中东和非洲心脏安全服务市场,按服务(ECG/Holter 测量、血压测量、体外心脏安全评估服务、心血管成像、实时遥测监测、ECGS 中央过度读取、无创心脏成像、生理压力测试、全面 QT 研究、TQT 和暴露反应模型、血小板聚集和其他服务)、阶段(第 1 阶段、第 2 阶段和第 3 阶段)、类型(综合服务和独立服务)、最终用户(制药和生物制药公司、合同研究组织和学术及研究机构)划分,行业趋势及预测到 2029 年。

市场分析和见解

中东和非洲心脏安全服务市场受到临床试验数量增加、主要市场参与者数量增加和技术创新等因素的推动,这些因素增强了市场需求,而研发投资的增加也推动了市场增长。目前,正在进行各种研究,预计这将为制造商创造竞争优势,以开发新的创新心脏安全服务系统,这有望为心脏安全服务市场提供各种其他机会。然而,政府对审批的严格规定预计将阻碍增长。

中东和非洲心脏安全服务市场报告提供了市场份额、新发展和产品线分析的详细信息,国内和本地市场参与者的影响,分析了新兴收入来源、市场法规变化、产品批准、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情景,请联系我们获取分析师简报,我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。各地区发展中国家零售单位的可扩展性和业务扩展以及与供应商合作安全分销机器和药品是推动预测期内市场需求的主要驱动力。

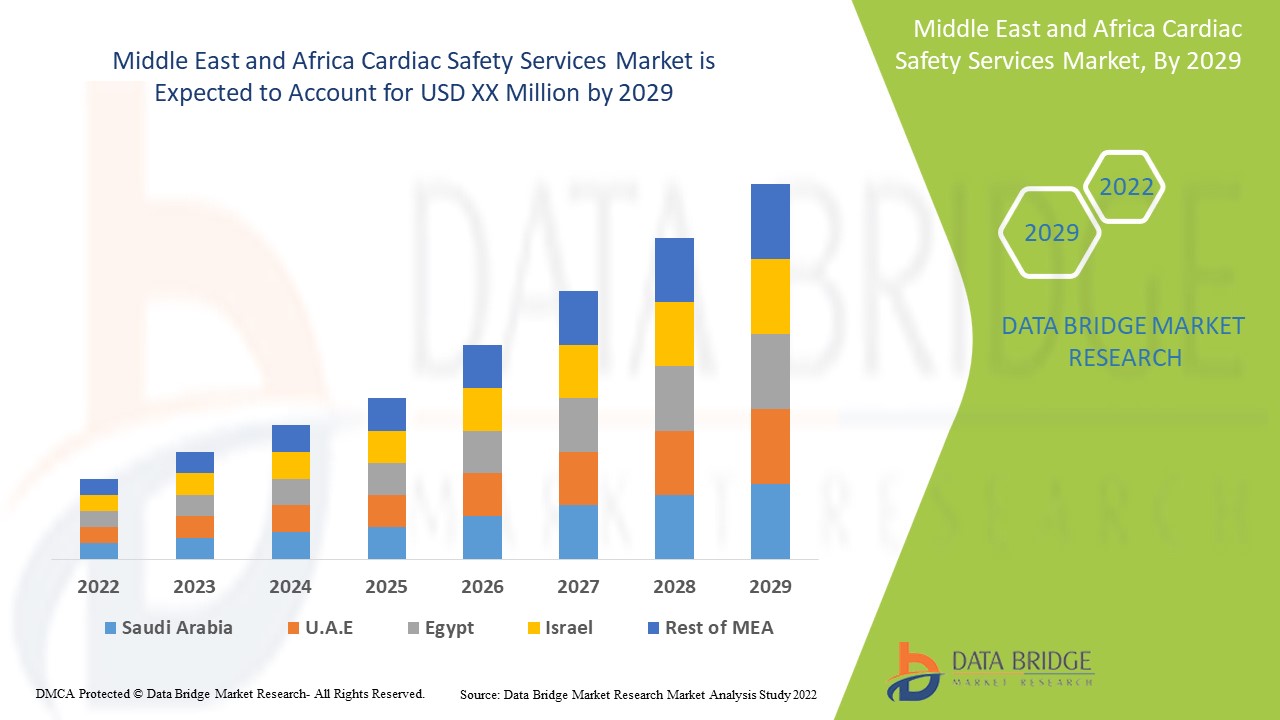

中东和非洲心脏安全服务市场具有支持性,旨在减缓疾病的进展。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,中东和非洲心脏安全服务市场将以 13.7% 的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按服务(ECG/Holter 测量、血压测量、体外心脏安全评估服务、心血管成像、实时遥测监测、ECGS 中央过度读取、无创心脏成像、生理压力测试、全面 QT 研究、TQT 和暴露反应建模、血小板聚集和其他服务)、阶段(第 1 阶段、第 2 阶段和第 3 阶段)、类型(综合服务和独立服务)、最终用户(制药和生物制药公司、合同研究组织和学术及研究机构) |

|

覆盖国家 |

南非、沙特阿拉伯、阿联酋、以色列、埃及和中东其他地区 |

|

涵盖的市场参与者 |

Koninklijke Philips NV、Laboratory Corporation of America Holdings、IQVIA、Medpace、Ncardia、Certara、Eurofins Scientific 和 SGS SA 等 |

市场定义:

心脏安全服务通常有助于支持和设计临床试验以及监测心脏安全所需的其他研究。发达国家和发展中国家对心脏安全服务市场的需求都在增加,其背后的原因是临床试验和产品推出的数量不断增加。由于创新产品的推出、技术产品的增加和可支配收入的增加,心脏安全服务市场正在增长。由于新兴市场的探索、市场参与者的战略举措、医疗保健支出的增加,市场将在预测期内增长。

中东和非洲心脏安全服务市场动态

驱动程序

- 临床试验数量的增加

临床试验是一个结构良好的系统,可以追溯到几百年前,至今仍然是药物获批所需的监管要求的支柱。最近,临床试验领域取得了很大进步,增加了临床试验的数量,预计将推动市场增长。

临床试验的监管发生了各种变化,增加了临床试验的数量及其积极成果。

例如,

- 根据《医学新闻》的文章,由于临床试验质量的提高,例如对所有工作人员进行强制性培训,试验数量显著增加。此外,2017 年,NIH 表示,在 NIH 资助的试验中,所有研究人员和工作人员都应接受良好临床实践 (GCP) 培训

医疗支出和资金增加

一个国家在医疗保健上所花费的资金量及其随时间的增长率受到多种经济和社会因素的影响,其中包括医疗卫生系统的融资安排和组织结构。

随着人们可支配收入的增长,发达国家和新兴经济体的医疗支出都在增加。医疗支出越多,一个国家的人口就越健康。

机会

- 新药开发增加

临床试验对于发现和开发用于治疗疾病的新药至关重要。这是研究人员发现哪些治疗方法对人类有效或无效的最佳方式。药物开发的特点是形成新的治疗方法,例如治疗癌症、内分泌、代谢等各种疾病的药物或设备。

- 因此,临床试验是确保治疗药物在上市和供人类使用之前的安全性和有效性的最有效方法,其中包括心脏安全性评估,这是任何医疗产品进入市场之前的必不可少的部分

克制/挑战

正确评估和报告临床心脏安全性数据至关重要。任何医疗产品的批准和产品召回都取决于心脏安全性评估。因此,有必要按照法律程序提供和进行心脏安全性评估,否则会导致产品审批延迟,从而抑制市场增长。

例如,

- 根据 IQVIA 的文章,1957 年至 2007 年间,共有 47 例药物上市后撤回,其中 45% 是因为担心心血管毒性。同样,过去二十年中,27% 的潜在新药分子在临床前阶段失败,原因是它们不符合所需的监管标准,导致心血管毒性

中东和非洲心脏安全服务市场细分

中东和非洲心脏安全服务市场分为类型、服务、阶段和最终用户。各细分市场的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

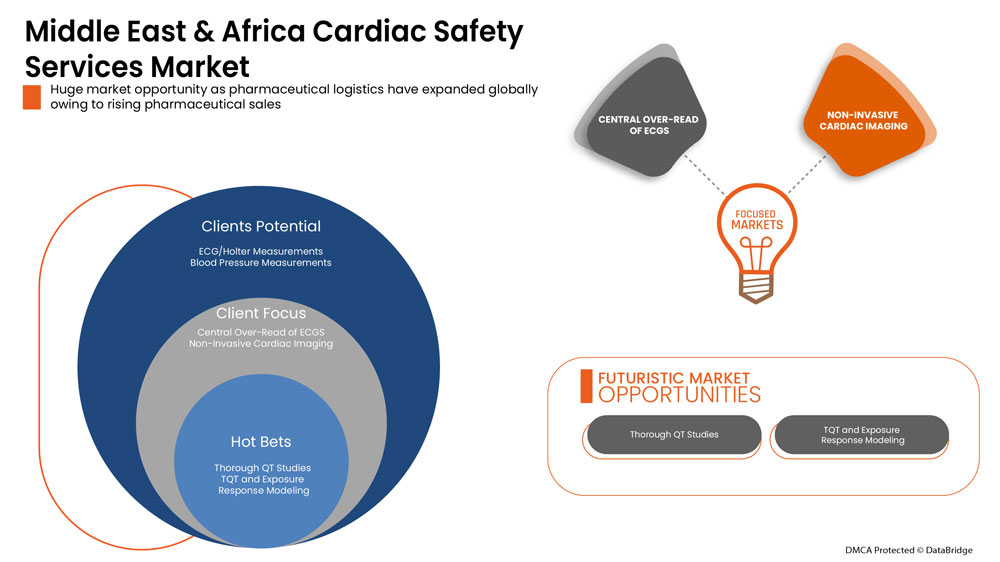

服务

- ECG/动态心电图测量

- 血压测量

- 体外心脏安全性评估服务

- 心血管成像

- 实时遥测监控

- 心电图中央超读

- 无创心脏成像

- 生理压力测试

- 彻底的 QT 研究

- TQT 和暴露反应模型

- 血小板聚集

- 其他服务

根据服务,心脏安全服务市场细分为 ECG/Holter 测量、血压测量、体外心脏安全评估服务、心血管成像、实时遥测监测、ECGS 中央过度读取、非侵入性心脏成像、生理压力测试、全面 QT 研究、TQT 和暴露反应建模、血小板聚集和其他服务

阶段

- 第 1 阶段

- 第 2 阶段

- 第 3 阶段

根据阶段,心脏安全服务市场分为第 1 阶段、第 2 阶段和第 3 阶段。

类型

- 综合服务

- 独立服务

根据类型,心脏安全服务市场分为综合服务和独立服务。

最终用户

- 制药和生物制药公司

- 合同研究组织

- 学术研究院

On the basis of end user, the cardiac safety services market is segmented pharmaceuticals & biopharmaceuticals companies, contract research organizations, and academic and research institute.

Cardiac Safety Services Regional Analysis/Insights

The cardiac safety services is analysed and market size insights and trends are provided by type, services, phase and end user as referenced above.

The countries covered in the cardiac safety services report are South Africa, Saudi Arabia, U.A.E, Israel, Egypt and Rest of Middle East.

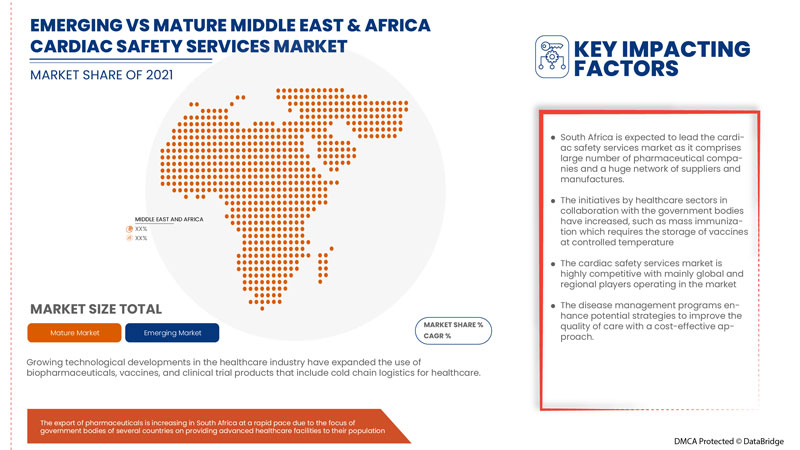

The South Africa is expected to dominate due to increase in healthcare expenditure and disposable income.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Cardiac Safety Services Analysis

Middle East and Africa cardiac safety services market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on cardiac safety services market.

Some of the major players in the market are Koninklijke Philips N.V., Laboratory Corporation of America Holdings, IQVIA, Medpace, Ncardia, Certara, Eurofins Scientific, and SGS SA among others.

Research Methodology

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、中东和非洲与地区和供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 PESTEL ANALYSIS

5 EPIDEMIOLOGY

5.1 INCIDENCE OF ALL BY GENDER

5.2 TREATMENT RATE

5.3 MORTALITY RATE

5.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6 INDUSTRY INSIGHT

6.1 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.2 PATENT ANALYSIS

6.3 PATENT FLOW DIAGRAM

6.4 KEY PATIENT ENROLLMENT STRATEGIES

6.5 PRICING STRATEGY

7 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: REGULATIONS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASE IN THE NUMBER OF CLINICAL TRIALS

8.1.2 INCREASE IN HEALTHCARE EXPENDITURE AND FUNDING

8.1.3 INCREASE IN STRATEGIC INITIATIVES BY MAJOR MARKET PLAYERS

8.1.4 INCREASE IN R&D ACTIVITIES

8.2 RESTRAINTS

8.2.1 HIGH COST OF CARDIAC SAFETY EVALUATION

8.2.2 STRICT REGULATORY

8.3 OPPORTUNITIES:

8.3.1 INCREASE IN NEW DRUG DEVELOPMENT

8.3.2 RISE IN THE EXPANSION OF THE CARDIAC SAFETY SERVICES

8.4 CHALLENGES

8.4.1 TIME-CONSUMING PROCEDURE

8.4.2 LACK OF SKILLED PERSON TO OPERATE DEVICES DURING CARDIAC SAFETY EVALUATION

9 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES

9.1 OVERVIEW

9.2 ECG/HOLTER MEASUREMENTS

9.3 BLOOD PRESSURE MEASUREMENTS

9.4 IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES

9.4.1 HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS

9.4.1.1 1 CONCENTRATIONS

9.4.1.2 4 CONCENTRATIONS

9.4.2 COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA)

9.4.2.1 3 CONCENTRATIONS

9.4.2.2 5 CONCENTRATIONS

9.4.3 IN VITRO HERG ASSAY

9.4.4 OTHERS

9.5 CARDIOVASCULAR IMAGING

9.6 REAL TIME TELEMETRY MONITORING

9.7 CENTRAL OVER-READ OF ECGS

9.8 NON-INVASIVE CARDIAC IMAGING

9.9 PHYSIOLOGIC STRESS TESTING

9.1 THOROUGH QT STUDIES

9.11 TQT AND EXPOSURE RESPONSE MODELLING

9.12 PLATELET AGGREGATION

9.13 OTHERS

10 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY PHASE

10.1 OVERVIEW

10.2 PHASE I

10.3 PHASE II

10.4 PHASE III

11 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY TYPE

11.1 OVERVIEW

11.2 INTEGRATED SERVICES

11.3 STANDALONE SERVICES

12 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY END USER

12.1 OVERVIEW

12.2 PHARMACEUTICALS & BIOPHARMACEUTICALS COMPANIES

12.3 CONTRACT RESEARCH ORGANIZATIONS

12.4 ACADEMIC AND RESEARCH INSTITUTE

13 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E.

13.1.4 ISRAEL

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 COMPANY PROFILE

15.1 EUROFINS SCIENTIFIC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.1.5.1 AGREEMENTS

15.1.5.2 ACQUISITION

15.2 PPD INC. (SUBSIDIARY OF THERMO FISHER SCIENTIFIC INC)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.2.5.1 INVESTMENT

15.3 KONINKLIJKE PHILIPS N.V.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.3.5.1 ACQUISITION

15.4 IQVIA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.4.5.1 ACQUISITION

15.5 LABORATORY CORPORATION OF AMERICA HOLDINGS

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 NEW LABORATORY

15.5.5.2 ACQUISITION

15.6 BANOOK

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.6.3.1 AGREEMENT

15.7 BIOTRIAL

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.7.3.1 NEW CENTER OPENING

15.8 CELERION

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.8.3.1 NEW CENTER OPENING

15.9 CERTARA

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 CONTRACT

15.9.4.2 ACQUISITION

15.1 CLARIO

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 PRODUCT EXPANSION

15.11 MEDPACE

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.11.4.1 ACQUISITION

15.12 NCARDIA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.12.3.1 PARTNERSHIP

15.13 NEXEL CO., LTD

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.13.3.1 JOINT VENTURE

15.13.3.2 PARTNERSHIP

15.14 PHYSIOSTIM

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 PARTNERSHIP

15.15 RICHMOND PHARMACOLOGY

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 EVENT

15.16 SGS SA

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.16.4.1 ACQUISITION

15.17 SHANGHAI MEDICILON INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.17.3.1 PARTNERSHIP

15.17.3.2 PARTNERSHIP

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 PROPORTION OF WOMEN IN CLINICAL STUDIES, ACCORDING TO DEVELOPMENT PHASE

TABLE 2 PROBABILITY OF SUCCESS BY CLINICAL TRIAL PHASE TO THERAPEUTIC AREA

TABLE 3 MORTALITY RATES FROM CLINICAL TRIALS AND EUROPEAN SAFETY AND EXPOSURE SURVEY (ESES), DEATHS PER 100 (PYE)

TABLE 4 ADHERENCE RATE TO COMMON CARDIOVASCULAR MEDICATION

TABLE 5 PROPORTION OF WOMEN IN CLINICAL STUDIES, ACCORDING TO DEVELOPMENT PHASE

TABLE 6 INITIATIVES TO INCREASE ENROLLMENT IN CLINICAL TRIALS AMONG UNDERREPRESENTED POPULATIONS

TABLE 7 ESTIMATED COST OF CARDIAC SAFETY EVALUATION DEVICES

TABLE 8 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ECG/HOLTER MEASUREMENTS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA BLOOD PRESSURE MEASUREMENTS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA CARDIOVASCULAR IMAGING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA REAL TIME TELEMETRY MONITORING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA CENTRAL OVER-READ OF ECGS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA NON-INVASIVE CARDIAC IMAGING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA PHYSIOLOGIC STRESS TESTING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA THOROUGH QT STUDIES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA TQT AND EXPOSURE RESPONSE MODELLING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA PLATELET AGGREGATION IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA OTHERS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA PHASE I IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PHASE II IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA PHASE III IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA INTEGRATED SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA STANDALONE SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA PHARMACEUTICALS & BIOPHARMACEUTICALS COMPANIES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA CONTRACT RESEARCH ORGANIZATIONS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA ACADEMIC AND RESEARCH INSTITUTE IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 U.A.E. CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 58 U.A.E. IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 59 U.A.E. HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 60 U.A.E. COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 61 U.A.E. CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 ISRAEL CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 65 ISRAEL IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 66 ISRAEL HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 67 ISRAEL COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 68 ISRAEL CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 69 ISRAEL CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 ISRAEL CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 EGYPT CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 72 EGYPT IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 73 EGYPT HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 74 EGYPT COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 75 EGYPT CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 76 EGYPT CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 EGYPT CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 REST OF MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: MIDDLE EAST & AFRICA VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: MARKET END USER GRID

FIGURE 9 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN DEMAND FOR CARDIAC SAFETY SERVICES ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ECG/HOLTER MEASUREMENTS SUBSTITUTE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET IN 2022 & 2029

FIGURE 13 PATIENT FLOW DIAGRAM FOR ANY RANDOM DRUG

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET

FIGURE 15 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, 2021

FIGURE 16 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, 2021

FIGURE 20 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, 2021

FIGURE 24 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY END USER, 2021

FIGURE 28 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: SNAPSHOT (2021)

FIGURE 32 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: BY COUNTRY (2021)

FIGURE 33 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES (2022-2029)

FIGURE 36 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。