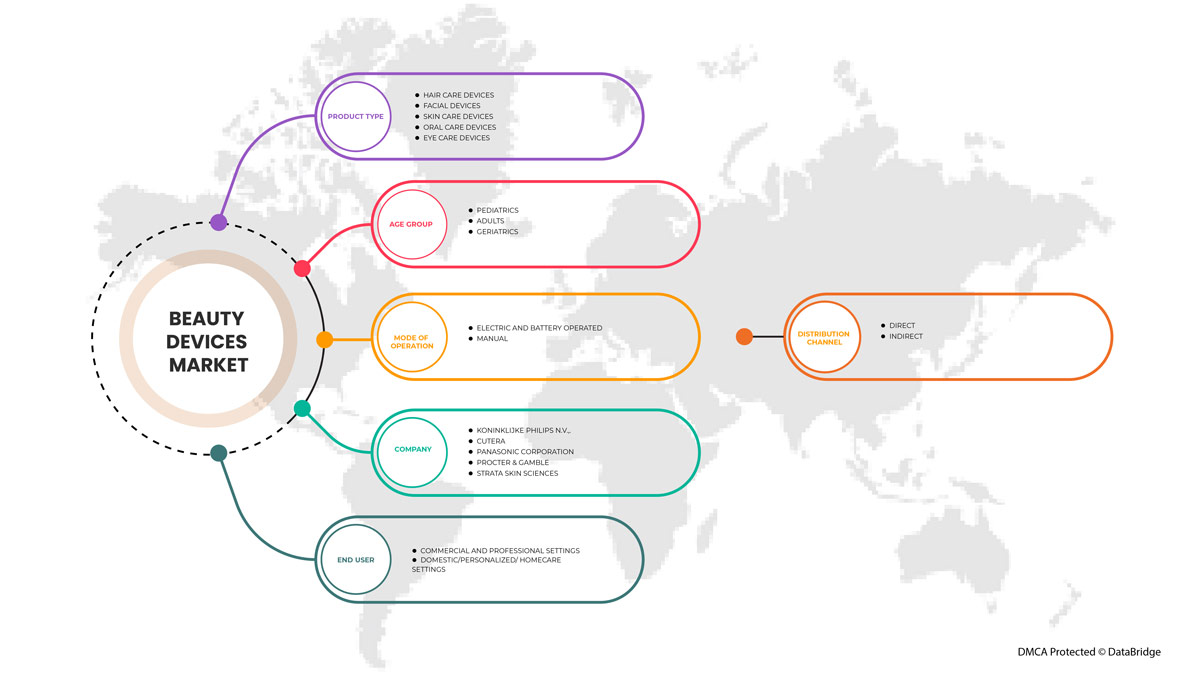

>北美美容设备市场按产品类型(护发设备、面部设备、皮肤护理设备、口腔护理设备和眼部护理设备)、年龄组(儿科、成人和老年人)、操作方式(电动和电池供电和手动)、最终用户(商业和专业设置和家庭/个性化/家庭护理设置)、分销渠道(直接和间接)、行业趋势和预测到 2029 年。

北美美容设备市场分析与洞察

男性和女性对皮肤的认识不断提高,这加速了美容设备的需求。皮肤相关问题,如皱纹、痤疮、色素沉着、皱纹以及事故造成的烧伤疤痕在人们中非常常见,需要适当的治疗来改善皮肤的外观。

预测年美容设备市场将增长,原因包括消费者对美丽外表的认识不断提高以及消费者生活方式的改善。与此同时,制造商正致力于研发活动,以在美容设备市场推出基于新技术的先进产品。

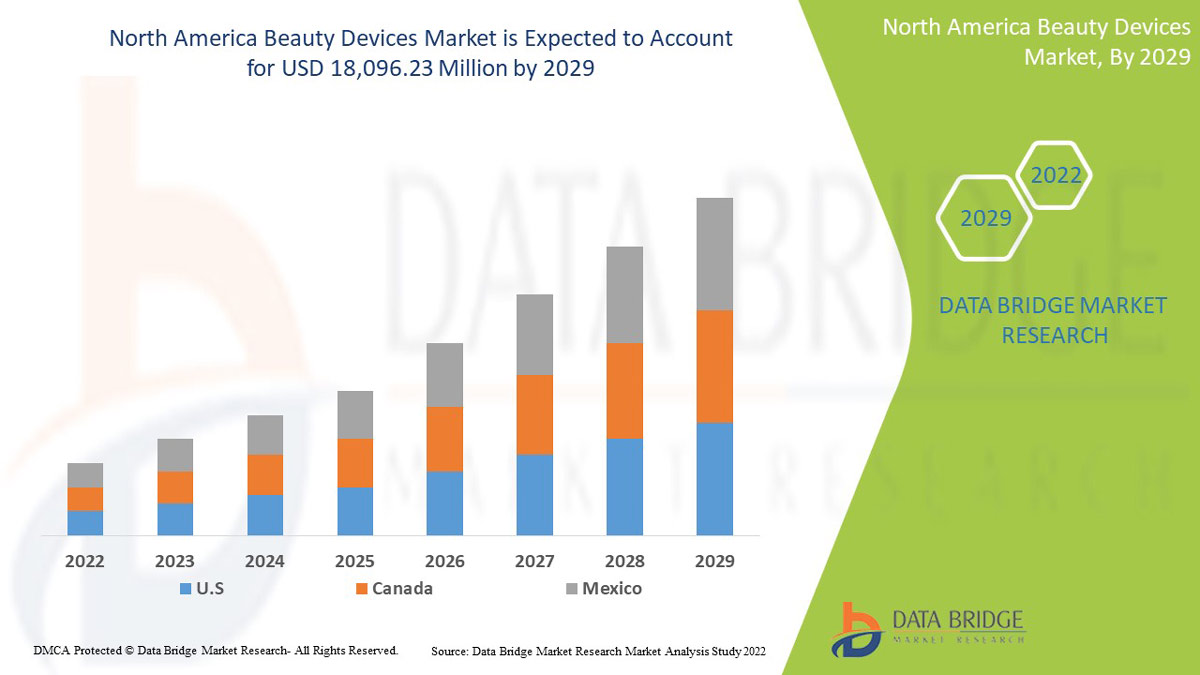

北美美容设备市场预计将在 2022 年至 2029 年的预测期内实现市场增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,该市场的复合年增长率为 13.5%,预计到 2029 年将达到 180.9623 亿美元。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

产品类型(护发设备、面部护理设备、皮肤护理设备、口腔护理设备和眼部护理设备)、年龄组(儿科、成人和老年人)、操作方式(电动和电池供电和手动)、最终用户(商业和专业设置和家庭/个性化/家庭护理设置)、分销渠道(直接和间接)。 |

|

覆盖国家 |

美国、加拿大、墨西哥 |

|

涵盖的市场参与者 |

Nu Skin、CANDELA CORPORATION、Curallux LLC、FOREO、Koninklijke Philips NV、Conair Corporation、Lumenis Be Ltd、Cynosure、Sciton, Inc.、Fotona、Procter & Gamble、LUTRONIC、STRATA Skin Sciences、NuFACE、Spectrum Brands, Inc.、Cutera、Merz North America, Inc.、Panasonic Corporation、Procter & Gamble 等。 |

北美美容设备市场定义

Beauty is the essential characteristic of women as well as men. Beauty devices are used in various types of beauty appearance related issues including hair, facial, skin, oral and eye. Beauty devices are extremely beneficial for the treatment of beauty related problems. Various types of beauty devices such as hair care devices, facial devices, skin care devices, oral care devices and eye care devices are commercialized in the market which is used to improve the beauty appearance.

Light / LED & photo rejuvenation therapy devices is a form of beauty system that uses narrow band and non-thermal LED light energy to activate the natural cell processes in the body to promote skin rejuvenation and repair. Anti-aging is one of the greatest challenges for beauty related issue, the cases of anti-aging is increasing very rapidly along with that the beauty devices target the multiple signs of anti-aging and reduce the appearance of wide range of aging signs including wrinkles or fine lines. The beauty industry is fragmented by the introduction of advanced technology based products in the market which is highly adopted among the end users.

North America Beauty Devices Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

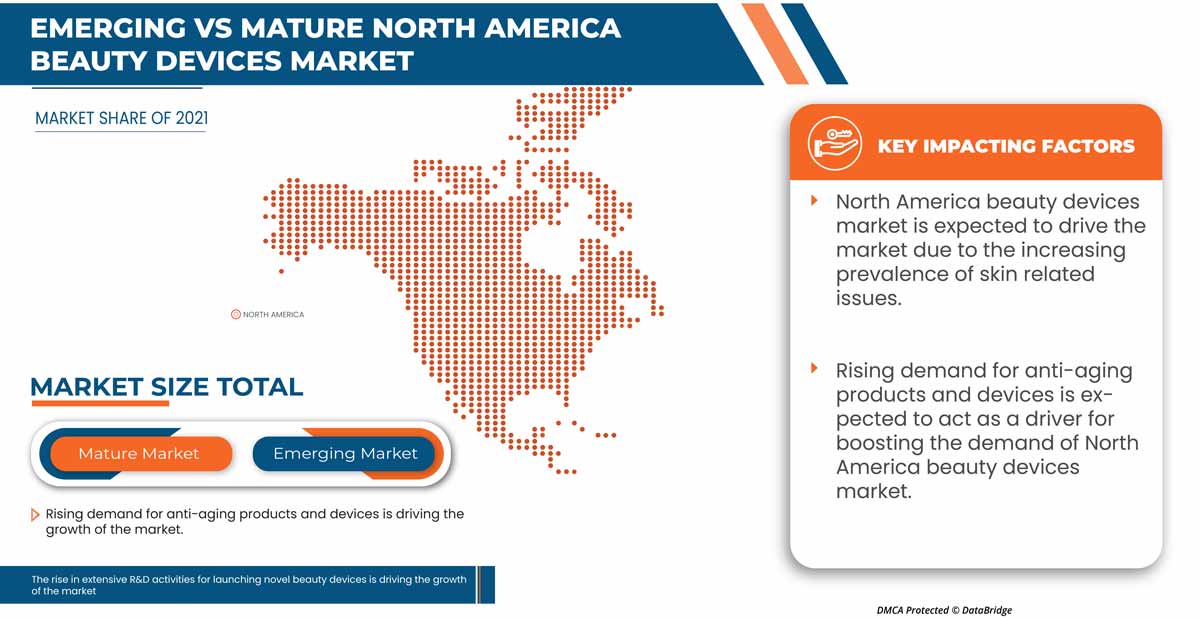

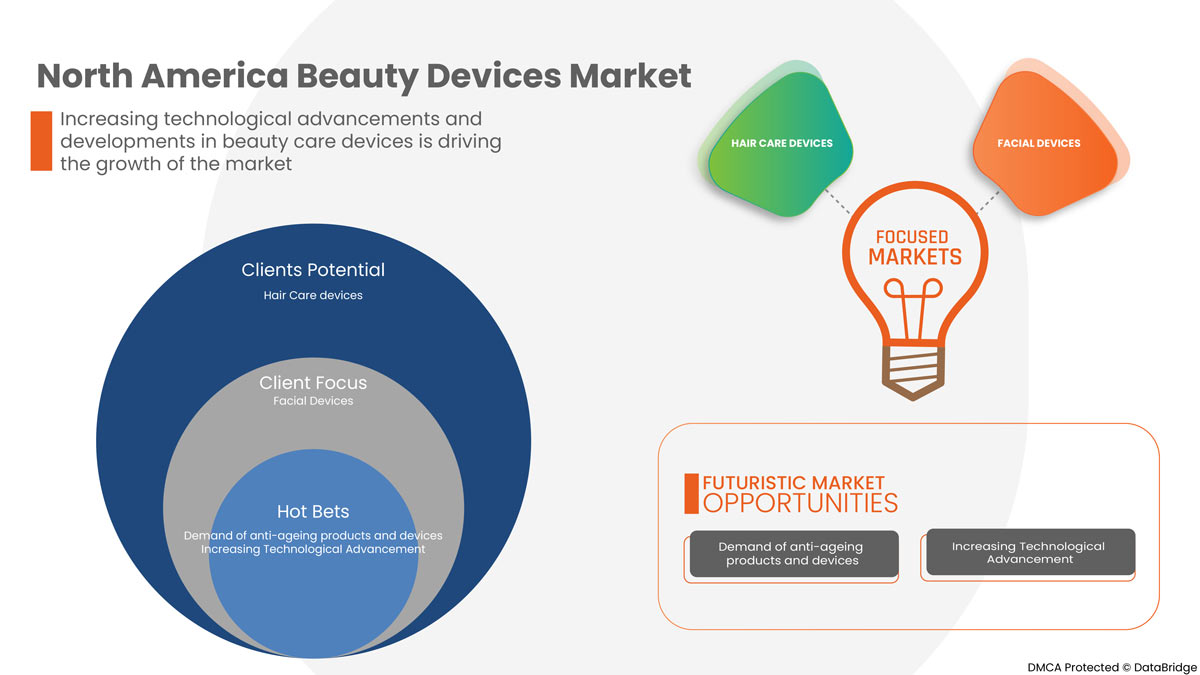

Rising demand for anti-aging products and devices

Anti-aging is a type of complex biological process which is influenced by the combination of exogenous or extrinsic factors and endogenous or intrinsic. The Anti-aging populations is one of the greatest challenges facing beauty related issue such skin firmness, loss of hairs, anti-aging wrinkle and oral care issue, among others. There are wide ranges of beauty devices are commercialized in the market which are used to minimize the effect of anti-aging on the beauty of aging population.

The elderly populations are increasing very rapidly along with that the beauty devices are targets the multiple signs of anti-aging and reduce the appearance of wide range of aging sings including wrinkles or fine lines, due to which rising demand for anti-aging products and devices is propelling the demand of the market.

Increasing prevalence of skin related IssueS

Skin related issues are generally among the most common issue seen in the primary care settings. According to the study of National Center for Biotechnology Information, under the age of 18 to 44 years the prevalence of skin related issue was 34% and prevalence increased to 49.4% among the people who are age 65 years and older. Acne is a type of universal skin disease which afflicting 79% to 95% of the adolescent population.

According to the American Medical Association, In the U.S. between 40 million and 50 million individuals are suffering from acne. According to the report, women and men in the U.S. who are over 25 have some degree of facial acne by 40 percent to 54 percent, and clinical facial acne in 12 percent of women and 3 percent of men continues in middle age.

The usages of beauty skin care devices provide additional benefit for skin appearance. Beauty devices are used to improve the health and appearance of the skin, due to which, the increasing prevalence of skin related issues is propelling the demand of the market.

Skin related problems such as creases, acne, pigmentation, wrinkles as well as accident-based burn scars are extremely common among humans. According to the Association of American Academy of Dermatology, acne is the most common skin disease in the USA. Annually, acne affects some 50 million people in the U.S. About 5.1 million people seek acne treatment each year. Approximately between the ages of 12 and 24 years 85% of people experience the onset of minor acne.

Facial wrinkling is one of the most notable signs of skin related issues. Men and women show the different wrinkling patterns of lifestyle and physiological factors. Wide range skin care beauty devices such as light/LED & photo rejuvenation therapy devices, cellulite reduction devices, acne removal devices, oxygen & steamer devices, dermal rollers, cleansing devices and smart devices are used to enhance the appearance of skin, for this reason increasing prevalence of skin related issues is acting as a driver for boosting the demand of North America beauty devices market.

OPPORTUNITIES

Increasing beauty expenditure

According to data from Aesthetic Society members, Americans spent over USD 6 billion on aesthetic surgical procedures and over USD 3 billion on non-surgical aesthetic procedures in 2020. Increase in the beauty expenditure due to several reasons such as improving lifestyle of people and increasing demand of beauty devices to enhance their appearance.

The increasing beauty expenditure will increase the process of adoption of advance beauty devices which will enhance the product profile in the market-leading, for this reason increasing beauty expenditure is acting as an opportunity for boosting the demand of North America beauty devices market.

RESTRAINTS/ CHALLENGES

High cost of beauty devices

The modern technology based beauty devices helps in tone and tightens the face muscles also the devices are used to reducing the appearance of fine lines and wrinkles. Consumers can use beauty device in their home itself.

The beauty devices have been exploding variety of options to treat multiple type of beauty related issue such skin care, hair care and oral care among others. But along with this beauty devices are very expensive to purchase, due to which high cost of beauty devices is hampering the demand of the North America beauty devices market.

Recent Developments

- 2021 年 1 月,全球领先的医疗美容设备公司 Candela Corporation 宣布推出 Frax Pro 系统,这是一款经 FDA 批准的非剥脱性点阵皮肤重塑设备,配备 Frax 1550 和新型 Frax 1940 涂抹器。这有助于该公司扩大其在北美市场的美容产品组合。

- 2021 年 6 月,Cutera 宣布推出 Secret 射频 (RF) 微针设备 Secret PRO。该设备将为从业者提供多层次的皮肤年轻化方法,使用 CO2 皮肤重塑应用“UltraLight”针对表皮。这有助于该公司扩大其产品组合。

北美美容设备市场范围

北美美容设备市场细分为产品类型、年龄组、操作模式、最终用户和分销渠道。细分市场之间的增长有助于您分析利基增长点和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

北美美容设备市场,按产品类型划分

- 护发设备

- 面部护理设备

- 护肤设备

- 口腔护理设备

- 眼部护理设备

根据产品类型,北美美容设备市场分为护发设备、面部设备、皮肤护理设备、口腔护理设备和眼部护理设备。

北美美容设备市场,按年龄段划分

- 儿科

- 成人

- 老年病学

根据年龄组,北美美容设备市场分为儿科、成人和老年科。

北美美容设备市场,按运营模式划分

- 电动和电池供电

- 手动的

根据操作模式,北美美容设备市场分为电动和电池供电以及手动。

北美美容设备市场,按最终用户划分

- 商业和专业设置

- 家庭/个性化/居家护理设置

北美美容设备市场分为商业和专业环境以及家庭/个性化/家庭护理环境。

北美美容设备市场,按分销渠道划分

- 直接的

- 间接

根据分销渠道,北美美容设备市场分为直接分销渠道和间接分销渠道。

竞争格局和北美美容设备市场份额分析

北美美容设备市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对北美美容设备市场的关注有关。

在北美美容设备市场开展业务的主要公司有 Nu Skin、CANDELA CORPORATION、Curallux LLC、FOREO、Koninklijke Philips NV、Conair Corporation、Lumenis Be Ltd、Cynosure、Sciton, Inc.、Fotona、Procter & Gamble、LUTRONIC、STRATA Skin Sciences、NuFACE、Spectrum Brands, Inc.、Cutera、Merz North America, Inc.、Panasonic Corporation、Procter & Gamble 等。

研究方法:北美美容设备市场

数据收集和基准年分析是使用具有大样本量的数据收集模块进行的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、北美与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BEAUTY DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 LIFELINE CURVE, BY PRODUCT TYPE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 NORTH AMERICA BEAUTY DEVICES MARKET: PRICING ANALYSIS

4.4 INDUSTRIAL INSIGHTS:

5 NORTH AMERICA BEAUTY DEVICE MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR ANTI-AGING PRODUCTS AND DEVICES

6.1.2 INCREASING PREVALENCE OF SKIN RELATED ISSUES

6.1.3 GROWING TECHNOLOGICAL ADVANCEMENTS AND DEVELOPMENTS

6.1.4 EXTENSIVE R&D ACTIVITIES FOR LAUNCHING NOVEL BEAUTY DEVICES

6.2 RESTRAINTS

6.2.1 HIGH COST OF BEAUTY DEVICES

6.2.2 SIDE EFFECTS AND ALLERGIES ASSOCIATED WITH THE USAGE OF BEAUTY DEVICES

6.3 OPPORTUNITIES

6.3.1 INCREASING APPEARANCE CONSCIOUSNESS AND AWARENESS

6.3.2 INCREASING BEAUTY EXPENDITURE

6.4 CHALLENGES

6.4.1 STRICT REGULATIONS AND STANDARDS FOR THE APPROVAL AND COMMERCIALIZATION OF BEAUTY DEVICES

6.4.2 PRODUCT RECALL

7 NORTH AMERICA BEAUTY DEVICES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 HAIR CARE DEVICES

7.2.1 HAIR REMOVAL DEVICES

7.2.1.1 LASER DEVICES

7.2.1.2 TRIMERS

7.2.1.3 SHAVERS

7.2.1.4 EPILATORS

7.2.1.5 OTHERS

7.2.2 HAIR GROWTH DEVICES

7.2.3 OTHERS

7.3 FACIAL DEVICES

7.3.1 CLEANING DEVICES

7.3.1.1 FACIAL CLEANING BRUSH

7.3.1.2 CLEANING MASSAGER

7.3.1.3 OTHERS

7.3.2 WHITENING DEVICES

7.3.3 MASSAGE DEVICES

7.3.4 OTHER FACIAL DEVICES

7.4 SKIN CARE DEVICES

7.4.1 CLEANSING DEVICES

7.4.2 ACNE TREATMENT DEVICES

7.4.3 ANTI AGING DEVICES

7.4.4 DERMAL ROLLERS

7.4.5 REJUVENATION DEVICES

7.4.6 LIGHT/LED & PHOTO REJUVENATION THERAPY DEVICES

7.4.7 CELLULITE REDUCTION DEVICES

7.4.8 SKIN TEXTURE TONE ENHANCEMENT

7.4.9 OXYGEN & STEAMER DEVICES

7.4.10 OTHERS

7.5 ORAL CARE DEVICES

7.5.1 TOOTHBRUSHES & ACCESSORIES

7.5.1.1 MANUAL TOOTHBRUSHES

7.5.1.2 ELECTRIC TOOTHBRUSHES

7.5.1.3 BATTERY POWERED TOOTHBRUSHES

7.5.1.4 REPLACEMENT TOOTHBRUSH HEAD

7.5.2 OTHERS

7.6 EYE CARE DEVICES

8 NORTH AMERICA BEAUTY DEVICES MARKET, BY AGE GROUP

8.1 OVERVIEW

8.2 ADULT

8.2.1 FEMALE

8.2.2 MALE

8.3 GERIATRICS

8.3.1 FEMALE

8.3.2 MALE

8.4 PEDIATRICS

8.4.1 FEMALE

8.4.2 MALE

9 NORTH AMERICA BEAUTY DEVICES MARKET, BY MODE OF OPERATION

9.1 OVERVIEW

9.2 ELECTRIC AND BATTERY OPERATED

9.2.1 POCKET-SIZED/HANDHELD DEVICE

9.2.2 FIXED

9.3 MANUAL

9.3.1 POCKET-SIZED/HANDHELD DEVICE

9.3.2 FIXED

10 NORTH AMERICA BEAUTY DEVICES MARKET, BY END USER

10.1 OVERVIEW

10.2 COMMERCIAL AND PROFESSIONAL SETTINGS

10.2.1 MEDICAL SPA

10.2.2 BEAUTY SPA

10.2.3 CLINICAL

10.3 DOMESTIC/PERSONALIZED/HOMECARE SETTINGS

11 NORTH AMERICA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

11.3.1 STORE BASED RETAILING

11.3.1.1 MODERN TRADE

11.3.1.2 DEPARTMENTAL STORES

11.3.1.3 SPECIALTY STORE

11.3.1.4 OTHERS

11.3.2 NON-STORE BASED RETAILING

11.3.2.1 MULTIBRAND ONLINE SHOP

11.3.2.2 COMPANY WEBSITE

12 NORTH AMERICA BEAUTY DEVICES MARKET, BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA BEAUTY DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 PROCTER & GAMBLE

15.1.1 COMPANY SNAPSHOT

15.1.2 RECENT FINANCIALS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 KONINKLIJKE PHILIPS N.V.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 PANASONIC CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 RECENT FINANCIALS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 CONAIR CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 FOREO

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 BAUSCH HEALTH COMPANIES INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 RECENT FINANCIALS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 CANDELA CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CURALLUX LLC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CUTERA

15.9.1 COMPANY SNAPSHOT

15.9.2 RECENT FINANCIALS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 CYNOSURE. INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 DD KARMA LLC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 FOTONA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 HITACHI POWER SEMICONDUCTOR DEVICE, LTD (2021)

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 LUTRONIC

15.14.1 COMPANY SNAPSHOT

15.14.2 RECENT FINANCIALS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 LIGHTSTIM

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 LUMENIS BE LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 MERZ NORTH AMERICA, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 NU SKIN

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 PHOTOMEDEX

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 PURE DAILY CARE

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 SCITON, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SPECTRUM BRANDS, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 STRATA SKIN SCIENCE

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENTS

15.24 SILKN

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 SINCLAIR

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 UNILEVER

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENTS

15.27 VENUS CONCEPT

15.27.1 COMPANY SNAPSHOT

15.27.2 RECENT FINANCIALS

15.27.3 PRODUCT PORTFOLIO

15.27.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 THE FOLLOWING ARE THE PRICES OF PRODUCTS OFFERED BY THE COMPANIES:

TABLE 2 DEVICES WITH BEAUTY PURPOSE LISTED IN FDA MEDICAL DEVICE CLASSIFICATION DATABASE

TABLE 3 SIDE EFFECTS ASSOCIATED WITH THE USAGE OF BEAUTY DEVICES

TABLE 4 NORTH AMERICA BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BEAUTY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 26 U.S. BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.S. HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 U.S. HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 U.S. FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.S. CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 U.S. SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 35 U.S. ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 36 U.S. GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 37 U.S. PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 38 U.S. BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 39 U.S. ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 40 U.S. MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 41 U.S. BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 U.S. COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 43 U.S. BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 U.S. INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 U.S. STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 U.S. NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 47 CANADA BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 CANADA HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 CANADA HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 CANADA FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CANADA CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 CANADA TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 56 CANADA ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 57 CANADA GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 58 CANADA PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 59 CANADA BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 60 CANADA ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 61 CANADA MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 62 CANADA BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 CANADA COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 CANADA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 CANADA INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 CANADA STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 CANADA NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 MEXICO BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 77 MEXICO ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 78 MEXICO GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 79 MEXICO PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 80 MEXICO BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 81 MEXICO ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 82 MEXICO MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 83 MEXICO BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 MEXICO COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 MEXICO BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 MEXICO INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 MEXICO STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 MEXICO NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA BEAUTY DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BEAUTY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BEAUTY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BEAUTY DEVICES MARKET: REGIONAL VS COUNRTY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BEAUTY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BEAUTY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BEAUTY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BEAUTY DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA BEAUTY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA BEAUTY DEVICES MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR ANTI-AGING PRODUCTS AND DEVICES AND GROWING TECHNOLOGICAL ADVANCEMENTS AND DEVELOPMENTS ARE EXPECTED TO DRIVE THE NORTH AMERICA BEAUTY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HAIR CARE DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BEAUTY DEVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA BEAUTY DEVICES MARKET

FIGURE 14 NUMBER OF AESTHETIC PROCEDURES PERFORMED, U.S., 2020

FIGURE 15 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, 2021

FIGURE 16 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, 2021

FIGURE 20 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 23 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, 2021

FIGURE 24 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, LIFELINE CURVE

FIGURE 27 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, 2021

FIGURE 28 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, LIFELINE CURVE

FIGURE 31 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 NORTH AMERICA BEAUTY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 36 NORTH AMERICA BEAUTY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 37 NORTH AMERICA BEAUTY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 NORTH AMERICA BEAUTY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 NORTH AMERICA BEAUTY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 NORTH AMERICA BEAUTY DEVICES MARKET: COMPANY SHARE 2021 (%)

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.