Global Data Center Storage Market

市场规模(十亿美元)

CAGR :

%

USD

61.61 Billion

USD

147.79 Billion

2024

2032

USD

61.61 Billion

USD

147.79 Billion

2024

2032

| 2025 –2032 | |

| USD 61.61 Billion | |

| USD 147.79 Billion | |

|

|

|

|

全球資料中心儲存市場細分,按部署方式(儲存區域網路 (SAN) 系統、網路附加儲存 (NAS) 系統和直連儲存 (DAS) 系統)、應用領域(IT 和電信、銀行、金融服務和保險 (BFSI)、政府、醫療保健及其他)、儲存類型(傳統儲存、全快閃儲存和混合儲存)劃分-產業趨勢

資料中心儲存市場規模

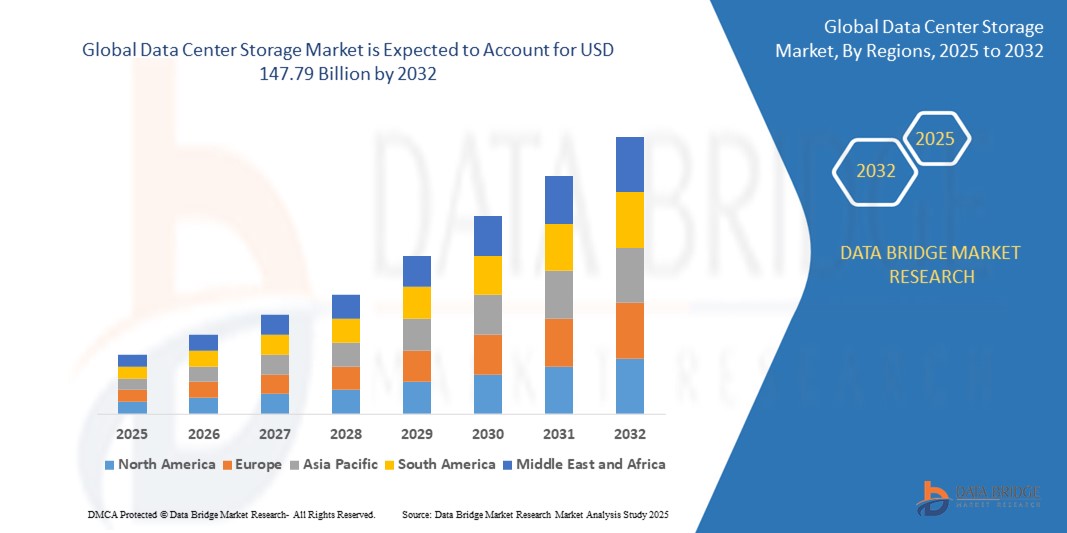

- 2024年全球資料中心儲存 市場規模為616.1億美元,預計到2032年將達到1,477.9億美元,預測期內複合年增長率為11.49% 。

- 這種成長是由多種因素推動的,例如企業產生的數據量不斷增加、儲存技術的進步以及各行業數位轉型的日益普及。

資料中心儲存市場分析

- 資料中心儲存解決方案對於管理和儲存現代資料中心中的大量資料至關重要,它提供高容量、高速的儲存系統,以滿足雲端運算、大數據分析和企業應用的需求。

- 資料中心儲存需求的主要驅動力來自企業資料量的不斷增長、雲端服務的快速普及以及固態硬碟 (SSD) 和軟體定義儲存 (SDS) 等儲存技術的進步。全球超過一半的資料中心儲存需求是由對雲端儲存服務日益增長的需求所驅動的,其中數位轉型地區的需求最為旺盛。

- 由於雲端服務的廣泛應用,預計北美將以 40.1% 的最大市場份額主導資料中心儲存市場。

- 由於人們對眼部健康的日益關注,預計亞太地區將在預測期內成為資料中心儲存市場成長最快的地區。

- 由於雲端運算、5G網路和人工智慧應用的快速成長,IT和電信產業預計將以23.9%的市場份額主導市場。

報告範圍和資料中心儲存市場細分

|

屬性 |

資料中心儲存關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家/地區 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了市場價值、成長率、市場細分、地理覆蓋範圍、市場參與者和市場狀況等市場洞察外,Data Bridge Market Research 團隊精心編制的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 PESTLE 分析。 |

資料中心儲存市場趨勢

“軟體定義儲存 (SDS) 和雲端整合的日益普及”

- 全球資料中心儲存市場的一個顯著趨勢是軟體定義儲存 (SDS) 和雲端整合技術的日益普及。

- 這些先進的解決方案透過將儲存管理與硬體分離,提供了更高的可擴展性、靈活性和成本效益,使企業能夠更敏捷地管理大量資料。

- 例如,SDS 使組織能夠輕鬆擴展其儲存基礎設施以滿足不斷增長的資料需求,而雲端整合則可實現對異地儲存的無縫訪問,從而簡化資料備份、災難復原和全球存取。

- 雲端整合還能增強跨地域的協作和資料共享,進而推動混合雲和多雲環境的普及,而這種環境在現代資料中心正變得越來越普遍。

- 這一趨勢正在改變資料儲存和管理方式,從而支持各行業雲端服務、大數據分析和數位轉型的快速發展。

資料中心儲存市場動態

司機

“數據生成激增帶來的需求日益增長”

- 企業、雲端服務以及物聯網、人工智慧和大數據分析等新興技術產生的資料量日益增長,顯著推動了對資料中心儲存解決方案的需求。

- 隨著全球各行各業進行數位轉型,對高容量、可擴展和高效能儲存系統的需求不斷增長,以應對大量資料的湧入。

- 雲端運算尤其對資料爆炸性成長起到了推波助瀾的作用,因為越來越多的企業將資料遷移到雲端環境進行儲存、管理和分析。

- 儲存技術的不斷進步,例如軟體定義儲存 (SDS) 和基於 NVMe 的解決方案的開發,進一步凸顯了對尖端儲存基礎架構的需求,以支援複雜的工作負載並確保高效的資料管理。

- 隨著企業、政府和個人產生的資料量不斷增加,對可靠且可擴展的儲存解決方案的需求也日益增長,以確保資料的可用性、安全性和對關鍵資訊的快速存取。

例如,

- 根據 Statista 於 2022 年 4 月發布的一份報告,預計到 2025 年,全球資料量將達到 175 ZB,這將進一步推動對先進資料中心儲存技術的需求,以管理和儲存這些海量資料集。

- 2021年8月,IDC發布的一項研究預測,到2025年,全球資料中心儲存的資料總量將顯著成長,這將進一步推動對高效、可擴展儲存解決方案的需求,以適應不斷擴大的資料規模。

- 由於數位轉型和對雲端服務的日益依賴推動了資料生成量的激增,對資料中心儲存解決方案的需求也顯著增長。

機會

“利用人工智慧整合推進數據管理”

- 人工智慧驅動的資料中心儲存解決方案透過自動化儲存分配、優化資料檢索和改進預測性維護,增強了資料管理能力。這些人工智慧驅動的技術使資料中心能夠更有效率、更經濟地處理大量資料。

- 人工智慧演算法可以分析使用模式、預測儲存需求並提供即時洞察,幫助企業優化儲存資源,確保關鍵數據在需要時始終可用。

- 此外,人工智慧還可以輔助異常檢測,使資料中心能夠在潛在安全威脅或硬體故障中斷運行之前識別它們,從而提高系統可靠性並減少停機時間。

- 將人工智慧整合到資料中心儲存解決方案中,還能提高營運效率、增強資料安全性並降低整體基礎架構成本。透過利用人工智慧驅動的技術,資料中心可以更好地管理儲存資產、降低風險並確保持續、高效能的資料存取。

克制/挑戰

“高昂的設備和基礎設施成本阻礙了市場滲透”

- 資料中心儲存解決方案的高昂成本仍然是一個重大挑戰,尤其對於預算有限的中小型企業或發展中地區的組織而言更是如此。

- 包括高效能固態硬碟 (SSD)、軟體定義儲存 (SDS) 和混合式儲存解決方案在內的先進儲存技術,通常需要大量的初始投資,這可能會阻礙企業升級其基礎設施或採用新技術。

- 這種財務障礙可能導致人們依賴老舊、效率較低的儲存系統,這限制了他們獲取最新的資料管理創新技術,並阻礙了市場的整體成長。

例如,

- 根據資料中心知識網 (Data Center Knowledge) 於 2024 年 6 月發布的報告,資料中心基礎設施高昂成本引發的主要擔憂之一是其對業務可擴展性和長期營運效率的潛在影響。高效能儲存系統的初始投資往往會超出小型企業的預算,從而阻礙它們採用尖端技術。

- 因此,這些限制可能導致大型企業和中小企業在資料管理能力方面存在差距,最終阻礙全球資料中心儲存市場的更廣泛應用和成長。

資料中心儲存市場範圍

市場按部署方式、應用領域和儲存類型進行細分。

|

分割 |

子細分 |

|

按部署 |

|

|

透過申請 |

|

|

依儲存類型 |

|

預計到2025年,資訊科技和電信業將主導市場,在應用領域佔據最大份額。

預計到2025年,IT和電信業將以23.9%的市佔率主導資料中心儲存市場。這一主導地位主要歸功於該產業對大規模資料處理、儲存和管理解決方案的高度依賴。雲端運算、5G基礎設施和人工智慧驅動型應用的快速發展顯著提升了對高容量、高效且可擴展儲存系統的需求。此外,對即時數據存取、網路優化和提升客戶體驗的日益增長的需求也進一步加速了該行業對儲存解決方案的採用。

預計在預測期內,儲存區域網路(SAN)系統 將在部署領域佔據最大份額。

預計到2025年,儲存區域網路(SAN)系統將以17.8%的市佔率主導資料中心儲存市場。 SAN系統之所以能佔據主導地位,主要得益於其能夠提供高速、可靠且可擴展的資料儲存解決方案,這對於支援企業工作負載和關鍵任務型應用至關重要。各行業對虛擬化、雲端服務和大數據分析的日益普及,也推動了對SAN系統的需求,因為這些系統能夠提供更強大的資料管理、集中式儲存和更佳的網路效能。此外,儲存技術的進步以及對高效災難復原解決方案的需求,也進一步促進了SAN系統市場的成長。

資料中心儲存市場區域分析

“北美是 資料中心儲存市場的主導地區”

- 北美在全球資料中心儲存市場佔據主導地位,市佔率高達 40.1%,這主要得益於其先進的 IT 基礎設施、雲端服務的廣泛應用以及領先市場參與者的強大影響力。

- 由於對高效能儲存解決方案的需求不斷增長、資料中心不斷擴張以及 NVMe 和軟體定義儲存 (SDS) 等儲存技術的不斷進步,美國佔據了 30.5% 的顯著市場份額。

- 健全的資料安全法規、成熟的雲端服務供應商以及大型企業對技術的巨額投資,進一步鞏固了市場。

- 此外,大數據分析、人工智慧和物聯網的日益普及也推動了該地區對可擴展、高效儲存系統的需求。

“亞太地區預計將實現最高成長率”

- 受數位基礎設施快速擴張、數據生成量不斷增長以及雲端運算普及率上升的推動,亞太地區預計將成為資料中心儲存市場成長最快的地區。

- 由於快速的城市化進程、不斷提高的網路普及率以及對資料中心基礎設施的大量投資,中國、印度和日本等國家正在崛起為關鍵市場。

- 日本擁有先進的技術基礎設施和對可靠儲存解決方案的旺盛需求,仍然是資料中心儲存供應商的關鍵市場。該國在採用高容量、高效能儲存系統方面持續處於領先地位,以支持其數位轉型。

- 中國和印度人口眾多且持續成長,兩國政府加大了對資料儲存和雲端服務的投資,私部門也蓬勃發展。全球IT巨頭的不斷擴張以及數據本地化的需求,進一步推動了該地區市場的成長。

資料中心儲存市場份額

市場競爭格局部分按競爭對手提供詳細信息,包括公司概況、財務狀況、收入、市場潛力、研發投入、新市場拓展計劃、全球佈局、生產基地及設施、產能、公司優勢與劣勢、產品發布、產品線寬度與廣度以及應用領域優勢。以上數據僅與各公司在市場上的業務重點相關。

市場上的主要市場領導者包括:

- 戴爾科技(美國)

- 惠普企業(美國)

- IBM公司(美國)

- NetApp(美國)

- 日立萬塔拉(日本)

- 華為技術有限公司(中國)

- 西部數據公司(美國)

- 希捷科技(美國)

- Pure Storage(美國)

- 思科系統(美國)

全球資料中心儲存市場最新發展動態

- 2023年5月,Pure Storage Inc. 推出了 FlashBlade//E,進一步拓展了其快閃儲存產品組合。該產品旨在解決儲存在磁碟系統中約80%的非主資料或「冷資料」問題。這項創新解決方案旨在提升資料中心儲存環境的效率和成本效益。

- 2023年4月,微軟在波蘭推出首個可信任雲端空間,進一步拓展其全球業務,這是微軟在中東歐地區的首個可信任雲端空間,具有里程碑式的意義。這項策略性舉措旨在提升該地區的雲端服務可存取性並改善數據服務。

- 2022年6月,Pure Storage Inc.在班加羅爾設立了研發中心,其策略重點是推動儲存和資料管理解決方案的發展,包括FlashArray、FlashBlade、FlashStack和Pure as-a-Service。

- 2020年9月,專注於創新的技術平台INVITE Systems與華為合作,共同開發了一款高可靠性資料中心,旨在滿足企業多樣化的需求。此次合作彰顯了雙方致力於為科技業的企業提供強大可靠的基礎設施解決方案的共同努力。

- 2022年12月,三星電子宣布其採用業界首款12奈米製程技術製造的16Gb DDR5 DRAM已研發成功,並完成了與AMD的產品相容性測試。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DATA CENTER STORAGE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DATA CENTER STORAGE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMAPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DATA CENTER STORAGE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

6 GLOBAL DATA CENTER STORAGE MARKET, BY STORAGE SYSTEM TYPE

6.1 OVERVIEW

6.2 DIRECT ATTACHED STORAGE (DAS)

6.3 NETWORK ATTACHED STORAGE (NAS)

6.3.1 BY PROTOCOLS

6.3.1.1. NETWORK FILE SYSTEM (NFS)

6.3.1.2. COMMON INTERNET FILE SYSTEM (CIFS)

6.3.1.3. FILE TRANSFER PROTOCOL (FTP)

6.3.1.4. HYPER TEXT TRANSFER PROTOCOL (HTTP)

6.3.1.5. OTHERS

6.4 STORAGE AREA NETWORK (SAN)

6.4.1 BY TYPE

6.4.1.1. FC-SAN

6.4.1.2. IP-SAN

7 GLOBAL DATA CENTER STORAGE MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 ROUTERS

7.2.2 SWITCHES

7.2.3 FIREWALLS

7.2.4 OTHERS

7.3 SOFTWARE

7.3.1 STORAGE MANAGEMENT SOFTWARE

7.3.2 BACKUP MANAGEMENT SOFTWARE

7.3.3 OTHERS

7.4 SERVICES

7.4.1 PROFESSIONAL SERVICES

7.4.1.1. CONSULTING

7.4.1.2. INTEGRATION

7.4.1.3. SUPPORT & MAINTENANCE

7.4.2 MANAGED SERVICES

8 GLOBAL DATA CENTER STORAGE MARKET, BY SYSTEM ARCHITECTURE

8.1 OVERVIEW

8.2 BLOCK STORAGE DEVICES

8.3 FILE STORAGE DEVICES

9 GLOBAL DATA CENTER STORAGE MARKET, BY STORAGE TECHNOLOGY

9.1 OVERVIEW

9.2 HARD DISK DRIVE (HDD)

9.3 SOLID STATE DRIVE (SSD)

9.4 HYBRID STORAGE

10 GLOBAL DATA CENTER STORAGE MARKET, BY DEPLOYMENT MODE

10.1 OVERVIEW

10.2 ON-PREMISES

10.3 CLOUD

11 GLOBAL DATA CENTER STORAGE MARKET, BY TYPE OF DATA CENTER

11.1 OVERVIEW

11.2 ENTERPRISE DATA CENTERS

11.3 MANAGED SERVICES DATA CENTERS

11.4 COLOCATION DATA CENTERS

11.5 CLOUD DATA CENTERS

11.6 EDGE DATA CENTERS

11.7 OTHERS

12 GLOBAL DATA CENTER STORAGE MARKET, BY TIER TYPE

12.1 OVERVIEW

12.2 TIER I

12.3 TIER II

12.4 TIER III

12.5 TIER IV

13 GLOBAL DATA CENTER STORAGE MARKET, BY DATA CENTER SIZE

13.1 OVERVIEW

13.2 MICRO DATA CENTER

13.3 SMALL DATA CENTERS

13.4 MID-SIZED DATA CENTERS

13.5 LARGE DATA CENTERS

14 GLOBAL DATA CENTER STORAGE MARKET, BY STORAGE TYPE

14.1 OVERVIEW

14.2 TRADITIONAL STORAGE

14.3 ALL-FLASH STORAGE

14.4 HYBRID STORAGE

15 GLOBAL DATA CENTER STORAGE MARKET, BY END USER

15.1 OVERVIEW

15.2 ENTERPRISE

15.2.1 BY SIZE,

15.2.1.1. SMALL & MEDIUM SIZE ENTERPRISE

15.2.1.2. LARGE SIZE ENTERPRISE

15.3 COLOCATION PROVIDERS

15.4 CLOUD PROVIDERS

16 GLOBAL DATA CENTER STORAGE MARKET, BY INDUSTRY

16.1 OVERVIEW

16.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

16.2.1 BY STORAGE SYSTEM TYPE

16.2.1.1. DIRECT ATTACHED STORAGE (DAS)

16.2.1.2. NETWORK ATTACHED STORAGE (NAS)

16.2.1.2.1. BY PROTOCOLS

16.2.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.2.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.2.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.2.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.2.1.2.1.5 OTHERS

16.2.1.3. STORAGE AREA NETWORK (SAN)

16.2.1.3.1. BY TYPE

16.2.1.3.1.1 FC-SAN

16.2.1.3.1.2 IP-SAN

16.3 GOVERNMENT & DEFENSE

16.3.1 BY STORAGE SYSTEM TYPE

16.3.1.1. DIRECT ATTACHED STORAGE (DAS)

16.3.1.2. NETWORK ATTACHED STORAGE (NAS)

16.3.1.2.1. BY PROTOCOLS

16.3.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.3.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.3.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.3.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.3.1.2.1.5 OTHERS

16.3.1.3. STORAGE AREA NETWORK (SAN)

16.3.1.3.1. BY TYPE

16.3.1.3.1.1 FC-SAN

16.3.1.3.1.2 IP-SAN

16.4 HEALTHCARE

16.4.1 BY STORAGE SYSTEM TYPE

16.4.1.1. DIRECT ATTACHED STORAGE (DAS)

16.4.1.2. NETWORK ATTACHED STORAGE (NAS)

16.4.1.2.1. BY PROTOCOLS

16.4.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.4.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.4.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.4.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.4.1.2.1.5 OTHERS

16.4.1.3. STORAGE AREA NETWORK (SAN)

16.4.1.3.1. BY TYPE

16.4.1.3.1.1 FC-SAN

16.4.1.3.1.2 IP-SAN

16.5 MANUFACTURING

16.5.1 BY STORAGE SYSTEM TYPE

16.5.1.1. DIRECT ATTACHED STORAGE (DAS)

16.5.1.2. NETWORK ATTACHED STORAGE (NAS)

16.5.1.2.1. BY PROTOCOLS

16.5.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.5.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.5.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.5.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.5.1.2.1.5 OTHERS

16.5.1.3. STORAGE AREA NETWORK (SAN)

16.5.1.3.1. BY TYPE

16.5.1.3.1.1 FC-SAN

16.5.1.3.1.2 IP-SAN

16.6 RETAIL

16.6.1 BY STORAGE SYSTEM TYPE

16.6.1.1. DIRECT ATTACHED STORAGE (DAS)

16.6.1.2. NETWORK ATTACHED STORAGE (NAS)

16.6.1.2.1. BY PROTOCOLS

16.6.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.6.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.6.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.6.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.6.1.2.1.5 OTHERS

16.6.1.3. STORAGE AREA NETWORK (SAN)

16.6.1.3.1. BY TYPE

16.6.1.3.1.1 FC-SAN

16.6.1.3.1.2 IP-SAN

16.7 IT & TELECOM

16.7.1 BY STORAGE SYSTEM TYPE

16.7.1.1. DIRECT ATTACHED STORAGE (DAS)

16.7.1.2. NETWORK ATTACHED STORAGE (NAS)

16.7.1.2.1. BY PROTOCOLS

16.7.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.7.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.7.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.7.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.7.1.2.1.5 OTHERS

16.7.1.3. STORAGE AREA NETWORK (SAN)

16.7.1.3.1. BY TYPE

16.7.1.3.1.1 FC-SAN

16.7.1.3.1.2 IP-SAN

16.8 MEDIA & ENTERTAINMENT

16.8.1 BY STORAGE SYSTEM TYPE

16.8.1.1. DIRECT ATTACHED STORAGE (DAS)

16.8.1.2. NETWORK ATTACHED STORAGE (NAS)

16.8.1.2.1. BY PROTOCOLS

16.8.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.8.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.8.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.8.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.8.1.2.1.5 OTHERS

16.8.1.3. STORAGE AREA NETWORK (SAN)

16.8.1.3.1. BY TYPE

16.8.1.3.1.1 FC-SAN

16.8.1.3.1.2 IP-SAN

16.9 TRANSPORTATION & LOGISTICS

16.9.1 BY STORAGE SYSTEM TYPE

16.9.1.1. DIRECT ATTACHED STORAGE (DAS)

16.9.1.2. NETWORK ATTACHED STORAGE (NAS)

16.9.1.2.1. BY PROTOCOLS

16.9.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.9.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.9.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.9.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.9.1.2.1.5 OTHERS

16.9.1.3. STORAGE AREA NETWORK (SAN)

16.9.1.3.1. BY TYPE

16.9.1.3.1.1 FC-SAN

16.9.1.3.1.2 IP-SAN

16.1 EDUCATION

16.10.1 BY STORAGE SYSTEM TYPE

16.10.1.1. DIRECT ATTACHED STORAGE (DAS)

16.10.1.2. NETWORK ATTACHED STORAGE (NAS)

16.10.1.2.1. BY PROTOCOLS

16.10.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.10.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.10.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.10.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.10.1.2.1.5 OTHERS

16.10.1.3. STORAGE AREA NETWORK (SAN)

16.10.1.3.1. BY TYPE

16.10.1.3.1.1 FC-SAN

16.10.1.3.1.2 IP-SAN

16.11 OTHERS

17 GLOBAL DATA CENTER STORAGE MARKET, BY GEOGRAPHY

GLOBAL DATA CENTER STORAGE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

17.2 EUROPE

17.2.1 GERMANY

17.2.2 FRANCE

17.2.3 U.K.

17.2.4 ITALY

17.2.5 SPAIN

17.2.6 RUSSIA

17.2.7 TURKEY

17.2.8 BELGIUM

17.2.9 NETHERLANDS

17.2.10 NORWAY

17.2.11 FINLAND

17.2.12 SWITZERLAND

17.2.13 DENMARK

17.2.14 SWEDEN

17.2.15 POLAND

17.2.16 REST OF EUROPE

17.3 ASIA PACIFIC

17.3.1 JAPAN

17.3.2 CHINA

17.3.3 SOUTH KOREA

17.3.4 INDIA

17.3.5 AUSTRALIA

17.3.6 NEW ZEALAND

17.3.7 SINGAPORE

17.3.8 THAILAND

17.3.9 MALAYSIA

17.3.10 INDONESIA

17.3.11 PHILIPPINES

17.3.12 TAIWAN

17.3.13 VIETNAM

17.3.14 REST OF ASIA PACIFIC

17.4 SOUTH AMERICA

17.4.1 BRAZIL

17.4.2 ARGENTINA

17.4.3 REST OF SOUTH AMERICA

17.5 MIDDLE EAST AND AFRICA

17.5.1 SOUTH AFRICA

17.5.2 EGYPT

17.5.3 SAUDI ARABIA

17.5.4 U.A.E

17.5.5 OMAN

17.5.6 BAHRAIN

17.5.7 ISRAEL

17.5.8 KUWAIT

17.5.9 QATAR

17.5.10 REST OF MIDDLE EAST AND AFRICA

17.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

18 GLOBAL DATA CENTER STORAGE MARKET,COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

18.7 EXPANSIONS

18.8 REGULATORY CHANGES

18.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 GLOBAL DATA CENTER STORAGE MARKET, SWOT & DBMR ANALYSIS

20 GLOBAL DATA CENTER STORAGE MARKET, COMPANY PROFILE

20.1 T-SYSTEMS INTERNATIONAL GMBH(A PART OF DEUTSCHE TELEKOM)

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 CISCO SYSTEMS, INC.

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 HYPERTEC GROUP INC

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 WESTERN DIGITAL CORPORATION

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 MICRON TECHNOLOGY, INC

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 DELL INC.

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT DEVELOPMENT

20.7 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENT

20.8 NETAPP

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENT

20.9 HITACHI VANTARA LLC

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENT

20.1 PURE STORAGE, INC

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

20.11 LENOVO

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENT

20.12 FUJITSU

20.12.1 COMPANY SNAPSHOT

20.12.2 REVENUE ANALYSIS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT DEVELOPMENT

20.13 SEAGATE TECHNOLOGY LLC

20.13.1 COMPANY SNAPSHOT

20.13.2 REVENUE ANALYSIS

20.13.3 PRODUCT PORTFOLIO

20.13.4 RECENT DEVELOPMENT

20.14 AMAZON WEB SERVICES, INC.

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENT

20.15 CLOUDIAN INC

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENT

20.16 EQUINIX, INC.

20.16.1 COMPANY SNAPSHOT

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT DEVELOPMENT

20.17 HUAWEI TECHNOLOGIES CO., LTD

20.17.1 COMPANY SNAPSHOT

20.17.2 REVENUE ANALYSIS

20.17.3 PRODUCT PORTFOLIO

20.17.4 RECENT DEVELOPMENT

20.18 ORACLE

20.18.1 COMPANY SNAPSHOT

20.18.2 REVENUE ANALYSIS

20.18.3 PRODUCT PORTFOLIO

20.18.4 RECENT DEVELOPMENT

20.19 NUTANIX

20.19.1 COMPANY SNAPSHOT

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT DEVELOPMENT

20.2 DATADIRECT NETWORKS

20.20.1 COMPANY SNAPSHOT

20.20.2 REVENUE ANALYSIS

20.20.3 PRODUCT PORTFOLIO

20.20.4 RECENT DEVELOPMENT

20.21 NFINA TECHNOLOGIES, INC

20.21.1 COMPANY SNAPSHOT

20.21.2 REVENUE ANALYSIS

20.21.3 PRODUCT PORTFOLIO

20.21.4 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 CONCLUSION

22 QUESTIONNAIRE

23 RELATED REPORTS

24 ABOUT DATA BRIDGE MARKET RESEARCH

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。