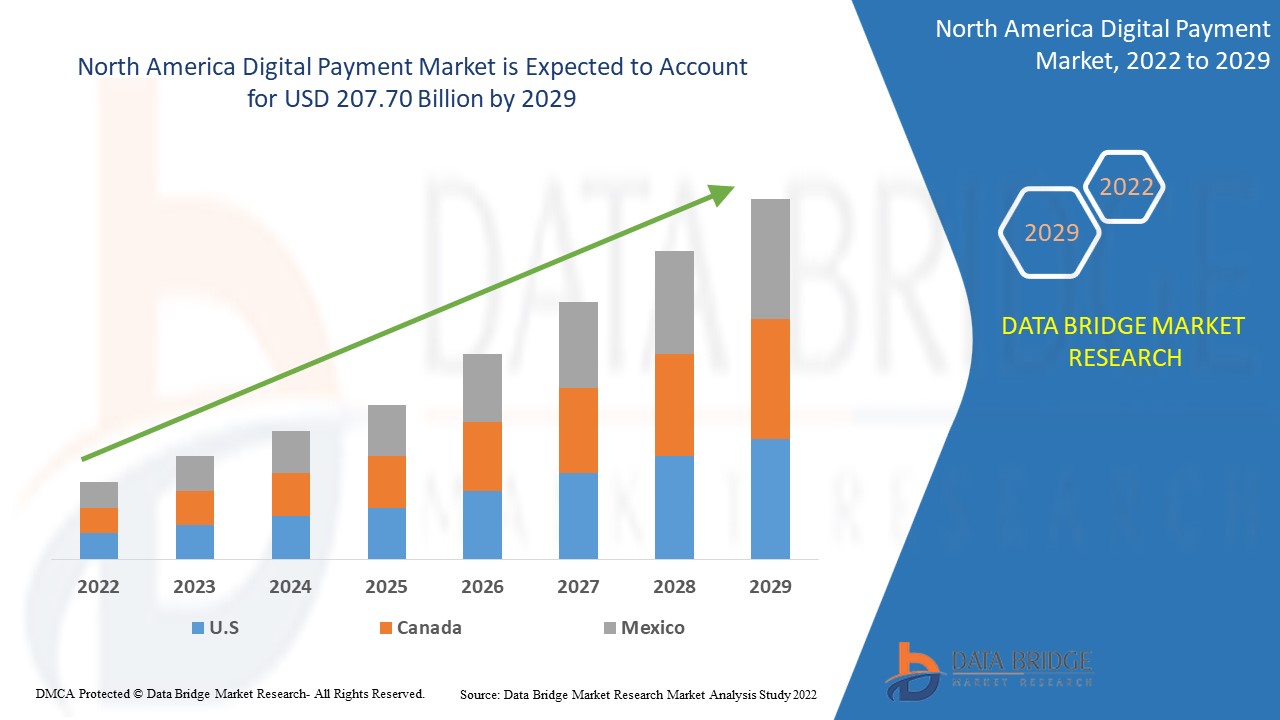

North America Digital Payment Market

市场规模(十亿美元)

CAGR :

%

USD

50.62 Billion

USD

207.70 Billion

2021

2029

USD

50.62 Billion

USD

207.70 Billion

2021

2029

| 2022 –2029 | |

| USD 50.62 Billion | |

| USD 207.70 Billion | |

|

|

|

|

北美數位支付市場,按產品(解決方案、服務)、部署模式(本地、雲端)、組織規模(大型企業、中小型企業 (SME))、支付方式(支付卡、銷售點、統一支付介面 (UPI) 服務、行動支付、線上支付)、使用模式(行動應用程式、桌面/Web 瀏覽器)、技術(應用程式資料)、技術(應用程式分類)、軟體程式設計(P/C)、商家/企業、政府)、最終用戶(商業、消費者)– 產業趨勢與預測到 2029 年。

數位支付市場分析和規模

2020年,印度的即時數位交易量超過256億筆,比2019年成長了70%。在快速數位化的時代,行動錢包、數位錢包和電子錢包都越來越受歡迎。各國之間的快速融合與互聯互通,使得數位支付的吸引力大幅提升。

2021年,全球數位支付市場規模為506.2億美元,預計到2029年將達到2077億美元,在2022-2029年的預測期內,複合年增長率為19.30%。除了市場價值、成長率、細分市場、地理覆蓋範圍、市場參與者和市場情景等市場洞察外,Data Bridge市場研究團隊整理的市場報告還包含深入的專家分析、進出口分析、定價分析、生產消費分析和Pestle分析。

數位支付市場範圍和細分

|

報告指標 |

細節 |

|

預測期 |

2022年至2029年 |

|

基準年 |

2021 |

|

歷史歲月 |

2020(可自訂為 2014 - 2019) |

|

定量單位 |

收入(十億美元)、銷售(單位)、定價(美元) |

|

涵蓋的領域 |

產品(解決方案、服務)、部署模式(本地、雲端)、組織規模(大型企業、中小型企業 (SME))、支付方式(支付卡、銷售點、統一支付介面 (UPI) 服務、行動支付、線上支付)、使用模式(行動應用程式、桌面/Web 瀏覽器)、技術(應用程式介面 (API)、資料分析與軟體(P/C)、商家/企業、政府)、最終用戶(商業、消費者) |

|

覆蓋國家 |

美國、加拿大和墨西哥 |

|

涵蓋的市場參與者 |

ACI Worldwide(美國)、PayPal, Inc.(美國)、Novatti Group Ltd(澳洲)、Global Payments Inc.(美國)、Visa(美國)、Stripe, Inc.(愛爾蘭)、Google, LLC(美國)、Finastra.(英國)、三星(韓國)、Amazon Web Services, Inc.(美國)、Finastra.(英國)、三星(韓國)、Amazon Web Services, Inc.(美國)、美國 Software(美國)、美國) Inc.(美國)、Fiserv, Inc.(美國)、WEX Inc.(美國)、wirecard(美國)、Mastercard.(美國) |

|

市場機會 |

|

市場定義

數位支付是指一方向另一方購買商品或服務時進行的電子支付。數位支付的結果是,從付款方帳戶扣除相應金額,並將相同金額存入收款方帳戶。

數位支付市場動態

本節旨在了解市場驅動因素、優勢、機會、限制因素和挑戰。下文將詳細討論這些內容:

驅動程式

- 全球採用數位支付介面的新興舉措

全球範圍內,尤其是在亞太地區,大力推行統一支付接口,加上數位化進程的加快,正在推動市場成長。此外,人們對這些介面安全性和保障性的認識不斷提高,也將推動市場成長。此外,數位化趨勢的不斷增長 也為市場帶來了巨大的成長機會。

- 政府加強支持力度

中央和地方政府為促進市場成長(尤其是在亞太地區)而推出的措施和支持政策不斷增多,將大大拓寬成長空間。數位支付是該地區各國的主要成長動力之一。因此,政府加強關注將創造大量機會。

此外,城市化、工業化進程加快以及全球智慧型手機用戶數量的成長等因素,在預測期內進一步促進了整體市場的擴張。此外,每日支付介面數量的成長以及個人可支配收入的增加預計將推動市場的成長速度。

機會

- 電子商務購物的興起趨勢

電商通路數量的成長、消費者時尚品味和偏好的轉變以及西方化的加劇,將對市場成長率產生正面影響。主要電商通路(尤其是亞馬遜)的日益普及,正在推動市場成長率。

- 網路普及率不斷提高

發展中經濟體高速網路存取的不斷增長和互聯網基礎設施的不斷完善將再次推動市場成長率。 4G和5G網路服務的普及將擴大全球成長和擴張的範圍。

限制/挑戰

- 猶豫和恐懼

全球欠發達地區的民眾對此類介面的安全性感到猶豫和擔憂,這將阻礙其成長。此外,民眾缺乏安全意識和教育,加上這些地區的銀行基礎設施薄弱,也將限制其成長空間。

- 缺乏技術專業知識

專業知識和技術專長的匱乏,尤其是在已開發經濟體和發展中經濟體,以及跨境支付缺乏全球標準,將對市場價值的平穩成長造成障礙。此外,缺乏熟練的專業人員以及經驗商數較低也會阻礙市場的成長速度。

本數位支付市場報告詳細介紹了近期發展動態、貿易法規、進出口分析、生產分析、價值鏈優化、市場份額、國內和本地市場參與者的影響,並分析了新興收入來源、市場法規變化、戰略市場增長分析、市場規模、品類市場增長、應用領域和主導地位、產品審批、產品發布、地域擴張以及市場技術創新等方面的機遇。如需了解更多關於數位支付市場的信息,請聯繫 Data Bridge 市場研究公司以獲取分析師簡報,我們的團隊將協助您做出明智的市場決策,實現市場成長。

COVID-19對數位支付市場的影響

新冠疫情促進了市場擴張,疫情後時期將繼續推動市場成長。疫情期間,非接觸式支付系統(尤其是電子錢包)得到了廣泛應用。儘管製造業遭受重創,但在封鎖期間,數位支付市場的帳單支付、點對點 (P2P) 轉帳和客戶對企業 (C2B) 支付均有所增長。

最新動態

- Fiserv 將於 2021 年 11 月推出 EnteractSM,這是一個針對金融機構的全新雲端客戶關係管理 (CRM)平台。 Enteract 提供的基於 Microsoft Azure 的整合框架,可實現核心銀行業務、企業內容管理和數位管道之間的即時流程整合。它還能將消費者資料與後端系統同步。

- 維珍金融與 Global Payments Inc. 於 2021 年 9 月簽署了一項合同,利用 Global Payments 獨特的雙邊網絡,讓維珍金融消費者能夠享受全球業界領先的數位支付體驗。

- RealNet 是一個基於雲端的全新軟體即服務 (SaaS) 平台,旨在為企業、個人和政府提供跨即時支付網路的帳戶到帳戶 (A2A) 交易。 RealNet 由 FIS 於 2021 年 4 月推出。

數位支付市場範圍

數位支付市場根據產品、部署模式、組織規模、支付方式、使用模式、技術、用例和最終用戶進行細分。這些細分市場的成長將有助於您分析行業中成長緩慢的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

奉獻

- 解決方案

- 支付網關解決方案

- 支付處理解決方案

- 支付錢包解決方案

- 支付安全和詐欺管理解決方案

- 銷售點 (POS) 解決方案

- 服務

- 專業服務

- 諮詢

- 執行

- 支援和維護

- 託管服務

部署模型

- 本地

- 雲

組織規模

- 大型企業

- 中小企業(SMEs)

付款方式

- 支付卡

- 銷售點

- 統一支付介面(UPI)服務

- 行動支付

- 網上支付

使用方式

- 行動應用程式

- 桌面/Web 瀏覽器

科技

- 應用程式介面(API)

- 數據分析與機器學習

- 數位帳本技術(DLT)

- 人工智慧和物聯網

- 生物特徵認證

用例

- 人(P/C)

- 商家/企業

- 政府

最終用戶

- 商業的

- 消費者

數位支付市場區域分析/洞察

對數位支付市場進行了分析,並按國家、產品、部署模式、組織規模、支付方式、使用方式、技術、用例和最終用戶提供了市場規模洞察和趨勢。

數位支付市場報告涵蓋的國家為北美的美國、加拿大和墨西哥。

美國在北美數位支付市場佔據主導地位,這得益於Visa、PayPal Holdings, Inc.和MasterCard等主要參與者的存在。該地區先進的基礎設施是決定其主導地位的另一個重要因素。

報告的國家部分還提供了各個市場的影響因素以及國內市場監管變化,這些變化會影響市場的當前和未來趨勢。下游和上游價值鏈分析、技術趨勢、波特五力模型分析以及案例研究等數據點是預測各國市場狀況的一些指標。此外,在對國家/地區數據進行預測分析時,還考慮了全球品牌的存在和可用性,以及它們因本土和國內品牌的激烈競爭或稀缺而面臨的挑戰,國內關稅和貿易路線的影響。

競爭格局與數位支付市場佔有率分析

數位支付市場競爭格局提供了按競爭對手劃分的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投入、新市場舉措、全球佈局、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度以及應用主導地位。以上提供的數據僅與公司在數位支付市場的重點相關。

數位支付市場的一些主要參與者包括

- ACI Worldwide(美國)

- PayPal, Inc.(美國)

- Novatti集團有限公司(澳洲)

- Global Payments Inc.(美國)

- 維薩卡(美國)

- Stripe, Inc.(愛爾蘭)

- Google, LLC(美國)

- Finastra。 (英國)

- 三星(韓國)

- 亞馬遜網路服務公司(美國)

- 金融軟體與系統私人有限公司(美國)

- Aurus Inc.(美國)

- Adyen(荷蘭)

- 蘋果公司(美國)

- Fiserv, Inc.(美國)

- WEX Inc.(美國)

- Wirecard(美國)

- 萬事達卡。 (美國)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DIGITAL PAYMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE NORTH AMERICA DIGITAL PAYMENT MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMAPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 NORTH AMERICA DIGITAL PAYMENT MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.3.1 APPLICATION PROGRAMMING INTERFACE (API)

5.3.2 DATA ANALYTICS AND ML

5.3.3 DIGITAL LEDGER TECHNOLOGY (DLT)

5.3.4 AI AND IOT

5.3.5 BIOMETRIC AUTHENTICATION

5.4 VALUE CHAIN ANALYSIS

5.5 PATENT ANALYSIS

5.6 KEY STRATEGIC INITIATIVES

5.7 USE CASES

5.8 COMPANY COMPARITIVE ANALYSIS

6 NORTH AMERICA DIGITAL PAYMENT MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 PAYMENT GATEWAY

6.2.2 PAYMENT PROCESSING

6.2.3 PAYMENT SECURITY & FRAUD MANAGEMENT

6.2.4 PAYMENT WALLET SOLUTIONS

6.2.5 TRANSACTION RISK MANAGEMENT

6.2.6 POS SOLUTIONS

6.2.7 OTHERS

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1. TRAINING & CONSULTING

6.3.2.2. IMPLEMENTATION& INTEGRATION

6.3.2.3. SUPPORT & MAINTENANCE

7 NORTH AMERICA DIGITAL PAYMENT MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 ON-PREMISE

7.3 CLOUD

8 NORTH AMERICA DIGITAL PAYMENT MARKET, BY MODE OF PAYMENT

8.1 OVERVIEW

8.2 PAYMENT CARD

8.2.1 DEBIT CARD

8.2.2 CREDIT CARD

8.2.3 CHARGE CARD

8.2.4 FLEET CARD

8.2.5 GIFT CARD

8.2.6 STORE CARD

8.3 POINT OF SALE

8.3.1 CONTACTLESS PAYMENT

8.3.2 CONTACT PAYMENT

8.4 UNIFIED PAYMENTS INTERFACE (UPI) SERVICE

8.4.1 INDEPENDENT MODE

8.4.2 EMBEDDED MODE

8.5 MOBILE PAYMENT

8.5.1 MOBILE WALLET

8.5.1.1. OPEN WALLET

8.5.1.2. CLOSED WALLET

8.5.1.3. SEMI CLOSED WALLET

8.5.2 MOBILE MONEY

8.6 ONLINE PAYMENT

8.6.1 DIGITAL CURRENCIES

8.6.2 NET BANKING

8.6.2.1. FUND TRANSFER

8.6.2.1.1. NATIONAL ELECTRONIC FUND TRANSFER (NEFT)

8.6.2.1.2. IMMEDIATE PAYMENT SERVICE (IMPS)

8.6.2.1.3. REAL TIME GROSS SETTLEMENT (RTGS)

8.6.2.1.4. ELECTRONIC CLEARING SYSTEM (ECS)

8.6.2.2. BILL PAYMENT SERVICE

8.6.2.3. RAILWAY PASS

8.6.2.4. PREPAID PHONE RECHARGE

8.6.3 DIGITAL WALLETS

8.6.4 PREPAID CARDS

8.6.5 OTHERS

9 NORTH AMERICA DIGITAL PAYMENT MARKET, BY MODE OF USAGE

9.1 OVERVIEW

9.2 MOBILE APPLICATION

9.3 DESKTOP/WEB BROWSER

10 NORTH AMERICA DIGITAL PAYMENT MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 SMALL & MEDIUM ORGANIZATION

10.3 LARGE ORGANIZATION

11 NORTH AMERICA DIGITAL PAYMENT MARKET, BY USE CASE

11.1 OVERVIEW

11.2 PERSON (P/C)

11.3 MERCHANT/ BUSINESS

11.4 GOVERNEMNT

12 NORTH AMERICA DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE

12.1 OVERVIEW

12.2 DOMESTIC

12.3 CROSS BORDER

13 NORTH AMERICA DIGITAL PAYMENT MARKET, BY END-USER

13.1 OVERVIEW

13.2 COMMERCIAL

13.2.1 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

13.2.1.1. BY OFFERING

13.2.1.1.1. SOLUTIONS

13.2.1.1.2. SERVICES

13.2.1.2. BY MODE OF PAYMENT

13.2.1.2.1. PAYMENT CARD

13.2.1.2.2. POINT OF SALE

13.2.1.2.3. UNIFIED PAYMENTS INTERFACE (UPI) SERVICE

13.2.1.2.4. MOBILE PAYMENT

13.2.1.2.5. ONLINE PAYMENT

13.2.2 HEALTHCARE

13.2.2.1. BY OFFERING

13.2.2.1.1. SOLUTIONS

13.2.2.1.2. SERVICES

13.2.2.2. BY MODE OF PAYMENT

13.2.2.2.1. PAYMENT CARD

13.2.2.2.2. POINT OF SALE

13.2.2.2.3. UNIFIED PAYMENTS INTERFACE (UPI) SERVICE

13.2.2.2.4. MOBILE PAYMENT

13.2.2.2.5. ONLINE PAYMENT

13.2.3 IT & TELECOM

13.2.3.1. BY OFFERING

13.2.3.1.1. SOLUTIONS

13.2.3.1.2. SERVICES

13.2.3.2. BY MODE OF PAYMENT

13.2.3.2.1. PAYMENT CARD

13.2.3.2.2. POINT OF SALE

13.2.3.2.3. UNIFIED PAYMENTS INTERFACE (UPI) SERVICE

13.2.3.2.4. MOBILE PAYMENT

13.2.3.2.5. ONLINE PAYMENT

13.2.4 RESTAURANTS

13.2.4.1. BY OFFERING

13.2.4.1.1. SOLUTIONS

13.2.4.1.2. SERVICES

13.2.4.2. BY MODE OF PAYMENT

13.2.4.2.1. PAYMENT CARD

13.2.4.2.2. POINT OF SALE

13.2.4.2.3. UNIFIED PAYMENTS INTERFACE (UPI) SERVICE

13.2.4.2.4. MOBILE PAYMENT

13.2.4.2.5. ONLINE PAYMENT

13.2.5 HOSPITALITY

13.2.5.1. BY OFFERING

13.2.5.1.1. SOLUTIONS

13.2.5.1.2. SERVICES

13.2.5.2. BY MODE OF PAYMENT

13.2.5.2.1. PAYMENT CARD

13.2.5.2.2. POINT OF SALE

13.2.5.2.3. UNIFIED PAYMENTS INTERFACE (UPI) SERVICE

13.2.5.2.4. MOBILE PAYMENT

13.2.5.2.5. ONLINE PAYMENT

13.2.6 AUTOMOTIVE

13.2.6.1. BY OFFERING

13.2.6.1.1. SOLUTIONS

13.2.6.1.2. SERVICES

13.2.6.2. BY MODE OF PAYMENT

13.2.6.2.1. PAYMENT CARD

13.2.6.2.2. POINT OF SALE

13.2.6.2.3. UNIFIED PAYMENTS INTERFACE (UPI) SERVICE

13.2.6.2.4. MOBILE PAYMENT

13.2.6.2.5. ONLINE PAYMENT

13.2.7 MEDIA& ENTERTAINMENT

13.2.7.1. BY OFFERING

13.2.7.1.1. SOLUTIONS

13.2.7.1.2. SERVICES

13.2.8 RETAIL & ECOMMERCE

13.2.8.1. BY OFFERING

13.2.8.1.1. SOLUTIONS

13.2.8.1.2. SERVICES

13.2.8.2. BY MODE OF PAYMENT

13.2.8.2.1. PAYMENT CARD

13.2.8.2.2. POINT OF SALE

13.2.8.2.3. UNIFIED PAYMENTS INTERFACE (UPI) SERVICE

13.2.8.2.4. MOBILE PAYMENT

13.2.8.2.5. ONLINE PAYMENT

13.2.9 TRANSPORTATION& LOGISTICS

13.2.9.1. BY OFFERING

13.2.9.1.1. SOLUTIONS

13.2.9.1.2. SERVICES

13.2.9.2. BY MODE OF PAYMENT

13.2.9.2.1. PAYMENT CARD

13.2.9.2.2. POINT OF SALE

13.2.9.2.3. UNIFIED PAYMENTS INTERFACE (UPI) SERVICE

13.2.9.2.4. MOBILE PAYMENT

13.2.9.2.5. ONLINE PAYMENT

13.2.10 OTHERS

13.3 CONSUMER

13.3.1.1. BY MODE OF PAYMENT

13.3.1.1.1. PAYMENT CARD

13.3.1.1.2. POINT OF SALE

13.3.1.1.3. UNIFIED PAYMENTS INTERFACE (UPI) SERVICE

13.3.1.1.4. MOBILE PAYMENT

13.3.1.1.5. ONLINE PAYMENT

14 NORTH AMERICA DIGITAL PAYMENT MARKET, BY COUNTRY

14.1 NORTH AMERICA DIGITAL PAYMENT MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

15 NORTH AMERICA DIGITAL PAYMENT MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.2 MERGERS & ACQUISITIONS

15.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.4 EXPANSIONS

15.5 REGULATORY CHANGES

15.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 NORTH AMERICA DIGITAL PAYMENT MARKET, SWOT & DBMR ANALYSIS

17 NORTH AMERICA DIGITAL PAYMENT MARKET, COMPANY PROFILE

17.1 PAYPAL HOLDINGS INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 VISA, INC

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 GOOGLE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 APPLE INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 MASTERCARD

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 AURUS INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 GLOBAL PAYMENTS INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 ADYEN

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 ACI WORLDWIDE, INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 FINASTRA

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 AMAZON WEB SERVICES, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 FISERV, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 FIS

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 SAMSUNG

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 STRIPE

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 WEX INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 VERIFONE, INC.

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 PAYTRACE, INC.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 CONCLUSION

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。