North America Flow Cytometry Market

市场规模(十亿美元)

CAGR :

%

| 2023 –2030 | |

| USD 2,725.01 Million | |

| USD 6,984.82 Million | |

|

|

|

|

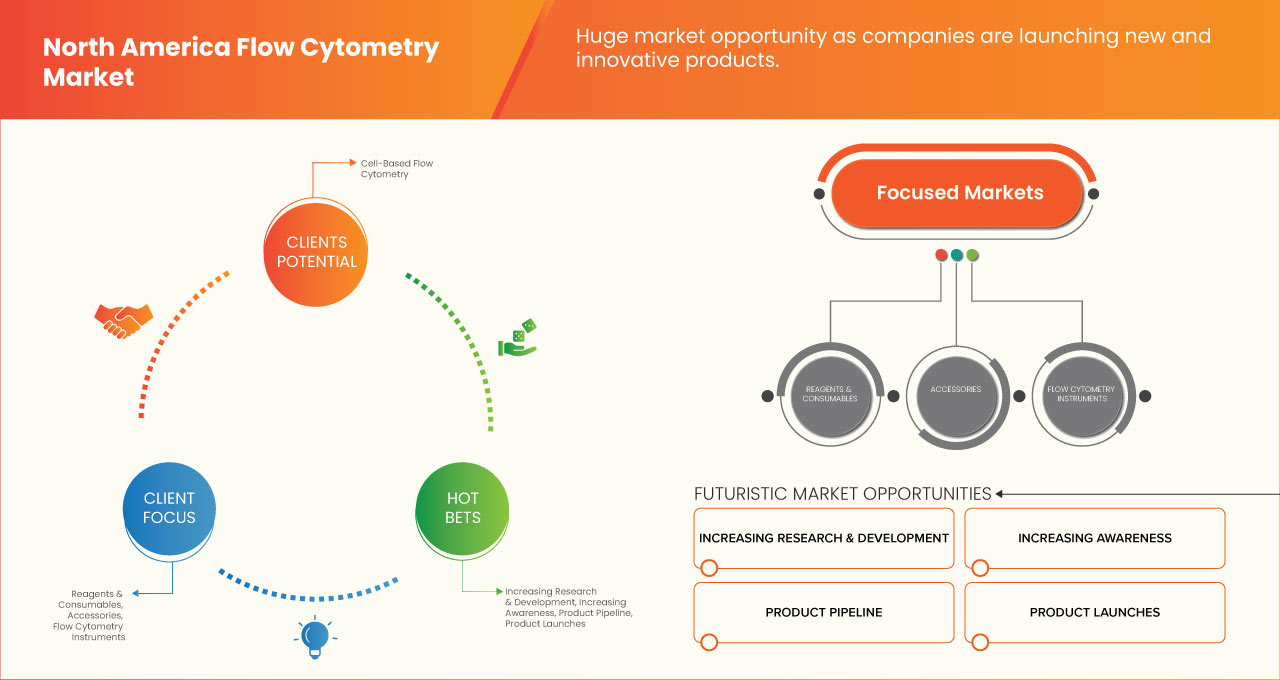

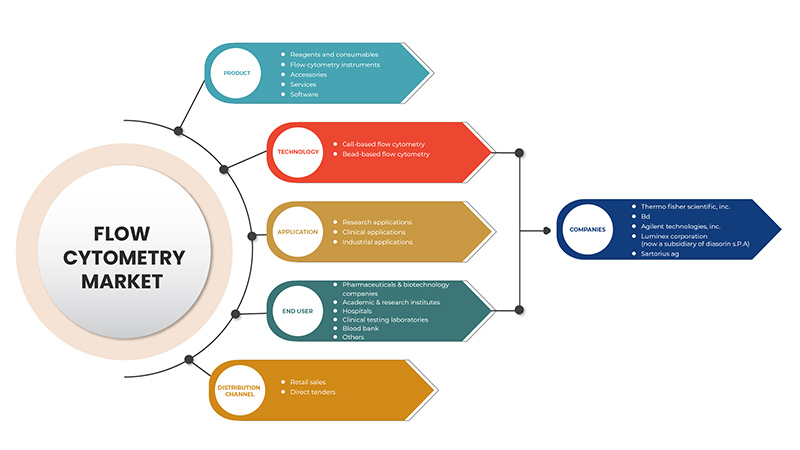

>北美流式细胞术市场,按产品(流式细胞术仪器、试剂和消耗品、软件、配件和服务)、技术(基于细胞的流式细胞术和基于珠子的流式细胞术)、应用(研究应用、临床应用和工业应用)、最终用户(学术和研究机构、医院、制药和生物技术公司、临床测试实验室、血库等)、分销渠道(直接招标和零售销售)划分 - 行业趋势和预测到 2030 年。

北美流式细胞仪市场分析与洞察

北美流式细胞仪市场受到多种因素的推动,例如慢性病患病率不断上升、流式细胞仪市场对新技术的需求不断增长(这增加了其需求),以及研发投资不断增加(这导致市场增长)。目前,发达国家和新兴国家的医疗保健支出都有所增加,这有望为制造商创造竞争优势,以开发新的创新型流式细胞仪市场。然而,流式细胞仪仪器的高成本预计将抑制北美流式细胞仪市场的增长。

北美流式细胞仪市场报告提供了市场份额、新发展和产品线分析的详细信息,国内和本地市场参与者的影响,分析了新兴收入来源、市场法规变化、产品批准、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情景,请联系我们获取分析师简报,我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。各地区发展中国家零售单位的可扩展性和业务扩展以及与供应商合作安全分销机器和药品是推动预测期内市场需求的主要驱动力。

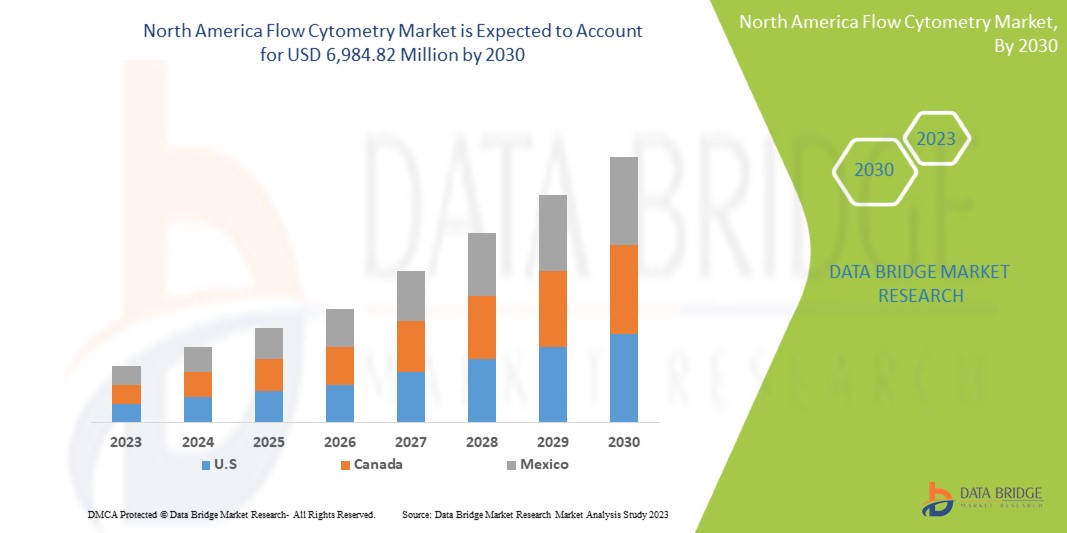

北美流式细胞仪市场预计将在 2023 年至 2030 年的预测期内实现市场增长。Data Bridge Market Research 分析称,在 2023 年至 2030 年的预测期内,该市场将以 12.6% 的复合年增长率增长,预计到 2030 年将从 2022 年的 27.2501 亿美元增至 69.8482 亿美元。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021 (可定制为 2015-2020) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

按产品(流式细胞仪、试剂和耗材、软件、配件和服务)、技术(基于细胞的流式细胞仪和基于珠子的流式细胞仪)、应用(研究应用、临床应用和工业应用)、最终用户(学术和研究机构、医院、制药和生物技术公司、临床检测实验室、血库等)、分销渠道(直接招标和零售) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

Thermo Fisher Scientific Inc.(美国)、BD(美国)、Agilent Technologies, Inc.(美国)、Nexcelom Bioscience LLC(美国)、Bio-Rad Laboratories, Inc.(美国)、Sysmex Corporation(日本)、Miltenyi Biotec(德国)、Coherent Corp.(美国)、Beckman Coulter, Inc.(Danaher Corporation 的子公司)(美国)、Cytek Biosciences(美国)、BIOMÉRIEUX(法国)、Q2 Solutions(IQVIA 的子公司)(美国)、Cytonome/ST, LLC(美国)、Merck KGaA(德国)、Sony Biotechnology Inc.(美国)、Cell Signaling Technology, Inc.(美国)、NanoCellect Biomedical(美国)、Apogee Flow Systems Ltd.(英国)、Bay bioscience Co., Ltd.(日本)、Stratedigm, Inc.、BioLegend, Inc.(美国)、NeoGenomics Laboratories(美国)、Enzo Biochem Inc.(美国)、Union Biometrica, Inc.(美国)、 BennuBio Inc.(美国)、ORLFO Technologies(美国)、Elabscience Biotechnology Inc.(美国)、Takara Bio Inc.(日本)等 |

市场定义

流式细胞术是从异源细胞混合物中筛选细胞的关键过程,可用于细胞分选、计数、蛋白质再生和工程。流式细胞术的常见用途包括分析细胞表面和细胞内分子表达、表征和定义异源细胞群中的各种细胞类型、评估分离亚群的纯度以及测量细胞大小和体积。它可以同时检查单个细胞的多个参数。流式细胞仪使用激光产生光,随后光被样本细胞散射,由检测器记录,并转换成信号进行分析和测量。

不断增长的创新和技术、市场参与者数量的增加以及新产品的推出也推动了北美流式细胞仪市场的增长。

北美流式细胞仪市场动态

驱动程序

-

慢性病患病率上升

慢性病的患病率和发病率不断上升,可能会通过专注于细胞计数设备来推动市场增长。疾病发病率的上升导致北美市场增长,因为许多公司都在投资研发。这导致对通过快速准确的技术诊断疾病的进步的需求大幅增加。

例如,

-

2021年1月,根据世界卫生组织的报告,癌症成为2020年死亡的主要原因,约有1000万人,其中最常见的是乳腺癌(226万)、肺癌(221万)、结肠和直肠癌(193万);前列腺癌(141万)、皮肤癌(120万)和胃癌(109万)

因此,这增加了北美流式细胞仪市场的需求。

-

流式细胞仪的应用日益广泛

细胞计数仪器的技术发展正在不断进步,它结合了多种新技术,以提供高分辨率和灵敏度来量化新的细胞实体。

免疫表型分析不仅对急性白血病、慢性淋巴增生性疾病和恶性淋巴瘤的初步诊断和分类很重要,而且对其治疗也很重要。流式细胞术可用作一种灵敏的检测方法,用于追踪患者化疗或移植后的病情好转情况,并检测微小残留病 (MRD)。

例如,

- 2021 年 3 月,贝克曼库尔特推出了 CytoFLEX 平台,可轻松提供多色应用,从而拓宽了该技术的激光和颜色选项,并带来了该领域的更多技术进步。该公司在 CytoFLEX 中结合了多种技术,以产生高分辨率和灵敏度

- 2022 年 1 月,北美医疗技术公司 Becton, Dickinson and Company 宣布与欧洲分子生物学实验室 (EMBL) 合作开展的一项研究,并发表了 BD 在流式细胞术方面的新创新,该创新增加了荧光成像和基于图像的去库功能,可根据每个细胞的视觉细节(而不是存在的生物标志物的类型或数量)以极高的速度对单个细胞进行分类。这种新方法有可能彻底改变免疫学、细胞生物学和基因组学研究,并推动开发新的基于细胞的疗法

因此,这有望成为北美流式细胞仪市场增长的推动力。

机会

- 流式细胞术技术在研究和学术领域的应用日益增多

新技术的批准为市场提供了新的启动机会。需要一种新的行动机制来推动市场,因为它通过采用不同的机制为流程提供创新。这导致需要在市场上推出新产品。

例如,

- 2021 年 3 月,贝克曼库尔特推出了 CytoFLEX 平台,可轻松提供多色应用,从而拓宽了该技术的激光和颜色选项,并带来了该领域的更多技术进步。该公司在 CytoFLEX 中结合了多种技术,以产生高分辨率和灵敏度

因此,流式细胞术为诊断疾病提供了快速而准确的技术。临床对先进诊断结果的需求不断增长,可能会推动市场快速增长。

- 医疗支出上涨

一个国家在医疗保健方面的支出及其随时间的增长速度受到各种经济和社会因素的影响,包括医疗系统的融资安排和组织结构。特别是,一个国家的整体收入水平与该国人口在医疗保健方面的支出之间存在很强的相关性。

此外,主要市场参与者采取的战略举措将为 2023-2030 年预测期内的北美流式细胞仪市场提供结构完整性和未来机会。

限制/挑战

- 流式细胞仪成本高

流式细胞仪有各种形状和尺寸,但台式仪器是最常见的。它们提供最佳的数据分析、使用便利性以及各种系统的升级和选项,所有这些都旨在解决定制分离、细胞/颗粒分选、探索性细胞分析和其他问题。所有流式细胞仪都具有三个共同的组件 - 流体、光学和电子/信息学。

流式细胞仪非常昂贵,特别是考虑到维修和维护相关的成本。

COVID-19 对北美流式细胞仪市场的影响

由于疾病诊断和研究目的,COVID-19 对市场产生了积极影响,从而增加了这一时期对流式细胞仪的需求。

近期发展

- 2022 年 1 月,索尼生物技术公司推出了一种新型封闭细胞分离系统 CGX10,用于符合 GMP 的细胞分选应用。借助这一举措,该公司有望获得新的增长机会。这种技术进步将带来成本效益、更高的准确性和便携性,并可能创造未来的增长机会。

北美流式细胞仪市场范围

北美流式细胞仪市场细分为产品、技术、应用、最终用户和分销渠道。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

产品

- 试剂和耗材

- 流式细胞仪

- 配件

- 服务

- 软件

根据产品,北美流式细胞仪市场分为流式细胞仪仪器、试剂和耗材、软件、配件和服务。

技术

- 基于细胞的流式细胞术

- 基于珠子的流式细胞术

根据技术,北美流式细胞术市场分为基于细胞的流式细胞术和基于珠子的流式细胞术。

应用

- 研究应用

- 临床应用

- 工业应用

根据应用,北美流式细胞仪市场分为研究应用、临床应用和工业应用。

最终用户

- 制药和生物技术公司

- 学术及研究机构

- 医院

- 临床检测实验室

- 血库

- 其他的

根据最终用户,北美流式细胞仪市场分为学术和研究机构、医院、制药和生物技术公司、临床检测实验室、血库等。

分销渠道

- 零售

- 直接招标

根据分销渠道,北美流式细胞仪市场分为零售和直接招标。

北美流式细胞仪市场区域分析/见解

对北美流式细胞仪市场进行了分析,并按上述国家、产品、技术、应用、最终用户和分销渠道提供了市场规模洞察和趋势。

美国是该市场的主要主导国家,因为该国人口中癌症和艾滋病毒等疾病的发病率不断上升,这推动了对用于诊断应用的流式细胞仪的需求。他们在市场份额和市场收入方面占据流式细胞仪市场的主导地位,并将在预测期内继续保持主导地位。

报告的国家部分还提供了影响单个市场因素和市场法规变化的信息,这些因素和变化会影响市场的当前和未来趋势。新车和替代车销售、国家人口统计、疾病流行病学和进出口关税等数据点是预测单个国家市场情况的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了北美品牌的存在和可用性、当地和国内品牌激烈竞争所带来的挑战以及销售渠道的影响。

竞争格局和北美流式细胞仪市场份额分析

北美流式细胞仪市场竞争格局提供了有关竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对流式细胞仪市场的关注有关。

流式细胞仪市场的一些主要参与者包括赛默飞世尔科技公司 (Thermo Fisher Scientific Inc.)、BD、安捷伦科技公司 (Agilent Technologies, Inc.)、Nexcelom Bioscience LLC、Bio-Rad Laboratories, Inc.、Sysmex Corporation、Miltenyi Biotec、Coherent Corp.、Beckman Coulter, Inc.(丹纳赫集团的子公司)、Cytek Biosciences、bioMérieux SA、Q2 Solutions(IQVIA 的子公司)、Cytonome/ST, LLC、Merck KGaA、Sony Biotechnology Inc.、Cell Signaling Technology, Inc.、NanoCellect Biomedical、Apogee Flow Systems Ltd.、Bay bioscience Co., Ltd.、Stratedigm, Inc.、BioLegend, Inc.、NeoGenomics Laboratories、Enzo Biochem Inc.、Union Biometrica, Inc.、BennuBio Inc.、ORLFO Technologies、Elabscience Biotechnology Inc.、Takara Bio Inc. 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA FLOW CYTOMETRY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING PREVALENCE OF CHRONIC DISEASES

5.1.2 INCREASING APPLICATION OF CYTOMETRY INSTRUMENTS

5.1.3 INCREASE IN USE OF FLOW CYTOMETRY IN DRUG DISCOVERY

5.1.4 GROWTH IN STEM CELL RESEARCH AND ACQUISITION OF RECOMBINATION OF DNA TECHNOLOGIES

5.2 RESTRAINTS

5.2.1 HIGH COST OF FLOW CYTOMETRY INSTRUMENTS

5.2.2 LIMITATIONS OF FLOW CYTOMETRY

5.2.3 LACK OF SKILLED PROFESSIONALS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN ADOPTION OF FLOW CYTOMETRY TECHNIQUES IN RESEARCH AND ACADEMIA

5.3.2 DEVELOPMENT IN PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES

5.3.3 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.4 DEVELOPING A PIPELINE OF STEM CELL RESEARCH

5.4 CHALLENGES

5.4.1 DIFFICULTY IN THE DEVELOPMENT AND VALIDATION OF FLOW CYTOMETRY ASSAYS

5.4.2 COMPLEXITIES RELATED TO REAGENT DEVELOPMENT

6 NORTH AMERICA FLOW CYTOMETRY MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 REAGENTS AND CONSUMABLES

6.2.1 DYE

6.2.2 ANTIBODIES

6.2.3 BEADS

6.2.4 OTHERS

6.3 FLOW CYTOMETRY INSTRUMENTS

6.3.1 CELL ANALYZERS

6.3.1.1 CELL ANALYZERS, BY TYPE

6.3.1.1.1 IMAGING FLOW CYTOMETERS

6.3.1.1.2 NON-IMAGING FLOW CYTOMETERS

6.3.1.2 CELL ANALYZERS, BY MODALITY

6.3.1.2.1 BENCHTOP

6.3.1.2.2 STANDALONE

6.3.2 CELL SORTERS

6.3.2.1 BENCHTOP

6.3.2.2 STANDALONE

6.4 ACCESSORIES

6.4.1 FILTERS

6.4.2 DETECTORS

6.4.3 OTHERS

6.5 SERVICES

6.6 SOFTWARE

7 NORTH AMERICA FLOW CYTOMETRY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 CELL-BASED FLOW CYTOMETRY

7.3 BEAD-BASED FLOW CYTOMETRY

8 NORTH AMERICA FLOW CYTOMETRY MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 RESEARCH APPLICATIONS

8.2.1 CELL CYCLE ANALYSIS

8.2.2 CELL SORTING/SCREENING

8.2.3 CELL TRANSFECTION/VIABILITY

8.2.4 PHARMACEUTICAL AND BIOTECHNOLOGY

8.2.4.1 DRUG DISCOVERY

8.2.4.2 STEM CELL RESEARCH

8.2.4.3 IN VITRO TOXICITY TESTING

8.2.5 IMMUNOLOGY

8.2.6 APOPTOSIS

8.2.7 CELL COUNTING

8.2.8 OTHERS

8.3 CLINICAL APPLICATIONS

8.3.1 HAEMATOLOGY

8.3.2 CANCER

8.3.3 IMMUNODEFICIENCY DISEASES

8.3.4 ORGAN TRANSPLANTATION

8.3.5 OTHER CLINICAL APPLICATION

8.4 INDUSTRIAL APPLICATIONS

9 NORTH AMERICA FLOW CYTOMETRY MARKET, BY END USER

9.1 OVERVIEW

9.2 PHARMACEUTICALS & BIOTECHNOLOGY COMPANIES

9.3 ACADEMIC & RESEARCH INSTITUTES

9.4 HOSPITALS

9.5 CLINICAL TESTING LABORATORIES

9.6 BLOOD BANK

9.7 OTHERS

10 NORTH AMERICA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 RETAIL SALES

10.3 DIRECT TENDERS

11 NORTH AMERICA FLOW CYTOMETRY MARKET, BY GEOGRAPHY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA FLOW CYTOMETRY MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 BD

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.2.5.1 COLLABORATION

14.3 AGILENT TECHNOLOGIES, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 SARTORIUS AG

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 NEXCELOM BIOSCIENCE LLC

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.5.4 COMPANY SHARE ANALYSIS

14.6 APOGEE FLOW SYSTEMS LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BAY BIOSCIENCE CO., LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 BIOMÉRIEUX

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 BECKMAN COULTER, INC. (A SUBSIDIARY OF DANAHER CORPORATION)

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.9.4.1 ACQUISITION

14.9.4.2 PRODUCT LAUNCH

14.1 BENNUBIO INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 BIOLEGEND, INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 BIO-RAD LABORATORIES, INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 CELL SIGNALING TECHNOLOGY, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 CELLKRAFT BIOTECH PVT. LTD

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 CYTEK BIOSCIENCES

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.15.3.1 PRODUCT LAUNCH

14.15.3.2 ACQUISITION

14.16 CYTOBUOY B.V.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 CYTONOME/ST, LLC

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.18 COHERENT CORP.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.18.4.1 Announcement

14.18.4.2 PRODUCT LAUNCH

14.18.4.3 AWARDS

14.18.5 RECENT DEVELOPMENT

14.19 ELABSCIENCE BIOTECHNOLOGY INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 ENZO BIOCHEM INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

14.21 IKEDA SCIENTIFIC CO., LTD.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 MERCK KGAA

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT DEVELOPMENT

14.23 MILTENYI BIOTEC

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENT

14.23.3.1 PRODUCT LAUNCH

14.24 NANOCELLECT BIOMEDICAL

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

14.25 NEOGENOMICS LABORATORIES

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENT

14.26 ON-CHIP BIOTECHNOLOGIES CO., LTD. CORPORATION

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENTS

14.27 ORFLO TECHNOLOGIES

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT PORTFOLIO

14.27.3 RECENT DEVELOPMENT

14.28 Q2 SOLUTION

14.28.1 COMPANY SNAPSHOT

14.28.2 REVENUE ANALYSIS

14.28.3 SERVICE PORTFOLIO

14.28.4 RECENT DEVELOPMENT

14.29 SONY BIOTECHNOLOGY INC.

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT PORTFOLIO

14.29.3 RECENT DEVELOPMENT

14.3 STRATEDIGM, INC

14.30.1 COMPANY SNAPSHOT

14.30.2 PRODUCT PORTFOLIO

14.30.3 RECENT DEVELOPMENT

14.31 SYSMEX CORPORATION

14.31.1 COMPANY SNAPSHOT

14.31.2 REVENUE ANALYSIS

14.31.3 PRODUCT PORTFOLIO

14.31.4 RECENT DEVELOPMENT

14.32 TAKARA BIO INC.

14.32.1 COMPANY SNAPSHOT

14.32.2 REVENUE ANALYSIS

14.32.3 PRODUCT PORTFOLIO

14.32.4 RECENT DEVELOPMENTS

14.33 UNION BIOMETRICA, INC.

14.33.1 COMPANY SNAPSHOT

14.33.2 PRODUCT PORTFOLIO

14.33.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA SERVICES IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA SOFTWARE IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA CELL-BASED FLOW CYTOMETRY IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA BEAD-BASED FLOW CYTOMETRY IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA INDUSTRIAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FLOW CYTOMETRY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA PHARMACEUTICALS & BIOTECHNOLOGY COMPANIES IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA ACADEMIC & RESEARCH INSTITUTES IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA HOSPITALS IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA CLINICAL TESTING LABORATORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA BLOOD BANK IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA DIRECT TENDERS IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA FLOW CYTOMETRY MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA FLOW CYTOMETRY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 48 U.S. FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 49 U.S. REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 50 U.S. FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 51 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 53 U.S. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 54 U.S. ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 55 U.S. FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 56 U.S. FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 57 U.S. RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 58 U.S. PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 59 U.S. CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 60 U.S. FLOW CYTOMETRY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 61 U.S. FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 62 CANADA FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 63 CANADA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 64 CANADA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 65 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 67 CANADA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 68 CANADA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 69 CANADA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 70 CANADA FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 71 CANADA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 CANADA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 73 CANADA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 CANADA FLOW CYTOMETRY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 75 CANADA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 76 MEXICO FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 77 MEXICO REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 78 MEXICO FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 79 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 81 MEXICO CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 82 MEXICO ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 83 MEXICO FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 84 MEXICO FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 85 MEXICO RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 86 MEXICO PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 MEXICO CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 88 MEXICO FLOW CYTOMETRY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 89 MEXICO FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA FLOW CYTOMETRY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FLOW CYTOMETRY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FLOW CYTOMETRY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FLOW CYTOMETRY MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FLOW CYTOMETRY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FLOW CYTOMETRY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FLOW CYTOMETRY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FLOW CYTOMETRY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA FLOW CYTOMETRY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA FLOW CYTOMETRY MARKET: SEGMENTATION

FIGURE 11 INCREASING INCIDENCE AND PREVALENCE OF CHRONIC DISEASES ARE EXPECTED TO DRIVE THE NORTH AMERICA FLOW CYTOMETRY MARKET IN THE FORECAST PERIOD

FIGURE 12 THE REAGENTS AND CONSUMABLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FLOW CYTOMETRY MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FLOW CYTOMETRY MARKET

FIGURE 14 NORTH AMERICA FLOW CYTOMETRY MARKET: BY PRODUCT, 2022

FIGURE 15 NORTH AMERICA FLOW CYTOMETRY MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA FLOW CYTOMETRY MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA FLOW CYTOMETRY MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, 2022

FIGURE 19 NORTH AMERICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 22 NORTH AMERICA FLOW CYTOMETRY MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA FLOW CYTOMETRY MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA FLOW CYTOMETRY MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA FLOW CYTOMETRY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA FLOW CYTOMETRY MARKET: BY END USER, 2022

FIGURE 27 NORTH AMERICA FLOW CYTOMETRY MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA FLOW CYTOMETRY MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA FLOW CYTOMETRY MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 31 NORTH AMERICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 NORTH AMERICA FLOW CYTOMETRY MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA FLOW CYTOMETRY MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA FLOW CYTOMETRY MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA FLOW CYTOMETRY MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA FLOW CYTOMETRY MARKET: PRODUCT (2023-2030)

FIGURE 39 NORTH AMERICA FLOW CYTOMETRY MARKET: COMPANY SHARE 2022 (%)

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.