India Digital Stethoscope Market

市场规模(十亿美元)

CAGR :

%

USD

5.70 Million

USD

8.62 Million

2024

2032

USD

5.70 Million

USD

8.62 Million

2024

2032

| 2025 –2032 | |

| USD 5.70 Million | |

| USD 8.62 Million | |

|

|

|

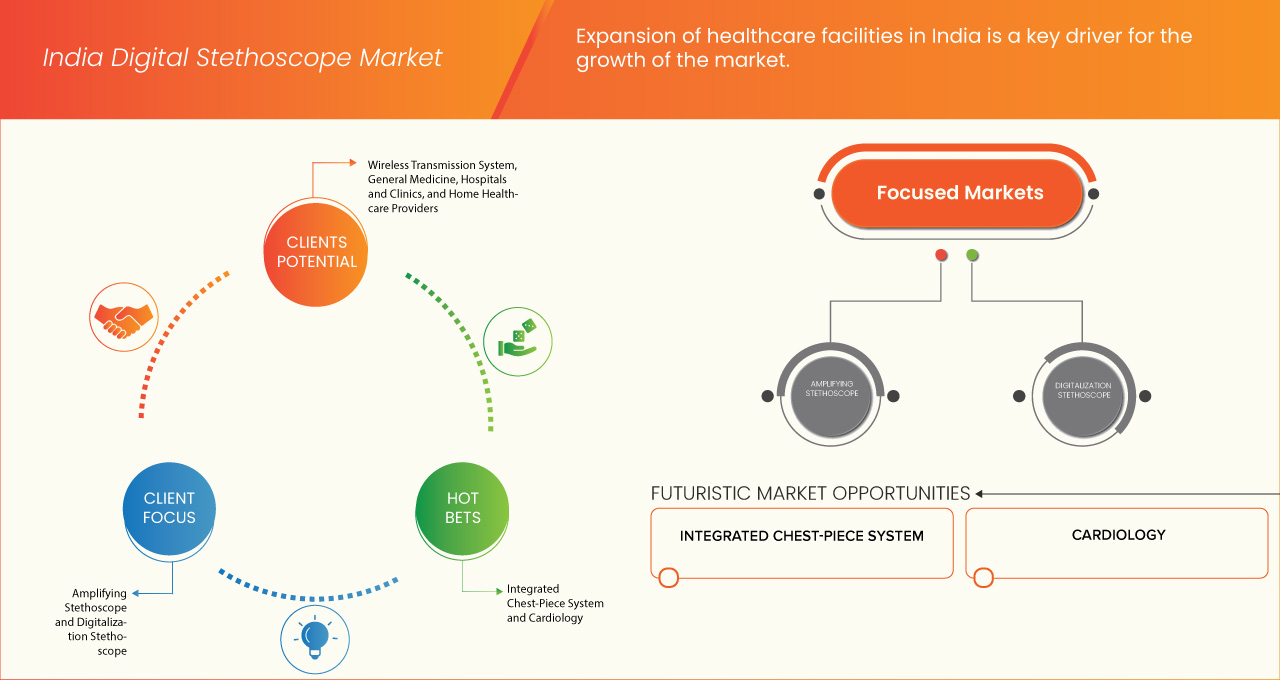

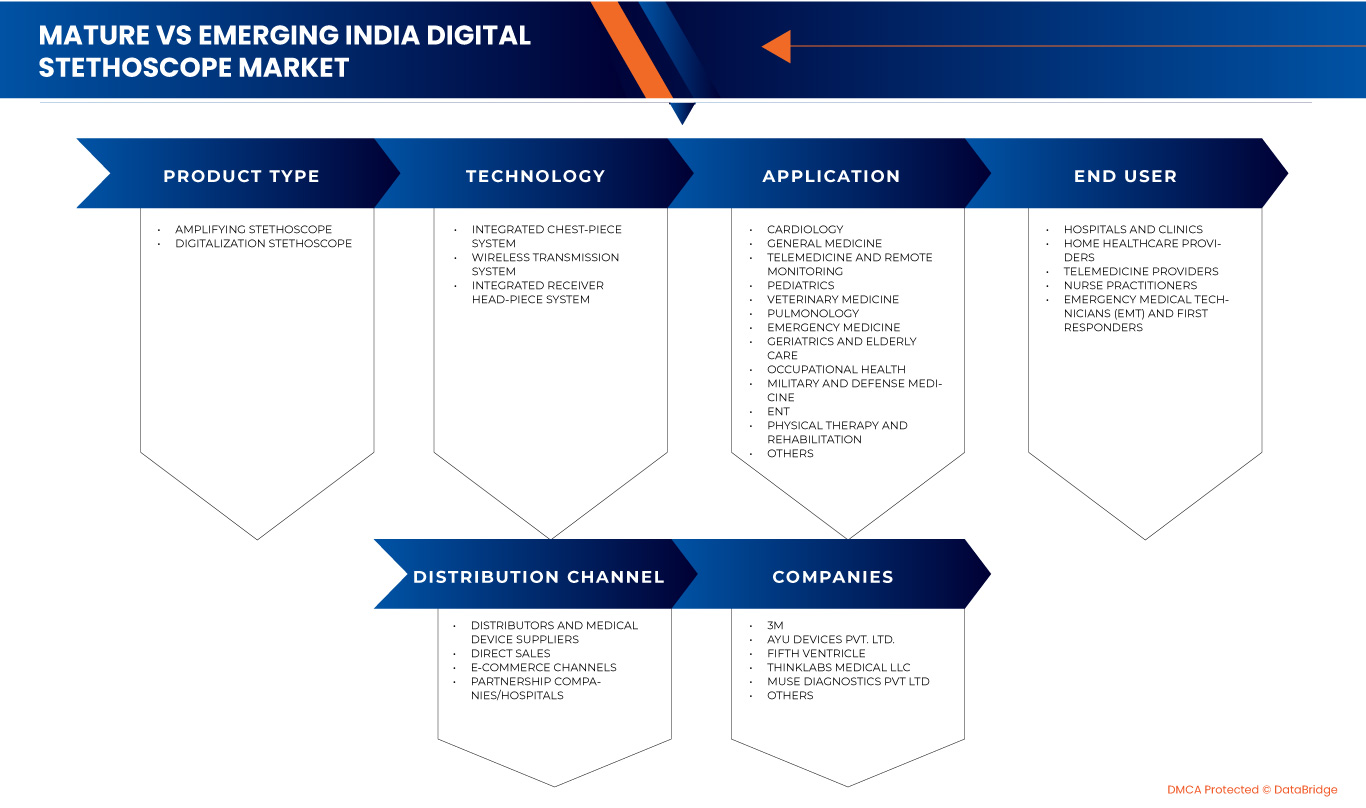

印度數位聽診器市場細分,按產品類型(放大聽診器和數位聽診器)、技術(整合胸部零件系統、無線傳輸系統和整合接收器頭件系統)、應用(心臟病學、全科醫學、遠距醫療和遠端監控、兒科、獸醫學、肺病學、急診醫學、老年病學和老年護理、職業健康、軍事和國防醫學、耳鼻喉科、物理治療和復健等)、最終用戶(醫院和診所、家庭醫療保健提供者、遠距醫療提供者、執業護理師、緊急醫療技術人員(EMT) 和急救人員)、分銷管道(分銷商和醫療器材供應商、直銷、電子商務通路和合作公司/醫院)– 行業趨勢和預測到 2032 年

數位聽診器市場分析

印度數位聽診器市場是指印度醫療保健系統內數位聽診器的開發、分銷和使用的領域。由於醫療技術的進步、人們對心臟和呼吸系統健康的認識不斷提高以及醫療專業人員對增強診斷工具的需求不斷增長,該市場實現了顯著增長。印度的數位聽診器具有聲音放大、數位錄音以及與智慧型手機或電腦連接進行分析和數據共享等功能,有助於改善患者護理並提高醫療實踐的效率。此外,市場也受到遠距醫療的成長、遠距病人監控的需求以及全國醫療保健基礎設施投資增加等因素的影響。

數位聽診器市場規模

印度數位聽診器市場預計將從 2024 年的 570 萬美元增加到 2032 年的 862 萬美元,在 2025 年至 2032 年的預測期內以 5.4% 的複合年增長率增長。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察外,Data Bridge Market Research 策劃的市場報告還包括深度專家分析、患者流行病學、管道分析、定價分析和監管框架。

數位聽診器市場 趨勢

“人工智慧(AI)和機器學習技術的日益融合”

數位聽診器市場的一個突出趨勢是人工智慧 (AI) 和機器學習技術的日益融合。隨著醫療保健專業人員尋求更有效的診斷工具,人們正在開發支援人工智慧的數位聽診器來即時分析聽診聲音,提供有助於診斷各種醫療狀況的見解。這些設備可以從大量音訊資料中學習,提高其識別心音和肺音模式和異常的能力。這一趨勢不僅提高了傳統聽診的準確性,而且透過提供自動分析和支援簡化了臨床環境中的工作流程,最終幫助醫療保健提供者做出更明智的決策並改善患者護理結果。此外,對遠距醫療的日益重視進一步加速了這些創新聽診器的採用,促進了遠距諮詢和監測。

報告範圍和數位聽診器市場 細分

|

屬性 |

數位聽診器市場 洞察 |

|

涵蓋的領域 |

|

|

主要市場參與者 |

3M(美國)、Ayu Devices Pvt. Ltd.(印度)、Fifth Ventricle(印度)、Thinklabs Medical LLC(美國)、MUSE DIAGNOSTICS PVT LTD. (印度)、Cardionics Inc.(美國)、HD Medical Inc.(美國)、Hulu Devices(美國)、MCM Industries、JAENTS Corp. |

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深度專家分析、患者流行病學、管道分析、定價分析和監管框架。 |

數位聽診器市場 定義

數位聽診器是一種使用數位技術放大和記錄心肺聲音的聽診器,可以進行更準確、更詳細的診斷。它通常由一個聽診器頭組成,該聽診器頭將聲波轉換為電訊號,然後由數位電路處理和放大。放大的聲音隨後顯示在螢幕上或儲存以供日後審查,使醫療保健專業人員可以即時或回顧性地觀察和分析聲音。數位聽診器通常具有降噪、濾波和壓縮等高級功能,使醫療保健專業人員能夠專注於特定聲音並更有效地診斷病情。

數位聽診器市場 動態

驅動程式

- 印度醫療設施的擴建

印度醫療保健基礎設施的擴張,特別是在城市和半城市地區,在推動包括數位聽診器在內的先進診斷設備的採用方面發揮著重要作用。隨著印度不斷發展其醫療設施以滿足日益增長的優質醫療服務需求,其明顯轉向採用能夠提高診斷準確性和效率的現代技術。在城市中心,醫院和診所正在不斷升級其設備以符合全球醫療保健標準,而數位聽診器憑藉其噪音消除、增強音質和數據記錄功能等先進功能,正在成為這一轉變的重要組成部分。半城市地區醫療保健基礎設施的改善也促進了這一趨勢,因為新建的醫療保健中心希望提供最新的診斷工具來服務日益增長的患者群體。政府和私營部門旨在改善醫療保健服務覆蓋率和品質的投資進一步支持了這一轉變。因此,先進醫療設施的日益普及直接加速了數位聽診器的採用,並透過在城市和半城市地區創造對現代診斷工具的更高需求,使其成為市場的主要驅動力。

例如,

2024年6月,根據國際貿易管理局發表的文章,印度醫療保健產業正在經歷快速轉型,對基礎設施進行了大量投資,2024財年預算增加了12.59%,重點是改善優質醫療和基礎設施的取得。這一發展促進了數位聽診器等先進診斷工具的採用,從而推動了市場成長。

- 印度心血管疾病盛行率不斷上升

印度心血管疾病(CVD)盛行率的不斷上升,大大促進了對包括數位聽診器在內的先進診斷工具的需求不斷增長。隨著受心臟病、高血壓和其他心血管疾病影響的人數增加,醫療保健專業人員需要更準確、更有效的診斷方法。傳統聽診器雖然有效,但在檢測細微的心音時往往有其局限性,因此數位聽診器成為首選替代品。這些先進的設備具有增強的聲音放大、降噪功能以及記錄和傳輸遠端諮詢數據的能力,對於診斷和監測心血管疾病至關重要。隨著心血管疾病負擔的增加,對精確、可靠和先進的診斷設備的需求也日益增加。這一趨勢推動了醫院、診所和診斷中心對數位聽診器的採用,使其成為關鍵的市場驅動力。隨著心血管疾病的不斷增加,數位聽診器的需求將會成長,從而進一步擴大其市場佔有率。

例如,

2020年1月,根據NCBI發表的一篇文章,《全球疾病負擔研究》報告稱,印度年齡標準化心血管疾病(CVD)死亡率為每10萬人272人,高於全球平均235人。此外,亞洲印度人的冠狀動脈疾病(CAD)死亡率比其他族群高出20-50%。心血管疾病盛行率的不斷上升推動了對數位聽診器等先進診斷工具的需求,從而促進了市場成長。

機會

- 人口老化導致數位聽診器使用量增加

印度老齡人口的增加為數位聽診器市場帶來了巨大的機遇,因為老年人通常更容易患慢性疾病,尤其是心血管疾病。隨著老年人口的增長,對能夠促進定期健康監測和早期發現疾病的先進診斷工具的需求也日益增加。數位聽診器具有增強的音訊功能和整合技術,可以更好地管理數據,使醫療保健提供者能夠更準確地進行全面評估。這一趨勢促進了積極主動的醫療保健管理,並推動了針對老年人特定需求的創新醫療設備的必要性。

例如,

2024年7月,根據《到2050年,印度老年人口可能翻一番:聯合國人口基金印度負責人》一文,預計到2050年,60歲及以上人口數量將翻一番,達到3.46億,迫切需要增加對醫療保健、住房和養老金計劃的投資。這個數字最終將導致整體人口中慢性病的增多,從而帶動市場的成長。

- 穿戴式科技集成

穿戴式科技融入醫療保健生態系統為印度的數位聽診器市場帶來了重大機遇,因為這些設備可以透過持續監測生命徵象來補充傳統的診斷工具。智慧型手錶和健身追蹤器等穿戴式裝置可以收集心率、活動水平和其他健康指標的數據,這些數據可以與數位聽診器同步,以創建患者的全面健康狀況。此功能豐富了數位聽診器的功能,使其更加通用,同時也使醫療保健提供者能夠根據即時數據做出更明智的決策。透過提供這些集成,製造商可以增強產品吸引力,尤其是對於精通技術的醫療保健專業人士和尋求主動健康管理解決方案的年輕患者。

例如,

2022年5月,根據《用於自動化疾病診斷的軟穿戴式聽診器全便攜式連續即時聽診》一文,軟穿戴式聽診器被用作各種疾病的定量疾病診斷工具。此軟裝置可偵測噪音最小的連續心肺音,並對即時訊號異常進行分類。據同一消息來源稱,穿戴式數位聽診器設備使遠距醫療和其他形式的遠距醫療診斷更加容易實現,從而可以透過持續監測早期發現心血管和呼吸系統疾病。

限制/挑戰

- 有效使用數位聽診器的額外培訓

由於印度醫療保健環境多樣化且資源往往受限,有效使用數位聽診器的額外培訓對印度數位聽診器市場來說是一個重大挑戰。許多醫療保健專業人員,特別是在農村或較小的城市環境中。這種訓練對於有效操作設備和準確解釋數據是必要的。對聲音放大、數位儲存和連接選項等高級功能缺乏熟悉可能會導致設備功能未充分利用,最終降低其在臨床實踐中的感知價值。

例如,

2023年4月,根據美國國家醫學圖書館發表的一篇文章,年紀較大且經驗豐富的醫療保健專業人員很難融入和過渡到更新、更複雜的數位聽診器系統,因為他們已經習慣了傳統的聽診器,他們可能需要多次醫療器材培訓才能保持最新狀態。

- 維護和技術支援要求

維護和技術支援的要求對印度的數位聽診器市場提出了重大挑戰,特別是在營運永續性和用戶信心方面。數位聽診器是一種先進的技術設備,需要定期維護以確保其最佳性能。這包括軟體更新、校準和故障排除以解決任何技術故障。在一個醫療機構通常預算緊張、人力有限的國家,投入資源進行持續維護可能是一項艱鉅的任務。農村地區的小型診所和醫療保健提供者可能缺乏支援此類技術需求的基礎設施,導致設備在故障或使用者不確定如何解決問題時無法充分利用。

本市場報告提供了最新發展、貿易法規、進出口分析、生產分析、價值鏈優化、市場份額、國內和本地化市場參與者的影響的詳細信息,分析了新興收入領域的機會、市場法規的變化、戰略市場增長分析、市場規模、類別市場增長、應用領域和主導地位、產品批准、產品發布、地理擴展、市場技術創新。要獲取更多市場信息,請聯繫 Data Bridge Market Research 獲取分析師簡報,我們的團隊將幫助您做出明智的市場決策,實現市場成長。

數位聽診器市場範圍

根據產品類型、應用、技術、最終用戶和分銷管道,市場可分為五個顯著的部分。這些細分市場之間的成長將幫助您分析行業中成長微弱的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

產品類型

- 放大聽診器

- 電子擴大機

- 基於聲學的放大器

- 數位化聽診器

- 有線傳統聽診器和數位聽診器

- USB連接

- 直接類比轉換

- 無線聽診器

- 藍牙連接

- Wi-Fi 連接

- 智慧聽診器

- 人工智慧聽診器

- 自我診斷能力

- 數據分析和遠端監控功能

- 有線傳統聽診器和數位聽診器

科技

- 整合胸件系統

- 無線傳輸系統

- 短距離無線

- 長距離無線

- 基於雲端的資料儲存和傳輸功能

- 整合接收頭戴式系統

- 嵌入式數位接收器

- 雙模接收機

- 即時數位視覺化

應用

- 心臟病學

- 一般醫學

- 遠距醫療和遠端監控

- 兒科

- 獸醫學

- 肺部疾病學

- 急診醫學

- 老年病學和老年護理

- 職業健康

- 軍事和國防醫學

- 耳鼻喉科

- 物理治療與復健

- 其他的

最終用戶

- 醫院和診所

- 私立醫院

- 政府醫院和醫療機構

- 小型診所和診所

- 家庭醫療保健提供者

- 遠距醫療提供者

- 三級遠距醫療平台

- 二級遠距醫療服務提供者

- 直接面向患者的遠距醫療應用

- 執業護理師

- 緊急醫療技術人員 (EMT) 和急救人員

分銷管道

- 分銷商和醫療器材供應商

- 直銷

- 電子商務通路

- 合作公司/醫院

數位聽診器市場份額

市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、全球影響力、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用優勢。以上提供的數據點僅與公司對市場的關注有關。

在市場上運營的數位聽診器市場領導者有:

- 3M(美國)

- Ayu Devices Pvt.有限公司(印度)

- 第五腦室(印度)

- Thinklabs Medical LLC(美國)

- MUSE DIAGNOSTICS PVT LTD. (印度)

- Cardionics Inc.(美國)

- HD Medical Inc.(美國)

- Hulu 設備(美國)

- MCM儀器公司(印度)

- Rijuven Corp.(美國)

- VJ Industries(美國)

數位聽診器市場的最新發展

- 2024年3月,3M宣布新的領導任命。該公司任命了新的高階主管擔任關鍵職位,加強了對成長和創新的承諾。這些變化旨在加強 3M 的領導團隊,與其策略重點保持一致,為股東創造價值,並提高各個業務部門的營運績效

- 2022 年 5 月,Hulu Devices、包括 Stemoscope PRO 及其配套應用程式在內的心肺鏡設備獲得 FDA 醫療器材批准。這一里程碑標誌著數位聽診技術的重大進步,擴大了其在醫療保健領域的應用

- 2021年6月,HD Medical與Stethoscope.com簽署了整合心電圖的HD Steth智慧聽診器的經銷協議。 Nelson B. Schiller 博士對其音質和診斷能力讚不絕口。 Arvind Thiagarajan 對此合作表示興奮,旨在加強心臟護理

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE INDIA DIGITAL STETHOSCOPE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 INDIA DIGITAL STETHOSCOPE MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE ASIA-PACIFIC REGION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 EXPANSION OF HEALTHCARE FACILITIES IN INDIA

6.1.2 INCREASING PREVALENCE OF CARDIOVASCULAR DISEASES IN INDIA

6.1.3 ENHANCED DIAGNOSTICS AND PRECISION OVER TRADITIONAL STETHOSCOPES

6.1.4 TECHNOLOGICAL ADVANCEMENTS IN DIGITAL STETHOSCOPES

6.2 RESTRAINTS

6.2.1 HIGH COST OF DIGITAL STETHOSCOPES

6.2.2 RURAL AREAS FACE UNDERDEVELOPED HEALTHCARE INFRASTRUCTURE

6.3 OPPORTUNITIES

6.3.1 INCREASED USAGE OF DIGITAL STETHOSCOPES DUE TO THE AGING POPULATION

6.3.2 INTEGRATION OF WEARABLE TECHNOLOGY

6.3.3 GROWING TELEMEDICINE AND REMOTE MONITORING MARKET

6.4 CHALLENGES

6.4.1 ADDITIONAL TRAINING TO EFFECTIVELY USE DIGITAL STETHOSCOPES

6.4.2 REQUIREMENTS OF MAINTENANCE AND TECHNICAL SUPPORT

7 INDIA DIGITAL STETHOSCOPE MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 AMPLIFYING STETHOSCOPE

7.2.1 ELECTRONIC-BASED AMPLIFIERS

7.2.2 ACOUSTIC-BASED AMPLIFIERS

7.3 DIGITALIZATION STETHOSCOPE

7.3.1 WIRED CONVENTIONAL AND DIGITAL STETHOSCOPES

7.3.1.1 USB CONNECTIVITY

7.3.1.2 DIRECT ANALOG CONVERSION

7.3.2 WIRELESS-ENABLED STETHOSCOPES

7.3.2.1 BLUETOOTH CONNECTIVITY

7.3.2.2 WI-FI CONNECTIVITY

7.3.3 SMART STETHOSCOPES

7.3.3.1 AI-INTEGRATED STETHOSCOPES

7.3.3.2 SELF-DIAGNOSING CAPABILITIES

7.3.3.3 DATA ANALYTICS AND REMOTE MONITORING FUNCTIONS

8 INDIA DIGITAL STETHOSCOPE MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 INTEGRATED CHEST-PIECE SYSTEM

8.3 WIRELESS TRANSMISSION SYSTEM

8.3.1 SHORT-RANGE WIRELESS

8.3.2 LONG-RANGE WIRELESS

8.3.3 CLOUD-BASED DATA STORAGE AND TRANSMISSION FEATURES

8.4 INTEGRATED RECEIVER HEAD-PIECE SYSTEM

8.4.1 EMBEDDED DIGITAL RECEIVERS

8.4.2 DUAL-MODE RECEIVERS

8.4.3 REAL-TIME DIGITAL VISUALIZATION

9 INDIA DIGITAL STETHOSCOPE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CARDIOLOGY

9.3 GENERAL MEDICINE

9.4 TELEMEDICINE AND REMOTE MONITORING

9.5 PEDIATRICS

9.6 VETERINARY MEDICINE

9.7 PULMONOLOGY

9.8 EMERGENCY MEDICINE

9.9 GERIATRICS AND ELDERLY CARE

9.1 OCCUPATIONAL HEALTH

9.11 MILITARY AND DEFENSE MEDICINE

9.12 ENT

9.13 PHYSICAL THERAPY AND REHABILITATION

9.14 OTHERS

10 INDIA DIGITAL STETHOSCOPE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS AND CLINICS

10.2.1 PRIVATE HOSPITALS

10.2.2 GOVERNMENT HOSPITALS AND MEDICAL INSTITUTIONS

10.2.3 SMALL CLINICS AND PRACTICES

10.3 HOME HEALTHCARE PROVIDERS

10.4 TELEMEDICINE PROVIDERS

10.4.1 TERTIARY TELEHEALTH PLATFORMS

10.4.2 SECONDARY CARE TELEHEALTH PROVIDERS

10.4.3 DIRECT-TO-PATIENT TELEMEDICINE APPLICATIONS

10.5 NURSE PRACTITIONERS

10.6 EMERGENCY MEDICAL TECHNICIANS (EMT) AND FIRST RESPONDERS

11 INDIA DIGITAL STETHOSCOPE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DISTRIBUTORS AND MEDICAL DEVICE SUPPLIERS

11.2.1 NATIONAL DISTRIBUTORS (LARGE-SCALE, MULTI-BRAND)

11.2.2 REGIONAL DISTRIBUTORS (LOCALIZED, FOCUSED ON RURAL AREAS)

11.2.3 SPECIALIZED DISTRIBUTORS (FOCUSING EXCLUSIVELY ON DIGITAL OR HIGH-TECH MEDICAL EQUIPMENT)

11.3 DIRECT SALES

11.3.1 DIRECT SALES TO HOSPITALS AND CLINICS

11.3.2 DIRECT SALES TO GOVERNMENT HEALTH PROGRAMS

11.4 E-COMMERCE CHANNELS

11.4.1 MAJOR ONLINE RETAIL PLATFORMS (E.G., AMAZON INDIA, FLIPKART)

11.4.2 SPECIALIZED MEDICAL EQUIPMENT E-COMMERCE PLATFORMS

11.4.3 OEM WEBSITES AND BRAND-SPECIFIC ONLINE STORES

11.5 PARTNERSHIP COMPANIES/HOSPITALS

11.5.1 PRIVATE HOSPITAL CHAINS WITH IN-HOUSE MEDICAL DEVICE PROCUREMENT

11.5.2 MEDICAL COLLEGES AND TEACHING HOSPITALS

11.5.3 PUBLIC-PRIVATE PARTNERSHIPS (PPP) FOR DIGITAL HEALTH EQUIPMENT

12 INDIA DIGITAL STETHOSCOPE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: INDIA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 3M

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 AYU DEVICES PVT. LTD

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 FIFTH VENTRICLE

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENT

14.4 THINKLABS MEDICAL LLC

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENT

14.5 MUSE DIAGNOSTICS PVT LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 CARDIONICS INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 HULU DEVICES

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 HD MEDICAL INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 MCM INSTRUMENTS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 RIJUVEN CORP.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 V J INDUSTRIES

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 INDIA DIGITAL STETHOSCOPE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 INDIA AMPLIFYING STETHOSCOPE IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 INDIA DIGITALIZATION STETHOSCOPE IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 INDIA WIRED CONVENTIONAL AND DIGITAL STETHOSCOPES IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 INDIA WIRELESS-ENABLED STETHOSCOPES IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 INDIA SMART STETHOSCOPES IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 INDIA DIGITAL STETHOSCOPE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 8 INDIA WIRELESS TRANSMISSION SYSTEM IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 INDIA INTEGRATED RECEIVER HEAD-PIECE SYSTEM IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 INDIA DIGITAL STETHOSCOPE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 11 INDIA DIGITAL STETHOSCOPE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 12 INDIA HOSPITALS AND CLINICS IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 INDIA TELEMEDICINE PROVIDERS IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 INDIA DIGITAL STETHOSCOPE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 15 INDIA DISTRIBUTORS AND MEDICAL DEVICE SUPPLIERS IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 INDIA DIRECT SALES IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 INDIA E-COMMERCE CHANNELS IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 INDIA PARTNERSHIP COMPANIES/HOSPITALS IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 INDIA DIGITAL STETHOSCOPE MARKET: SEGMENTATION

FIGURE 2 INDIA DIGITAL STETHOSCOPE MARKET: DATA TRIANGULATION

FIGURE 3 INDIA DIGITAL STETHOSCOPE MARKET: DROC ANALYSIS

FIGURE 4 INDIA DIGITAL STETHOSCOPE MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 INDIA DIGITAL STETHOSCOPE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA DIGITAL STETHOSCOPE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA DIGITAL STETHOSCOPE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 INDIA DIGITAL STETHOSCOPE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 INDIA DIGITAL STETHOSCOPE MARKET: SEGMENTATION

FIGURE 10 TWO SEGMENTS COMPRISE THE INDIA DIGITAL STETHOSCOPE MARKET, BY PRODUCT TYPE

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 EXPANSION OF HEALTHCARE FACILITIES IN INDIA IS DRIVING THE GROWTH OF THE INDIA DIGITAL STETHOSCOPE MARKET FROM 2025 TO 2032

FIGURE 14 THE AMPLIFYING STETHOSCOPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA DIGITAL STETHOSCOPE MARKET IN 2025 AND 2032

FIGURE 15 DROC ANALYSIS

FIGURE 16 INDIA DIGITAL STETHOSCOPE MARKET: BY PRODUCT TYPE, 2024

FIGURE 17 INDIA DIGITAL STETHOSCOPE MARKET: BY PRODUCT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 18 INDIA DIGITAL STETHOSCOPE MARKET: BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 19 INDIA DIGITAL STETHOSCOPE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 20 INDIA DIGITAL STETHOSCOPE MARKET: BY TECHNOLOGY, 2024

FIGURE 21 INDIA DIGITAL STETHOSCOPE MARKET: BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

FIGURE 22 INDIA DIGITAL STETHOSCOPE MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 23 INDIA DIGITAL STETHOSCOPE MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 24 INDIA DIGITAL STETHOSCOPE MARKET: BY APPLICATION, 2024

FIGURE 25 INDIA DIGITAL STETHOSCOPE MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 26 INDIA DIGITAL STETHOSCOPE MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 27 INDIA DIGITAL STETHOSCOPE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 INDIA DIGITAL STETHOSCOPE MARKET: BY END USER, 2024

FIGURE 29 INDIA DIGITAL STETHOSCOPE MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 30 INDIA DIGITAL STETHOSCOPE MARKET: BY END USER, CAGR (2025-2032)

FIGURE 31 INDIA DIGITAL STETHOSCOPE MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 INDIA DIGITAL STETHOSCOPE MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 33 INDIA DIGITAL STETHOSCOPE MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 34 INDIA DIGITAL STETHOSCOPE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 35 INDIA DIGITAL STETHOSCOPE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 36 INDIA DIGITAL STETHOSCOPE MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。