Global Sensors Market

市场规模(十亿美元)

CAGR :

%

USD

236.75 Billion

USD

557.44 Billion

2024

2032

USD

236.75 Billion

USD

557.44 Billion

2024

2032

| 2025 –2032 | |

| USD 236.75 Billion | |

| USD 557.44 Billion | |

|

|

|

|

全球感測器市場細分,按類型(溫度感測器、影像感測器、運動感測器壓力感測器觸控感測器接近和位移感測器、加速度計和速度感測器、濕度和水分感測器、氣體感測器、光學感測器、力感測器、流量感測器、液位感測器、生物感測器位置感測器等)、技術(MEMS、CMOS、NEMS 等)和電信、石油和天然氣、化學、食品和飲料、建築、採礦、造紙和紙漿等)- 行業趨勢和預測到 2032 年

感測器市場規模

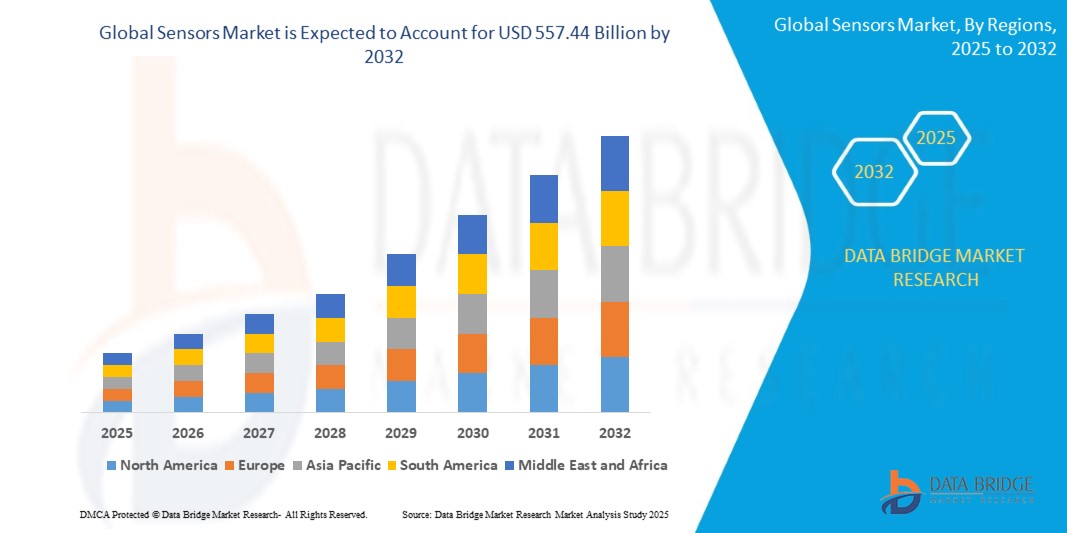

- 2024 年全球感測器市場規模為2,367.5 億美元,預計到 2032 年將達到 5,574.4 億美元

- 在 2025 年至 2032 年的預測期內,市場可能以11.4% 的複合年增長率成長,主要受汽車、醫療保健、消費性電子和工業自動化等產業需求成長的推動

- 這種成長受到物聯網、智慧型設備和人工智慧驅動應用等因素的推動,推動了先進感測器在即時監控和數據收集方面的應用

感測器市場分析

- 全球感測器市場經歷了顯著成長,這得益於各行各業對永續、輕量和耐用包裝解決方案的需求不斷增長。電子商務、食品飲料、醫藥、消費品等重點產業

- 數位印刷和智慧包裝技術的創新進一步增強了品牌和客製化機會,滿足了不斷變化的消費者偏好

- 自動化、材料創新和循環經濟措施的進步將決定包裝產業的未來,從而確保提高包裝生產的效率和永續性

- 例如,2023 年 3 月,索尼半導體解決方案推出了專為智慧型手機設計的 SPAD(單光子雪崩二極體)深度感測器,提供高精度、低功耗的距離測量性能。此感測器具有業界最高的光子探測效率,可實現精確的深度感應和增強的 3D 功能

- 此外,嚴格的環境法規和對環保包裝解決方案的推動正在加速市場擴大

報告範圍和感測器市場細分

|

屬性 |

感測器關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

南美洲

中東和非洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、按地理位置表示的公司生產和產能、分銷商和合作夥伴的網絡佈局、詳細和更新的價格趨勢分析以及供應鏈和需求的缺口分析。 |

感測器市場趨勢

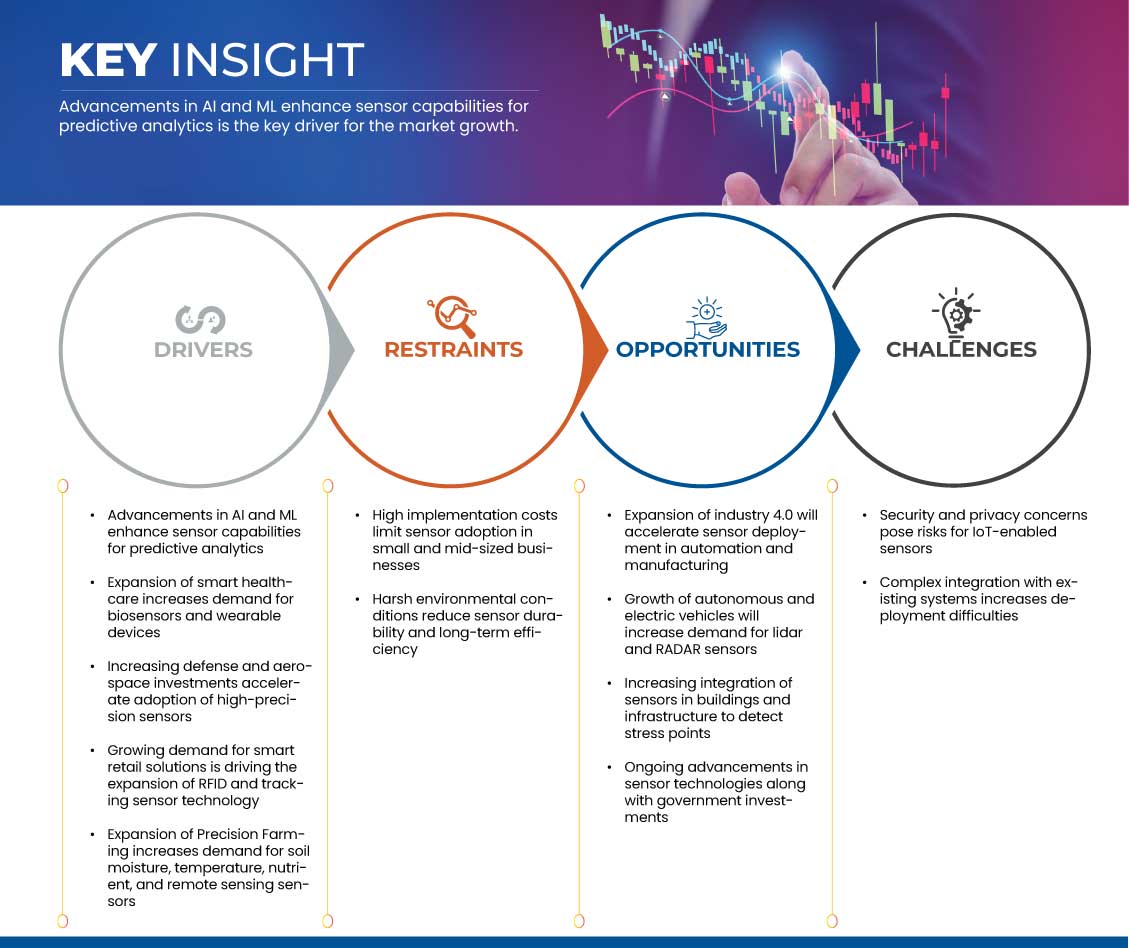

“人工智慧和機器學習的進步增強了感測器的預測分析能力”

- 人工智慧和機器學習與感測器的結合正在透過實現即時數據處理、異常檢測和預測性維護來改變產業。這些技術使感測器能夠提供智慧洞察,減少營運停機時間並提高效率

- 隨著人工智慧演算法變得越來越複雜,感測器也不斷發展以處理複雜的資料集,從而實現更快、更準確的決策。智慧電網、自動駕駛汽車和工業物聯網等領域對人工智慧感測器的需求正在增長,這些領域的預測能力可以提高營運安全性和效率

- 例如,根據 digit7 的報導,2024 年 8 月,機器學習演算法已應用於現實世界場景。邏輯回歸有助於檢測信用卡欺詐,決策樹改善了客戶支持,隨機森林實現了預測性維護。神經網路為自動駕駛汽車和語音辨識提供動力,而協同過濾增強了個人化推薦。人工智慧和機器學習的進步提高了感測器的預測分析能力,使各行各業能夠分析即時感測器數據,以進行設備監控、氣候變遷分析和醫療風險評估

- 因此,採用智慧數據驅動解決方案和人工智慧增強型感測器的產業正在推動全球感測器市場的顯著成長

- 智慧家庭技術和預測性維護解決方案的廣泛採用進一步推動了感測器的部署

感測器市場動態

司機

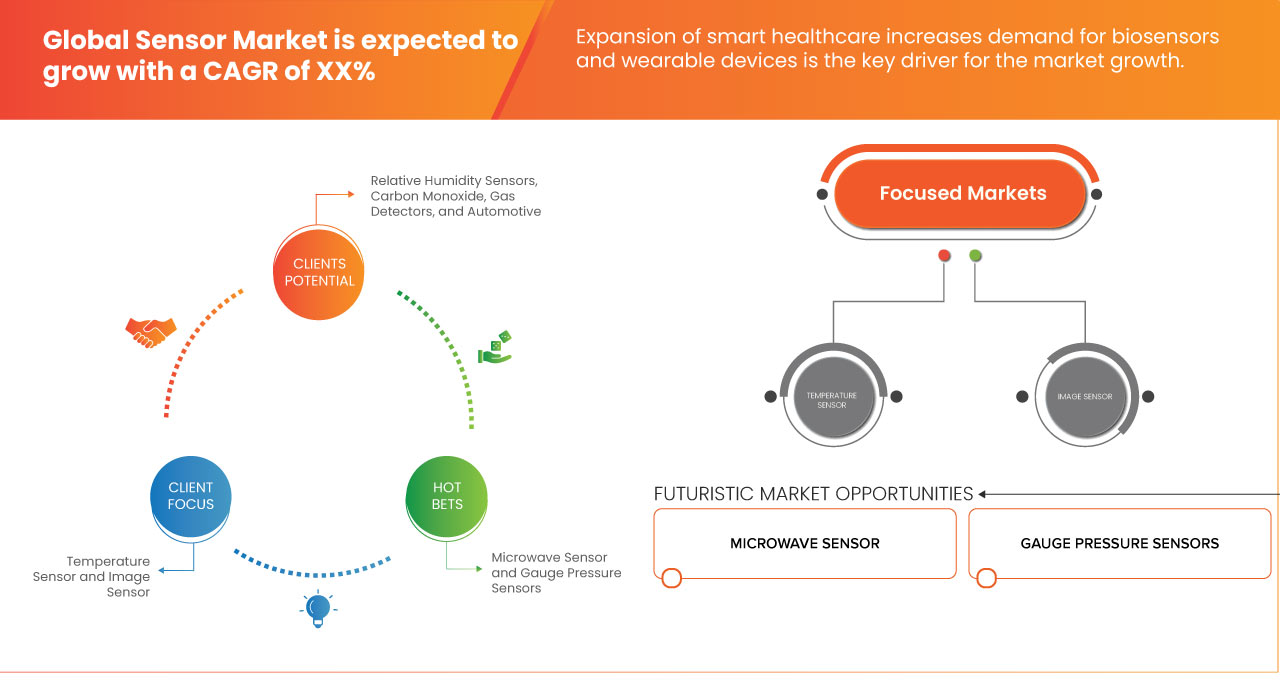

“智慧醫療的擴展增加了對生物感測器和可穿戴設備的需求”

- 生物感測器和穿戴式裝置正在透過即時監測心率、血糖水平和體溫等生命體徵,徹底改變醫療保健

- 小型化和無線連接方面的進步使得這些設備更易於使用,從而改善了患者護理和診斷。物聯網和人工智慧驅動的監控解決方案的日益普及進一步推動了對生物感測器的需求

- 此外,與基於雲端的平台整合的可穿戴生物感測器可實現患者和醫療保健提供者之間的無縫資料共享。這項進步增強了早期疾病的檢測,改善了慢性疾病的管理,並支持積極的醫療幹預以獲得更好的健康結果

- 例如,2025 年 2 月,醫學未來學家報告稱,包括智慧感測器在內的數位健康技術可以透過監測健康狀況和使用人工智慧分析數據來增強老年人護理。儘管存在諸如負擔能力和缺乏有針對性的創新等挑戰,但隨著醫療保健系統優先考慮生活質量,對此類技術的需求正在增長。由於感測器在追蹤生命體徵和支持遠距照護方面發揮著至關重要的作用,其採用率預計將上升,從而促進老年醫療保健解決方案的進步

- 隨著醫療保健轉向遠端監控和數據驅動解決方案,先進感測器的採用正在加速市場

- 隨著準確性、效率和可訪問性的不斷提高,基於感測器的解決方案的整合度將進一步提高

機會

“工業4.0的擴展將加速感測器在自動化和製造業中的部署”

- 工業 4.0 的快速發展正在推動自動化和製造業對智慧感測器的需求。隨著各行各業擁抱物聯網、人工智慧和機器學習,感測器在實現即時資料收集、預測性維護和自動決策方面發揮著至關重要的作用

- 隨著機器人、數位孿生和智慧工廠的日益普及,汽車、電子和醫療保健等各個領域對高精度感測器的需求持續增長。投資自動化和互聯繫統的公司依靠感測器來監控流程、確保品質控制和優化資源利用率

- 這一趨勢不僅加速了創新,也為感測器製造商擴大了開發下一代節能、高度整合的解決方案的機會

- 例如,根據甲骨文公司的數據,2023 年 12 月,工業 4.0 將透過整合自動化、人工智慧和數據分析來改變製造業,從而創建智慧工廠,提高效率、降低成本並改善品質。 BMW、西門子和 LG 等公司正在利用感測器、機器人和即時分析來優化生產。這種擴展推動了對感測器的更高需求,包括接近感測器、視覺感測器、溫度感測器和運動感測器,從而實現即時數據收集、預測性維護和無縫自動化

- 先進技術在工業過程中的日益融合為感測器的創新和擴展提供了重大機會

- 隨著自動化、人工智慧和物聯網的普及,對高效能、可靠和智慧感測器的需求只會增加

克制/挑戰

“高昂的實施成本限制了中小型企業對感測器的採用”

- 雖然感測器提供了顯著的好處,但安裝、校準和整合到現有系統所需的高額初始投資仍然是一個挑戰,特別是對於中小型企業而言

- 先進的感測器,尤其是人工智慧和物聯網感測器,通常需要昂貴的基礎設施升級和熟練的人員來操作。這種財務負擔限制了其廣泛採用,延緩了製造業、醫療保健和零售業等行業的數位轉型

- 許多中小企業難以證明昂貴的基於感測器的自動化的投資回報,導致採用率下降。努力開發價格實惠、即插即用的感測器解決方案可以幫助小型企業彌補差距

- 例如,2024 年 11 月,Qviro BV 分析表明,2025 年工業自動化的成本將根據系統類型、產業需求和定製而有所不同。費用包括硬體、軟體、安裝、培訓和維護。機器人的價格從 20,000 美元到 500,000 美元不等,此外還需要額外的整合和支援成本。高昂的實施成本限制了感測器市場的成長,因為小型企業在採用先進的自動化技術時面臨財務障礙

- 然而,實施感測器的財務負擔仍然是中小企業面臨的重大挑戰,限制了它們採用自動化和智慧技術的能力

- 安裝、維護和系統整合相關的高成本減緩了市場擴張,限制了先進感測器應用的獲取

感測器市場範圍

根據類型、技術和最終用戶,市場分為三個顯著的部分。

|

分割 |

細分 |

|

按類型 |

|

|

依技術 |

|

|

按最終用戶 |

|

感測器市場區域分析

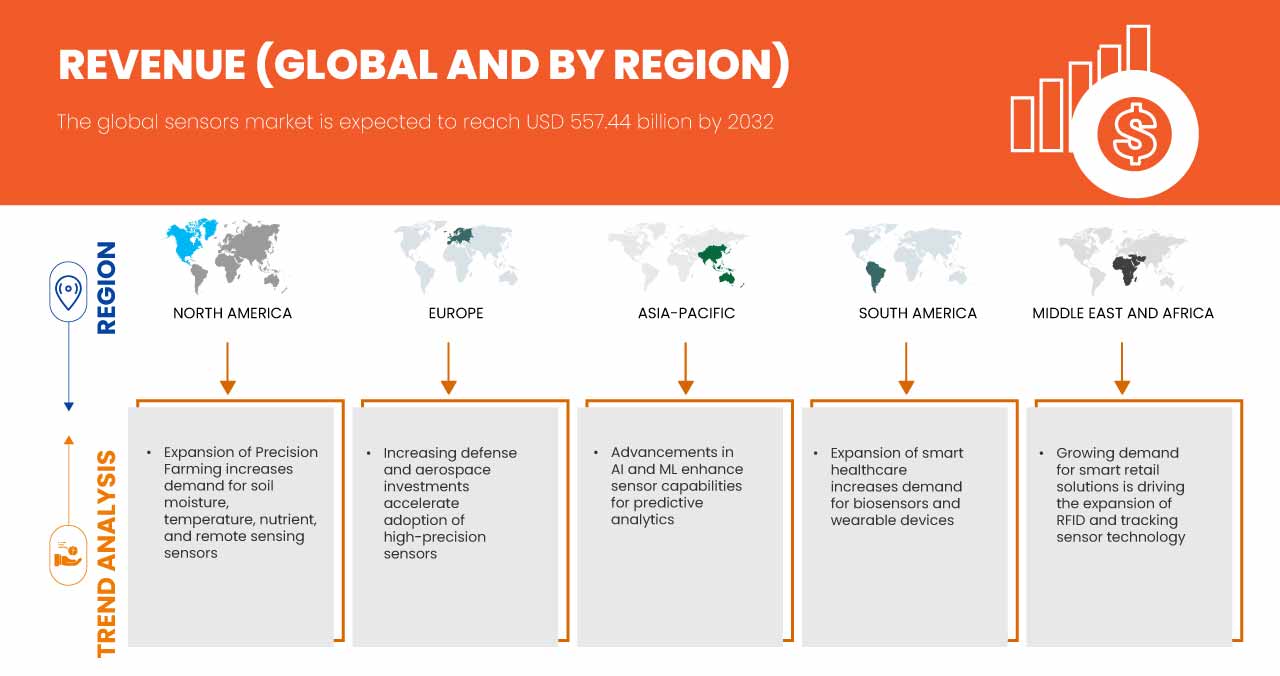

“亞太地區是感測器市場的主導地區,預計將實現最高的成長率”

- 由於工業化進程加快、自動化程度不斷提高以及對物聯網設備的需求不斷增長,亞太地區預計將主導全球感測器市場

- 該地區不斷擴大的製造業,加上政府推動智慧工廠和工業 4.0 的舉措,正在推動各行各業對先進感測器的需求

- 此外,智慧型設備、電動車和醫療保健監控系統的普及率不斷提高,正在推動市場成長。半導體製造商的強大影響力和人工智慧驅動的感測器技術的進步進一步鞏固了該地區在全球感測器市場的領導地位

感測器市場佔有率

市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、全球影響力、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用優勢。以上提供的數據點僅與公司對市場的關注有關。

市場中主要的市場領導者有:

- 台灣半導體製造股份有限公司 (中國)

- 博世感測器技術有限公司(德國)

- 索尼半導體解決方案公司(日本)

- 三菱電機株式會社(日本)

- 霍尼韋爾國際公司(美國)

- 高通科技公司(美國)

- Endress+Hauser集團服務股份公司(瑞士)

- 恩智浦半導體(荷蘭)

- TE Connectivity(愛爾蘭)

- WIKA 儀器印度私人有限公司有限公司(印度)

- 瑞薩電子株式會社(日本)

- Teledyne Technologies Incorporated(美國)

- 羅克韋爾自動化(美國)

- 英飛凌科技股份公司(德國)

- ams-OSRAM AG(奧地利)

- TDK公司(日本)

- Sensirion AG(瑞士)

- Figaro Engineering Inc.(日本)

- Omega Engineering inc(美國)

- First Sensor AG(德國)

- 德懷爾儀器有限責任公司(我們)

- 藏紅花(法國)

- 安費諾公司(美國)

- 松下控股公司(日本)

- 艾默生電氣公司(美國)

- 意法半導體(荷蘭)

- 微晶片科技公司(美國)

- 西門子(德國)

- 德州儀器公司(美國)

- 橫河電機株式會社(日本)

感測器市場的最新發展

- 2025 年 2 月,《醫學未來學家》報道稱,包括智慧感測器在內的數位健康技術可以透過監測健康狀況和使用人工智慧分析數據來加強老年人護理。儘管存在諸如負擔能力和缺乏有針對性的創新等挑戰,但隨著醫療保健系統優先考慮生活質量,對此類技術的需求正在增長。由於感測器在追蹤生命體徵和支持遠距照護方面發揮著至關重要的作用,其採用率預計將上升,從而促進老年醫療保健解決方案的進步

- 2023 年 12 月,TriMedika 分享的數據 顯示,感測器已整合到各種醫療設備中,從血糖監測儀到穿戴式健康追蹤器,從而增強了患者護理。 TRITEMP 非接觸式溫度計展示了感測器技術如何提高準確性和便利性。隨著醫療保健採用更先進的傳感器,對基於感測器的解決方案的需求不斷增長,推動了感測器市場的擴張

- 2021年6月,霍尼韋爾國際公司報告稱,醫療感測器透過增強診斷、監測和治療顯著改善了醫療保健。它們被整合到呼吸機、輸液幫浦和病床等設備中,以提供精確的即時數據。居家健康監測也隨著感測器技術的進步而進步,可以實現遠距病人照護。隨著醫療保健行業越來越多地採用感測器驅動的設備,對感測器的需求不斷增長,從而推動了感測器市場

- 2024年10月,Spirit Electronics簽署了TE Connectivity感測器產品的特許分銷協議,為航空航太和國防提供高可靠性解決方案。 TE 感測器用於駕駛艙控制、飛行系統、引擎和太空任務,包括 NASA 專案。它們的先進技術和在惡劣環境下的耐用性增加了對衛星和軍事行動中感測應用的需求。此次合作透過擴展航空航太和國防工業的專用解決方案,為不斷增長的感測器市場做出了貢獻

- 2023年9月,AMETEK感測器和流體管理系統為軍用飛機提供先進的感測器,包括壓力、溫度、液位和運動感測器。這些感測器提高了飛機在惡劣戰場環境下的性能、安全性和任務效率。 AMETEK 的技術為 F-35 和 F/A-18 等主要軍用飛機提供支援。國防應用對可靠、高性能感測器的需求不斷增長,促進了全球感測器市場的成長

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2 COMPETITOR KEY PRICING STRATEGIES

4.3 TECHNOLOGY ANALYSIS OF THE GLOBAL SENSOR MARKET

4.4 PENETRATION AND GROWTH PROSPECT MAPPING

4.5 GROWTH PROSPECT ANALYSIS:

4.6 COMPETITIVE INTELLIGENCE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVANCEMENTS IN AI AND ML ENHANCE SENSOR CAPABILITIES FOR PREDICTIVE ANALYTICS

5.1.2 EXPANSION OF SMART HEALTHCARE INCREASES DEMAND FOR BIOSENSORS AND WEARABLE DEVICES

5.1.3 INCREASING DEFENSE AND AEROSPACE INVESTMENTS ACCELERATE THE ADOPTION OF HIGH-PRECISION SENSORS

5.1.4 DEMAND FOR SMART RETAIL SOLUTIONS IS DRIVING THE EXPANSION OF RFID AND TRACKING SENSOR TECHNOLOGY

5.1.5 EXPANSION OF PRECISION FARMING INCREASES DEMAND FOR SOIL MOISTURE, TEMPERATURE, NUTRIENT, AND REMOTE SENSING SENSORS

5.2 RESTRAINTS

5.2.1 HIGH IMPLEMENTATION COSTS LIMIT SENSOR ADOPTION IN SMALL AND MID-SIZED BUSINESSES

5.2.2 HARSH ENVIRONMENTAL CONDITIONS REDUCE SENSOR DURABILITY AND LONG-TERM EFFICIENCY

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF INDUSTRY 4.0 WILL ACCELERATE SENSOR DEPLOYMENT IN AUTOMATION AND MANUFACTURING

5.3.2 GROWTH OF AUTONOMOUS AND ELECTRIC VEHICLES WILL INCREASE DEMAND FOR LIDAR AND RADAR SENSORS

5.3.3 INCREASING INTEGRATION OF SENSORS IN BUILDINGS AND INFRASTRUCTURE TO DETECT STRESS POINTS

5.3.4 ONGOING ADVANCEMENTS IN SENSOR TECHNOLOGIES, ALONG WITH GOVERNMENT INVESTMENTS

5.4 CHALLENGES

5.4.1 SECURITY AND PRIVACY CONCERNS POSE RISKS FOR IOT-ENABLED SENSORS

5.4.2 COMPLEX INTEGRATION WITH EXISTING SYSTEMS INCREASES DEPLOYMENT DIFFICULTIES

6 GLOBAL SENSORS MARKET, BY TYPE

6.1 OVERVIEW

6.2 TEMPERATURE SENSOR

6.2.1 TEMPERATURE SENSOR, BY TYPE

6.2.1.1 CONTACT

6.2.1.1.1 CONTACT, BY TYPE

6.2.1.1.1.1 THERMISTORS

6.2.1.1.1.2 THERMOCOUPLES

6.2.1.1.1.3 RESISTIVE TEMPERATURE DETECTORS (RTDS)

6.2.1.1.1.4 TEMPERATURE SENSOR ICS

6.2.1.1.1.5 BIMETALLIC TEMPERATURE SENSORS

6.2.1.2 NON-CONTACT

6.2.1.2.1 NON-CONTACT, BY TYPE

6.2.1.2.1.1 INFRARED TEMPERATURE SENSORS

6.2.1.2.1.2 FIBER OPTIC TEMPERATURE SENSORS

6.2.2 TEMPERATURE SENSOR, BY OUTPUT

6.2.2.1 DIGITAL

6.2.2.1.1 DIGITAL, BY TYPE

6.2.2.1.1.1 SINGLE CHANNEL

6.2.2.1.1.2 MULTI CHANNEL

6.2.2.2 ANALOG

6.2.3 TEMPERATURE SENSOR, BY CONNECTIVITY

6.2.3.1 WIRED

6.2.3.2 WIRELESS

6.2.4 TEMPERATURE SENSOR, BY MATERIAL

6.2.4.1 IRON/CONSTANTAN (CODE J)

6.2.4.2 NICKEL CHROMIUM/CONSTANTAN (CODE E)

6.2.4.3 COPPER/CONSTANTAN (CODE T)

6.2.4.4 CERAMIC

6.2.4.5 POLYMER

6.2.4.6 NICKEL MOLYBDENUM-NICKEL COBALT THERMOCOUPLES (TYPE M)

6.2.4.7 OTHERS

6.3 IMAGE SENSOR

6.3.1 IMAGE SENSOR, BY TECHNOLOGY

6.3.1.1 CMOS

6.3.1.2 CCD

6.3.1.3 OTHERS

6.3.2 IMAGE SENSOR, BY PROCESSING TECHNIQUE

6.3.2.1 2D IMAGE SENSORS

6.3.2.2 3D IMAGE SENSORS

6.3.3 IMAGE SENSOR, BY RESOLUTION

6.3.3.1 12 MP TO 16 MP

6.3.3.2 5 MP TO 10 MP

6.3.3.3 LESS THAN 3MP

6.3.3.4 MORE THAN 16 MP

6.3.4 IMAGE SENSOR, BY SPECTRUM

6.3.4.1 VISIBLE

6.3.4.2 NON-VISIBLE

6.3.5 IMAGE SENSOR, BY ARRAY TYPE

6.3.5.1 AREA IMAGE SENSOR

6.3.5.2 LINEAR IMAGE SENSOR

6.4 MOTION SENSOR

6.4.1 MOTION SENSOR, BY MOTION TECHNOLOGY

6.4.1.1 PASSIVE

6.4.1.1.1 PASSIVE, BY TYPE

6.4.1.1.1.1 INFRARED MOTION SENSOR

6.4.1.1.1.2 DUAL OR HYBRID TECHNOLOGY

6.4.1.1.1.3 OTHERS

6.4.1.2 ACTIVE

6.4.1.2.1 ACTIVE, BY TYPE

6.4.1.2.1.1 MICROWAVE SENSOR

6.4.1.2.1.2 ULTRASONIC SENSOR

6.4.1.2.1.3 TOMOGRAPHIC SENSOR

6.4.2 MOTION SENSOR, BY FUNCTION

6.4.2.1 FULLY-AUTOMATIC

6.4.2.2 SEMI-AUTOMATIC

6.5 PRESSURE SENSOR

6.5.1 PRESSURE SENSOR, BY TYPE

6.5.1.1 WIRED

6.5.1.2 WIRELESS

6.5.2 PRESSURE SENSOR, BY PRODUCT

6.5.2.1 GAUGE PRESSURE SENSORS

6.5.2.2 DIFFERENTIAL PRESSURE SENSORS

6.5.2.3 ABSOLUTE PRESSURE SENSORS

6.5.2.4 VACUUM PRESSURE SENSORS

6.5.2.5 SEALED PRESSURE SENSORS

6.5.3 PRESSURE SENSOR, BY TECHNOLOGY

6.5.3.1 PIEZORESISTIVE

6.5.3.2 CAPACITIVE

6.5.3.3 PIEZOELECTRIC

6.5.3.4 OPTICAL

6.5.3.5 RESONANT SOLID-STATE

6.5.3.6 THERMAL

6.5.3.7 ELECTROMAGNETIC

6.5.3.8 POTENTIOMETRIC

6.6 TOUCH SENSOR

6.7 PROXIMITY AND DISPLACEMENT SENSOR

6.7.1 PROXIMITY AND DISPLACEMENT SENSOR, BY TYPE

6.7.1.1 ADJUSTABLE DISTANCE PROXIMITY SENSOR

6.7.1.2 FIXED DISTANCE PROXIMITY SENSOR TYPE

6.7.2 PROXIMITY AND DISPLACEMENT SENSOR, BY TECHNOLOGY

6.7.2.1 INDUCTIVE

6.7.2.2 CAPACITIVE

6.7.2.3 PHOTOELECTRIC

6.7.2.4 MAGNETIC

6.8 ACCELEROMETER AND SPEED SENSOR

6.8.1 ACCELEROMETER AND SPEED SENSOR, BY DIMENSION

6.8.1.1 1-AXIS

6.8.1.2 2-AXIS

6.8.1.3 3-AXIS

6.8.2 ACCELEROMETER AND SPEED SENSOR, BY TYPE

6.8.2.1 PIEZORESISTIVE

6.8.2.2 MEMS

6.8.2.3 PIEZOELECTRIC

6.8.2.4 OTHERS

6.9 HUMIDITY AND MOISTURE SENSOR

6.9.1 HUMIDITY AND MOISTURE SENSOR, BY TYPE

6.9.1.1 DIGITAL

6.9.1.1.1 DIGITAL, BY TYPE

6.9.1.1.1.1 RELATIVE HUMIDITY AND TEMPERATURE (RHT) SENSORS

6.9.1.1.1.2 RELATIVE HUMIDITY SENSOR (RHS)

6.9.1.2 ANALOG

6.9.2 HUMIDITY AND MOISTURE SENSOR, BY PRODUCT

6.9.2.1 RELATIVE HUMIDITY SENSORS

6.9.2.2 OSCILLATING HYGROMETER

6.9.2.3 ABSOLUTE HUMIDITY SENSORS

6.9.2.4 OPTICAL HYGROMETER

6.9.2.5 GRAVIMETRIC HYGROMETER

6.1 GAS SENSOR

6.10.1 GAS SENSOR, BY GAS TYPE

6.10.1.1 CARBON MONOXIDE

6.10.1.2 METHANE

6.10.1.3 CARBON DIOXIDE

6.10.1.4 OXYGEN

6.10.1.5 HYDROGEN SULFIDE

6.10.1.6 NITROGEN OXIDES

6.10.1.7 VOLATILE ORGANIC COMPOUNDS

6.10.1.8 AMMONIA

6.10.1.9 CHLORINE

6.10.1.10 HYDROCARBONS

6.10.1.11 HYDROGEN

6.10.2 GAS SENSOR, BY TECHNOLOGY

6.10.2.1 ELECTROCHEMICAL

6.10.2.2 SOLID STATE/METAL-OXIDE-SEMICONDUCTORS

6.10.2.3 CATALYTIC

6.10.2.4 INFRARED

6.10.2.5 ZIRCONIA

6.10.2.6 PHOTOIONIZATION DETECTORS (PID)

6.10.2.7 LASER-BASED

6.10.2.8 HOLOGRAPHIC

6.10.3 GAS SENSOR, BY PRODUCT TYPE

6.10.3.1 GAS DETECTORS

6.10.3.2 GAS ANALYZER AND MONITOR

6.10.3.3 AIR QUALITY MONITOR

6.10.3.4 HVAC

6.10.3.5 MEDICAL EQUIPMENT

6.10.3.6 AIR PURIFIER/AIR CLEANER

6.10.3.7 OTHERS

6.10.4 GAS SENSOR, BY OUTPUT TYPE

6.10.4.1 DIGITAL

6.10.4.2 ANALOG

6.10.5 GAS SENSOR, BY CONNECTIVITY

6.10.5.1 WIRED

6.10.5.2 WIRELESS

6.11 OPTICAL SENSOR

6.11.1 OPTICAL SENSOR, BY SENSING

6.11.1.1 INTRINSIC

6.11.1.1.1 INTRINSIC, BY TYPE

6.11.1.1.1.1 ENCODERS

6.11.1.1.1.2 OPTICAL COHERENCE TOMOGRAPHY (OCT)

6.11.1.1.1.3 SPECTROSCOPY

6.11.1.1.1.4 PYROMETERS

6.11.1.1.1.5 LASER DOPPLER VELOCIMETRY (LDV)

6.11.1.1.1.6 FABRY–PEROT INTERFEROMETERS

6.11.1.2 EXTRINSIC

6.11.1.2.1 EXTRINSIC, BY TYPE

6.11.1.2.1.1 SCATTERING BASED

6.11.1.2.1.2 SCATTERING BASED, BY TYPE

6.11.1.2.1.3 RAYLEIGH SCATTERING

6.11.1.2.1.4 RAMAN SCATTERING

6.11.1.2.1.5 BRILLOUIN SCATTERING

6.11.1.2.1.6 FIBER BRAGG GRATING BASED

6.11.1.2.1.7 FIBER BRAGG GRATING BASED, BY TYPE

6.11.1.2.1.8 SPATIALLY CONTINUOUS BASED

6.11.1.2.1.9 POINT FBG BASED

6.11.2 OPTICAL SENSOR, BY APPLICATION

6.11.2.1 PRESSURE AND STRAIN SENSING

6.11.2.2 TEMPERATURE SENSING

6.11.2.3 BIOCHEMICAL

6.11.2.4 BIOMETRIC AND AMBIENCE

6.11.2.5 GEOLOGICAL SURVEY

6.11.2.6 OTHERS

6.12 FORCE SENSOR

6.12.1 FORCE SENSOR, BY FORCE TYPE

6.12.1.1 COMPRESSION

6.12.1.2 COMPRESSION AND TENSION

6.12.1.3 TENSION

6.12.2 FORCE SENSOR, BY TECHNOLOGY

6.12.2.1 STRAIN GAUGE

6.12.2.2 LOAD CELL

6.12.2.3 PIEZOELECTRIC

6.12.2.4 CAPACITIVE

6.12.2.5 MAGNETOELASTIC

6.12.2.6 OTHERS

6.12.3 FORCE SENSOR, BY OPERATION

6.12.3.1 DIGITAL

6.12.3.2 ANALOG

6.13 FLOW SENSOR

6.13.1 FLOW SENSOR, BY TYPE

6.13.1.1 LIQUID

6.13.1.2 GAS

6.13.2 FLOW SENSOR, BY APPLICATION

6.13.2.1 MAGNETIC

6.13.2.1.1 MAGNETIC, BY TYPE

6.13.2.1.1.1 IN-LINE MAGNETIC

6.13.2.1.1.2 LOW FLOW MAGNETIC

6.13.2.1.1.3 INSERTION MAGNETIC

6.13.2.2 ULTRASONIC

6.13.2.2.1 ULTRASONIC, BY TYPE

6.13.2.2.1.1 CLAMP-ON ULTRASONIC

6.13.2.2.1.2 INSERTION MAGNETIC

6.13.2.2.1.3 INSERTION MAGNETIC

6.13.2.3 DIFFERENTIAL FLOW

6.13.2.4 CORIOLIS

6.13.2.5 VORTEX

6.13.2.6 POSITICE DISPLACEMENT

6.13.2.7 OTHERS

6.14 LEVEL SENSOR

6.14.1 LEVEL SENSOR, BY TYPE

6.14.1.1 ULTRASONIC

6.14.1.2 RADAR/MICROWAVE

6.14.1.3 HYDROSTATIC

6.14.1.4 CAPACITANCE

6.14.1.5 MAGNETIC & MECHANICAL FLOAT

6.14.1.6 GUIDED WAVE RADAR

6.14.1.7 VIBRATORY PROBE

6.14.1.8 OPTICAL

6.14.1.9 MAGNETOSTRICTIVE

6.14.1.10 PNEUMATIC

6.14.1.11 NUCLEAR

6.14.1.12 LASER

6.14.1.13 OTHERS

6.14.2 LEVEL SENSOR, BY TECHNOLOGY

6.14.2.1 CONTACT

6.14.2.2 NON CONTACT

6.14.3 LEVEL SENSOR, BY MONITORING TYPE

6.14.3.1 CONTINUOUS LEVEL MONITORING

6.14.3.2 POINT LEVEL MONITORING

6.15 BIOSENSOR

6.15.1 BIOSENSOR, BY TYPE

6.15.1.1 ELECTROCHEMICAL

6.15.1.2 SENSOR PATCH

6.15.2 BIOSENSOR, BY TECHNOLOGY

6.15.2.1 ELECTROCHEMICAL

6.15.2.1.1 ELECTROCHEMICAL, BY TYPE

6.15.2.1.1.1 AMPEROMETRIC SENSORS

6.15.2.1.1.2 CONDUCTOMETRIC SENSORS

6.15.2.1.1.3 POTENTIOMETRIC SENSORS

6.15.2.2 OPTICAL BIOSENSORS

6.15.2.2.1 OPTICAL BIOSENSORS, BY TYPE

6.15.2.2.1.1 COLORIMETRIC BIOSENSORS

6.15.2.2.1.2 SPR

6.15.2.2.1.3 FLUORESCENCE BIOSENSORS

6.15.2.3 PIEZOELECTRIC BIOSENSORS

6.15.2.3.1 PIEZOELECTRIC BIOSENSORS, BY TYPE

6.15.2.3.1.1 ACOUSTIC BIOSENSORS

6.15.2.3.1.2 MICROCANTILEVER BIOSENSORS

6.15.3 BIOSENSOR, BY COMPONENT

6.15.3.1 BIORECEPTOR MOLECULES

6.15.3.2 TRANSDUCER

6.15.3.3 BIOLOGICAL ELEMENT

6.15.3.4 OTHERS

6.15.4 BIOSENSOR, BY PRODUCT TYPE

6.15.4.1 NON-WEARABLE BIOSENSORS

6.15.4.2 WEARABLE BIOSENSORS

6.15.4.2.1 WEARABLE BIOSENSOR, BY TYPE

6.15.4.2.1.1 WRISTWEAR

6.15.4.2.1.2 FOOTWEAR

6.15.4.2.1.3 BODYWEAR

6.15.4.2.1.4 EYEWEAR

6.15.4.2.1.5 NECKWEAR

6.15.4.2.1.6 OTHERS

6.16 POSITION SENSOR

6.16.1 POSITION SENSOR, BY TYPE

6.16.1.1 PROXIMITY SENSORS

6.16.1.2 DISPLACEMENT SENSORS

6.16.1.3 LINEAR SENSORS

6.16.1.3.1 LINEAR SENSOR, BY TYPE

6.16.1.3.1.1 MAGNETOSTRICTIVE SENSORS

6.16.1.3.1.2 LINEAR VARIABLE DIFFERENTIAL TRANSFORMERS

6.16.1.3.1.3 LASER POSITION SENSORS

6.16.1.3.1.4 LINEAR ENCODERS

6.16.1.3.1.5 LINEAR POTENTIOMETERS

6.16.1.4 PHOTOELECTRIC SENSORS

6.16.1.5 ROTARY SENSORS

6.16.1.5.1 ROTARY SENSORS, BY TYPE

6.16.1.5.1.1 ROTARY ENCODERS

6.16.1.5.1.2 ROTARY POTENTIOMETERS

6.16.1.5.1.3 ROTARY VARIABLE DIFFERENTIAL TRANSFORMERS

6.16.1.5.1.4 RESOLVERS

6.16.1.6 3D SENSORS

6.16.2 POSITION SENSOR, BY CONTACT TYPE

6.16.2.1 CONTACT

6.16.2.2 NON CONTACT

6.16.3 POSITION SENSOR, BY OUTPUT

6.16.3.1 ANALOG

6.16.3.2 DIGITAL

6.16.4 POSITION SENSOR, BY APPLICATION

6.16.4.1 MATERIAL HANDLING

6.16.4.2 MOTION SYSTEMS

6.16.4.3 ROBOTICS

6.16.4.4 TEST EQUIPMENT

6.16.4.5 MACHINE TOOLS

6.16.4.6 OTHERS

6.17 OTHERS

7 GLOBAL SENSORS MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 MEMS

7.3 CMOS

7.4 NEMS

7.5 OTHERS

8 GLOBAL SENSORS MARKET, BY END USER

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.2.1 AUTOMOTIVE, BY APPLICATION

8.2.1.1 POWERTRAIN

8.2.1.2 DRIVER ASSISTANCE & APPLICATION

8.2.1.3 SAFETY & CONTROLS SYSTEMS

8.2.1.4 CHASSIS

8.2.1.5 TELEMATICS SYSTEMS

8.2.1.6 VEHICLE BODY ELECTRONICS

8.2.1.7 EXHAUST SYSTEMS

8.2.1.8 OTHERS

8.2.2 AUTOMOTIVE, BY VEHICLE TYPE

8.2.2.1 PASSENGER CAR

8.2.2.2 LIGHT COMMERCIAL VEHICLE

8.2.2.3 HEAVY COMMERCIAL VEHICLE

8.2.3 AUTOMOTIVE, BY SALES CHANNEL

8.2.3.1 OEMS

8.2.3.2 AFTERMARKETS

8.2.4 AUTOMOTIVE, BY TYPE

8.2.4.1 RADAR SENSORS

8.2.4.2 IMAGE SENSORS

8.2.4.3 LIDAR SENSORS

8.2.4.4 CURRENT SENSORS

8.2.4.5 LEVEL SENSORS

8.2.4.6 INERTIAL SENSORS

8.2.4.7 ULTRASONIC SENSORS

8.2.4.8 TEMPERATURE SENSORS

8.2.4.9 PRESSURE SENSORS

8.2.4.10 OXYGEN SENSORS

8.2.4.11 POSITION SENSORS

8.2.4.12 SPEED SENSORS

8.2.4.13 CHEMICAL SENSORS

8.2.4.14 NOX SENSORS

8.2.4.15 OTHERS

8.3 CONSUMER ELECTRONICS

8.3.1 CONSUMER ELECTRONICS, BY TYPE

8.3.1.1 IMAGE SENSOR

8.3.1.2 MOTION SENSOR

8.3.1.3 TEMPERATURE SENSOR

8.3.1.4 PRESSURE SENSOR

8.3.1.5 PROXIMITY AND DISPLACEMENT SENSOR

8.3.1.6 OPTICAL SENSOR

8.3.1.7 ACCELEROMETER & SPEED SENSOR

8.3.1.8 HUMIDITY AND MOISTURE SENSOR

8.3.1.9 GAS SENSOR

8.3.1.10 FLOW SENSOR

8.3.1.11 LEVEL SENSOR

8.3.1.12 POSITION SENSOR

8.3.1.13 BIOSENSOR

8.3.1.14 FORCE SENSOR

8.3.1.15 OTHERS

8.4 HEALTHCARE

8.4.1 HEALTHCARE, BY TYPE

8.4.1.1 BIOSENSOR

8.4.1.2 TEMPERATURE SENSOR

8.4.1.3 PRESSURE SENSOR

8.4.1.4 IMAGE SENSOR

8.4.1.5 FLOW SENSOR

8.4.1.6 OPTICAL SENSOR

8.4.1.7 GAS SENSOR

8.4.1.8 ACCELEROMETER & SPEED SENSOR

8.4.1.9 MOTION SENSOR

8.4.1.10 PROXIMITY AND DISPLACEMENT SENSOR

8.4.1.11 FORCE SENSOR

8.4.1.12 HUMIDITY AND MOISTURE SENSOR

8.4.1.13 LEVEL SENSOR

8.4.1.14 POSITION SENSOR

8.4.1.15 OTHERS

8.5 MANUFACTURING

8.5.1 MANUFACTURING, BY TYPE

8.5.1.1 IMAGE SENSOR

8.5.1.2 FLOW SENSOR

8.5.1.3 TEMPERATURE SENSOR

8.5.1.4 PRESSURE SENSOR

8.5.1.5 LEVEL SENSOR

8.5.1.6 HUMIDITY AND MOISTURE SENSOR

8.5.1.7 GAS SENSOR

8.5.1.8 PROXIMITY AND DISPLACEMENT SENSOR

8.5.1.9 BIOSENSOR

8.5.1.10 OPTICAL SENSOR

8.5.1.11 MOTION SENSOR

8.5.1.12 FORCE SENSOR

8.5.1.13 ACCELEROMETER & SPEED SENSOR

8.5.1.14 POSITION SENSOR

8.5.1.15 OTHERS

8.6 AEROSPACE & DEFENCE

8.6.1 AEROSPACE & DEFENCE, BY TYPE

8.6.1.1 IMAGE SENSOR

8.6.1.2 PRESSURE SENSOR

8.6.1.3 TEMPERATURE SENSOR

8.6.1.4 ACCELEROMETER & SPEED SENSOR

8.6.1.5 PROXIMITY AND DISPLACEMENT SENSOR

8.6.1.6 OPTICAL SENSOR

8.6.1.7 POSITION SENSOR

8.6.1.8 MOTION SENSOR

8.6.1.9 FLOW SENSOR

8.6.1.10 GAS SENSOR

8.6.1.11 FORCE SENSOR

8.6.1.12 HUMIDITY AND MOISTURE SENSOR

8.6.1.13 LEVEL SENSOR

8.6.1.14 BIOSENSOR

8.6.1.15 OTHERS

8.7 ENERGY & POWER

8.7.1 ENERGY & POWER, BY TYPE

8.7.1.1 CURRENT SENSOR

8.7.1.2 PRESSURE SENSOR

8.7.1.3 TEMPERATURE SENSOR

8.7.1.4 FLOW SENSOR

8.7.1.5 GAS SENSOR

8.7.1.6 LEVEL SENSOR

8.7.1.7 HUMIDITY AND MOISTURE SENSOR

8.7.1.8 OPTICAL SENSOR

8.7.1.9 PROXIMITY AND DISPLACEMENT SENSOR

8.7.1.10 MOTION SENSOR

8.7.1.11 ACCELEROMETER & SPEED SENSOR

8.7.1.12 POSITION SENSOR

8.7.1.13 FORCE SENSOR

8.7.1.14 BIOSENSOR

8.7.1.15 OTHERS

8.8 IT & TELECOMMUNICATION

8.8.1 IT & TELECOMMUNICATION, BY TYPE

8.8.1.1 PRESSURE SENSOR

8.8.1.2 TEMPERATURE SENSOR

8.8.1.3 OPTICAL SENSOR

8.8.1.4 PROXIMITY AND DISPLACEMENT SENSOR

8.8.1.5 ACCELEROMETER & SPEED SENSOR

8.8.1.6 HUMIDITY AND MOISTURE SENSOR

8.8.1.7 GAS SENSOR

8.8.1.8 MOTION SENSOR

8.8.1.9 FLOW SENSOR

8.8.1.10 LEVEL SENSOR

8.8.1.11 POSITION SENSOR

8.8.1.12 IMAGE SENSOR

8.8.1.13 FORCE SENSOR

8.8.1.14 BIOSENSOR

8.8.1.15 OTHERS

8.9 OIL & GAS

8.9.1 OIL & GAS, BY TYPE

8.9.1.1 GAS SENSOR

8.9.1.2 FLOW SENSOR

8.9.1.3 PRESSURE SENSOR

8.9.1.4 TEMPERATURE SENSOR

8.9.1.5 LEVEL SENSOR

8.9.1.6 HUMIDITY AND MOISTURE SENSOR

8.9.1.7 OPTICAL SENSOR

8.9.1.8 PROXIMITY AND DISPLACEMENT SENSOR

8.9.1.9 POSITION SENSOR

8.9.1.10 MOTION SENSOR

8.9.1.11 ACCELEROMETER & SPEED SENSOR

8.9.1.12 IMAGE SENSOR

8.9.1.13 FORCE SENSOR

8.9.1.14 BIOSENSOR

8.9.1.15 OTHERS

8.1 CHEMICAL

8.10.1 CHEMICAL, BY TYPE

8.10.1.1 GAS SENSOR

8.10.1.2 FLOW SENSOR

8.10.1.3 PRESSURE SENSOR

8.10.1.4 TEMPERATURE SENSOR

8.10.1.5 LEVEL SENSOR

8.10.1.6 HUMIDITY AND MOISTURE SENSOR

8.10.1.7 BIOSENSOR

8.10.1.8 OPTICAL SENSOR

8.10.1.9 POSITION SENSOR

8.10.1.10 MOTION SENSOR

8.10.1.11 IMAGE SENSOR

8.10.1.12 PROXIMITY AND DISPLACEMENT SENSOR

8.10.1.13 FORCE SENSOR

8.10.1.14 ACCELEROMETER & SPEED SENSOR

8.10.1.15 OTHERS

8.11 FOOD & BEVERAGES

8.11.1 FOOD & BEVERAGES, BY TYPE

8.11.1.1 BIOSENSOR

8.11.1.2 FLOW SENSOR

8.11.1.3 LEVEL SENSOR

8.11.1.4 TEMPERATURE SENSOR

8.11.1.5 POSITION SENSOR

8.11.1.6 HUMIDITY AND MOISTURE SENSOR

8.11.1.7 GAS SENSOR

8.11.1.8 OPTICAL SENSOR

8.11.1.9 MOTION SENSOR

8.11.1.10 ACCELEROMETER & SPEED SENSOR

8.11.1.11 FORCE SENSOR

8.11.1.12 IMAGE SENSOR

8.11.1.13 PROXIMITY AND DISPLACEMENT SENSOR

8.11.1.14 PRESSURE SENSOR

8.11.1.15 OTHERS

8.12 CONSTRUCTION

8.12.1 CONSTRUCTION, BY TYPE

8.12.1.1 PRESSURE SENSOR

8.12.1.2 TEMPERATURE SENSOR

8.12.1.3 PROXIMITY AND DISPLACEMENT SENSOR

8.12.1.4 HUMIDITY AND MOISTURE SENSOR

8.12.1.5 LEVEL SENSOR

8.12.1.6 MOTION SENSOR

8.12.1.7 FLOW SENSOR

8.12.1.8 GAS SENSOR

8.12.1.9 FORCE SENSOR

8.12.1.10 OPTICAL SENSOR

8.12.1.11 POSITION SENSOR

8.12.1.12 ACCELEROMETER & SPEED SENSOR

8.12.1.13 IMAGE SENSOR

8.12.1.14 BIOSENSOR

8.12.1.15 OTHERS

8.13 MINING

8.13.1 MINING, BY TYPE

8.13.1.1 GAS SENSOR

8.13.1.2 PRESSURE SENSOR

8.13.1.3 FLOW SENSOR

8.13.1.4 LEVEL SENSOR

8.13.1.5 TEMPERATURE SENSOR

8.13.1.6 HUMIDITY AND MOISTURE SENSOR

8.13.1.7 OPTICAL SENSOR

8.13.1.8 PROXIMITY AND DISPLACEMENT SENSOR

8.13.1.9 ACCELEROMETER & SPEED SENSOR

8.13.1.10 MOTION SENSOR

8.13.1.11 POSITION SENSOR

8.13.1.12 IMAGE SENSOR

8.13.1.13 FORCE SENSOR

8.13.1.14 BIOSENSOR

8.13.1.15 OTHERS

8.14 PAPER & PULP

8.14.1 PAPER & PULP, BY TYPE

8.14.1.1 FLOW SENSOR

8.14.1.2 TEMPERATURE SENSOR

8.14.1.3 PRESSURE SENSOR

8.14.1.4 LEVEL SENSOR

8.14.1.5 HUMIDITY AND MOISTURE SENSOR

8.14.1.6 OPTICAL SENSOR

8.14.1.7 POSITION SENSOR

8.14.1.8 GAS SENSOR

8.14.1.9 PROXIMITY AND DISPLACEMENT SENSOR

8.14.1.10 MOTION SENSOR

8.14.1.11 FORCE SENSOR

8.14.1.12 ACCELEROMETER & SPEED SENSOR

8.14.1.13 IMAGE SENSOR

8.14.1.14 BIOSENSOR

8.14.1.15 OTHERS

8.15 OTHERS

9 GLOBAL SENSORS MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA-PACIFIC

9.2.1 CHINA

9.2.2 JAPAN

9.2.3 INDIA

9.2.4 SOUTH KOREA

9.2.5 SINGAPORE

9.2.6 MALAYSIA

9.2.7 THAILAND

9.2.8 AUSTRALIA

9.2.9 INDONESIA

9.2.10 PHILIPPINES

9.2.11 REST OF ASIA-PACIFIC

9.3 NORTH AMERICA

9.3.1 U.S.

9.3.2 CANADA

9.3.3 MEXICO

9.4 EUROPE

9.4.1 GERMANY

9.4.2 U.K.

9.4.3 FRANCE

9.4.4 RUSSIA

9.4.5 ITALY

9.4.6 SPAIN

9.4.7 NETHERLANDS

9.4.8 BELGIUM

9.4.9 TURKEY

9.4.10 SWITZERLAND

9.5 MIDDLE EAST AND AFRICA

9.5.1 UNITED ARAB EMIRATES

9.5.2 SAUDI ARABIA

9.5.3 SOUTH AFRICA

9.5.4 EGYPT

9.5.5 REST OF MIDDLE EAST AND AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 ARGENTINA

9.6.3 REST OF SOUTH AMERICA

10 GLOBAL SENSORS MARKET

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.4 COMPANY SHARE ANALYSIS: EUROPE

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 BOSCH SENSORTEC GMBH

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 SONY SEMICONDUCTOR SOLUTIONS CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT/NEWS

12.4 MITSUBISHI ELECTRIC CORPORATION

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 HONEYWELL INTERNATIONAL INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 AMPHENOL CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 AMS-OSRAM AG

12.7.1 COMPANY SNAPSHOTS

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 DWYER INSTRUMENTS, LLC.

12.8.1 COMPANY SNAPSHOTS

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 EMERSON ELECTRIC CO.

12.9.1 COMPANY SNAPSHOTS

12.9.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENT

12.1 ENDRESS+HAUSER GROUP SERVICES AG

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT CERTIFICATION

12.11 FIGARO ENGINEERING INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 FIRST SENSOR AG

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENT

12.13 INFINEON TECHNOLOGIES AG

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 MICROCHIP TECHNOLOGY INC.

12.14.1 COMPANY SNAPSHOTS

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 NXP SEMICONDUCTORS

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENT

12.16 OMEGA ENGINEERING INC

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 PANASONIC HOLDINGS CORPORATION

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 PRODUCT PORTFOLIO

12.17.4 RECENT DEVELOPMENT

12.18 QUALCOMM TECHNOLOGIES, INC.

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENTS

12.19 RENESAS ELECTRONICS CORPORATION.

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 1.1.5RECENT DEVELOPMENT

12.2 ROCKWELL AUTOMATION

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT DEVELOPMENT

12.21 SAFRAN

12.21.1 COMPANY SNAPSHOT

12.21.2 REVENUE ANALYSIS

12.21.3 PRODUCT PORTFOLIO

12.21.4 RECENT DEVELOPMENT/NEWS

12.22 SENSIRION AG

12.22.1 COMPANY SNAPSHOT

12.22.2 REVENUE ANALYSIS

12.22.3 PRODUCT PORTFOLIO

12.22.4 RECENT DEVELOPMENT

12.23 SIEMENS

12.23.1 COMPANY SNAPSHOT

12.23.2 REVENUE ANALYSIS

12.23.3 PRODUCT PORTFOLIO

12.23.4 RECENT DEVELOPMENT

12.24 STMICROELECTRONICS

12.24.1 COMPANY SNAPSHOT

12.24.2 REVENUE ANALYSIS

12.24.3 PRODUCT PORTFOLIO

12.24.4 RECENT DEVELOPMENT/NEWS

12.25 TDK CORPORATION.

12.25.1 COMPANY SNAPSHOTS

12.25.2 REVENUE ANALYSIS

12.25.3 PRODUCT PORTFOLIO

12.25.4 RECENT DEVELOPMENT

12.26 TE CONNECTIVITY

12.26.1 COMPANY SNAPSHOT

12.26.2 REVENUE ANALYSIS

12.26.3 PRODUCT PORTFOLIO

12.26.4 RECENT DEVELOPMENT

12.27 TELEDYNE TECHNOLOGIES INCORPORATED.

12.27.1 COMPANY SNAPSHOTS

12.27.2 REVENUE ANALYSIS

12.27.3 PRODUCT PORTFOLIO

12.27.4 RECENT DEVELOPMENT/NEWS

12.28 TEXAS INSTRUMENTS INCORPORATED

12.28.1 COMPANY SNAPSHOT

12.28.2 REVENUE ANALYSIS

12.28.3 PRODUCT PORTFOLIO

12.28.4 RECENT DEVELOPMENTS

12.29 WIKA INSTRUMENTS INDIA PVT. LTD.

12.29.1 COMPANY SNAPSHOT

12.29.2 PRODUCT PORTFOLIO

12.29.3 RECENT DEVELOPMENT/NEWS

12.3 YOKOGAWA ELECTRIC CORPORATION

12.30.1 COMPANY SNAPSHOTS

12.30.2 REVENUE ANALYSIS

12.30.3 PRODUCT PORTFOLIO

12.30.4 RECENT DEVELOPMENT/NEWS

13 QUESTIONNAIRE

14 RELATED REPORTS

表格列表

TABLE 1 KEY PLAYERS AND THEIR TECHNOLOGY ANALYSIS IN SENSOR MARKET

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 FUNDING DETAILS—INVESTOR DETAILS, REASON OF INVESTMENT FROM INVESTOR

TABLE 4 SENSOR COST COMPARISON

TABLE 5 GLOBAL SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 GLOBAL TEMPERATURE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 7 GLOBAL TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 GLOBAL CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 9 GLOBAL NON-CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 10 GLOBAL TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 11 GLOBAL DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 12 GLOBAL TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 13 GLOBAL TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 14 GLOBAL IMAGE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 15 GLOBAL IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 16 GLOBAL IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 17 GLOBAL IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 18 GLOBAL IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 19 GLOBAL IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 20 GLOBAL MOTION SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 GLOBAL MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 22 GLOBAL PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 23 GLOBAL ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 24 GLOBAL MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 25 GLOBAL PRESSURE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 26 GLOBAL PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 27 GLOBAL PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 28 GLOBAL PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 29 GLOBAL TOUCH SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 30 GLOBAL PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 GLOBAL PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 32 GLOBAL PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 33 GLOBAL ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 GLOBAL ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 35 GLOBAL ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 36 GLOBAL HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 37 GLOBAL HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 38 GLOBAL DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 GLOBAL HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 40 GLOBAL GAS SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 41 GLOBAL GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 42 GLOBAL GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 43 GLOBAL GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 44 GLOBAL GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 45 GLOBAL GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 46 GLOBAL OPTICAL SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 GLOBAL OPTICAL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 48 GLOBAL INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 49 GLOBAL EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 50 GLOBAL SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 GLOBAL FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 52 GLOBAL OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 53 GLOBAL FORCE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 54 GLOBAL FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 55 GLOBAL FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 56 GLOBAL FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 57 GLOBAL FLOW SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 58 GLOBAL FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 GLOBAL FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 60 GLOBAL MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 61 GLOBAL ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 62 GLOBAL LEVEL SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 63 GLOBAL LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 64 GLOBAL LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 65 GLOBAL LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 66 GLOBAL BIOSENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 67 GLOBAL BIOSENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 68 GLOBAL BIOSENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 69 GLOBAL ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 70 GLOBAL OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 GLOBAL PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 GLOBAL BIOSENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 73 GLOBAL BIOSENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 74 GLOBAL WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 75 GLOBAL POSITION SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 76 GLOBAL POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 GLOBAL LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 78 GLOBAL ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 GLOBAL POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 80 GLOBAL POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 81 GLOBAL POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 82 GLOBAL OTHERS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 83 GLOBAL SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 84 GLOBAL MEMS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 85 GLOBAL CMOS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 86 GLOBAL NEMS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 87 GLOBAL OTHERS SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 88 GLOBAL SENSORS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 89 GLOBAL AUTOMOTIVE IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 90 GLOBAL AUTOMOTIVE IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 91 GLOBAL AUTOMOTIVE IN SENSORS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 92 GLOBAL AUTOMOTIVE IN SENSORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 93 GLOBAL AUTOMOTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 94 GLOBAL CONSUMER ELECTRONICS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 95 GLOBAL CONSUMER ELECTRONICS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 96 GLOBAL HEALTHCARE IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 97 GLOBAL HEALTHCARE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 98 GLOBAL MANUFACTURING IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 99 GLOBAL MANUFACTURING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 100 GLOBAL AEROSPACE & DEFENCE IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 101 GLOBAL AEROSPACE & DEFENCE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 102 GLOBAL ENERGY & POWER IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 103 GLOBAL ENERGY & POWER IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 104 GLOBAL IT & TELECOMMUNICATION IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 105 GLOBAL IT & TELECOMMUNICATION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 106 GLOBAL OIL & GAS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 107 GLOBAL OIL & GAS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 108 GLOBAL CHEMICAL IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 109 GLOBAL CHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 110 GLOBAL FOOD & BEVERAGES IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 111 GLOBAL FOOD & BEVERAGES IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 112 GLOBAL CONSTRUCTION IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 113 GLOBAL CONSTRUCTION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 114 GLOBAL MINING IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 115 GLOBAL MINING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 116 GLOBAL PAPER & PULP IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 117 GLOBAL PAPER & PULP IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 118 GLOBAL OTHERS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 119 GLOBAL SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 120 ASIA-PACIFIC SENSORS MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 121 ASIA-PACIFIC SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 122 ASIA-PACIFIC TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 123 ASIA-PACIFIC CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 124 ASIA-PACIFIC NON CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 125 ASIA-PACIFIC TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 126 ASIA-PACIFIC DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 127 ASIA-PACIFIC TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 128 ASIA-PACIFIC TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 129 ASIA-PACIFIC IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 130 ASIA-PACIFIC IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 131 ASIA-PACIFIC IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 132 ASIA-PACIFIC IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 133 ASIA-PACIFIC IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 134 ASIA-PACIFIC MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 135 ASIA-PACIFIC PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 136 ASIA-PACIFIC ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 137 ASIA-PACIFIC MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 138 ASIA-PACIFIC PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 139 ASIA-PACIFIC PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 140 ASIA-PACIFIC PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 141 ASIA-PACIFIC PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 142 ASIA-PACIFIC PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 143 ASIA-PACIFIC ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 144 ASIA-PACIFIC ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 145 ASIA-PACIFIC HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 146 ASIA-PACIFIC DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 147 ASIA-PACIFIC HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 148 ASIA-PACIFIC GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 149 ASIA-PACIFIC GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 150 ASIA-PACIFIC GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 151 ASIA-PACIFIC GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 152 ASIA-PACIFIC GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 153 ASIA-PACIFIC OPTICAL SENSOR IN SENSORS MARKET, BY SENSING, 2018-2032 (USD MILLION)

TABLE 154 ASIA-PACIFIC INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 155 ASIA-PACIFIC EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 156 ASIA-PACIFIC SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 157 ASIA-PACIFIC FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 158 ASIA-PACIFIC OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 159 ASIA-PACIFIC FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 160 ASIA-PACIFIC FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 161 ASIA-PACIFIC FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 162 ASIA-PACIFIC FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 163 ASIA-PACIFIC FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 164 ASIA-PACIFIC MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 165 ASIA-PACIFIC ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 166 ASIA-PACIFIC LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 167 ASIA-PACIFIC LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 168 ASIA-PACIFIC LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 169 ASIA-PACIFIC BIO SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 170 ASIA-PACIFIC BIO SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 171 ASIA-PACIFIC ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 172 ASIA-PACIFIC OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 173 ASIA-PACIFIC PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 174 ASIA-PACIFIC BIO SENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 175 ASIA-PACIFIC BIO SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 176 ASIA-PACIFIC WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 177 ASIA-PACIFIC POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 178 ASIA-PACIFIC LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 179 ASIA-PACIFIC ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 180 ASIA-PACIFIC POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 181 ASIA-PACIFIC POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 182 ASIA-PACIFIC POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 183 ASIA-PACIFIC SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 184 ASIA-PACIFIC SENSORS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 185 ASIA-PACIFIC AUTOMOTIVE IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 186 ASIA-PACIFIC AUTOMOTIVE IN SENSORS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 187 ASIA-PACIFIC AUTOMOTIVE IN SENSORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 188 ASIA-PACIFIC AUTOMOTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 189 ASIA-PACIFIC CONSUMER ELECTRONICS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 190 ASIA-PACIFIC HEALTHCARE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 191 ASIA-PACIFIC MANUFACTURING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 192 ASIA-PACIFIC AEROSPACE & DEFENSE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 193 ASIA-PACIFIC ENERGY & POWER IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 194 ASIA-PACIFIC IT & TELECOMMUNICATION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 195 ASIA-PACIFIC OIL & GAS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 196 ASIA-PACIFIC CHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 197 ASIA-PACIFIC FOOD & BEVERAGES IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 198 ASIA-PACIFIC CONSTRUCTION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 199 ASIA-PACIFIC MINING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 200 ASIA-PACIFIC PAPER & PULP IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 201 CHINA SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 202 CHINA TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 203 CHINA CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 204 CHINA NON CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 205 CHINA TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 206 CHINA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 207 CHINA TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 208 CHINA TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 209 CHINA IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 210 CHINA IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 211 CHINA IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 212 CHINA IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 213 CHINA IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 214 CHINA MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 215 CHINA PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 216 CHINA ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 217 CHINA MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 218 CHINA PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 219 CHINA PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 220 CHINA PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 221 CHINA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 222 CHINA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 223 CHINA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 224 CHINA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 225 CHINA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 226 CHINA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 227 CHINA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 228 CHINA GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 229 CHINA GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 230 CHINA GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 231 CHINA GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 232 CHINA GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 233 CHINA OPTICAL SENSOR IN SENSORS MARKET, BY SENSING, 2018-2032 (USD MILLION)

TABLE 234 CHINA INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 235 CHINA EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 236 CHINA SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 237 CHINA FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 238 CHINA OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 239 CHINA FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 240 CHINA FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 241 CHINA FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 242 CHINA FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 243 CHINA FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 244 CHINA MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 245 CHINA ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 246 CHINA LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 247 CHINA LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 248 CHINA LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 249 CHINA BIO SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 250 CHINA BIO SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 251 CHINA ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 252 CHINA OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 253 CHINA PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 254 CHINA BIO SENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 255 CHINA BIO SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 256 CHINA WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 257 CHINA POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 258 CHINA LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 259 CHINA ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 260 CHINA POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 261 CHINA POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 262 CHINA POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 263 CHINA SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 264 CHINA SENSORS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 265 CHINA AUTOMOTIVE IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 266 CHINA AUTOMOTIVE IN SENSORS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 267 CHINA AUTOMOTIVE IN SENSORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 268 CHINA AUTOMOTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 269 CHINA CONSUMER ELECTRONICS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 270 CHINA HEALTHCARE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 271 CHINA MANUFACTURING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 272 CHINA AEROSPACE & DEFENSE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 273 CHINA ENERGY & POWER IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 274 CHINA IT & TELECOMMUNICATION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 275 CHINA OIL & GAS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 276 CHINA CHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 277 CHINA FOOD & BEVERAGES IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 278 CHINA CONSTRUCTION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 279 CHINA MINING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 280 CHINA PAPER & PULP IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 281 JAPAN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 282 JAPAN TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 283 JAPAN CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 284 JAPAN NON CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 285 JAPAN TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 286 JAPAN DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 287 JAPAN TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 288 JAPAN TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 289 JAPAN IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 290 JAPAN IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 291 JAPAN IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 292 JAPAN IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 293 JAPAN IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 294 JAPAN MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 295 JAPAN PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 296 JAPAN ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 297 JAPAN MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 298 JAPAN PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 299 JAPAN PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 300 JAPAN PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 301 JAPAN PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 302 JAPAN PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 303 JAPAN ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 304 JAPAN ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 305 JAPAN HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 306 JAPAN DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 307 JAPAN HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 308 JAPAN GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 309 JAPAN GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 310 JAPAN GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 311 JAPAN GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 312 JAPAN GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 313 JAPAN OPTICAL SENSOR IN SENSORS MARKET, BY SENSING, 2018-2032 (USD MILLION)

TABLE 314 JAPAN INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 315 JAPAN EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 316 JAPAN SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 317 JAPAN FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 318 JAPAN OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 319 JAPAN FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 320 JAPAN FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 321 JAPAN FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 322 JAPAN FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 323 JAPAN FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 324 JAPAN MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 325 JAPAN ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 326 JAPAN LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 327 JAPAN LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 328 JAPAN LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 329 JAPAN BIO SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 330 JAPAN BIO SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 331 JAPAN ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 332 JAPAN OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 333 JAPAN PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 334 JAPAN BIO SENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 335 JAPAN BIO SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 336 JAPAN WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 337 JAPAN POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 338 JAPAN LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 339 JAPAN ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 340 JAPAN POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 341 JAPAN POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 342 JAPAN POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 343 JAPAN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 344 JAPAN SENSORS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 345 JAPAN AUTOMOTIVE IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 346 JAPAN AUTOMOTIVE IN SENSORS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 347 JAPAN AUTOMOTIVE IN SENSORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 348 JAPAN AUTOMOTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 349 JAPAN CONSUMER ELECTRONICS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 350 JAPAN HEALTHCARE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 351 JAPAN MANUFACTURING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 352 JAPAN AEROSPACE & DEFENSE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 353 JAPAN ENERGY & POWER IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 354 JAPAN IT & TELECOMMUNICATION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 355 JAPAN OIL & GAS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 356 JAPAN CHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 357 JAPAN FOOD & BEVERAGES IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 358 JAPAN CONSTRUCTION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 359 JAPAN MINING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 360 JAPAN PAPER & PULP IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 361 INDIA SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 362 INDIA TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 363 INDIA CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 364 INDIA NON CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 365 INDIA TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 366 INDIA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 367 INDIA TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 368 INDIA TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 369 INDIA IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 370 INDIA IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 371 INDIA IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 372 INDIA IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 373 INDIA IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 374 INDIA MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 375 INDIA PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 376 INDIA ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 377 INDIA MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 378 INDIA PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 379 INDIA PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 380 INDIA PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 381 INDIA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 382 INDIA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 383 INDIA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 384 INDIA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 385 INDIA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 386 INDIA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 387 INDIA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 388 INDIA GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 389 INDIA GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 390 INDIA GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 391 INDIA GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 392 INDIA GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 393 INDIA OPTICAL SENSOR IN SENSORS MARKET, BY SENSING, 2018-2032 (USD MILLION)

TABLE 394 INDIA INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 395 INDIA EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 396 INDIA SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 397 INDIA FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 398 INDIA OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 399 INDIA FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 400 INDIA FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 401 INDIA FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 402 INDIA FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 403 INDIA FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 404 INDIA MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 405 INDIA ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 406 INDIA LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 407 INDIA LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 408 INDIA LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 409 INDIA BIO SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 410 INDIA BIO SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 411 INDIA ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 412 INDIA OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 413 INDIA PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 414 INDIA BIO SENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 415 INDIA BIO SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 416 INDIA WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 417 INDIA POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 418 INDIA LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 419 INDIA ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 420 INDIA POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 421 INDIA POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 422 INDIA POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 423 INDIA SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 424 INDIA SENSORS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 425 INDIA AUTOMOTIVE IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 426 INDIA AUTOMOTIVE IN SENSORS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 427 INDIA AUTOMOTIVE IN SENSORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 428 INDIA AUTOMOTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 429 INDIA CONSUMER ELECTRONICS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 430 INDIA HEALTHCARE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 431 INDIA MANUFACTURING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 432 INDIA AEROSPACE & DEFENSE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 433 INDIA ENERGY & POWER IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 434 INDIA IT & TELECOMMUNICATION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 435 INDIA OIL & GAS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 436 INDIA CHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 437 INDIA FOOD & BEVERAGES IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 438 INDIA CONSTRUCTION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 439 INDIA MINING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 440 INDIA PAPER & PULP IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 441 SOUTH KOREA SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 442 SOUTH KOREA TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 443 SOUTH KOREA CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 444 SOUTH KOREA NON CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 445 SOUTH KOREA TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 446 SOUTH KOREA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 447 SOUTH KOREA TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 448 SOUTH KOREA TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 449 SOUTH KOREA IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 450 SOUTH KOREA IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 451 SOUTH KOREA IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 452 SOUTH KOREA IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 453 SOUTH KOREA IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 454 SOUTH KOREA MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 455 SOUTH KOREA PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 456 SOUTH KOREA ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 457 SOUTH KOREA MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 458 SOUTH KOREA PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 459 SOUTH KOREA PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 460 SOUTH KOREA PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 461 SOUTH KOREA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 462 SOUTH KOREA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 463 SOUTH KOREA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 464 SOUTH KOREA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 465 SOUTH KOREA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 466 SOUTH KOREA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 467 SOUTH KOREA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 468 SOUTH KOREA GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 469 SOUTH KOREA GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 470 SOUTH KOREA GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 471 SOUTH KOREA GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 472 SOUTH KOREA GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 473 SOUTH KOREA OPTICAL SENSOR IN SENSORS MARKET, BY SENSING, 2018-2032 (USD MILLION)

TABLE 474 SOUTH KOREA INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 475 SOUTH KOREA EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 476 SOUTH KOREA SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 477 SOUTH KOREA FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 478 SOUTH KOREA OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 479 SOUTH KOREA FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 480 SOUTH KOREA FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 481 SOUTH KOREA FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 482 SOUTH KOREA FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 483 SOUTH KOREA FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 484 SOUTH KOREA MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 485 SOUTH KOREA ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 486 SOUTH KOREA LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 487 SOUTH KOREA LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 488 SOUTH KOREA LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 489 SOUTH KOREA BIO SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 490 SOUTH KOREA BIO SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 491 SOUTH KOREA ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 492 SOUTH KOREA OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 493 SOUTH KOREA PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 494 SOUTH KOREA BIO SENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 495 SOUTH KOREA BIO SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 496 SOUTH KOREA WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 497 SOUTH KOREA POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 498 SOUTH KOREA LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 499 SOUTH KOREA ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 500 SOUTH KOREA POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 501 SOUTH KOREA POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 502 SOUTH KOREA POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 503 SOUTH KOREA SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)