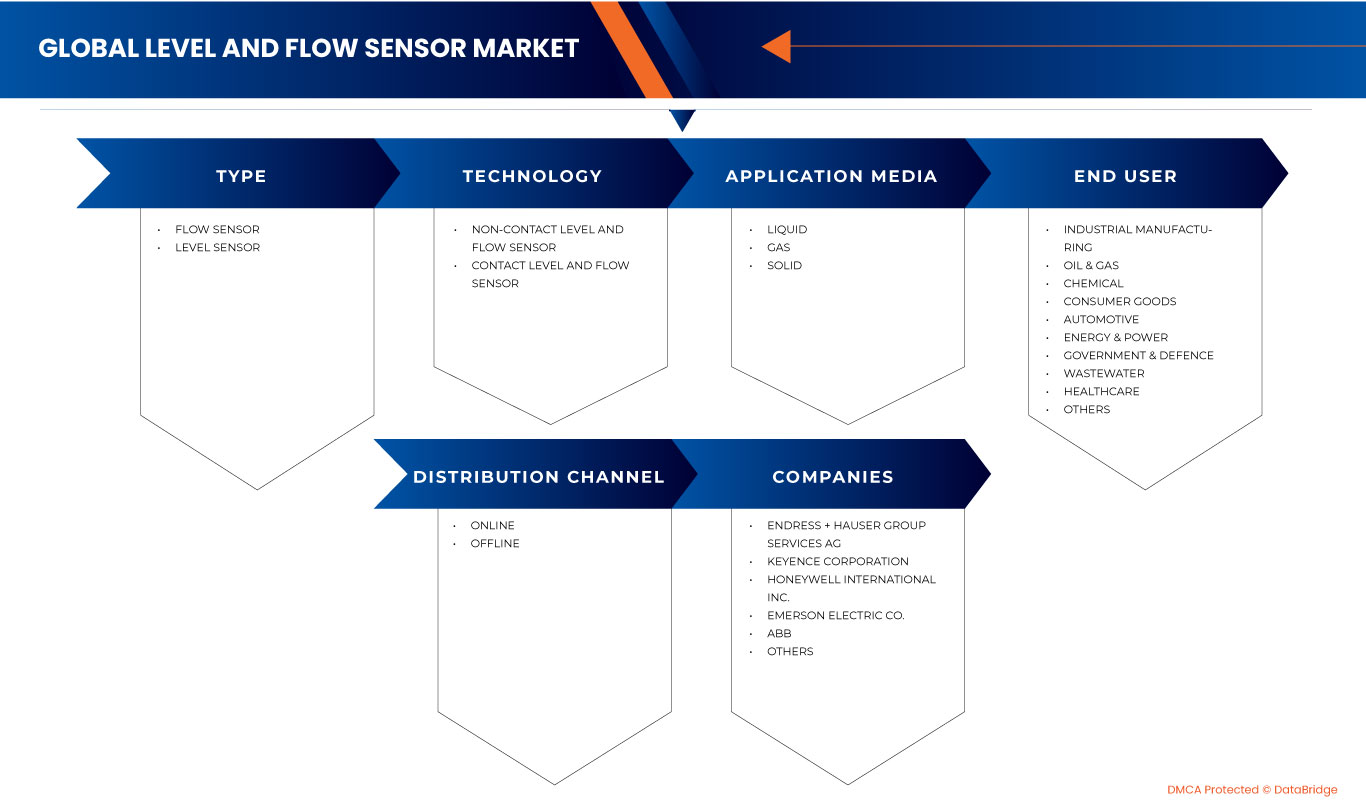

Global Level and Flow Sensor Market, By Type (Flow Sensor and Level Sensor), Technology (Non- Contact Level and Flow Sensor and Contact Level and Flow Sensor), Application Media (Solids, Liquid, and Gas), End User (Industrial Manufacturing, Oil & Gas, Chemical, Consumer Goods, Automotive, Energy & Power, Government & Defence, Wastewater, Healthcare, and Others) – Industry Trends and Forecast to 2030.

Level and Flow Sensor Market Analysis and Sizes

The global level and flow sensor market refers to the sector within the economy that caters to the provision of electrical power solutions tailored for industrial facilities and operations. This market encompasses a wide range of products and services focused on power generation, distribution, and control to meet the specific demands of manufacturing plants, factories, warehouses, and other industrial sites. Key components of the market include power generation equipment like gas turbines, diesel generators, and renewable energy sources, power distribution systems such as transformers and switchgear, power control and monitoring equipment, motor control centres and programmable logic controllers, and energy storage solutions like batteries. In addition, the market includes services for installation, maintenance, and project management related to global level and flow sensor systems. Factors influencing this market include industrial growth, energy policies, technological advancements, and environmental sustainability concerns.

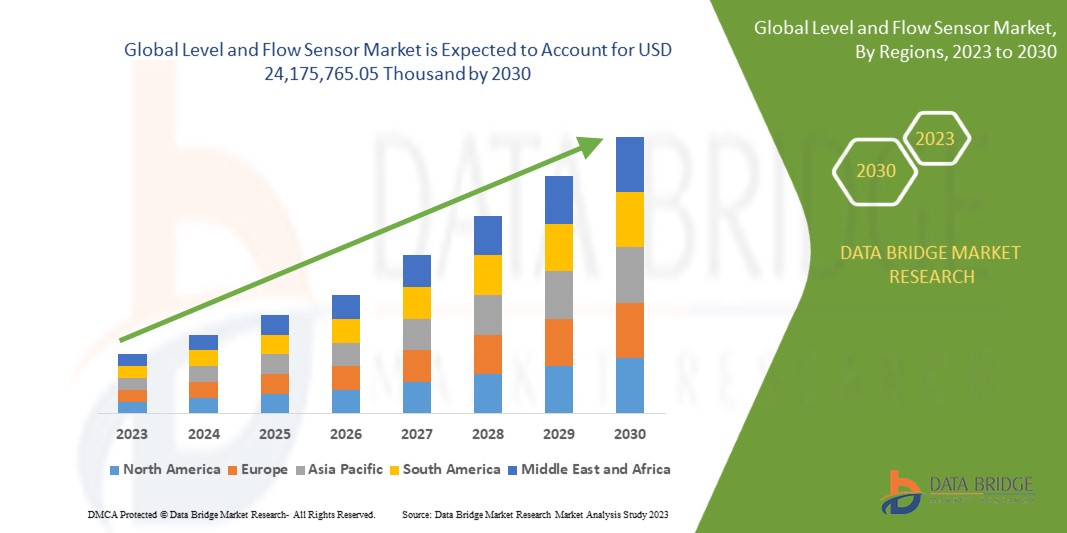

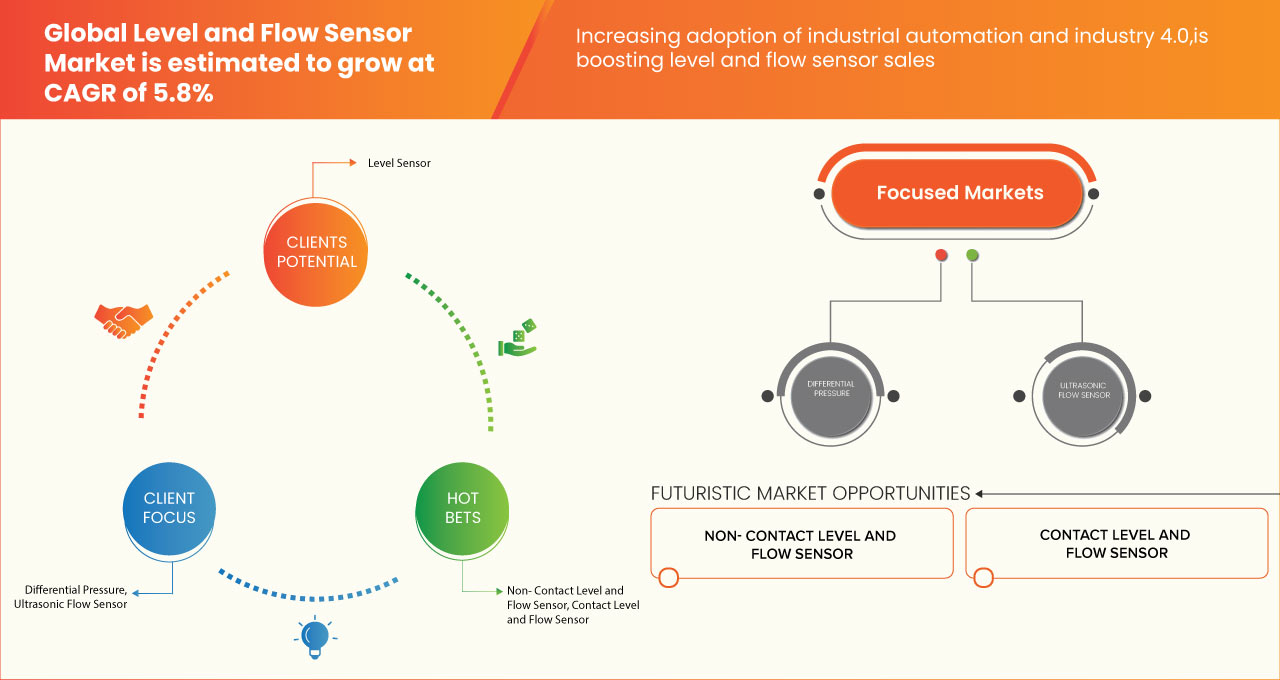

Data Bridge Market Research analyses that the global level and flow sensor market is expected to grow at a CAGR of 5.8% in the forecast period of 2023 to 2030 and is expected to reach USD 24,175,765.05 thousand by 2030. Level and flow sensor market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Type (Flow Sensor and Level Sensor), Technology (Non- Contact Level and Flow Sensor and Contact Level and Flow Sensor), Application Media (Solids, Liquid, and Gas), End User (Industrial Manufacturing, Oil & Gas, Chemical, Consumer Goods, Automotive, Energy & Power, Government & Defence, Wastewater, Healthcare, and Others) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Poland, Netherlands, Belgium, Switzerland, Denmark, Finland, Sweden, Norway, Turkey, Rest of Europe, China, Japan, South Korea, India, Taiwan, Australia, Thailand, Indonesia, Malaysia, Singapore, New Zealand, Philippines, Vietnam, Rest of Asia-Pacific, Brazil, Argentina, and the rest of South America, Saudi Arabia, U.A.E., South Africa, Kuwait, Qatar, Egypt, Israel, Oman, Bahrain, and Rest of Middle East and Africa |

|

Market Players Covered |

TE Connectivity, Temposonics (A Subsidiarity of Amphenol Corporation), AMETEK Inc., Emerson Electric Co., KEYENCE CORPORATION, ABB, Fortive, SICK AG, OMRON Corporation, Azbil Corporation, Honeywell International Inc., Endress+Hauser Group Services AG, SSI Technologies, LLC, Balluff Automation India Pvt. Ltd, KROHNE, Siemens, Schneider Electric, Omega Engineering inc., Yokogawa Electric Corporation, ifm electronic GmbH, Baumer, Nanjing AH Electronic Science & Technology Co., Ltd., UWT GmbH, NOHKEN INC., FAFNIR GmbH, Sapcon Instruments Pvt Ltd, Anderson-Negele, Senix Ultrasonic Distance and Ultrasonic Level Sensors, GF Piping Systems, Fuelics PC, Aplus Finetek Sensor, Inc (A Subsidiary of Finetek CO, LTD.), Pulsar Measurement and Flowline among others |

Market Definition

The global level and flow sensor market is the collective demand, supply, and trade of devices designed to measure and monitor fluid levels and flow rates in various industrial, commercial, and residential applications. These sensors play a crucial role in ensuring efficient and accurate management of liquids and gases within systems, processes, and equipment. The market encompasses a wide range of sensor types, technologies, and applications, catering to industries such as manufacturing, chemical processing, water and wastewater management, and energy among others.

Global Level and Flow Sensor Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increasing Adoption of Industrial Automation and Industry 4.0

The increasing adoption of industrial automation across sectors such as manufacturing, chemicals, and pharmaceuticals has led to a higher demand for accurate and reliable sensors. Level and flow sensors provide real-time data, helping industries optimize their processes, reduce manual intervention, and enhance overall productivity.

- Wide Applications of Level and Flow Sensors in Oil and Gas Industry

Flow sensors are used in manufacturing to measure the flow of liquids and gases. This information is used to control the production process and ensure that products are manufactured to specifications. Automation is increasingly being used in a variety of industries, such as manufacturing, energy, and transportation. Flow sensors are used in automation systems to measure the flow of fluids and control the operation of machines and equipment.

Opportunity

- Growing Need for Accuracy in Various Industries

The growing need for accuracy in various industries is creating opportunities for the global level and flow sensor market. Flow sensor manufacturers are developing new and innovative technologies to meet the demanding requirements of these industries. As a result, the global level and flow sensor market is expected to grow significantly in the coming years.

Restraint/Challenge

- High Initial Cost of Level and Flow Sensors

Many industries and applications that rely on level and flow sensors, such as manufacturing, water treatment, and oil and gas, are often cost-sensitive. High initial expenses can deter potential customers from adopting these sensors, especially in cases where large numbers of sensors are needed.

Recent Developments

- In May 2023, Murata Manufacturing Co., Ltd introduced the EVA series of multi-layer ceramic capacitors (MLCCs) with advanced resin moulding capabilities, designed for electric vehicle (EV) applications like on-board chargers, inverters, battery management systems, and wireless power transfer. These safety-certified Y2 class MLCCs feature 305VAC/1500VDC voltage ratings, 10mm creepage distances, and capacitance values ranging from 0.1nF to 4.7nF, addressing the demands of migration to 800V powertrains while maintaining miniaturization in modern automotive systems. The use of resin molding allows these compact components to achieve both extended creepage and compactness, ensuring long-term reliability in EV powertrains with higher voltages.

- In March 2023, Delta Electronics, Inc. showcased its industrial power supplies and wireless charging solutions for autonomous mobile robots (AMRs) at the Taipei International Machine Tool Show (TIMTOS) Future Manufacturing Forum. They presented the low-profile panel mount power supply PMT2 Series and the ultra-slim DIN rail type LYTE II Series for industrial power needs. In addition, Delta introduced the M∞Vair 1 kW Wireless Charging System for AMRs and AGVs, highlighting their commitment to smart factory operations and efficient solutions.

- In August 2022, UWT Gmbh received the prestigious "Supplier Performance Award" from Siemens in recognition of their exceptional collaboration and outstanding performance throughout the previous year, reflecting the strong partnership between the two companies.

- In April 2021, Temposonics officially became a part of the esteemed Amphenol Corporation. Amphenol, renowned as one of the world's largest manufacturers of interconnect products, specializes in cutting-edge electrical, electronic, and fiber optic connectors, interconnect systems, and more.

- In July 2020, Yokogawa Electric Corporation announced the expansion of its Sushi Sensor wireless industrial IoT (IIoT) solution with the introduction of new pressure and temperature sensors.

Global Level and Flow Sensor Market Scope

Global level and flow sensor market is segmented on the basis of type, technology, application media, end user, and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Flow Sensor

- Level Sensor

On the basis of type, the global level and flow sensor market is segmented into flow sensor and level sensor.

Technology

- Non- Contact Level and Flow Sensor

- Contact Level and Flow Sensor

On the basis of technology, the global level and flow sensor market is segmented into non- contact level and flow sensor, and contact level and flow sensor.

Application Media

- Solid

- Liquid

- Gas

On the basis of application media, the global level and flow sensor market is segmented into solid, liquid, and gas.

End User

- Industrial Manufacturing

- Oil & Gas

- Chemical

- Consumer Goods

- Automotive

- Energy & Power

- Government & Defense

- Wastewater

- Healthcare

- Others

On the basis of end user, the global level and flow sensor market is segmented into industrial manufacturing, oil & gas, chemical, consumer goods, automotive, energy & power, government & defence, wastewater, healthcare, and others.

Distribution Channel

- Offline

- Online

On the basis of distribution channel, the global level and flow sensor market is segmented into offline, and online.

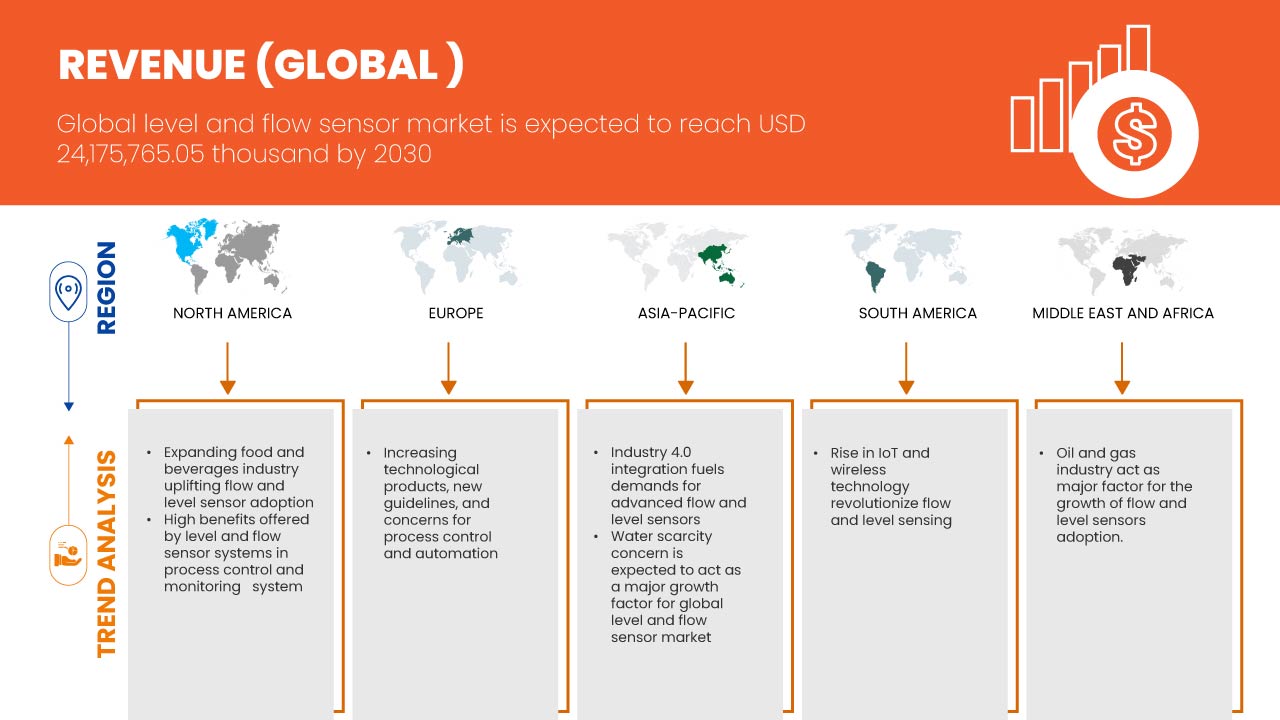

Global Level and Flow Sensor Market Regional Analysis/Insights

Global level and flow sensor market is analysed and market size insights and trends are provided by region, type, technology, application media, end user, and distribution channel as referenced above.

The countries covered in the global level and flow sensor market report are U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Poland, Netherlands, Belgium, Switzerland, Denmark, Finland, Sweden, Norway, Turkey, Rest of Europe, China, Japan, South Korea, India, Taiwan, Australia, Thailand, Indonesia, Malaysia, Singapore, New Zealand, Philippines, Vietnam, Rest of Asia-Pacific, Brazil, Argentina, and the rest of South America, Saudi Arabia, U.A.E., South Africa, Kuwait, Qatar, Egypt, Israel, Oman, Bahrain, and Rest of Middle East and Africa.

Asia-Pacific is expected to dominate the global level and flow sensor market owing to many product launches in the region's major markets and increasing consumer awareness. In Asia-Pacific region, China is expected to dominate the region as it has rapidly grown into a global hub for manufacturing and technology. In North America, U.S. is expected to dominate as it has one of the largest and most developed economies in the world. In Europe, Germany is expected to dominate as it is known for its strong engineering tradition and skilled workforce.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Level and Flow Sensor Market Share Analysis

Global level and flow sensor market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the global level and flow sensor market are TE Connectivity, Temposonics (A Subsidiarity of Amphenol Corporation), AMETEK Inc., Emerson Electric Co., KEYENCE CORPORATION, ABB, Fortive, SICK AG, OMRON Corporation, Azbil Corporation, Honeywell International Inc., Endress+Hauser Group Services AG, SSI Technologies, LLC, Balluff Automation India Pvt. Ltd, KROHNE, Siemens, Schneider Electric, Omega Engineering inc., Yokogawa Electric Corporation, ifm electronic GmbH, Baumer, Nanjing AH Electronic Science & Technology Co., Ltd., UWT GmbH, NOHKEN INC., FAFNIR GmbH, Sapcon Instruments Pvt Ltd, Anderson-Negele, Senix Ultrasonic Distance and Ultrasonic Level Sensors, GF Piping Systems, Fuelics PC, Aplus Finetek Sensor, Inc (A Subsidiary of Finetek CO, LTD.), and Pulsar Measurement and Flowline among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL LEVEL AND FLOW SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 UPCOMING PROJECTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF INDUSTRIAL AUTOMATION AND INDUSTRY 4.0

5.1.2 CONTINUOUS ADVANCEMENTS IN SENSOR TECHNOLOGY

5.1.3 RISING AWARENESS OF SAFETY IN PROCESS CONTROL

5.1.4 WIDE APPLICATIONS OF LEVEL AND FLOW SENSORS IN THE OIL AND GAS INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH INITIAL COST OF LEVEL AND FLOW SENSORS

5.2.2 STRICT REGULATORY COMPLIANCES RELATED TO SENSOR TECHNOLOGY

5.3 OPPORTUNITIES

5.3.1 INCREASING COLLABORATION AND PARTNERSHIPS AMONG MARKET PLAYERS

5.3.2 GROWING NEED FOR ACCURACY IN VARIOUS INDUSTRIES

5.3.3 EMERGING TECHNOLOGIES, SUCH AS IIOT, ASSET MANAGEMENT, AND ADVANCED DIAGNOSTICS

5.4 CHALLENGES

5.4.1 REQUIREMENT OF TIMELY CALIBRATION AND MAINTENANCE

5.4.2 LESS AVAILABILITY OF SKILLED LABOR

5.4.3 TECHNICAL LIMITATIONS RELATED TO LEVEL AND FLOW SENSORS

6 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TYPE

6.1 OVERVIEW

6.2 FLOW SENSOR

6.2.1 DIFFERENTIAL PRESSURE

6.2.2 ULTRASONIC FLOW SENSOR

6.2.3 MAGNETIC INDUCTION FLOW SENSOR

6.2.4 VORTEX FLOW SENSOR

6.2.5 THERMAL FLOW SENSOR

6.2.6 TURBINE FLOW SENSOR

6.2.7 CURIOUS SENSOR

6.2.8 POSITIVE DISPLACEMENT FLOW SENSOR

6.2.9 OTHERS

6.3 LEVEL SENSOR

6.3.1 ULTRASONIC LEVEL SENSOR

6.3.2 CAPACITANCE LEVEL SENSOR

6.3.3 OPTICAL LEVEL SENSOR

6.3.4 CONDUCTIVITY OR RESISTANCE LEVEL SENSOR

6.3.5 VIBRATING OR TUNING FORK LEVEL SENSOR

6.3.6 FLOAT LEVEL SENSOR

6.3.7 OTHERS

7 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 NON- CONTACT LEVEL AND FLOW SENSOR

7.3 CONTACT LEVEL AND FLOW SENSOR

8 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY APPLICATION MEDIA

8.1 OVERVIEW

8.2 LIQUID

8.3 GAS

8.4 SOLID

9 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY END USER

9.1 OVERVIEW

9.2 INDUSTRIAL MANUFACTURING

9.2.1 FLOW SENSOR

9.2.2 LEVEL SENSOR

9.3 OIL & GAS

9.3.1 FLOW SENSOR

9.3.2 LEVEL SENSOR

9.4 CHEMICAL

9.4.1 FLOW SENSOR

9.4.2 LEVEL SENSOR

9.5 CONSUMER GOODS

9.5.1 FLOW SENSOR

9.5.2 LEVEL SENSOR

9.6 AUTOMOTIVE

9.6.1 FLOW SENSOR

9.6.2 LEVEL SENSOR

9.7 ENERGY & POWER

9.7.1 FLOW SENSOR

9.7.2 LEVEL SENSOR

9.8 GOVERNMENT & DEFENSE

9.8.1 FLOW SENSOR

9.8.2 LEVEL SENSOR

9.9 WASTEWATER

9.9.1 FLOW SENSOR

9.9.2 LEVEL SENSOR

9.1 HEALTHCARE

9.10.1 FLOW SENSOR

9.10.2 LEVEL SENSOR

9.11 OTHERS

9.11.1 FLOW SENSOR

9.11.2 LEVEL SENSOR

10 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.2.1 SPECIALITY STORES

10.2.2 RETAIL STORES

10.2.3 OTHERS

10.3 ONLINE

10.3.1 COMPANY WEBSITE

10.3.2 THIRD PARTY E-COMMERCE WEBSITE

11 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY REGION

11.1 OVERVIEW

11.2 NORTH AMERICA

11.2.1 U.S.

11.2.2 CANADA

11.2.3 MEXICO

11.3 EUROPE

11.3.1 GERMANY

11.3.2 U.K.

11.3.3 FRANCE

11.3.4 ITALY

11.3.5 SPAIN

11.3.6 RUSSIA

11.3.7 POLAND

11.3.8 NETHERLANDS

11.3.9 BELGIUM

11.3.10 SWITZERLAND

11.3.11 DENMARK

11.3.12 FINLAND

11.3.13 SWEDEN

11.3.14 NORWAY

11.3.15 TURKEY

11.3.16 REST OF EUROPE

11.4 ASIA-PACIFIC

11.4.1 CHINA

11.4.2 JAPAN

11.4.3 SOUTH KOREA

11.4.4 INDIA

11.4.5 TAIWAN

11.4.6 AUSTRALIA

11.4.7 THAILAND

11.4.8 INDONESIA

11.4.9 MALAYSIA

11.4.10 SINGAPORE

11.4.11 NEWZEALAND

11.4.12 PHILIPPINES

11.4.13 VIETNAM

11.4.14 REST OF ASIA-PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 SAUDI ARABIA

11.5.2 U.A.E.

11.5.3 SOUTH AFRICA

11.5.4 KUWAIT

11.5.5 QATAR

11.5.6 EGYPT

11.5.7 ISRAEL

11.5.8 OMAN

11.5.9 BAHRAIN

11.5.10 REST OF MIDDLE EAST AND AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL LEVEL AND FLOW SENSOR MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL FLOW SENSOR MARKET

12.2 COMPANY SHARE ANALYSIS: GLOBAL LEVEL SENSOR MARKET

12.3 COMPANY SHARE ANALYSIS: NORTH AMERICA FLOW SENSOR MARKET

12.4 COMPANY SHARE ANALYSIS: NORTH AMERICA LEVEL SENSOR MARKET

12.5 COMPANY SHARE ANALYSIS: EUROPE FLOW SENSOR MARKET

12.6 COMPANY SHARE ANALYSIS: EUROPE LEVEL SENSOR MARKET

12.7 COMPANY SHARE ANALYSIS: ASIA-PACIFIC FLOW SENSOR MARKET

12.8 COMPANY SHARE ANALYSIS: ASIA-PACIFIC LEVEL SENSOR MARKET

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ENDRESS + HAUSER GROUP SERVICES AG

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 KEYENCE CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 HONEYWELL INTERNATIONAL INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 EMERSON ELECTRIC CO.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 ABB

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 AMETEK INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 ANDERSON-NEGELE

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 APLUS FINETEK SENSOR, INC

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 AZBIL CORPORATION

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BALLUFF AUTOMATION INDIA PVT. LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 BAUMER

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 FAFNIR GMBH

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 FLOWLINE

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 FORTIVE

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 FUELICS PC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 GF PIPING SYSTEMS

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 IFM ELECTRONIC GMBH

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 KROHNE

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 NANJING AH ELECTRONIC SCIENCE & TECHNOLOGY CO., LTD.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 NOHKEN INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 OMEGA ENGINEERING, INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.22 OMRON CORPORATION

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT DEVELOPMENT

14.23 PULSAR MEASUREMENT

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 SAPCON INSTRUMENTS PVT LTD

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

14.25 SCHNEIDER ELECTRIC

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENTS

14.26 SENIX ULTRASONIC DISTANCE AND ULTRASONIC LEVEL SENSORS

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENTS

14.27 SICK AG

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT PORTFOLIO

14.27.3 RECENT DEVELOPMENTS

14.28 SIEMENS (2022)

14.28.1 COMPANY SNAPSHOT

14.28.2 REVENUE ANALYSIS

14.28.3 PRODUCT PORTFOLIO

14.28.4 RECENT DEVELOPMENTS

14.29 SSI TECHNOLOGIESM, LLC

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT PORTFOLIO

14.29.3 RECENT DEVELOPMENTS

14.3 TE CONNECTIVITY

14.30.1 COMPANY SNAPSHOT

14.30.2 REVENUE ANALYSIS

14.30.3 PRODUCT PORTFOLIO

14.30.4 RECENT DEVELOPMENTS

14.31 TEMPOSONICS (A SUBSIDIARITY OF AMPHENOL CORPORATION)

14.31.1 COMPANY SNAPSHOT

14.31.2 PRODUCT PORTFOLIO

14.31.3 RECENT DEVELOPMENTS

14.32 UWT GMBH

14.32.1 COMPANY SNAPSHOT

14.32.2 PRODUCT PORTFOLIO

14.32.3 RECENT DEVELOPMENTS

14.33 YOKOGAWA ELECTRIC CORPORATION

14.33.1 COMPANY SNAPSHOT

14.33.2 REVENUE ANALYSIS

14.33.3 PRODUCT PORTFOLIO

14.33.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 OPTICAL MEASUREMENT SYSTEMS AND COST ASSOCIATED (USD)

TABLE 2 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 GLOBAL FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 GLOBAL LEVEL SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL LEVEL SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL NON-CONTACT LEVEL AND FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 GLOBAL CONTACT LEVEL AND FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY APPLICATION MEDIA, 2021-2030 (USD THOUSAND)

TABLE 11 GLOBAL LIQUID IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 GLOBAL GAS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 GLOBAL SOLID IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 15 GLOBAL INDUSTRIAL MANUFACTURING IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 GLOBAL INDUSTRIAL MANUFACTURING IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 GLOBAL OIL & GAS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 GLOBAL OIL & GAS IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 GLOBAL CHEMICAL IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 GLOBAL CHEMICAL IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 GLOBAL CONSUMER GOODS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 GLOBAL CONSUMER GOODS IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 GLOBAL AUTOMOTIVE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 GLOBAL AUTOMOTIVE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 GLOBAL ENERGY & POWER IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 GLOBAL ENERGY & POWER IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 GLOBAL GOVERNMENT & DEFENSE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 GLOBAL GOVERNMENT & DEFENSE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 GLOBAL WASTEWATER IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 GLOBAL WASTEWATER IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 GLOBAL HEALTHCARE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 GLOBAL HEALTHCARE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 GLOBAL OTHERS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 GLOBAL OTHERS IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 36 GLOBAL OFFLINE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 GLOBAL OFFLINE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 GLOBAL ONLINE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 GLOBAL ONLINE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 MARKET SHARE OF TOP 15 COMPANIES IN GLOBAL FLOW AND LEVEL SENSOR MARKET

TABLE 41 MARKET SHARE OF TOP 15 COMPANIES IN NORTH AMERICA FLOW AND LEVEL SENSOR MARKET

TABLE 42 MARKET SHARE OF TOP 15 COMPANIES IN EUROPE FLOW AND LEVEL SENSOR MARKET

TABLE 43 MARKET SHARE OF TOP 15 COMPANIES IN ASIA-PACIFIC FLOW AND LEVEL SENSORS MARKET

图片列表

FIGURE 1 GLOBAL LEVEL AND FLOW SENSOR MARKET: SEGMENTATION

FIGURE 2 GLOBAL LEVEL AND FLOW SENSOR MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL LEVEL AND FLOW SENSOR MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL LEVEL AND FLOW SENSOR MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL LEVEL AND FLOW SENSOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL LEVEL AND FLOW SENSOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL LEVEL AND FLOW SENSOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL LEVEL SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL FLOW SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL LEVEL AND FLOW SENSOR MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 GLOBAL LEVEL AND FLOW SENSOR MARKET: MULTIVARIATE MODELLING

FIGURE 12 GLOBAL LEVEL AND FLOW SENSOR MARKET: TYPE TIMELINE CURVE

FIGURE 13 GLOBAL LEVEL AND FLOW SENSOR MARKET: SEGMENTATION

FIGURE 14 THE INCREASING ADOPTION OF INDUSTRIAL AUTOMATION AND INDUSTRY 4.0 IS EXPECTED TO BE KEY DRIVERS FOR THE GLOBAL LEVEL AND FLOW SENSOR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 FLOW SENSOR IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL LEVEL AND FLOW SENSOR MARKET IN 2023 TO 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL LEVEL AND FLOW SENSOR MARKET

FIGURE 17 INCREASING AUTOMATION IN INDIA (IN %)

FIGURE 18 ADVANCEMENTS IN SENSOR TECHNOLOGY

FIGURE 19 VARIOUS STRATEGIC INITIATIVES

FIGURE 20 GROWING NEED FOR ACCURACY IN VARIOUS INDUSTRIES

FIGURE 21 TOP IOT CATEGORIES BASED ON 2020 MARKET SHARE

FIGURE 22 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY TYPE, 2022

FIGURE 23 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY TECHNOLOGY, 2022

FIGURE 24 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY APPLICATION MEDIA, 2022

FIGURE 25 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY END USER, 2022

FIGURE 26 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 27 GOBAL LEVEL AND FLOW SENSOR MARKET: SNAPSHOT (2022)

FIGURE 28 GLOBAL FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 29 GLOBAL LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 30 NORTH AMERICA FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 31 NORTH AMERICA LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 32 EUROPE FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 33 EUROPE LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 34 ASIA-PACIFIC FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 35 ASIA-PACIFIC LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。