Global Digital Insurance Platform Market

市场规模(十亿美元)

CAGR :

%

| 2023 –2029 | |

|

|

|

|

>全球数字保险平台市场,按组件(工具、服务)、最终用户(保险公司、第三方管理员和经纪人、聚合器)、保险应用(汽车和运输、住宅和商业建筑、生命和健康、商业和企业、消费电子和工业机器、旅行)、部署类型(本地和云)、组织规模(大型企业、中小型企业)、国家(美国、加拿大、墨西哥、巴西、阿根廷、南美洲其他地区、德国、意大利、英国、法国、西班牙、荷兰、比利时、瑞士、土耳其、俄罗斯、欧洲其他地区、日本、中国、印度、韩国、澳大利亚、新加坡、马来西亚、泰国、印度尼西亚、菲律宾、亚太其他地区、沙特阿拉伯、阿联酋、南非、埃及、以色列、中东和非洲其他地区)划分的行业趋势和预测到 2029 年。

市场分析与洞察全球数字保险平台市场

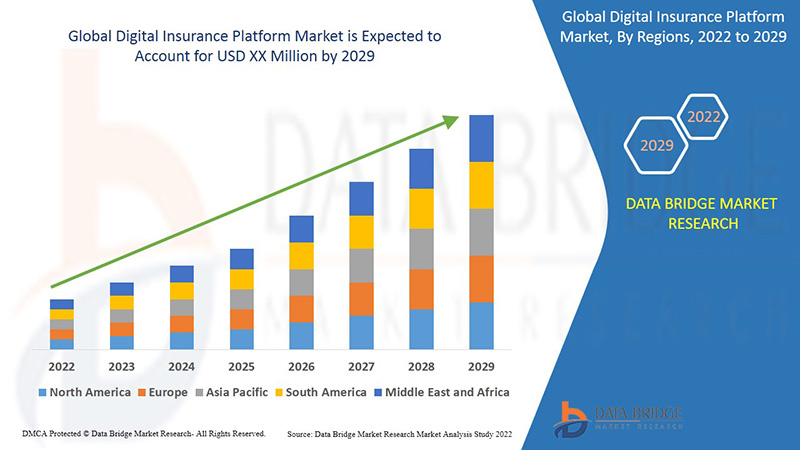

Data Bridge Market Research 分析称,数字保险平台市场在 2022-2029 年的预测期内将呈现 13.7% 的复合年增长率。

保险平台是提供保险单信息和其他相关信息的网站集合。数字保险平台的创建和开发旨在帮助客户应对快速发展的技术进入保险行业所带来的挑战。消费者可以使用数字技术轻松获取保险信息。通过关注个人客户的需求并通过数字保险平台满足这些需求,保险公司能够专注于新兴技术。数字保险平台是一种软件或技术,可帮助企业监控、创建、管理和控制数字保险生态系统。它帮助企业将数字化纳入保险流程。数字保险平台是一种软件或技术,可让保险公司或总代理 (MGA) 跟踪、管理和监管数字保险生态系统。公司可以使用数字保险平台将数字化纳入整个保险流程。在数字保险生态系统中,这些平台结合了不同的模块/孤岛和异构系统。保单实施、索赔管理、再保险管理、监管备案以及计费和保费核算都是这些模块或系统的示例。这些平台还为保单持有人提供了一个门户网站,使他们可以轻松地远程查看客户数据库。

The digital insurance platform market is being driven by the rising adoption of IoT products. The upsurge in the adoption rate of underwater acoustic modems in naval defense is a major factor driving the market's growth. The changing insurer’s focus from product-based to consumer-centric strategies is driving up demand for digital insurance platform equipment market. Other significant factors such as rising awareness amongst insurers towards digital channels, and technological advancement will cushion the growth rate of digital insurance platform market. Furthermore, upsurge in the adoption rate of cloud-based digital solutions by the insurers to obtain the high scalability will accelerate the growth rate of digital insurance platform market for the forecast period mentioned above.

Moreover, increasing awareness amongst insurers to access a broader segment of the market and emerging new markets will boost the beneficial opportunities for the digital insurance platform market growth.

However, difficulties involved in the integration of insurance platforms with legacy systems will act as major retrain and further impede the market's growth. The dearth of skilled workforce will challenge the growth of the digital insurance platform market.

This digital insurance platform market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographical expansions, technological innovations in the market. To gain more info on digital insurance platform market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Digital Insurance Platform Market Scope and Market Size

The digital insurance platform market is segmented on the basis of component, end-user, insurance application, deployment type and organization size. The growth amongst the different segments helps you in attaining the knowledge related to the different growth factors expected to be prevalent throughout the market and formulate different strategies to help identify core application areas and the difference in your target market.

- On the basis of component, digital insurance platform market is segmented into tools and services. Based on service segment, digital insurance platform market is further sub-segmented into managed and professional service. The professional services segment is divided into consulting, implementation and support and maintenance.

- Based on end-users, digital insurance platform market is segmented into insurance companies, third-party administrators and brokers and aggregators.

- Based on insurance application, digital insurance platform market is segmented into automotive and transportation, home and commercial buildings, life and health, business and enterprise, consumer electronics and industrial machines and travel.

- Based on deployment type, digital insurance platform market is segmented into on-premises and cloud.

- Based on organization size, digital insurance platform market is segmented into large enterprises and small and medium-sized enterprises.

Digital Insurance Platform Market Country Level Analysis

The digital insurance platform market is segmented on the basis of component, end-user, insurance application, deployment type and organization size.

The countries covered in the digital insurance platform market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the digital insurance platform market and will continue to flourish its trend of dominance during the forecast period due to the high concentration of large insurance companies in this region. Asia-Pacific is expected to grow during the forecast period of 2022-2029 due to the rise in the level of commercial investment by various industries.

The country section of the digital insurance platform market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, down-stream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Digital Insurance Platform Market Share Analysis

数字保险平台市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对数字保险平台市场的关注有关。

数字保险平台市场的一些主要参与者包括塔塔咨询服务有限公司、DXC 科技公司、印孚瑟斯有限公司、Pegasystems 公司、Appian、Mindtree 有限公司、Prima Solutions、FINEOS、Cognizant、Inzura 有限公司、Cogitate 科技解决方案公司、Duck Creek 科技公司、Bolt Solutions、Majesco、EIS 集团、iPipeline 公司、Vertafore 公司、易保科技公司、IBM、微软、埃森哲、甲骨文和 SAP SE 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.