>欧洲蒸煮包装市场,按产品类型(袋、托盘、纸箱及其他)、材料(PET、聚丙烯、铝箔、聚酰胺 (PA)、纸和纸板、EVOH 及其他)、分销渠道(线下和线上)、最终用途(食品、饮料、药品及其他)划分 - 行业趋势和预测到 2029 年。

市场分析和规模

工业化和城镇化改变了介质或流体的加工技术和运输方式,导致几乎每个流体起主要作用的行业都需要蒸煮包装。因此,蒸煮包装市场受到更安全的生产和充足的基础设施需求的推动。

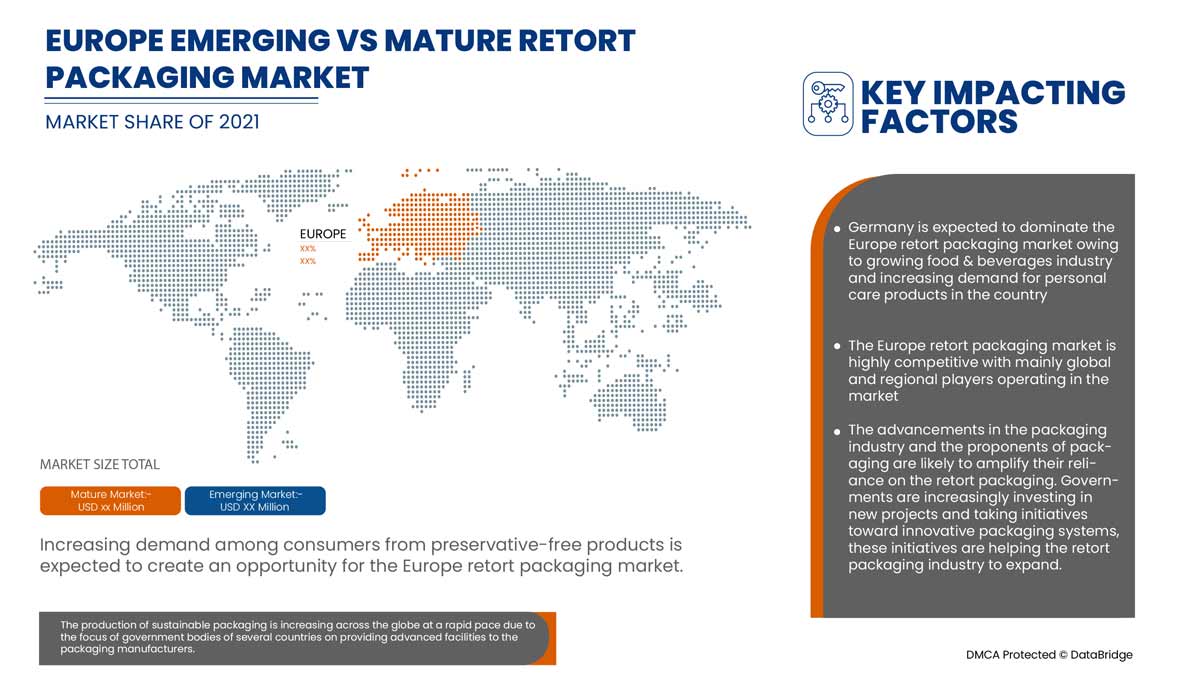

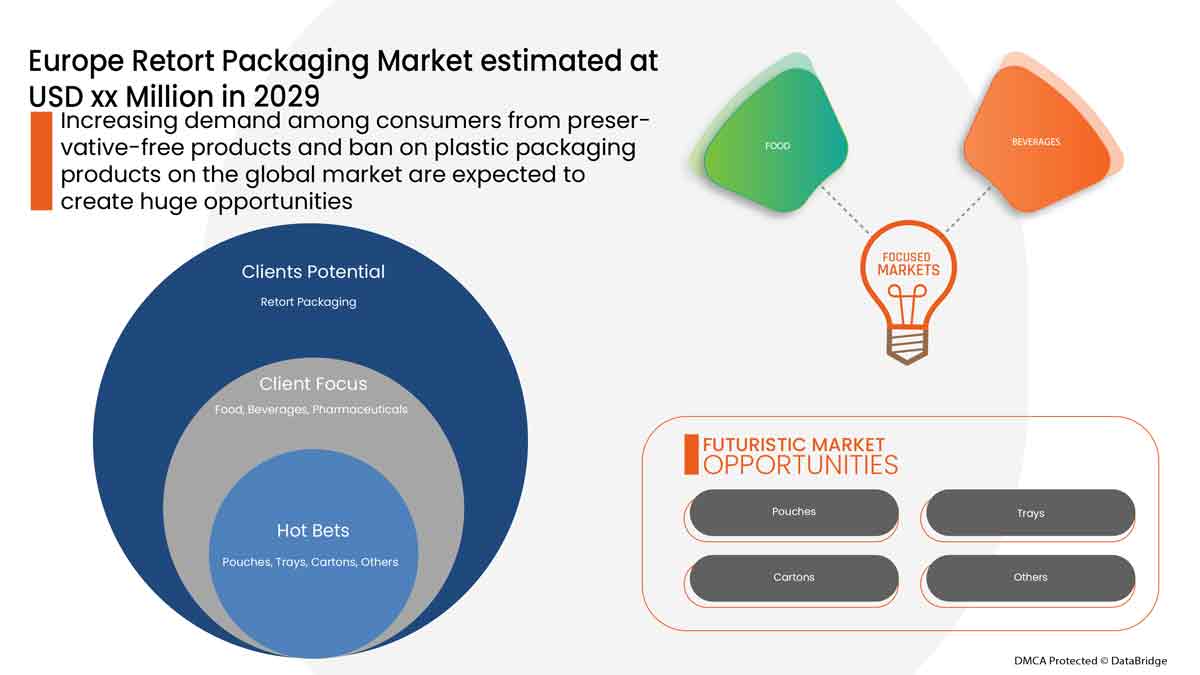

推动市场发展的一些因素包括消费者对不含防腐剂产品的需求不断增长、对可持续和美观包装解决方案的需求不断增长以及对避免食品浪费的智能包装的需求不断增长。然而,与研发活动相关的高成本阻碍了市场的增长。

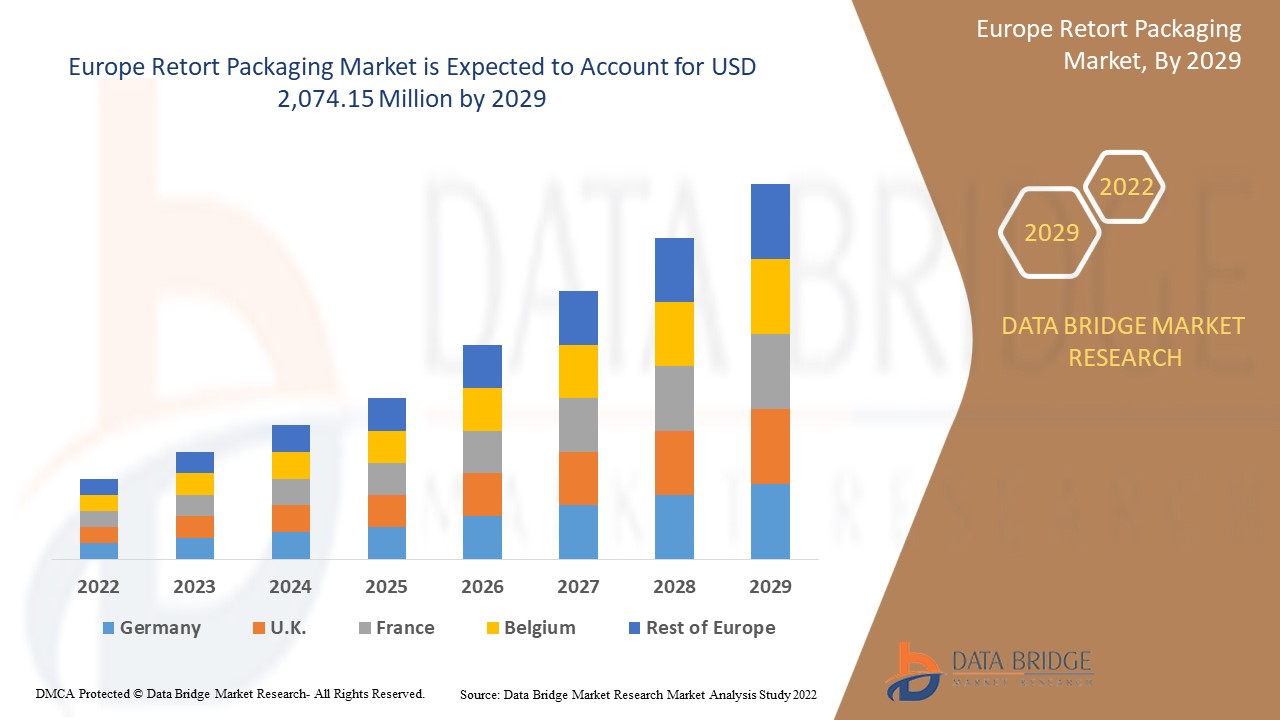

Data Bridge Market Research 分析称,到 2029 年,蒸煮包装市场预计将达到 20.7415 亿美元的价值,预测期内的复合年增长率为 5.6%。由于替代传统包装的商业化技术途径发展迅速,“袋装”成为蒸煮包装市场中最大的产品类型细分市场。蒸煮包装市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020 |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按产品类型(袋、托盘、纸箱等)、按材料(PET、聚丙烯、铝箔、聚酰胺 (PA)、纸和纸板、EVOH 等)、按分销渠道(线下和线上)、按最终用途(食品、饮料、药品等) |

|

覆盖国家 |

英国、德国、法国、西班牙、意大利、荷兰、瑞士、俄罗斯、比利时、土耳其、卢森堡和欧洲其他国家, |

|

涵盖的市场参与者 |

Coveris、FLAIR Flexible Packaging Corporation、IMPAK CORPORATION、PORTCO PACKAGING、Constantia Flexibles、Mondi、Tetra Pak、Clifton Packaging Group Limited 等。 |

市场定义

Retort packaging is a type of food packaging made from a laminate of flexible plastic and metal foils. It allows the sterile packaging of a wide variety of food and drink handled by aseptic processing, and is used as an alternative to traditional industrial canning methods. Packaged foods range from water to fully cooked, thermo-stabilized (heat-treated), high-caloric (1,300 kcal on average) meals like Meals, Ready-to-Eat (MREs), which can be eaten cold, warmed by submerging in hot water, or heated with a flameless ration heater, a meal component first introduced by the military in 1992. Field rations, space food, fish products, camping meals, quick noodles, and companies like Capri Sun and Tasty Bite all employ retort packaging.

Initially, the retort packaging were developed for industrial applications and pipe-organs. Gradually the design was adapted in the bio-pharmaceutical industry for sterilizing methods by using compliant materials. And now it is being used in almost every industry for safe production and adequate infrastructure, such as food & beverage, and chemical processing among other verticals.

Retort packaging Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Increasing demand among consumers for preservative-free products

Retort takes place when non-sterile products are hermetically sealed, which literally means non-sterile packaging. The packaging is loaded into a retort pressure vessel and subjected to pressurized steam. The product is also exposed to high temperatures for a much longer period than in hot-filling. The additional time can significantly deteriorate the overall quality and nutritional content of the product.

The increasing demand among consumers across the globe for preservative-free products is a key driver for the Europe retort packaging market. As consumers are getting more concerned about the harmful effects of preservatives in their beverages, the demand for preservative-free products is at its peak.

- Increase in demand for retort packaging by airlines

Recently, there is an increasing shift of consumers toward sustainable and environment friendly packaging options that has further introduced fully recyclable packaging and stand-up bags of various designs. In addition to providing environmental advantages, sustainable packaging can also help companies to increase profits and eliminate unnecessary manufacturing spare parts, thereby improving the safety of production lines, and minimizing disposal costs. The main objective of packaging is not only to protect the product from damage during transit, but to protect the warehouse and retail shops before selling the product. Different types of packaging are used for different kind of products. Also, retort packaging is used for heavy and bulky food products and also used for other products.

- Growing demand for intelligent packaging to avoid food wastage

Intelligent packaging offers various solutions to reduce food wastage as it provides different indicators to avoid food spoilage. Thus, increasing food wastage is attracting consumers to buy food with intelligent packaging.

Intelligent packaging includes indicators (time-temperature indicators; integrity or gas indicators; freshness indicators); barcodes and radiofrequency identification tags (RFID); sensors (biosensors; gas sensors; fluorescence-based oxygen sensors), among others. Hence, intelligent packaging helps food manufacturers to track the status of their food products in real-time, thus contributing to a reduction in food wastage.

Furthermore, intelligent packaging can also act as the primary tool for consumers to choose their products at the retail level as intelligent packaging concepts can enable consumers to judge the quality of the products. As a result, intelligent packaging is expected to play a major role in attracting consumers.

- High cost associated with research and development activities

Research and development expenses are associated directly with the research and development of a company's goods or services and any intellectual property generated in the process. A company generally incurs R&D expenses in the process of finding and creating new products or services.

Packaging companies rely heavily on their research and development capabilities; so they can relatively outsize R&D expenses. For instance, changing the preferences of consumers from regular packaging to intelligent and active packaging, increasing consumers' awareness about food safety, among others. Thus, companies have to invest in research & development activities to diversify their business and find new growth opportunities as technology continues to evolve.

- Ban on plastic packaging products on the Europe market

With rise in environmental concerns in several regions, the government has taken strict steps toward banning single-use plastic products and non-biodegradable packaging products in the market. This is because plastic products take longer to decompose and is dangerous for aquatic and land animals.

For instance,

Natural Environment estimates that approximately 100,000 sea turtles and other marine animals die every year because they get strangled in bags or mistake them for food.

In North America, single-use plastic bags used for the food products and consumer goods packaging are banned. As a result, the demand for paperboard and retort packaging is increasing in the region.

Several types of packaging are used in different applications, resulting in the production of the waste and are very harmful to the environment. Plastic packaging is used for consumer goods packaging, which produces non-biodegradable plastic packaging waste, releases toxic gases in the soil, which is dangerous for animals and ground water. Hence, steps have been taken to ban plastic bag packaging as it is harmful to the environment.

- Supply chain disruption due to pandemic

The COVID-19 has disrupted the supply chain and has declined markets of retort packaging worldwide. Disruptions have led to the delayed stock of the products as well as lower access, and supplies of food and beverage products. With the persistent persistence of COVID-19, there have been restrictions on transportation, import, and export of materials. Also, with the movement restriction on workers as well, the manufacturing of retort packaging has been affected due to which the demand for consumers has not been fulfilled. Also, with restrictions on import and export, it made it difficult for the manufacturers to supply the raw materials and their end products across the countries in the world which also has impacted the prices of retort packaging. Thus, with ongoing restrictions due to COVID-19, the supply chain for retort packaging has been disrupted which is creating a major challenge for the manufacturers.

With the persistence of COVID-19 and restrictions on movement, there is a disruption in the supply chain which is posing a major challenge for the Europe retort packaging market.

Post COVID-19 Impact on Retort Packaging Market

COVID-19 created a major impact on the retort packaging market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

Due to the outbreak of the pandemic caused by the virus, many small sectors were closed down and on the other hand some sectors decided to cut off some of the employees which resulted in a major unemployment. Retort packaging are also used in the packaging of products as well as in industries. Due to the outbreak of a pandemic, the demand for such products has gone up to an extent especially for the medical sector, healthcare, pharmaceutical, groceries, e-commerce, and various other sectors. But the unexpected demand, along with limited production capacities and supply chain interruptions is continuing to cause difficulties in all of these industries.

制造商正在制定各种战略决策,以在新冠疫情后实现复苏。参与者正在进行多项研发活动,以改进蒸煮包装所涉及的技术。借助此技术,这些公司将向市场推出先进而精确的控制器。此外,政府部门在食品和饮料中使用蒸煮包装也推动了市场的增长。

近期发展

- 2022 年 2 月,利乐公司投资了四家新的回收设施,使全球包装回收量每年超过 500 亿欧元。利乐公司与回收商和行业参与者共同投资了超过 1150 万欧元,帮助在土耳其、沙特阿拉伯、乌克兰和澳大利亚建立了四种全新的包装回收解决方案。这项投资有助于改善公司的产品组合和全球影响力。

- 2022 年 4 月,Amcor 推出更具可持续性的药品包装。其药品包装产品组合中加入了更具可持续性的新型 High Shield 层压板。新的低碳、可回收包装选项在两个方面均有体现,既满足了行业所需的高阻隔性和性能要求,又支持了制药公司的可回收性议程。此次新产品发布将有助于扩大产品组合和收益。进一步扩大公司的全球影响力。

欧洲蒸煮包装市场范围

蒸煮包装市场根据产品类型、材料、分销渠道和最终用途进行细分。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

产品类型

- 托盘

- 袋装

- 纸箱

- 其他的

根据产品类型,欧洲蒸煮包装市场分为托盘、袋装、纸箱和其他。

材料

- 宠物

- 聚丙烯

- 铝箔

- 聚酰胺(PA)

- 纸和纸板

- 乙烯醇

- 其他的

根据材料,欧洲蒸煮包装市场细分为 PET、聚丙烯、铝箔、聚酰胺 (PA)、纸和纸板、EVOH 等。

分销渠道

- 离线

- 在线的

根据分销渠道,欧洲蒸煮包装市场细分为线下和线上。

最终用途

- 食物

- 饮料

- 药品

- 其他的

根据最终用途,欧洲蒸煮包装市场分为食品、饮料、药品和其他。

蒸煮包装市场区域分析/见解

对蒸煮包装市场进行了分析,并按上述产品类型、材料、分销渠道和最终用途行业提供了市场规模洞察和趋势。

蒸煮包装市场报告涵盖的国家包括英国、德国、法国、西班牙、意大利、荷兰、瑞士、俄罗斯、比利时、土耳其、卢森堡和欧洲其他国家。

由于德国加大了对蒸煮包装的投资,德国在欧洲蒸煮包装市场占据主导地位。此外,预计该地区的需求将受到食品和饮料对蒸煮包装需求增长的推动。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了欧洲品牌的存在和可用性以及它们因来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

竞争格局和蒸煮包装市场份额分析

蒸煮包装市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、欧洲业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对蒸煮包装市场的关注有关。

蒸煮包装市场的一些主要参与者包括 Coveris、FLAIR Flexible Packaging Corporation、IMPAK CORPORATION、PORTCO PACKAGING、Constantia Flexibles、Mondi、Tetra Pak、Clifton Packaging Group Limited 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 introduction

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE RETORT PACKAGING MARKET

1.4 Currency and Pricing

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 geographicAL scope

2.3 years considered for the study

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 primary interviews with key opinion leaders

2.6 DBMR MARKET POSITION GRID

2.7 vendor share analysis

2.8 Multivariate Modeling

2.9 PRODUCT type timeline curve

2.1 MARKET APPLICATION COVERAGE GRID

2.11 secondary sourcEs

2.12 assumptions

3 EXECUTIVE SUMMARY

4 premium insights

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.1.1 overview

4.1.2 development of advanced smart packaging products

4.1.3 temperature balancing smart packaging

4.1.4 smart packaging to improve consumer safety

4.2 regulations

4.2.1 overview

4.2.2 Food and Drug Administration

4.2.3 european Food Packaging Regulations

4.2.4 Food Safety and Standards Authority of India (FSSAI)

4.3 EMERGING TREND

4.4 PRICE TREND ANALYSIS

4.5 production consumption analysis

4.6 import-export scenario

4.7 porter’s five force analysis

4.8 SUPPLIER OVERVIEW

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 market overview

5.1 drivers

5.1.1 increasing demand among consumers for preservative-free products

5.1.2 rising demand for sustainable and aesthetic packaging solutions

5.1.3 growing demand for intelligent packaging to avoid food wastage

5.1.4 growing consumption of packaged products

5.2 restraints

5.2.1 high costS associated with research and development activities

5.2.2 availability of ALTERNATIVES IN THE MARKET

5.3 opportunities

5.3.1 ban on plastic packaging products in the Europe market

5.3.2 recent innovation and new product launches

5.3.3 increasing cases of food contamination

5.4 challenge

5.4.1 supply chain disruption due to pandemic

6 EUROPE Retort packaging market, BY product type

6.1 overview

6.2 Pouches

6.2.1 STAND-UP-POUCHES

6.2.2 GUSSETED POUCHES

6.2.3 BACK-SEAL QUAD

6.2.4 SPOUTED POUCHES

6.3 Trays

6.4 cartons

6.5 others

7 EUROPE Retort packaging market, BY Material

7.1 overview

7.2 PET

7.3 Polypropylene

7.4 ALUMINIUM Foil

7.5 Polyamide (PA)

7.6 Paper & Paperboard

7.7 EVOH

7.8 Others

8 EUROPE Retort packaging market, BY Distribution channel

8.1 overview

8.2 Offline

8.3 Online

9 EUROPE Retort packaging market, BY End-Use

9.1 overview

9.2 Food

9.2.1 Ready to Eat Meals

9.2.2 Meat, Poultry, & Sea Food

9.2.3 Pet Food

9.2.4 Baby Food

9.2.5 Soups & Sauces

9.2.6 Spices & Condiments

9.2.7 Others

9.3 Beverages

9.3.1 NON-ALCOHOLIC

9.3.2 Alcoholic

9.4 Pharmaceuticals

9.5 Others

10 Europe Retort packaging Market, by REGION

10.1 Europe

10.1.1 GERMANY

10.1.2 ITALY

10.1.3 FRANCE

10.1.4 SPAIN

10.1.5 U.K.

10.1.6 RUSSIA

10.1.7 BELGIUM

10.1.8 SWITZERLAND

10.1.9 NETHERLANDS

10.1.10 TURKEY

10.1.11 LUXEMBURG

10.1.12 REST OF EUROPE

11 EUROPE Retort packaging market: COMPANY landscape

11.1 company share analysis: EUROPE

12 swot analysis

13 company profile

13.1 Tetra Pak

13.1.1 COMPANY snapshot

13.1.2 company share analysis

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 Sealed Air

13.2.1 COMPANY snapshot

13.2.2 REVENUE ANALYSIS

13.2.3 company share analysis

13.2.4 Product PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 Sonoco Products Company

13.3.1 COMPANY snapshot

13.3.2 REVENUE ANALYSIS

13.3.3 company share analysis

13.3.4 Product PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 proampac

13.4.1 COMPANY snapshot

13.4.2 company share analysis

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 Amcor plc

13.5.1 COMPANY snapshot

13.5.2 REVENUE ANALYSIS

13.5.3 company share analysis

13.5.4 Product PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 berry Europe inc.

13.6.1 COMPANY snapshot

13.6.2 COMPANY snapshot

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 Clifton Packaging Group Limited

13.7.1 COMPANY snapshot

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 Constantia Flexibles

13.8.1 COMPANY snapshot

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 coveris

13.9.1 COMPANY snapshot

13.9.2 RODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 DNP America, LLC.

13.10.1 COMPANY snapshot

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 flair flexible packaging corporation

13.11.1 COMPANY snapshot

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 Floeter India Retort Pouches (P) Ltd

13.12.1 COMPANY snapshot

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 Huhtamaki

13.13.1 COMPANY snapshot

13.13.2 REVENUE ANALYSIS

13.13.3 Product PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 impak corporation

13.14.1 COMPANY snapshot

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LD PACKAGING CO .,LTD

13.15.1 COMPANY snapshot

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 Mondi

13.16.1 COMPANY snapshot

13.16.2 REVENUE ANALYSIS

13.16.3 Product PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 Paharpur 3P

13.17.1 COMPANY snapshot

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 portco packaging

13.18.1 COMPANY snapshot

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 Printpack

13.19.1 COMPANY snapshot

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 WINPAK LTD.

13.20.1 COMPANY snapshot

13.20.2 REVENUE ANALYSIS

13.20.3 Product PORTFOLIO

13.20.4 RECENT DEVELOPMENT

14 questionnaire

15 related reports

表格列表

TABLE 1 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 3 EUROPE POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 5 EUROPE POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 8 EUROPE CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 10 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 12 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 14 EUROPE PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 16 EUROPE POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 18 EUROPE ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 20 EUROPE POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 22 EUROPE PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 24 EUROPE EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 26 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 28 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 30 EUROPE OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 32 EUROPE ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 34 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 36 EUROPE FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 38 EUROPE FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 41 EUROPE BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 42 EUROPE PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 44 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 46 EUROPE RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 EUROPE RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 48 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 50 EUROPE POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 52 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 53 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 55 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 56 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 57 EUROPE FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 EUROPE BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 59 GERMANY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 GERMANY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 61 GERMANY POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 GERMANY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 63 GERMANY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 64 GERMANY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 GERMANY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 66 GERMANY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 67 GERMANY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 68 GERMANY FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 69 GERMANY BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 70 ITALY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 ITALY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 72 ITALY POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 ITALY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 ITALY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 75 ITALY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 ITALY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 77 ITALY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 78 ITALY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 79 ITALY FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 80 ITALY BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 81 FRANCE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 FRANCE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 83 FRANCE POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 FRANCE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 85 FRANCE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 86 FRANCE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 FRANCE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 88 FRANCE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 89 FRANCE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 90 FRANCE FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 91 FRANCE BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 SPAIN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 SPAIN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 94 SPAIN POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 SPAIN RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 SPAIN RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 97 SPAIN RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 SPAIN RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 99 SPAIN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 100 SPAIN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 101 SPAIN FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 102 SPAIN BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 103 U.K. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.K. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 105 U.K. POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.K. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 107 U.K. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 108 U.K. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 109 U.K. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 110 U.K. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 111 U.K. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 112 U.K. FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 113 U.K. BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 116 RUSSIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 117 RUSSIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 118 RUSSIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 119 RUSSIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 RUSSIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 121 RUSSIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 122 RUSSIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 123 RUSSIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 124 RUSSIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 125 BELGIUM RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 BELGIUM RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 127 BELGIUM POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 BELGIUM RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 129 BELGIUM RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 130 BELGIUM RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 BELGIUM RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 132 BELGIUM RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 133 BELGIUM RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 134 BELGIUM FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 135 BELGIUM BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 136 SWITZERLAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 SWITZERLAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 138 SWITZERLAND POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 SWITZERLAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 140 SWITZERLAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 141 SWITZERLAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 SWITZERLAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 143 SWITZERLAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 144 SWITZERLAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 145 SWITZERLAND FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 146 SWITZERLAND BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 147 NETHERLANDS RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 NETHERLANDS RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 149 NETHERLANDS POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 150 NETHERLANDS RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 151 NETHERLANDS RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 152 NETHERLANDS RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 153 NETHERLANDS RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 154 NETHERLANDS RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 155 NETHERLANDS RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 156 NETHERLANDS FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 157 NETHERLANDS BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 158 TURKEY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 159 TURKEY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 160 TURKEY POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 161 TURKEY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 162 TURKEY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 163 TURKEY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 164 TURKEY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 165 TURKEY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 166 TURKEY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 167 TURKEY FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 168 TURKEY BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 169 LUXEMBURG RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 170 LUXEMBURG RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 171 LUXEMBURG POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 LUXEMBURG RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 173 LUXEMBURG RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 174 LUXEMBURG RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 LUXEMBURG RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 176 LUXEMBURG RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 177 LUXEMBURG RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 178 LUXEMBURG FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 179 LUXEMBURG BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 180 REST OF EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 181 REST OF EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

图片列表

FIGURE 1 EUROPE RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE RETORT PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE RETORT PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE RETORT PACKAGING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE RETORT PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE RETORT PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE RETORT PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE RETORT PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE RETORT PACKAGING MARKET: END-USE COVERAGE GRID

FIGURE 10 EUROPE RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS IS EXPECTED TO DRIVE THE EUROPE RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 POUCHES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE RETORT PACKAGING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE EUROPE RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF EUROPE RETROT PACKAGING MARKET

FIGURE 15 THE BELOW PIE CHART SHOWS THE RESULT OF FOODBORNE OUTBREAKS IN 2018

FIGURE 16 EUROPE RETORT PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 EUROPE RETORT PACKAGING MARKET: BY MATERIAL, 2021

FIGURE 18 EUROPE RETORT PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 EUROPE RETORT PACKAGING MARKET: BY END-USE, 2021

FIGURE 20 EUROPE RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 21 EUROPE RETORT PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 22 EUROPE RETORT PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE RETORT PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 25 EUROPE RETORT PACKAGING MARKET: COMPANY SHARE 2021 (%)

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.