Global Contract Pharmaceutical Packaging Market

市场规模(十亿美元)

CAGR :

%

10,313,375.65

2022

2030

10,313,375.65

2022

2030

| 2023 –2030 | |

| USD 10,313,375.65 | |

|

|

|

|

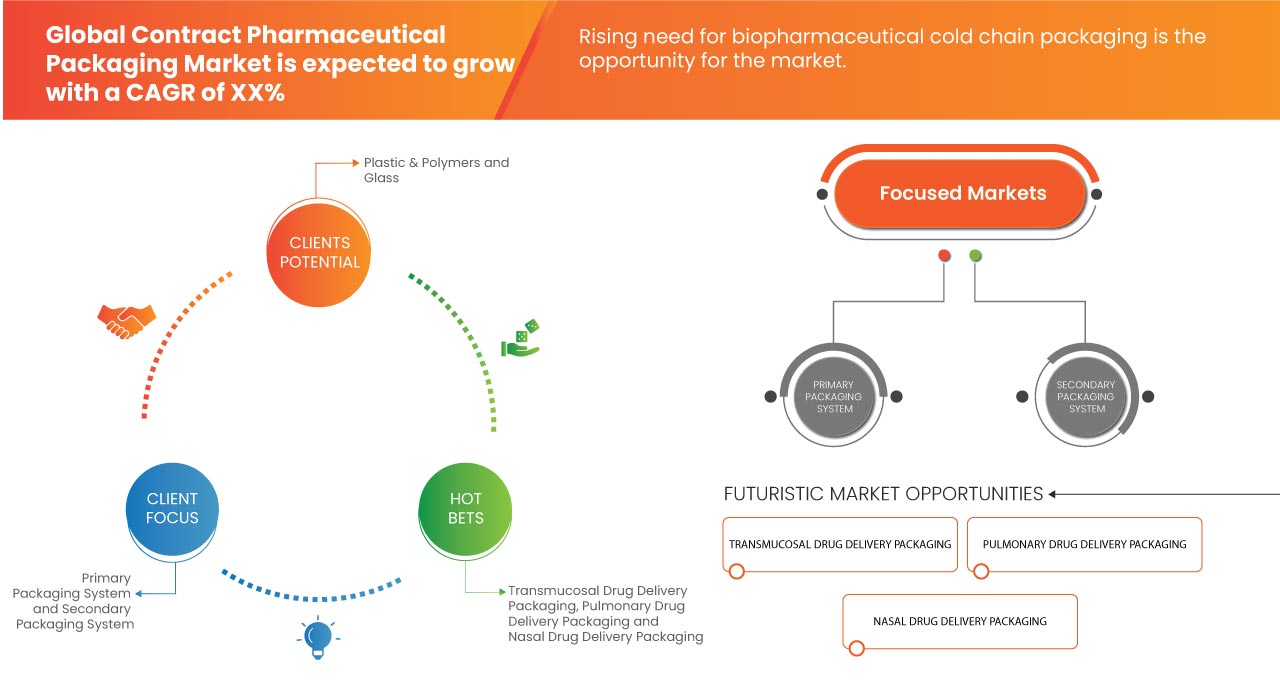

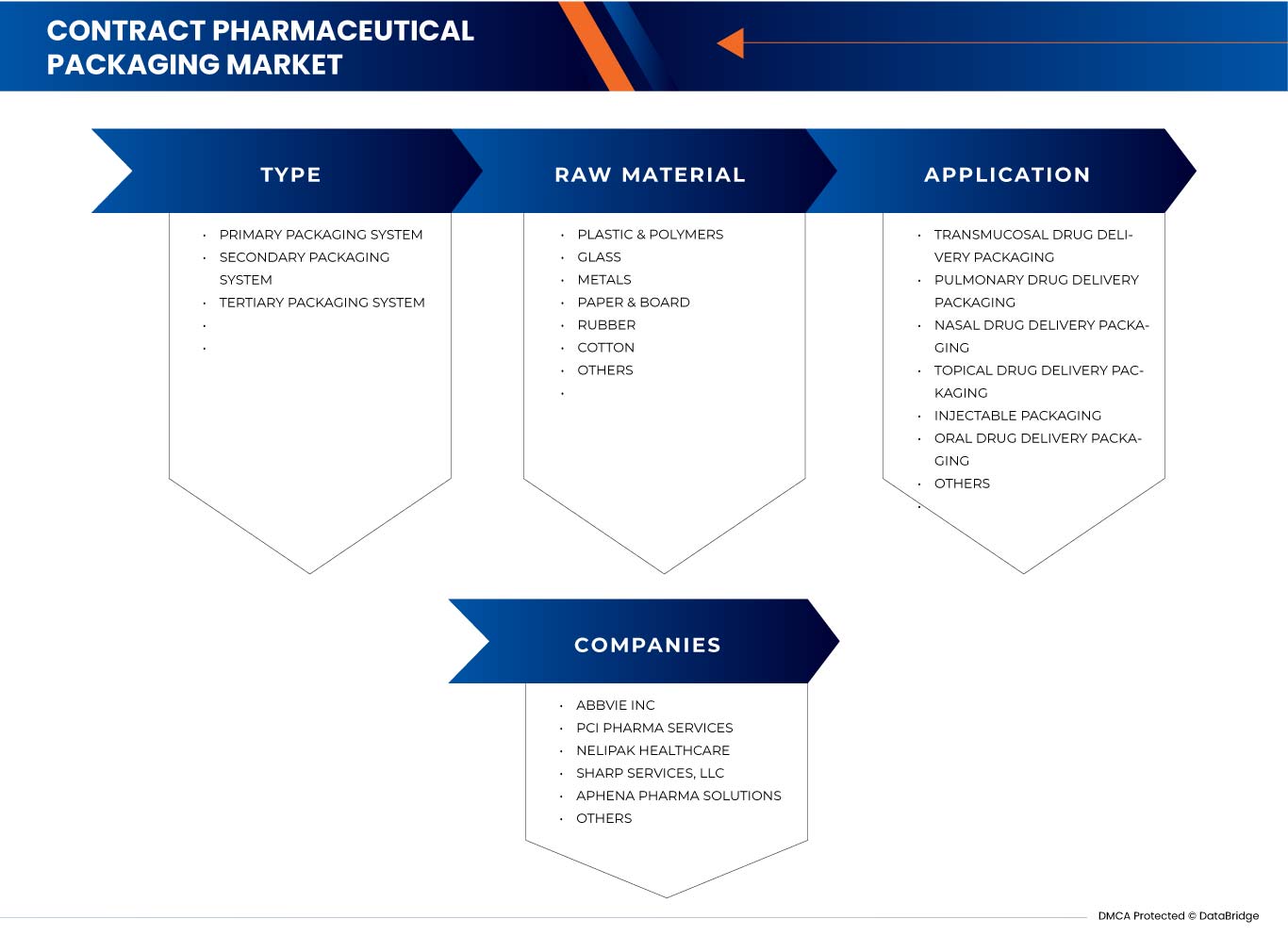

Global Contract Pharmaceutical Packaging Market, By Type (Primary Packaging System, Secondary Packaging System, and Tertiary Packaging System), Raw Material (Plastic & Polymers, Glass, Metals, Paper & Board, Rubber, Cotton, and Others), Application (Transmucosal Drug Delivery Packaging, Pulmonary Drug Delivery Packaging, Nasal Drug Delivery Packaging, Topical Drug Delivery Packaging, Injectable Packaging, Oral Drug Delivery Packaging, and Others) - Industry Trends and Forecast to 2030.

Contract Pharmaceutical Packaging Market Analysis and Size

The contract pharmaceutical packaging market is a critical segment within the pharmaceutical industry, consisting of packaging services by pharmaceutical companies. This market is driven by the increasing demand for efficient packaging solutions and stringent regulations, with a growing emphasis on patient safety and innovative technologies, the contract pharmaceutical packaging sector is poised for steady growth.

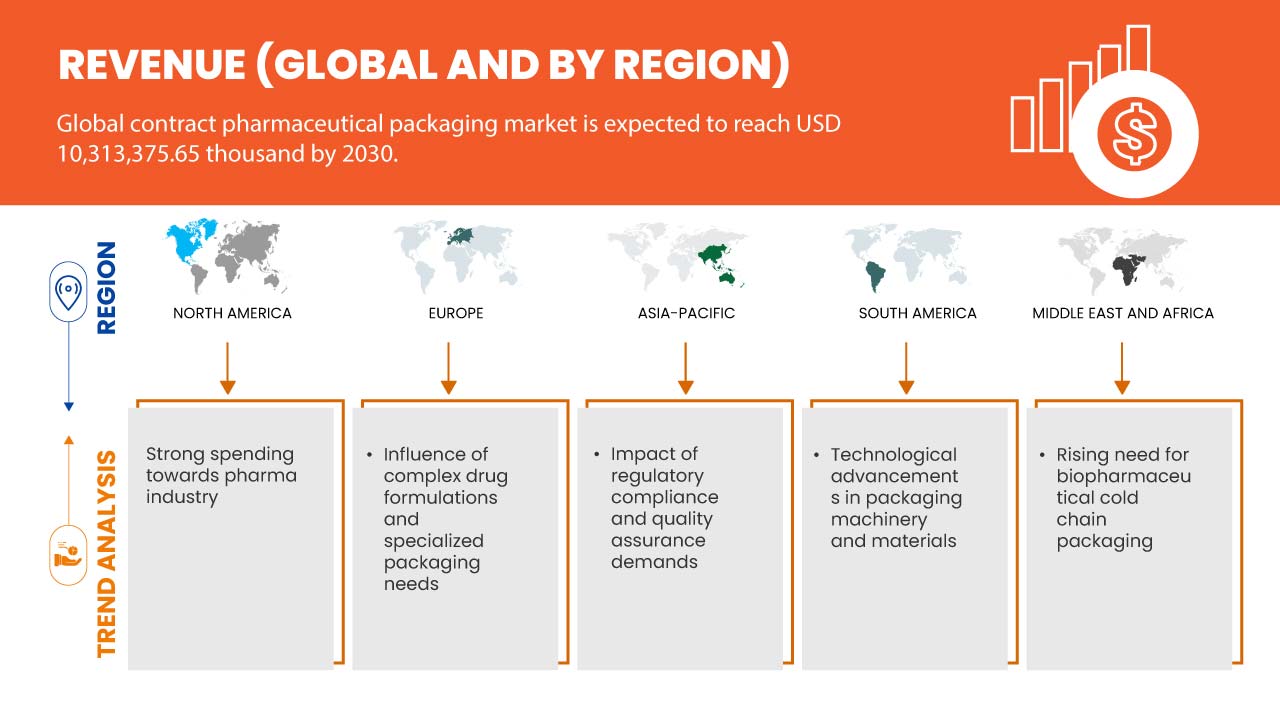

Data Bridge Market Research analyses that the global contract pharmaceutical packaging market is expected to reach the value of USD 10,313,375.65 thousand by 2030, at a CAGR of 7.4% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Type (Primary Packaging System, Secondary Packaging System, and Tertiary Packaging System), Raw Material (Plastic & Polymers, Glass, Metals, Paper & Board, Rubber, Cotton, and Others), Application (Transmucosal Drug Delivery Packaging, Pulmonary Drug Delivery Packaging, Nasal Drug Delivery Packaging, Topical Drug Delivery Packaging, Injectable Packaging, Oral Drug Delivery Packaging, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico, Germany, U.K., France, Italy, Spain, Netherlands, Belgium, Russia, Turkey, Switzerland, Luxembourg, and Rest of Europe, China, India, Japan, South Korea, Australia and New Zealand, Indonesia, Singapore, Malaysia, Thailand, Philippines, and Rest of Asia-Pacific, Brazil, Argentina, and Rest of South America, United Arab Emirates, South Africa, Egypt, Saudi Arabia, Israel, and Rest of Middle East and Africa |

|

Market Players Covered |

AbbVie Inc, PCI Pharma Services, Nelipak Healthcare, Sharp Services, LLC, Aphena Pharma Solutions, ROPACK INC., SilganUnicep 2, Reed-Lane, Jones Healthcare Group, Wasdell Packaging Group, SternMaid &Co. KG, Sepha, Tripak Pharmaceuticals, Assemblies Unlimited, Inc., AmeriPac, and Tjoapack, among others. |

Market Definition

The contract pharmaceutical packaging market encompasses a specialized sector within the pharmaceutical industry, focusing on tailored packaging solutions. It involves the design, development, and production of primary, secondary, and tertiary packaging, and labeling and artwork management solutions for pharmaceutical products. Key market drivers include increased demand, the need for complex packaging due to innovative products, and stringent regulations. Notable trends include the adoption of postponement packaging for efficiency and reduced wastage, serialization for data integrity and supply chain improvements, and a shift toward eco-friendly materials to minimize environmental impact. This market aims to preserve product integrity, user-friendliness, and marketability while complying with industry regulations and guidelines.

Global Contract Pharmaceutical Packaging Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers:

- High Spending Towards Pharma Industry

In recent years, pharmaceutical companies have been increasingly developing complex drug formulations to enhance drug efficacy, improve patient compliance, and reduce side effects. These formulations often require precise dosing, specialized delivery mechanisms, and controlled release profiles. Therefore, pharmaceutical packaging has evolved beyond simple blister packs and bottles. The demand for specialized packaging that can preserve the integrity of these complex formulations while ensuring accurate dosing and administration has surged. This shift has opened up opportunities for contract packaging providers who possess the technical expertise to handle these intricate packaging requirements.

- Impact of Complex Drug Formulations and Specialized Packaging Needs

The substantial rise in financial allocation within the pharmaceutical industry has emerged as a significant catalyst for the expansion of the global contract pharmaceutical packaging market. This upsurge in investment can be attributed to several factors collectively driving the growth of the packaging sector. The escalating demand for pharmaceutical products, driven by factors such as aging populations and the prevalence of chronic diseases, has led to heightened production volumes. This surge in production naturally entails a proportional need for packaging services. Contract pharmaceutical packaging providers step in to fulfil this demand by offering scalable solutions that cater to diverse product portfolios and quantities.

Opportunities

- Technological Advancements in Packaging Machinery and Materials

Technological advancements in packaging machinery and materials have been instrumental in shaping the landscape of the global contract pharmaceutical packaging market. These advancements, driven by innovations in automation, materials science, and sustainability, are poised to create substantial opportunities for market growth. One key aspect of technological advancement is the automation of packaging processes. Modern packaging machinery is equipped with sophisticated robotic systems, computerized controls, and real-time monitoring capabilities. This translates to enhanced precision, efficiency, and reduced human errors in the packaging process.

- Rising Need for Biopharmaceutical Cold Chain Packaging

The escalating demand for biopharmaceutical cold chain packaging has emerged as a pivotal driver in the pharmaceutical industry, fostering substantial opportunities for the growth of the global contract pharmaceutical packaging market. This surge is underpinned by the imperative need to maintain the efficacy and integrity of temperature-sensitive biopharmaceutical products throughout their intricate supply chains. Biopharmaceuticals, including vaccines, gene therapies, and specialized drugs, are often vulnerable to temperature variations, necessitating stringent temperature control during storage and transportation.

Restraints/ Challenges

- Availability of Choice of In-House Packaging from Manufacturers

In the realm of contract packaging, the availability of in-house packaging choices from manufacturers has emerged as a significant factor. Companies are constantly seeking avenues to enhance efficiency and optimize their production and packaging processes. The trend towards investing in automating packaging processes in-house has gained substantial traction. The prospect of packaging products in-house presents a profitable opportunity for businesses that are looking into new market territories or those seeking to streamline their established operations. This involves acquiring capital packaging equipment and conducting the packaging process within the company's facilities. This states that in-house packaging can yield good returns over a long period, with ongoing expenses limited to personnel wages, maintenance, and replacement of worn parts.

- Sustainability Concerns due to Usage of Plastics in Packaging Materials

The extensive use of single-use plastics in pharmaceutical packaging, while serving the purpose of maintaining product integrity and patient safety, contradicts the growing sustainability concerns worldwide. The pharmaceutical sector's adherence to good manufacturing practices (GMP) is essential for ensuring the quality and safety of drugs, but these regulations often lack explicit guidance on sustainable packaging practices. This leads to practices such as double packaging with plastic liners and ties, and the internal lining of equipment with plastic to avoid cleaning costs. These practices align with GMP but run counter to sustainable objectives, resulting in environmental challenges. GMP ensures patient safety and product quality, it doesn't prioritize environmental sustainability. This contradiction showcases the industry's struggle to balance patient well-being with environmental responsibility.

- Diverse Concerns Related to Operational Hurdles

The contract pharmaceutical packaging has its advantages however encounters a wide range of challenges that are risen from diverse concerns related to operational hurdles. In a landscape where packaging dynamics are constantly changing the complexities of the packaging supply chain have become a problem of concern. The essential role of packaging engineers in designing folding cartons and ensuring consistent label line operations is vital. However, the pursuit of competitive pricing often clashes with the need to meet production teams' demands for timely and complete orders.

One challenge is the lack of available space for production in densely populated areas and high-value real estate locations. The imperative to maximize profitability within confined spaces places immense pressure on contract packaging equipment to enhance productivity. Changeovers, another challenging aspect, pose a direct threat to efficiency and profitability.

Recent Developments

- In December 2022, Nelipak Corporation established a cutting-edge flexible packaging production site in Winston-Salem, North Carolina. This strategic move will extend Nelipak's healthcare packaging capabilities from Europe to the Americas, catering to the increasing demand in the region. The 110,000 square-foot facility, equipped with ISO-7 clean room space and ISO 13485 certification, represents a USD 20 million investment and is projected to generate approximately 80 jobs over the next five years.

- In October 2022, Aphena Pharma Solutions Inc. announced that its USD 20 million expansion and renovation, which began mid-2019 in Cookeville, Tennessee, is now complete, adding a large amount of available solid dose packaging capacity. This added space has allowed Aphena to grow the company’s bottle and blister packaging capacity largely, with four additional high-speed bottling lines and two additional high-speed blister lines for solid-based products, making Aphena a strong strategic growth partner for any generic or OTC pharmaceutical company.

- In September 2022, Nelipak Corporation achieved International Sustainability and Carbon Certification (ISCC) PLUS for its facilities in Phoenix, AZ, and Whitehall, PA. This recognition highlighted Nelipak's dedication to sustainable practices, utilizing a circular supply chain by incorporating recycled and bio-based materials.

- In October 2020, Alnylam Pharmaceuticals partnered with Sharp to package its approved RNAi therapeutic products in European markets. Sharp's Hamont-Achel site in Belgium will handle the packaging for Alnylam's offerings across European countries. This collaboration marked a significant international investment for Alnylam in Belgium, aligning with their strategy to enhance their presence in the region and establish it as a key hub for operations.

- In May 2020, Sharp, acquired a pharmaceutical packaging facility in Macungie, Pennsylvania. This facility, formerly owned by Quality Packaging Specialists International, LLC (QPSI), spans 160,000 sq. ft. and is fully equipped for primary and secondary pharmaceutical packaging, including bottling, blistering, vial labeling, medical device kitting, and serialization services. The strategic acquisition catered to escalating client volume demands, bolstering Sharp's capacity to provide efficient packaging solutions.

Global Contract Pharmaceutical Packaging Market Scope

The global contract pharmaceutical packaging market is segmented into type, raw material, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Primary Packaging System

- Secondary Packaging System

- Tertiary Packaging System

On the basis of type, the market is segmented into primary packaging system, secondary packaging system, and tertiary packaging system.

Raw Material

- Plastic & Polymers

- Glass

- Metals

- Paper & Board

- Rubber

- Cotton

- Others

On the basis of raw material, the market is segmented into plastic & polymers, glass, metals, paper & board, rubber, cotton, and others.

Application

- Transmucosal Drug Delivery Packaging

- Pulmonary Drug Delivery Packaging

- Nasal Drug Delivery Packaging

- Topical Drug Delivery Packaging

- Injectable Packaging

- Oral Drug Delivery Packaging

- Others

On the basis of application, the market is segmented into transmucosal drug delivery packaging, pulmonary drug delivery packaging, nasal drug delivery packaging, topical drug delivery packaging, injectable packaging, oral drug delivery packaging, and others.

Global Contract Pharmaceutical Packaging Market Regional Analysis/Insights

The global contract pharmaceutical packaging market is analyzed and market size insights and trends are provided by country on type, raw material, and application as referenced above.

The countries covered in the global contract pharmaceutical packaging market report are U.S., Canada, and Mexico, Germany, U.K., France, Italy, Spain, Netherlands, Belgium, Russia, Turkey, Switzerland, Luxembourg, and Rest of Europe, China, India, Japan, South Korea, Australia and New Zealand, Indonesia, Singapore, Malaysia, Thailand, Philippines, and Rest of Asia-Pacific, Brazil, Argentina, and Rest of South America, United Arab Emirates, South Africa, Egypt, Saudi Arabia, Israel, and Rest of Middle East and Africa.

North America region is expected to dominate the market and growing due to the increasing demand for efficient packaging solutions and stringent regulations. The U.S. is expected to dominate in the North America region due to escalating adoption of innovative packaging methods to satisfy rapidly changing consumer preferences and rising environmental concerns. Germany is expected to dominate in Europe region due to the increasing consumption and demand. China is expected to dominate in the Asia-Pacific region due to significant developments and investments made by various pharmaceutical industries worldwide.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Contract Pharmaceutical Packaging Market Share Analysis

The global contract pharmaceutical packaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the global contract pharmaceutical packaging market are AbbVie Inc, PCI Pharma Services Nelipak Healthcare, Sharp Services, LLC, Aphena Pharma Solutions, ROPACK INC., SilganUnicep 2, Reed-Lane, Jones Healthcare Group, Wasdell Packaging Group, SternMaid & Co. KG, Sepha, Tripak Pharmaceuticals, Assemblies Unlimited, Inc., AmeriPac, and Tjoapack, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS:

4.1.2 ECONOMIC FACTORS:

4.1.3 SOCIAL FACTORS:

4.1.4 TECHNOLOGICAL FACTORS:

4.1.5 LEGAL FACTORS:

4.1.6 ENVIRONMENTAL FACTORS:

4.2 PORTER’S FIVE FORCES

4.3 VENDOR SELECTION CRITERIA

5 DYNAMICS OF RAW MATERIAL PREFERENCES

5.1 PLASTIC AND POLYMERS:

5.1.1 HDPE (HIGH-DENSITY POLYETHYLENE):

5.1.2 LDPE (LOW-DENSITY POLYETHYLENE):

5.1.3 PET (POLYETHYLENE TEREPHTHALATE):

5.1.4 PVC (POLYVINYL CHLORIDE):

5.1.5 PP (POLYPROPYLENE):

5.1.6 COC (CYCLIC OLEFIN COPOLYMER):

5.2 GLASS:

5.2.1 TYPE IV-NP (GENERAL PURPOSE SODA LIME GLASS):

5.2.2 TYPE I (BOROSILICATE GLASS):

5.2.3 TYPE III (REGULAR SODA-LIME GLASS):

5.2.4 TREATED SODA LIME GLASS:

5.3 METAL:

5.3.1 TIN:

5.3.2 IRON:

5.3.3 ALUMINIUM:

5.3.4 LEAD:

5.4 PAPER AND BOARD:

5.4.1 SOLID BOARD:

5.4.2 CHIPBOARD:

5.4.3 CARDBOARD:

5.4.4 FIBER BOARD:

5.5 RUBBER:

5.5.1 NATURAL RUBBER IN CONTRACT PHARMACEUTICAL PACKAGING:

5.5.2 NEOPRENE RUBBER IN CONTRACT PHARMACEUTICAL PACKAGING:

5.5.3 BUTYL RUBBER IN CONTRACT PHARMACEUTICAL PACKAGING:

6 PARTNERSHIP DETAILS

7 TECHNOLOGICAL ADVANCEMENTS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 STRONG SPENDING TOWARDS PHARMA INDUSTRY

8.1.2 IMPACT OF COMPLEX DRUG FORMULATIONS AND SPECIALIZED PACKAGING NEEDS

8.1.3 IMPACT OF REGULATORY COMPLIANCE AND QUALITY ASSURANCE DEMANDS

8.2 RESTRAINTS

8.2.1 AVAILABILITY OF CHOICE OF IN-HOUSE PACKAGING FROM MANUFACTURERS

8.2.2 SUSTAINABILITY CONCERNS DUE TO USAGE OF PLASTICS IN PACKAGING MATERIALS

8.3 OPPORTUNITIES

8.3.1 TECHNOLOGICAL ADVANCEMENTS IN PACKAGING MACHINERY AND MATERIALS

8.3.2 RISING NEED FOR BIOPHARMACEUTICAL COLD CHAIN PACKAGING

8.4 CHALLENGE

8.4.1 DIVERSE CONCERNS RELATED TO OPERATIONAL HURDLES

9 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: BY REGION

9.1 OVERVIEW

9.2 EUROPE

9.3 NORTH AMERICA

9.4 SOUTH AMERICA

9.5 ASIA-PACIFIC

9.6 MIDDLE EAST & AFRICA

10 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: EUROPE

10.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 ABBVIE INC.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SERVICE PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 PCI PHARMA SERVICES

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 SERVICE PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 NELIPAK CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 SHARP SERVICES, LLC

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENTS

12.5 APHENA PHARMA SOLUTIONS

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 SERVICE PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 AMERIPAC

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 ASSEMBLIES UNLIMITED, INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 SERVICE PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 JONES HEALTHCARE GROUP

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 REED-LANE

12.9.1 SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 ROPACK INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 SEPHA

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 SILGANUNICEP

12.12.1 COMPANY SNAPSHOT

12.12.2 SERVICE PORTFOLIO

12.12.3 RECENT DEVELOPMENTS

12.13 STERNMAID GMBH & CO. KG

12.13.1 COMPANY SNAPSHOT

12.13.2 SERVICE PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 TJOAPACK

12.14.1 COMPANY SNAPSHOT

12.14.2 SERVICE PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 TRIPAK PHARMACEUTICALS

12.15.1 COMPANY SNAPSHOT

12.15.2 SERVICE PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 WASDELL PACKAGING GROUP

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

图片列表

FIGURE 1 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: SEGMENTATION

FIGURE 2 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: APPLICATION COVERAGE GRID

FIGURE 10 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET, WHILE ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 13 STRONG SPENDING TOWARDS PHARMA INDUSTRY IS EXPECTED TO DRIVE THE GROWTH OF THE GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET IN THE FORECAST PERIOD

FIGURE 14 THE PRIMARY PACKAGING SYSTEM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET IN 2023 AND 2030

FIGURE 15 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR THE GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET IN THE FORECAST PERIOD

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET

FIGURE 18 FDI INFLOWS IN DRUGS & PHARMACEUTICALS ACTIVITIES

FIGURE 19 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 20 EUROPE CONTRACT PHARMACEUTICAL PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA CONTRACT PHARMACEUTICAL PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 22 SOUTH AMERICA CONTRACT PHARMACEUTICAL PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 23 ASIA-PACIFIC CONTRACT PHARMACEUTICAL PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 24 MIDDLE EAST & AFRICA CONTRACT PHARMACEUTICAL PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 25 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: COMPANY SHARE 2022 (%)

FIGURE 26 EUROPE CONTRACT PHARMACEUTICAL PACKAGING MARKET: COMPANY SHARE 2022 (%)

FIGURE 27 NORTH AMERICA CONTRACT PHARMACEUTICAL PACKAGING MARKET: COMPANY SHARE 2022 (%)

FIGURE 28 ASIA-PACIFIC CONTRACT PHARMACEUTICAL PACKAGING MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。