India Phthalates And Non Phthalates Market

市场规模(十亿美元)

CAGR :

%

| 2024 –2030 | |

| USD 132,586.98 | |

|

|

|

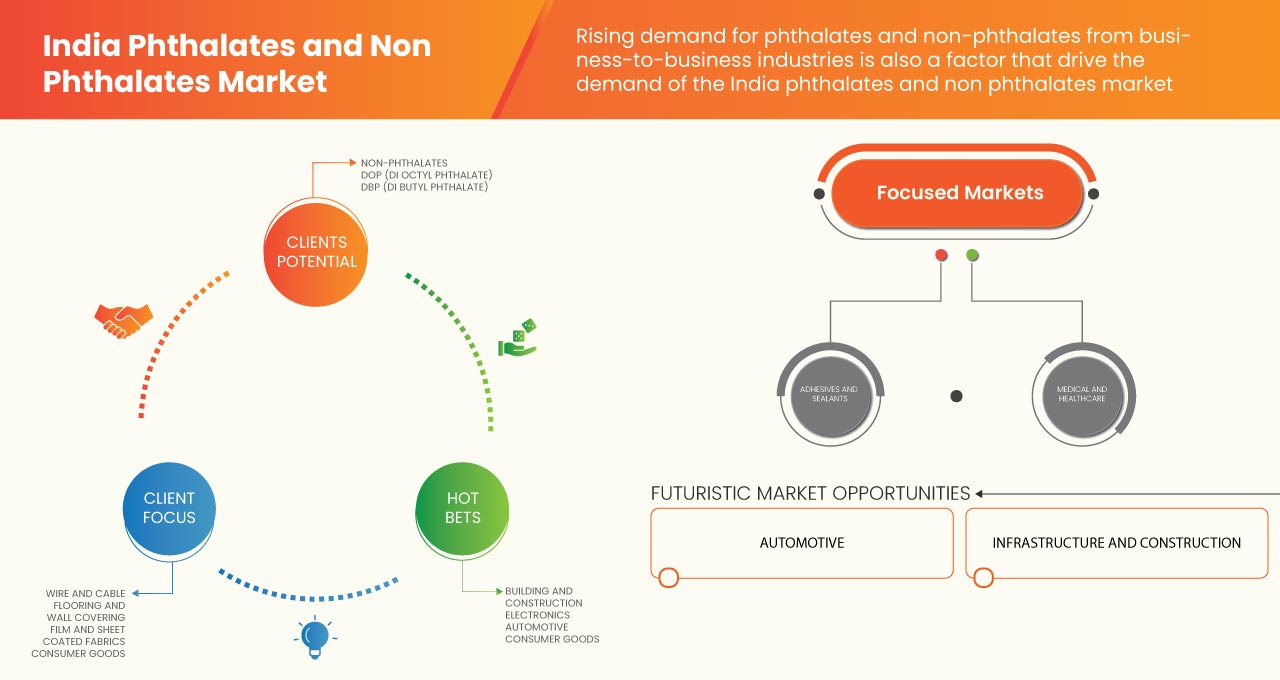

>印度邻苯二甲酸酯和非邻苯二甲酸酯市场,按产品(非邻苯二甲酸酯、DOP(邻苯二甲酸二辛酯)、DBP(邻苯二甲酸二丁酯)、DMP(邻苯二甲酸二甲酯)、DEP(邻苯二甲酸二乙酯)、DOA(己二酸二辛酯)、Tec(柠檬酸三乙酯)和其他邻苯二甲酸酯)、应用(电线电缆、地板和墙面覆盖物、薄膜和片材、涂层织物、消费品、包装、粘合剂和密封剂等)、最终用途(建筑和施工、电子、汽车、消费品、医疗保健、食品和饮料、体育和休闲等)、行业趋势和预测到 2030 年。

印度邻苯二甲酸酯和非邻苯二甲酸酯市场分析和见解

预计印度邻苯二甲酸酯和非邻苯二甲酸酯市场将在 2023 年至 2030 年间实现显着增长。Data Bridge Market Research 分析称,2023 年至 2030 年间,该市场的复合年增长率为 7.2%,预计到 2030 年将达到 1,325.8698 亿印度卢比。推动印度邻苯二甲酸酯和非邻苯二甲酸酯市场增长的主要因素是企业对邻苯二甲酸酯和非邻苯二甲酸酯的需求不断增加。

非邻苯二甲酸酯本质上是不含邻苯二甲酸酯的增塑剂。非邻苯二甲酸酯增塑剂用于软化 PVC 产品并提高产品强度。非邻苯二甲酸酯增塑剂由石油或生物基产品制成。邻苯二甲酸酯增塑剂是塑料工业不可或缺的一部分;90% 至 95% 的邻苯二甲酸酯用作生产柔性 PVC 的增塑剂。

印度邻苯二甲酸酯和非邻苯二甲酸酯市场报告提供了市场份额、新发展和国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品批准、战略决策、产品发布、地域扩张和市场技术创新方面的机会。请联系我们获取分析师简报,以了解分析和市场情况。我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021(可定制为 2020 - 2015) |

|

定量单位 |

收入(百万印度卢比) |

|

涵盖的领域 |

产品(非邻苯二甲酸酯、DOP(邻苯二甲酸二辛酯)、DBP(邻苯二甲酸二丁酯)、DMP(邻苯二甲酸二甲酯)、DEP(邻苯二甲酸二乙酯)、DOA(己二酸二辛酯)、Tec(柠檬酸三乙酯)和其他邻苯二甲酸酯)、应用(电线电缆、地板和墙面覆盖物、薄膜和片材、涂层织物、消费品、包装、粘合剂和密封剂等)、最终用途(建筑和施工、电子、汽车、消费品、医疗保健、食品和饮料、体育和休闲等) |

|

覆盖国家 |

印度 |

|

涵盖的市场参与者 |

KLJ Group、BASF SE、三菱化学株式会社、Aarti Industries Ltd.、DIC Corporation、LG Chem、Evonik Industries AG、Kao Corporation、Eastman Chemical Company 或其子公司、NAN YA PLASTICS CORPORATION、Avient Corporation、LANXESS、埃克森美孚株式会社、DOW、Nayakem、Nishant Organics Pvt. Ltd.、Supreme Plasticizers.、Payal Group、ABC Chemicals、河南 GO Biotech Co.,Ltd、Perstorp、Velsicol Chemical LLC、Indo-Nippon Chemical Co. Ltd.、MarvelVinyls 等。 |

市场定义

非邻苯二甲酸酯增塑剂是不含邻苯二甲酸酯的增塑剂。非邻苯二甲酸酯增塑剂用于软化 PVC 产品并增加其强度。非邻苯二甲酸酯增塑剂由石油或生物基产品制成,对人体的影响较小。一些非邻苯二甲酸酯包括 DOTP(二乙基己基对苯二甲酸酯,又名 DEHT)、Hexamoll DINCH(二异壬基环己烷二羧酸酯)以及基于大豆油、植物油的生物基增塑剂。邻苯二甲酸酯增塑剂是塑料行业不可或缺的一部分,尤其是 PVC 塑料,因为大多数塑料产品在制造时都需要柔韧的低粘度材料。由于汽车、建筑和消费品对塑料的需求增加,预计塑料行业将在未来几年稳步增长。

印度邻苯二甲酸酯和非邻苯二甲酸酯市场动态

本节旨在了解市场驱动因素、机遇、挑战和限制。下文将详细讨论所有这些内容:

驱动程序

- 医疗保健行业的增长

医疗保健行业是印度就业和收入方面蓬勃发展的行业之一。过去二十年来,该行业的蓬勃发展主要得益于可支配收入的增加、人口老龄化、生活方式疾病的增加、远程医疗等数字技术的使用以及外国直接投资的增加。最近的 COVID-19 疫情为该行业的发展铺平了道路,印度初创企业组织、低成本医疗设备和仿制药的生产不断增加。医疗保险用户数量的增加和农村地区公共卫生部门数量的增加促进了医疗保健和以医疗为基础的行业的发展。

- 企业对企业行业对邻苯二甲酸酯和非邻苯二甲酸酯的需求不断增长

近年来,B2B 行业,尤其是与塑料相关的市场,出现了增长。塑料行业是印度增长最快的行业之一。塑料已成为现代生活各个方面的重要组成部分。塑料的应用范围从汽车行业(如汽车内饰)到电子行业(如电线、电缆、塑料外壳和许多其他应用)。汽车行业需要各种柔性或可塑性部件。因此,要制造 PVC、邻苯二甲酸酯和非邻苯二甲酸酯等塑料的此类部件,需要使用增塑剂。

- 邻苯二甲酸酯和非邻苯二甲酸酯在企业对消费者行业中的使用

B2C 行业正在迅速改变印度的商业运作方式。B2C 行业包括从事化妆品、个人护理产品、食品和饮料、家庭护理产品等生产的各种行业。这些产品大多通过超市、杂货店和电子商务网站从消费者那里购买。可支配收入的增加、制造产品的新技术、外国直接投资的增加、有利的政府框架、独特的营销策略、快速的城市化以及电子商务平台的繁荣都是导致 B2C 行业增长的因素。

邻苯二甲酸酯常见于食品包装和塑料制品中,例如储物容器和午餐盒。它们还被用作水瓶和婴儿奶瓶制造中的增塑剂。

机会

- 基础设施和建筑活动增加

印度经济的主要推动力是基础设施行业。该行业受到政府的高度重视,出台政策确保该国在规定期限内建成世界一流的基础设施。该行业在推动印度整体增长方面发挥着重要作用。电力、桥梁、水坝、高速公路和城市基础设施建设都属于基础设施行业。换句话说,基础设施行业推动了相关行业的发展,包括城镇、住房、建成基础设施和建筑开发项目,成为印度经济增长的催化剂。

邻苯二甲酸酯是一种化学物质,用于使乙烯基(或 PVC)变得柔韧、易塑且耐用。使用邻苯二甲酸酯可以使地板更有弹性、维护成本更低且更耐污。

- 印度塑料行业的增长

塑料行业是印度增长最快的行业之一。塑料和塑料包装现已渗透到现代生活的方方面面。塑料的应用范围广泛,从医疗保健领域(如诊断设备、塑料注射器和培养皿)到食品领域(如包装食品相关物品)。印度生产许多商品,包括塑料、家居用品、绳索、渔网、地板覆盖物、医疗用品、包装、管道、塑料薄膜和原材料。这些塑料用于电子、建筑、包装、医疗保健和运输等各个行业。

限制

- 严重的环境和健康影响

邻苯二甲酸酯是塑料和化妆品中最常用的材料,还有许多其他应用。它们是众所周知的增塑剂,可用于制造各种产品,例如塑料包装膜、玩具、地板、个人护理产品以及汽车和电气元件。由于应用范围如此广泛,邻苯二甲酸酯会在环境中释放,人们可能会无意中摄入、吸入或吸收它。邻苯二甲酸酯暴露造成的环境影响和有害健康问题可能会抑制印度邻苯二甲酸酯和非邻苯二甲酸酯市场的增长。

食品、饮用水和饮料是消费者摄入邻苯二甲酸酯的主要途径。邻苯二甲酸酯不会以化学方式附着在塑料物品上。它们会逐渐从塑料物品中渗出并蒸发到空气、水、食物、家用灰尘、土壤和生物中,尤其是在炎热的天气里。

- 可持续替代品的可信威胁

许多化合物已被公认为邻苯二甲酸酯增塑剂的替代品。这些替代品包括柠檬酸盐、癸二酸盐、己二酸盐和磷酸盐。它们用于替代玩具、婴儿用品和医疗设备等产品中的邻苯二甲酸酯。这些化合物除了用作 PVC 增塑剂的替代品外,还用作化妆品、油墨、粘合剂和其他消费品中的溶剂和固定剂。

环氧大豆油 (ESBO) 用作增塑剂、增容剂和邻苯二甲酸酯。ESBO 还可用作玻璃罐密封件中的增塑剂和减少聚氯乙烯紫外线降解的稳定剂。同样,偏苯三酸酯也用作邻苯二甲酸二乙酯的替代品,后者用于墙面覆盖物、包装和地板。在化妆品中,乙酰柠檬酸三丁酯用作化妆品和 PVC 应用中的增塑剂。DINCH 等化学品可代替邻苯二甲酸酯用于玩具、医疗设备和食品包装等商业产品中。

挑战

- 严格的规章制度

尽管邻苯二甲酸酯和非邻苯二甲酸酯在我们的日常生活中有多种用途,但与之相反的是,还有许多其他健康问题,如肥胖、糖尿病、哮喘和胰岛素抵抗,这些都与邻苯二甲酸酯的使用和合成有关。印度对邻苯二甲酸酯的使用和接触实施了严格的规定,以规范此类化学品的使用并保护公众健康。

最新动态

- 2022年12月28日,据《财富印度》报道,到2026年,预计印度将出口价值300亿卢比的汽车零部件,该行业总价值预计将达到2000亿卢比,占印度GDP的5-7%。

- 2022年12月24日,据《印度商业线》报道,印度的医疗旅游产业价值估计为90亿卢比,这使得印度成为印度第十大医疗旅游中心,预计到2026年将达到130亿卢比。

印度邻苯二甲酸酯和非邻苯二甲酸酯市场范围

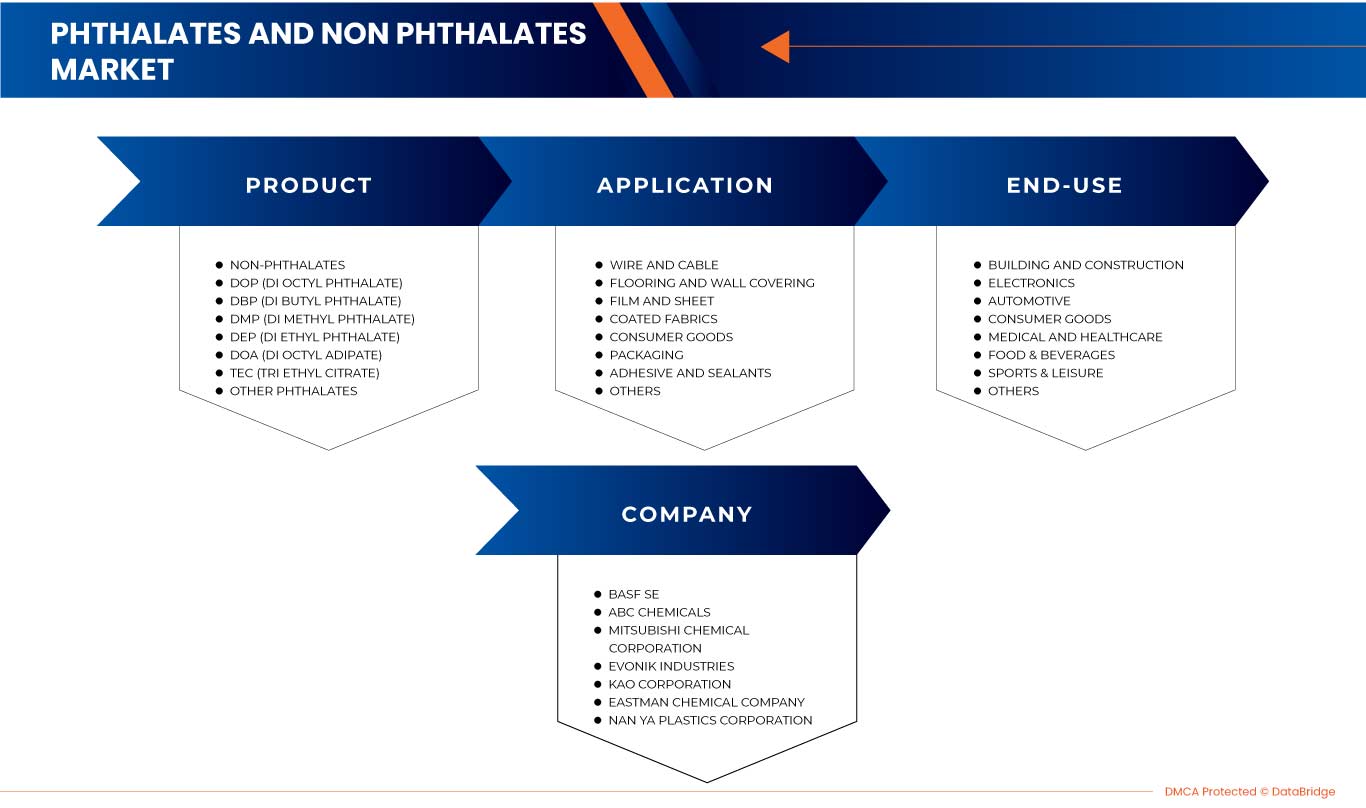

印度邻苯二甲酸酯和非邻苯二甲酸酯市场根据产品、应用和最终用途进行分类。这些细分市场之间的增长将帮助您分析主要的行业增长细分市场,并为用户提供有价值的市场概览和见解,以便做出战略决策以确定核心市场应用。

产品

- 不含邻苯二甲酸酯

- DOP(邻苯二甲酸二辛酯)

- DBP(邻苯二甲酸二丁酯)

- DMP(邻苯二甲酸二甲酯)

- DEP(邻苯二甲酸二乙酯)

- DOA(己二酸二辛酯)

- TEC(柠檬酸三乙酯)

- 其他邻苯二甲酸酯

根据产品,印度邻苯二甲酸酯和非邻苯二甲酸酯市场分为非邻苯二甲酸酯、DOP(邻苯二甲酸二辛酯)、DBP(邻苯二甲酸二丁酯)、DMP(邻苯二甲酸二甲酯)、DEP(邻苯二甲酸二乙酯)、DOA(己二酸二辛酯)、TEC(柠檬酸三乙酯)和其他邻苯二甲酸酯。

应用

- 电线电缆

- 地板和墙面覆盖层

- 薄膜和片材

- 涂层织物

- 消费品

- 包装

- 粘合剂和密封剂

- 其他的

根据应用,印度邻苯二甲酸酯和非邻苯二甲酸酯市场分为电线电缆、地板和墙壁覆盖物、薄膜和片材、涂层织物、消费品、包装、粘合剂和密封剂等。

最终用途

- 建筑和施工

- 电子产品

- 汽车

- 消费品

- 医疗保健

- 食品和饮料

- 运动休闲

- 其他的

根据最终用途,印度邻苯二甲酸盐和非邻苯二甲酸盐市场分为建筑和施工、电子、汽车、消费品、医疗保健、食品和饮料、体育和休闲等。

竞争格局和印度邻苯二甲酸酯和非邻苯二甲酸酯市场份额分析

印度邻苯二甲酸酯和非邻苯二甲酸酯市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品批准、专利、产品宽度和广度、应用优势、产品生命线曲线。以上数据点仅与公司对印度邻苯二甲酸酯和非邻苯二甲酸酯市场的关注有关。

印度邻苯二甲酸酯和非邻苯二甲酸酯市场的一些知名参与者包括 KLJ 集团、巴斯夫 SE、三菱化学株式会社、Aarti Industries Ltd.、DIC Corporation、LG Chem、Evonik Industries AG、花王株式会社、伊士曼化学公司或其子公司、南亚塑料株式会社、Avient Corporation、朗盛、埃克森美孚株式会社、陶氏、Nayakem、Nishant Organics Pvt. Ltd.、Supreme Plasticizers.、Payal Group、ABC Chemicals、河南 GO Biotech Co.,Ltd、Perstorp、Velsicol Chemical LLC、Indo-Nippon Chemical Co. Ltd. 和 MarvelVinyls 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA PHTHALATES AND NON PHTHALATES MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS- GEOPOLITICAL SCENARIO AND INDIAN MARKET SCENARIO

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 SUPPLY CHAIN ANALYSIS

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT'S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 RAW MATERIAL PRODUCTION COVERAGE

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VALUE CHAIN OF INDIA PHTHALATES AND NON- PHTHALATES MARKET

4.9 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN THE MEDICAL AND HEALTHCARE SECTOR

6.1.2 RISING DEMAND FOR PHTHALATES AND NON-PHTHALATES FROM BUSINESS-TO-BUSINESS INDUSTRIES

6.1.3 USE OF PHTHALATES AND NON-PHTHALATES IN BUSINESS-TO-CONSUMER INDUSTRIES

6.2 RESTRAINTS

6.2.1 SERIOUS ENVIRONMENTAL AND HEALTH EFFECTS

6.2.2 CREDIBLE THREAT OF SUSTAINABLE SUBSTITUTES

6.3 OPPORTUNITIES

6.3.1 INCREASE IN INFRASTRUCTURE AND CONSTRUCTION ACTIVITIES

6.3.2 GROWTH IN THE INDIAN PLASTIC INDUSTRY

6.4 CHALLENGE

6.4.1 STRINGENT RULES AND REGULATIONS

7 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 NON-PHTHALATES

7.2.1 MONOMERIC PLASTICIZERS

7.2.1.1 ADIPATES

7.2.1.2 TEREPHTHALATES

7.2.1.3 EPOXIES

7.2.1.4 ALIPHATICS

7.2.1.5 MALEATES

7.2.1.6 BENZOATES

7.2.1.7 TRIMELLITATES

7.2.1.8 MONOALCOHOLS

7.2.1.9 OTHERS

7.2.2 POLYMERIC PLASTICIZERS

7.2.2.1 HAXENEDIOIC ACID

7.2.2.2 PHOSPHATE ESTERS

7.2.2.3 ALKYL SULFONIC ACID ESTERS

7.2.2.4 POLYOL-CARBOXYLIC ACID ESTERS

7.2.2.5 SEBACIC

7.2.2.6 CITRIC ACID ESTERS

7.2.2.7 PENTAERYTHRITOL ESTER OF VALERIC ACID

7.2.2.8 OTHERS

7.3 DOP (DI, OCTYL PHTHALATE)

7.4 DBP (DI BUTYL PHTHALATE)

7.5 DMP (DI METHYL PHTHALATE)

7.6 DEP (DI ETHYL PHTHALATE)

7.7 DOA (DI OCTYL ADIPATE)

7.8 TEC (TRI ETHYL CITRATE)

7.9 OTHER PHTHALATES

7.9.1 DI-ISONONYL PHTHALATE (DINP)

7.9.2 DI-ISODECYL PHTHALATE (DIDP)

7.9.3 DI-ISOBUTYL PHTHALATE (DIBP)

7.9.4 DI-PROPYLHEPTYL PHTHALATE (DPHP)

7.9.5 DI-ETHYLHEXYL PHTHALATE (DEHP)

7.9.6 OTHERS

8 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 WIRE AND CABLE

8.3 FLOORING AND WALL COVERING

8.4 FILM AND SHEET

8.5 COATED FABRICS

8.6 CONSUMER GOODS

8.7 PACKAGING

8.8 ADHESIVE AND SEALANTS

8.9 OTHERS

9 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY END-USE

9.1 OVERVIEW

9.2 BUILDING AND CONSTRUCTION

9.2.1 BY SEGMENT

9.2.1.1 RESIDENTIAL

9.2.1.2 COMMERCIAL

9.2.1.3 INFRASTRUCTURE

9.2.1.4 INDUSTRIAL

9.2.2 BY PRODUCT

9.2.2.1 PHTHALATES PLASTICIZERS

9.2.2.2 NON-PHTHALATES PLASTICIZERS

9.3 ELECTRONICS

9.3.1 BY SEGMENT

9.3.1.1 CONSUMER ELECTRONICS

9.3.1.2 INDUSTRIAL ELECTRONICS

9.3.2 BY PRODUCT

9.3.2.1 PHTHALATES PLASTICIZERS

9.3.2.2 NON-PHTHALATES PLASTICIZERS

9.4 AUTOMOTIVE

9.4.1 BY SEGMENT

9.4.1.1 PASSENGER VEHICLE

9.4.1.2 COMMERCIAL VEHICLE

9.4.1.3 HEAVY DUTY VEHICLE

9.4.1.4 OTHERS

9.4.2 BY PRODUCT

9.4.2.1 PHTHALATES PLASTICIZERS

9.4.2.2 NON-PHTHALATES PLASTICIZERS

9.5 CONSUMER GOODS

9.5.1 BY SEGMENT

9.5.1.1 TOYS

9.5.1.2 STATIONERY

9.5.1.3 CHILD CARE ARTICLES

9.5.1.4 OTHERS

9.5.2 BY PRODUCT

9.5.2.1 PHTHALATES PLASTICIZERS

9.5.2.2 NON-PHTHALATES PLASTICIZERS

9.6 MEDICAL AND HEALTHCARE

9.6.1 BY PRODUCT

9.6.1.1 PHTHALATES PLASTICIZERS

9.6.1.2 NON-PHTHALATES PLASTICIZERS

9.7 FOOD & BEVERAGES

9.7.1 BY PRODUCT

9.7.1.1 PHTHALATES PLASTICIZERS

9.7.1.2 NON-PHTHALATES PLASTICIZERS

9.8 SPORTS & LEISURE

9.8.1 BY PRODUCT

9.8.1.1 PHTHALATES PLASTICIZERS

9.8.1.2 NON-PHTHALATES PLASTICIZERS

9.9 OTHERS

9.9.1 BY PRODUCT

9.9.1.1 PHTHALATES PLASTICIZERS

9.9.1.2 NON-PHTHALATES PLASTICIZERS

10 COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: INDIA

10.2 EVENT

10.3 NEW PRODUCT LAUNCH

10.4 CERTIFICATION

10.5 COMPANY LAUNCH

10.6 AWARD

10.7 COLLABORATION

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 KLJ GROUP

12.1.1 COMPANY SNAPSHOT

12.1.2 PRODUCT PORTFOLIO

12.1.3 RECENT DEVELOPMENT

12.2 BASF SE

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 MITSUBISHI CHEMICAL CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 AARTI INDUSTRIES LTD.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 DIC CORPORATION

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 ABC CHEMICAL

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 AVIENT CORPORATION

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 DOW

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENTS

12.9 EASTMAN CHEMICAL COMPANY

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENT

12.1 EVONIK INDUSTRIES AG

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

12.11 EXXON MOBIL CORPORATION

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 HENAN GO BIOTECH CO.,LTD

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 INDO-NIPPON CHEMICAL CO. LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 KAO CORPORATION

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 LANXESS

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENT

12.16 LG CHEM

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENTS

12.17 MARVELVINYLS

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 NAN YA PLASTICS CORPORATION

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENT

12.19 NAYAKEM

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

12.2 NISHANT ORGANICS PVT. LTD.

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENTS

12.21 PAYAL GROUP

12.21.1 COMPANY SNAPSHOT

12.21.2 PRODUCT PORTFOLIO

12.21.3 RECENT DEVELOPMENTS

12.22 PERSTORP HOLDING AB

12.22.1 COMPANY SNAPSHOT

12.22.2 PRODUCT PORTFOLIO

12.22.3 RECENT DEVELOPMENT

12.23 SUPREME PLASTICIZERS

12.23.1 COMPANY SNAPSHOT

12.23.2 PRODUCT PORTFOLIO

12.23.3 RECENT DEVELOPMENT

12.24 VELSICOL CHEMICAL LLC.

12.24.1 COMPANY SNAPSHOT

12.24.2 PRODUCT PORTFOLIO

12.24.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF COMPOUND PLASTICISERS FOR RUBBER OR PLASTICS, N.E.S.; HS CODE – 381220 (USD THOUSAND)

TABLE 2 EXPORT DATA OF COMPOUND PLASTICISERS FOR RUBBER OR PLASTICS, N.E.S.; HS CODE – 381220 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 5 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 6 INDIA NON-PHTHALATES IN PHTHALATES AND NON PHTHALATES MARKET, BY TYPE, 2021-2030 (INR MILLION)

TABLE 7 INDIA MONOMERIC PLASTICIZERS IN PHTHALATES AND NON PHTHALATES MARKET, BY TYPE, 2021-2030 (INR MILLION)

TABLE 8 INDIA POLYMERIC PLASTICIZERS IN PHTHALATES AND NON PHTHALATES MARKET, BY TYPE, 2021-2030 (INR MILLION)

TABLE 9 INDIA OTHER PHTHALATES IN PHTHALATES AND NON PHTHALATES MARKET, BY TYPE, 2021-2030 (INR MILLION)

TABLE 10 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY APPLICATION, 2021-2030 (INR MILLION)

TABLE 11 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY END-USE, 2021-2030 (INR MILLION)

TABLE 12 INDIA BUILDING AND CONSTRUCTION IN PHTHALATES AND NON PHTHALATES MARKET, BY SEGMENT, 2021-2030 (INR MILLION)

TABLE 13 INDIA BUILDING AND CONSTRUCTION IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 14 INDIA ELECTRONICS IN PHTHALATES AND NON PHTHALATES MARKET, BY SEGMENT, 2021-2030 (INR MILLION)

TABLE 15 INDIA ELECTRONICS IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 16 INDIA AUTOMOTIVE IN PHTHALATES AND NON PHTHALATES MARKET, BY SEGMENT, 2021-2030 (INR MILLION)

TABLE 17 INDIA AUTOMOTIVE IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 18 INDIA CONSUMER GOODS IN PHTHALATES AND NON PHTHALATES MARKET, BY SEGMENT, 2021-2030 (INR MILLION)

TABLE 19 INDIA CONSUMER GOODS IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 20 INDIA MEDICAL AND HEALTHCARE IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 21 INDIA FOOD & BEVERAGES IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 22 INDIA SPORTS & LEISURE IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 23 INDIA OTHERS IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

图片列表

FIGURE 1 INDIA PHTHALATES AND NON PHTHALATES MARKET

FIGURE 2 INDIA PHTHALATES AND NON PHTHALATES MARKET: DATA TRIANGULATION

FIGURE 3 INDIA PHTHALATES AND NON PHTHALATES MARKET: DROC ANALYSIS

FIGURE 4 INDIA PHTHALATES AND NON PHTHALATES MARKET: INDIA MARKET ANALYSIS

FIGURE 5 INDIA PHTHALATES AND NON PHTHALATES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA PHTHALATES AND NON PHTHALATES MARKET: THE RAW MATERIAL LIFE LINE CURVE

FIGURE 7 INDIA PHTHALATES AND NON PHTHALATES MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE GAS BARRIER MEMBRANE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 INDIA PHTHALATES AND NON PHTHALATES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 INDIA PHTHALATES AND NON PHTHALATES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 INDIA PHTHALATES AND NON PHTHALATES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 INDIA PHTHALATES AND NON PHTHALATES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 INDIA PHTHALATES AND NON PHTHALATES MARKET: SEGMENTATION

FIGURE 14 RISING DEMAND FOR PHTHALATE AND NON PHTHALATE FROM BUSINESS-TO-BUSINESS INDUSTRIES IS EXPECTED TO DRIVE INDIA PHTHALATES AND NON PHTHALATES MARKET IN THE FORECAST PERIOD

FIGURE 15 NON-PHTHALATES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA PHTHALATES AND NON PHTHALATES MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE INDIA PHTHALATES AND NON PHTHALATES MARKET

FIGURE 17 INDIA PHTHALATES AND NON PHTHALATES MARKET: BY PRODUCT, 2022

FIGURE 18 INDIA PHTHALATES AND NON PHTHALATES MARKET: BY APPLICATION, 2022

FIGURE 19 INDIA PHTHALATES AND NON PHTHALATES MARKET: BY END-USE, 2022

FIGURE 20 INDIA PHTHALATE AND NON PHTHALATES MARKET: COMPANY SHARE 2022 (%)

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.