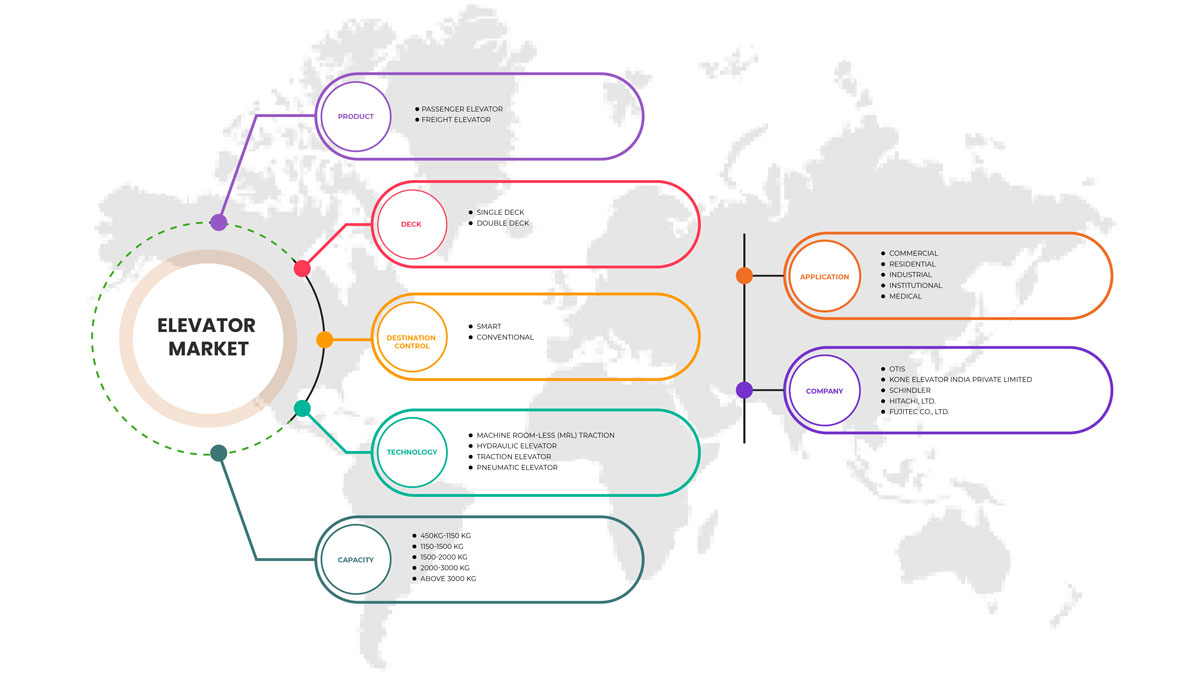

印度电梯市场,按产品(乘客电梯和货运电梯)、技术(无机房 (MRL) 牵引电梯、液压电梯、牵引电梯和气动电梯)、层板(单层和双层)、容量(450KG-1150 KG、1150-1500 KG、1500-2000 KG、2000-3000 KG 和 3000 KG 以上)、目的地控制(智能、传统)、应用(商业、住宅、工业、机构和医疗)划分 - 行业趋势和预测到 2029 年。

印度电梯市场分析及规模

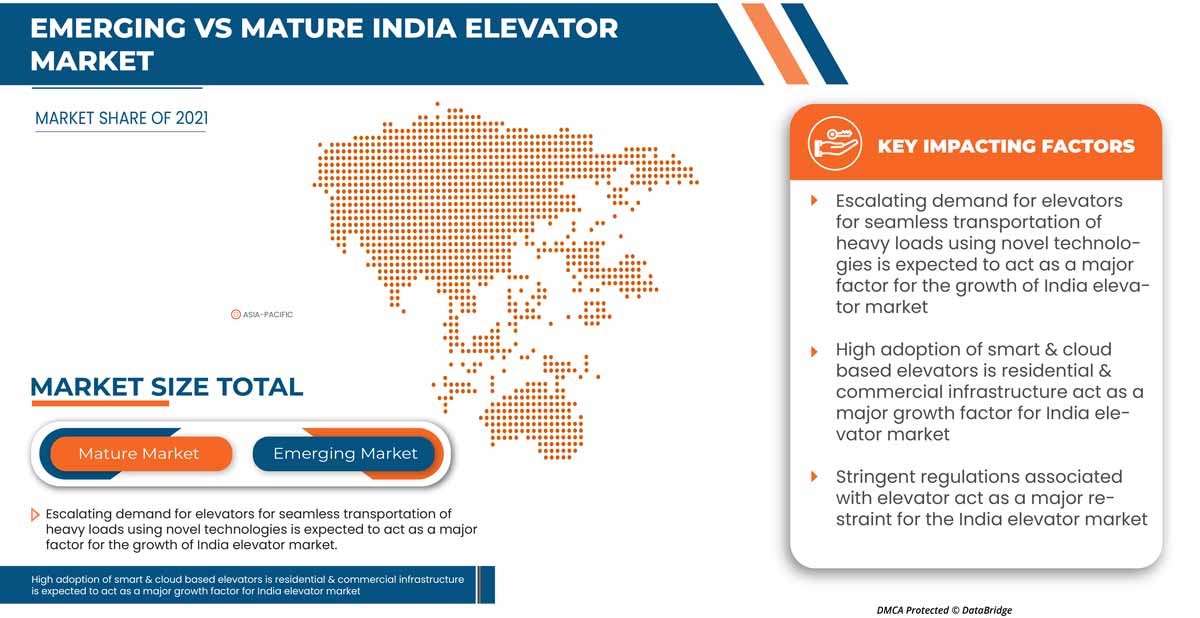

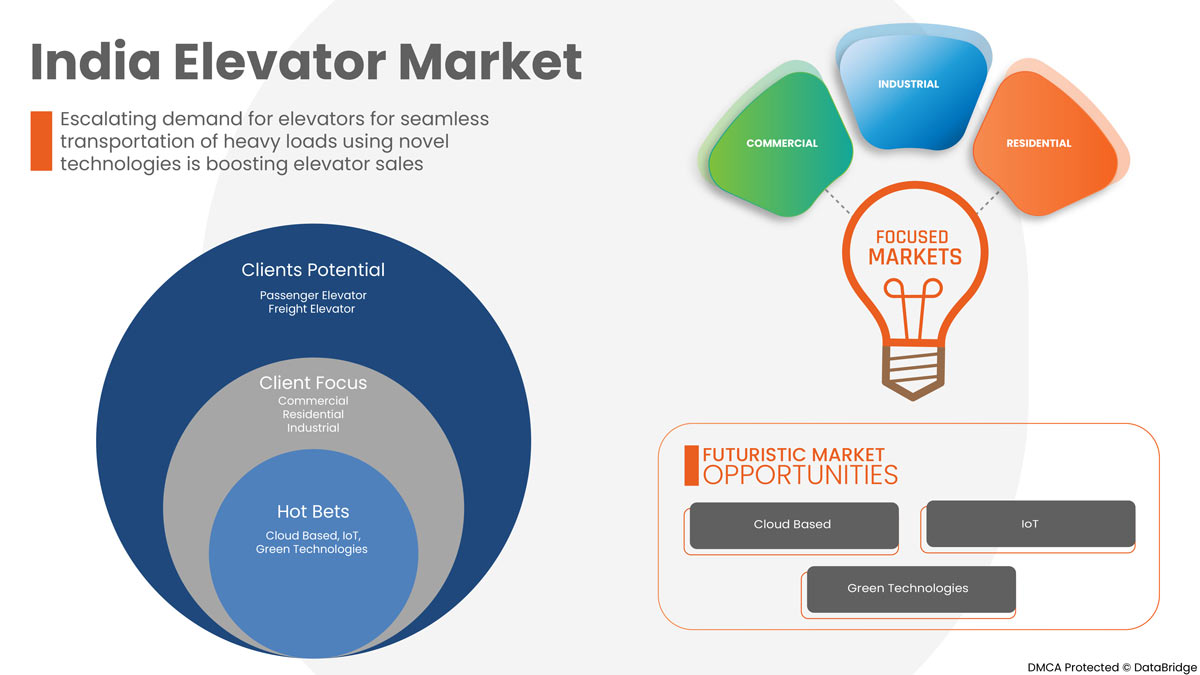

近年来,电梯作为基础设施建设的重要组成部分,其普及度呈指数级增长。制造商不断尝试寻找方法来增加具有创新技术特征的电梯产量。技术进步是推动市场增长的主要因素之一。快速的城市化、商业建设以及工业和住宅空间基础设施的升级是促进该国市场增长的其他主要因素。随着数字化转型的采用,使用基于云的解决方案也推动并促进了印度市场的增长。这些因素预计将推动印度电梯市场的增长。

Data Bridge Market Research 分析称,预计到 2029 年,印度电梯市场价值将达到 24.2103 亿美元,预测期内复合年增长率为 4.5%。电梯市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020 (可定制至 2019-2014) |

|

定量单位 |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

按产品(乘客电梯和货运电梯)、技术(无机房(MRL)牵引电梯、液压电梯、牵引电梯和气动电梯)、层板(单层和双层)、容量(450KG-1150 KG、1150-1500 KG、1500-2000 KG、2000-3000 KG 及 3000 KG 以上)、目的地控制(智能、传统)、应用(商业、住宅、工业、机构和医疗) |

|

覆盖国家 |

印度 |

|

涵盖的市场参与者 |

富士达株式会社、现代电梯有限公司、Sigma Gearless Pvt. Ltd.、TK 电梯、三菱电梯印度私人有限公司、迅达、通力电梯印度私人有限公司、日立有限公司、奥的斯、东芝公司等。 |

市场定义

电梯可以定义为用于在建筑物楼层之间垂直运输货物和人员的电动升降机。通常,这些设备是在电动机的帮助下启动或操作的,电动机还驱动配重系统电缆进行驱动交易,以提升负载和人员的重量。电梯有多种类型。例如,

- 有齿轮和无齿轮牵引电梯

- 液压升降机

- 无机房电梯

- 真空(气动)家用电梯

根据用途,市场上有各种其他类型的电梯。这些电梯适用于各种领域,例如工业、商业和住宅领域。

印度电梯市场动态

本节旨在了解市场驱动因素、机遇、限制和挑战。以下内容将详细讨论所有这些内容:

驱动程序

-

增加节能电梯的使用

在印度,电梯可以完全依靠太阳能运行。与传统电梯相比,这项最新的电梯技术创新每年可节省高达 50% 的能源。新电梯可以使用太阳能、电网电力或两者结合运行。根据配置和可用的阳光,电梯可以完全依靠太阳能运行。太阳能电池板放置在建筑物的屋顶上,为电梯提供电力。太阳能电池板捕获的能量可以立即使用,储存在电池中,甚至可以转售给电网。它具有在停电期间储存电力的独特优势,因此比传统电梯更安全。

• 安装先进的物联网技术电梯

物联网 (IoT) 使电梯能够使用人工智能 (AI) 有效地实现乘客和货物的垂直运输。这是一个升级电梯关键部件的过程,以处理新技术、提高性能、提高安全性并确保维护是最新的。

先进技术电梯功能有两个关键组件:它能够访问所有建筑,例如商业和住宅建筑。它完全定制,以有意义的形式向各种企业提供数据和服务。物联网电梯的第二个组件是它可以映射和编排数据以实现业务逻辑。

机会

- 使用绿色建筑材料减少碳足迹

建筑行业面临的主要问题之一是温室气体的产生,因为建筑行业使用重型电梯来运输货物和其他物品。这与能源消耗有间接关系。根据 VIATechnik LLC 的数据,建筑物消耗了全球约 40% 的能源,而电梯占建筑能源消耗的 10%。能源消耗越多,自然资源(如生物质、煤炭等)的使用就越多。这往往会产生较高的碳足迹。为了减少建筑行业的碳足迹,必须使用智能创新的电梯系统,并配备再生驱动系统、高效的轿厢内传感器和计算机控制系统等创新功能,以最大限度地减少电力消耗,使建筑行业更加环保。

限制/挑战

- 维护和安装成本高

电梯市场面临的主要挑战之一是电梯的高维护要求。由于电梯面临因故障和故障而产生的多个问题。这些频繁的故障和故障是由于以下因素造成的:

- 停电

- 磨损的滑轮

- 污染

- 轴承故障或轴承噪音

- 电机驱动失准

可以通过采取主动的预防措施来尽量减少故障的影响,从而避免这种情况。预防胜于治疗,因为主动和预防措施比修理损坏的电梯要容易得多。定期检查是确保电梯平稳可靠运行的第一步,检查与日常维护相结合可以消除停机时间并减少高达 15% 的能耗,从而显著提高生产率。

最新动态

- 2022 年 2 月,迅达安装了迅达电梯机器人安装系统。这是世界上第一个自动爬升、自主机器人系统,可在电梯井内进行安装工作。首次部署在亚太地区的客户项目中

- 2019 年 3 月,三菱电梯印度私人有限公司宣布推出 NEXIEZ-LITE MRL 电梯,这是一款印度生产的无需机房的电梯

印度电梯市场范围

印度电梯市场根据产品、技术、层板、应用、目的地控制和容量进行细分。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

产品

- 乘客电梯

- 载货电梯

根据产品,印度电梯市场分为乘客电梯和货运电梯

技术

- 无机房(MRL)牵引

- 液压升降机

- 牵引电梯

- 气动升降机

根据技术,印度电梯市场分为无机房(MRL)牵引电梯、液压电梯、牵引电梯和气动电梯。

甲板

- 单层

- 双层

根据层数,印度电梯市场分为单层和双层

容量

- 450公斤-1150公斤,

- 1150-1500公斤,

- 1500-2000公斤,

- 2000-3000公斤,

- 3000公斤以上

根据容量,印度电梯市场分为450kg-1150kg、1150-1500kg、1500-2000kg、2000-3000kg和3000kg以上。

目的地控制

- 聪明的

- 传统的

根据目的地控制,印度电梯市场分为智能电梯和传统电梯。

应用

- 商业的

- 住宅

- 工业的

- 机构

- 医疗的

根据应用,印度电梯市场分为商业、住宅、工业、机构和医疗。

竞争格局和印度电梯市场份额分析

印度电梯市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、印度业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对印度电梯市场的关注有关。

印度电梯市场的一些主要参与者包括富士达株式会社、现代电梯有限公司、Sigma Gearless Pvt. Ltd.、TK Elevator、三菱电梯印度私人有限公司、迅达、通力电梯印度私人有限公司、日立有限公司、奥的斯、东芝公司等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE INDIA ELEVATOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENRAIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATIONS

4.2 VENDOR SELECTION CRITERIA

4.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4 REGULATION COVERAGE

4.5 DBMR ANALYSIS

4.5.1 STRENGTH:

4.5.2 THREAT:

4.5.3 OPPORTUNITY:

4.5.4 WEAKNESS:

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INSTALLATION OF ADVANCED IOT TECHNOLOGY-ENABLED ELEVATOR

5.1.2 INCREASED USAGE OF ENERGY-EFFICIENT ELEVATOR

5.1.3 RAPID URBANIZATION & URBAN COMMERCIAL CONSTRUCTION

5.1.4 ESCALATION IN DEMAND FOR ELEVATORS FOR SEAMLESS TRANSPORTATION OF HEAVY LOADS USING NOVEL TECHNOLOGIES

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATIONS ASSOCIATED WITH ELEVATORS

5.3 OPPORTUNITIES

5.3.1 MINIMIZATION OF THE CARBON FOOTPRINT USING GREEN-BUILDING MATERIALS

5.3.2 GROWTH IN THE FOCUS ON UPGRADING INFRASTRUCTURE OF INDUSTRIAL AND RESIDENTIAL SPACES

5.4 CHALLENGES

5.4.1 HIGH MAINTENANCE AND INSTALLATION COSTS

5.4.2 OVER-THE-TOP DEMAND FOR TOP-NOTCH ASSISTANCE/SKILLED WORKFORCE

6 INDIA ELEVATOR MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 PASSENGER ELEVATOR

6.2.1 RESIDENTIAL ELEVATORS

6.2.2 OBSERVATION ELEVATORS

6.2.3 BED ELEVATORS

6.3 FREIGHT ELEVATOR

6.3.1 VEHICLE

6.3.2 DUMBWAITERS

7 INDIA ELEVATOR MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 MACHINE ROOM-LESS (MRL) TRACTION

7.3 HYDRAULIC ELEVATOR

7.3.1 DIRECT ACTING HYDRAULIC LIFT

7.3.2 SUSPENDED HYDRAULIC LIFT

7.4 TRACTION ELEVATOR

7.4.1 GEARED

7.4.2 GEARLESS

7.5 PNEUMATIC ELEVATOR

8 INDIA ELEVATOR MARKET, BY DECK

8.1 OVERVIEW

8.2 SINGLE DECK

8.3 DOUBLE DECK

9 INDIA ELEVATOR MARKET, BY CAPACITY

9.1 OVERVIEW

9.2 450KG-1150 KG

9.3 1150-1500 KG

9.4 1500-2000 KG

9.5 2000-3000 KG

9.6 ABOVE 3000 KG

10 INDIA ELEVATOR MARKET, BY DESTINATION CONTROL

10.1 OVERVIEW

10.2 SMART

10.3 CONVENTIONAL

11 INDIA ELEVATOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 COMMERCIAL

11.2.1 MACHINE ROOM-LESS (MRL) TRACTION

11.2.2 HYDRAULIC ELEVATOR

11.2.3 TRACTION ELEVATOR

11.2.4 PNEUMATIC ELEVATOR

11.2.4.1 AIRPORTS

11.2.4.2 PARKING BUILDINGS

11.2.4.3 MALLS

11.2.4.4 HOTELS

11.2.4.5 RETAIL

11.2.4.6 HOSPITALS

11.2.4.7 CORPORATE OFFICES

11.2.4.8 RAILWAY STATIONS

11.2.4.9 RESTAURANTS

11.2.4.10 OTHERS

11.3 RESIDENTIAL

11.3.1 MACHINE ROOM-LESS (MRL) TRACTION

11.3.2 HYDRAULIC ELEVATOR

11.3.3 TRACTION ELEVATOR

11.3.4 PNEUMATIC ELEVATOR

11.4 INDUSTRIAL

11.4.1 MACHINE ROOM-LESS (MRL) TRACTION

11.4.2 HYDRAULIC ELEVATOR

11.4.3 TRACTION ELEVATOR

11.4.4 PNEUMATIC ELEVATOR

11.5 INSTITUTIONAL

11.5.1 SCHOOL

11.5.2 COLLEGES & UNIVERSITIES

11.5.2.1 MACHINE ROOM-LESS (MRL) TRACTION

11.5.2.2 HYDRAULIC ELEVATOR

11.5.2.3 TRACTION ELEVATOR

11.5.2.4 PNEUMATIC ELEVATOR

11.6 MEDICAL

11.6.1 MACHINE ROOM-LESS (MRL) TRACTION

11.6.2 HYDRAULIC ELEVATOR

11.6.3 TRACTION ELEVATOR

11.6.4 PNEUMATIC ELEVATOR

12 SWOT

13 INDIA ELEVATOR MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GERMANY

14 COMPANY PROFILES

14.1 OTIS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 KONE ELEVATOR INDIA PRIVATE LIMITED

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 SCHINDLER

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 HITACHI, LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 FUJITEC CO., LTD.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 MITSUBISHI ELEVATOR INDIA PVT LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 HYUNDAI ELEVATOR LTD

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 SIGMA ELEVATOR.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 TK ELEVATOR

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 TOSHIBA CORPORATION

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 INDIA ELEVATOR MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 INDIA ELEVATOR MARKET, BY PRODUCTS, 2020-2029 (UNITS)

TABLE 3 PRICE (USD/UNIT)

TABLE 4 INDIA PASSENGER ELEVATOR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 5 INDIA FREIGHT ELEVATOR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 6 INDIA ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 7 INDIA ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (UNITS)

TABLE 8 PRICE (USD/UNIT)

TABLE 9 INDIA HYDRAULIC ELEVATOR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 10 INDIA TRACTION ELEVATOR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 11 INDIA ELEVATOR MARKET, BY DECK, 2020-2029 (USD MILLION)

TABLE 12 INDIA ELEVATOR MARKET, BY DECK, 2020-2029 (UNITS)

TABLE 13 PRICE (USD/UNIT)

TABLE 14 INDIA ELEVATOR MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 15 INDIA ELEVATOR MARKET, BY CAPACITY, 2020-2029 (UNITS)

TABLE 16 PRICE (USD/UNIT)

TABLE 17 INDIA ELEVATOR MARKET, BY DESTINATION CONTROL, 2020-2029 (USD MILLION)

TABLE 18 INDIA ELEVATOR MARKET, BY DESTINATION CONTROL, 2020-2029 (UNITS)

TABLE 19 PRICE (USD/UNIT)

TABLE 20 INDIA ELEVATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 INDIA ELEVATOR MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 22 PRICE (USD/UNIT)

TABLE 23 INDIA COMMERCIAL ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 24 INDIA COMMERCIAL ELEVATOR MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 25 INDIA RESIDENTIAL ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 26 INDIA INDUSTRIAL ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 27 INDIA INSTITUTIONAL ELEVATOR MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 28 INDIA INSTITUTIONAL ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 29 INDIA MEDICAL ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 INDIA ELEVATOR MARKET: SEGMENTATION

FIGURE 2 INDIA ELEVATOR MARKET: DATA TRIANGULATION

FIGURE 3 INDIA ELEVATOR MARKET: DROC ANALYSIS

FIGURE 4 INDIA ELEVATOR MARKET: GLOBAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 INDIA ELEVATOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA ELEVATOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA ELEVATOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA ELEVATOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 INDIA ELEVATOR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 INDIA ELEVATOR MARKET: SEGMENTATION

FIGURE 11 RAPID URBANIZATION & URBAN COMMERCIAL CONSTRUCTION IS EXPECTED TO DRIVE THE INDIA ELEVATOR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PASSENGER ELEVATOR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA ELEVATOR MARKET IN 2022 & 2029

FIGURE 13 TECHNOLOGICAL TRENDS IN AUDIO-CRITICAL COMMUNICATIONS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE INDIA ELEVATOR MARKET

FIGURE 15 GLOBAL CARBON EMISSION BY EACH SECTOR

FIGURE 16 INDIA ELEVATOR MARKET: BY PRODUCT, 2021

FIGURE 17 INDIA ELEVATOR MARKET: BY TECHNOLOGY, 2021

FIGURE 18 INDIA ELEVATOR MARKET: BY DECK, 2021

FIGURE 19 INDIA ELEVATOR MARKET: BY CAPACITY, 2021

FIGURE 20 INDIA ELEVATOR MARKET: BY DESTINATION CONTROL, 2021

FIGURE 21 INDIA ELEVATOR MARKET: BY APPLICATION, 2021

FIGURE 22 INDIA ELEVATOR MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。