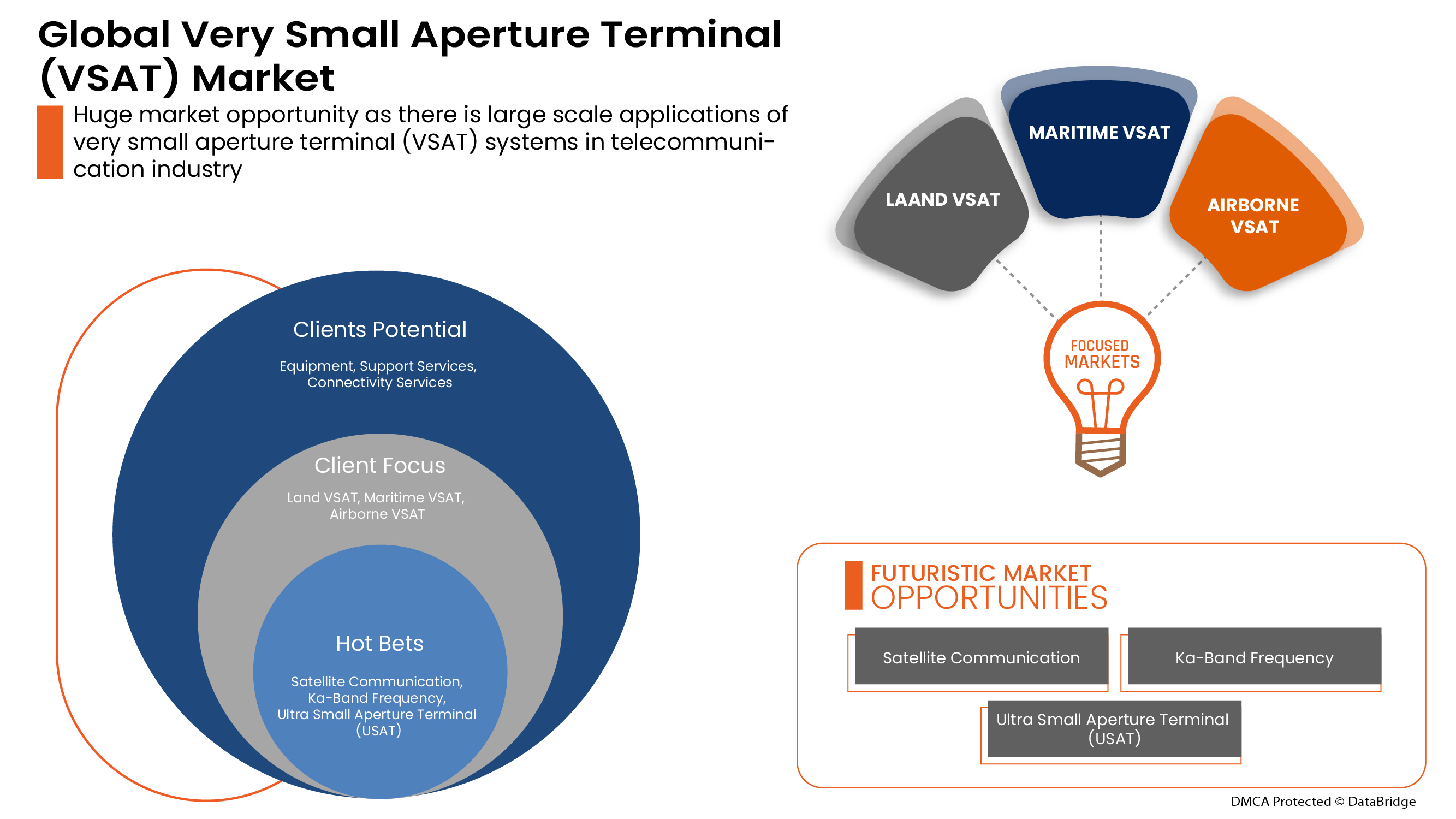

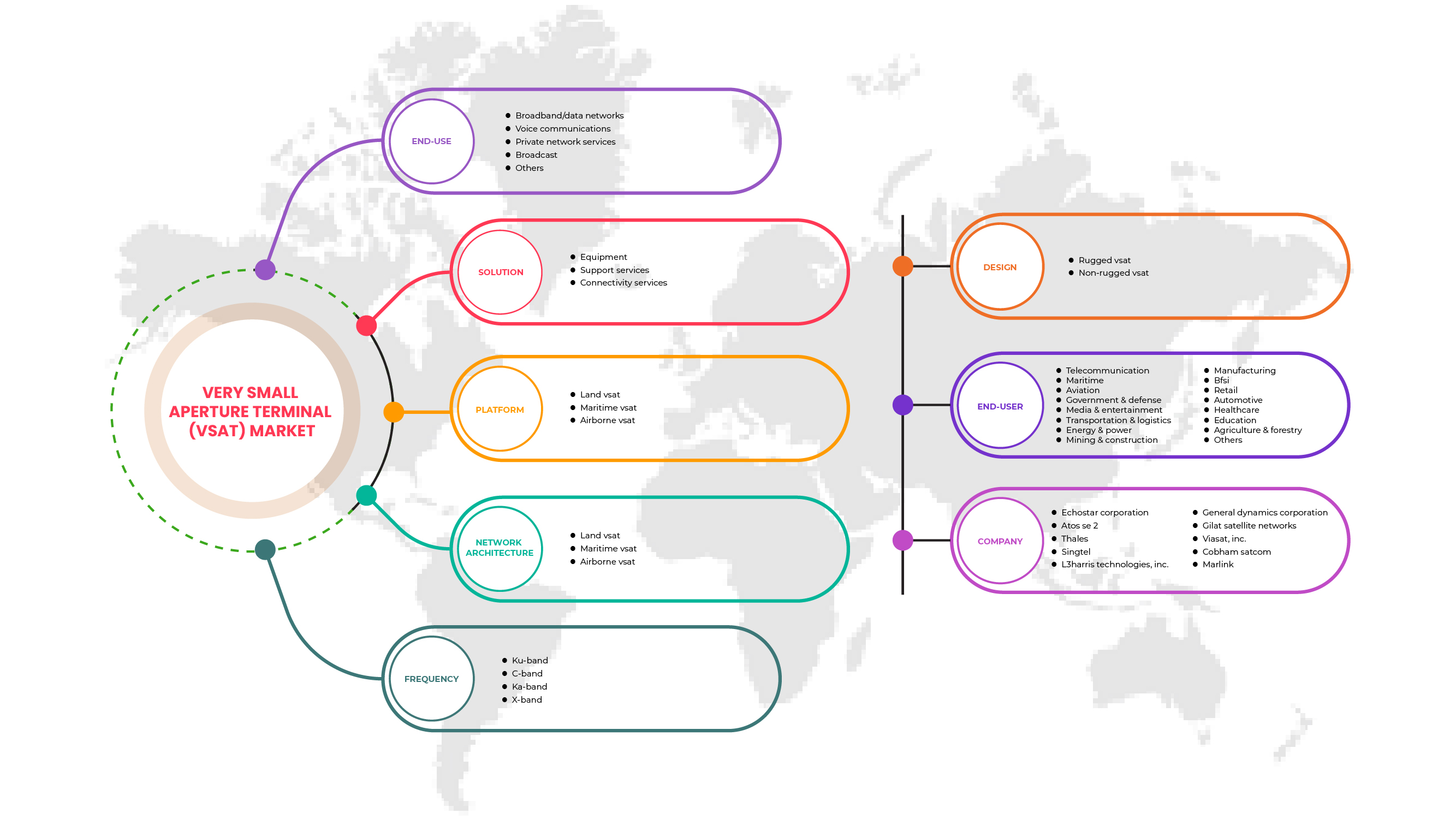

Global Very Small Aperture Terminal (VSAT) Market, By Solution (Equipment, Support Services, Connectivity Services), Platform (Land VSAT, Maritime VSAT, Airborne VSAT), Frequency (Ku-Band, C-Band, Ka-Band, X-Band), Network Architecture (Star Topology, Mesh Topology, Hybrid Topology, Point-To-Point Links), Design (Rugged VSAT and Non-Rugged VSAT), Vertical (Telecommunication, Maritime, Aviation, Government & Defense, Media & Entertainment, Transportation & Logistics, Energy & Power, Mining & Construction, Manufacturing, BFSI, Retail, Automotive, Transportation & Logistics, Healthcare, Education, Agriculture & Forestry and Others), End Use (Broadband/Data Network, Voice Communication, Private Network Service, Broadcast and Others) – Industry Trends and Forecast to 2029.

Very Small Aperture Terminal (VSAT) Market Market Analysis and Size

The massive growth in satellite capacity has resulted in a significant price drop, making very small aperture terminals (VSATs) a viable solution for many industries and regions for the first time. Furthermore, there has been an increased adoption of in VSAT technology in industries such as maritime, oil & gas, aviation among others. These systems also provide the required connectivity between users of medical applications, databases, video, and phones at remote locations, and allow communication with remote and mobile sites.

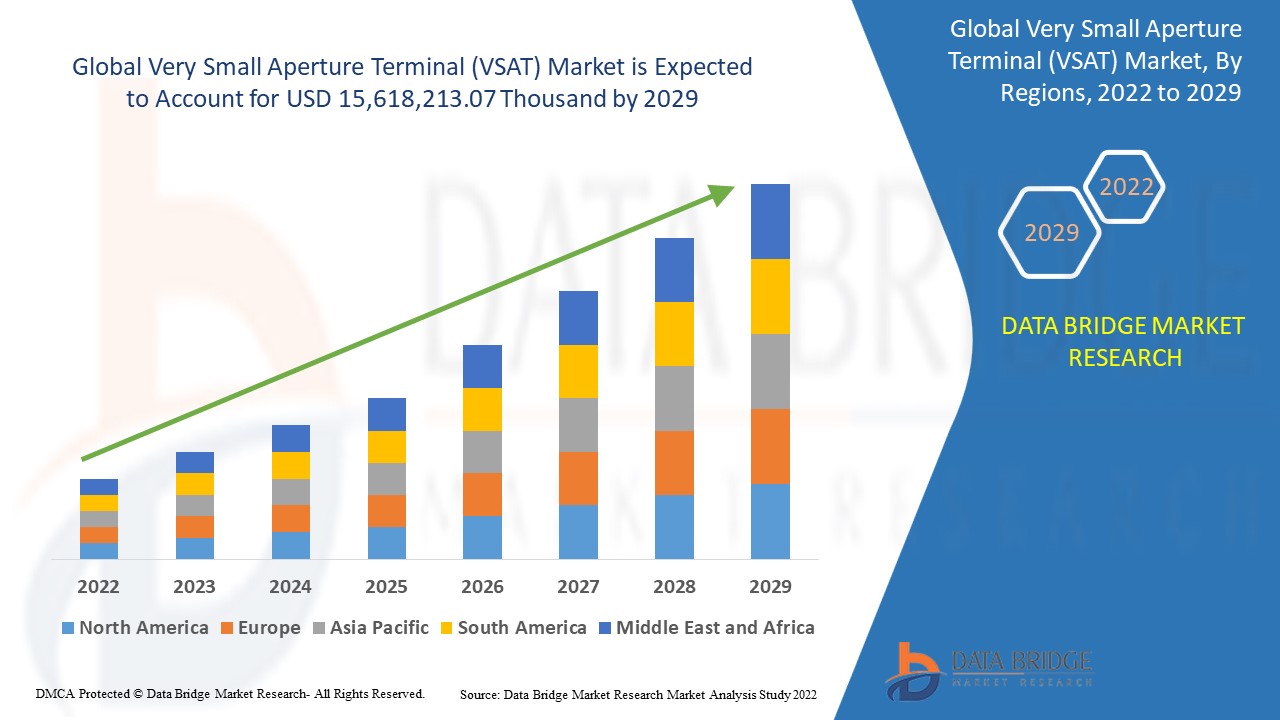

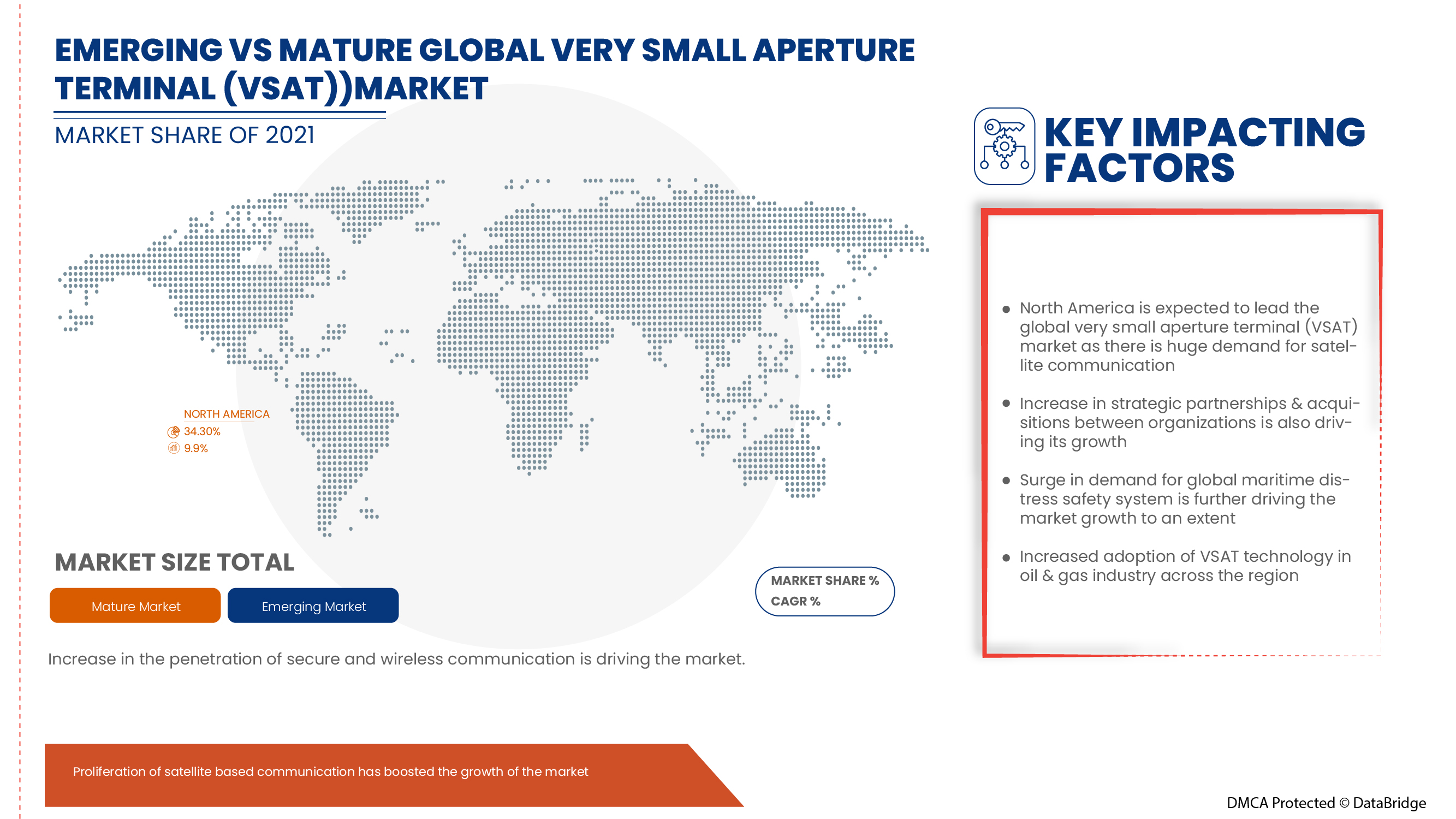

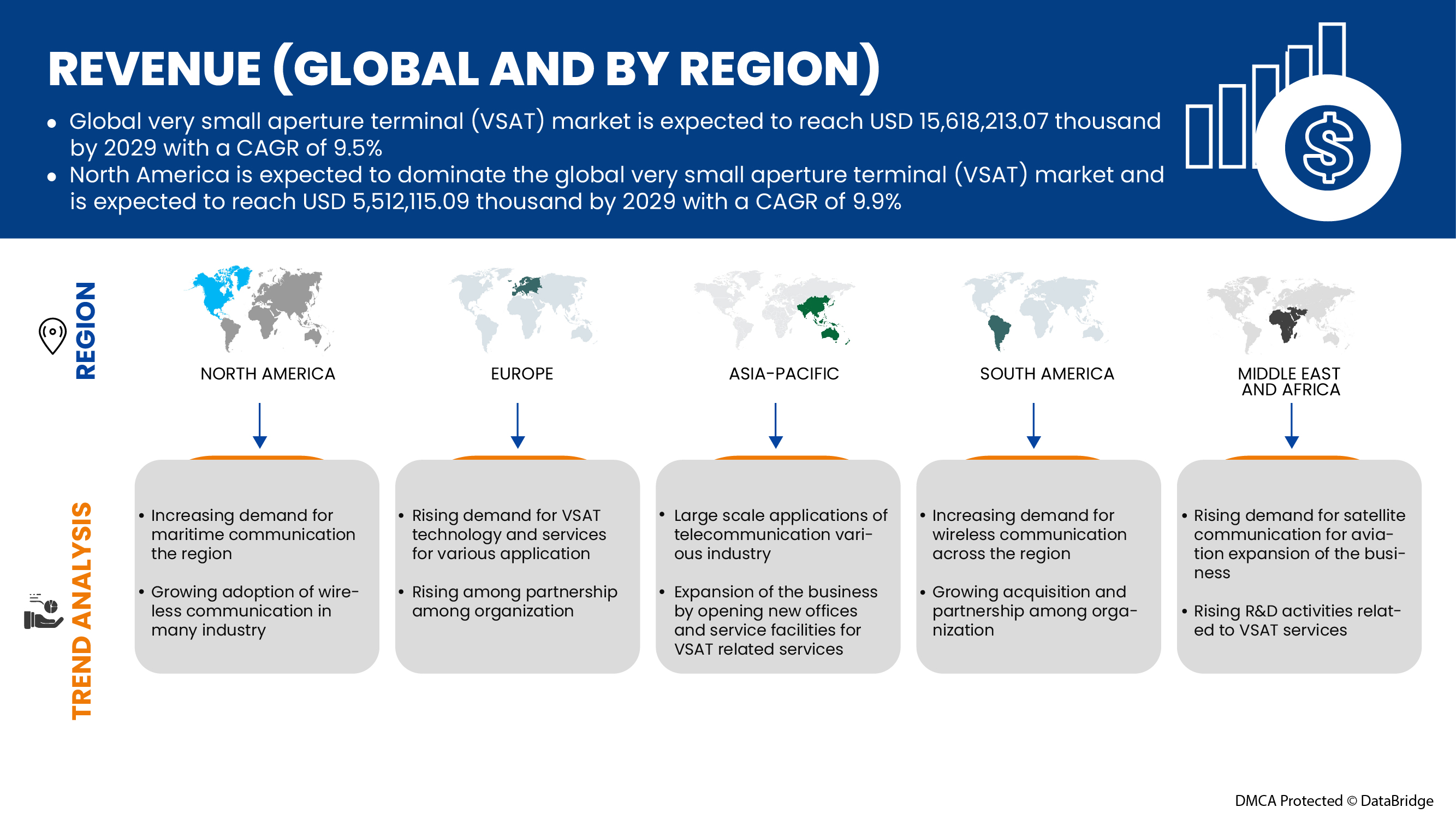

Data Bridge Market Research analyses that the very small aperture terminal (VSAT) market is expected to reach the value of USD 15,618,213.07 thousand by 2029, at a CAGR of 9.5% during the forecast period. The very small aperture terminal (VSAT) market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

By Solution (Equipment, Support Services, Connectivity Services), Platform (Land VSAT, Maritime VSAT, Airborne VSAT), Frequency (Ku-Band, C-Band, Ka-Band, X-Band), Network Architecture (Star Topology, Mesh Topology, Hybrid Topology, Point-To-Point Links), Design (Rugged VSAT and Non-Rugged VSAT), Vertical (Telecommunication, Maritime, Aviation, Government & Defense, Media & Entertainment, Transportation & Logistics, Energy & Power, Mining & Construction, Manufacturing, BFSI, Retail, Automotive, Transportation & Logistics, Healthcare, Education, Agriculture & Forestry and Others), End Use (Broadband/Data Network, Voice Communication, Private Network Service, Broadcast and Others) |

|

Countries Covered |

U.S., Canada and Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Sweden, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia & New Zealand, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America. |

|

Market Players Covered |

Singtel, Vizocom Company, x2nSat, C-COM Satellite Systems Inc, Marlink, Thuraya Telecommunications Company, Speedcast, NSSLGlobal, ST Engineering, Atos SE 2, Iridium Communications Inc., EchoStar Corporation, Orbit Communications Systems Ltd., Ultra, Nisshinbo Holdings Inc., General Dynamics Corporation, Honeywell International Inc., Cobham Satcom, Thales, GILAT SATELLITE NETWORKS, L3Harris Technologies, Inc., Viasat, Inc., KVH Industries, Inc., CPI International Inc., Global Invacom |

Market Definition

A two-way satellite communication system is referred to as a VSAT, or Very Small Aperture Terminal. This system's dish is typically less than 3.8 meters in diameter. A VSAT system's effectiveness may be negatively impacted by the weather. Also, there are three topologies for VSAT networks that are typically used which are star, mesh, or hybrid. Hence, VSAT systems provide the required connectivity between users of medical applications, databases, video, and phones at remote locations, and allow communication with remote and mobile sites.

Global Very Small Aperture Terminal (VSAT) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Growing demand for secure communication for maritime IoT applications

VSAT technology has become a major deal for the maritime industry. They are used for two-way satellite communications for internet, data and telephony, typically in rural areas and harsh environments. In recent years, there has been a progressive shift in the maritime IoT ecosphere. This ecosphere is served by various standard electronic parts that is the hardware integrated with various software. IoT services via satellite enable businesses to access data from assets in the most affordable way. Therefore, ships at sea are remote, vessels and other discrete entities are adopting digital systems as part of larger IoT networks. Using IoT devices and sensor systems across vessels/fleet helps gain competitive edge, by enabling such technologies companies are able to harness the full potential of data for more effective operations and decision-making.

- Increased adoption of VSAT technology in oil & gas industry

Nowadays, the oil and gas sector is undergoing a huge change due to the various digital innovations. There are multiple demands such as safety, security, exploring new areas for oil and increasing visibility between the rig and headquarters, all while keeping operational costs in check. Therefore, rig operators are constantly being pressured to make faster decisions and run operations more efficiently. Also, the oil & gas industry operates in remote onshore and offshore environments where the use of land-based communications is not practical or reliable. Hence, many companies have started implementing VSAT technology so that rig operators can make quick and more informed decisions, which will lower operating costs, raise productivity and provide safer working conditions for crew regardless of location.

Opportunities

- Increasing strategic partnership and acquisition among various organizations

Coordinating and investing in projects is essential for achieving sustained improvements in the very small aperture terminal (VSAT) sector. Due to which the government and other private organizations are striving through partnerships and acquisitions, thereby accelerating the growth of the industries. This helps to build awareness and profit for the organization and thereby creates scope for a new invention in the industry. Also, through partnerships, the company can invest more in advanced technologies to provide more secure and reliable very small aperture terminal (VSAT) services and solutions. Furthermore, this helps both the companies to get recognized in the competitive market, thereby generating profit to an extent.

Restraints/Challenges

- Rising cyber security concerns and data breaches

Cybercrime/hacking and cybersecurity issues have increased by 600% during the pandemic across all sectors. Flaws in network or software security is a weakness which is exploited by hackers to perform unauthorized actions within a system.

According to the recent report published Maritime Cybersecurity Survey by Safety at Sea and BIMCO, in the 12 months prior to February 2020, 31% of organizations fell victim of cyberattacks which is a 9% increase compared to 2019. According to another report published by Robert Rizika, head of North American operations at Naval Dome, reported that cyberattacks on maritime industry’s operational technology (OT) have increased by 900% from 50% in 2017, to 120% and 310% in the year 2018 and 2019 respectively.

- Issues related to reliability of very small aperture terminal (VSAT) network during bad weather

Space weather interferes with radio communication between the earth and satellites because it can cause ionosphere disturbances that reflect, refract, or absorb radio waves. Given that satellite signals must travel great distances in the air, satellite internet services for rural users may be vulnerable to severe weather. While wind rarely affects radio signals, it can wobble, vibrate, or even displace equipment like satellite dishes. Latency and rain fade are two particular factors that affect satellites' capacity to send signals. Rain and atmospheric moisture are the main causes of rain fade, which can weaken or degrade the satellite signal at higher Ku and Ka-band frequencies.

Post COVID-19 Impact on Global Very Small Aperture Terminal (VSAT) Market

COVID-19 created a negative impact on the very small aperture terminal (VSAT) market due to lockdown regulations and shutdown of manufacturing facilities.

The COVID-19 pandemic has impacted the very small aperture terminal (VSAT) market to an extent in negative manner. However, surge in demand for global maritime distress safety system across the world has helped the market to grow after the pandemic. Also, the growth has been high after the market has opened after COVID-19, and it is expected that there would be considerable growth in the sector owing to increasing proliferation of satellite based communication in military and defence sector.

Solution providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the very small aperture terminal (VSAT). With this, the companies will bring advanced technologies to the market. In addition, government initiatives for use of automation technology has led to the market's growth

Recent Developments

- In June 2022, Cobham Satcom entered into partnership with Mangata Networks. The main objective behind this partnership was to strengthen satellite tracking systems and ground infrastructure. Under this partnership, Cobham Satcom agreed to deploy multiple Cobham Satcom 4.0M TRACKER gateway antennas globally. Through this, both companies gained a reputation among their customers and expanded their market presence.

- In December 2021, Orbit Communications Systems Ltd. Acquired Euclid Systems Engineering, a company specialized in the development of smart, lightweight positioners & tracking systems for the defence industries. The motive behind this acquisition was to strengthen the company’s maritime and airborne SATCOM capabilities with the help of Euclid Systems Engineering. This development will help the company to expand its product portfolio and global presence in the market.

Global Very Small Aperture Terminal (VSAT) Market Scope

Global very small aperture terminal (VSAT) market is segmented on the basis of by solution, platform, frequency, network architecture, design, vertical, end use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Solution

- Equipment

- Support Services

- Connectivity Services

On the basis of solution, the global very small aperture terminal (VSAT) market is segmented into equipment, support services, connectivity services.

Platform

- Land VSAT

- Maritime VSAT

- Airborne VSAT

On the basis of platform, the global very small aperture terminal (VSAT) market has been segmented into land VSAT, maritime VSAT, airborne VSAT.

Frequency

- Ku-Band

- C-Band

- Ka-Band

- X-Band

On the basis of frequency, the global very small aperture terminal (VSAT) market has been segmented into Ku-band, C-band, Ka-band and X-band.

Network Architecture

- Star Topology

- Mesh Topology

- Hybrid Topology

- Point-To-Point Links

On the basis of network architecture, the global very small aperture terminal (VSAT) market has been segmented into star topology, mesh topology, hybrid topology and point-to-point links.

Design

- Rugged VSAT

- Non-Rugged VSAT

On the basis of design, the global very small aperture terminal (VSAT) market is segmented into rugged VSAT, non-rugged VSAT.

Vertical

- Telecommunication

- Maritime

- Aviation

- Government & Defense

- Media & Entertainment

- Transportation & Logistics

- Energy & Power

- Mining & Construction

- Manufacturing

- BFSI

- Retail

- Automotive

- Transportation & Logistics

- Healthcare

- Education

- Agriculture & Forestry

- Others

On the basis of vertical, the global very small aperture terminal (VSAT) market is segmented into telecommunication, maritime, aviation, government & defence, media & entertainment, transportation & logistics, energy & power, mining & construction, manufacturing, BFSI, retail, automotive, transportation & logistics, healthcare, education, agriculture & forestry, others.

End Use

- Broadband/Data Network

- Voice Communication

- Private Network Service

- Broadcast

- Others

On the basis of End Use, the global very small aperture terminal (VSAT) market is segmented into broadband/data network, voice communication, private network service, broadcast, others.

Global Very Small Aperture Terminal (VSAT) Market Regional Analysis/Insights

Global very small aperture terminal (VSAT) market is analysed and market size insights and trends are provided by country, material type, manufacturing process and end-use industry as referenced above.

The countries covered in the very small aperture terminal (VSAT) market report are U.S., Canada and Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Sweden, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia & New Zealand, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

North America dominates the very small aperture terminal (VSAT) market owing to rapid adoption of satellite communication technology and increasing research and development activities for reducing antenna size. U.S. dominates in the North America region owing to rising utilization of VSAT in government & defence applications. China dominates in the Asia-Pacific region as it is the world’s biggest manufacturing hub for technological products. Germany dominates in Europe region owing to growing demand for secure communication for maritime and airborne IoT applications.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Very Small Aperture Terminal (VSAT) Market Share Analysis

Global very small aperture terminal (VSAT) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to very small aperture terminal (VSAT) market.

Some of the major players operating in the global very small aperture terminal (VSAT) market are Singtel, Vizocom Company, x2nSat, C-COM Satellite Systems Inc, Marlink , Thuraya Telecommunications Company, Speedcast, NSSLGlobal, ST Engineering, Atos SE 2, Iridium Communications Inc., EchoStar Corporation, Orbit Communications Systems Ltd., Ultra, Nisshinbo Holdings Inc., General Dynamics Corporation, Honeywell International Inc., Cobham Satcom, Thales, GILAT SATELLITE NETWORKS, L3Harris Technologies, Inc., Viasat, Inc., KVH Industries, Inc., CPI International Inc., Global Invacom among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SOLUTION TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 MARKET PLATFORM COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 TECHNOLOGY ANALYSIS

4.3 USE CASES

4.3.1 RELIABLE VSAT CONNECTIVITY IMPROVES OPERATIONAL STABILITY FOR SUN ENTERPRISES

4.3.2 CUSTOMER WINS MAJOR OIL AND GAS CONTRACT USING WINEGARD'S SECRET WEAPON

4.3.3 VIZOCOM'S SATELLITE SOLUTION PROVIDES THE DEPARTMENT OF DEFENSE EDUCATION ACTIVITY (DODEA) WITH INTERNET CONNECTIVITY TO PUERTO RICO AFTER HURRICANE MARIA IN 2017

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR SECURE COMMUNICATION FOR MARITIME IOT APPLICATIONS

5.1.2 INCREASED ADOPTION OF VSAT TECHNOLOGY IN THE OIL AND GAS INDUSTRY

5.1.3 PROLIFERATION OF SATELLITE-BASED COMMUNICATION IN THE MILITARY AND DEFENSE SECTOR

5.2 RESTRAINTS

5.2.1 RISING CYBER SECURITY CONCERNS AND DATA BREACHES

5.2.2 ISSUES RELATED TO DATA LATENCY IN VSAT TECHNOLOGY

5.3 OPPORTUNITIES

5.3.1 SURGE IN DEMAND FOR GLOBAL MARITIME DISTRESS SAFETY SYSTEM

5.3.2 INCREASING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG VARIOUS ORGANIZATIONS

5.3.3 ADVENT OF VSAT SERVICE PROVIDERS IN VARIOUS ENTERPRISE SECTORS

5.4 CHALLENGES

5.4.1 HIGHER HARDWARE AND INSTALLATION COSTS OF VSAT SYSTEMS

5.4.2 ISSUES RELATED TO RELIABILITY OF VSAT NETWORK DURING BAD WEATHER

5.4.3 HIGHER CHANCES OF INTERFERENCE IN VERY SMALL APERTURE TERMINAL (VSAT) NETWORKS

6 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION

6.1 OVERVIEW

6.2 EQUIPMENT

6.2.1 OUT-DOOR UNITS

6.2.1.1 ANTENNAS

6.2.1.2 RF FREQUENCY CONVERTERS

6.2.1.3 AMPLIFIERS

6.2.1.4 DIPLEXERS

6.2.1.5 OTHERS

6.2.2 IN-DOOR UNITS

6.2.2.1 SATELLITE MODEM

6.2.2.2 SATELLITE ROUTER

6.2.3 MOUNTS

6.2.4 ANTENNA CONTROL UNITS

6.2.5 OTHERS

6.2.6 SUPPORT SERVICES

6.2.6.1 PROFESSIONAL SERVICES

6.2.6.1.1 MAINTENANCE & SUPPORT SERVICES

6.2.6.1.2 ENGINEERING & CONSULTATION

6.2.6.1.3 TRAINING

6.2.6.2 MANAGED SERVICES

6.2.6.2.1 INSTALLATION & SETUP

6.2.6.2.2 NETWORK DESIGN & OPTIMIZATION

6.2.6.2.3 NETWORK OPERATIONS

6.3 CONNECTIVITY SERVICES

7 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY PLATFORM

7.1 OVERVIEW

7.2 LAND VSAT

7.2.1 FIXED

7.2.1.1 EARTH STATION

7.2.1.2 COMMERCIAL BUILDINGS

7.2.1.3 COMMAND & CONTROL CENTERS

7.2.2 ON-THE-MOVE

7.2.2.1 COMMERCIAL VEHICLES

7.2.2.2 MILITARY VEHICLES

7.2.2.3 TRAINS

7.2.2.4 EMERGENCY VEHICLES

7.2.2.5 UNMANNED GROUND VEHICLES

7.2.3 PORTABLE/MANPACKS

7.3 MARITIME VSAT

7.3.1 COMMERCIAL SHIP

7.3.2 MILITARY SHIP

7.3.3 UNMANNED MARINE SHIP

7.4 AIRBORNE VSAT

7.4.1 COMMERCIAL AIRCRAFT

7.4.2 MILITARY AIRCRAFT

7.4.3 UNMANNED MARINE SHIP

8 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY NETWORK ARCHITECTURE

8.1 OVERVIEW

8.2 STAR TOPOLOGY

8.3 MESH TOPOLOGY

8.4 HYBRID TOPOLOGY

8.5 POINT-TO-POINT LINKS

9 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY FREQUENCY

9.1 OVERVIEW

9.2 KU-BAND

9.3 C-BAND

9.4 KA-BAND

9.5 X-BAND

10 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY DESIGN

10.1 OVERVIEW

10.2 RUGGED VSAT

10.3 NON- RUGGED VSAT

11 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 TELECOMMUNICATION

11.2.1 EQUIPMENT

11.2.2 SUPPORT SERVICES

11.2.3 CONNECTIVITY SERVICES

11.3 MARITIME

11.3.1 EQUIPMENT

11.3.2 SUPPORT SERVICES

11.3.3 CONNECTIVITY SERVICES

11.4 AVIATION

11.4.1 EQUIPMENT

11.4.2 SUPPORT SERVICES

11.4.3 CONNECTIVITY SERVICES

11.5 GOVERNMENT & DEFENSE

11.5.1 EQUIPMENT

11.5.2 SUPPORT SERVICES

11.5.3 CONNECTIVITY SERVICES

11.6 MEDIA & ENTERTAINMENT

11.6.1 EQUIPMENT

11.6.2 SUPPORT SERVICES

11.6.3 CONNECTIVITY SERVICES

11.7 TRANSPORTATION & LOGISTICS

11.7.1 EQUIPMENT

11.7.2 SUPPORT SERVICES

11.7.3 CONNECTIVITY SERVICES

11.8 ENERGY & POWER

11.9 MINING & CONSTRUCTION

11.9.1 EQUIPMENT

11.9.2 SUPPORT SERVICES

11.9.3 CONNECTIVITY SERVICES

11.1 MANUFACTURING

11.10.1 EQUIPMENT

11.10.2 SUPPORT SERVICES

11.10.3 CONNECTIVITY SERVICES

11.11 BFSI

11.12 RETAIL

11.12.1 EQUIPMENT

11.12.2 SUPPORT SERVICES

11.12.3 CONNECTIVITY SERVICES

11.13 AUTOMOTIVE

11.13.1 EQUIPMENT

11.13.2 SUPPORT SERVICES

11.13.3 CONNECTIVITY SERVICES

11.14 HEALTHCARE

11.15 EDUCATION

11.16 AGRICULTURE & FORESTRY

11.16.1 EQUIPMENT

11.16.2 SUPPORT SERVICES

11.16.3 CONNECTIVITY SERVICES

11.17 OTHERS

12 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY END-USE

12.1 OVERVIEW

12.2 BROADBAND/DATA NETWORKS

12.3 VOICE COMMUNICATIONS

12.4 PRIVATE NETWORK SERVICES

12.5 BROADCAST

12.6 OTHERS

13 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 ASIA-PACIFIC

13.3.1 CHINA

13.3.2 JAPAN

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 AUSTRALIA & NEW ZEALAND

13.3.6 INDONESIA

13.3.7 THAILAND

13.3.8 SINGAPORE

13.3.9 MALAYSIA

13.3.10 PHILIPPINES

13.3.11 REST OF ASIA-PACIFIC

13.4 EUROPE

13.4.1 GERMANY

13.4.2 U.K.

13.4.3 FRANCE

13.4.4 SPAIN

13.4.5 ITALY

13.4.6 RUSSIA

13.4.7 NETHERLANDS

13.4.8 SWITZERLAND

13.4.9 SWEDEN

13.4.10 BELGIUM

13.4.11 TURKEY

13.4.12 REST OF EUROPE

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST & AFRICA

13.6.1 SAUDI ARABIA

13.6.2 U.A.E.

13.6.3 SOUTH AFRICA

13.6.4 ISRAEL

13.6.5 EGYPT

13.6.6 REST OF MIDDLE EAST & AFRICA

14 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.3 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANLYSIS

16 COMPAMY PROFILE

16.1 ECHOSTAR CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ATOS SE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 THALES

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SINGTEL

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 L3HARRIS TECHNOLOGIES, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 GENERAL DYNAMICS CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 GILAT SATELLITE NETWORKS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 C-COM SATELLITE SYSTEMS INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 COBHAM SATCOM

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CPI INTERNATIONAL INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 GLOBAL INVACOM

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 SERVICES PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 HONEYWELL INTERNATIONAL INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 IRIDIUM COMMUNICATIONS INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 KVH INDUSTRIES, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SOLUTION PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 MARLINK

16.15.1 COMPANY SNAPSHOT

16.15.2 SOLUTION PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 NISSHINBO HOLDINGS INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NSSL GLOBAL

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 ORBIT COMMUNICATIONS SYSTEMS LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SPEEDCAST

16.19.1 COMPANY SNAPSHOT

16.19.2 SOLUTION PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 ST ENGINEERING

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 THURAYA TELECOMMUNICATIONS COMPANY

16.21.1 COMPANY SNAPSHOT

16.21.2 SERVICE PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 ULTRA

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 VIASAT, INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 VIZOCOM COMPANY

16.24.1 COMPANY SNAPSHOT

16.24.2 SOLUTION PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 X2NSAT

16.25.1 COMPANY SNAPSHOT

16.25.2 SERVICE PORTFOLIO

16.25.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 CYBER-ATTACKS ON VESSELS/MARITIME INDUSTRY

TABLE 2 TYPICAL HARDWARE AND INSTALLATION COSTS

TABLE 3 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 4 GLOBAL EQUIPMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 GLOBAL EQUIPMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 GLOBAL OUT-DOOR UNITS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 GLOBAL IN-DOOR UNITS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 GLOBAL SUPPORT SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 GLOBAL SUPPORT SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 GLOBAL PROFESSIONAL SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 GLOBAL MANAGED SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 GLOBAL CONNECTIVITY SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY PLATFORM, 2020-2029 (USD THOUSAND)

TABLE 14 GLOBAL LAND VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 GLOBAL LAND VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 GLOBAL FIXED IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 GLOBAL ON-THE-MOVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 GLOBAL MARITIME VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 GLOBAL MARITIME VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 GLOBAL AIRBORNE VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 GLOBAL AIRBORNE VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY NETWORK ARCHITECTURE, 2020-2029 (USD THOUSAND)

TABLE 23 GLOBAL STAR TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 GLOBAL MESH TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 GLOBAL HYBRID TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 GLOBAL POINT-TO-POINT LINKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY FREQUENCY, 2020-2029 (USD THOUSAND)

TABLE 28 GLOBAL KU-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 GLOBAL C-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 GLOBAL KA-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 GLOBAL X-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY DESIGN, 2020-2029 (USD THOUSAND)

TABLE 33 GLOBAL RUGGED VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 GLOBAL NON- RUGGED VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 36 GLOBAL TELECOMMUNICATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 GLOBAL TELECOMMUNICATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 38 GLOBAL MARITIME IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 GLOBAL MARITIME IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 40 GLOBAL AVIATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 GLOBAL AVIATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 42 GLOBAL GOVERNMENT & DEFENSE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 GLOBAL GOVERNMENT & DEFENSE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 44 GLOBAL MEDIA & ENTERTAINMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 GLOBAL MEDIA & ENTERTAINMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 46 GLOBAL TRANSPORTATION & LOGISTICS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 GLOBAL TRANSPORTATION & LOGISTICS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 48 GLOBAL ENERGY & POWER IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 GLOBAL MINING & CONSTRUCTION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 50 GLOBAL MINING & CONSTRUCTION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 51 GLOBAL MANUFACTURING IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 52 GLOBAL MANUFACTURING IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 53 GLOBAL BFSI IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 54 GLOBAL RETAIL IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 55 GLOBAL RETAIL IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 56 GLOBAL AUTOMOTIVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 57 GLOBAL AUTOMOTIVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 58 GLOBAL HEALTHCARE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 59 GLOBAL EDUCATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 60 GLOBAL AGRICULTURE & FORESTRY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 61 GLOBAL AGRICULTURE & FORESTRY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 62 GLOBAL OTHERS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 64 GLOBAL BROADBAND/DATA NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 65 GLOBAL VOICE COMMUNICATIONS NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 66 GLOBAL PRIVATE NETWORK SERVICES NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 67 GLOBAL BROADCAST IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 68 GLOBAL OTHERS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 69 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 70 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 72 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 73 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 74 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

图片列表

FIGURE 1 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SEGMENTATION

FIGURE 2 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: MARKET PLATFORM COVERAGE GRID

FIGURE 10 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE WHEREAS ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN THE FORECAST PERIOD

FIGURE 12 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR GLOBAL VERY SMALL APERTURE TERMINAL MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 13 PROLIFERATION OF SATELLITE-BASED COMMUNICATION IN THE MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 14 EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN 2022 & 2029

FIGURE 15 IMPACT OF VARIOUS SATELLITE TECHNOLOGY TRENDS AND INNOVATIONS IN 2022

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET

FIGURE 17 REGIONAL MARKET SHARE IN SERVICE ENTERPRISE FOR THE YEAR 2016

FIGURE 18 GLOBAL SHIPPING LOSSES BY THE NUMBER OF VESSELS OVER THE YEARS

FIGURE 19 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, SOLUTION, 2021

FIGURE 20 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, PLATFORM, 2021 (USD THOUSAND)

FIGURE 21 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, NETWORK ARCHITECTURE, 2021 (USD THOUSAND)

FIGURE 22 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, FREQUENCY, 2021 (USD THOUSAND)

FIGURE 23 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, DESIGN, 2021 (USD THOUSAND)

FIGURE 24 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, VERTICAL, 2021

FIGURE 25 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, END-USE, 2021 (USD THOUSAND)

FIGURE 26 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 27 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 28 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 31 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 32 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 33 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 36 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 37 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 38 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 41 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 42 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 43 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 46 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 47 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 48 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 49 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 50 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 51 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 52 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 53 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 54 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 55 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 56 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

FIGURE 58 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

FIGURE 59 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。