Europe And Us Recycled Solid Board Market

市场规模(十亿美元)

CAGR :

%

| 2024 –2031 | |

| USD 9.02 Billion | |

| USD 11.19 Billion | |

|

|

|

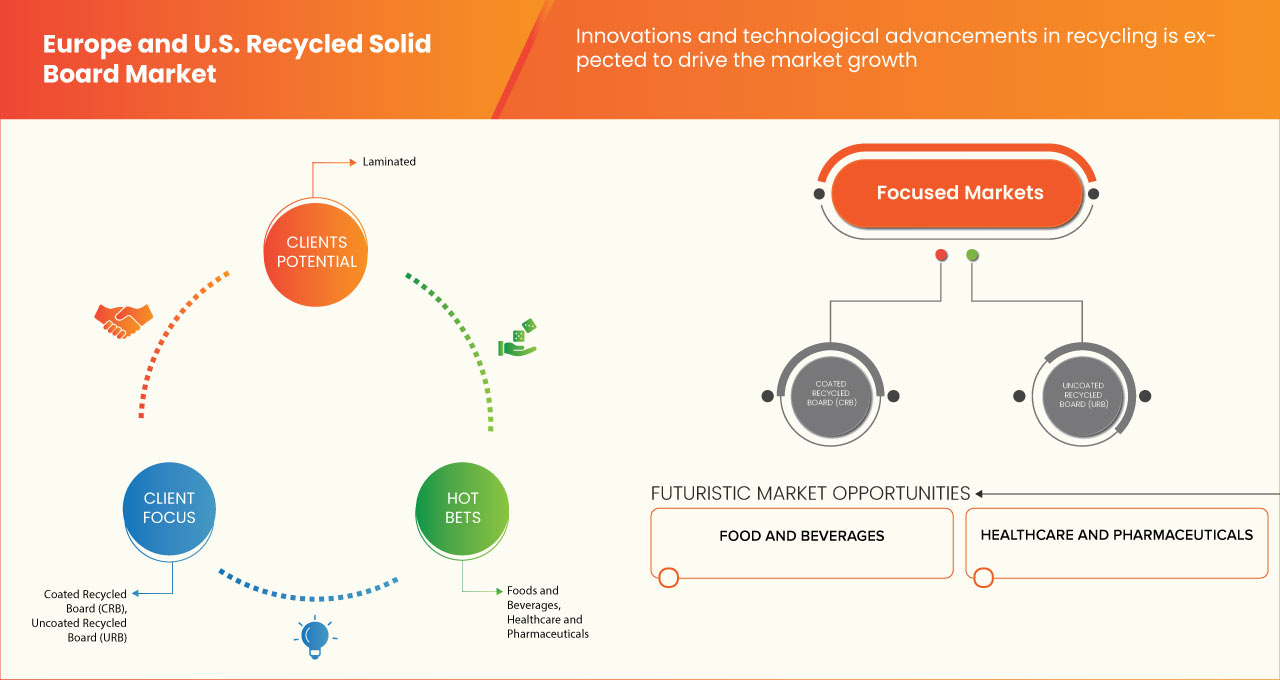

>欧洲和美国再生实心纸板市场,按产品类型(涂层再生纸板 (CRB) 和无涂层再生纸板 (URB))、类别(层压和非层压)、重量(300-600 GSM、601-800 GSM、801-1200 GSM 和 1200 GSM 以上)、应用(盒子、Pop 显示器、托盘、层垫、边缘保护器等)、最终用途(食品和饮料、医疗保健和制药、化妆品和个人护理、电气和电子、建筑和施工、工业包装、烟草包装等)划分 - 行业趋势和预测到 2031 年。

欧洲和美国再生实心板市场分析及规模

欧洲和美国的再生实心板市场正在经历稳步增长,推动了来自各个终端行业的需求增长。人们对可持续性的认识不断提高,环境问题日益严重,推动着市场向前发展。然而,原材料供应有限可能会在一定程度上阻碍市场扩张。

Data Bridge Market Research 分析称,欧洲和美国再生实心板市场预计将从 2023 年的 90.2 亿美元增至 2031 年的 111.9 亿美元,在 2024-2031 年预测期内的复合年增长率为 2.7%。

|

报告指标 |

细节 |

|

预测期 |

2024 至 2031 年 |

|

基准年 |

2023 |

|

历史岁月 |

2022 (可定制为 2016-2021) |

|

定量单位 |

收入(十亿美元) |

|

涵盖的领域 |

产品类型(涂层再生纸板 (CRB) 和无涂层再生纸板 (URB))、类别(层压和非层压)、重量(300-600 GSM、601-800 GSM、801-1200 GSM 和 1200 GSM 以上)、应用(盒子、展示架、托盘、层垫、边缘保护垫等)、最终用途(食品和饮料、医疗保健和制药、化妆品和 个人护理、电气和电子产品、建筑和施工、工业包装、烟草包装等) |

|

覆盖国家 |

美国、德国、意大利、英国、法国、波兰、俄罗斯、西班牙、土耳其、荷兰、比利时、瑞典、芬兰、瑞士、丹麦、挪威和欧洲其他地区 |

|

涵盖的市场参与者 |

Smurfit Kappa、Reno De Medici SpA、DS Smith、VPK Group NV、Schumacher Packaging、Solidus、Koehler Paper、LEIPA GROUP、广州bmpaper、Cartiera San Martino、Cartiera Fornaci spa.、Cartiera Marchigiana、Kartonfabrik Porstendorf、Preston Board & Packaging Ltd. 、Magnia Group、PREMIER PAPER GROUP、Cartiera Cama、SEVEROČESKÁ PAPÍRNA, sro、Advanced Packaging Ltd.、KAPAG Karton + Papier AG 和 Merckens 等 |

市场定义

再生纸板是一种由再生纸纤维制成的材料。它通常用于包装和各种纸制品。该过程包括收集废纸和纸板,将它们分解成纤维,然后将它们重新组合成纸板材料。这种材料因其环保效益而受到追捧,因为它减少了对原生纸纤维的需求并有助于将垃圾从垃圾填埋场转移。此外,它通常坚固耐用且用途广泛,适用于各种应用。

欧洲和美国再生纸板市场动态

驱动程序

- 各终端行业需求增加

各终端使用行业需求的增长源于人们越来越认识到再生纸板的环境效益。食品和饮料、零售、电子商务、化妆品和电子等行业越来越多地寻求符合其可持续发展目标并满足环保消费者期望的包装材料。再生纸板提供了一种引人注目的解决方案,它为传统包装材料(如原纸板或塑料)提供了可再生和可回收的替代品。此外,再生纸板的多功能性和适应性使其适用于广泛的应用,包括瓦楞纸箱、纸箱、展示架和插入物,满足终端使用行业的多样化需求。随着各个行业的企业都将可持续性和环境管理放在首位,对再生纸板的需求预计将继续呈上升趋势,从而推动欧洲和美国的市场增长和创新。

- 电子商务扩张

随着消费者越来越多地转向网上购物以获得便利和可及性,对确保货物安全高效交付的包装材料的需求激增。再生实心纸板因其环保特性而成为电子商务包装的理想解决方案,既具有保护能力又具有可持续性。随着在线零售平台的兴起,对坚固可靠的包装材料的需求日益增长,这些材料既能承受运输和搬运的严酷考验,又能最大限度地减少对环境的影响。再生实心纸板满足了这一要求,它提供了一种可持续的替代品来替代塑料或原纸板等传统包装材料,符合消费者和企业的环保价值观。此外,随着法规和消费者偏好越来越重视可持续性,电子商务公司面临着采用环保包装解决方案的压力。这为再生实心纸板创造了有利的市场环境,推动了需求和市场增长。

机会

- 产品创新和新市场拓展

产品开发创新使制造商能够克服技术限制,提高再生实心纸板的性能、功能和美感。例如,回收和制造技术的进步使生产的再生实心纸板具有更高的强度、耐用性和可印刷性,使其适用于更广泛的应用,包括高级包装、销售点展示和宣传材料。此外,表面处理、涂层和层压板方面的创新增强了再生实心纸板的外观和功能,满足了不同行业客户的不同需求和偏好。此外,拓展新市场为增长和多元化提供了机会。通过瞄准食品和饮料、化妆品、电子产品和零售等越来越重视可持续性和环保包装的行业,制造商可以挖掘新的收入来源并扩大客户群。此外,开拓国际市场为将再生实心纸板产品出口到对可持续包装解决方案需求不断增长的地区提供了机会,从而进一步推动市场扩张。

- 可持续性意识不断增强,环境问题日益突出

随着消费者和企业越来越意识到其购买决策对环境的影响,对环保包装解决方案的需求也日益增长,这些解决方案可最大限度地减少资源枯竭、污染和浪费。再生实心纸板是一种可持续的传统包装材料替代品,因为它是由消费后或工业后回收的纤维制成的,减少了对原始资源的需求,并减少了垃圾填埋场的垃圾。此外,再生实心纸板符合循环经济原则,促进材料的再利用和回收,有助于建立更可持续、资源高效的供应链。

限制/挑战

- 缺乏对回收包装解决方案的认识

尽管环保意识日益增强,但许多消费者和企业可能并未充分了解再生纸板作为可持续包装选择的优势或可用性。这种缺乏意识的因素可能有很多,包括对再生材料质量和性能的误解、对回收过程的教育有限以及制造商和零售商对再生纸板的宣传不足。因此,消费者可能会默认使用由原生材料制成的传统包装,认为它们质量更高或更可靠。同样,企业可能会优先考虑熟悉的包装材料,而没有充分考虑其选择对环境的影响或再生替代品的可用性。应对这一挑战需要开展全面的教育和宣传活动,以强调再生纸板的优势,包括其对环境的影响更小、资源消耗更少以及对循环经济的贡献。

- 基础设施建设投入巨大

开发强大的回收基础设施,包括收集、分类、加工和制造设施,需要对设备、技术和人员进行大量投资。此外,回收行业的分散性和不同地区不同的法规可能会使基础设施项目的规划和实施变得复杂,导致延误和成本超支。此外,回收基础设施项目的投资回报可能不确定或延长,因为回收材料和最终产品的收入流受到市场动态、商品价格和需求波动的影响。高昂的前期成本和不确定的财务回报可能会阻碍私人投资者并限制回收基础设施的公共资金,从而限制支持再生实心板市场增长所需的设施的扩建和现代化。此外,监管障碍、许可流程和社区反对可能会进一步使基础设施开发工作复杂化,延迟项目并增加成本。克服这些挑战需要政府机构、行业利益相关者和金融机构的协调努力,以简化许可流程,为私人投资提供激励,并促进公私伙伴关系

最新动态

- 2019 年 7 月,根据美国国家医学图书馆的一篇文章,纸张和纸板在全球包装市场中被广泛使用,占 31%,这得益于其多功能性和环保声誉。它在食品包装中尤为突出,为消费者提供包容、保护和方便的信息传达。2000 年生产的近一半纸张和纸板用于包装应用。纸张以其环保的形象受到食品行业的青睐,尤其是用于直接接触食品和运输/储存目的。例子包括冰淇淋杯、微波爆米花袋、牛奶纸盒和快餐容器,突显了其多样化的应用,并推动了对再生实心纸板作为可持续替代品的需求

- 2023 年 9 月,制药行业使用再生纸板比传统包装材料具有显著优势,因为它具有可回收性。这种环保包装选择源自再生纸纤维,具有抗微生物性和易于回收的特点,符合行业对环保解决方案的需求。通过利用这一点,药品可以用对生态系统破坏最小且可生物降解的材料包装

- 2020 年 6 月,根据施普林格·自然杂志的一篇文章,电子商务的日益普及和社会经济水平的提高大大推动了对纸板包装材料的需求,导致回收和废物产生增加。因此,再生纸污泥废物成为能源和水处理应用的宝贵资源,有助于加强纸张和纸板回收行业的可持续性和循环经济实践

- 2023 年 7 月,根据 flinder 的一篇文章,随着电子商务的持续增长,对可持续包装解决方案(如再生实心板)的需求不断增加。实现电子商务的可持续性需要量身定制的方法,这些方法要考虑到企业的独特需求、消费者的期望和可用资源。一个关键方面是评估产品生命周期和采购实践,以最大限度地减少对环境的影响。这包括延长产品生命周期、提供维修、实施回收计划或销售二手物品。此外,评估供应链的生态足迹并从致力于道德和可持续实践的供应商那里采购也是必不可少的。企业还可以探索创新的包装解决方案,例如最小、可重复使用、可回收或可堆肥的选项

欧洲和美国再生实心板市场范围

欧洲和美国再生实心板 市场根据产品类型、类别、重量、应用和最终用途分为五个显著的细分市场。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策以确定核心市场应用。

产品类型

- 涂层再生纸板 (CRB)

- 无涂层再生纸板 (URB)

根据产品类型,市场分为涂层再生纸板(CRB)和无涂层再生纸板(URB)。

类别

- 层压

- 非层压

根据类别,市场分为层压和非层压。

重量

- 300-600 GSM

- 601-800 GSM

- 801-1200 GSM

- 1200 GSM 以上

根据重量,市场分为 300-600 GSM、601-800 GSM、801-1200 GSM 和 1200 GSM 以上。

应用

- 盒子

- 流行展示

- 托盘

- 层垫

- 边缘保护器

- 其他的

根据应用,市场分为盒子、弹出式展示架、托盘、层垫、边缘保护器等。

最终用途

- 食品和饮料

- 医疗保健和制药

- 化妆品和个人护理

- 电气和电子

- 建筑和施工

- 工业包装

- 烟草包装

- 其他的

根据最终用途,市场分为食品和饮料、医疗保健和药品、化妆品和个人护理、电气和电子、建筑和建筑、工业包装、烟草包装等。

欧洲和美国再生实心板市场区域分析/见解

根据产品类型、类别、重量、应用和最终用途,欧洲和美国的再生实心板市场分为五个显著的部分。

欧洲和美国再生实心板市场报告涉及的国家包括美国、德国、意大利、英国、法国、波兰、俄罗斯、西班牙、土耳其、荷兰、比利时、瑞典、芬兰、瑞士、丹麦、挪威和欧洲其他国家。

由于化妆品和个人护理等各个终端行业对再生实心纸板的使用和需求不断增加,预计德国将在欧洲占据主导地位。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。数据点下游和上游价值链分析、技术趋势波特五力分析和案例研究是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了北美品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局及欧美再生纸板市场份额分析

欧洲和美国再生实心板市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对欧洲和美国再生实心板市场的关注有关

在欧洲和美国再生实心纸板市场运营的一些知名参与者包括 Smurfit Kappa、Reno De Medici SpA、DS Smith、VPK Group NV、Schumacher Packaging、Solidus、Koehler Paper、LEIPA GROUP、Guangzhou bmpaper、Cartiera San Martino、Cartiera Fornaci spa.、Cartiera Marchigiana、Kartonfabrik Porstendorf、Preston Board & Packaging Ltd.、Magnia Group、PREMIER PAPER GROUP、Cartiera Cama、SEVEROČESKÁ PAPÍRNA, sro、Advanced Packaging Ltd.、KAPAG Karton + Papier AG 和 Merckens 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER'S FIVE FORCES

4.2.1 THE THREAT OF NEW ENTRANTS

4.2.2 THE THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 PRICING ANALYSIS

4.3.1 PRODUCTION COSTS

4.3.2 MARKET DEMAND AND COMPETITIVE PRICING

4.3.3 VALUE-ADDED FEATURES AND DIFFERENTIATION

4.3.4 REGULATORY COMPLIANCE AND SUSTAINABILITY

4.3.5 PRICE OPTIMIZATION AND STRATEGY

4.4 IMPORT EXPORT SCENARIO

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 VENDOR SELECTION CRITERIA

4.6.1 QUALITY STANDARDS COMPLIANCE

4.6.2 CERTIFICATIONS AND ACCREDITATIONS

4.6.3 PRODUCT RANGE AND CUSTOMIZATION

4.6.4 SUPPLY CHAIN TRANSPARENCY

4.6.5 LOCATION AND LOGISTICS

4.6.6 RISK MANAGEMENT

4.6.7 PRODUCTION CAPACITY AND LEAD TIMES

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 RAW MATERIAL SOURCING AND SUSTAINABILITY

4.7.3 STRINGENT REGULATIONS

4.7.4 TECHNOLOGICAL ADVANCEMENTS

4.7.5 SUPPLY CHAIN DISRUPTIONS

4.7.6 INVESTMENT IN CIRCULAR ECONOMY

4.7.7 PRICE VOLATILITY

4.8 RAW MATERIAL COVERAGE

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.10.1 ADVANCED RECYCLING TECHNOLOGIES

4.10.2 FIBER CLEANING AND DECONTAMINATION

4.10.3 REFINING AND FIBER MODIFICATION

4.10.4 BIO-BASED BINDERS AND ADDITIVES

4.10.5 FUNCTIONAL COATINGS AND TREATMENTS

4.10.6 DIGITALIZATION AND INDUSTRY 4.0

4.10.7 CIRCULAR ECONOMY INITIATIVES

4.10.8 ENERGY-EFFICIENT PRODUCTION PRACTICES

5 REGULATION COVERAGE

5.1 ENVIRONMENTAL REGULATIONS

5.2 PRODUCT QUALITY AND SAFETY REGULATIONS

5.3 LABELING AND CERTIFICATION

5.4 PACKAGING REGULATIONS:

5.5 TRADE AND IMPORT/EXPORT REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN DEMAND FROM VARIOUS END-USE INDUSTRIES

6.1.2 EXPANSION IN E-COMMERCE

6.1.3 INNOVATIONS AND TECHNOLOGICAL ADVANCEMENTS IN RECYCLING

6.2 RESTRAINTS

6.2.1 LIMITED SUPPLY OF RAW MATERIAL

6.2.2 COMPETITION FROM VIRGIN MATERIALS

6.3 OPPORTUNITIES

6.3.1 PRODUCT INNOVATION AND EXPANSION INTO NEW MARKETS

6.3.2 GROWING AWARENESS REGARDING SUSTAINABILITY AND RISING ENVIRONMENTAL CONCERN

6.3.3 REGULATORY SUPPORT FOR RECYCLING

6.4 CHALLENGES

6.4.1 LACK OF AWARENESS REGARDING RECYCLED PACKAGING SOLUTIONS

6.4.2 HIGH INVESTMENTS IN INFRASTRUCTURE DEVELOPMENT

7 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 COATED RECYCLED BOARD (CRB)

7.3 UNCOATED RECYCLED BOARD (URB)

8 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 LAMINATED

8.3 NON-LAMINATED

9 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY WEIGHT

9.1 OVERVIEW

9.2 300-600 GSM

9.3 601-800 GSM

9.4 801-1200 GSM

9.5 ABOVE 12,00 GSM

10 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BOXES

10.3 POP DISPLAYS

10.4 TRAYS

10.5 LAYER PADS

10.6 EDGE PROTECTORS

10.7 OTHERS

11 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY END-USE

11.1 OVERVIEW

11.2 HEALTHCARE AND PHARMACEUTICALS

11.3 COSMETICS AND PERSONAL CARE

11.4 ELECTRICAL AND ELECTRONICS

11.5 BUILDING AND CONSTRUCTION

11.6 INDUSTRIAL PACKAGING

11.7 TOBACCO PACKAGING

11.8 OTHERS

12 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY COUNTRY

12.1 EUROPE AND U.S.

12.2 EUROPE

12.2.1 GERMANY

12.2.2 ITALY

12.2.3 U.K.

12.2.4 FRANCE

12.2.5 POLAND

12.2.6 RUSSIA

12.2.7 SPAIN

12.2.8 TURKEY

12.2.9 NETHERLANDS

12.2.10 BELGIUM

12.2.11 SWEDEN

12.2.12 FINLAND

12.2.13 SWITZERLAND

12.2.14 DENMARK

12.2.15 NORWAY

12.2.16 REST OF EUROPE

12.3 U.S.

13 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

13.2 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 SMURFIT KAPPA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 RENO DE MEDICI S.P.A.

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENTS

15.3 DS SMITH

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 VPK GROUP

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENTS

15.5 SCHUMACHER PACKAGING

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ADVANCED PACKAGING LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 CARTIERA CAMA

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 CARTIERA FORNACI SPA.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CARTIERA MARCHIGIANA

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 CARTIERA SAN MARTINO S.P.A.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 GUANGZHOU BMPAPER

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 KAPAG KARTON + PAPIER AG

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 KARTONFABRIK PORSTENDORF

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 KOEHLER PAPER

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 LIEPA GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 MAGNIA GROUP

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 MERCKENS JOSEFSTAL

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 PREMIER PAPER GROUP

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 PRESTON BOARD & PACKAGING LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 SEVEROČESKÁ PAPÍRNA, SRO

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 SOLIDUS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 REGULATIONS ACROSS EUROPE AND U.S.

TABLE 2 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 3 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 4 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 5 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 6 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 7 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 8 EUROPE AND U.S. FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 9 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, BY REGION, 2022-2031 (KILO TONS)

TABLE 11 EUROPE RECYCLED SOLID BOARD MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 12 EUROPE RECYCLED SOLID BOARD MARKET, BY COUNTRY, 2022-2031 (KILO TONS)

TABLE 13 EUROPE RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 14 EUROPE RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 15 EUROPE RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 16 EUROPE RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 17 EUROPE RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 18 EUROPE RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 19 EUROPE FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 20 GERMANY RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 21 GERMANY RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 22 GERMANY RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 23 GERMANY RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 24 GERMANY RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 25 GERMANY RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 26 GERMANY FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 27 ITALY RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 28 ITALY RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 29 ITALY RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 30 ITALY RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 31 ITALY RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 32 ITALY RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 33 ITALY FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 34 U.K. RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 35 U.K. RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 36 U.K. RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 37 U.K. RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 38 U.K. RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 39 U.K. RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 40 U.K. FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 41 FRANCE RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 42 FRANCE RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 43 FRANCE RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 44 FRANCE RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 45 FRANCE RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 46 FRANCE RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 47 FRANCE FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 48 POLAND RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 POLAND RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 50 POLAND RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 51 POLAND RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 52 POLAND RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 53 POLAND RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 54 POLAND FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 55 RUSSIA RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 RUSSIA RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 57 RUSSIA RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 58 RUSSIA RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 59 RUSSIA RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 60 RUSSIA RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 61 RUSSIA FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 62 SPAIN RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 63 SPAIN RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 64 SPAIN RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 65 SPAIN RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 66 SPAIN RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 67 SPAIN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 68 SPAIN FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 69 TURKEY RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 TURKEY RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 71 TURKEY RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 72 TURKEY RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 73 TURKEY RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 74 TURKEY RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 75 TURKEY FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 76 NETHERLANDS RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 77 NETHERLANDS RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 78 NETHERLANDS RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 79 NETHERLANDS RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 80 NETHERLANDS RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 81 NETHERLANDS RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 82 NETHERLANDS FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 83 BELGIUM RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 84 BELGIUM RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 85 BELGIUM RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 86 BELGIUM RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 87 BELGIUM RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 88 BELGIUM RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 89 BELGIUM FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 90 SWEDEN RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 91 SWEDEN RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 92 SWEDEN RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 93 SWEDEN RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 94 SWEDEN RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 95 SWEDEN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 96 SWEDEN FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 97 FINLAND RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 FINLAND RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 99 FINLAND RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 100 FINLAND RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 101 FINLAND RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 102 FINLAND RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 103 FINLAND FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 104 SWITZERLAND RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 105 SWITZERLAND RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 106 SWITZERLAND RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 107 SWITZERLAND RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 108 SWITZERLAND RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 109 SWITZERLAND RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 110 SWITZERLAND FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 111 DENMARK RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 DENMARK RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 113 DENMARK RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 114 DENMARK RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 115 DENMARK RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 116 DENMARK RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 117 DENMARK FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 118 NORWAY RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 119 NORWAY RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 120 NORWAY RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 121 NORWAY RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 122 NORWAY RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 123 NORWAY RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 124 NORWAY FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 125 REST OF EUROPE RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 126 REST OF EUROPE RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 127 U.S. RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 128 U.S. RECYCLED SOLID BOARD MARKET, BY PRODUCT TYPE, 2022-2031 (KILO TONS)

TABLE 129 U.S. RECYCLED SOLID BOARD MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 130 U.S. RECYCLED SOLID BOARD MARKET, BY WEIGHT, 2022-2031 (USD THOUSAND)

TABLE 131 U.S. RECYCLED SOLID BOARD MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 132 U.S. RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 133 U.S. FOOD AND BEVERAGES IN RECYCLED SOLID BOARD MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

图片列表

FIGURE 1 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET

FIGURE 2 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: DROC ANALYSIS

FIGURE 4 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: SEGMENTATION

FIGURE 12 RISING DEMAND FROM VARIOUS END-USE INDUSTRIES IS EXPECTED TO DRIVE THE EUROPE AND U.S. RECYCLED SOLID BOARD MARKET IN THE FORECAST PERIOD

FIGURE 13 COATED RECYCLED BOARD (CRB) IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE AND U.S. RECYCLED SOLID BOARD MARKET IN 2024 AND 2031

FIGURE 14 PESTEL ANALYSIS

FIGURE 15 PORTER’S FIVE FORCES

FIGURE 16 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET, 2022-2031, AVERAGE SELLING PRICE (USD/TON)

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 PRODUCTION CONSUMPTION ANALYSIS: EUROPE RECYCLED SOLID BOARD MARKET

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MARKET

FIGURE 21 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: BY PRODUCT TYPE, 2023

FIGURE 22 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: BY CATEGORY, 2023

FIGURE 23 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: BY WEIGHT, 2023

FIGURE 24 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: BY APPLICATION, 2023

FIGURE 25 EUROPE AND U.S. RECYCLED SOLID BOARD MARKET: BY END-USE, 2023

FIGURE 26 EUROPE RECYCLED SOLID BOARD MARKET: SNAPSHOT (2023)

FIGURE 27 EUROPE RECYCLED SOLID BOARD MARKET: COMPANY SHARE 2023 (%)

FIGURE 28 U.S. RECYCLED SOLID BOARD MARKET: COMPANY SHARE 2023 (%)

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.