Global Rubber Additive Market

市场规模(十亿美元)

CAGR :

%

USD

5,340.64 Million

USD

8,196.20 Million

2022

2030

USD

5,340.64 Million

USD

8,196.20 Million

2022

2030

| 2023 –2030 | |

| USD 5,340.64 Million | |

| USD 8,196.20 Million | |

|

|

|

|

Global Rubber Additives Market, By Type (Accelerators, Activators, Peptizers, Antidegradants, Plasticizers, Tackifiers, Vulcanization Inhibitors, Rubber Antioxidant, Insoluble Sulfur, Others), Application (Adhesives, Electric Cables And Hoses, Insulation, Specialty Tapes, Tiers, Others), Coating Agents (Silicon, Teflon, Others), Materials (Fibre, Silica, Silicates, Carbon Black, Others), End User (Tire and Tubing, Consumer Goods, Construction, Electrical Insulation, Others) – Industry Trends and Forecast to 2030.

Rubber Additives Market Analysis and Size

Industrial construction and household electrical insulations are the dominating factor for driving the business line of the rubber additive market globally Due to their potential attribute of insulation rubber additives are the most preferred material for tire and tubing fabrication, consumer goods, and industrial construction

The increasing rate of vehicles and the automotive industry is defining the success verticals of the global rubber additive market in the forecasted period 2023 to 2030 However, the acrimonious rules and regulations imposed by the government may act as restraints for the rubber additive market, whereas the emission of hazardous gasses and pollutants hamper the ecosystem thus the restriction on the same may curb down the market growth.

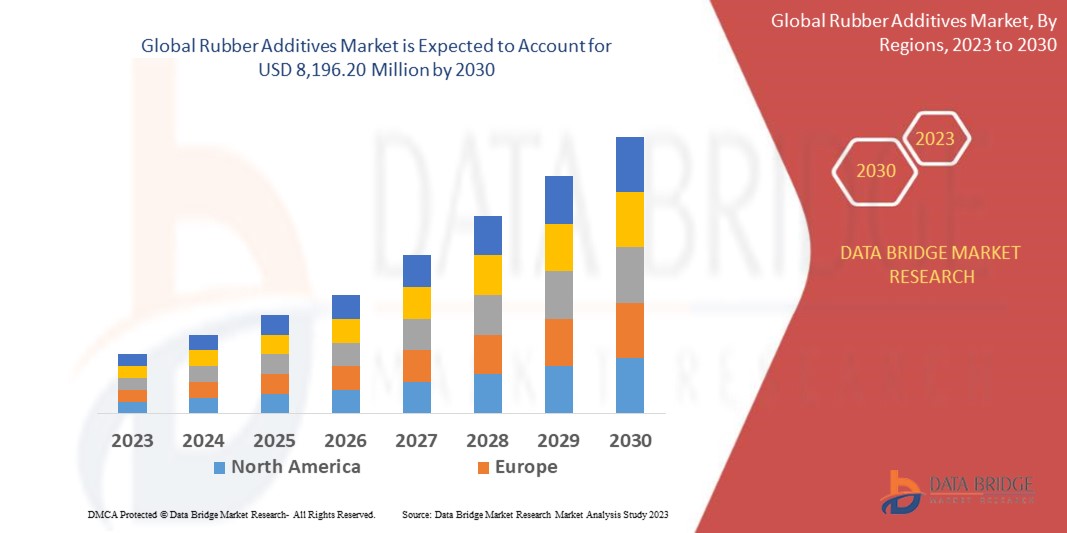

Data Bridge Market Research analyses that the rubber additives market which was USD 5,340.64 million in 2022, would rocket up to USD 8,196.20 million by 2030, and is expected to undergo a CAGR of 5.50% during the forecast period. This indicates the market value. Tire & Tubing dominates the end user segment of the rubber additives market due to the expansion of the tire and rubber industries in developing nations caused by industrialization.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Rubber Additives Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Accelerators, Activators, Peptizers, Antidegradants, Plasticizers, Tackifiers, Vulcanization Inhibitors, Rubber Antioxidant, Insoluble Sulfur, Others), Application (Adhesives, Electric Cables And Hoses, Insulation, Specialty Tapes, Tiers, Others), Coating Agents (Silicon, Teflon, Others), Materials (Fibre, Silica, Silicates, Carbon Black, Others), End User (Tire and Tubing, Consumer Goods, Construction, Electrical Insulation, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Akrochem Corporation, Akzo Nobel N.V., Arkema, BEHN MEYER, Eastman Chemical Company, LANXESS, Struktol Company of America, LLC, Thomas Swan & Co. Ltd., LUMITOS AG, Wacker Chemie AG, Velox Solutions Pvt. Ltd., IMCD N.V., BASF SE, Solvay, China Petrochemical Corporation, Emery Oleochemicals, R.T. Vanderbilt Holding Company, Inc and among others. |

|

Market Opportunities |

|

Market Definition.

Rubber additives are rubber polymers processed by the amalgamation of some chemicals to increase or enhance the overall performance. Due to high viscosity and cross-linkage capability, they are tremendously adopted in industrial manufacturing and production. They represent the rubber industry through an array of portfolios such as processing agents, high-performance bladders for tires, anti-sun check waxes, and others.

Global Rubber Additives Market Dynamics

Drivers

- Increasing demand from non-tire rubber applications

Due to rubber additives strong demand in applications other than tires, it is predicted that the need for rubber additives would rise. Developing countries are rapidly industrializing, which is driving up demand for rubber goods. Additionally, the market for rubber additives that give rubber products excellent attributes is driven by the growing demand for high-quality rubber products.

- Growth in the tire and rubber industry

The demand for rubber additives is increasing due to the expansion of the tire and rubber industries. The market for rubber additives is significantly dominated by the tire industry. The automotive industry's rising need for tires, particularly in emerging markets, is anticipated to fuel market expansion. The growing customer preference for tires that last longer and are more robust is also anticipated to increase demand for rubber additives.

Opportunities

High-performance rubbers have become more common as a result of technological advancements and advances in the rubber sector. These materials offer excellent qualities such as high strength, durability, and resistance to heat, abrasion, chemicals, and ozone. To improve their processing and performance, some rubbers need unique additives. In order to increase the adhesion between rubber and fillers like silica and carbon black, silane coupling agents are utilized. Similarly, rubber compounds are stabilized and protected from burning by the application of organophosphites. The market for rubber additives in a variety of applications, including tires, hoses, belts, seals, gaskets, and medical devices, is anticipated to benefit from the development of these high-performance rubbers.

Restraints/Challenges

The price changes of raw materials like natural rubber, synthetic rubber, carbon black, zinc oxide, and others have an impact on the market for rubber additives. These raw resources come from petroleum and natural gas, whose supply and demand are unstable. The market for rubber additives is unstable as a result of fluctuations in the price of raw materials, which can have an impact on manufacturers' profitability. Therefore the fluctuation in raw materials acts as a restraint to the global rubber additives market

The significant obstacle faced by the rubber additives market is environmental laws and sustainability worries. Numerous compounds that may be harmful to the environment and human health are included in rubber compositions. Some rubber additives, including nitrosamines, polycyclic aromatic hydrocarbons (PAHs), and heavy metals, are thought to be hazardous or carcinogenic. As a result, different regulatory organizations like REACH, EPA, FDA, etc. have either restricted or outright forbidden the use of certain compounds. To lessen the negative environmental effects of rubber additives, manufacturers must adhere to these laws and use environmentally appropriate substitutes, Hence, the environmental regulations act as a challenge for the rubber additives market.

Recent Development

- In June 2022, Evonik launched POLYVEST eCO, sustainable liquid polybutadiene it can be used as raw material for adhesives and sealants or as a liquid rubber additive in tire production. This product line is said to reduce the use of fossil raw materials by up to 99.9%.

- In March 2023, According to H.M. Royal. , Bruggemann, a polymer additives company, has introduced a new technology in rubber additives that involves the combination of two additives, TP 1862 and LP21-103, to create a rubber-to-metal adhesive that eliminates the need for resorcinol and cobalt salt

Global Rubber Additives Market Scope

The rubber additives market is segmented on the basis of type, price range, application, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Accelerators

- Activators

- Peptizers

- Plasticizers

- Tackifiers

- Vulcanization Inhibitors

- Rubber Antioxidant

- Insoluble Sulfur

- Antidegradants

- Others

Application

- Adhesives

- Electric cables and Hoses

- Insulations

- Specialty tapes

- Tiers

- Others

Coating Agents

- Silicon

- Teflon

- Others

Materials

- Fibre

- Silica

- Silicates

- Carbon black

- Others

End User

- Tire and Tubing

- Consumer Goods

- Construction

- Electrical Insulation

- Others

Rubber Additives Market Regional Analysis/Insights

The rubber additives market is analysed and market size insights and trends are provided by country, type, application, coating agents, materials and end user and as referenced above.

The countries covered in the rubber additives market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa

North America dominates the rubber additive market due to the large market share of the U.S. in the availability of automotive as well as other associated infrastructure in the region. Asia-Pacific region is expected to hold the largest growth rate due to the establishment of assembling facilities for the rubber additive market in this region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Increasing demand from tire and non-tire rubber applications

The rubber additives market also provides you with detailed market analysis for every country's growth in expenditure for capital equipment, installed base of different kinds of products for the Rubber Additives market, impact of technology using lifeline curves, and changes in regulatory scenarios and their impact on the rubber additives market. The data is available for the historic period 2010-2020.

Competitive Landscape and Rubber Additives Market Share Analysis

The rubber additives market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the rubber additives market.

Some of the major players operating in the rubber additives market are:

- Akrochem Corporation

- Akzo Nobel N.V.

- Arkema

- BEHN MEYER

- Eastman Chemical Company

- LANXESS

- Struktol Company of America, LLC

- Thomas Swan & Co. Ltd.

- LUMITOS AG

- Wacker Chemie AG

- Velox Solutions Pvt. Ltd.

- IMCD N.V.

- BASF SE

- Solvay

- China Petrochemical Corporation

- Emery Oleochemicals

- R.T. Vanderbilt Holding Company, Inc.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。