北美纸巾市场,按产品类型(卷巾、折叠毛巾、餐巾和豪华毛巾、盒装毛巾)、最终用途(个人护理、家庭护理、医疗保健、酒店、商业、其他)、分销渠道(直销、电子商务、零售店、其他)划分 - 行业趋势和预测到 2029 年。

市场分析和规模

由于健康和卫生意识的增强,全球纸巾市场在不久的将来可能会大幅增长。由于先天性疾病数量的增加、气候变化和城市化进程的加快,纸巾市场预计将得到发展。因此,市场增长将在预测期内大幅增长。

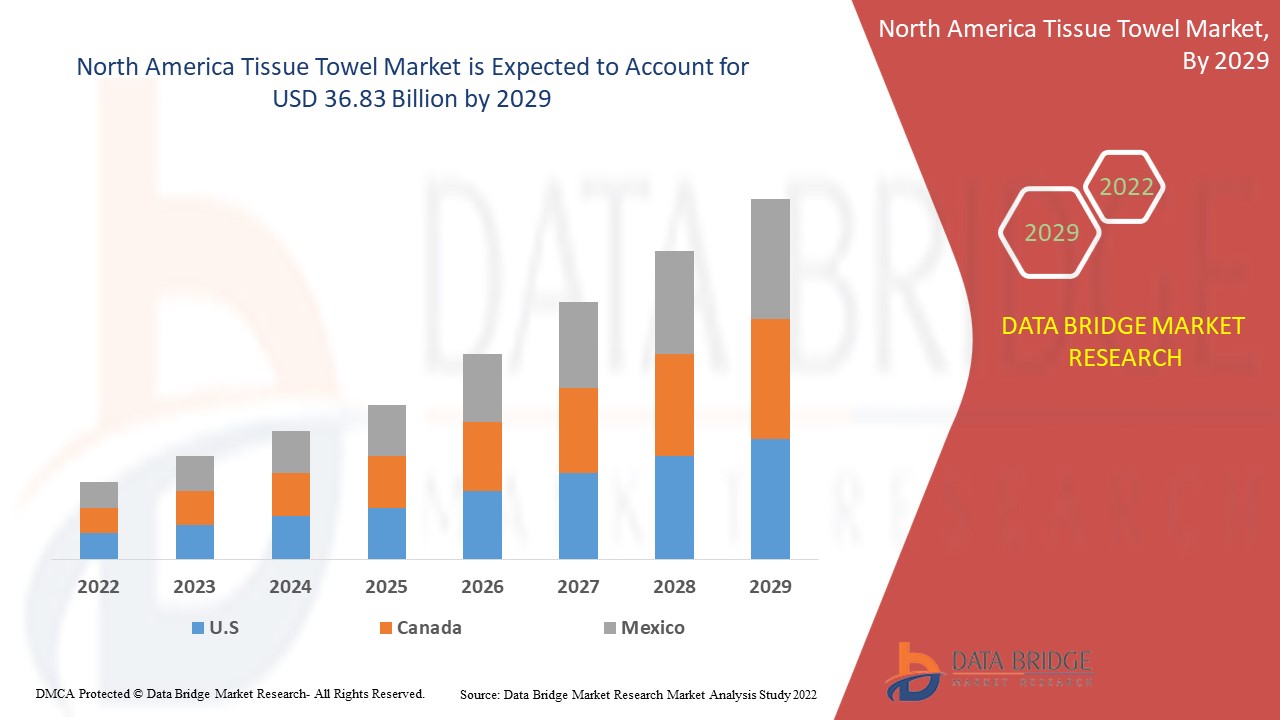

2021 年,北美纸巾市场价值为 250 亿美元,预计到 2029 年将达到 368.3 亿美元,2022-2029 年复合年增长率为 4.40%。Data Bridge 市场研究团队策划的市场报告包括深入的专家分析、进出口分析、定价分析、生产消费分析和气候链情景。

市场定义

纸巾是用于清洁地板、窗户和其他表面以及擦干双手的纸巾。由于采用快速吸收技术,这些物品具有预防和清洁等优点,而且可以回收利用。它们也被称为一次性纸巾,因为它们只能使用一次,然后扔掉。

报告范围和市场细分

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

|

|

覆盖国家 |

美国、加拿大、墨西哥 |

|

涵盖的市场参与者 |

KALSINT(美国)、Queenex(阿联酋)、American waste & Textiles, LLC(美国)、Riverside Paper Co. lnc.(美国)、National Wiper Alliance lnc.(美国)、Larsen Packaging products, lnc.(美国)、Ovasco Industries(美国)、Carl Hubenthal GmbH& Co. KG.(德国)、Georgia-Pacific(美国)、METSÄ TISSUE(芬兰)、宝洁(美国)、KCWW(美国)、CARE Ratings Limited(印度)、恒安(中国)、SHP Group(斯洛伐克)、Grigeo(立陶宛)、Essity Aktiebolag (publ)(瑞典) |

|

市场机会 |

|

卫生纸市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。以下内容将详细讨论所有这些内容:

驱动程序

- 卫生纸需求增加

由于天气条件的变化、建筑等其他行业的需求增加以及天气的变化,纸巾市场正在增长。户外活动和新地区等新兴行业对纸巾的需求激增,由于气候变化导致家庭规模扩大,流感和普通感冒发病率上升,纸巾需求增加,这些因素都影响了纸巾市场。

使用纸巾的各种好处(包括预防传染病)、旅游和酒店业的发展以及职业女性人数的增加等因素将进一步推动纸巾市场的增长率。此外,民众健康意识的增强、纸巾因其成本效益而广泛使用、消费者生活方式的改变以及快速的城市化也将推动市场价值的增长。酒店业的扩张和人们可支配收入的激增预计将促进市场的增长。

机会

- 环保又实惠的纸巾

此外,环保型可生物降解一次性纸巾的开发将为 2022 年至 2029 年预测期内的市场参与者带来盈利机会。此外,为发展中国家开发价格实惠的平板纸巾将进一步扩大纸巾毛巾市场的未来增长。

限制/挑战

- 对环境的担忧

人们对这些毛巾生产过程的担忧日益增加,其中包括许多损害环境的污染因素,例如危险废物处理和森林砍伐,这预计将阻碍纸巾市场的扩张。

- 严格的规定

此外,对森林砍伐的监管加强也有望阻碍全球纸巾市场的增长。

- 原材料价格

此外,原材料价格波动影响制造商的利润,预计对纸巾市场不利。因此,这将对纸巾市场的增长率构成挑战。

本纸巾市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入领域的机会、市场法规的变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新。如需了解有关纸巾市场的更多信息,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您做出明智的市场决策,实现市场增长。

COVID-19 对卫生纸市场的影响

最近爆发的冠状病毒对纸巾市场产生了积极影响,因为对纸巾的需求巨大。纸巾需求的上升可以归因于消费者对清洁和消毒需求的认识提高,而使用纸巾可以实现这一点。它们主要用于快速擦拭和擦干双手以及擦拭可能被污染或经常被多人触碰的区域,例如门把手和杯子。由于该产品易于使用、吸收率高且一次性使用,因此成为消费者清单中的必备品。此外,多个用户使用同一条布巾会增加病毒污染的风险,因此纸巾是一种更好、更安全的替代品。

北美卫生纸巾市场范围

纸巾市场根据产品类型、最终用途和分销渠道进行细分。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

产品类型

- 卷毛巾

- 折叠毛巾

- 餐巾和豪华毛巾

- 盒装毛巾

最终用途

- 个人护理

- 家庭护理

- 卫生保健

- 酒店业

- 商业的

- 其他的

分销渠道

- 直销

- 电子商务

- 零售店

- 其他的

纸巾市场区域分析/见解

对纸巾市场进行了分析,并按国家、类型、产品类型、最终用途和分销渠道提供了市场规模洞察和趋势。

纸巾市场报告涉及的国家包括北美的美国、加拿大和墨西哥。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

竞争格局和纸巾市场份额分析

纸巾市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对纸巾市场的关注有关。

卫生纸市场的一些主要参与者包括

- KALSINT(美国)

- Queenex(阿联酋)

- American waste & Textiles, LLC(美国)

- Riverside Paper Co. lnc.(美国)

- National Wiper Alliance lnc.(美国)

- Larsen Packaging products, lnc.(美国)

- Ovasco Industries (美国)

- Carl Hubenthal GmbH& Co. KG.(德国)

- 乔治亚太平洋 (美国)

- METSÄ TISSUE(芬兰)

- 宝洁(美国)

- KCWW(美国)

- CARE 评级有限公司 (印度)

- 恒安(中国)

- SHP集团(斯洛伐克)

- Grigeo(立陶宛)

- Essity Aktiebolag (publ)(瑞典)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TISSUE TOWEL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH LEVEL OF ABSORBENCY AS COMPARED TO OTHER ALTERNATIVES INCLUDING HOT AIR DRYERS

5.1.2 PAPER TOWEL IS MORE ENVIRONMENTALLY EFFICIENT AS COMPARED TO ELECTRIC AIR DRYERS

5.1.3 INCREASING HEALTH AWARENESS AND PREVENTION FROM CROSS-CONTAMINATION

5.2 RESTRAINTS

5.2.1 ENVIRONMENTAL DEGRADATION CAUSED DUE TO TISSUE INDUSTRIES

5.2.2 ENVIRONMENTAL CONCERNS DUE TO CUTTING DOWN OF TREES IMPACTING URBAN ECOSYSTEM

5.2.3 STRENGTHENING OF REGULATIONS TOWARDS DEFORESTATION

5.3 OPPORTUNITIES

5.3.1 DEVELOPMENT OF ECO-FRIENDLY BIODEGRADABLE DISPOSABLE TISSUES

5.3.2 DEVELOPMENT OF AFFORDABLE TABLET TISSUES FOR DEVELOPING COUNTRIES

5.4 CHALLENGE

5.4.1 FLUCTUATION IN RAW MATERIAL PRICES IMPACTING BOTTOM LINE OF MANUFACTURERS

6 IMPACT OF COVID-19 PANDEMIC ON THE NORTH AMERICA TISSUE TOWEL MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA TISSUE TOWEL MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA TISSUE TOWEL MARKET

6.3 STRATERGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 ROLLED TOWELS

7.2.1 STANDARD ROLLS

7.2.2 CENTER PULL ROLLS

7.3 FOLDED TOWELS

7.3.1 CENTREFOLD

7.3.2 MULTI-FOLD

7.4 BOXED TOWELS

7.5 NAPKINS AND LUXURY TOWELS

8 NORTH AMERICA TISSUE TOWEL MARKET, BY END-USE

8.1 OVERVIEW

8.2 HOME CARE

8.3 COMMERCIAL

8.3.1 OFFICE

8.3.2 RESTAURANTS

8.4 PERSONAL CARE

8.5 HEALTH CARE

8.6 HOSPITALITY

8.7 OTHERS

8.7.1 EDUCATION & RESEARCH INSTITUTES

8.7.2 PUBLIC WASHROOMS

9 NORTH AMERICA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 RETAIL STORES

9.2.1 HYPERMARKETS

9.2.2 SUPERMARKETS

9.2.3 WHOLESALE STORE

9.2.4 SPECIALTY STORES

9.2.5 OTHERS

9.3 E-COMMERCE

9.4 DIRECT SALES

9.5 OTHERS

10 NORTH AMERICA TISSUE TOWEL MARKET BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA TISSUE TOWEL MARKET, COMPANY LANDSCAPE

11.1 MERGERS & ACQUISITIONS

11.2 EXPANSIONS

11.3 NEW PRODUCT DEVELOPMENTS

11.4 PARTNERSHIP

12 SWOT AND DATABRIDGE MARKET RESEARCH ANALYSIS: NORTH AMERICA TISSUE TOWEL MARKET

12.1 SWOT ANALYSIS

12.1.1 STRENGTH: - STRONG GEOGRAPHICAL PRESENCE

12.1.2 WEAKNESS: - VOLATILE INPUT PRICES

12.1.3 OPPORTUNITY: - STRATEGIC ACQUISITIONS

12.1.4 THREAT: - AVAILABLITY OF SUBSTITUTES

12.2 DATABRIDGE MARKET RESEARCH ANALYSIS: NORTH AMERICA TISSUE TOWEL MARKET

13 COMPANY PROFILE

13.1 GEORGIA-PACIFIC

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT UPDATES

13.2 PROCTER & GAMBLE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 KCWW

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 KP TISSUE INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 METSÄ TISSUE (A SUBSIDIARY OF METSÄ GROUP)

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATE

13.6 CASCADES INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT UPDATE

13.7 IRVING CONSUMER PRODUCTS LIMITED.

13.7.1 COMPANY SNAPSHOT

13.7.2 BRAND PORTFOLIO

13.7.3 RECENT UPDATES

13.8 ASALEO CARE LIMITED

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 BRAND PORTFOLIO

13.8.4 RECENT UPDATE

13.9 BLUE RIDGE TISSUE CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATE

13.1 ESSITY AKTIEBOLAG (PUBL).

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 BRAND PORTFOLIO

13.10.4 RECENT UPDATES

13.11 FLOWER CITY TISSUE MILLS CO

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATE

13.12 GLOBAL TISSUE GROUP, INC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATE

13.13 GORHAM PAPER & TISSUE.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT UPDATE

13.14 NOVA TISSUE

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATE

13.15 WEPA HYGIENEPRODUKTE GMBH

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATE

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF TOILET OR FACIAL TISSUE STOCK, TOWEL OR NAPKIN STOCK AND SIMILAR PAPER FOR HOUSEHOLD OR SANITARY PURPOSES, CELLULOSE WADDING AND WEBS OF CELLULOSE FIBRES, WHETHER OR NOT CREPED, CRINKLED, EMBOSSED, PERFORATED, SURFACE-COLOURED, SURFACE-DECORATED OR PRINTED, IN ROLLS OF A WIDTH > 36 CM OR IN SQUARE OR RECTANGULAR SHEETS WITH ONE SIDE > 36 CM AND THE OTHER SIDE > 15 CM IN THE UNFOLDED STATE; HS CODE: 4803 (USD THOUSAND)

TABLE 2 EXPORT DATA OF TOILET OR FACIAL TISSUE STOCK, TOWEL OR NAPKIN STOCK AND SIMILAR PAPER FOR HOUSEHOLD OR SANITARY PURPOSES, CELLULOSE WADDING AND WEBS OF CELLULOSE FIBRES, WHETHER OR NOT CREPED, CRINKLED, EMBOSSED, PERFORATED, SURFACE-COLOURED, SURFACE-DECORATED OR PRINTED, IN ROLLS OF A WIDTH > 36 CM OR IN SQUARE OR RECTANGULAR SHEETS WITH ONE SIDE > 36 CM AND THE OTHER SIDE > 15 CM IN THE UNFOLDED STATE; HS CODE: 4803 (USD THOUSAND)

TABLE 3 SUMMARY OF PRIMARY OR ESSENTIAL PROPERTIES OF AWAY FROM HOME (AFH) TISSUE PRODUCTS IN THE U.S. MARKET (2005)

TABLE 4 RANK ORDER 0F ENVIRONMEMNTAL IMPACT OF THE PRODUCTS

TABLE 5 NORTH AMERICA TREE GRADES CONSUMPTION, BY TISSUE TOWEL TYPE (2019)

TABLE 6 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 7 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 8 NORTH AMERICA ROLLED TOWELS IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 9 NORTH AMERICA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 10 NORTH AMERICA ROLLED TOWELS IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 11 NORTH AMERICA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 12 NORTH AMERICA FOLDED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 13 NORTH AMERICA FOLDED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 14 NORTH AMERICA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 15 NORTH AMERICA FOLDED TOWEL IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 16 NORTH AMERICA BOXED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 17 NORTH AMERICA BOXED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 18 NORTH AMERICA NAPKINS AND LUXURY TOWELS PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 19 NORTH AMERICA NAPKINS AND LUXURY TOWELS PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 20 NORTH AMERICA TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 21 NORTH AMERICA HOME CARE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 22 NORTH AMERICA COMMERCIAL END-USE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 23 NORTH AMERICA COMMERCIAL END-USE IN TISSUE TOWEL MARKET, BY COMMERCIAL TYPE, 2019-2027 (USD MILLION)

TABLE 24 NORTH AMERICA PEESONAL CARE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 25 NORTH AMERICA HEALTH CARE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 26 NORTH AMERICA HOSPITALITY IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 28 NORTH AMERICA OTHERS IN TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 29 NORTH AMERICA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 30 NORTH AMERICA RETAIL STORE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 31 NORTH AMERICA RETAIL STORE IN TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLIO N)

TABLE 32 NORTH AMERICA E-COMMERCE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 33 NORTH AMERICA DIRECT SALES IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 34 NORTH AMERICA OTHERS IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 35 NORTH AMERICA TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 36 NORTH AMERICA TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 37 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 38 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 39 NORTH AMERICA ROLLED TOWELS IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 40 NORTH AMERICA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 41 NORTH AMERICA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027, 2019-2027 (THOUSAND TONS)

TABLE 42 NORTH AMERICA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 43 NORTH AMERICA TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 44 NORTH AMERICA COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 45 NORTH AMERICA COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 46 NORTH AMERICA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 47 NORTH AMERICA RETAIL STORE TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 48 U.S. TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 49 U.S. TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 50 U.S. ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 51 U.S ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 52 U.S. FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 53 U.S FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 54 U.S. TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 55 U.S. COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 56 U.S. COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 57 U.S. TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 58 U.S. RETAIL STORE IN TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 59 CANADA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 60 CANADA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 61 CANADA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 62 CANADA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 63 CANADA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 64 CANADA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 65 CANADA TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 66 CANADA COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 67 CANADA COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 68 CANADA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 69 CANADA RETAIL STORES IN TISSUE TOWEL MARKET, BY RETAIL STORES DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 70 MEXICO TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 71 MEXICO TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 72 MEXICO ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 73 MEXICO ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 74 MEXICO FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 75 MEXICO FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 76 MEXICO TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 77 MEXICO COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 78 MEXICO COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 79 MEXICO TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 80 MEXICO RETAIL STORES IN TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA TISSUE TOWEL MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TISSUE TOWEL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TISSUE TOWEL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TISSUE TOWEL MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TISSUE TOWEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TISSUE TOWEL MARKET: PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA TISSUE TOWEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA TISSUE TOWEL MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TISSUE TOWEL MARKET: MARKET END-USE COVERAGE GRID

FIGURE 10 NORTH AMERICA TISSUE TOWEL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA TISSUE TOWEL MARKET: SEGMENTATION

FIGURE 12 HIGH LEVEL OF ABSORBENCY AS COMPARED TO OTHER ALTERNATIVES INCLUDING HOT AIR DRYERS IS DRIVING THE NORTH AMERICA TISSUE TOWEL MARKET IN THE FORECAST PERIOD OF 2021 TO 2027

FIGURE 13 ROLLED TOWELS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TISSUE TOWEL MARKET IN 2021 & 2027

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA TISSUE TOWEL MARKET

FIGURE 15 GLOBAL PER CAPITA TOILET PAPER ROLLS CONSUMPTION, BY COUNTRY (2019)

FIGURE 16 GLOBAL FOREST COVER LOSS, SQ. KM (2000-2005)

FIGURE 17 GLOBAL PER CAPITA CONSUMPTION OF TISSUE, BY REGIONS, 2017 (KG)

FIGURE 18 NORTH AMERICA TISSUE TOWEL MARKET: BY PRODUCT TYPE, 2020

FIGURE 19 NORTH AMERICA TISSUE TOWEL MARKET: BY END-USE, 2020

FIGURE 20 NORTH AMERICA TISSUE TOWEL MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 21 NORTH AMERICA TISSUE TOWEL MARKET: SNAPSHOT (2020)

FIGURE 22 NORTH AMERICA TISSUE TOWEL MARKET: BY COUNTRY (2020)

FIGURE 23 NORTH AMERICA TISSUE TOWEL MARKET: BY COUNTRY (2021 & 2027)

FIGURE 24 NORTH AMERICA TISSUE TOWEL MARKET: BY COUNTRY (2020 & 2027)

FIGURE 25 NORTH AMERICA TISSUE TOWEL MARKET: BY PRODUCT TYPE (2020-2027)

FIGURE 26 NORTH AMERICA TISSUE TOWEL MARKET: COMPANY SHARE 2019 (%)

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.