Europe Primers In Construction Market

市场规模(十亿美元)

CAGR :

%

USD

3,292.79 Million

USD

6,094.72 Million

2022

2030

USD

3,292.79 Million

USD

6,094.72 Million

2022

2030

| 2023 –2030 | |

| USD 3,292.79 Million | |

| USD 6,094.72 Million | |

|

|

|

欧洲建筑市场底漆,按材料(醇酸树脂、环氧树脂、聚氨酯、丙烯酸等)、表面(水泥、混凝土、石膏、金属、塑料、木材、地板砖等)、类型(水基和溶剂型)、最终用途(新住宅建筑、新非住宅建筑、新土木工程、土木工程改造、非住宅改造和住宅改造)划分 - 行业趋势和预测到 2030 年。

欧洲建筑底漆市场分析及规模

由于金属和木材在结构上依赖于底漆来延长使用寿命和提供保护,欧洲地区木材和金属消费量的增加可视为建筑底漆市场增长的最强大推动力之一。人们越来越意识到这些挥发性化学物质对健康的危害,以及制定了有关这些化学物质使用的标准,限制了建筑底漆市场的增长,因为大多数含有这些化学物质的底漆的含量都超过了允许的限度。办公室和商业空间建筑活动的增加为欧洲建筑底漆市场细分市场带来了黄金机会,因为新的建筑活动将推动这些地区对底漆的需求。

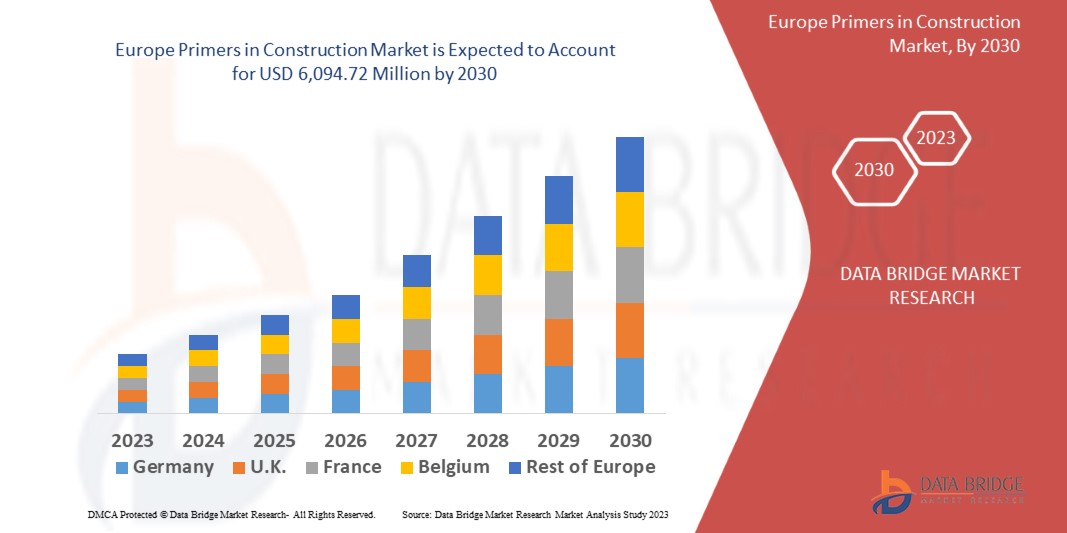

Data Bridge Market Research 分析,2022 年建筑底漆市场规模为 32.9279 亿美元,到 2030 年将飙升至 60.9472 亿美元,预计在 2023 年至 2030 年的预测期内复合年增长率为 8.0%。由于人口增加和对住宅区的需求不断增加,终端用途领域的“新住宅建设”部分在建筑底漆市场中占据主导地位。

除了对市场价值、增长率、细分、地理覆盖范围和主要参与者等市场情景的洞察之外,Data Bridge Market Research 策划的市场报告还包括深度专家分析、渠道分析、定价分析和监管框架。

欧洲建筑入门市场范围和细分

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021 (可定制为 2015-2020) |

|

定量单位 |

收入(千美元)、数量(吨)、定价(美元) |

|

涵盖的领域 |

按材料(醇酸树脂、环氧树脂、聚氨酯、丙烯酸等)、表面(水泥、混凝土、石膏、金属、塑料、木材、地板砖等)、类型(水基和溶剂基)、最终用途(新住宅建筑、新非住宅建筑、新土木工程、土木工程改造、非住宅改造和住宅改造) |

|

覆盖国家 |

德国、法国、意大利、英国、波兰、罗马尼亚和捷克共和国 |

|

涵盖的市场参与者 |

PPG Industries, Inc.(美国)、Sherwin-Williams Company(美国)、AKZO NOBEL NV(荷兰)、RPM International Inc.(美国)、Axalta Coating Systems, LLC(美国)、BASF SE(德国)、Jotun(挪威)、关西涂料株式会社(日本)、Henkel AG & Co. kGaA(德国)、Tikkurila(芬兰)、Hempel A/S(丹麦)和日本涂料控股株式会社(日本) |

|

市场机会 |

|

市场定义

底漆是涂装油漆前涂在材料表面的一种基本涂层,可确保表面与油漆之间有更好的粘合性。除了提高附着力外,底漆还可以提高油漆的耐久性,并为被涂装的表面提供一层保护。它广泛应用于建筑、汽车、家具、航空航天和海上运输车辆等许多行业。

建筑底漆市场动态

驱动程序

- 该地区的建筑和改造活动不断增加

欧洲地区的住宅、商业和基础设施领域的建筑和翻新活动显著增加。这些项目需要使用底漆,因为它们对于表面处理、增强附着力以及防腐蚀和防风化至关重要。

- 欧洲基础设施建设项目不断增加

欧洲正在进行的基础设施建设项目很多,包括道路、桥梁、铁路和公共设施建设。这些项目通常需要底漆进行表面处理、防腐和长期耐久性,从而增加了该地区建筑行业对底漆的需求。

- 加强研发活动,提高底漆的应用

底漆配方和应用方法的技术进步和创新不断增加,也推动了欧洲底漆施工的增长。主要制造商正在投资研发活动,以推出具有改进性能特征的创新底漆,例如固化速度更快、附着力更好、耐化学性更强。这些进步有助于提高建筑项目的效率和效果。

机会

- 绿色和可持续建筑活动的兴起

欧洲对环保和可持续建筑活动的需求日益增长。对低 VOC(挥发性有机化合物)排放且符合可持续建筑和施工认证(如 LEED(能源与环境设计先锋)和 BREEAM(建筑研究机构环境评估方法)等)的底漆的需求日益增长。

- 加强制造商与建筑师、规范制定者和建筑行业专业人士之间的合作

制造商、建筑师、规范制定者和建筑专业人士之间的协作和关系建立活动可以为市场带来增长机会。底漆制造商可以与这些利益相关者密切合作,提供技术专业知识、产品建议和规范流程支持,从而增加建筑项目中底漆的使用量。

限制/挑战

- 法规日益严格,环境问题日益突出

欧洲建筑行业受到政府关于化学品使用及其环境影响的严格监管。需要遵守 REACH(化学品注册、评估、授权和限制)和 VOC 排放限制等法规,这些法规可能给底漆制造商和最终用户带来挑战。需要开发符合监管要求且不影响性能的配方。

- 缺乏对底漆的认识和教育

承包商、建筑师和建筑专业人士对使用底漆的重要性和好处缺乏认识和理解。对正确的表面处理和底漆作用的了解有限,可能导致其在施工中利用不足或应用不当。需要开展教育、培训和技能提升计划,以促进在建筑和翻新项目中正确使用和应用底漆。

本建筑市场入门报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入领域的机会、市场法规的变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新。如需了解有关建筑市场入门的更多信息,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您做出明智的市场决策,实现市场增长。

近期发展

- 2023 年 3 月,PPG Industries, Inc. 推出了 PPG ENVIROCRON Primeron 粉末底漆系列,用于高性能防腐。该产品旨在为钢、热镀锌钢、金属化钢和铝等金属基材提供高耐腐蚀性。PPG Envirocron Primeron 底漆粉末产品组合已根据腐蚀性类别进行测试,并获得了 QUALISTEELCOAT 涂层钢国际质量标签的批准。该产品的推出将加强产品组合并提高公司在市场上的份额

- 2022 年 7 月,艾仕得推出了 Plascoat PPA 742,这是一款适用于建筑市场金属基材的单层热塑性底漆解决方案。Plascoat PPA 742 易于涂抹,即使在锋利的基材上也是如此,因此适用于各种组件设计。该底漆在城市家具、建筑围栏、金属结构和其他金属部件等应用中提供出色的保护

欧洲建筑底漆市场范围

建筑市场中的底漆根据材料、表面、类型和最终用途进行细分。这些细分市场之间的增长将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

材料

- 醇酸

- 环氧树脂

- 聚氨酯

- 丙烯酸纤维

- 其他的

表面

- 水泥

- 具体的

- 石膏

- 金属

- 塑料

- 木头

- 地砖

- 其他的

类型

- 水基

- 溶剂型

最终用途

- 新住宅建设

- 新建非住宅建筑

- 新土木工程

- 土木工程改造

- 非住宅装修

- 住宅装修

建筑市场区域分析/洞察入门指南

对建筑市场中的底漆进行了分析,并按国家、材料、表面、类型和最终用途提供了市场规模见解和趋势。

建筑底漆市场报告涉及的国家包括德国、法国、意大利、英国、波兰、罗马尼亚和捷克共和国。

由于德国建筑和装修活动的不断增长,德国在建筑底漆市场中占据主导地位。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化会影响市场的当前和未来趋势。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测单个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

建筑业的增长和新技术的渗透

建筑底漆市场还为您提供有关每个国家建筑行业增长、翻新活动增加及其对建筑底漆市场影响的详细市场分析。数据涵盖 2015-2020 年的历史时期。

建筑业的竞争格局和底漆市场份额分析

The primers in construction market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to primers in construction market.

Some of the major players operating in the primers in construction market are:

- PPG Industries, Inc. (U.S.)

- The Sherwin-Williams Company (U.S.)

- AKZO NOBEL N.V. (Netherlands)

- RPM International Inc. (U.S.)

- Axalta Coating Systems, LLC (U.S.)

- BASF SE (Germany)

- Jotun (Norway)

- Kansai Paint Co.,Ltd. (Japan)

- Henkel AG & Co. kGaA (Germany)

- Tikkurila (Finland)

- Hempel A/S (Denmark)

- Nippon Paint Holdings Co., Ltd. (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of the Europe primers in construction market

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- material LIFELINE CURVE

- MULTIVARIATE MODELLING

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- DBMR MARKET CHALLENGE MATRIX

- IMPORT-EXPORT DATA

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- Market Overview

- drivers

- Growing demand fOR primers in new residential construction

- Increasing usage of wood and metals in constructions

- Substantial rise in the economic and living standards

- RestrainTs

- Presence of volatile organic compounds could result in toxicity and health hazards

- Availability of alternatives such as plasters and white cement

- opportunities

- Increasing number of office establishments due to Digitalization and globalization

- Rising demand for more residential buildings and complexes

- Growth in THE tourism industry

- challenge

- Commercialization of VARIOUS Type of paints which don’t require primers

- COVID-19 Impact on Europe Primers in Construction Market

- ANALYSIS ON IMPACT OF COVID-19 ON the Market

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE Market

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- PRICE IMPACT

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Europe primers in construction market, BY material

- overview

- Alkyd

- ABSORBENT SUBSTRATE

- NON ABSORBENT SUBSTRATE

- Epoxy

- ABSORBENT SUBSTRATE

- NON ABSORBENT SUBSTRATE

- Polyurethane

- ABSORBENT SUBSTRATE

- NON ABSORBENT SUBSTRATE

- Acrylic

- ABSORBENT SUBSTRATE

- NON ABSORBENT SUBSTRATE

- Others

- ABSORBENT SUBSTRATE

- NON ABSORBENT SUBSTRATE

- Europe primers in construction market, BY Surface

- overview

- Cement

- Plaster

- Concrete

- Metal

- Wood

- Plastic

- Flooring Tiles

- Others

- Europe primers in construction market, BY type

- overview

- Solvent Based

- Water Based

- Europe primers in construction market, BY End User

- overview

- New Residential Construction

- New Non-Residential Construction

- New Civil Engineering

- Civil Engineering Renovation

- Residential Renovation

- Non-Residential Renovation

- Europe Primers in Construction Market-COUNTRY

- Europe

- GERMANY

- u.k.

- France

- Italy

- Poland

- Romania

- Czech Republic

- Europe Primers in Construction Market: COMPANY landscape

- company share analysis: Europe

- Swot analysis

- COMPANY PROFILE

- AKZO NOBEL N.V.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Axalta Coating Systems, llc

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- BASF SE

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Hempel A/S

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Henkel AG & Co. KGaA

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Jotun

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Kansai Paint Co.,Ltd.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Nippon Paint Holdings Co., Ltd.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- PPG INDUSTRIES, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- RPM International Inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- THE SHERWIN-WILLIAMS COMPANY

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- TIKKURILA

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- questionnaire

- related reports

表格列表

TABLE 1 IMPORT DATA of Paints and varnishes, incl. enamels and lacquers, based on synthetic or chemically modified natural polymers, dispersed or dissolved in an aqueous medium (excluding those based on acrylic or vinyl polymers); HS code: 320990 (USD thousand)

TABLE 2 export DATA OF PAINTS AND VARNISHES, INCL. ENAMELS AND LACQUERS, BASED ON SYNTHETIC OR CHEMICALLY MODIFIED NATURAL POLYMERS, DISPERSED OR DISSOLVED IN AN AQUEOUS MEDIUM (EXCLUDING THOSE BASED ON ACRYLIC OR VINYL POLYMERS); HS CODE: 3209 (USD thousand)

TABLE 3 consumption of steEl in Latin America (Million tonnes)

TABLE 4 Maximum voc content limit values for paints and varnishes (U.K.)

TABLE 5 Maximum voc content limit values inPrimers (U.S.)

TABLE 6 Maximum voc content limit values for paints and varnishes

TABLE 7 Europe primers in construction market, BY material, 2019-2028 (USD Thousand)

TABLE 8 Europe primers in construction market, BY material, 2019-2028 (Tons)

TABLE 9 Europe primers in construction market Alkyd, By material, 2019-2028 (USD Thousand)

TABLE 10 Europe primers in construction300 market, Epoxy By material, 2019-2028 (USD Thousand)

TABLE 11 Europe primers in construction3350 market, Polyurethane By material, 2019-2028 (USD Thousand)

TABLE 12 Europe primers in construction market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 13 Europe primers in construction market, other By material, 2019-2028 (USD Thousand)

TABLE 14 Europe primers in construction market, BY Surface, 2019-2028 (USD Thousand)

TABLE 15 Europe primers in construction market, BY type, 2019-2028 (USD Thousand)

TABLE 16 Europe primers in construction market, BY End User, 2019-2028 (USD Thousand)

TABLE 17 Europe Primers in Construction market, By COUNTRY, 2019-2028 (tone)

TABLE 18 Europe Primers in Construction market, By COUNTRY, 2019-2028 (USD Thousand)

TABLE 19 Europe primers in construction market, By Material, 2019-2028 (Tons)

TABLE 20 Europe primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 21 Europe primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 22 Europe primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 23 Europe primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 24 Europe primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 25 Europe primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 26 Europe primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 27 Europe primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 28 Europe primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 29 Germany primers in construction market, By Material, 2019-2028 (Tons)

TABLE 30 Germany primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 31 Germany primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 32 Germany primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 33 Germany primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 34 Germany primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 35 Germany primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 36 Germany primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 37 Germany primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 38 Germany primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 39 U.k. primers in construction market, By Material, 2019-2028 (Tons)

TABLE 40 U.k. primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 41 U.k. primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 42 U.k. primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 43 U.k. primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 44 U.k. primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 45 U.k. primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 46 U.k. primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 47 U.k. primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 48 U.k. primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 49 France primers in construction market, By Material, 2019-2028 (Tons)

TABLE 50 France primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 51 France primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 52 France primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 53 France primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 54 France primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 55 France primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 56 France primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 57 France primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 58 France primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 59 Italy primers in construction market, By Material, 2019-2028 (Tons)

TABLE 60 Italy primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 61 Italy primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 62 Italy primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 63 Italy primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 64 Italy primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 65 Italy primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 66 Italy primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 67 Italy primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 68 Italy primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 69 Poland primers in construction market, By Material, 2019-2028 (Tons)

TABLE 70 Poland primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 71 Poland primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 72 Poland primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 73 Poland primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 74 Poland primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 75 Poland primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 76 Poland primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 77 Poland primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 78 Poland primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 79 Romania primers in construction market, By Material, 2019-2028 (Tons)

TABLE 80 Romania primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 81 Romania primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 82 Romania primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 83 Romania primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 84 Romania primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 85 Romania primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 86 Romania primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 87 Romania primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 88 Romania primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 89 Czech Republic primers in construction market, By Material, 2019-2028 (Tons)

TABLE 90 Czech Republic primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 91 Czech Republic primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 92 Czech Republic primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 93 Czech Republic primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 94 Czech Republic primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 95 Czech Republic primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 96 Czech Republic primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 97 Czech Republic primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 98 Czech Republic primers in construction Market, By End User, 2019-2028 (USD Thousand)

图片列表

FIGURE 1 Europe primers in construction market segmentation

FIGURE 2 EUROPE PRIMERS IN CONSTRUCTION MARKET: data triangulation

FIGURE 3 Europe primers in construction market: DROC ANALYSIS

FIGURE 4 Europe primers in construction market: REGIONAL VS. country MARKET ANALYSIS

FIGURE 5 EUROPE PRIMERS IN CONSTRUCTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PRIMERS IN CONSTRUCTION MARKET: THE material LIFELINE CURVE

FIGURE 7 EUROPE PRIMERS IN CONSTRUCTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 Europe primers in construction market: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE PRIMERS IN CONSTRUCTION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 10 Europe primers in construction market: SEGMENTATION

FIGURE 11 Growing demand of primers in new residential construction IS EXPECTED TO DRIVE THE PRIMERS in construction MARKET IN THE FORECAST PERIOD of 2021 to 2028

FIGURE 12 Alkyd segment is expected to account for the largest share of the Europe primers in construction market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF Europe Primers in Construction Market

FIGURE 14 Private new housing contributed the most to the rise in new work in recent year

FIGURE 15 PRIVATE NEW HOUSING CONTRIBUTED THE MOST TO THE RISE IN NEW WORK IN RECENT YEAR

FIGURE 16 STEEL CONSUMPTION PER STEEL-USING SECTOR

FIGURE 17 Mean Equivalized Net Income (Euros) for sweden, iceland and u.k.

FIGURE 18 MEAN EQUIVALIZED NET INCOME (EUROS) FOR ICELAND

FIGURE 19 Private new housing contributed the most to the rise in new work in recent years

FIGURE 20 PRIVATE NEW HOUSING CONTRIBUTED THE MOST TO THE RISE IN NEW WORK IN RECENT YEAR

FIGURE 21 Europe primers in construction market: BY material, 2020

FIGURE 22 Europe primers in construction market: BY Surface, 2020

FIGURE 23 Europe primers in construction market: BY type, 2020

FIGURE 24 Europe primers in construction market: BY End User, 2020

FIGURE 25 EUROPE Primers in Construction market: SNAPSHOT (2020)

FIGURE 26 EUROPE Primers in Construction market: BY COUNTRY (2020)

FIGURE 27 EUROPE Primers in Construction market: BY COUNTRY (2021 & 2028)

FIGURE 28 EUROPE Primers in Construction market: BY COUNTRY (2021 & 2028)

FIGURE 29 EUROPE Primers in Construction market: BY material (2019-2028)

FIGURE 30 Europe Primers in Construction Market: company share 2020 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。