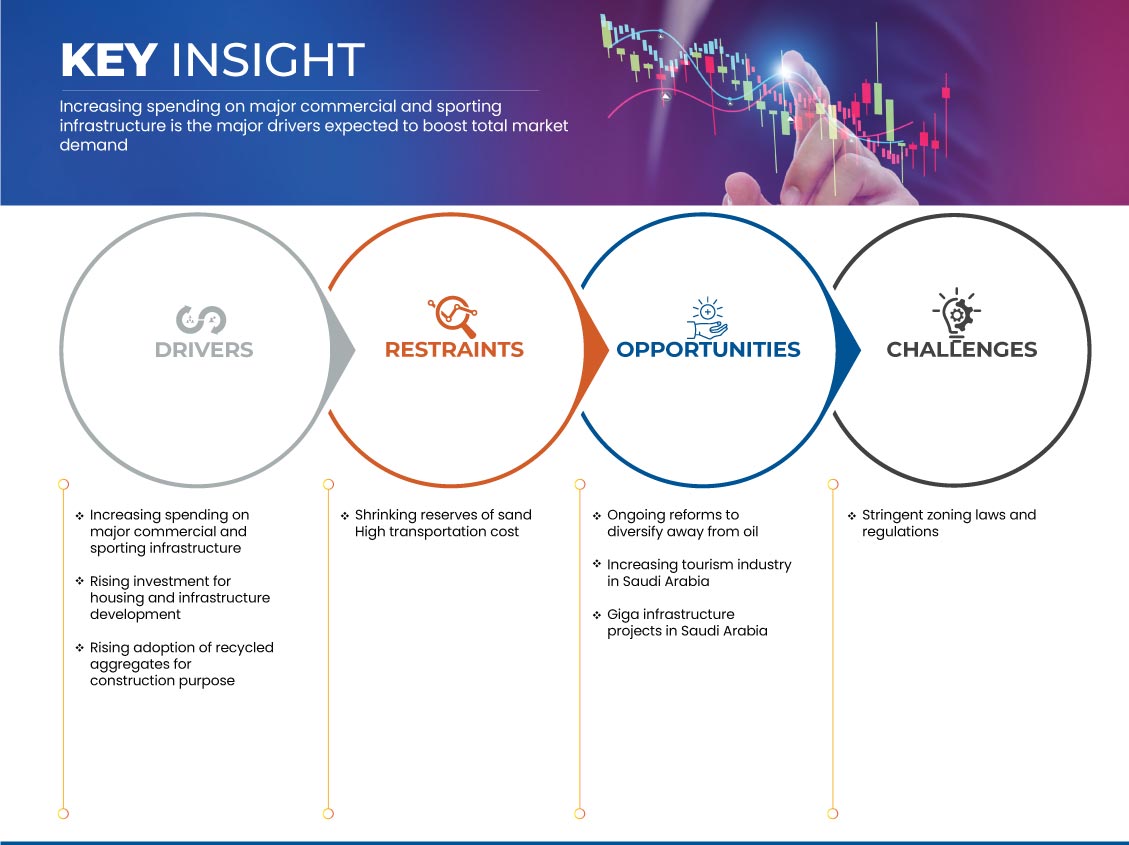

预计沙特阿拉伯骨料市场将在 2023 年至 2030 年的预测期内实现显着增长。Data Bridge Market Research 分析称,在 2023 年至 2030 年的预测期内,该市场将以 3.6% 的复合年增长率增长,预计到 2030 年将达到 17.1953 亿美元。推动骨料市场增长的主要因素是主要商业和体育基础设施支出的增加、住房和基础设施开发投资的增加以及建筑用途中再生骨料的采用率的提高。

骨料是指质地粗糙、颗粒状的建筑材料。一些常用的骨料包括沙子、碎石、砾石、破碎的高炉矿渣、锅炉灰、烧成页岩和粘土。这些骨料与水泥、沥青、石灰和石膏混合用于建筑应用。它们为建筑物提供增强的磨蚀力、孔隙率、体积、稳定性、耐磨性和抗侵蚀性。与其他建筑材料相比,骨料更耐用、耐化学腐蚀,并且可以承受高温。因此,它们在工业、商业和住宅综合体的建设中得到广泛应用。

沙特阿拉伯综合市场报告提供了市场份额、新发展以及国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情景,请联系我们获取分析师简报,我们的团队将帮助您创建收入影响解决方案,以实现您的期望目标。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021(可定制为 2020 - 2015) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

产品(沙子、砾石、再生混凝土、碎石)、应用(基础设施、商业、工业、住宅) |

|

覆盖国家 |

沙特阿拉伯 |

|

涵盖的市场参与者 |

沙特 ReadyMix、CityCement、YCC、沙特水泥、SPCC、Eastern Province Cement Co.、Yamama Cement、Mastour Readymix(Mastour Holding Group 子公司)、Al-Rashed Cement Company、Al Safwa Ltd.、Qassim Cement Co.、Nassir Haza & Bros. 等 |

市场定义

骨料是指质地粗糙、颗粒状的建筑材料。一些常用的骨料包括沙子、碎石、砾石、破碎的高炉矿渣、锅炉灰、烧成页岩和粘土。这些骨料与水泥、沥青、石灰和石膏混合用于建筑用途。它们为建筑物提供增强的磨蚀力、孔隙率、体积、稳定性、耐磨性和抗侵蚀性。与其他建筑材料相比,骨料更耐用、耐化学腐蚀,并且可以承受高温。因此,它们在工业、商业和住宅综合体的建设中得到广泛应用。

沙特阿拉伯总体市场动态

驱动程序

- 增加对主要商业和体育基础设施的支出

随着沙特阿拉伯在主要商业和体育基础设施上投入巨资,例如在齐迪亚规划世界最大的娱乐城和在利雅得规划萨尔曼国王公园,沙特阿拉伯的骨料需求预计将上升。沙特阿拉伯已成为中东体育产业增长的主要力量之一。这是由于各种改革和对各种骨料的需求不断增加,例如用于体育场馆建设的沥青和用于建设大型建筑物和商业空间(如办公室和其他公共场所)的混凝土。

- 住房和基础设施开发投资不断增加

天然骨料包括碎石、沙子和砾石,是住宅建筑项目的基本原材料。沙特阿拉伯的住宅市场不断扩大,这将产生积极影响,并有利于沙特阿拉伯骨料市场的增长。这是由于快速增长的城市人口的需求不断增长,而这直接源于沙特国民和外籍人士从其他地区迁入利雅得和其他城市。与利雅得类似,吉达的住宅市场也在 2021 年第三季度看到公寓价格飙升 11.7%,这是至少五年来最强劲的增长率。

- 再生骨料在建筑领域的应用日益广泛

在建筑行业,混凝土回收至关重要,因为混凝土是建筑和拆除废物中最主要的废物。现代建筑行业正在为采用此类再生骨料材料提供有效而持久的解决方案,以利用其相对于传统材料的优势。这将刺激对建筑骨料的需求并推动沙特阿拉伯骨料市场的发展。

机会

- 正在进行的改革,摆脱对石油的依赖

沙特愿景 2030 是一个战略框架,旨在减少沙特阿拉伯对石油的依赖,实现经济多元化,发展医疗、教育、基础设施、娱乐和旅游等公共服务部门。主要目标包括加强经济和投资活动,增加非石油国际贸易,以及提升沙特王国更温和、更世俗的形象。

- 沙特阿拉伯的千兆基础设施项目

沙特主要城市建设项目包括阿卜杜拉国王安全大院(第五期)和大清真寺(圣地扩建),均由市政和农村事务部在麦加开发,总投资达213亿美元。此外,该地区还开发了各种大型项目。

- 沙特阿拉伯旅游业蓬勃发展

随着建筑业的发展,休闲项目也得到了发展,这将促进沙特阿拉伯旅游业的发展。这反过来又有望在短期内推动沙特阿拉伯骨料市场的增长。此外,由于骨料具有减少空隙率、混凝土混合物致密、混凝土耗水量低、生产成本低、混凝土机械强度高、水力传导率高等优点,因此在住宅、商场、道路、水坝、机场、高速公路和桥梁的建设中得到了广泛的应用。所有这些地方都受到游客的广泛利用,用于通勤和住宿。

限制/挑战

- 沙储量减少

此外,这场危机的主要原因是快速的城市化。因此,沙子供应的减少将成为制约沙特阿拉伯需求增长的主要因素。这是因为沙子是混凝土中细骨料的重要成分。沙子在混凝土混合物中是一种惰性材料,其作用不容忽视。在各种骨料产品中使用沙子为粘合材料膜的粘附和扩散提供了必要的表面积。然而,沙特阿拉伯正试图应对沙子储量迅速枯竭的问题,这将限制长期供应,并将继续提高区域市场的消费价格。

- 运输成本高

运输成本是运输服务提供商内部承担的成本。它们包括固定成本(基础设施成本)和可变成本(运营成本),具体取决于地理、基础设施、行政壁垒、能源以及客运和货运方式。与交易、装运和距离摩擦相关的三个主要因素影响运输成本。此外,尽管产品相互依赖,但装运、装卸港口作业和内陆储存加起来构成了各种总产品的成本。

- 严格的分区法律法规

沙特阿拉伯政府实施了各种分区和房地产法律法规,涉及基础设施和建筑物的所有权、建设和开发。其中,沙特建筑规范 (SBC) 是一套法律、行政和技术法规和要求,规定了建筑物的最低建筑标准,以确保公共安全和健康。该国已经研究并实施了多项国际规范,以选择沙特建筑规范的基本规范。

近期发展

- 2021年1月,CityCement宣布完成其子公司的章程和商业登记。该子公司专门为废物处理和回收提供环境解决方案和服务,现为CityCement全资拥有的有限责任公司。

- 2021年9月,Al Safwa, ltd.在海湾可持续发展奖中与国际公司竞争后,荣获“绿色建筑”和“水或废物管理”类别两项金奖。

- 2021年1月,CityCement宣布完成其子公司的章程大纲签发和商业登记。

- 2021 年 7 月,沙特水泥向 Ehsan 捐赠了 100 万沙特里亚尔。Ehsan 是国家慈善工作平台。

- 2022 年 5 月,SPCC 完成技术研究,并开始在其吉赞水泥厂建设一条新的 5000 吨/日的生产线。

沙特阿拉伯总体市场范围

沙特阿拉伯骨料市场根据产品和应用进行分类。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策以确定核心市场应用。

产品

- 沙

- 碎石

- 再生混凝土

- 碎石

根据产品,沙特阿拉伯骨料市场分为沙子、砾石、再生混凝土和碎石。

应用

- 基础设施

- 住宅

- 商业的

- 工业的

根据应用,沙特阿拉伯骨料市场分为基础设施、住宅、商业和工业。

沙特阿拉伯总体市场区域分析/见解

沙特阿拉伯快速消费品行业的骨料市场根据产品和应用进行细分。

由于对主要商业和体育基础设施的支出增加,沙特阿拉伯骨料市场预计将占据市场主导地位。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。数据点下游和上游价值链分析、技术测试和波特五力分析以及案例研究是用于预测各个国家市场情景的一些指标。此外,在对该国数据进行预测分析时,还考虑了沙特阿拉伯品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局和沙特阿拉伯总体市场份额分析

沙特阿拉伯骨料市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用主导地位、技术生命线曲线。以上提供的数据点仅与公司对沙特阿拉伯骨料市场的关注有关。

沙特阿拉伯骨料市场的一些知名参与者包括沙特沙特 ReadyMix、CityCement、YCC、沙特水泥、SPCC、东部省水泥公司、Yamama 水泥、Mastour Readymix(Mastour 控股集团的子公司)、Al-Rashed 水泥公司、Al Safwa 有限公司、卡西姆水泥公司、Nassir Haza & Bros 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SAUDI ARABIA AGGREGATE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.3 CLIMATE CHANGE SCENARIO

4.4 KEY INDUSTRIAL TRENDS

4.5 MANUFACTURING PROCESS SCENARIO

4.6 RAW MATERIAL PRODUCTION COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 RAW MATERIAL PROCUREMENT

4.7.2 MANUFACTURING AND PACKING

4.7.3 MARKETING AND DISTRIBUTION

4.7.4 APPLICATIONS

4.8 STANDARDS / CERTIFICATIONS

4.9 SAUDI ARABIA AGGREGATES MARKET: REGULAION COVERAGE

4.1 VENDOR SELECTION CRITERIA

4.10.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5 PRODUCTION AND CONSUMPTION ANALYSIS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING SPENDING ON MAJOR COMMERCIAL AND SPORTING INFRASTRUCTURE

6.1.2 RISING INVESTMENT IN HOUSING AND INFRASTRUCTURE DEVELOPMENT

6.1.3 RISING ADOPTION OF RECYCLED AGGREGATES FOR CONSTRUCTION PURPOSES

6.2 RESTRAINTS

6.2.1 SHRINKING RESERVES OF SAND

6.2.2 HIGH TRANSPORTATION COST

6.3 OPPORTUNITIES

6.3.1 ONGOING REFORMS TO DIVERSIFY AWAY FROM OIL

6.3.2 GIGA INFRASTRUCTURE PROJECTS IN SAUDI ARABIA

6.3.3 INCREASING TOURISM INDUSTRY IN SAUDI ARABIA

6.4 CHALLENGE

6.4.1 STRINGENT ZONING LAWS AND REGULATIONS

7 SAUDI ARABIA AGGREGATE MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 SAND

7.3 GRAVEL

7.4 CRUSHED STONE

7.5 RECYCLED CONCRETE

8 SAUD ARABIA AGGREGATE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 INFRASTRUCTURE

8.3 COMMERCIAL

8.4 RESIDENTIAL

8.5 INDUSTRIAL

9 SAUDI ARABIA AGGREGATE MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA AGGREGATE MARKET

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 SAUDI READYMIX

11.1.1 COMPANY SNAPSHOT

11.1.2 PRODUCT PORTFOLIO

11.1.3 RECENT DEVELOPMENT

11.2 CITYCEMENT

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 PRODUCT PORTFOLIO

11.2.4 RECENT DEVELOPMENT

11.3 SAUDI CEMENT

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 SPCC

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 RECENT DEVELOPMENT

11.5 EASTERN PROVINCE CEMENT CO.

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENT

11.6 AL-RASHED CEMENT COMPANY

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT DEVELOPMENT

11.7 AL SAFWA LTD.

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENTS

11.8 MASTOUR READYMIX (SUBSIDIARY OF MASTOUR HOLDING GROUP)

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENT

11.9 NASSIR HAZZA & BROS.

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENT

11.1 QASSIM CEMENT CO.

11.10.1 COMPANY SNAPSHOT

11.10.2 REVENUE ANALYSIS

11.10.3 PRODUCT PORTFOLIO

11.10.4 RECENT DEVELOPMENT

11.11 YAMAMA CEMENT

11.11.1 COMPANY SNAPSHOT

11.11.2 REVENUE ANALYSIS

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT DEVELOPMENT

11.12 YCC

11.12.1 COMPANY SNAPSHOT

11.12.2 REVENUE ANALYSIS

11.12.3 PRODUCT PORTFOLIO

11.12.4 RECENT DEVELOPMENT

12 QUARRIES PROFILES

12.1 AL- FUTTAIM

12.1.1 COMPANY SNAPSHOT

12.1.2 PRODUCTION RATE

12.2 AL TAKDOM

12.2.1 COMPANY SNAPSHOT

12.2.2 PRODUCTION RATE

12.3 ARABIAN ROCK BLASTING CO.,LTD

12.3.1 COMPANY SNAPSHOT

12.3.2 PRODUCTION RATE

12.4 BIN HARKIL CO. LTD.

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCTION RATE

12.5 CDE GROUP

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCTION RATE

12.6 DARMCO. (A SUBSIDIARY OF THE RASHED AL RASHED & SONS GROUP )

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCTION RATE

12.7 NASSIR HAZZA & BROS.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCTION RATE

12.8 PARAVISION

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCTION RATE

12.9 SAR

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCTION RATE

12.1 SAUDI READY MIX (A SUBSIDIARY OF KHALID ALI ALTURKI & SONS HOLDING COMPANY)

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCTION RATE

13 QUESTIONNAIRE

14 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF GRAVEL, AND CRUSHED STONE, FOR CONCRETE AGGREGATES; HS CODE - 251710 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PEBBLES, GRAVEL, BROKEN OR CRUSHED STONE, FOR CONCRETE AGGREGATES; HS CODE – 25170 (USD THOUSAND)

TABLE 3 STANDARDS/CERTIFICATIONS FRAMEWORK

TABLE 4 REGULATORY FRAMEWORK

TABLE 5 SAUDI ARABIA AGGREGATE MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 6 SAUDI ARABIA AGGREGATE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 7 SAUDI ARABIA AGGREGATE, PRODUCTION RATES, 2021-2030 (MILLION TONS)

TABLE 8 SAUDI ARABIA AGGREGATE, PRODUCTION RATES, 2021-2030 (MILLION TONS)

TABLE 9 SAUDI ARABIA AGGREGATE, PRODUCTION RATES, 2021-2030 (MILLION TONS)

TABLE 10 SAUDI ARABIA AGGREGATE, PRODUCTION RATES, 2021-2030 (MILLION TONS)

TABLE 11 SAUDI ARABIA AGGREGATE, PRODUCTION RATES, 2021-2030 (MILLION TONS)

TABLE 12 SAUDI ARABIA AGGREGATE, PRODUCTION RATES, 2021-2030 (MILLION TONS)

TABLE 13 SAUDI ARABIA AGGREGATE, PRODUCTION RATES, 2021-2030 (MILLION TONS)

TABLE 14 SAUDI ARABIA AGGREGATE, PRODUCTION RATES, 2021-2030 (MILLION TONS)

TABLE 15 SAUDI ARABIA AGGREGATE, PRODUCTION RATES, 2021-2030 (MILLION TONS)

TABLE 16 SAUDI ARABIA AGGREGATE, PRODUCTION RATES, 2021-2030 (MILLION TONS)

图片列表

FIGURE 1 SAUDI ARABIA AGGREGATE MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA AGGREGATE MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA AGGREGATE MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA AGGREGATE MARKET: SAUDI ARABIA MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA AGGREGATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA AGGREGATE MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 SAUDI ARABIA AGGREGATE MARKET: MULTIVARIATE MODELLING

FIGURE 8 SAUDI ARABIA AGGREGATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SAUDI ARABIA AGGREGATE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SAUDI ARABIA AGGREGATE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 SAUDI ARABIA AGGREGATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 SAUDI ARABIA AGGREGATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 SAUDI ARABIA AGGREGATE MARKET: SEGMENTATION

FIGURE 14 INCREASING SPENDING ON MAJOR COMMERCIAL AND SPORTING INFRASTRUCTURE IS EXPECTED TO DRIVE THE SAUDI ARABIA AGGREGATE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 SAND SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA AGGREGATE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 MANUFACTURING OF SAND AGGREGATE

FIGURE 17 SUPPLY CHAIN ANALYSIS- SAUDI ARABIA AGGREGATE MARKET

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF SAUDI ARABIA AGGREGATE MARKET

FIGURE 20 SAUDI ARABIA AGGREGATE MARKET: BY PRODUCT, 2022

FIGURE 21 SAUDI ARABIA AGGREGATE MARKET: BY APPLICATION, 2022

FIGURE 22 SAUDI ARABIA AGGREGATE MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。