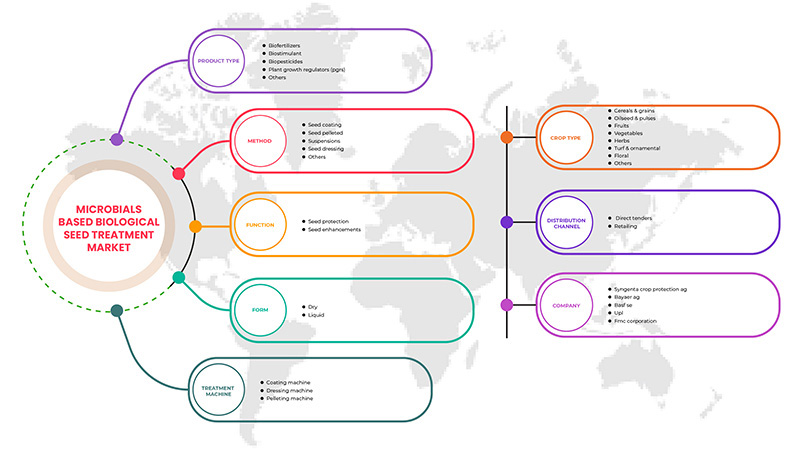

北美基于微生物的生物种子处理市场,按产品(生物肥料、生物刺激素、生物农药、植物生长调节剂 (PGR) 等)、形式(干性和液体)、方法(种子包衣、种子丸粒化、悬浮液、种子包衣等)、处理机(包衣机、包衣机和制粒机)、功能(种子保护和种子附魔)、分销渠道(直接招标和零售)、作物类型(谷物和谷类、油籽和豆类、水果、蔬菜、草本植物、草坪和观赏植物、花卉等)行业趋势和预测到 2029 年。

北美基于微生物的生物种子处理市场分析与洞察

与化学种植食品相关的过敏症患病率不断上升,收购和兼并不断增加。许多公司与全球主要参与者合作推出大量有机和生物基种子处理产品,如生物农药、生物刺激素等,以扩大其影响力,并在整个地区提供产品,这些预计将推动市场的增长。

例如,

- 2022 年 2 月,Valent BioSciences 成立了一个新的生物刺激素运营部门,以支持母公司住友化学到 2050 年实现碳中和的目标。这个新的运营部门旨在通过新的内部和外部开发的产品扩大其生物刺激素产品线,以满足美国和全球市场这一重要且快速增长的作物生产领域的需要

收购和合作将在未来几年推动市场增长。而有机食品、天然种植和生物农药的高比例可能会限制该地区的市场增长。

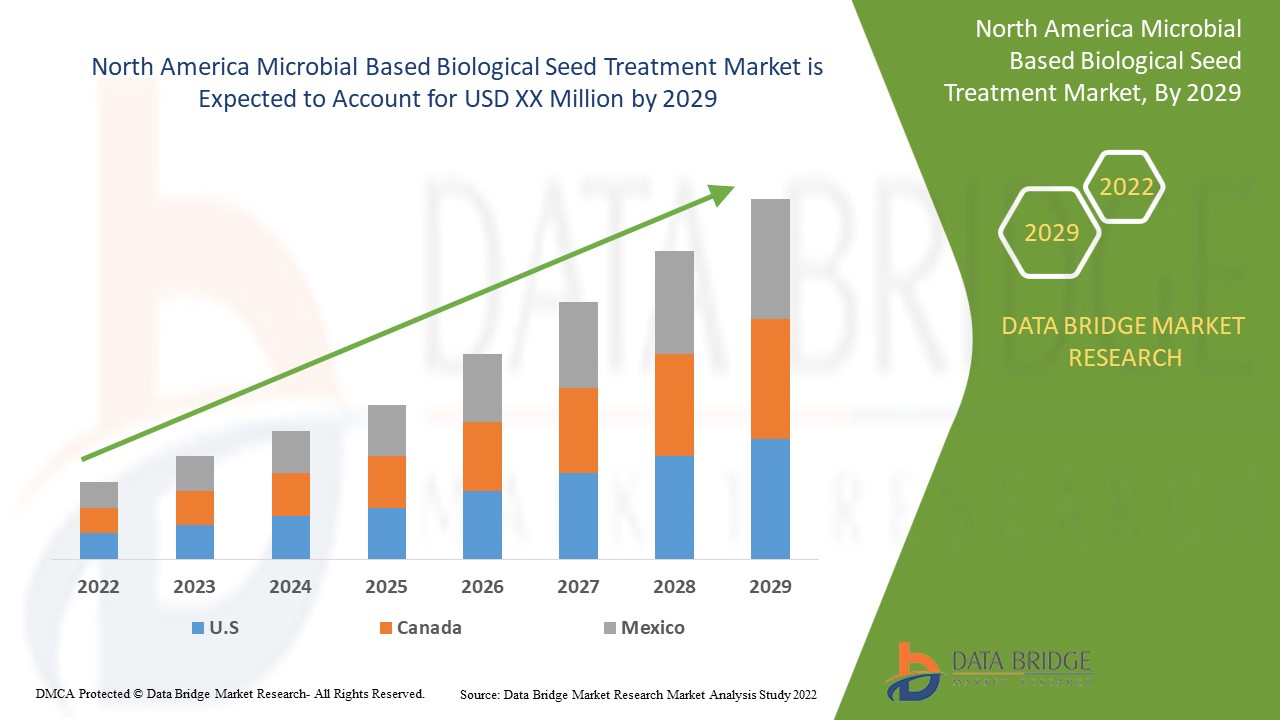

Data Bridge Market Research分析,北美基于微生物的生物种子处理市场在2022年至2029年的预测期内将以11.3%的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2015) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按产品(生物肥料、生物刺激素、生物农药、植物生长调节剂(PGR)等)、形式(干的和液体)、方法(种子包衣、种子丸粒化、悬浮液、拌种等)、处理机器(包衣机、拌种机和丸粒化机)、功能(种子保护和种子附魔)、分销渠道(直接招标和零售)、作物类型(谷物和谷类、油籽和豆类、水果、蔬菜、草本植物、草皮和观赏植物、花卉等)。 |

|

覆盖区域 |

美国、加拿大和墨西哥。 |

|

涵盖的市场参与者 |

先正达作物保护公司、拜耳公司、巴斯夫公司、UPL、FMC Corporation、安道麦、Albaugh, LLC.、Arysta LifeScience Corporation、BioWorks Inc.、Croda International Plc、Germains Seed Technology、Hello Nature International、Koppert、Marrone Bio Innovations, Inc.、诺维信、Plant Health Care plc.、T.Stanes and Company Limited、Tagros Chemicals India Pvt. Ltd.、Valent BioSciences LLC 和 Verdesian Life Sciences 等。 |

市场定义

生物种子处理剂是一类广泛的产品,含有活性成分,包括活微生物、植物提取物、发酵产品、植物激素,甚至硬化学品。生物物质以粉末或液体的形式应用于种子。均匀的涂层覆盖整个种子。这样,种子在需要时就可以获得有益成分。生物种子处理剂中的活性剂可以包括真菌和细菌等微生物,以及植物提取物和藻类提取物。丛枝菌根真菌、木霉属、根瘤菌和其他细菌中的有益微生物在播种前应用于种子,以提高发芽率。用生物种子处理过的作物可作为生物刺激剂,使其更强壮、更高效。这种处理方法可以提高农业产量,同时帮助植物抵御疾病并减少生物胁迫。支持植物生长的微生物在根部定殖,并在整个生长季节保护作物。基于微生物的生物种子处理剂的应用多种多样。

北美基于微生物的生物种子处理市场动态

本节旨在了解市场驱动因素、机遇、限制和挑战。以下内容将详细讨论所有这些内容:

驱动程序

-

农业用生物植物生长产品的推出增加

生物杀虫剂、生物杀线虫剂、生物杀菌剂、生物除草剂等生物农药制造商推出的产品数量增加是市场增长的主要驱动因素之一。随着人们对化学农药对农作物和环境有害影响的认识不断提高,农民对有机或天然和生物产品的需求也在增加。这一因素将推动市场的增长。农民正在采用从天然来源提取且易于分解的农药来提高生产力并通过减少污染来支持环境。

例如,

-

2021 年 3 月,据 Meister Media Worldwide 报道,Botanical Solution Inc. 和先正达在墨西哥推出了一款名为 BotriStop 的生物杀菌剂产品,该产品有助于控制灰葡萄孢菌

-

2020 年 3 月,据 AgroSpectrum India 报道,拜耳公司在中国推出了生物杀菌剂 Serenade

-

2020 年 4 月,先正达与诺维信合作,将名为 TAEGRO 的生物杀菌剂商业化

随着农民对天然和生物种子处理产品的需求不断增长以支持可持续农业实践,主要制造商推出的产品数量增加可能会推动基于微生物的生物种子处理市场的增长。

机会

- 企业采取的战略举措

由于公众和监管机构要求减少化学农药的使用,使用微生物作为生物替代品变得越来越重要。微生物可以作为生物刺激剂,使植物更容易获取和吸收土壤中的养分,提高植物对环境压力的耐受性,并在不同的生长阶段为植物提供帮助,从而有效地对抗各种害虫。

公司正在制定战略、发布产品和计划以满足消费者的需求并提高人们对可持续农业的认识,为制造商提供更多的扩张机会。

越南的公司一直致力于推出创新解决方案,帮助农民应对日常活动中的挑战,同时提高作物产量和质量,同时保护环境。推出新产品和新技术可以发挥创新作用,应对农业挑战。

例如,

- 2022 年 6 月,先正达推出了新的种子处理产品 VICTRATO。革命性的线虫控制产品 VICTRATO 基于先正达的 TYMIRIUMTM 技术,为这一具有挑战性的问题提供了创造性的方法。所有主要的线虫种类和真菌疾病都得到有效控制,而不会损害土壤或植物的健康。它是一种非常简单的产品,活性成分剂量极少

- 2022 年 3 月,赢创推出了用于种子处理应用的 BREAK-THRU 产品。BREAK-THRU BP 787 是一种可生物降解、不含微塑料的传统粘合剂溶液替代品。BREAK-TRHU BP 787 与二氧化硅(如 Aerosil 200)结合时可用作粘合剂成分,因为它与水可混溶

- 2021 年 7 月,Rizobacter 和 Marrone Bio 扩大了战略联盟,在巴西提供新的种子处理剂。Rizonem 是一种针对线虫和土壤昆虫的生物种子处理剂,将通过扩大的分销安排在巴西的行栽作物中提供。Rizonema 对大豆和玉米中重要线虫物种的有效性已在巴西的众多监管试验中得到证实。

因此,公司的战略创新和满足消费者需求的新产品将在预测期内推动市场增长。

限制/挑战

- 生物种子处理产品的政府监管壁垒

不同国家和地区对活性生物成分的监管环境不同。在一些国家,生物制品必须根据特定法律进行注册,或者可以像化学植物保护产品一样进行注册。有时对数据的要求较少,有时甚至可能没有明确定义的注册流程。欧盟要求对生物农药产品的功效进行量化并证明其支持标签声明。只有获准的生物农药才能合法用于作物保护。根据经合组织的建议,只有风险较小的生物农药才应获得批准。

此外,监管机构要求的生物农药登记数据组合通常是现有传统化学农药的修改版本。监管机构利用它进行风险评估。它包含有关作用方法、毒理学和生态毒理学评估、宿主范围测试和其他因素的详细信息。生成这些数据的成本可能会阻碍企业将生物农药商业化,因为生物农药通常是小众市场产品。

因此,没有适当的生物农药登记制度可以确保安全并且不会阻碍商业化,这可能会对基于微生物的生物种子处理市场产生负面影响。

COVID-19 对北美微生物生物种子处理市场的影响

疫情过后,由于不再限制人员流动,产品供应将变得容易,生物种子处理的需求有所增加。此外,使用生物基有机和天然种子处理产品的趋势日益增长,可能会推动市场的增长。

基于微生物的生物种子处理的需求增加使得制造商能够推出创新和多功能的种子处理产品,这最终增加了基于微生物的生物种子处理的需求并帮助市场增长。

此外,对生物种子处理产品的高需求将推动市场增长。此外,COVID-19 疫情后对有机和天然产品的需求增加也推动了市场增长,因为消费者更加关心自己的健康。此外,消费者对新技术和多用途产品的兴趣预计将推动北美基于微生物的生物种子处理市场的增长。

最新动态

- 2022 年 3 月,UPL 与 Kimitec 的 MAAVi 创新中心合作,将北美生物刺激素产品商业化。此次与该公司及其研发中心 MAAVi 的合作扩大了 UPL 的产品范围,以支持可持续食品生产,同时提高种植者的盈利能力

- 2022 年 2 月,Valent BioSciences 成立了一个新的生物刺激素运营部门,以支持母公司住友化学到 2050 年实现碳中和的目标。这个新的运营部门旨在通过新的内部和外部开发的产品扩大其生物刺激素产品线,以满足美国和全球市场在这个重要且快速增长的作物生产领域的需要。

北美基于微生物的生物种子处理市场范围

北美微生物种子处理市场根据产品、形式、方法、处理机器、功能、分销渠道和作物类型进行细分。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

产品

- 生物肥料

- 生物刺激素

- 生物农药

- 植物生长调节剂 (PGR)

- 其他的

根据产品,北美基于微生物的生物种子处理市场分为生物肥料、生物刺激素、生物农药、植物生长调节剂(PGR)等。

形式

- 干燥

- 液体

根据形式,北美基于微生物的生物种子处理市场分为干性和液体性。

方法

- 种子包衣

- 种子丸粒化

- 暂停

- 拌种

- 其他的

根据方法,北美基于微生物的生物种子处理市场分为种子包衣、种子丸粒化、悬浮液、拌种等。

治疗机

- 涂布机

- 修整机

- 制粒机

根据处理机器,北美基于微生物的生物种子处理市场分为包衣机、敷料机和制粒机。

功能

- 种子保护

- 种子增强

根据功能,北美基于微生物的生物种子处理市场分为种子保护和种子增强。

分销渠道

- 直接招标

- 零售

根据分销渠道,北美基于微生物的生物种子处理市场分为直接招标和零售。

作物类型

- 谷物与谷类

- 油籽和豆类

- 水果

- 蔬菜

- 香草

- 草坪和观赏植物

- 花的

- 其他的

根据作物类型,北美基于微生物的生物种子处理市场分为谷物和谷类、油籽和豆类、水果、蔬菜、草本植物、草皮和观赏植物、花卉等。

北美基于微生物的生物种子处理市场区域分析/见解

对北美基于微生物的生物种子处理市场进行了分析,并根据上述参考提供了市场规模洞察和趋势。

北美微生物生物种子处理市场报告涵盖的国家包括美国、加拿大和墨西哥

就市场份额和收入而言,美国有望在北美微生物种子处理市场占据主导地位。由于与化学种植食品相关的过敏症增加、北美地区收购和兼并不断增加,预计美国将在预测期内保持主导地位。

报告的区域部分还提供了影响市场当前和未来趋势的各个市场影响因素和法规变化。新车和替代车销售、国家人口统计、疾病流行病学和进出口关税等数据点是预测各个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了北美品牌的存在和可用性以及它们因来自本地和国内品牌的激烈竞争而面临的挑战以及销售渠道的影响。

竞争格局和北美基于微生物的生物种子处理市场份额分析

竞争激烈的北美微生物生物种子处理市场提供了有关竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上数据点仅与公司对北美微生物生物种子处理市场的关注有关。

北美微生物生物种子处理市场的一些主要参与者包括先正达作物保护股份有限公司、拜耳公司、巴斯夫欧洲公司、UPL、FMC Corporation、安道麦、Albaugh, LLC.、Arysta LifeScience Corporation、BioWorks Inc.、Croda International Plc、Germains Seed Technology、Hello Nature International、Koppert、Marrone Bio Innovations, Inc.、诺维信、Plant Health Care plc.、T.Stanes and Company Limited、Tagros Chemicals India Pvt. Ltd.、Valent BioSciences LLC 和 Verdesian Life Sciences 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER BUYING BEHAVIOR

4.2.1 RECOMMENDATIONS FROM FAMILY, FRIENDS, AND DEALERS -

4.2.2 RESEARCH

4.2.3 IMPULSIVE

4.2.4 ADVERTISEMENT:

4.2.4.1 TELEVISION ADVERTISEMENT

4.2.4.2 ONLINE ADVERTISEMENT

4.2.4.3 IN-STORE ADVERTISEMENT

4.2.4.4 OUTDOOR ADVERTISEMENT

4.3 FACTORS INFLUENCING PURCHASING DECISION

4.3.1 SUSTAINABLE AGRICULTURE

4.3.2 NEW COMBINATIONS

4.3.3 BIOSTIMULANTS

4.4 NEW PRODUCT LAUNCH STRATEGY

4.4.1 OVERVIEW

4.4.2 NUMBER OF PRODUCT LAUNCHES

4.4.2.1 LINE EXTENSION

4.4.2.2 NEW PACKAGING

4.4.2.3 RE-LAUNCHED

4.4.2.4 NEW FORMULATION

4.4.3 DIFFERENTIAL PRODUCT OFFERING

4.4.4 MEETING CONSUMER REQUIREMENT

4.4.5 PACKAGE DESIGNING

4.4.6 PRODUCT POSITIONING

4.4.7 CONCLUSION

5 SUPPLY CHAIN ANALYSIS

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING PROCESS

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

6 REGULATORY FRAMEWORK

6.1 BIOSCIENCE SOLUTIONS

6.1.1 U.S.

6.1.2 NCBI

6.1.3 FSSAI

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN THE NUMBER OF APPROVALS FOR BIOPESTICIDES BY GOVERNMENTAL BODIES

7.1.2 INCREASE IN LAUNCHES OF BIOLOGICAL PLANT GROWTH PRODUCTS FOR AGRICULTURE

7.1.3 INCLINATION TOWARD THE SUSTAINABLE AGRICULTURE

7.1.4 GROWING ADOPTION OF ORGANIC FARMING

7.2 RESTRAINTS

7.2.1 LIMITED SHELF LIFE OF MICROBES

7.2.2 GOVERNMENT REGULATORY BARRIERS FOR BIOLOGICAL SEED TREATMENT PRODUCTS

7.3 OPPORTUNITIES

7.3.1 BIOENCAPSULATION TECHNOLOGY FOR BIOLOGICAL SEED TREATMENT

7.3.2 RISE IN ENVIRONMENTAL POLLUTION CAUSED BY CHEMICAL PESTICIDES

7.3.3 RISE IN AWARENESS ABOUT BIOSTIMULANTS

7.3.4 STRATEGIC INITIATIVES TAKEN BY COMPANIES

7.4 CHALLENGES

7.4.1 HIGH PRICES OF BIOPESTICIDES

7.4.2 AVAILABILITY OF CHEMICAL-BASED SUBSTITUTES

8 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 BIO PESTICIDES

8.2.1 BIO INSECTICIDES

8.2.1.1 BACILLUS THURINGIENSIS

8.2.1.2 METARHIZIUM ANISOPLIAE

8.2.1.3 BEAUVERIA BASSIANA

8.2.1.4 VERTICILLIUM LECANII

8.2.1.5 BACULOVIRUS

8.2.1.6 OTHERS

8.2.2 BIO FUNGICIDES

8.2.2.1 BACILLUS

8.2.2.2 TRICHODERMA VIRIDE

8.2.2.3 PSEUDOMONAS

8.2.2.4 STREPTOMYCES

8.2.2.5 TRICHODERMA HARZIANUM

8.2.2.6 OTHERS

8.2.3 BIONEMATICIDES

8.2.3.1 BACILLUS FIRMUS

8.2.3.2 OTHERS

8.2.4 BIO HERBICIDES

8.3 BIO STIMULANTS

8.4 BIO FERTILIZERS

8.4.1 NITROGEN FIXING BIO FERTILIZERS

8.4.1.1 RHIZOBIA BACTERIA

8.4.1.2 AZOSPIRILLUM

8.4.1.3 FRAMKIA

8.4.2 OTHERS

8.5 PLANT GROWTH REGULATORS (PGRS)

8.6 OTHERS

9 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM

9.1 OVERVIEW

9.2 DRY

9.2.1 WETTABLE POWDER

9.2.2 DRY GRANULES

9.2.3 WATER DIPS

9.3 LIQUID

9.3.1 SUSPENSION CONCENTRATE

9.3.2 EMULSIFIABLE CONCENTRATE

9.3.3 SOLUBLE LIQUID CONCENTRATE

10 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD

10.1 OVERVIEW

10.2 SEED DRESSING

10.3 SEED COATING

10.3.1 FILM COATED

10.3.2 BIOPRIMED

10.3.3 SLURRY COATED

10.4 SEED PELLETED

10.5 SUSPENSIONS

10.5.1 BACTERIAL SUSPENSION

10.5.2 SPORE SUSPENSION

10.5.3 CONIDIAL SUSPENSION

10.6 OTHERS

11 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINE

11.1 OVERVIEW

11.2 DRESSING MACHINE

11.3 COATING MACHINE

11.4 PELLETING MACHINE

12 NORTH AMERICA MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 SEED PROTECTION

12.2.1 DISEASE CONTROL

12.2.2 INVERTEBRATE PEST CONTROL

12.2.3 WEED CONTROL

12.3 SEED ENHANCEMENTS

12.3.1 SEED PRIMING

12.3.1.1 IMPROVED YIELD

12.3.1.2 DROUGHT RESISTANCE

12.3.1.3 SALINITY RESISTANCE

12.3.1.4 OTHERS

12.3.2 SEED DISINFECTION

13 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDERS

13.3 RETAILING

14 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE

14.1 OVERVIEW

14.2 CEREALS & GRAINS

14.2.1 WHEAT

14.2.2 RICE

14.2.3 MAIZE

14.2.4 BARLEY

14.2.5 OTHER

14.3 OILSEED & PULSES

14.3.1 SOYBEAN

14.3.2 COTTONSEED

14.3.3 PEANUT

14.3.4 RAPESEED

14.3.5 PEA

14.3.6 GRAM

14.3.7 CHICKPEAS

14.3.8 LENTIL

14.3.9 OTHERS

14.4 FRUITS

14.4.1 BANANA

14.4.2 APPLE

14.4.3 ORANGE

14.4.4 GRAPES

14.4.5 STRAWBERRIES

14.4.6 PINEAPPLE

14.4.7 MANGOES

14.4.8 POMEGRANATE

14.4.9 PEACH

14.4.10 PASSIONFRUIT

14.4.11 WATERMELON

14.4.12 OTHERS

14.5 VEGETABLES

14.5.1 SOLANAECEOUS

14.5.1.1 EGGPLANT

14.5.1.2 PEPPER

14.5.1.3 TOMATO

14.5.1.4 OTHERS

14.5.2 CUCURBITS

14.5.2.1 CUCUMBER

14.5.2.2 ZUCCHINI

14.5.2.3 BITTERGOURD

14.5.2.4 BOTTLEGOURD

14.5.2.5 SQUASH

14.5.2.6 OTHERS

14.5.3 ROOT & BULB

14.5.3.1 CARROTS

14.5.3.2 BEET ROUTE

14.5.3.3 ONION

14.5.3.3.1 RED ONION

14.5.3.3.2 WHITE ONION

14.5.3.4 RADISHES

14.5.3.5 RUTABAGA

14.5.3.6 OTHERS

14.5.4 BRASSICA

14.5.4.1 CABBAGE

14.5.4.2 PAK CHOI

14.5.4.3 SPINACH

14.5.4.4 CAULIFLOWER

14.5.4.5 LETTUCE

14.5.4.6 BROCCOLI

14.5.4.7 ARUGULA

14.5.4.8 MUSTARD

14.5.4.9 OTHERS

14.5.5 LARGE CROPS

14.5.5.1 BEAN

14.5.5.2 SWEETCORN

14.5.5.3 BABYCORN

14.5.5.4 OTHERS

14.6 HERBS

14.6.1 BASIL

14.6.2 CILANTRO

14.6.3 PARSLEY

14.6.4 DILL

14.6.5 OTHERS

14.7 FLORAL

14.8 TURF & ORNAMENTAL

14.9 OTHERS

15 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SYNGENTA CROP PROTECTION AG

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 BAYER AG

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 BASF SE

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 UPL

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 FMC CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 ADAMA

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 ALBAUGH, LLC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 ARYSTA LIFESCIENCE CORPORATION

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 BIOWORKS INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 CRODA INTERNATIONAL PLC

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 GERMAINS SEED TECHNOLOGY

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HELLO NATURE INTERNATIONAL

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 KOPPERT

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 MARRONE BIO INNOVATIONS, INC.

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 NOVOZYMES

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 PLANT HEALTH CARE PLC.

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENT

18.17 TAGROS CHEMICALS INDIA PVT. LTD.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENTS

18.18 T.STANES AND COMPANY LIMITED

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENTS

18.19 VALENT BIOSCIENCES LLC

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 VERDESIAN LIFE SCIENCES

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

表格列表

TABLE 1 PRICES OF BIOPESTICIDES

TABLE 2 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BIO STIMULANTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PLANT GROWTH REGULATORS (PGRS) IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION))

TABLE 14 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SEED DRESSING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA SEED PELLETED IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SUSPENSION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DRESSING MACHINE IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA COATING MACHINE IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA PELLETING MACHINE IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA SEED PROTECTION IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SEED PROTECTION IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA SEED ENHANCEMENTS IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA SEED ENHANCEMENTS IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SEED PRIMING IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA DIRECT TENDERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA RETAILING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION))

TABLE 45 NORTH AMERICA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA FLORAL IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA TURF & ORNAMENTAL IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA OTHERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION))

TABLE 60 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 U.S. BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 U.S. NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 U.S. BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 96 U.S. BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 97 U.S. BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 U.S. BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 100 U.S. DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 101 U.S. LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 103 U.S. SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 104 U.S. SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 105 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 106 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 107 U.S. SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 108 U.S. SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 109 U.S. SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 110 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 111 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.S. CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.S. OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 114 U.S. FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 115 U.S. VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 116 U.S. SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 117 U.S. CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 118 U.S. ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 119 U.S. ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 120 U.S. BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 121 U.S. LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 122 U.S. HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 123 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 124 CANADA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 CANADA NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 126 CANADA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 127 CANADA BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 128 CANADA BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 129 CANADA BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 130 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 131 CANADA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 132 CANADA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 133 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 134 CANADA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 135 CANADA SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 136 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 137 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 138 CANADA SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 139 CANADA SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 140 CANADA SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 141 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 143 CANADA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 144 CANADA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 145 CANADA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 146 CANADA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 147 CANADA SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 148 CANADA CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 149 CANADA ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 150 CANADA ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 151 CANADA BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 152 CANADA LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 153 CANADA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 154 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 155 MEXICO BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 156 MEXICO NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 157 MEXICO BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 158 MEXICO BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 159 MEXICO BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 160 MEXICO BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 161 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 162 MEXICO DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 163 MEXICO LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 164 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 165 MEXICO SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 166 MEXICO SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 167 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 168 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 169 MEXICO SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 170 MEXICO SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 171 MEXICO SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 172 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 173 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 174 MEXICO CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 175 MEXICO OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 176 MEXICO FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 177 MEXICO VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 178 MEXICO SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 179 MEXICO CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 180 MEXICO ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 181 MEXICO ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 182 MEXICO BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 183 MEXICO LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 184 MEXICO HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: SEGMENTATION

FIGURE 10 INCREASE IN THE NUMBER OF APPROVALS FOR BIOPESTICIDES BY GOVERNMENTAL BODIES DRIVING THE NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET IN THE FORECAST PERIOD 2022-2029

FIGURE 11 BIOPESTICIDES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET

FIGURE 15 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY PRODUCT, 2021

FIGURE 16 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY FORM, 2021

FIGURE 17 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY METHOD, 2021

FIGURE 18 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY TREATMENT MACHINES, 2021

FIGURE 19 NORTH AMERICA MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET: BY FUNCTION, 2021

FIGURE 20 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY CROP TYPE, 2021

FIGURE 22 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY PRODUCT (2022-2029)

FIGURE 27 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。