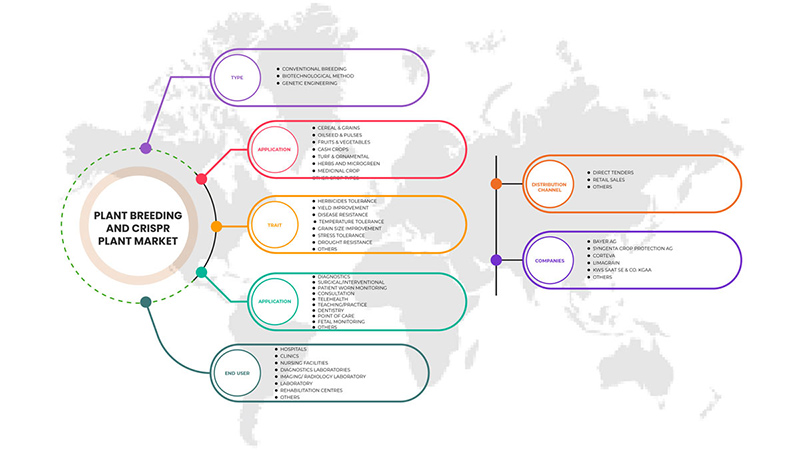

北美植物育种和 CRISPR 植物市场,按类型(传统方法、生物技术方法和基因工程)、性状(除草剂耐受性、抗病性、产量提高、温度耐受性、粒度改良、抗逆性、抗旱性等)、应用(谷物和谷类、油籽和豆类、水果和蔬菜、经济作物、草坪和观赏植物、草本植物和微型蔬菜、药用作物等)划分 - 行业趋势和预测到 2029 年。

北美植物育种和 CRISPR 植物市场分析与洞察

植物育种和 CRISPR 植物对于创造具有更好种质的新品种植物非常重要,这些新品种植物具有高产、优质作物、抗病等优良特性。植物育种和 CRISPR 植物对于拉丁美洲农民来说非常重要,因为这样他们才能生产出高产作物来满足人口不断增长的需求。此外,植物育种和 CRISPR 植物是满足拉丁美洲人口不断增长的需求所必需的,也是推动市场发展的主要因素。因此,许多公司正在扩大其生产设施,以满足拉丁美洲农民对新品种产品的更高需求。

推动市场增长的因素包括人们对植物育种和 CRISPR 植物在农业领域的好处的认识不断提高,以及拉丁美洲地区植物育种作物的高采用率。限制植物育种和 CRISPR 植物增长的因素是人们越来越意识到植物育种作物中存在不良毒素,这些毒素可能对人类健康造成潜在危害。

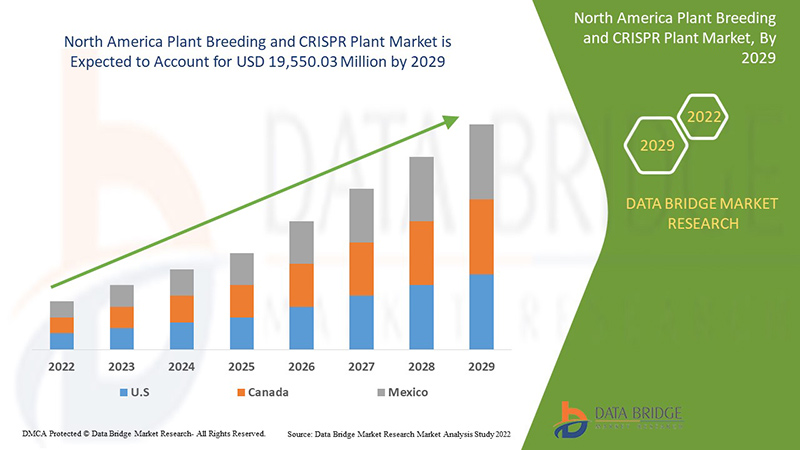

Data Bridge Market Research 分析,北美植物育种和 CRISPR 植物市场预计到 2029 年将达到 195.5003 亿美元,预测期内复合年增长率为 17.3%。由于北美对植物育种和 CRISPR 植物的需求迅速增长,类型占据了市场中最大的类型部分。本市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020 (可定制为 2019-2014) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按类型(传统方法、生物技术方法和基因工程)、特性(除草剂耐受性、抗病性、产量提高、温度耐受性、颗粒大小改良、抗逆性、抗旱性等)、应用(谷物和谷类、油籽和豆类、水果和蔬菜、经济作物、草坪和观赏植物、草本植物和微型蔬菜、药用作物等) |

|

覆盖国家 |

美国、加拿大、墨西哥 |

|

涵盖的市场参与者 |

BAYER AG、Syngenta Crop Protection AG、Corteva、BASF SE、Limagrain、DLF、Bioceres Crop Solutions、KWS SAAT SE & Co. KGaA、Stine Seed Company.(Stine Seed Farm, Inc. 的子公司)、RAGT、InVivo、pairwise、TMG Tropical Improvement & Genetics SA、SAKATA SEED CORPORATION、DONMARIO、UPL、Benson Hill Inc.、Yield10 Bioscience, Inc.、Tropic 等等。 |

北美植物育种和 CRISPR 植物市场定义

植物育种是种植者用来开发或改良作物品种并提高产量的技术,通过借助保守或分子工具操纵植物基因组以获得所需的基因或性状。植物育种技术使用定点核酸酶将 DNA 转化或靶向为所需的 DNA,非常完美。CRISPR 是一种用于植物育种的技术,其中来自原核生物的 CRISPR-Cas 基因用于改变植物基因组,以产生具有优良和有益性状的种质。通过植物育种或 CRISPR 技术生产的作物具有高产量、比传统作物质量更好、抗病、耐除草剂、耐气候等特性。此外,植物育种方法还用于创造具有多种益处的作物,例如产量更高、质量更好、抗病等。此外,植物育种和 CRISPR 技术是可持续作物生产的最佳选择。

北美植物育种和 CRISPR 植物市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 植物育种和 CRISPR 植物研发的兴起

植物育种是一种通过以极致完美方式靶向和转化 DNA 来引入所需性状,从而改变植物性状的技术。植物育种用于提高作物产量并改善作物的营养品质,以供人类或动物食用。CRISPR 是植物育种中使用的主要和重要技术之一,因为它具有改善品质、产量、提供抗病性和抗除草剂性等应用。随着对改良作物的需求增加,以提高作物的产量和质量并减少作物损害,该地区对植物育种和 CRISPR 植物的研究和开发也在增加。农民对通过植物育种或 CRISPR 技术生产的作物或植物的需求不断增长,以生产高质量的作物,这导致对植物育种和 CRISPR 植物的研究和开发不断增长。

植物育种和 CRISPR 植物研发活动的增加,促进了该地区植物育种和 CRISPR 植物的增长。

- 人口激增导致粮食生产需求增加

人口增长是植物育种和 CRISPR 植物的主要驱动因素之一。随着人口的增长,对食物的需求也在增加,需要养活的人也越来越多,这增加了对新技术(即植物育种)的需求。通过提高作物产量和提高质量可以满足对食物的需求,而这只有通过植物育种和 CRISPR 技术才能实现。农民和人民对改良植物品种的需求日益增加,以消除北美人口增长带来的粮食短缺问题。植物育种和 CRISPR 植物是增加优质作物产量以养活北美更多人口的唯一途径。因此,人口增长正在增加植物育种和 CRISPR 植物市场的需求。

因此,人口的增加产生了对更多农作物生产的需求,从而导致北美植物育种和 CRISPR 植物市场的增长。

克制

- 与传统育种技术相比,现代育种技术成本较高

传统育种依赖于将同一物种内不同种群的特性混合,然后选择整个天然植物的遗传元素。现代育种方法通常在育种过程的一个或多个阶段涉及体外技术和/或分子生物学。本文介绍了几种技术,包括胚胎拯救、体外选择、体细胞克隆变异、双单倍体和染色体消除以及转化/基因工程。植物育种通常被称为数字游戏,主要的竞争性商品项目在高效的种子处理、种植、分级和收获方法上投入了大量资金。随着遗传收益的积累,门槛逐渐提高,需要越来越多的投资来保持遗传发展的稳定。

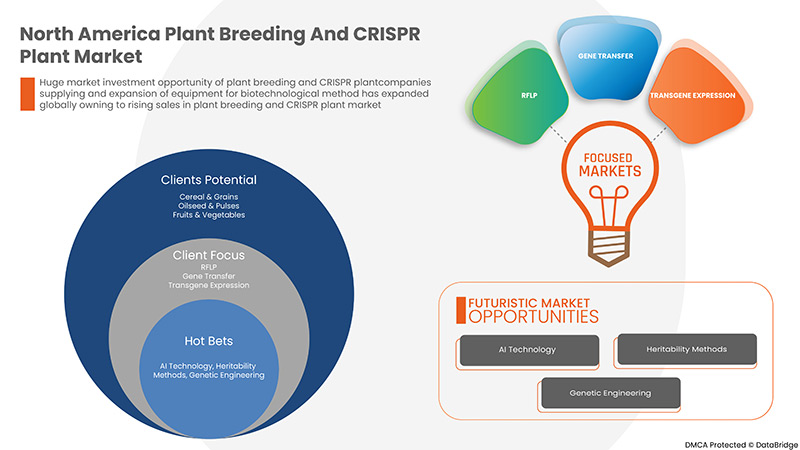

机会

-

波动的条件是否会增加植物育种和 CRISPR 技术的机会

不断变化的气候条件是否会损害农作物并导致重大农作物损失,这为北美的植物育种和 CRISPR 植物创造了机会。借助植物育种和 CRISPR 技术,可以开发对干旱、暴雨等气候条件的耐受性,这将有助于抵御气候对农作物造成的损失。对能够抵抗恶劣气候条件的新品种农作物的需求正在增加,这为北美的植物育种和 CRISPR 植物创造了机会。恶劣气候条件导致的农作物损失增加为市场创造了重大机遇。

因此,恶劣气候条件导致的农作物受损数量的增加,增加了植物育种和 CRISPR 植物的需求,并为植物育种和 CRISPR 植物市场创造了机会。

挑战

- 无组织零售网络

农业零售网络在一段时间内经历了巨大的转变。它从短周期发展到复杂的链条。随着农业零售业的快速增长,供应链中出现了空白,导致其效率低下。无组织的零售网络包括

- 管理质量差

- 采购流程繁琐

- 高度发达的技术

- 品种少且价格高

- 缺乏对高科技仪器的了解

零售网络占农业的很大一部分,这种无组织、高度发达的零售业也影响着小农户和当地农民。高度发达的设备以及对设备的缺乏了解使小农户的处境变得艰难。

新冠肺炎疫情对北美植物育种和 CRISPR 植物市场的影响

由于交通限制,COVID-19 疫情对植物育种和 CRISPR 植物市场影响不大。政府已免除了所有类型的农业活动受封锁或中断的影响,因此没有受到新冠疫情的这种影响。事实上,由于农民的恐慌性购买,农用化学品公司的利润与去年相比实现了两位数。农民对植物育种好处的认识不断提高,这导致了政府的支持。发展中国家政府在国家和村庄层面管理多个种子库,以储存经过种子处理化学品适当处理的种子,防止种子腐烂。

制造商正在制定各种战略决策,以在新冠疫情后实现复苏。参与者正在进行多项研发活动、产品发布和战略合作,以改进医药医疗显示器市场的技术和测试结果。

最新动态

- 2022年8月,拜耳扩大现有投资,收购可持续低碳油籽生产商CoverCress Inc.的多数股权。这项投资履行了拜耳的可持续发展承诺,可以利用现有投资者邦吉和雪佛龙/农民的专业知识,通过将油籽商业化为可再生燃料和动物饲料来获得新的收入来源,通过覆盖作物提供生态系统效益,利用拜耳对CoverCress Inc.的现有投资。这有助于公司扩大业务。

北美植物育种和 CRISPR 植物市场范围

北美植物育种和 CRISPR 植物市场分为类型、特性和应用。各细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

北美植物育种和 CRISPR 植物市场(按类型划分)

- 传统育种

- 生物技术方法

- 基因工程

根据类型,北美植物育种和 CRISPR 植物市场分为传统育种、生物技术方法和基因工程。

北美植物育种和 CRISPR 植物市场(按特性划分)

- 除草剂耐受性

- 产量提高

- 抗病能力

- 耐温性

- 晶粒尺寸改进

- 抗压能力

- 抗旱能力

- 其他的

根据特性,植物育种和 CRISPR 植物市场细分为除草剂耐受性、抗病性、产量提高、温度耐受性、谷物大小改良、抗逆性、抗旱性等

- 北美植物育种和 CRISPR 植物市场(按应用划分)

- 谷物和谷类

- 油籽和豆类

- 水果和蔬菜

- 经济作物

- 草坪和观赏植物

- 香草和微型蔬菜

- 药用作物

- 其他作物类型

根据应用,植物育种和 CRISPR 植物市场分为谷物和谷类、油籽和豆类、水果和蔬菜、经济作物、草皮和观赏植物、草本植物和微型蔬菜、药用作物和其他。

北美植物育种和 CRISPR 植物市场区域分析/见解

分析了北美植物育种和 CRISPR 植物市场,并提供了市场规模信息、类型、特性和应用。

本市场报告涵盖的国家包括美国、加拿大和墨西哥。

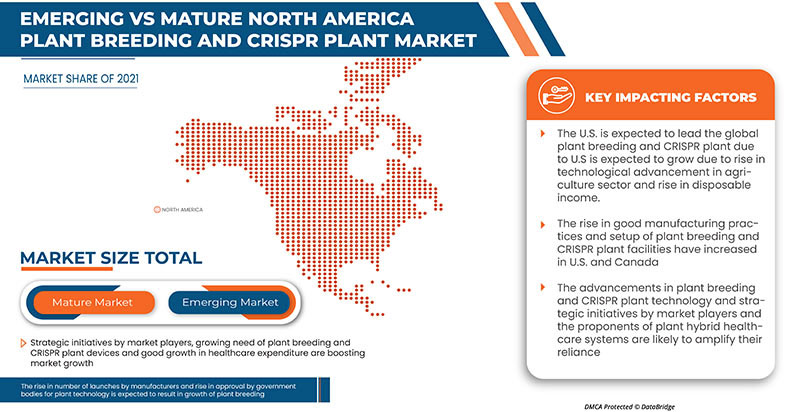

2022 年,美国将占据主导地位,因为美国是最大的消费市场,GDP 较高,拥有主要市场参与者。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化会影响市场的当前和未来趋势。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测单个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了北美品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀少竞争而面临的挑战,以及销售渠道的影响。

竞争格局和北美植物育种及 CRISPR 植物市场份额分析

北美植物育种和 CRISPR 植物市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对北美植物育种和 CRISPR 植物市场的关注有关。

北美植物育种和 CRISPR 植物市场的一些主要参与者包括拜耳公司 (BAYER AG)、先正达作物保护公司 (Syngenta Crop Protection AG)、科迪华 (Corteva)、巴斯夫公司 (BASF SE)、利马格兰 (Limagrain)、DLF、Bioceres Crop Solutions、KWS SAAT SE & Co. KGaA、Stine Seed Company.(Stine Seed Farm, Inc. 的子公司)、RAGT、InVivo、pairwise、TMG Tropical Improvement & Genetics SA、SAKATA SEED CORPORATION、DONMARIO、UPL、Benson Hill Inc.、Yield10 Bioscience, Inc. 和 Tropic 等。

研究方法:北美植物育种和 CRISPR 植物市场

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、北美与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET: CONSUMER BUYING BEHAVIOUR

3.1.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

3.1.2 RESEARCH

3.1.3 IMPULSIVE

3.1.4 ADVERTISEMENT:

3.1.5 TELEVISION ADVERTISEMENT

3.1.6 ONLINE ADVERTISEMENT

3.1.7 IN-STORE ADVERTISEMENT

3.1.8 OUTDOOR ADVERTISEMENT

4 SUPPLY CHAIN OF NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET

4.1 BAYER

4.1.1 PROCUREMENT

4.1.2 SUSTAINABILITY IN THE SUPPLY CHAIN

4.1.3 BAYER TRANSPORTATION AND ENVIRONMENT SAFETY IN SUPPLY CHAIN-

4.2 SYNGENTA GROUP

4.2.1 WORKING WITH SUPPLIERS

4.2.2 KEY PERFORMANCE INDICATORS AND BASIS OF PREPARATION-

4.3 UPCOMING TRENDS

5 BRAND COMPETITIVE ANALYSIS NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET

6 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN R&D FOR PLANT BREEDING & CRISPR PLANTS

7.1.2 THE SURGE IN THE NORTH AMERICA POPULATION LED TO AN INCREASE IN THE DEMAND FOR FOOD PRODUCTION

7.1.3 RISE IN AWARENESS ABOUT PLANT BREEDING & CRISPR PLANTS THROUGH VARIOUS PROGRAMMES

7.1.4 RISING IN NUMBER OF LAUNCHES BY MANUFACTURERS FOR PLANT BREEDING & CRISPR PLANTS

7.2 RESTRAINTS

7.2.1 HIGH COSTS ARE ASSOCIATED WITH THE MODERN BREEDING TECHNIQUES AS COMPARED TO CONVENTIONAL BREEDING TECHNIQUES

7.2.2 POTENTIAL HAZARD TO HUMAN HEALTH DUE TO UNDESIRED TOXIN GENERATED FROM CROPS PRODUCED BY BREEDING METHOD

7.3 OPPORTUNITIES

7.3.1 FLUCTUATING WEATHER CONDITIONS WILL INCREASE THE OPPORTUNITY FOR PLANT BREEDING & CRISPR TECHNIQUE

7.3.2 INCREASE IN NUMBER OF APPROVAL BY GOVERNMENTAL BODIES FOR PLANT BREEDING

7.4 CHALLENGE

7.4.1 UNORGANIZED RETAIL NETWORK

8 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 CONVENTIONAL BREEDING

8.2.1 HYBRIDIZATION

8.2.2 SELECTION

8.2.3 MUTATION BREEDING

8.3 BIOTECHNOLOGICAL METHOD

8.3.1 CELL AND TISSUE CULTURE

8.3.2 MOLECULAR MARKERS

8.3.3 PHENO TYPING

8.4 GENETIC ENGINEERING

8.4.1 RFLP

8.4.2 GENE TRANSFER

8.4.3 TRANSGENE EXPRESSION

8.4.4 SELECTION AND PLANT REGENERATION

9 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT

9.1 OVERVIEW

9.2 HERBICIDES TOLERANCE

9.3 YIELD IMPROVEMENT

9.4 DISEASE RESISTANCE

9.5 TEMPERATURE TOLERANCE

9.6 GRAIN SIZE IMPROVEMENT

9.7 STRESS TOLERANCE

9.8 DROUGHT RESISTANCE

9.9 OTHERS

10 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CEREAL & GRAINS

10.2.1 MAIZE

10.2.2 WHEAT

10.2.3 RICE

10.2.4 OATS

10.2.5 OTHERS

10.3 OILSEED & PULSES

10.3.1 SOYBEAN

10.3.2 SUNFLOWER

10.3.3 PEA

10.3.4 GRAM

10.3.5 OTHERS

10.4 FRUITS & VEGETABLES

10.4.1 BANANA

10.4.2 POTATO

10.4.3 TOMATO

10.4.4 APPLE

10.4.5 ORANGE

10.4.6 GRAPEFRUIT

10.4.7 BERRIES

10.4.8 CUCUMBERS

10.4.9 CARROTS

10.4.10 EGGPLANT

10.4.11 BROCCOLI

10.4.12 LEAFY GREEN

10.4.12.1 SPINACH

10.4.12.2 LETTUCE

10.4.12.3 CABBAGE

10.4.12.4 KALE

10.4.12.5 OTHERS

10.4.13 OTHERS

10.5 CASH CROPS

10.5.1 COFFEE & TEA

10.5.2 COTTON

10.5.3 SUGARCANE

10.5.4 OTHERS

10.6 TURF & ORNAMENTAL

10.7 HERBS AND MICROGREENS

10.7.1 HERBS

10.7.2 BASIL

10.7.3 WHEATGRASS

10.8 MEDICINAL CROP

10.9 OTHER CROP TYPES

11 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET, BY GEOGRAPHY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA PLANT BREEDING AND CSIPR PLANT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 BAYER AG

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 SYNGENTA CROP PROTECTION AG

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 CORTEVA (2021)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 LIMAGRAIN

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 KWS SAAT SE & CO. KGAA (2021)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 BASF SE

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 BENSON HILL INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BIOCERES CROP SOLUTIONS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 DLF

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 DONMARIO ( 2021)

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 INVIVO.( 2021)

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 PAIRWISE ( 2021)

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 PLANASA ( 2021)

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 RAGT (2021)

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 SAKATA SEED CORPORATION ( 2021)

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 STINE SEED COMPANY. (A SUBSIDIARY OF STINE SEED FARM, INC) (2021)

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 TMG TROPICAL IMPROVEMENT & GENETICS SA ( 2021)

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 TROPIC

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 UPL (2021)

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 YIELD10 BIOSCIENCE, INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 LABELING REQUIREMENTS FOR GMOS IN THE EUROPEAN UNION

TABLE 2 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA HERBICIDES TOLERANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA YIELD IMPROVEMENT IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DISEASE RESISTANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA TEMPERATURE TOLERANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA GRAIN SIZE IMPROVEMENT IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA STRESS TOLERANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DROUGHT RESISTANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA CEREALS & GRAINS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CEREALS & GRAINS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OILSEED & PULSES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OILSEEDS & PULSES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA FRUITS & VEGETABLES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA FRUITS & VEGETABLES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA LEAFY GREEN IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA CASH CROPS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA CASH CROPS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA TURF & ORNAMENTAL IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA HERBS AND MICROGREENS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA HERBS AND MICROGREENS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA MEDICINAL CROP IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA OTHER CROP TYPES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CEREAL & GRAIN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OILSEED & PULSES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA FRUITS & VEGETABLES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA LEAFY GREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA CASH CROPS IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA HERBS AND MICROGREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 U.S. PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.S. PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 51 U.S. PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 U.S. CEREAL & GRAIN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 U.S. OILSEED & PULSES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 U.S. FRUITS & VEGETABLES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 U.S. LEAFY GREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 U.S. CASH CROPS IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 U.S. HERBS AND MICROGREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 CANADA PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 CANADA CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 63 CANADA PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CANADA CEREAL & GRAIN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 CANADA OILSEED & PULSES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 CANADA FRUITS & VEGETABLES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 CANADA LEAFY GREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 CANADA CASH CROPS IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 CANADA HERBS AND MICROGREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 MEXICO PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 75 MEXICO PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 MEXICO CEREAL & GRAIN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 MEXICO OILSEED & PULSES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 MEXICO FRUITS & VEGETABLES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 MEXICO LEAFY GREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 MEXICO CASH CROPS IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 MEXICO HERBS AND MICROGREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: SEGMENTATION

FIGURE 11 INCREASING IMPORTANCE FOR SUSTAINABLE CROP PRODUCTION IS EXPECTED TO DRIVE THE NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 CONVENTIONAL BREEDING ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET IN 2022 & 2029

FIGURE 13 SOME OF THE FACTORS THAT AFFECT THE BUYING BEHAVIOR OF CONSUMERS BEFORE PURCHASING-

FIGURE 14 THE WORKFLOW MANUFACTURING PROCESS-

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE NORTH AMERICA ANT BREEDING & CRISPR PLANT MARKET

FIGURE 16 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET : BY TYPE, 2021

FIGURE 17 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET : BY TYPE, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET : BY TYPE, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET : BY TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET : BY TRAIT, 2021

FIGURE 21 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET : BY TRAIT, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET : BY TRAIT, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET : BY TRAIT, LIFELINE CURVE

FIGURE 24 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY APPLICATION, 2021

FIGURE 25 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY TYPE (2022-2029)

FIGURE 33 NORTH AMERICA PLANT BREEDING AND CSIPR PLANT MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。