North America hydrogen storage Market, By Form (Physical, Material Based), Type (Cylinder, Merchant, On-Site, On-Board), Distribution (Pipelines, On-Site Production, Road Transport), Application (Stationary Power, Portable Power, Transportation), End-User (Chemicals, Oil Refining, Transportation, Industrial, Metal Working, Others) – Industry Trends and Forecast to 2029

Market Analysis and Size

Adoption of hydrogen storage as an alternative for fossil fuels among several end-users is driving the growth of the hydrogen storage market. According to the International Energy Agency (IEA). In 2020 the demand for hydrogen reached 90 Mt. Among this, 70 Mt used as pure hydrogen, and remaining was used for conventional uses like refining and industrial uses. The major potential of hydrogen that is used as an alternative fuel. The main requirement of hydrogen storage for fueling vehicles and industrial uses, and augmented trust among investors in the hydrogen fuel as an alternative, remains the main drivers of growth for the hydrogen storage market.

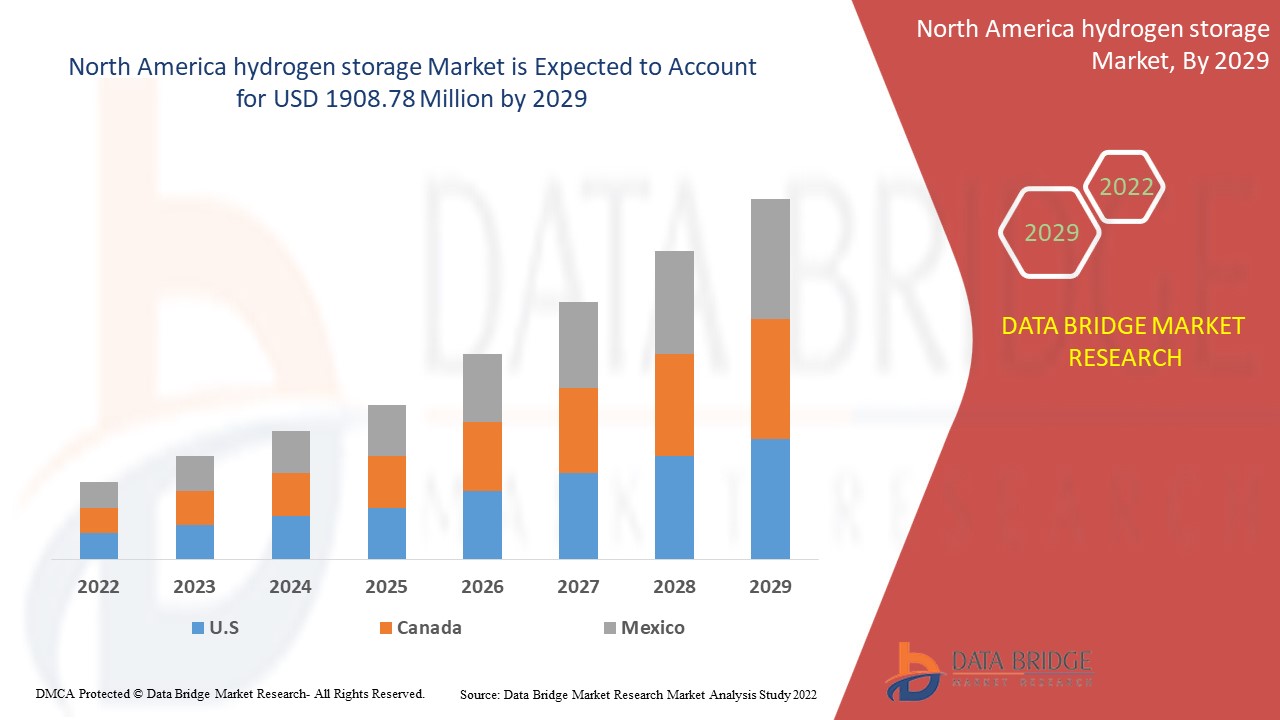

Data Bridge Market Research analyses that the hydrogen storage market was valued at USD 1554.45 million in 2021 and is expected to reach USD 1908.78 million by 2029, registering a CAGR of 2.60 % during the forecast period of 2022 to 2029. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and technological advancements.

Market Definition

Hydrogen can be extracted from biomass and fossil fuels from water, or from a mix of both. Hydrogen can be stored in various ways, such as physically as either a liquid or gas. Storage of hydrogen as a liquid requires cryogenic temperatures due to their boiling point which is −252.8°C at one-atmosphere pressure. Storage of hydrogen as a gas usually needs high-pressure tanks (350–700 bar [5,000–10,000 psi] tank pressure).

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Form (Physical, Material Based), Type (Cylinder, Merchant, On-Site, On-Board), Distribution (Pipelines, On-Site Production, Road Transport), Application (Stationary Power, Portable Power, Transportation), End-User (Chemicals, Oil Refining, Transportation, Industrial, Metal Working, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

Linde plc (Ireland), Air Liquide (France), Hexagon Composites ASA (Norway), Luxfer Gas Cylinders (UK), Worthington Industries, (US), McPhy Energy S.A (France), General Motors (US), Toshiba Energy Systems & Solutions Corporation (Japan), HYDROGEN COMPONENTS, INC.(US), Steelhead Composites, INC (US), Process Kana (US), Hydrogenics (Canada), FuelCell Energy, Inc (US), Air Products and Chemicals, Inc (US). Panasonic Corporation (Japan), Cummins Inc (US) |

|

Market Opportunities |

|

Hydrogen Storage Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Growth in the demand of transportation fuels

Companies are focusing on adopting clean fuels in the transportation industry, which has created profitable avenues during the forecast period. Specifically, fuel cells are gaining popularity on the back of serious efforts taken by governments in several countries to increase their energy security.

- Rise in demand as an alternative of fossil fuel

Rise in application of hydrogen storage as an alternative of fossil fuel in various end users industry which is expected to fuel the market growth of hydrogen storage. For instance, in July 2018, Canada has Canada Enbridge Gas Distribution, a distributor of Hydrogenics opened power-to-gas and natural gas facility using the Markham hydrogen energy storage facility in Ontario, Canada.

- Increase the demand for sustainable power sources

Rising importance of sustainable energy facilities will drive the growth of hydrogen storage market g. Hydrogen energy can be used for transportation sectors and grid energy services. As governments converge more on sustainable power sources, the market is anticipated to witness steady growth in the forecast timeframe.

Opportunities

- Increasing use of hydrogen as substitute fuel in energy-intensive regions catalyzing beneficial avenues

Hydrogen is emerging as a substitute clean fuel for producing electricity in several industries. This has strengthened the need for harmless storage of the gas. Increasing use of fuel cells in heavy-duty and medium-duty and marine and trucks vessels is escalating the revenue potential. These factors that will open up significant opportunities.

- Technological advancement

Growing the commercialization of power-to-gas technology create possible opportunities for the hydrogen storage market. In this technology, hydrogen can be transformed back to electricity and used for powering the electric grid during peak hours.

Restraints/ Challenges

Hydrogen storage is a task for portable and stationary applications because of its low-density property and remains a substantial challenge for transportation uses. Currently, existing storage possibilities usually require large-volume systems that can store hydrogen in gaseous form. This is less of a problem for stationary applications, where the footprint of compressed gas tanks may be less critical. These are the major market restrains that will obstruct the market's growth rate.

This North America hydrogen storage market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the hydrogen storage market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on North America Hydrogen Storage Market

However, the crisis which has caused by COVID- 19 considerably disrupted their momentum. Factors such as delays in completing renewable energy projects, supply chain disruptions, and the threat of being unable to profit from government incentives are expected to reduce the growth and investment of renewable technologies. However, reduced the investment due to COVID-and major incentives are set to expire by the end of 2020.

North America Hydrogen Storage Market Scope

North America hydrogen storage market is segmented on the basis of form, type, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Form

- Physical

- Material Based

Type

- Cylinder

- Merchant

- On-Site

- On-Board

Distribution

- Pipelines

- On-Site Production

- Road Transport

- Application

- Stationary Power

- Portable Power

- Transportation

End-User

- Chemicals

- Oil Refining

- Transportation

- Industrial

- Metal Working

- Others

Hydrogen Storage Market Regional Analysis/Insights

North America hydrogen storage market is analysed and market size insights and trends are provided by country, form, type, application and end-user as referenced above.

The countries covered in the North America hydrogen storage market report are U.S., Canada and Mexico in North America.

U.S dominates the hydrogen storage market during the forecast period. This is due to large number of physical storage in the U.S. is made up of hydrogen storage and growing demand for low emission fuel overall U.S. also drives the market with growing investment in production of hydrogen storage in Canada.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Hydrogen Storage Market Share Analysis

North America hydrogen storage market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to hydrogen storage market.

Some of the major players operating in the North America hydrogen storage market are:

- Linde plc (Ireland)

- Air Liquide (France)

- Hexagon Composites ASA (Norway)

- Luxfer Gas Cylinders (UK)

- Worthington Industries, (US)

- McPhy Energy S.A (France)

- General Motors (Us)

- Toshiba Energy Systems & Solutions Corporation (Japan)

- HYDROGEN COMPONENTS, INC. (US)

- Steelhead Composites, INC (US)

- Process Kana (US)

- Hydrogenics (Canada)

- FuelCell Energy, Inc (US)

- Air Products and Chemicals, Inc (US)

- Panasonic Corporation (Japan)

- Cummins Inc (US)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HYDROGEN STORAGE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 STORAGE FORM LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 IMPACT OF COVID-19 PANDEMIC ON THE NORTH AMERICA HYDROGEN STORAGE MARKET

5.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

5.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE NORTH AMERICA HYDROGEN STORAGE MARKET

5.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

5.4 PRICE IMPACT

5.5 IMPACT ON DEMAND

5.6 IMPACT ON SUPPLY CHAIN

5.7 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR LOW EMISSION FUEL

6.1.2 RISE IN DEMAND FOR AMMONIA AND METHANOL

6.1.3 INCREASED USAGE OF HYDROGEN STORAGE TANKS IN TRANSPORTATION APPLICATION

6.2 RESTRAINTS

6.2.1 LIMITED AVAILABILITY OF HYDROGEN REFUELING INFRASTRUCTURE IN DEVELOPED ECONOMIES

6.2.2 STRINGENT TECHNICAL REQUIREMENTS

6.3 OPPORTUNITIES

6.3.1 DEVELOPMENT OF NEW APPLICATIONS FOR HYDROGEN POWERED FUEL CELLS

6.3.2 DEVELOPMENT OF LOW WEIGHT STORAGE TANK FOR TRANSPORTATION APPLICATION

6.4 CHALLENGE

6.4.1 ESTABLISHING INFRASTRUCTURE FOR ELECTRIC CARS IN MEXICO

7 NORTH AMERICA HYDROGEN STORAGE MARKET, BY STORAGE FORM

7.1 OVERVIEW

7.2 PHYSICAL

7.2.1 COMPRESSED GAS

7.2.2 COLD OR CRYO COMPRESSED

7.2.3 LIQUID HYDROGEN

7.3 MATERIAL BASED

7.3.1 CHEMICAL HYDROGEN

7.3.2 INTERSTITIAL HYDRIDE

7.3.3 COMPLEX HYDRIDE

7.3.4 LIQUID ORGANIC

7.3.5 ADSORBENTS

8 NORTH AMERICA HYDROGEN STORAGE MARKET, BY STORAGE TYPE

8.1 OVERVIEW

8.2 CYLINDER

8.3 MERCHANT

8.4 ON-SITE

8.5 ON-BOARD

9 NORTH AMERICA HYDROGEN STORAGE MARKET, BY DISTRIBUTION

9.1 OVERVIEW

9.2 PIPELINES

9.3 ON-SITE PRODUCTION

9.4 ROAD TRANSPORT

10 NORTH AMERICA HYDROGEN STORAGE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 STATIONARY POWER

10.2.1 POWER GENERATION

10.2.2 THERMAL SYSTEMS

10.2.3 ENERGY SYSTEMS

10.3 PORTABLE POWER

10.3.1 FUEL CELLS FOR OFF-ROAD USAGE

10.3.2 FUEL CELLS FOR AUXILIARY POWER GENERATION

10.3.3 FUEL CELLS FOR CONSUMER ELECTRONIC DEVICES

10.4 TRANSPORTATION POWER APPLICATION

10.4.1 HYDROGEN-POWERED BUSES

10.4.2 HYDROGEN-POWERED FOR KLIFT TRUCKS

10.4.3 HYDROGEN POWERED BIKES

10.4.4 OTHERS

11 NORTH AMERICA HYDROGEN STORAGE MARKET, BY END-USER

11.1 OVERVIEW

11.2 CHEMICALS

11.3 OIL REFINING

11.4 TRANSPORTATION

11.5 INDUSTRIAL

11.6 METAL WORKING

11.7 OTHERS

12 NORTH AMERICA HYDROGEN STORAGE MARKET BY COUNTRY

12.1 NORTH AMERICA

12.2 U.S.

12.3 CANADA

12.4 MEXICO

13 NORTH AMERICA HYDROGEN STORAGE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.2 MERGER & ACQUISITION

13.3 EXPANSIONS

13.4 NEW PRODUCT DEVELOPMENT

13.5 PARTNERSHIP

14 SWOT ANALYSIS

15 NORTH AMERICA HYDROGEN STORAGE MARKET, COMPANY PROFILE

15.1 GENERAL MOTORS

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 BRAND PORTFOLIO

15.1.4 RECENT UPDATE

15.2 PANASONIC CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 BRAND PORTFOLIO

15.2.4 RECENT UPDATES

15.3 AIR PRODUCTS AND CHEMICALS, INC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 WORTHINGTON INDUSTRIES, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATE

15.5 AIR LIQUIDE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATE

15.6 LINDE PLC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATE

15.7 STEELHEAD COMPOSITES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT UPDATE

15.8 HYDROGEN COMPONENTS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

15.9 FUELCELL ENERGY, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 HEXAGON COMPOSITES ASA

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 HYDROGENICS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

15.12 LUXFER GAS CYLINDERS (A SUBSIDIARY OF LUXFER HOLDINGS PLC)

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATE

15.13 MCPHY ENERGY S.A.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATE

15.14 PROCESS/KANA INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT UPDATE

15.15 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION (A SUBSIDIARY OF TOSHIBA CORPORATION)

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

LIST OF TABLES

TABLE 1 IMPORT DATA OF HYDROGEN; HS CODE: 280410 (USD THOUSAND)

TABLE 2 EXPORT DATA OF HYDROGEN; HS CODE: 280410 (USD THOUSAND)

TABLE 3 NORTH AMERICA HYDROGEN STORAGE MARKET, BY STORAGE FORM, 2018-2027 (USD MILLION)

TABLE 4 NORTH AMERICA RIGID PRODUCT IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (THOUSAND UNITS)

TABLE 5 NORTH AMERICA RIGID PRODUCT IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 6 NORTH AMERICA PHYSICAL IN HYDROGEN STORAGE MARKET, BY PHYSICAL STORAGE FORM, 2018-2027 (USD MILLION)

TABLE 7 NORTH AMERICA FLEXIBLE PRODUCT IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (THOUSAND UNITS)

TABLE 8 NORTH AMERICA FLEXIBLE PRODUCT IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA MATERIAL BASED IN HYDROGEN STORAGE MARKET, BY MATERIAL BASED STORAGE FORM, 2018-2027 (USD MILLION)

TABLE 10 NORTH AMERICA HYDROGEN STORAGE MARKET, BY STORAGE TYPE, 2018-2027 (USD MILLION)

TABLE 11 NORTH AMERICA CYLINDER IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 12 NORTH AMERICA MERCHANT IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA ON-SITE IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 14 NORTH AMERICA ON-BOARD IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 15 NORTH AMERICA HYDROGEN STORAGE MARKET, BY DISTRIBUTION, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA PIPELINES TYPE IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 17 NORTH AMERICA ON-SITE PRODUCTION TYPE IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 18 NORTH AMERICA ROAD TRANSPORT TYPE IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICA STATIONARY POWER IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICA FILLERS IN HYDROGEN STORAGE MARKET, BY FILLERS RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA PORTABLE POWER IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICA PORTABLE POWER IN HYDROGEN STORAGE MARKET, BY PORTABLE POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICA TRANSPORTATION POWER APPLICATIONIN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA TRANSPORTATION HYDROGEN STORAGE MARKET, BY TRANSPORTATION POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICA HYDROGEN STORAGE MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 27 NORTH AMERICA CHEMICALS IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICA OIL REFINING IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 29 NORTH AMERICA TRANSPORTATION IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA INDUSTRIAL IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA METAL WORKING IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 32 NORTH AMERICA OTHERS IN HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICA HYDROGEN STORAGE MARKET,2018-2027 (USD MILLION)

TABLE 34 NORTH AMERICA HYDROGEN STORAGE MARKET,2018-2027 (THOUSAND UNITS)

TABLE 35 NORTH AMERICA HYDROGEN STORAGE MARKET, BY STORAGE FORM 2018-2027 (USD MILLION)

TABLE 36 NORTH AMERICA HYDROGEN STORAGE MARKET, BY STORAGE FORM 2018-2027 (THOUSAND UNITS)

TABLE 37 NORTH AMERICA PHYSICAL IN HYDROGEN STORAGE MARKET, BY PHYSICAL STORAGE FORM, 2018-2027 (USD MILLION)

TABLE 38 NORTH AMERICA MATERIAL BASED IN HYDROGEN STORAGE MARKET, BY MATERIAL BASED STORAGE FORM, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA HYDROGEN STORAGE MARKET, BY STORAGE TYPE , 2018-2027 (USD MILLION)

TABLE 40 NORTH AMERICA HYDROGEN STORAGE MARKET, BY DISTRIBUTION,2018-2027 (USD MILLION)

TABLE 41 NORTH AMERICA HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 42 NORTH AMERICA STATIONARY POWER IN HYDROGEN STORAGE MARKET, BY STATIONARY POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 43 NORTH AMERICA PORTABLE POWER IN HYDROGEN STORAGE MARKET, BY PORTABLE POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 44 NORTH AMERICA TRANSPORTATION POWER IN HYDROGEN STORAGE MARKET, BY TRANSPORTATION POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 45 NORTH AMERICA HYDROGEN STORAGE MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 46 U.S. HYDROGEN STORAGE MARKET, BY STORAGE FORM, 2018-2027 (USD MILLION)

TABLE 47 U.S. HYDROGEN STORAGE MARKET, BY STORAGE FORM, 2018-2027 (THOUSAND UNITS)

TABLE 48 U.S. PHYSICAL IN HYDROGEN STORAGE MARKET, BY PHYSICAL STORAGE FORM, 2018-2027 (USD MILLION)

TABLE 49 U.S. MATERIAL BASED IN HYDROGEN STORAGE MARKET, BY MATERIAL BASED STORAGE FORM, 2018-2027 (USD MILLION)

TABLE 50 U.S. HYDROGEN STORAGE MARKET, BY STORAGE TYPE , 2018-2027 (USD MILLION)

TABLE 51 U.S. HYDROGEN STORAGE MARKET, BY DISTRIBUTION,2018-2027 (USD MILLION)

TABLE 52 U.S. HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 53 U.S. STATIONARY POWER IN HYDROGEN STORAGE MARKET, BY STATIONARY POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 54 U.S. PORTABLE POWER IN HYDROGEN STORAGE MARKET, BY PORTABLE POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 55 U.S. TRANSPORTATION POWER IN HYDROGEN STORAGE MARKET, BY TRANSPORTATION POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 56 U.S. HYDROGEN STORAGE MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 57 CANADA HYDROGEN STORAGE MARKET, BY STORAGE FORM 2018-2027 (USD MILLION)

TABLE 58 CANADA HYDROGEN STORAGE MARKET, BY STORAGE FORM 2018-2027 (THOUSAND UNITS)

TABLE 59 CANADA PHYSICAL IN HYDROGEN STORAGE MARKET, BY PHYSICAL STORAGE FORM, 2018-2027 (USD MILLION)

TABLE 60 CANADA MATERIAL BASED IN HYDROGEN STORAGE MARKET, BY MATERIAL BASED STORAGE FORM, 2018-2027 (USD MILLION)

TABLE 61 CANADA HYDROGEN STORAGE MARKET, BY STORAGE TYPE , 2018-2027 (USD MILLION)

TABLE 62 CANADA HYDROGEN STORAGE MARKET, BY DISTRIBUTION,2018-2027 (USD MILLION)

TABLE 63 CANADA HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 64 CANADA STATIONARY POWER IN HYDROGEN STORAGE MARKET, BY STATIONARY POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 65 CANADA PORTABLE POWER IN HYDROGEN STORAGE MARKET, BY PORTABLE POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 66 CANADA TRANSPORTATION POWER IN HYDROGEN STORAGE MARKET, BY TRANSPORTATION POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 67 CANADA HYDROGEN STORAGE MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 68 MEXICO HYDROGEN STORAGE MARKET, BY STORAGE FORM 2018-2027 (USD MILLION)

TABLE 69 MEXICO HYDROGEN STORAGE MARKET, BY STORAGE FORM 2018-2027 (THOUSAND UNITS)

TABLE 70 MEXICO PHYSICAL IN HYDROGEN STORAGE MARKET, BY PHYSICAL STORAGE FORM, 2018-2027 (USD MILLION)

TABLE 71 MEXICO MATERIAL BASED IN HYDROGEN STORAGE MARKET, BY MATERIAL BASED STORAGE FORM, 2018-2027 (USD MILLION)

TABLE 72 MEXICO HYDROGEN STORAGE MARKET, BY STORAGE TYPE , 2018-2027 (USD MILLION)

TABLE 73 MEXICO HYDROGEN STORAGE MARKET, BY DISTRIBUTION,2018-2027 (USD MILLION)

TABLE 74 MEXICO HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 75 MEXICO STATIONARY POWER IN HYDROGEN STORAGE MARKET, BY STATIONARY POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 76 MEXICO PORTABLE POWER IN HYDROGEN STORAGE MARKET, BY PORTABLE POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 77 MEXICO TRANSPORTATION POWER IN HYDROGEN STORAGE MARKET, BY TRANSPORTATION POWER APPLICATION, 2018-2027 (USD MILLION)

TABLE 78 MEXICO HYDROGEN STORAGE MARKET, BY END-USER, 2018-2027 (USD MILLION)

图片列表

LIST OF FIGURES

FIGURE 1 NORTH AMERICA HYDROGEN STORAGE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HYDROGEN STORAGE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HYDROGEN STORAGE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HYDROGEN STORAGE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HYDROGEN STORAGE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HYDROGEN STORAGE MARKET: THE STORAGE FORMLIFE LINE CURVE

FIGURE 7 NORTH AMERICA HYDROGEN STORAGE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA HYDROGEN STORAGE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA HYDROGEN STORAGE MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA HYDROGEN STORAGE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA HYDROGEN STORAGE MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA HYDROGEN STORAGE MARKET: SEGMENTATION

FIGURE 13 INCREASED USAGE OF HYDROGEN STORAGE TANKS INTRANSPORTATION APPLICATION IS EXPECTED TO DRIVE THE NORTH AMERICA HYDROGEN STORAGE MARKET IN THE FORECAST PERIOD OF 2020-2027

FIGURE 14 PHYSICAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HYDROGEN STORAGE MARKET IN 2020 & 2027

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA HYDROGEN STORAGE MARKET

FIGURE 16 NORTH AMERICA HYDROGEN STORAGE MARKET: BY STORAGE FORM, 2019

FIGURE 17 NORTH AMERICA HYDROGEN STORAGE MARKET: BY STORAGE TYPE, 2019

FIGURE 18 NORTH AMERICA HYDROGEN STORAGE MARKET: BY DISTRIBUTION, 2019

FIGURE 19 NORTH AMERICA HYDROGEN STORAGE MARKET: BY APPLICATION, 2019

FIGURE 20 NORTH AMERICA HYDROGEN STORAGE MARKET: BY MANUFACTURING PROCESS, 2019

FIGURE 21 NORTH AMERICA REFRACTORIES MARKET: SNAPSHOT (2019)

FIGURE 22 NORTH AMERICA REFRACTORIES MARKET: BY COUNTRY (2019)

FIGURE 23 NORTH AMERICA REFRACTORIES MARKET: BY COUNTRY (2020 & 2027)

FIGURE 24 NORTH AMERICA REFRACTORIES MARKET: BY COUNTRY (2019 & 2027)

FIGURE 25 NORTH AMERICA REFRACTORIES MARKET: BY TYPE (2020-2027)

FIGURE 26 NORTH AMERICA HYDROGEN STORAGE MARKET: COMPANY SHARE 2019 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。