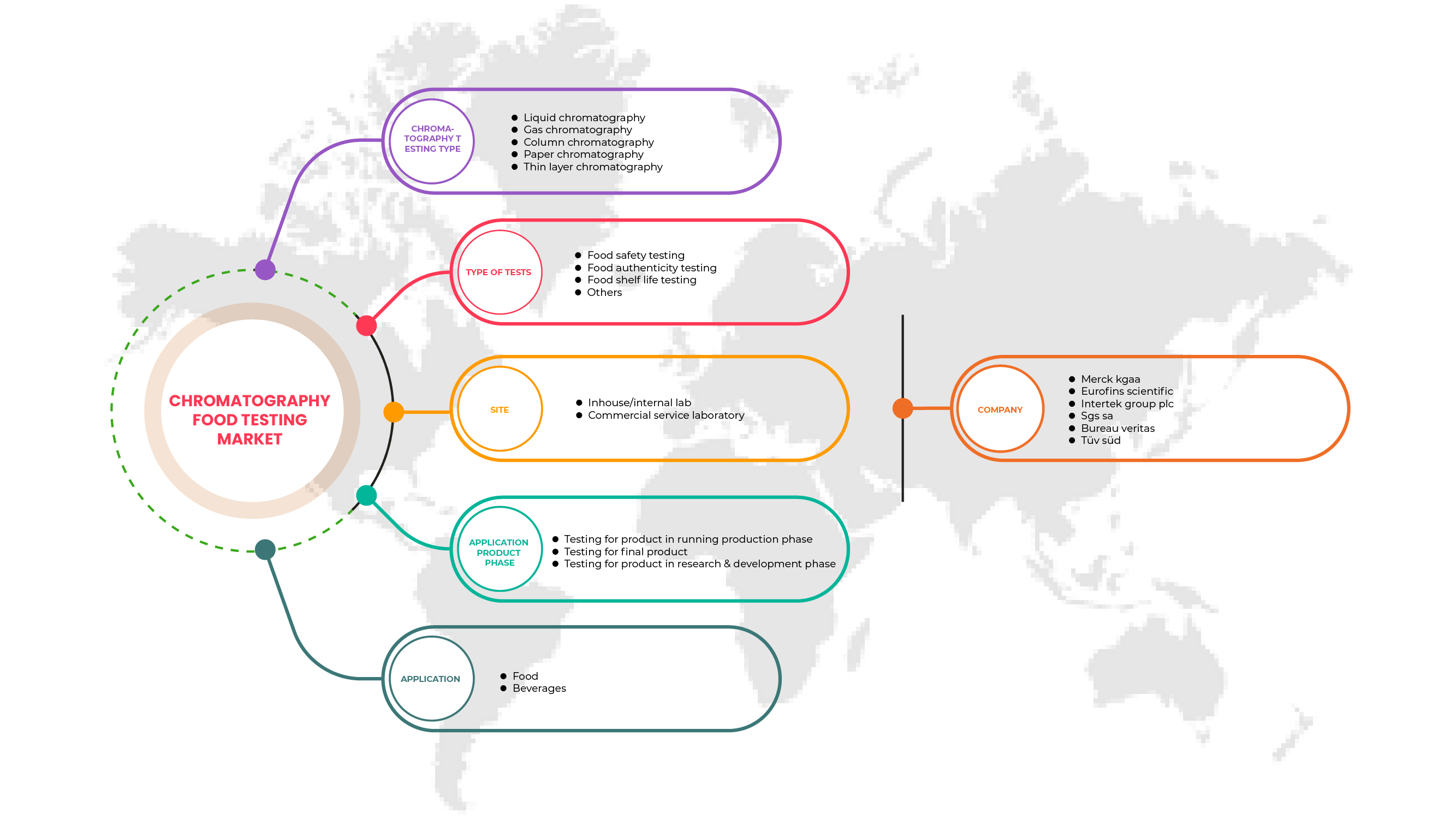

北美色谱食品检测市场,按色谱测试类型(液相色谱、气相色谱、柱色谱、纸色谱和薄层色谱)、测试类型(食品安全测试、食品真实性测试、食品保质期测试等)、地点(内部实验室和商业服务实验室)、应用产品阶段(运行生产阶段的产品测试、最终产品测试和研发阶段的产品测试)、应用(食品和饮料)行业趋势及预测到 2029 年。

北美色谱食品检测市场分析与洞察

色谱食品检测可用于食品链的各个阶段,从确定食品质量到检测添加剂、农药、病原体和其他可能影响人类健康的有害污染物。各地区新冠疫情的增多促进了食品检测(包括色谱食品检测)的发展。

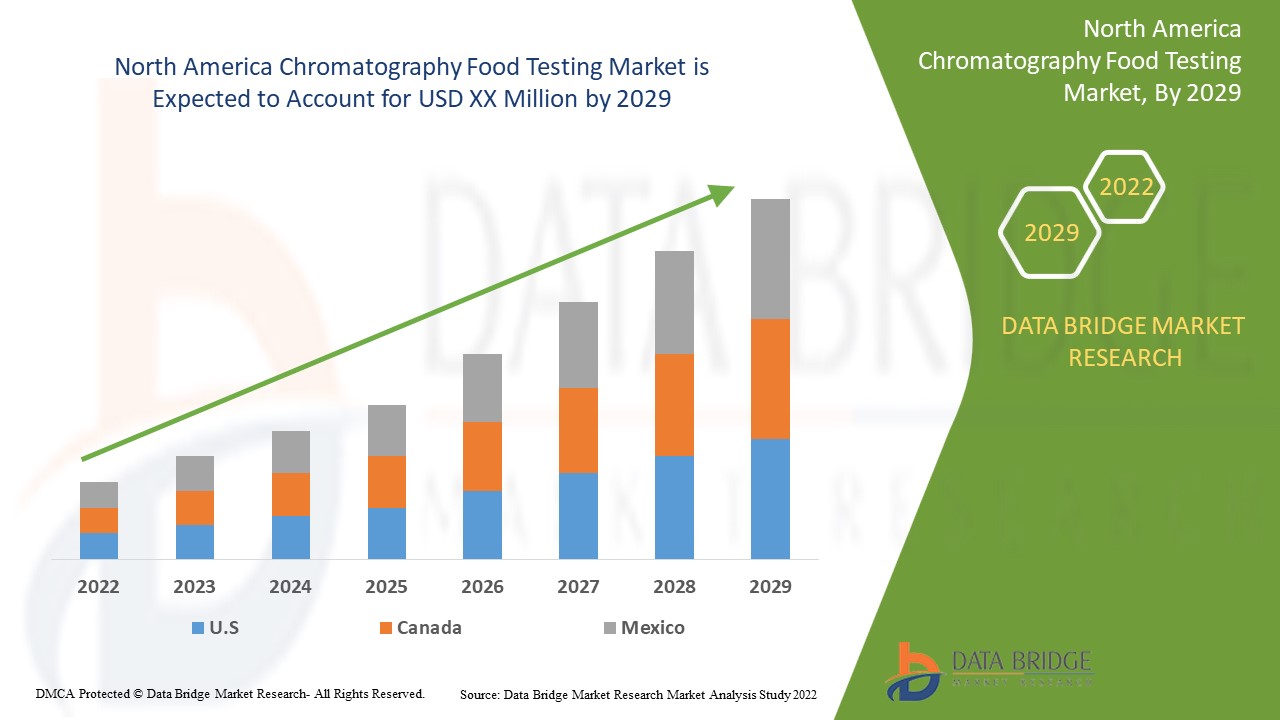

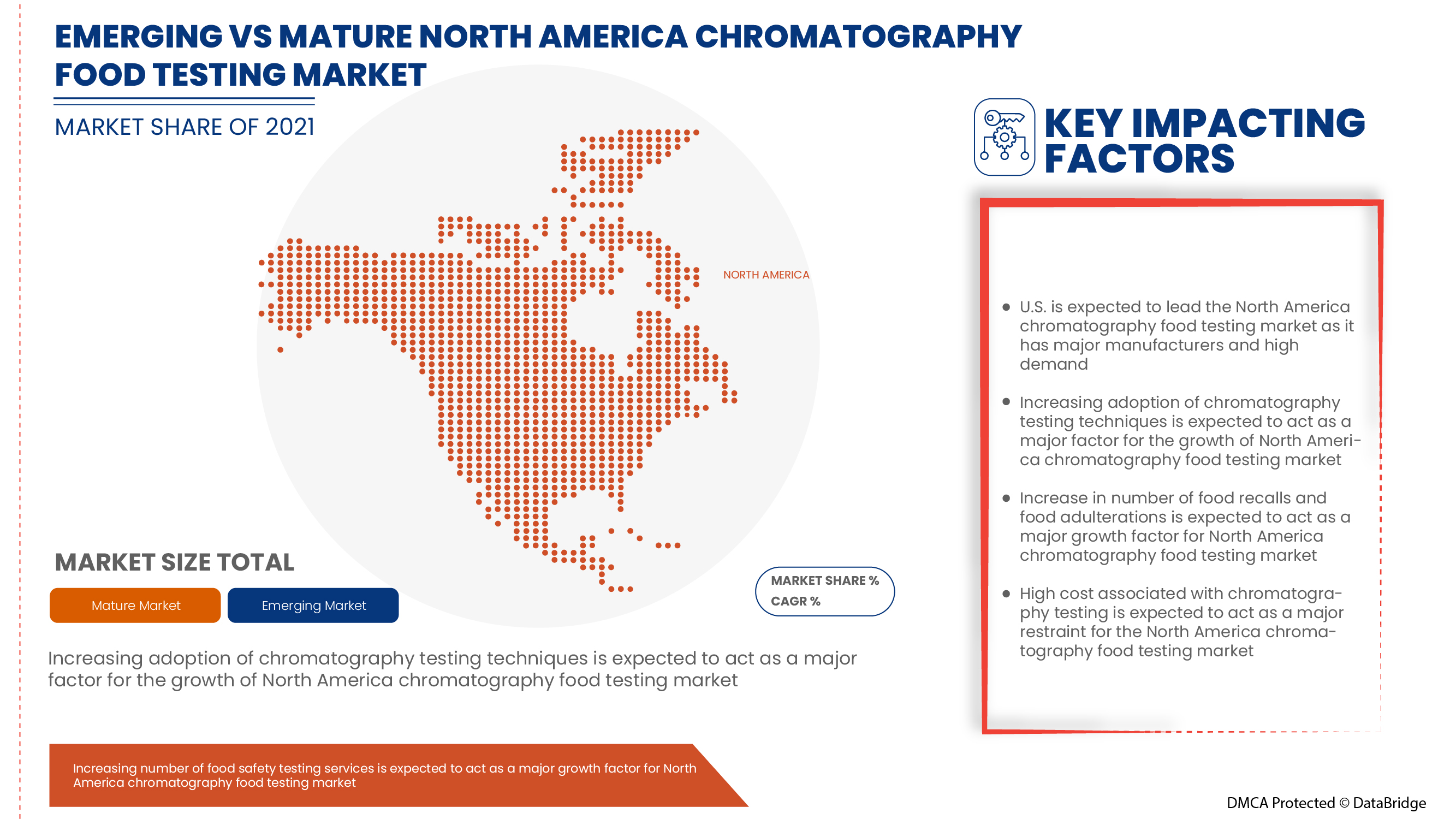

食源性疾病数量的增加、检测行业的技术进步、食品法规和标准的严格性以及对食品安全检测服务的投资不断增加是推动市场发展的一些因素。然而,色谱设备的高成本和替代食品检测技术的存在可能会阻碍市场的增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,北美色谱食品检测市场将以 6.6% 的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(千美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

按色谱测试类型(液相色谱、气相色谱、柱色谱、纸色谱和薄层色谱)、测试类型(食品安全测试、食品真实性测试、食品保质期测试等)、地点(内部实验室和商业服务实验室)、应用产品阶段(生产阶段产品测试、最终产品测试和研发阶段产品测试)、应用(食品和饮料) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

SGS SA、Bureau Veritas、Eurofins Scientific、TÜV SÜD、ALS、Intertek Group plc、QIMA、Merck KGaA、Cotecna、Mérieux NutriSciences Corporation、Food Safety Net Services、ADPEN Laboratories, Inc.、Element Materials Technology、NSF、Neogen Corporation、Waters Corporation、Thermo Fisher Scientific Inc. 和 Shimadzu Corporation 等 |

市场定义

食源性疾病是由食用变质或受添加剂、杀虫剂、致病菌、病毒、寄生虫等污染的食物引起的,从而导致感染。食源性疾病可以通过各种因素传播,例如食物处理不当、缺乏意识等等。这些致病因素必须在食用食物之前进行检测。色谱法可用于食物链的各个阶段,从确定食物质量到检测添加剂、杀虫剂和其他有害污染物。

北美色谱食品检测市场动态

驱动程序

- 食源性疾病数量上升

食源性疾病是由食用受污染的食物或饮料引起的。已知的食源性疾病有 250 多种。大多数感染是由细菌、病毒和寄生虫引起的,有些是由化学物质和毒素引起的。大肠杆菌是生活在人体肠道中的主要细菌种类。

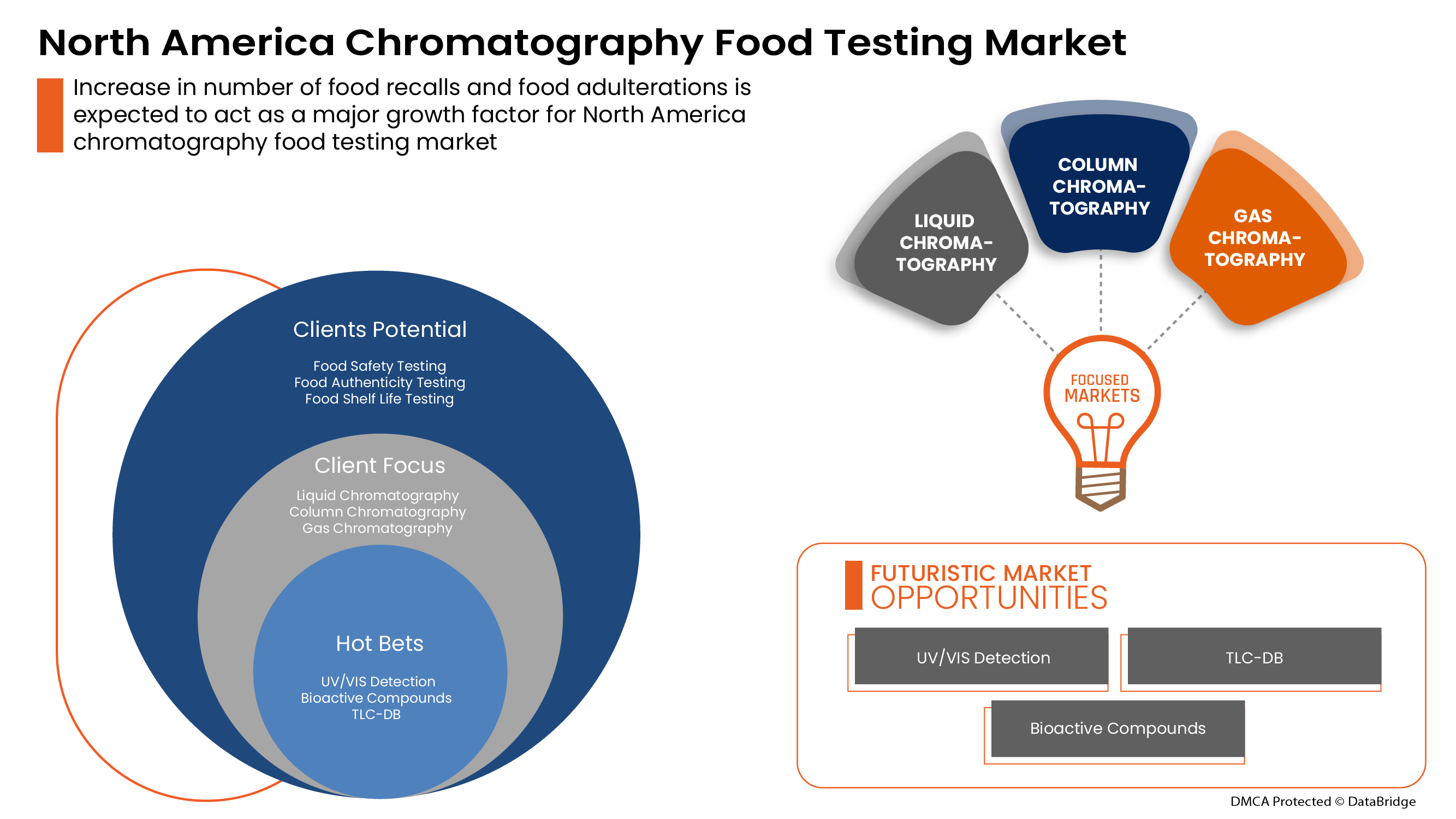

- 色谱检测技术的应用日益广泛

色谱法是一种重要的生物物理技术,可以分离、识别和纯化混合物的成分,以进行定性和定量分析。如今,色谱法使食品行业能够提供有关特定食品营养成分的准确信息,等等。

- 食品召回和食品掺假数量增加

食品召回是为了停止销售、分销和消费可能对消费者造成安全风险的特定食品而采取的措施。食品召回可能是根据来自各种来源(例如制造商、批发商、零售商、政府机构和消费者)的报告或投诉而发起的。

机会

-

测试行业的技术进步

近年来推动市场增长的色谱食品检测技术趋势包括人工智能 (AI)、数字化、连接技术以及由数据和机器学习推动的智能自动化技术。在疫情爆发之前,人们对智能和自动化技术的好处很感兴趣。

限制/挑战

- 色谱检测成本高且有替代食品检测技术存在

然而,目前色谱测试有多种类型,例如纸色谱、薄层色谱、气相色谱、膜色谱和染料配体色谱。这些色谱测试广泛应用于食品、生物制药、营养品和生物加工等行业。色谱测试用于各个行业,以获得准确的测试后结果,但色谱测试成本高昂且测试耗时长。另一个可能阻碍色谱测试在食品行业使用的因素是与之相关的成本。

COVID-19 对北美色谱食品检测市场的影响

随着食品检测服务的蓬勃发展,COVID-19 对市场产生了积极影响。由于 COVID-19,消费者对色谱食品检测系统和服务的需求很高,检测污染和病原体是食品行业必须遵循的义务。这促进了各种类型的食品检测服务的增长,包括色谱食品检测。

近期发展

- 2022 年 6 月,PerkinElmer, Inc. 推出了下一代自动化气相色谱平台解决方案。该解决方案的主要特点是其自动化气相色谱 (GC)、顶空采样器和气相色谱/质谱 (GC/MS) 解决方案

北美色谱食品检测市场范围

北美色谱食品检测市场根据色谱检测类型、检测类型、地点、应用产品阶段和应用进行细分。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

色谱检测类型

- 液相色谱法

- 气相色谱法

- 柱层析

- 纸色谱法

- 薄层色谱法

根据色谱测试类型,北美色谱食品检测市场分为液相色谱、气相色谱、柱色谱、纸色谱和薄层色谱。

测试类型

- 食品安全检测

- 食品真伪检测

- 食品保质期检测

- 其他的

根据测试类型,北美色谱食品检测市场分为食品安全检测、食品真实性检测、食品保质期测试等。

地点

- 内部实验室

- 商业服务实验室

根据地点,北美色谱食品检测市场分为内部实验室和商业服务实验室。

应用产品阶段

- 正在生产阶段进行产品测试

- 最终产品测试

- 研发阶段产品测试

根据应用产品阶段,北美色谱食品检测市场分为生产运行阶段的产品测试、最终产品测试和研发阶段的产品测试。

应用

- 食物

- 饮料

根据应用,北美色谱食品检测市场分为食品和饮料。

北美色谱食品检测市场区域分析/见解

对北美色谱食品检测市场进行了分析,并按国家、色谱检测类型、检测类型、地点、应用产品阶段和应用提供了市场规模见解和趋势,如上所述。

2022 年,由于疫情蔓延、对食品安全的重视以及该地区检测行业的技术进步不断提高,色谱检测技术的采用日益广泛,预计美国将主导北美色谱食品检测市场。

报告的国家部分还提供了影响单个市场因素和国内市场法规变化,这些因素和变化会影响市场的当前和未来趋势。新销售、替代销售、国家人口统计、疾病流行病学和进出口关税等数据点是用于预测单个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了北美品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战,以及销售渠道的影响。

竞争格局和北美色谱食品检测市场份额分析

色谱食品检测市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、解决方案发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对北美色谱食品检测市场的关注有关。

北美色谱食品检测市场的一些主要参与者包括 SGS SA、Bureau Veritas、Eurofins Scientific、TÜV SÜD、ALS、Intertek Group plc、QIMA、Merck KGaA、Cotecna、Mérieux NutriSciences Corporation、Food Safety Net Services、ADPEN Laboratories, Inc.、Element Materials Technology、NSF、Neogen Corporation、Waters Corporation、Thermo Fisher Scientific Inc. 和 Shimadzu Corporation 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 LIQUID CHROMATOGRAPHY TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.2 GROWING FOOD ADULTERATION CASES

4.3 INDUSTRY TRENDS & FUTURE PERSPECTIVE

4.4 SUPPLY CHAIN ANALYSIS

4.5 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF CHROMATOGRAPHY FOOD TESTING TECHNOLOGIES

4.6 OVERVIEW OF TECHNOLOGICAL ADVANCEMENT IN THE FIELD

4.7 TECHNOLOGICAL TRENDS IN CHROMATOGRAPHY FOOD TESTING

4.8 EMERGING TREND ANALYSIS

4.8.1 ETHYLENE OXIDE AND 2-CHLOROETHANOL ANALYSIS

4.8.2 NEW TECHNOLOGIES WITH HIGH ACCURACY AND PRECISION

5 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, REGULATORY FRAMEWORK AND GUIDELINES

5.1 FOOD AND BEVERAGES SAFETY AND QUALITY REGULATIONS

5.2 FOOD SAFETY & STANDARDS PACKAGING & LABELLING REGULATIONS 2011

5.3 ANALYSIS OF LAWSUITS RELATED TO CHROMATOGRAPHY FOOD TESTING

5.4 FOODBORNE ILLNESS OUTBREAKS AND RELEVANT ACTIONS TAKEN BY GOVERNMENT BODIES

5.5 RECENTLY FORMED LAWS FOR CHROMATOGRAPHY FOOD TESTING BY GOVERNMENT BODIES CHANGES IN NORTH AMERICA FOOD SAFETY REGULATIONS

5.6 CHANGES IN NORTH AMERICA FOOD SAFETY REGULATIONS

5.7 FOOD PRODUCTS RECALLS

5.8 FOOD PRODUCTS WITHDRAWALS

6 REGIONAL SUMMARY

6.1 SUMMARY WRITE-UP (NORTH AMERICA)

6.1.1 OVERVIEW

6.2 SUMMARY WRITE-UP (EUROPE)

6.2.1 OVERVIEW

6.3 SUMMARY WRITE-UP (ASIA-PACIFIC)

6.3.1 OVERVIEW

6.4 SUMMARY WRITE-UP (SOUTH AMERICA)

6.4.1 OVERVIEW

6.5 SUMMARY WRITE-UP (MIDDLE EAST AND AFRICA)

6.5.1 OVERVIEW

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN NUMBER OF FOODBORNE ILLNESSES

7.1.2 AN INCREASE IN THE AMOUNT OF FOOD RECALLS AND FOOD ADULTERATIONS

7.1.3 INCREASING ADOPTION OF CHROMATOGRAPHY TESTING TECHNIQUES

7.2 RESTRAINTS

7.2.1 HIGH COST ASSOCIATED WITH CHROMATOGRAPHY TESTING

7.2.2 PRESENCE OF ALTERNATIVE FOOD TESTING TECHNOLOGIES

7.3 OPPORTUNITIES

7.3.1 TECHNOLOGICAL ADVANCEMENTS IN THE TESTING INDUSTRY

7.3.2 GROWING APPLICATIONS OF CHROMATOGRAPHY IN VARIOUS FIELDS

7.3.3 INCREASING NUMBER OF FOOD SAFETY TESTING SERVICE PROVIDERS

7.3.4 RIGIDITY IN FOOD REGULATION AND STANDARDS

7.3.5 INCREASING ACQUISITIONS AND PARTNERSHIPS AMONG MARKET PLAYERS

7.4 CHALLENGES

7.4.1 LACK OF HARMONIZATION IN FOOD SAFETY STANDARDS

7.4.2 LACK OF INFRASTRUCTURE AND SKILLED PROFESSIONALS

8 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY CHROMATOGRAPHY TESTING TYPE

8.1 OVERVIEW

8.2 LIQUID CHROMATOGRAPHY

8.3 GAS CHROMATOGRAPHY

8.4 COLUMN CHROMATOGRAPHY

8.5 PAPER CHROMATOGRAPHY

8.6 THIN LAYER CHROMATOGRAPHY

9 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE OF TESTS

9.1 OVERVIEW

9.2 FOOD SAFETY TESTING

9.2.1 ALLERGEN TESTING

9.2.1.1 MILK

9.2.1.2 EGG

9.2.1.3 SEAFOOD

9.2.1.4 PEANUT & SOY

9.2.1.5 GLUTEN

9.2.1.6 TREE NUTS

9.2.1.7 OTHERS

9.2.2 PATHOGENS TESTING

9.2.2.1 SALMONELLA SPP

9.2.2.2 E. COLI

9.2.2.3 LISTERIA SPP

9.2.2.4 LISTERIA

9.2.2.5 CAMPYLOBACTER

9.2.2.6 VIBRIO SPP

9.2.2.7 OTHERS

9.2.3 HEAVY METALS TESTING

9.2.3.1 LEAD

9.2.3.2 ARSENIC

9.2.3.3 CADMIUM

9.2.3.4 MERCURY

9.2.3.5 OTHERS

9.2.4 NUTRITIONAL LABELLING

9.2.5 GMO TESTING

9.2.5.1 STACKED

9.2.5.2 HERBICIDE TOLERANCE

9.2.5.3 INSECT RESISTANCE

9.2.6 ORGANIC CONTAMINANTS TESTING

9.2.7 MYCOTOXINS TESTING

9.2.7.1 AFLATOXINS

9.2.7.2 OCHRATOXINS

9.2.7.3 PATULIN

9.2.7.4 FUMONISINS

9.2.7.5 TRICHOTHECENES

9.2.7.6 DEOXYNIVALENOL

9.2.7.7 ZEARALENONE

9.2.8 PESTICIDES TESTING

9.2.8.1 INSECTICIDES

9.2.8.2 HERBICIDES

9.2.8.3 FUNGICIDES

9.2.8.4 OTHERS

9.3 FOOD AUTHENTICITY TESTING

9.3.1 ADULTERATION TESTS

9.3.2 ORGANIC

9.3.3 ALLERGEN TESTING

9.3.4 MEAT SPECIATION

9.3.5 GMO TESTING

9.3.6 HALAL VERIFICATION

9.3.7 KOSHER VERIFICATION

9.3.8 PROTECTED GEOGRAPHICAL INDICATION (PGI)

9.3.9 PROTECTED DENOMINATION OF ORIGIN (PDO)

9.3.10 FALSE LABELLING

9.4 FOOD SHELF LIFE TESTING

9.4.1 ORGANOLEPTIC AND APPEARANCE

9.4.1.1 COLOR

9.4.1.2 TEXTURE

9.4.1.3 PACKAGING

9.4.1.4 AROMA

9.4.1.5 TASTE

9.4.1.6 SEPARATION

9.4.1.7 STRATIFICATION

9.4.2 RANCIDITY

9.4.2.1 PEROXIDE VALUE (PV)

9.4.2.2 P-ANISIDINE (P-AV)

9.4.2.3 FREE FATTY ACIDS (FFA)

9.4.3 INGREDIENT ACTIVITY

9.4.4 NUTRIENT STABILITY

9.4.5 CHEMICAL TESTS

9.4.6 ACIDITY LEVELS

9.4.7 BROWNING

9.4.7.1 ENZYMATIC BROWNING

9.4.7.2 CHEMICAL BROWNING

9.4.8 REAL-TIME SHELF TESTING

9.4.9 ACCELERATED SHELF-LIFE TESTING

9.4.10 ACCELERATED (40C/75%RH)

9.4.11 INTERMEDIATE (30C/65%RH)

9.4.12 AMBIENT (25C/60%RH)

9.4.13 TROPICAL (30C/75%RH)

9.4.14 REFRIGERATED (2C TO 8C)

9.4.15 FROZEN (-15C TO -20C)

9.4.16 OTHERS

9.5 OTHERS

10 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET , BY SITE

10.1 OVERVIEW

10.2 INHOUSE/INTERNAL LAB

10.3 COMMERCIAL SERVICE LABORATORY

11 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION PRODUCT PHASE

11.1 OVERVIEW

11.2 TESTING FOR PRODUCT IN RUNNING PRODUCTION PHASE

11.3 TESTING FOR FINAL PRODUCT

11.4 TESTING FOR PRODUCT IN RESEARCH & DEVELOPMENT PHASE

12 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 PROCESSED FOOD

12.2.1.1 PROCESSED FOOD, BY TYPE

12.2.1.1.1 CANNED FRUITS & VEGETABLES

12.2.1.1.2 JAMS, PRESERVES & MARMALADES

12.2.1.1.3 FRUIT & VEGETABLE PUREE

12.2.1.1.4 SAUCES, DRESSINGS & CONDIMENTS

12.2.1.1.5 READY MEALS

12.2.1.1.6 SOUPS

12.2.1.1.7 PICKLES

12.2.1.1.8 OTHERS

12.2.1.2 PROCESSED FOOD, BY CHROMATOGRAPHY TESTING TYPE

12.2.1.2.1 LIQUID CHROMATOGRAPHY

12.2.1.2.2 GAS CHROMATOGRAPHY

12.2.1.2.3 COLUMN CHROMATOGRAPHY

12.2.1.2.4 THIN LAYER CHROMATOGRAPHY

12.2.1.2.5 PAPER CHROMATOGRAPHY

12.2.2 DAIRY PRODUCTS

12.2.2.1 DAIRY PRODUCTS, BY TYPE

12.2.2.1.1 ICE CREAM

12.2.2.1.2 CHEESE

12.2.2.1.3 MILK DESSERT

12.2.2.1.3.1 MILK DESSERT, BY TYPE

12.2.2.1.3.2 Pudding

12.2.2.1.3.3 Custard

12.2.2.1.3.4 Others

12.2.2.1.4 YOGURT

12.2.2.1.5 CHEESE BASED DESERTS

12.2.2.1.5.1 CHEESE BASED DESERTS, BY TYPE

12.2.2.1.5.2 Cheese Cake

12.2.2.1.5.3 Cheese Pudding

12.2.2.1.5.4 Cheese Cake

12.2.2.1.5.5 Others

12.2.2.1.6 OTHERS

12.2.2.2 DAIRY PRODUCTS, BY CHROMATOGRAPHY TESTING TYPE

12.2.2.2.1 LIQUID CHROMATOGRAPHY

12.2.2.2.2 GAS CHROMATOGRAPHY

12.2.2.2.3 COLUMN CHROMATOGRAPHY

12.2.2.2.4 THIN LAYER CHROMATOGRAPHY

12.2.2.2.5 PAPER CHROMATOGRAPHY

12.2.3 MEAT & POULTRY PRODUCTS

12.2.3.1 MEAT & POULTRY PRODUCTS, BY TYPE

12.2.3.1.1 CHICKEN & EGGS

12.2.3.1.2 SEAFOOD

12.2.3.1.3 BEEF

12.2.3.1.4 LAMB & GOAT

12.2.3.1.5 PORK

12.2.3.1.6 OTHERS

12.2.3.2 MEAT & POULTRY PRODUCTS, BY CHROMATOGRAPHY TESTING TYPE

12.2.3.2.1 LIQUID CHROMATOGRAPHY

12.2.3.2.2 GAS CHROMATOGRAPHY

12.2.3.2.3 COLUMN CHROMATOGRAPHY

12.2.3.2.4 THIN LAYER CHROMATOGRAPHY

12.2.3.2.5 PAPER CHROMATOGRAPHY

12.2.4 VEGETABLES

12.2.4.1 Vegetables, BY TYPE

12.2.4.1.1 LEAFY GREENS

12.2.4.1.2 CRUCIFEROUS VEGETABLES

12.2.4.1.3 MARROW VEGETABLES

12.2.4.1.4 ROOT VEGETABLES

12.2.4.1.5 ONION

12.2.4.1.6 GARLIC

12.2.4.1.7 OTHERS

12.2.4.2 VEGETABLES, BY CHROMATOGRAPHY TESTING TYPE

12.2.4.2.1 LIQUID CHROMATOGRAPHY

12.2.4.2.2 GAS CHROMATOGRAPHY

12.2.4.2.3 COLUMN CHROMATOGRAPHY

12.2.4.2.4 THIN LAYER CHROMATOGRAPHY

12.2.4.2.5 PAPER CHROMATOGRAPHY

12.2.5 FRUITS

12.2.5.1 Fruits, BY TYPE

12.2.5.1.1 APPLE & PEARS

12.2.5.1.2 CITRUS FRUITS

12.2.5.1.3 TROPICAL FRUITS

12.2.5.1.4 BERRIES

12.2.5.1.5 MELONS

12.2.5.1.6 OTHERS

12.2.5.2 Fruits, BY CHROMATOGRAPHY TESTING TYPE

12.2.5.2.1 LIQUID CHROMATOGRAPHY

12.2.5.2.2 GAS CHROMATOGRAPHY

12.2.5.2.3 COLUMN CHROMATOGRAPHY

12.2.5.2.4 THIN LAYER CHROMATOGRAPHY

12.2.5.2.5 PAPER CHROMATOGRAPHY

12.2.6 CEREALS & GRAINS

12.2.6.1 CEREALS & GRAINS, BY TYPE

12.2.6.1.1 RICE

12.2.6.1.2 WHEAT

12.2.6.1.3 BARLEY

12.2.6.1.4 MAIZE

12.2.6.1.5 OAT

12.2.6.1.6 SORGHUM

12.2.6.1.7 OTHERS

12.2.6.2 Cereals & Grains, BY CHROMATOGRAPHY TESTING TYPE

12.2.6.2.1 LIQUID CHROMATOGRAPHY

12.2.6.2.2 GAS CHROMATOGRAPHY

12.2.6.2.3 COLUMN CHROMATOGRAPHY

12.2.6.2.4 THIN LAYER CHROMATOGRAPHY

12.2.6.2.5 PAPER CHROMATOGRAPHY

12.2.7 EDIBLE OILS

12.2.7.1 EDIBLE OILS, BY TYPE

12.2.7.1.1 SOYBEAN OIL

12.2.7.1.2 SUNFLOWER OIL

12.2.7.1.3 GROUNDNUT OIL

12.2.7.1.4 COCONUT OIL

12.2.7.1.5 OLIVE OIL

12.2.7.1.6 OTHERS

12.2.7.2 EDIBLE OILS, BY CHROMATOGRAPHY TESTING TYPE

12.2.7.2.1 LIQUID CHROMATOGRAPHY

12.2.7.2.2 GAS CHROMATOGRAPHY

12.2.7.2.3 COLUMN CHROMATOGRAPHY

12.2.7.2.4 THIN LAYER CHROMATOGRAPHY

12.2.7.2.5 PAPER CHROMATOGRAPHY

12.2.8 OILSEEDS & PULSES

12.2.8.1 OILSEEDS & PULSES, BY TYPE

12.2.8.1.1 GRAM

12.2.8.1.2 PEA

12.2.8.1.3 SUNFLOWERS

12.2.8.1.4 LENTILS

12.2.8.1.5 SOYBEANS

12.2.8.1.6 GROUNDNUT

12.2.8.1.7 SESAME

12.2.8.1.8 PALM

12.2.8.1.9 COTTON SEED

12.2.8.1.10 OTHERS

12.2.8.2 OILSEEDS & PULSES, BY CHROMATOGRAPHY TESTING TYPE

12.2.8.2.1 LIQUID CHROMATOGRAPHY

12.2.8.2.2 GAS CHROMATOGRAPHY

12.2.8.2.3 COLUMN CHROMATOGRAPHY

12.2.8.2.4 THIN LAYER CHROMATOGRAPHY

12.2.8.2.5 PAPER CHROMATOGRAPHY

12.2.9 CONFECTIONERY

12.2.9.1 CONFECTIONERY, BY TYPE

12.2.9.1.1 CHOCOLATES

12.2.9.1.2 CANDY BARS

12.2.9.1.3 JELLIES

12.2.9.1.4 MERINGUES

12.2.9.1.5 MARMALADES

12.2.9.1.6 OTHERS

12.2.9.2 CONFECTIONERY, BY CHROMATOGRAPHY TESTING TYPE

12.2.9.2.1 LIQUID CHROMATOGRAPHY

12.2.9.2.2 GAS CHROMATOGRAPHY

12.2.9.2.3 COLUMN CHROMATOGRAPHY

12.2.9.2.4 THIN LAYER CHROMATOGRAPHY

12.2.9.2.5 PAPER CHROMATOGRAPHY

12.2.10 SPICES

12.2.11 NUTS

12.2.11.1 NUTS, BY TYPE

12.2.11.1.1 ALMOND

12.2.11.1.2 WALNUT

12.2.11.1.3 CASHEWNUT

12.2.11.1.4 BRAZIL NUT

12.2.11.1.5 MACADAMIA NUTS

12.2.11.1.6 OTHERS

12.2.11.2 NUTS, BY CHROMATOGRAPHY TESTING TYPE

12.2.11.2.1 LIQUID CHROMATOGRAPHY

12.2.11.2.2 GAS CHROMATOGRAPHY

12.2.11.2.3 COLUMN CHROMATOGRAPHY

12.2.11.2.4 THIN LAYER CHROMATOGRAPHY

12.2.11.2.5 PAPER CHROMATOGRAPHY

12.2.12 HERBAL EXTRACTS AND HERBS

12.2.13 HONEY

12.2.14 BABY FOOD

12.2.15 PLANT-BASED MEAT AND MEAT ALTERNATIVES

12.2.15.1 PLANT-BASED MEAT AND MEAT ALTERNATIVES, BY TYPE

12.2.15.1.1 TOFU

12.2.15.1.2 BURGER AND PATTIES

12.2.15.1.3 SAUSAGES

12.2.15.1.4 SEITEN

12.2.15.1.5 STRIPS AND NUGGETS

12.2.15.1.6 MEATBALLS

12.2.15.1.7 TEMPEH

12.2.15.1.8 OTHERS

12.2.15.2 PLANT-BASED MEAT AND MEAT ALTERNATIVES, BY CHROMATOGRAPHY TESTING TYPE

12.2.15.2.1 LIQUID CHROMATOGRAPHY

12.2.15.2.2 GAS CHROMATOGRAPHY

12.2.15.2.3 COLUMN CHROMATOGRAPHY

12.2.15.2.4 THIN LAYER CHROMATOGRAPHY

12.2.15.2.5 PAPER CHROMATOGRAPHY

12.2.16 OTHERS

12.3 BEVERAGES

12.3.1 BEVERAGES, BY TYPE

12.3.1.1 NON-ALCOHOLIC

12.3.1.1.1 CARBONATED DRINKS

12.3.1.1.2 JUICES

12.3.1.1.3 SPORT DRINKS

12.3.1.1.4 COFFEE

12.3.1.1.5 NUTRITIONAL DRINKS

12.3.1.1.6 PLANT-BASED MILK

12.3.1.1.6.1 SOY MILK

12.3.1.1.6.2 ALMOND MILK

12.3.1.1.6.3 OAT MILK

12.3.1.1.6.4 CASHEW MILK

12.3.1.1.6.5 RICE

12.3.1.1.6.6 OTHERS

12.3.1.1.7 SMOOTHIES

12.3.1.1.8 TEA

12.3.1.1.9 MINERAL WATER

12.3.1.1.10 OTHERS

12.3.1.2 ALCOHOLIC

12.3.1.2.1 BEER

12.3.1.2.2 WINE

12.3.1.2.3 VODKA

12.3.1.2.4 WHISKEY

12.3.1.2.5 BRANDY

12.3.1.2.6 GIN

12.3.1.2.7 TEQUILA

12.3.1.2.8 OTHERS

12.3.2 BEVERAGES, BY CHROMATOGRAPHY TESTING TYPE

12.3.2.1 LIQUID CHROMATOGRAPHY

12.3.2.2 GAS CHROMATOGRAPHY

12.3.2.3 COLUMN CHROMATOGRAPHY

12.3.2.4 THIN LAYER CHROMATOGRAPHY

12.3.2.5 PAPER CHROMATOGRAPHY

13 NORTH AMERICA CHROMATOGRAPHY FOOD TESTINGMARKET, BY GEOGRAPHY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA CHROMATOGRAPHY FOOD TETING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MERCK KGAA

16.1.1 COMPANY SNAPSHOT

16.1.2 RECENT FINANCIAL

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 EUROFINS SCIENTIFIC

16.2.1 COMPANY SNAPSHOT

16.2.2 RECENT FINANCIAL

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 INTERTEK GROUP PLC

16.3.1 COMPANY SNAPSHOT

16.3.2 RECENT FINANCIAL

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 INDUSTRIES AND SERVICE PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SGS SA

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 SERVICE PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 BUREAU VERITAS

16.5.1 COMPANY PROFILE

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SERVICES PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ADPEN LABORATORIES, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ALS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 SERVICE PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 ASUREQUALITY

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BVAQ

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 COTECNA

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICES PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 ELEMENT MATERIALS TECHNOLOGY (FORMERLY AVOMEEN)

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FOOD SAFETY NET SERVICES

16.12.1 COMPANY SNAPSHOT

16.12.2 SERVICE PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH

16.13.1 COMPANY SNAPSHOT

16.13.2 SOLUTION PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 MÉRIEUX NUTRISCIENCES CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 NEOGEN CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 NSF.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 PACIFIC LABS

16.17.1 COMPANY SNAPSHOT

16.17.2 SERVICES PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 QIMA

16.18.1 COMPANY SNAPSHOT

16.18.2 SOLUTION PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 R J HILL LABORATORIES LIMITED

16.19.1 COMPANY SNAPSHOT

16.19.2 SOLUTION PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 SHIMADZU CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

16.21 SPECTRO ANALYTICAL LABS PVT. LIMITED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SYMBIO LABORATORIES

16.22.1 COMPANY SNAPSHOT

16.22.2 SOLUTION PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 THERMO FISHER SCIENTIFIC INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 TÜV SÜD

16.24.1 COMPANY SNAPSHOT

16.24.2 SERVICE PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 WATERS CORPORATION

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 COMPARATIVE ANALYSIS

TABLE 2 FREQUENCY OF SIGNS AND SYMPTOMS AMONG CASES OF FOODBORNE ILLNESS.

TABLE 3 CHOLERA ATTACK RATE BY AGE GROUP, MANKHOWKWE CAMP, MALAWI, MARCH–MAY 1988, SHOWS THE HIGHEST DISEASE RATES AMONG PERSONS AGED 15 YEARS AND ABOVE.

TABLE 4 THE PRICE IS ASSOCIATED WITH THE SPACE PARTS OF HPLC AND GC INSTRUMENTS

TABLE 5 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA LIQUID CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA GAS CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA COLUMN CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA PAPER CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA THIN LAYER CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA FOOD SAFETY TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA ALLERGEN TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA PATHOGENS TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA HEAVY METALS TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA GMO TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA MYCOTOXINS TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA PESTICIDES TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA COMMUNICATIONS SATELLITES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA FOOD AUTHENTICITY TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA ORGANOLEPTIC AND APPEARANCE IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA RANCIDITY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA BROWNING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY METHOD, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY PACKAGED FOOD CONDITION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY SITE, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA INHOUSE/INTERNAL LAB IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA COMMERCIAL SERVICE LABORATORY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION PRODUCT PHASE, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA TESTING FOR PRODUCT IN RUNNING PRODUCTION PHASE IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA TESTING FOR FINAL PRODUCT IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA TESTING FOR PRODUCT IN RESEARCH & DEVELOPMENT PHASE IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA PROCESSED FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA PROCESSED FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA DAIRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA MILK DESSERT IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA CHEESE BASED DESERTS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA DAIRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA MEAT & POULTRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA MEAT & POULTRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA VEGETABLES IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA VEGETABLES IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA FRUITS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA FRUITS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA CEREALS & GRAINS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA CEREALS & GRAINS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA EDIBLE OILS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA EDIBLE OILS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA OILSEEDS & PULSES IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA OILSEEDS & PULSES IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 NORTH AMERICA CONFECTIONERY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 NORTH AMERICA CONFECTIONERY IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 NORTH AMERICA NUTS IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA NUTS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 NORTH AMERICA BEVERAGES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA BEVERAGES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 NORTH AMERICA NON-ALCOHOLIC IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA PLANT-BASED MILK IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 NORTH AMERICA ALCOHOLIC IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 NORTH AMERICA BEVERAGES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: SEGMENTATION

FIGURE 11 RISING NUMBER OF FOODBORNE ILLNESSES IS EXPECTED TO DRIVE NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 LIQUID CHROMATOGRAPHY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN OF CHROMATOGRAPHY FOOD TESTING MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET

FIGURE 15 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET : BY CHROMATOGRAPHY TESTING TYPE, 2021

FIGURE 16 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY TYPE OF TESTS, 2021

FIGURE 17 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET : BY SITE, 2021

FIGURE 18 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY APPLICATION PRODUCT PHASE, 2021

FIGURE 19 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY APPLICATION,2021

FIGURE 20 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY CHROMATOGRAPHY TESTING TYPE (2022-2029)

FIGURE 25 NORTH AMERICA CHROMATOGRAPHY FOOD TETING MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。