North America Insect Protein Market

市场规模(十亿美元)

CAGR :

%

USD

59.45 Billion

USD

340.97 Billion

2024

2032

USD

59.45 Billion

USD

340.97 Billion

2024

2032

| 2025 –2032 | |

| USD 59.45 Billion | |

| USD 340.97 Billion | |

|

|

|

|

北美昆蟲蛋白市場,依來源(鞘翅目和直翅目)、昆蟲類型(甲蟲、毛蟲、蜜蜂、黃蜂和螞蟻、蚱蜢、蝗蟲、蟋蟀、蝽象、黑水虻、蟬、葉蟬、飛蝨、介殼蟲、白蟻、蜻蜓、蒼蠅、黃粉蟲等、應用(食品和飼料、產業品2032 年。

昆蟲蛋白質市場規模

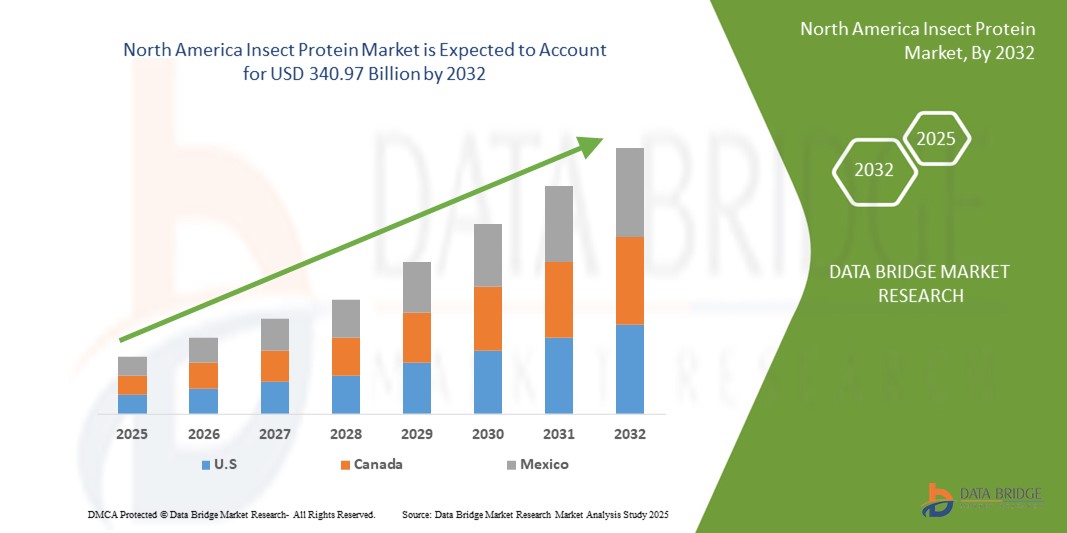

- 2024 年北美昆蟲蛋白市場規模價值594.5 億美元 ,預計 到 2032 年將達到 3,409.7 億美元,預測期內 複合年增長率為 24.40%。

- 市場成長主要得益於消費者對永續蛋白質來源的認識不斷提高、對環保食品替代品的需求不斷增長以及昆蟲養殖技術的進步

- 日益增長的環境問題,加上對高蛋白飲食的需求以及昆蟲成分在各種應用中的整合,正在加速昆蟲蛋白的採用,顯著促進行業增長

昆蟲蛋白質市場分析

- 昆蟲蛋白質源自可食用昆蟲,正成為傳統蛋白質來源的可持續且營養豐富的替代品,由於其蛋白質含量高、環境足跡低且可擴展,廣泛應用於食品飲料、動物飼料、藥品和化妝品領域。

- 消費者對替代蛋白質的接受度不斷提高、支持性監管框架以及對昆蟲食品生產的投資不斷增加,推動了昆蟲蛋白質需求的激增

- 美國在北美昆蟲蛋白質市場佔據主導地位,2024年其收入份額高達37.8%,位居榜首。這得益於美國對永續性的高度重視、在食品和飼料行業的廣泛應用以及領先市場參與者的積極參與。創新新創公司以及針對消費者偏好的新型昆蟲產品研發,進一步推動了美國市場的發展。

- 預計加拿大將成為預測期內昆蟲蛋白市場成長最快的國家,這歸因於消費者對永續飲食的興趣日益濃厚、政府的利好舉措以及城市化進程加快

- 2024 年,包括甲蟲在內的鞘翅目昆蟲佔據了最大的市場收入份額,達到 58.5%,這得益於甲蟲種類的多樣性和豐富性,尤其是黃粉蟲,它們蛋白質含量高,廣泛用於動物飼料和食品

報告範圍和昆蟲蛋白質市場細分

|

屬性 |

昆蟲蛋白質關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

昆蟲蛋白質市場趨勢

“先進加工技術與產品創新的融合日益加深”

- 北美昆蟲蛋白質市場正經歷先進加工技術與創新產品開發的融合趨勢

- 自動化農業系統、人工智慧驅動的品質控制和優化的蛋白質提取方法等技術正在提高昆蟲蛋白質生產的效率和可擴展性

- 這些進步使得人們能夠創造出多種多樣的產品,例如昆蟲蛋白粉、蛋白棒、零食和麵粉,從而吸引註重健康的消費者並擴大市場範圍

- 例如,企業正在利用人工智慧監測昆蟲的生長狀況,確保一致的品質和營養成分,而物聯網技術則優化農業運營,以提高產量

- 這一趨勢透過改善產品的一致性、口味和質地,使昆蟲蛋白更具吸引力,從而吸引個人消費者以及食品飲料、飼料和製藥等行業

- 高級分析技術也用於根據消費者的喜好定制產品,例如開發具有增強風味的蟋蟀蛋白棒或用於寵物食品的黃粉蟲粉

昆蟲蛋白質市場動態

司機

“對可持續蛋白質來源和環保食品解決方案的需求不斷增長”

- 消費者對環境永續性的意識不斷增強以及對替代蛋白質來源的需求是北美昆蟲蛋白質市場的主要驅動力

- 昆蟲蛋白質為傳統牲畜提供了一種可持續的替代品,它需要的土地、水和飼料更少,同時產生的溫室氣體排放也更少

- 美國(主要國家)和加拿大(成長最快的市場)的政府措施和消費者趨勢正在推動永續食品體系的發展,進一步推動昆蟲產品的普及

- 生酮飲食和原始人飲食等注重健康的飲食方式的興起,推動了對營養豐富的昆蟲蛋白產品的需求,這些產品蛋白質含量高(40%-70%),並富含必需氨基酸

- Aspire Food Group 和 EntomoFarms 等公司正在擴大加拿大和美國的生產能力,以滿足日益增長的昆蟲食品、飼料和化妝品的需求,並藉助 5G 和物聯網的進步實現高效的供應鏈管理

克制/挑戰

“生產成本高,消費者接受度低”

- 昆蟲養殖基礎設施、加工設備和法規遵循所需的高額初始投資構成了重大障礙,特別是對於北美昆蟲蛋白市場的小公司而言

- 擴大生產規模和開發具有成本效益的加工方法仍然很複雜且成本高昂,尤其是在該地區的新興市場

- 消費者的接受度,尤其是在美國和加拿大,受到文化上對食用昆蟲(昆蟲消費)的厭惡以及對其營養和環境效益認識不足的阻礙

- PureGym 2018 年的一項研究數據顯示,雖然 35% 的健身房會員願意嘗試食用昆蟲,但消費者仍然普遍存在猶豫,尤其是在食用昆蟲不太為人所知的西方市場

- 監管挑戰,例如美國、加拿大和墨西哥對昆蟲產品的不同標準,以及對過敏原風險(幾丁質相關敏感性)的擔憂,進一步使市場成長複雜化

昆蟲蛋白質市場範圍

市場根據來源、昆蟲類型、應用和分銷管道進行細分。

- 按來源

根據來源,北美昆蟲蛋白質市場分為鞘翅目和直翅目。鞘翅目昆蟲(包括甲蟲)在2024年佔據了最大的市場收入份額,達58.5%。這得歸功於甲蟲種類繁多、數量眾多,尤其是黃粉蟲,它們蛋白質含量高,廣泛用於動物飼料和食品。黃粉蟲的韌性和對大規模養殖的適應性進一步鞏固了它們的主導地位。

直翅目昆蟲,包括蟋蟀、蚱蜢和蝗蟲,預計在2025年至2032年間將達到26.8%的最快成長率。這一增長主要得益於直翅目昆蟲的高蛋白質含量(蚱蜢的蛋白質含量高達77%)以及它們在蛋白棒和零食等食品中的日益普及,吸引了注重健康的消費者。蟋蟀養殖和加工技術的進步也推動了這一領域的快速擴張。

- 按昆蟲類型

根據昆蟲種類,北美昆蟲蛋白市場細分為甲蟲、毛蟲、蜜蜂、黃蜂和螞蟻、蚱蜢、蝗蟲、蟋蟀、蝽象、黑水虻、蟬、葉蟬、飛蝨、介殼蟲、白蟻、蜻蜓、蒼蠅、黃粉蟲和其他昆蟲。甲蟲類昆蟲預計將在2024年佔據市場收入的42.5%份額,這得益於其高營養價值和在動物飼料中的廣泛應用,尤其是黃粉蟲,它具有成本效益和可持續性。

在2025年至2032年期間,蟋蟀細分市場將實現28.4%的最快增長率,這得益於其高蛋白質含量(高達69%)、易於養殖以及消費者對蟋蟀粉和蛋白棒等食品的接受度不斷提高。美國和加拿大對可持續且營養豐富的替代品的需求不斷增長,進一步加速了該細分市場的成長。

- 按應用

根據應用,北美昆蟲蛋白市場細分為食品飲料、飼料以及醫藥和化妝品。飼料領域在2024年佔據最大的市場收入份額,達到48.5%,這得益於水產養殖、家禽和寵物食品產業對永續動物飼料需求的不斷增長。昆蟲蛋白質蛋白質含量高達40-70%,且消化率高,因其環保特性而日益受到青睞。

預計2025年至2032年,食品和飲料產業將實現27.5%的最快成長率,這得益於消費者對永續和營養食品日益增長的興趣。加工過程的創新催生了昆蟲蛋白粉、蛋白棒和零食等產品,並在美國和加拿大註重健康的消費者中日益受到青睞。

- 按分銷管道

根據分銷管道,北美昆蟲蛋白市場分為直接通路和間接通路。間接通路包括零售商和分銷商,預計到2024年將佔據最大的市場收入份額,達到62.5%。這得益於其透過超市、專賣店和線上平台的廣泛覆蓋,能夠同時滿足商業和消費者市場的需求。

預計2025年至2032年期間,直銷市場將以25.9%的最快速度成長,這得益於昆蟲蛋白生產商與最終用戶(例如食品製造商和飼料公司)之間日益增長的合作關係。直銷能夠更好地控製品牌和供應鏈,尤其是在可持續蛋白質需求激增的加拿大。

昆蟲蛋白質市場區域分析

- 美國在北美昆蟲蛋白質市場佔據主導地位,2024年其收入份額高達37.8%,位居榜首。這得益於美國對永續性的高度重視、在食品和飼料行業的廣泛應用以及領先市場參與者的積極參與。創新新創公司以及針對消費者偏好的新型昆蟲產品研發,進一步推動了美國市場的發展。

- 預計加拿大將成為預測期內昆蟲蛋白市場成長最快的國家,這歸因於消費者對永續飲食的興趣日益濃厚、政府出台的有利舉措以及城市化進程加快

美國昆蟲蛋白質市場洞察

美國在北美昆蟲蛋白市場佔據主導地位,2024年其收入份額高達76%,這得益於消費者對永續性和營養價值的強烈關注。食品飲料和動物飼料產業對昆蟲製品(例如蟋蟀粉和黃粉蟲零食)的需求正在增加。由於消費者對環保飲食和健康產品的興趣,售後市場蓬勃發展,而寵物食品和水產養殖業對OEM(原始設備製造商)的採用也推動了市場成長。監管部門對飼料中昆蟲蛋白質應用的支持以及對生產設施投資的增加(例如Innovafeed與ADM的合作),進一步推動了市場的成長。

加拿大昆蟲蛋白市場洞察

加拿大是北美昆蟲蛋白質市場成長最快的國家,這得益於消費者對永續蛋白質來源日益增長的興趣以及政府對環保農業實踐的支持。食品和飲料領域對昆蟲蛋白的需求(例如蛋白棒和零食)正在成長,尤其是在註重健康和環保的消費者群體中。飼料產業(包括水產養殖和家禽養殖)也是一個重要的成長動力,Enterra Feed Corporation 等公司引領創新。加拿大對減少碳足跡的關注以及昆蟲養殖技術的進步促進了其市場的快速成長。

昆蟲蛋白質市場份額

昆蟲蛋白產業主要由知名公司主導,包括:

- AgriProtein(南非)

- Enterra 飼料公司(加拿大)

- Aspire食品集團(加拿大)

- Beta Hatch(美國)

- BIOFLYTECH(西班牙)

- Chapul 蟋蟀蛋白(美國)

- Entobel(越南)

- Entocycle(英國)

- Entomo Farms(法國)

- 北美蟲子(泰國)

- 浩誠黃粉蟲有限公司(中國)

- Hexafly(愛爾蘭)

- Innovafeed(法國)

- 挪威「INSECTUM」股份公司

- nextProtein(法國)

北美昆蟲蛋白質市場的最新發展如何?

- 2023年10月,泰森食品宣布與荷蘭昆蟲原料先驅Protix建立策略夥伴關係,以推動永續蛋白質生產。此次合作包括成立合資企業,在美國建造首個大型昆蟲原料工廠,並利用食品生產副產品培育黑水虻。這些昆蟲將被加工成高品質的蛋白質和脂質,用於寵物食品、水產養殖和牲畜飼料,從而形成一種循環、低影響的蛋白質來源。泰森也收購了Protix的少數股權,以支持其全球擴張,並強化其對創新、環保食品體系的承諾。

- 2023年3月,Aspire Food Group獲得加拿大下一代製造公司(NGen)的資助,用於推進其位於安大略省倫敦市的蟋蟀蛋白生產設施——全球首個全自動昆蟲蛋白生產基地。該設施整合了人工智慧、工業物聯網(IIoT)感測器以及自動化倉儲和檢索系統,以優化蟋蟀的養殖、加工和包裝,最終將其轉化為可持續的蛋白質原料。該計畫預計年產量為900萬公斤,旨在徹底改變食品級蛋白質的生產方式,支持寵物營養和人類消費,同時解決糧食不安全和環境永續性問題。

- 2023年2月,北美最大的食用昆蟲農場EntomoFarms與加拿大食品製造商Crickstart合作,推出了一系列以蟋蟀蛋白為基礎的全新產品。這些產品專為注重健康的消費者設計,旨在尋找可持續的高蛋白替代品。此次合作充分利用了EntomoFarms在蟋蟀粉生產方面的專業知識以及Crickstart在製作營養豐富的零食方面的經驗,擴大了其在北美功能性食品市場的影響力。此舉順應了消費者對環保蛋白質來源日益增長的興趣,這些蛋白質來源既有利於個人健康,又有利於環境永續性。

- 2023年1月,Ÿnsect成為美國飼料管理協會(AAFCO)授權在美國商業化脫脂黃粉蟲蛋白(Protein70)用於狗糧的首家公司。這項具有里程碑意義的批准是在兩年的評估和六個月的飼養試驗後獲得的,證實了該成分的營養價值,包括高蛋白質消化率、必需氨基酸、不飽和脂肪和微量營養素。此舉為Ÿnsect旗下的寵物食品品牌Sprÿng在美國市場打開了大門,並支持寵物營養向可持續、低影響蛋白質來源的轉變。

- 2022年12月,總部位於德克薩斯州奧斯汀的可持續寵物食品新創公司Neo Bites在北美推出了首款以昆蟲蛋白製成的功能性狗糧配料系列。這些配料採用該公司專有的超級昆蟲混合物(以蟋蟀蛋白為特色)配製而成,旨在滿足犬類的特定健康需求——消化健康、皮膚和毛髮護理以及日常活力。每種配方都包含薑黃、南瓜、亞麻籽和羽衣甘藍等全食超級食品,具有低致敏性和營養豐富的特性。此次推出的產品體現了Neo Bites的使命,即改善寵物健康,同時減少傳統肉類寵物食品對環境的影響。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INSECT PROTEIN MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 INSECT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PATENT ANALYSIS

3.2 COUNTRY LEVEL INSIGHTS

3.3 COMPANY BASED ANALYSIS

3.4 TECHNICAL CHALLENGES

3.5 CLIENT REQUIREMENT

3.5.1 COST OF MACHINES/EQUIPMENT USED IN INSECT REARING AND PROCESSING

3.5.2 PARTNERS AROUND THE WORLD SELLING INSECT REARING AND PROCESSING EQUIPMENT/TECHNOLOGY

3.6 REGULATIONS

3.6.1 EUROPEAN LAW ON INSECTS IN FOOD AND FEED

3.6.1.1 INSECTS AS FEED

3.6.1.2 INSECTS AS FOOD

4 MARKET OVERVIEW

4.1 DRIVERS

4.1.1 GROWING DEMAND FOR ALTERNATIVE PROTEIN SOURCE

4.1.2 RISING AWARENESS ABOUT THE BENEFITS OF INSECT PROTEINS

4.1.3 INCREASING INVESTMENT IN R&D

4.1.4 EASY AVAILABILITY OF EDIBLE INSECTS AND SNACKS

4.2 RESTRAINTS

4.2.1 LOWER CONSUMER ACCEPTANCE LEVEL

4.2.2 LACK OF AUTOMATED FARMING METHODS

4.2.3 STRINGENT REGULATORY FRAMEWORK

4.2.4 HIGHER COSTS OF INSECT PROTEINS

4.3 OPPORTUNITIES

4.3.1 NEW PRODUCT INNOVATION TO ATTRACT CONSUMERS

4.3.2 DEVELOPMENT OF INSECT REARING AND PROCESSING EQUIPMENT

4.4 CHALLENGES

4.4.1 GROWING TREND FOR PLANT-BASED FOOD PRODUCTS

4.4.2 MICROBIAL AND TOXICITY RISKS ASSOCIATED WITH INSECTS

5 NORTH AMERICA INSECT PROTEIN MARKET, BY INSECT TYPE

5.1 OVERVIEW

5.2 BEETLES

5.3 CATERPILLARS

5.4 BEES

5.5 WASPS & ANTS

5.6 GRASSHOPERS

5.7 LOCUSTS

5.8 CRICKETS

5.9 TRUE BUGS

5.1 BLACK SOLDIER FLIES

5.11 CICADAS

5.12 LEAFHOPPERS

5.13 PLANTHOPPERS

5.14 SCALE INSECTS

5.15 TERMITES

5.16 DRAGONFLIES

5.17 FLIES

5.18 MEALWORMS

5.19 OTHERS

6 NORTH AMERICA INSECT PROTEIN MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 FEED

6.2.1 AQUATIC ANIMALS

6.2.2 PETS

6.2.3 POULTRY

6.2.4 SWINE

6.2.5 EQUINE

6.2.6 RUMINANTS

6.2.7 OTHERS

6.3 FOOD & BEVERAGE

6.3.1 BAKERY PRODUCTS

6.3.1.1 BREADS & ROLLS

6.3.1.2 BISCUITS & COOKIES

6.3.1.3 CAKES & MUFFINS

6.3.1.4 OTHERS

6.3.2 CONVENIENCE FOOD

6.3.2.1 SAVOURY SNACKS

6.3.2.2 PASTA & NOODLES

6.3.2.3 RTE MEALS

6.3.2.4 OTHERS

6.3.3 MEAT PRODUCTS & ANALOGS

6.3.3.1 MINCED MEAT

6.3.3.2 PATTIES & SAUSAGES

6.3.3.3 PATÉS

6.3.3.4 OTHERS

6.3.4 ENERGY BARS/PROTEIN BARS

6.3.5 GRANOLA

6.3.6 DAIRY PRODUCTS

6.3.7 RTM POWDER

6.3.8 BEVERAGES

6.3.9 OTHERS

6.4 PHARMACEUTICALS AND COSMETICS

7 NORTH AMERICA INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL

7.1 OVERVIEW

7.2 DIRECT

7.3 INDIRECT

7.3.1 STORE BASED RETAILERS

7.3.2 NON-STORE RETAILERS

8 NORTH AMERICA INSECT PROTEIN MARKET, BY REGION

8.1 NORTH AMERICA

8.1.1 U.S.

8.1.2 CANADA

8.1.3 MEXICO

9 NORTH AMERICA INSECT PROTEIN MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 ENVIROFLIGHT

11.1.1 COMPANY SNAPSHOT

11.1.2 COMPANY SHARE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 PROTIFARM

11.2.1 COMPANY SNAPSHOT

11.2.2 PRODUCT PORTFOLIO

11.2.3 RECENT DEVELOPMENT

11.3 AGRIPROTEIN

11.3.1 COMPANY SNAPSHOT

11.3.2 COMPANY SHARE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENTS

11.4 ENTERRA FEED CORPORATION

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 RECENT DEVELOPMENT

11.5 ASPIRE FOOD GROUP

11.5.1 COMPANY SNAPSHOT

11.5.2 PRODUCT PORTFOLIO

11.5.3 RECENT DEVELOPMENT

11.6 BETA HATCH

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT DEVELOPMENT

11.7 BIOFLYTECH

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENT

11.8 CHAPUL CRICKET PROTEIN

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENT

11.9 ENTOBEL

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENT

11.1 ENTOCYCLE

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

11.11 ENTOMO FARMS

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT DEVELOPMENT

11.12 NORTH AMERICA BUGS

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENT

11.13 HAOCHENG MEALWORMS INC.

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT DEVELOPMENT

11.14 HEXAFLY

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT DEVELOPMENT

11.15 INNOVAFEED

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENTS

11.16 INSECTUM

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT DEVELOPMENT

11.17 NEXTPROTEIN

11.17.1 COMPANY SNAPSHOT

11.17.2 PRODUCT PORTFOLIO

11.17.3 RECENT DEVELOPMENT

11.18 PROTENGA PTE LTD

11.18.1 COMPANY SNAPSHOT

11.18.2 PRODUCT PORTFOLIO

11.18.3 RECENT DEVELOPMENT

11.19 PROTIFLY

11.19.1 COMPANY SNAPSHOT

11.19.2 PRODUCT PORTFOLIO

11.19.3 RECENT DEVELOPMENT

11.2 PROTIX

11.20.1 COMPANY SNAPSHOT

11.20.2 PRODUCT PORTFOLIO

11.20.3 RECENT DEVELOPMENT

11.21 SEEK FOOD

11.21.1 COMPANY SNAPSHOT

11.21.2 PRODUCT PORTFOLIO

11.21.3 RECENT DEVELOPMENT

11.22 THAILAND UNIQUE

11.22.1 COMPANY SNAPSHOT

11.22.2 PRODUCT PORTFOLIO

11.22.3 RECENT DEVELOPMENT

11.23 ŸNSECT

11.23.1 COMPANY SNAPSHOT

11.23.2 PRODUCT PORTFOLIO

11.23.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

表格列表

LIST OF TABLES

TABLE 1 NORTH AMERICA INSECT PROTEIN MARKET: VOLUME TABLE FOR INSECT PROTEIN SOLD AROUND THE GLOBE

TABLE 2 THE PRICE RANGE OF EQUIPMENT USED IN INSECT REARING AND PROCESSING

TABLE 3 COMPANIES OFFERING INSECT REARING AND PROCESSING EQUIPMENT AND TECHNOLOGY

TABLE 4 REGULATIONS FOR INSECT BASED FOOD AND FEED PRODUCT BY EUROPEAN UNION

TABLE 5 COST COMPARISON OF DIFFERENT PROTEIN SOURCES

TABLE 6 NORTH AMERICA INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 7 NORTH AMERICA BEETLES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 8 NORTH AMERICA CATERPILLARS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 9 NORTH AMERICA BEES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 10 NORTH AMERICA WASPS & ANTS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 11 NORTH AMERICA GRASSHOPPERS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 12 NORTH AMERICA LOCUSTS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 13 NORTH AMERICA CRICKETS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 14 NORTH AMERICA TRUE BUGS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 15 NORTH AMERICA BLACK SOLDIERS FLIES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 16 NORTH AMERICA CICADAS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 17 NORTH AMERICA LEAFHOPPERS INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 18 NORTH AMERICA PLANT HOPPERS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 19 NORTH AMERICA SCALE INSECTS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 20 NORTH AMERICA TERMITES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 21 NORTH AMERICA DRAGONFLIES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 22 NORTH AMERICA FLIES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 23 NORTH AMERICA MEALWORMS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 24 NORTH AMERICA OTHERS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 25 NORTH AMERICA INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 26 NORTH AMERICA FEED IN INSECT PROTEIN MARKET, BY REGION,2018-2027 (USD THOUSAND )

TABLE 27 NORTH AMERICA FEED IN INSECT PROTEIN MARKET, BY APPLICATION ,2018-2027 (USD THOUSAND )

TABLE 28 NORTH AMERICA FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY REGION,2018-2027 (USD THOUSAND )

TABLE 29 NORTH AMERICA FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 30 NORTH AMERICA BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 31 NORTH AMERICA CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 32 NORTH AMERICA MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 33 NORTH AMERICA PHARMACEUTICALS AND COSMETICS IN INSECT PROTEIN MARKET, BY REGION,2018-2027 (USD THOUSAND )

TABLE 34 NORTH AMERICA INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL ,2018-2027 (USD THOUSAND )

TABLE 35 NORTH AMERICA DIRECT IN INSECT PROTEIN MARKET, BY REGION,2018-2027 (USD THOUSAND )

TABLE 36 NORTH AMERICA NDIRECT IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSAND )

TABLE 37 NORTH AMERICA INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL 2018-2027 (USD THOUSAND )

TABLE 38 NORTH AMERICA INSECT PROTEIN MARKET, BY COUNTRY, 2018-2027 (USD THOUSANDS)

TABLE 39 NORTH AMERICA INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 40 NORTH AMERICA INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 41 NORTH AMERICA FEED IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 42 NORTH AMERICA FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 43 NORTH AMERICA BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 44 NORTH AMERICA MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 45 NORTH AMERICA CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 46 NORTH AMERICA INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 47 NORTH AMERICA INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 48 U.S. INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 49 U.S. INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 50 U.S. FEED IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 51 U.S. FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 52 U.S. BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 53 U.S. MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 54 U.S. CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 55 U.S. INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 56 U.S. INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 57 CANADA INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 58 CANADA INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 59 CANADA FEED IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 60 CANADA FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 61 CANADA BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 62 CANADA MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 63 CANADA CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 64 CANADA INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 65 CANADA INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 66 MEXICO INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 67 MEXICO INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 68 MEXICO FEED IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 69 MEXICO FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 70 MEXICO BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 71 MEXICO MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 72 MEXICO CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 73 MEXICO INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 74 MEXICO INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

图片列表

LIST OF FIGURES

FIGURE 1 NORTH AMERICA INSECT PROTEIN MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INSECT PROTEIN MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INSECT PROTEIN MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INSECT PROTEIN MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INSECT PROTEIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INSECT PROTEIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INSECT PROTEIN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA INSECT PROTEIN MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA INSECT PROTEIN MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA INSECT PROTEIN MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR ALTERNATIVE PROTEIN SOURCES TO DRIVE THE NORTH AMERICA INSECT PROTEIN MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 BEETLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INSECT PROTEIN MARKET IN 2020 & 2027

FIGURE 13 PATENT REGISTERED FOR ACEROLA, BY COUNTRY

FIGURE 14 PATENT REGISTERED BY YEAR (1999-2019)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA INSECT PROTEIN MARKET

FIGURE 16 PERCENTAGE OF EDIBLE PART OF ANIMAL

FIGURE 17 ABUNDANCE OF EDIBLE INSECTS (IN %)

FIGURE 18 SALE OF THE U.S. PLANT-BASED MEAT (IN USD MILLION)

FIGURE 19 NORTH AMERICA INSECT PROTEIN MARKET: BY INSECT TYPE, 2019

FIGURE 20 NORTH AMERICA INSECT PROTEIN MARKET: BY APPLICATION, 2019

FIGURE 21 NORTH AMERICA INSECT PROTEIN MARKET: BY DISTRIBUTION CHANNEL, 2019

FIGURE 22 NORTH AMERICA INSECT PROTEIN MARKET: SNAPSHOT (2019)

FIGURE 23 NORTH AMERICA INSECT PROTEIN MARKET: BY COUNTRY (2019)

FIGURE 24 NORTH AMERICA INSECT PROTEIN MARKET: BY COUNTRY (2020 & 2027)

FIGURE 25 NORTH AMERICA INSECT PROTEIN MARKET: BY COUNTRY (2019 & 2027)

FIGURE 26 NORTH AMERICA INSECT PROTEIN MARKET: BY TYPE (2020-2027)

FIGURE 27 NORTH AMERICA INSECT PROTEIN MARKET: COMPANY SHARE 2019 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。