Global Petrochemicals Market

市场规模(十亿美元)

CAGR :

%

USD

484.77 Million

USD

823.62 Million

2024

2032

USD

484.77 Million

USD

823.62 Million

2024

2032

| 2025 –2032 | |

| USD 484.77 Million | |

| USD 823.62 Million | |

|

|

|

|

全球石化市場細分,按產品(乙烯、丙烯、丁二烯、苯、二甲苯、甲苯、聚苯乙烯和甲醇)、製造工藝(流化催化裂化 (FCC)、蒸汽裂化和催化重整)、應用(聚合物、油漆和塗料、溶劑、橡膠、粘合劑和密封劑、表面活性劑、染料等)和最終用途(30 年)和最終行業(303 年)。

石化產品市場規模

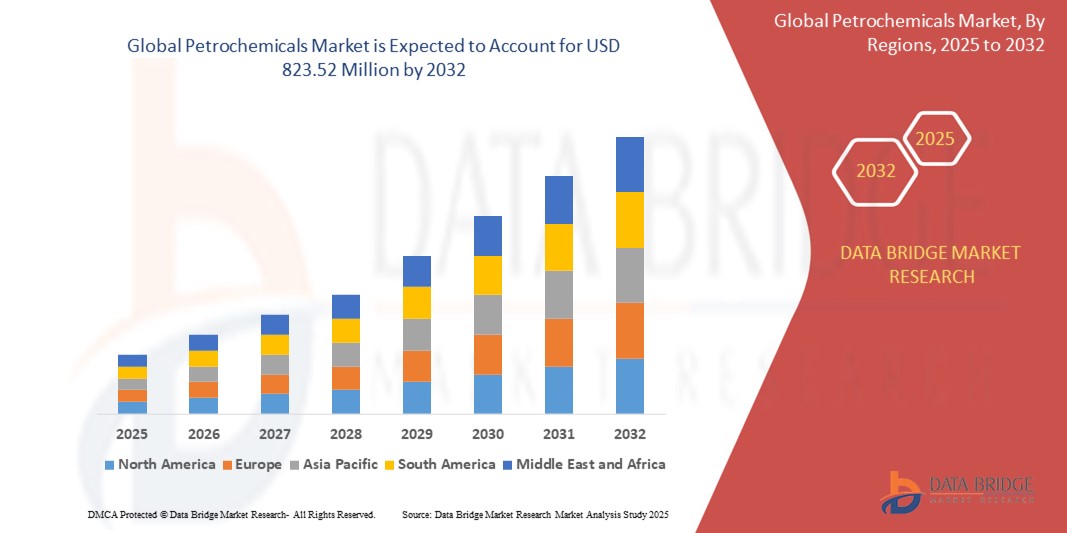

- 2024 年全球石化市場規模為4.8477 億美元 ,預計 到 2032 年將達到 8.2362 億美元,預測期內 複合年增長率為 6.85%。

- 市場成長的動力來自塑膠需求的增加、工業化程度的提高以及製造流程的進步,尤其是在新興經濟體

- 汽車和包裝行業對輕質材料的需求不斷增長,加上建築和電子行業的擴張,推動了全球石化產品的採用

石化產品市場分析

- 石油化學產品源自石油和天然氣,是各種產品的基本組成部分,包括各行各業使用的塑膠、化學品和合成材料

- 石化產品需求的成長主要源自於包裝、汽車和建築領域對聚合物的消費不斷增長,以及醫療保健和電子領域對特種化學品的使用不斷增加

- 北美在石化產品市場佔據主導地位,2024 年其收入份額最大,為 38.5%,這得益於先進的製造基礎設施、對頁岩氣的大量投資以及主要行業參與者的強大影響力

- 預計亞太地區將成為預測期內成長最快的地區,這得益於中國和印度等國家快速的城市化、不斷增長的工業活動以及不斷增長的可支配收入

- 乙烯領域在 2024 年佔據了最大的市場收入份額,為 28%,這得益於其在聚乙烯生產中的廣泛應用,而聚乙烯廣泛應用於包裝、紡織和汽車行業

報告範圍和石化產品市場細分

|

屬性 |

石化產品關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

石化產品市場趨勢

“對可持續和生物基石化替代品的需求不斷增長”

- 全球石化市場正見證著一種日益增長的趨勢,即開發和採用永續和生物基原料作為傳統化石燃料衍生石化產品的替代品

- 日益增長的環境問題、嚴格的政府法規以及企業的永續發展目標正在推動這一轉變

- 企業正在投資生物精煉廠、碳捕獲利用和循環經濟模式等綠色技術,以減少碳足跡

- 例如,幾家大型化學品生產商正在啟動商業規模的生物基乙烯和丙烯生產設施,利用甘蔗、藻類和廢油等再生原料

- 這一趨勢正在重塑整個產業的產品組合,並影響製造流程、應用和最終用途產業

- 此外,消費者和監管機構正在推動石化產品採購和生產的透明度和可追溯性,以進一步加速永續實踐的整合

石化產品市場動態

司機

“終端產業成長推動石化衍生物需求”

- 包裝、汽車和運輸、建築、電氣和電子以及醫療保健等關鍵終端用途行業的快速擴張,顯著推動了對石化產品的需求

- 乙烯和丙烯衍生的聚合物廣泛用於包裝材料、汽車零件和消費品

- 在建築領域,聚苯乙烯、溶劑和黏合劑等石化產品對於絕緣材料、油漆和密封劑至關重要

- 醫療保健產業依賴石化衍生物進行醫療器材製造、藥品包裝和一次性設備

- 亞太地區,尤其是中國和印度,由於城市化、工業化和可支配收入的增加而經歷強勁增長,使其成為市場增長最快的地區

- 北美仍是主導地區,得益於先進的製造業基礎設施、頁岩氣供應以及強大的石化加工技術研發能力

克制/挑戰

“原油價格波動與監管壓力”

- 原油價格波動直接影響石化生產原料的成本,導致價格不穩定,影響整個供應鏈的利潤率

- 地緣政治緊張局勢、供應鏈中斷和貿易限制進一步加劇了市場波動

- 歐洲和北美政府實施的嚴格環境法規和排放標準正在增加製造商的合規成本

- 這些法規限制了傳統石化工廠的擴張,並鼓勵對更乾淨但更昂貴的技術進行投資

- 此外,公眾出於對環境和健康的擔憂而反對新的石化項目,導致項目批准延遲,資本支出增加

- 這些挑戰促使企業探索替代原料和區域多元化策略,以降低風險

石化產品市場範圍

市場根據產品、製造流程、應用和最終用途行業進行細分。

- 按產品

根據產品類型,全球石化產品市場細分為乙烯、丙烯、丁二烯、苯、二甲苯、甲苯、聚苯乙烯和甲醇。乙烯板塊在2024年佔據了最大的市場收入份額,達到28%,這得益於其在聚乙烯生產中的廣泛應用,而聚乙烯又廣泛應用於包裝、紡織和汽車行業。

預計甲醇產業將在 2025 年至 2032 年間實現最快的成長率,這得益於甲醛、乙酸的化學合成以及作為運輸領域替代燃料的需求不斷增長,尤其是在亞太地區。

- 按製造工藝

根據生產工藝,全球石化產品市場可分為流體化床催化裂解 (FCC)、蒸汽裂解和催化重整。蒸汽裂解領域在2024年佔據了最大的市場收入份額,達到41%,這得益於其廣泛用於生產乙烯和丙烯等輕質碳氫化合物,而這些化合物是塑膠和合成材料的基本組成部分。

預計流化催化裂解 (FCC) 部門在 2025 年至 2032 年間將以 9.7% 的最快複合年增長率增長,這得益於新興經濟體對煉油基礎設施的投資不斷增加,以及對丙烯作為聚丙烯生產主要原料的需求不斷增長。

- 按應用

根據應用,全球石化產品市場細分為聚合物、油漆和塗料、溶劑、橡膠、黏合劑和密封劑、界面活性劑、染料等。由於包裝、消費品和汽車零件對聚乙烯和聚丙烯的大量消耗,聚合物領域在2024年佔據了市場主導地位,收入份額為34%。

預計溶劑領域將在預測期內實現最高成長率,這得益於製藥、油漆和塗料以及清潔劑領域應用範圍的擴大,尤其是在北美和歐洲。

- 按最終用途行業

根據終端用途產業,全球石化產品市場細分為包裝、汽車和運輸、建築、電氣和電子、醫療保健等。包裝產業在2024年的營收份額最高,為29%,這主要得益於食品飲料、消費品和電子商務領域對塑膠容器、薄膜和瓶子的需求旺盛。

預計從 2025 年到 2032 年,汽車和運輸領域將以 10.3% 的最快速度增長,這得益於輕質材料的採用、電動車產量的增加以及複合材料和合成橡膠使用量的增加。

石化產品市場區域分析

- 北美在石化產品市場佔據主導地位,2024 年其收入份額最大,為 38.5%,這得益於先進的製造基礎設施、對頁岩氣的大量投資以及主要行業參與者的強大影響力

- 北美市場的成長得益於製造流程的持續進步以及對永續性的日益重視。生產設施的數位化和自動化整合進一步提升了營運效率和市場競爭力。

美國石化市場洞察

受強勁的國內需求和對先進製造業的重視推動,美國石化市場在2024年佔據北美地區最大的收入份額,達87.9%。美國豐富的頁岩氣資源提供了經濟高效的原料,吸引了大量投資於新的生產能力,尤其是乙烯和丙烯產能。包裝、汽車和建築業對石化產品的使用日益增加,以及對高性能聚合物和特殊化學品的日益重視,也推動了市場的發展。

歐洲石化市場洞察

歐洲石化市場正在穩步成長,這得益於監管部門對永續性的嚴格重視以及向循環經濟模式的轉變。該地區是高價值石化產品的主要消費地區,尤其側重於汽車、建築以及電氣和電子行業的先進材料。該市場的特點是技術創新程度高,注重提高生產效率以及開發生物基或再生原料。

英國石化市場洞察

英國石化產品市場受各種應用需求驅動,尤其是在包裝和消費品領域。市場對永續解決方案的關注以及對生物塑膠和再生聚合物日益增長的興趣,推動了市場的成長。英國成熟的製造業基礎及其在全球廣泛產品供應鏈中的地位影響著其對關鍵石化基礎材料的消費。

德國石化市場洞察

德國憑藉其先進的汽車和製造業,成為歐洲石化市場的重要參與者。德國對工程和高品質產品的高度重視,推動了對專用石化產品和聚合物的需求。德國消費者和工業界優先考慮技術先進的材料,這些材料有助於提高最終產品的能源效率和性能,例如汽車的輕量化零件和建築的耐用材料。

亞太石化市場洞察

預計亞太地區將見證全球石化市場最快的成長速度,這得益於中國、印度和日本等國快速的城市化進程、不斷增長的可支配收入以及不斷擴張的工業部門。該地區汽車產量的不斷增長、建築業的蓬勃發展以及包裝業的蓬勃發展是石化產品需求的主要驅動力。對新產能的大量投資以及對滿足國內需求的日益重視是推動該地區市場擴張的關鍵因素。

日本石化市場洞察

日本石化市場的特點是消費者對高品質、技術先進的產品有著強烈的偏好。該國是汽車和電子產品製造的重要中心,推動了對特殊聚合物和其他石化衍生物的需求。該市場受益於大型石化製造商的入駐以及持續專注於研發,以創造適用於各種應用的創新材料。

中國石化市場洞察

中國佔據亞太地區石化產品市場最大份額,這得益於其龐大的製造業、快速的城市化進程以及不斷增長的汽車保有量。中國強大的國內製造能力、極具競爭力的價格以及不斷壯大的中產階級,推動了包裝、建築和紡織等各終端行業對石化產品的需求強勁。政府推動經濟成長和工業擴張的措施進一步刺激了市場發展。

石化產品市場佔有率

石化產業主要由知名公司主導,其中包括:

- 巴斯夫公司(德國)

- 利安德巴塞爾工業控股有限公司(美國)

- 英力士(英國)

- 殼牌有限公司(英國)

- 沙烏地基礎工業公司(SABIC)

- 信實工業有限公司(印度)

- 三菱化學控股公司(日本)

- 陶氏(美國)

- LG化學(韓國)

- 雪佛龍菲利普斯化學公司(美國)

- 中國石油天然氣集團公司(中國)

- 丸善石油化學(日本)

- 西布爾控股有限公司(俄羅斯)

- 獨角獸石油公司(印度)

全球石化市場的最新發展如何?

- 2025年5月,三菱化學集團旗下公司Gelest完成了位於賓州莫里斯維爾全球總部的特殊材料生產設施的擴建。這座佔地5萬平方英尺的新建築顯著提升了Gelest的生產能力,支援微電子、醫療設備、熱塗層和行動解決方案等領域的應用。該設施採用先進的設備和3000平方英尺的ISO 7級無塵室,提高了營運效率並確保了化學品的純度。此次擴建體現了Gelest對尖端材料科學的持續投資,以及其致力於滿足全球日益增長的高性能特種化學品需求的承諾。

- 2024年5月,霍尼韋爾推出了突破性的石腦油製乙烷和丙烷 (NEP) 技術,旨在透過提高能源效率和永續性來改變石化生產。這項創新製程能夠將石腦油和液化石油氣 (LPG) 原料轉化為乙烷和丙烷,然後送入專用裂解裝置,以最大程度地提高乙烯和丙烯的產量。與傳統的混合進料蒸汽裂解裝置相比,NEP 技術可減少高達 50% 的二氧化碳排放,並將淨現金利潤率提高 15-50%,同時最大限度地減少低價值副產品的產生。該技術的推出彰顯了霍尼韋爾致力於為全球石化產業推動低碳高效解決方案的承諾。

- 2023年11月,Braskem與Oxiteno宣佈建立策略夥伴關係,以推動利用再生資源生產生物乙烯。該乙烯經國際永續性與碳認證(ISCC)認證,採用品質平衡法生產,將傳統碳源與回收或再生原料混合。 Oxiteno將利用此認證原料開發創新、永續的化學解決方案,在維持與傳統產品相同品質的同時,大幅減少對化石燃料的依賴和溫室氣體排放。此次合作體現了兩家公司對石化產業脫碳、生態效率和循環經濟的共同承諾。

- 2023年11月,陶氏宣布投資89億美元,在加拿大阿爾伯塔省薩斯喀徹溫堡附近的工業中心地帶建造一座淨零排放石化綜合設施。該設施稱為Path2Zero項目,將成為全球首個實現範圍1和範圍2淨零排放的乙烯裂解及衍生品一體化生產基地。該項目每年將生產約300萬噸低碳至零碳乙烯和聚乙烯衍生品。在聯邦政府和省級政府的資金支持下,該項目計劃於2024年開工,並分階段於2029年竣工,這將進一步鞏固陶氏對工業脫碳的承諾。

- 2023年7月,SABIC推出了基於PCR的全新NORYL™產品組合,進一步推動其在石化產業永續發展和循環利用方面的承諾。這些創新樹脂包含25%或更多的消費後回收材料(PCR),部分牌號(例如NORYL NH5120RC3)與化石基同類產品相比,全球暖化潛勢降低了10%。該產品組合還包括經ISCC+認證的生物基變體,可在不影響性能的情況下直接取代傳統牌號。 SABIC現有超過200種牌號,並具備客製化新產品的能力,該計畫旨在幫助客戶在維持高材料標準的同時減少碳足跡。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。