全球汽车测试、检验和认证 (TIC) 市场,按服务类型(测试服务、检验服务、认证服务、其他)、采购类型(内部、外包)、应用(电气系统和组件、远程信息处理、车辆检验服务、认证测试、内部和外部材料、其他)划分 - 行业趋势和预测到 2029 年。

汽车测试检验和认证 (TIC) 市场分析和规模

由于车辆数量空前增长,污染水平不断上升,迫使监管机构制定严格的车辆排放法规。电动汽车和 自动驾驶汽车的出现促进了汽车行业的增长。电动汽车帮助汽车制造商满足了严格的车辆排放法规。日益严重的车辆污染推动了对汽车测试、检验和认证的需求,以确保符合法规要求。近年来,人们更加重视汽车制造业务的质量控制,以及额外的安全和测试措施。

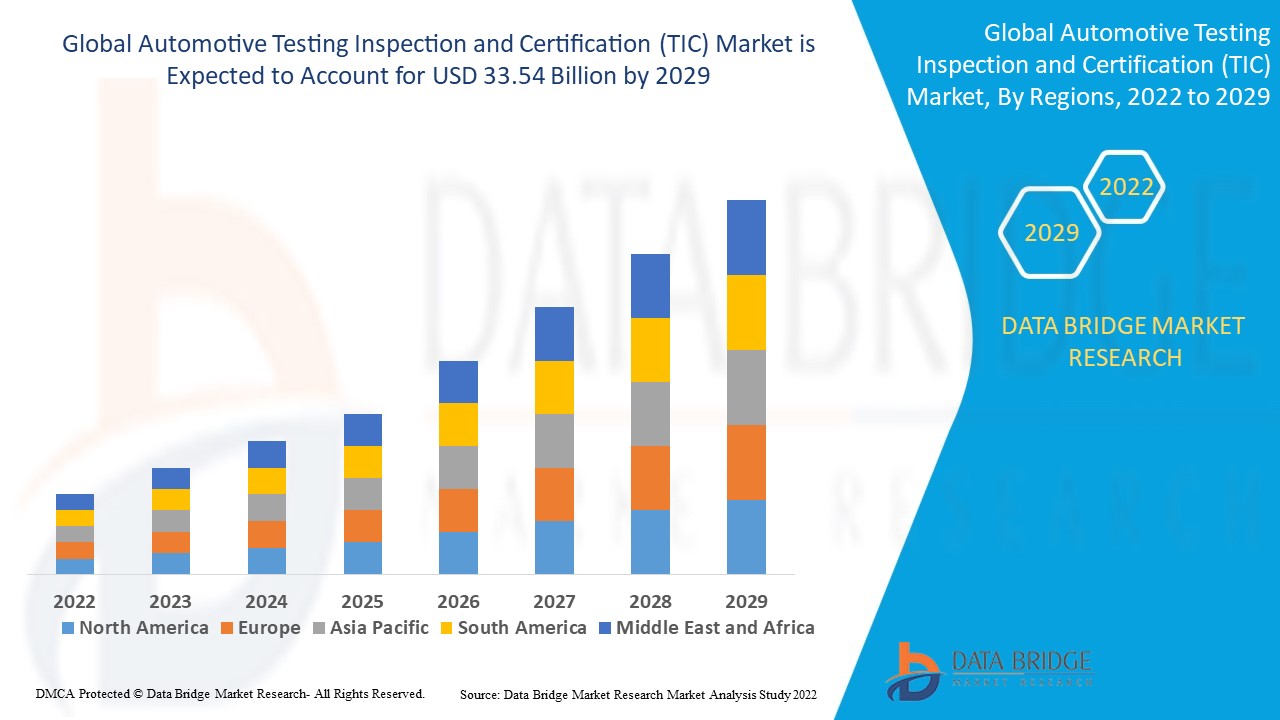

Data Bridge Market Research 分析称,汽车测试检验和认证 (TIC) 市场在 2021 年增长至 178.5 亿美元,预计到 2029 年将达到 335.4 亿美元,在 2022-2029 年的预测期内复合年增长率为 8.20%。除了对市场价值、增长率、细分、地理覆盖范围和主要参与者等市场情景的见解外,Data Bridge Market Research 策划的市场报告还包括深入的专家分析、按地理代表的公司生产和产能、分销商和合作伙伴的网络布局、详细和更新的价格趋势分析以及供应链和需求的缺口分析。

汽车测试检验和认证 (TIC) 市场范围和细分

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制为 2014 - 2019) |

|

定量单位 |

收入(单位:十亿美元)、销量(单位:台)、定价(美元) |

|

涵盖的领域 |

服务类型(测试服务、检验服务、认证服务、其他)、采购类型(内部、外包)、应用(电气系统和组件、远程信息处理、车辆检验服务、认证测试、内部和外部材料、其他) |

|

覆盖国家 |

北美洲的美国、加拿大和墨西哥、欧洲的德国、法国、英国、荷兰、瑞士、比利时、俄罗斯、意大利、西班牙、土耳其、欧洲其他地区、亚太地区 (APAC) 的中国、日本、印度、韩国、新加坡、马来西亚、澳大利亚、泰国、印度尼西亚、菲律宾、亚太地区 (APAC) 的其他地区、沙特阿拉伯、阿联酋、南非、埃及、以色列、中东和非洲 (MEA) 的其他地区、巴西、阿根廷和南美洲的其他地区。 |

|

涵盖的市场参与者 |

SGS SA(瑞士)、Bureau Veritas SA(法国)、Intertek Group Plc.(英国)、Dekra SE(德国)、TÜV SÜD(德国)、TÜV Rheinland Ag Group(美国)、DNV GL(挪威)、英国标准协会 (BSI)(英国)、Norges Elektriske Materiellkontroll (NEMKO)(挪威)、Eurofins Scientific SE(卢森堡)、Applus+(西班牙)、TÜV Nord Group(德国)、Mistras Group(美国)、Lloyd's Register Group Limited(英国)和 Element Materials Technology Ltd.(英国)等。 |

|

机会 |

|

市场定义

确保车辆或部件满足所有适用的安全和性能要求的过程称为“汽车测试、检查和认证”(TIC)。碰撞测试、噪声振动和声振粗糙度 (NVH) 测试、耐腐蚀测试和排放认证都是 TIC 测试和检查的例子。TIC 的目标是保护驾驶员和乘客的安全,同时确保车辆符合环境标准。

全球汽车测试、检验和认证 (TIC) 市场动态

驱动程序

- 实施各种法规和安全标准

全球汽车行业受到各种政府法规的约束,这些法规涉及乘客安全和环境问题。这些法规/标准对汽车零部件的设计有直接影响。严格的政府法规要求汽车制造商在其车辆中配备安全带、安全气囊和溃缩区等安全功能。主要监管机构征收关税和其他贸易壁垒,以惩罚和阻止制造商违反排放和安全标准。这迫使汽车制造商制造更省油、排放量更低的汽车,同时还包括安全功能,例如防滑制动系统 (ABS)、电子制动力分配 (EBD)、安全气囊和排放控制系统,例如带涡轮增压器的催化转换器和废气再循环 (EGR) 系统。

- 发展中地区汽车产业的扩张

在过去十年中,发达国家的汽车市场在生产率方面一直保持稳定和一致。相比之下,一些新兴市场,尤其是亚太地区的新兴市场,近年来市场规模增长了一倍多。随着汽车行业从成熟市场转向新兴市场,新兴市场有望成为现代汽车行业持续增长的关键。21 世纪初,新兴经济体仅占全球汽车总产量的四分之一,但到 2015 年,它们占全球汽车总产量的一半以上。这表明汽车行业经历了持续增长,尤其是在新兴经济体。

机会

- 电动和混合动力汽车普及率高

电动和混合动力汽车的日益普及,以及政府对车辆定期技术检验(PTI)的要求,为预测期内汽车测试、检验和认证(TIC)市场的增长创造了充足的机会。

限制

- 不断变化的法规和标准

预测期内,不同的法规和标准将阻碍汽车测试、检验和认证 (TIC) 市场的增长。

- 漫长的过程

全球汽车销售的恶化以及海外资格测试所需的漫长准备时间对汽车测试、检验和认证 (TIC) 市场的增长构成了重大挑战。

这份汽车测试检验和认证 (TIC) 市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入领域的机会、市场法规的变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新。如需了解有关汽车测试检验和认证 (TIC) 市场的更多信息,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您做出明智的市场决策,实现市场增长。

原材料短缺和运输延误的影响和当前市场状况

Data Bridge Market Research 提供高水平的市场分析,并通过考虑原材料短缺和运输延误的影响和当前市场环境来提供信息。这意味着评估战略可能性、制定有效的行动计划并协助企业做出重要决策。

除了标准报告外,我们还提供从预测的运输延迟、按区域划分的分销商映射、商品分析、生产分析、价格映射趋势、采购、类别绩效分析、供应链风险管理解决方案、高级基准测试等角度对采购层面的深入分析,以及其他采购和战略支持服务。

COVID-19 对汽车测试、检验和认证 (TIC) 市场的影响

由于冠状病毒的传播,世界各地的制造工厂都已关闭,展厅客流量暴跌,汽车销量也暴跌。主要汽车制造商是因 COVID-19 疫情而停止生产的全球汽车制造商之一。由于经济和工业活动基本停滞,预计需求侧将受到严重影响,导致汽车销量急剧下降。这种情况预计会对市场产生影响,因为市场的增长与汽车生产直接相关。另一方面,COVID-19 正在加速汽车 TIC 市场的数字化趋势。汽车 TIC 公司越来越依赖软件解决方案来进行审计和损害评估。

经济放缓对产品定价和供应的预期影响

当经济活动放缓时,行业开始受到影响。DBMR 提供的市场洞察报告和情报服务考虑了经济衰退对产品定价和可获得性的预测影响。借助这些,我们的客户通常可以领先竞争对手一步,预测他们的销售额和收入,并估算他们的盈亏支出。

最新动态

- 2019 年 7 月,Applus+ 美国汽车部门赢得了四份法定车辆检验合同续签。这些合同巩固了 Applus+ 作为美国市场主要参与者的地位,表明该公司致力于为政府、制造商和贸易商提供提高车辆安全性和降低有害车辆排放的最佳解决方案。

- 2019 年 4 月,TÜV SÜD 与泰国工业部和泰国汽车研究所 (TAI) 签署合作协议,在曼谷附近建立电池测试中心。该协议为东南亚国家联盟 (ASEAN) 建立最大、最现代化的锂离子电池测试中心铺平了道路,总投资额为 1350 万欧元。

- 2019 年 3 月,DEKRA 在深圳开设了第一家定期车辆检测 (PVI) 站,进军全球最大的汽车市场。第二家正在北京建设的检测站预计将于今年晚些时候开业,这将增强 DEKRA SE 在中国市场的地位。

全球汽车测试检验和认证 (TIC) 市场范围

汽车测试检验和认证 (TIC) 市场根据服务类型、采购类型和应用进行细分。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

服务类型

- 测试服务

- 检验服务

- 认证服务

- 其他

采购类型

- 内部

- 外包

应用

- 电气系统和组件

- 远程信息处理

- 车辆检验服务

- 认证测试

- 内部和外部材料

- 其他的

汽车测试检验和认证 (TIC) 市场区域分析/见解

对汽车测试、检验和认证 (TIC) 市场进行了分析,并按国家、服务类型、采购类型和应用提供了市场规模洞察和趋势。

汽车测试、检验和认证(TIC)市场报告涵盖的国家包括北美的美国、加拿大和墨西哥、欧洲的德国、法国、英国、荷兰、瑞士、比利时、俄罗斯、意大利、西班牙、土耳其、欧洲其他地区、中国、日本、印度、韩国、新加坡、马来西亚、澳大利亚、泰国、印度尼西亚、菲律宾、亚太地区(APAC)的其他地区、沙特阿拉伯、阿联酋、南非、埃及、以色列、中东和非洲(MEA)的其他地区、南美洲的巴西、阿根廷和南美洲其他地区。

亚太地区在汽车测试、检验和认证 (TIC) 市场占据主导地位,因为该地区汽车 TIC 服务易于获得且主要汽车制造商均位于该地区。

由于电动汽车需求增加、政府政策优惠以及该地区汽车召回次数增加,预计北美将在 2022 年至 2029 年期间经历最高增长率。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

竞争格局和汽车测试检验和认证 (TIC) 市场份额分析

The automotive testing inspection and certification (TIC) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to automotive testing inspection and certification (TIC) market.

Some of the major players operating in the automotive testing inspection and certification (TIC) market are:

- SGS S.A. (Switzerland)

- Bureau Veritas S.A. (France)

- Intertek Group Plc. (U.K.)

- Dekra SE (Germany)

- TÜV SÜD (Germany)

- TÜV Rheinland Ag Group (U.S.)

- DNV GL (Norway)

- British Standards Institution (BSI) (U.K.)

- Norges Elektriske Materiellkontroll (NEMKO) (Norway)

- Eurofins Scientific SE (Luxembourg)

- Applus+ (Spain)

- TÜV Nord Group (Germany)

- Mistras Group (U.S.)

- Lloyd’s Register Group Limited (U.K.)

- Element Materials Technology Ltd.(U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。