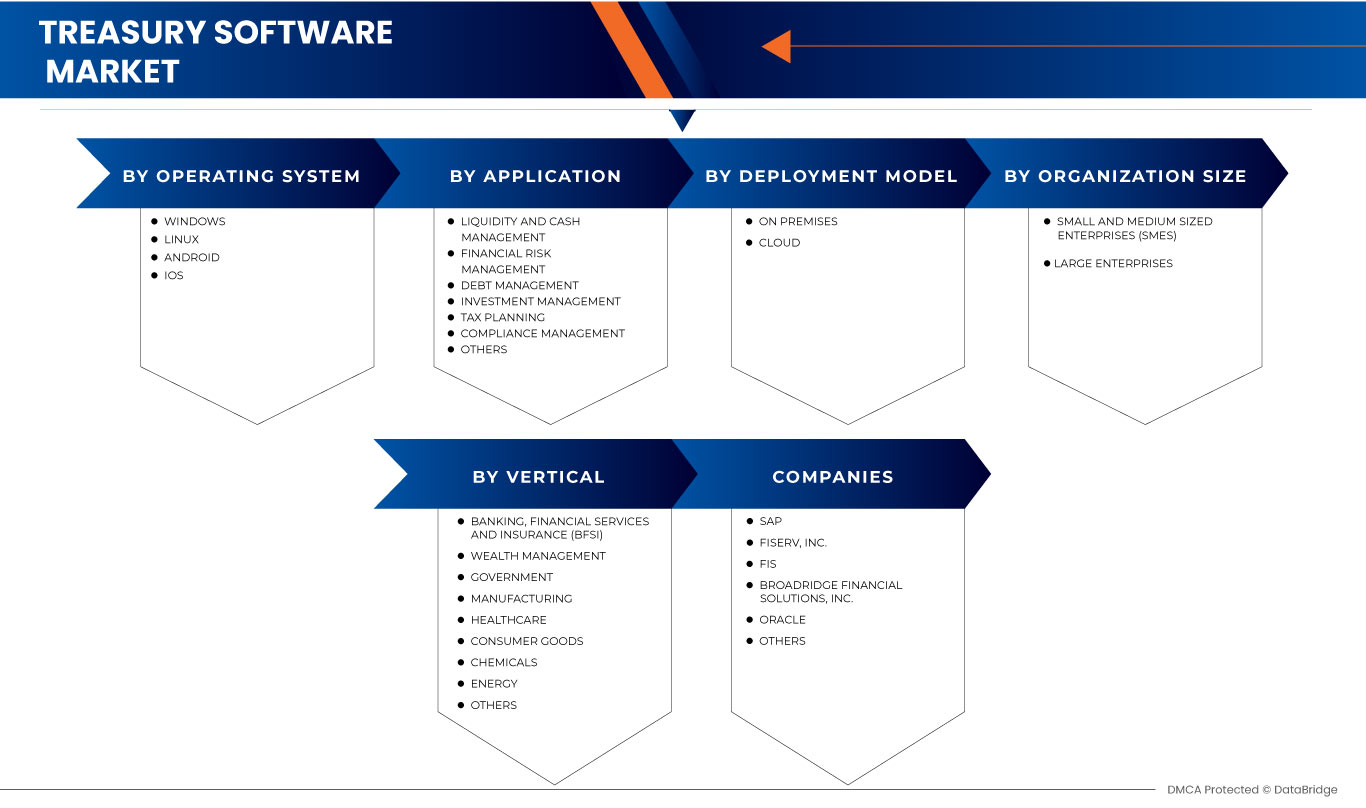

Asia-Pacific Treasury Software Market, By Operating System (Windows, Linux, IOS, Android, MAC), Application (Liquidity And Cash Management, Investment Management, Debt Management, Financial Risk Management, Compliance Management, Tax Planning, Others), Deployment Mode (On Premise, Cloud), Organization Size (Large Enterprises And Small And Medium Sized Enterprises), Vertical (Banking, Financial Services And Insurance, Government, Manufacturing, Healthcare, Consumer Goods, Chemicals, Energy, and Others) - Industry Trends and Forecast to 2030.

Asia-Pacific Treasury Software Market Analysis and Size

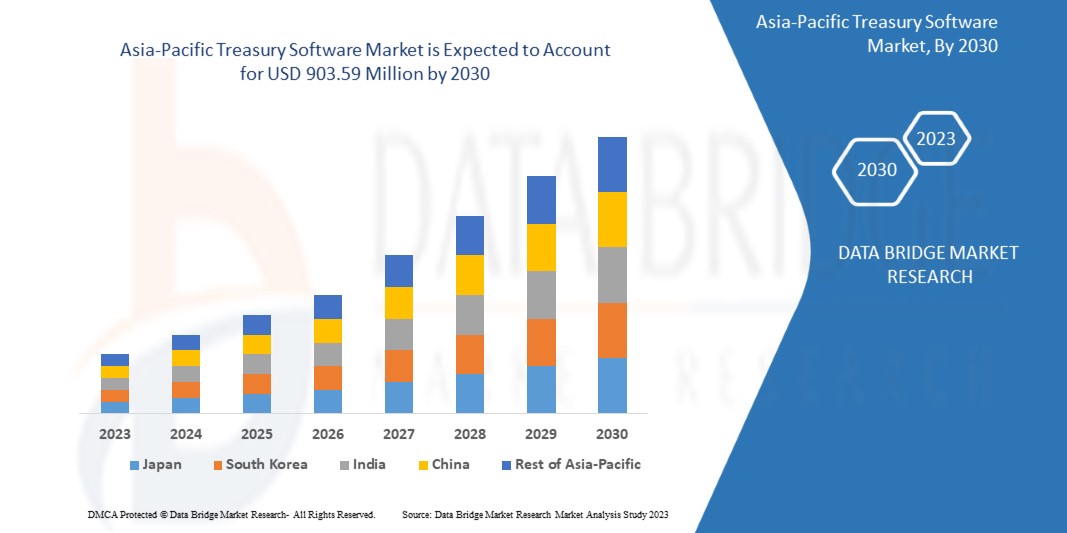

Asia-Pacific treasury software market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with the CAGR of 3.6% in the forecast period of 2023 to 2030 and expected to reach USD 903.59 million by 2030. Increase in the requirement of quick-decision making process in biotechnology is e expected to drive the growth of the market significantly.

Asia-Pacific treasury software market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact Data Bridge Market Research for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020-2016) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

Operating System (Windows, Linux, IOS, Android, MAC), Application (Liquidity And Cash Management, Investment Management, Debt Management, Financial Risk Management, Compliance Management, Tax Planning, Others), Deployment Mode (On Premise, Cloud), Organization Size (Large Enterprises And Small And Medium Sized Enterprises), Vertical (Banking, Financial Services And Insurance, Government, Manufacturing, Healthcare, Consumer Goods, Chemicals, Energy, and Others) |

|

Countries Covered |

China, India, Japan, South Korea, Australia, Indonesia, Malaysia, Thailand, Singapore, Philippines, and the rest of Asia-Pacific |

|

Market Players Covered |

Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX S.A.S, EdgeVerve Systems Limited (A wholly owned subsidiary of Infosys), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD and among others |

Market Definition

Treasury software is an application that automates a company's financial activities like cash flow, assets, and investments. It provides a treasury management system that tracks the ability of a business to convert assets into cash to meet a financial obligation. Financial managers and accounts use Treasury management software to monitor liquidity and the ability to convert assets into cash to meet financial obligations. The software automates and streamlines treasury management functions, reducing financial and reputational risks, saving costs, and improving operational efficiency and effectiveness. The greater visibility, analytics, and forecasting that the treasury management system provides improves decision-making and helps to create organizational financial strategies.

Asia-Pacific Treasury Software Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Growing demand for advanced treasury management systems for enhancing customer experience

Treasury management systems (TMS) are software that helps to automate manual treasury processes. Offering greater visibility into cash and liquidity while gaining control over bank accounts, maintaining compliance, and managing financial transactions has enhanced customer satisfaction. The treasury management system basically offers seven core benefits in the organization that can enhance the capabilities, including,

- Boost productivity

- Real-time and precise data availability

- Reduction in manual entry and calculation errors

- Limit redundant banking and FX costs

- Detailed activity monitoring

- Bank and connectivity flexibility

- Regulatory compliance and risk mitigation

According to Coupa Software Inc., adopting TMS solutions can get affected by various factors such as FX volatility by 52%, cash flow & financial risk exposure by 43%, cash repatriation by 40%, inadequate treasury infrastructure by 30%, Asia-Pacific tax reform impacts by 24%, operational and fraud risk due to traditional methods by 20%, treasury operational cost 12% and other factors 12%.

- Heaving adoption of artificial intelligence in treasury management

Artificial intelligence in recent times has played a vital role in strengthening and transforming industries around the globe. From governmental bodies, and large organizations to small online businesses, artificial intelligence (AI) is being used by multiple entities over multiple platforms across the globe.

In 2020, according to the survey conducted by NewVantage, 91.5% of top businesses were investing heavily in AI. Although companies with investments in AI are using AI technologies at a modest rate, just 14.6 % of them use AI technology extensively within their organization. Out of which, more than half of that, which is 51.2%, have AI deployed to limited production, and 26.8 % is piloting it. This signifies the growing cardinal of AI technologies and surges amongst businesses for adopting them.

Artificial intelligence (AI) has already shown its incredible potential for cash management and forecasting in treasury management. AI attempts to solve problems that were previously believed to be only solved by human intervention.

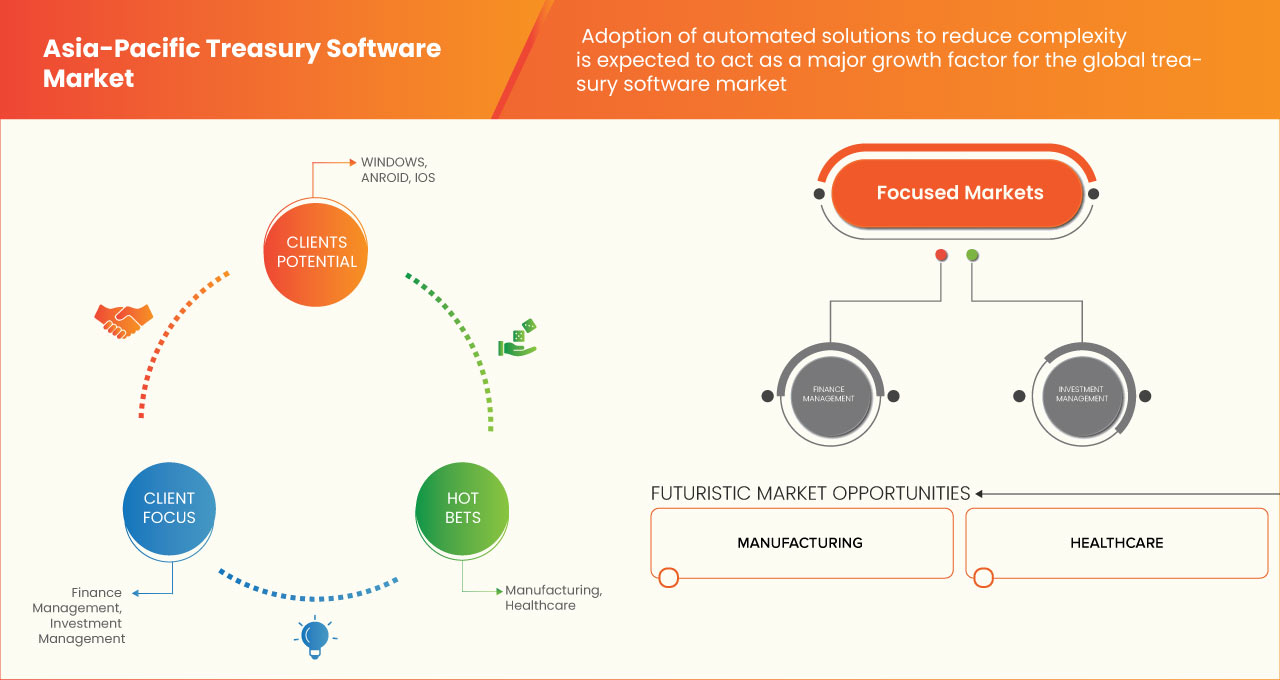

Opportunities

- Penetration of advanced analytics solutions in the banking sector

Nowadays, banks are increasingly using analytics to gain a competitive advantage and to form conclusions and insights based on the information and data collection. Advanced analytics can be used to predict customer behavior and preferences and to improve risk assessment. Sometimes data generated by banking and finance industries are of large scale, and these are not possible for the bank to handle with their traditional database. Therefore, analytics have paved a path for financial industries to handle a large amount of data at a time.

Furthermore, the digital world has made a revolution in the banking industry. Most of the advanced analytics solutions for banking are comprised of four different components: reporting, descriptive analytics, predictive analytics, and prescriptive analytics. Financial institutions can now target and engage customers on a continuous basis, and not just when they go into a branch. Their reach now includes customers who use mobile apps, ATMs, and online banking apps. Banks also can use analytics to offer customized products, services, and deals to customers based on their profiles and histories. Moreover, analytics in the banking world also helps to identify and prevent fraud. Banks use advanced analytics to compare customer usage patterns against their own fraud indicators and can immediately take action when potentially fraudulent activity is detected. The overall penetration of analytics in banking is still relatively low compared to its usage in other industries. However, the penetration of analytics in the banking sector is creating a lot of opportunities for the treasury software market to grow.

Restraints/Challenges

- Increasing cyber threats and data breaches

Due to the COVID-19, cybercrime and cybersecurity issues increased by 600% in 2020. Flaws in network security are exploited by hackers to perform unauthorized actions within a system.

According to Purple Sec LLC, in 2018, mobile malware variants for mobile increased by 54%, out of which 98% of mobile malware target various smart android devices. 25% of businesses are estimated to have been victims of crypto-jacking. The businesses include banking, financial management team of various businesses/industries.

In recent times businesses/industries are adopting digitization heavily. Banking, shopping, travel, and others, are moving towards digital models to enhance consumer experiences. Digitization generates a huge amount of customer data and information. This raises security concerns, and this data has always been at a higher risk of cyber-attacks and data breaches. Through this information and data, it becomes easy for fraudsters and cyber attackers to mimic or steal the identity of an individual, which can be used for various crimes.

According to an S&P Asia-Pacific study on the share of Asia-Pacific cyber-attacks incidents across the industries in the past five years from 2016 to 2021, financial institutions have topped the list with 26% cybersecurity incidents followed by healthcare 11%, software and technology services at 7% and retail at 6%.

Post-COVID-19 Impact on Asia-Pacific Treasury Software Market

The COVID-19 pandemic has had a significant impact on the Asia-Pacific Treasury Software market. The pandemic has caused major disruptions to Asia-Pacific supply chains, financial markets, and economic activities, leading to a shift in the priorities and strategies of treasury departments worldwide.

One of the most significant impacts of the pandemic on the treasury software market has been the increased demand for cloud-based solutions. The pandemic forced many organizations to quickly transition to remote work, which highlighted the importance of having secure, accessible, and scalable cloud-based treasury solutions. As a result, there has been a significant increase in demand for cloud-based treasury software solutions.

Another impact of the pandemic on the treasury software market is the increased focus on cash forecasting and liquidity management. The pandemic has created significant uncertainties and risks for businesses, making accurate cash forecasting and liquidity management critical for survival. Treasury software solutions that can provide accurate and real-time cash forecasting, liquidity management, and risk assessment have become increasingly essential.

Overall, the COVID-19 pandemic has accelerated the adoption of digital treasury solutions, leading to significant growth in the Asia-Pacific treasury software market. The demand for cloud-based solutions, cash forecasting and liquidity management, and advanced automation and integration capabilities is expected to continue in the post-pandemic world as organizations seek to improve their agility, resilience, and efficiency.

Recent Developments

- In March 2022, Lease Accounting Software for IFRS-16 was provided to Redington Gulf by ZenTreasury and their local partner MCA. Now Customers are not required to import data from many sources and store it on various platforms. Everything is completed with one software

- In September 2022, TIS and Delega collaborated to provide customers with next-generation automated multi-bank signatory rights management. Customers of TIS and Delega can take advantage of NextGen electronic bank account management thanks to the agreement (eBAM)

Asia-Pacific Treasury Software Market Scope

The Asia-Pacific treasury software market is segmented on the basis of operating system, application, deployment model, organization size, and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM

- MAC

- WINDOWS

- IOS

- ANDROID

- LINUX

On the basis of operating system, the Asia-Pacific treasury software market is segmented into windows, linux, MAC, android, and iOS.

ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY APPLICATION

- LIQUIDITY AND CASH MANAGEMENT

- FINANCIAL RISK MANAGEMENT

- DEBT MANAGEMENT

- INVESTMENT MANAGEMENT

- TAX PLANNING

- COMPLIANCE MANAGEMENT

- OTHERS

On the basis of application, the Asia-Pacific treasury software market is segmented into liquidity and cash management, investment management, debt management, financial risk management, compliance management, tax planning, and others

ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL

- ON PREMISES

- CLOUD

On the basis of deployment mode, the Asia-Pacific treasury software market is segmented into cloud and on premises.

ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE

- SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- LARGE ENTERPRISES

On the basis of organization size, the Asia-Pacific treasury software market is segmented into large enterprises and small and medium enterprises.

ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY VERTICAL

- BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

- WEALTH MANAGEMENT

- GOVERNMENT

- MANUFACTURING

- HEALTHCARE

- CONSUMER GOODS

- CHEMICALS

- ENERGY

- OTHERS

On the basis of vertical, the Asia-Pacific treasury software market is segmented into banking, financial services and insurance (BFSI), government, manufacturing, healthcare, consumer goods, chemicals, energy, and others.

Asia-Pacific Treasury Software Market Regional Analysis/Insights

The Asia-Pacific treasury software market is analysed and market size insights and trends are provided by country, operating system, application, deployment model, organization size, and vertical as referenced above.

The countries covered in the Asia-Pacific treasury software market report are China, India, Australia, Japan, South Korea, Malaysia, Thailand, Singapore, Indonesia, Philippines, and the Rest of Asia-Pacific.

China is expected to dominate the Asia-Pacific treasury software market due to the high number of software developers and the latest technology to develop the software.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Treasury Software Market Share Analysis

Asia-Pacific treasury software market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Asia-Pacific treasury software market.

Some of the major players operating in the Asia-Pacific treasury software market are Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX S.A.S, EdgeVerve Systems Limited (A wholly owned subsidiary of Infosys), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD and among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC TREASURY SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OPERATING SYSTEM TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 KEY PRIMARY INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF SMART ELECTRONIC PAYMENT MANAGEMENT TOOLS

5.1.2 GROWING DEMAND FOR ADVANCED TREASURY MANAGEMENT SYSTEM FOR ENHANCING CUSTOMER EXPERIENCE

5.1.3 HEAVING ADOPTION OF ARTIFICIAL INTELLIGENCE IN TREASURY MANAGEMENT

5.1.4 ADOPTION OF CLOUD BASED SOLUTION IN TREASURY MANAGEMENT

5.2 RESTRAINTS

5.2.1 INCREASING CYBER THREATS AND DATA BREACHES

5.2.2 HIGH COST ASSOCIATED WITH TREASURY MANAGEMENT SYSTEMS

5.2.3 CONTINUOUS CHANGES IN REGULATORY FRAMEWORK IN TREASURER MANAGEMENT

5.3 OPPORTUNITIES

5.3.1 PENETRATION OF ADVANCED ANALYTICS SOLUTIONS IN THE BANKING SECTOR

5.3.2 ADOPTION OF AUTOMATED SOLUTIONS TO REDUCE COMPLEXITY

5.3.3 RISE IN STRATEGIC PARTNERSHIP & COLLABORATION AMONG THE ORGANIZATION

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS REGARDING THE BENEFITS OF TREASURY SOFTWARE

5.4.2 FACTORS LIKE COMPLEXITIES, INADEQUATE INFRASTRUCTURE, AND FX VOLATILITY HAMPERS TMS EFFICIENCY

6 IMPACT OF COVID-19 ON THE ASIA PACIFIC TREASURY SOFTWARE MARKET

7 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM

7.1 OVERVIEW

7.2 WINDOWS

7.3 LINUX

7.4 MAC

7.5 ANDROID

7.6 IOS

8 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 LIQUIDITY AND CASH MANAGEMENT

8.3 INVESTMENT MANAGEMENT

8.4 DEBT MANAGEMENT

8.5 FINANCIAL RISK MANAGEMENT

8.6 COMPLIANCE MANAGEMENT

8.7 TAX PLANNING MANAGEMENT

8.8 OTHERS

9 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

10 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL

10.1 OVERVIEW

10.2 CLOUD

10.2.1 PUBLIC

10.2.2 HYBRID

10.2.3 PRIVATE

10.3 ON-PREMISES

11 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

11.2.1 WEALTH MANAGEMENT

11.2.2 BANKING

11.2.3 CAPITAL MARKET

11.2.4 OTHERS

11.3 GOVERNMENT

11.4 MANUFACTURING

11.5 HEALTHCARE

11.6 CONSUMER GOODS

11.7 CHEMICALS

11.8 ENERGY

11.9 OTHERS

12 ASIA PACIFIC TREASURY SOFTWARE MARKET , BY REGION

12.1 ASIA PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 INDIA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 INDONESIA

12.1.9 MALAYSIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC TREASURY SOFTWARE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILING

15.1 SAP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 APPLICATION PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 FISERV, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 FIS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SOLUTION PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BROADRIDGE FINANCIAL SOLUTIONS, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SOLUTION PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ORACLE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ABM CLOUD

15.6.1 COMPANY SNAPSHOT

15.6.2 SERVICE PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ACCESS SYSTEMS (UK) LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTION PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ADENZA

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CAPIX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 CASHANALYTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 COUPA SOFTWARE INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 DATALOG FINANCE

15.12.1 COMPANY SNAPSHOT

15.12.2 SOLUTION PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 EDGEVERVE SYSTEMS LIMITED (A WHOLLY OWNED SUBSIDIARY OF INFOSYS)

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 EMPHASYS SOFTWARE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 ERNST & YOUNG

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 FINASTRA

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 FINANCIAL SCIENCES CORP.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 ION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 MUREX S.A.S

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 NOMENTIA

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 SOLOMON SOFTWARE

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SS&C TECHNOLOGIES, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 TREASURY INTELLIGENCE SOLUTIONS

15.23.1 COMPANY SNAPSHOT

15.23.2 SERVICE PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 TREASURY SOFTWARE CORP

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 ZENTREASURY LTD

15.25.1 COMPANY SNAPSHOT

15.25.2 SOLUTION PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 2 ASIA PACIFIC WINDOWS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 ASIA PACIFIC LINUX IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 ASIA PACIFIC MAC IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 ASIA PACIFIC ANDROID IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 ASIA PACIFIC IOS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 ASIA PACIFIC TREASURY SOFTWARE MARKET, APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 ASIA PACIFIC LIQUIDITY AND CASH MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 ASIA PACIFIC INVESTMENT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 ASIA PACIFIC DEBT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 ASIA PACIFIC FINANCIAL RISK MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 ASIA PACIFIC COMPLIANCE MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 ASIA PACIFIC TAX PLANNING MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 ASIA PACIFIC OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 16 ASIA PACIFIC LARGE ENTERPRISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 ASIA PACIFIC SMALL AND MEDIUM SIZED ENTERPRISES (SMES) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 19 ASIA PACIFIC CLOUD IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 ASIA PACIFIC CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 ASIA PACIFIC ON-PREMISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 23 ASIA PACIFIC BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 ASIA PACIFIC BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 ASIA PACIFIC GOVERNMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 ASIA PACIFIC MANUFACTURING IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 ASIA PACIFIC HEALTHCARE IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 ASIA PACIFIC CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 ASIA PACIFIC CHEMICALS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 ASIA PACIFIC ENERGY IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 ASIA PACIFIC OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 34 ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 36 ASIA-PACIFIC CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 38 ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 39 ASIA-PACIFIC BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 CHINA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 41 CHINA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 CHINA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 43 CHINA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 CHINA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 45 CHINA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 46 CHINA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 JAPAN TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 48 JAPAN TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 JAPAN TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 50 JAPAN CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 JAPAN TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 52 JAPAN TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 53 JAPAN BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 SOUTH KOREA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 55 SOUTH KOREA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 SOUTH KOREA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 57 SOUTH KOREA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 SOUTH KOREA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 59 SOUTH KOREA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 60 SOUTH KOREA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 INDIA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 62 INDIA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 INDIA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 64 INDIA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 INDIA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 66 INDIA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 67 INDIA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 AUSTRALIA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 69 AUSTRALIA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 AUSTRALIA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 71 AUSTRALIA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 AUSTRALIA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 73 AUSTRALIA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 74 AUSTRALIA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 SINGAPORE TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 76 SINGAPORE TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 77 SINGAPORE TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 78 SINGAPORE CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 SINGAPORE TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 80 SINGAPORE TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 81 SINGAPORE BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 THAILAND TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 83 THAILAND TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 84 THAILAND TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 85 THAILAND CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 THAILAND TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 87 THAILAND TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 88 THAILAND BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 INDONESIA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 90 INDONESIA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 91 INDONESIA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 92 INDONESIA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 INDONESIA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 94 INDONESIA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 95 INDONESIA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 MALAYSIA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 97 MALAYSIA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 MALAYSIA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 99 MALAYSIA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 MALAYSIA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 101 MALAYSIA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 102 MALAYSIA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 PHILIPPINES TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 104 PHILIPPINES TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 105 PHILIPPINES TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 106 PHILIPPINES CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 PHILIPPINES TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 108 PHILIPPINES TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 109 PHILIPPINES BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 REST OF ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 ASIA PACIFIC TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TREASURY SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TREASURY SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TREASURY SOFTWARE MARKET: ASIA PACIFIC VS REGIONAL ANALYSIS

FIGURE 5 ASIA PACIFIC TREASURY SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TREASURY SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC TREASURY SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC TREASURY SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC TREASURY SOFTWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 11 SURGING UTILITY IN THE MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE ASIA PACIFIC TREASURY SOFTWARE MARKET IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC TREASURY SOFTWARE MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC TREASURY SOFTWARE MARKET

FIGURE 14 MOBILE PAYMENTS SHARE (%) BY COUNTRY

FIGURE 15 FACTORS AFFECTING THE TMS AND CUSTOMER EXPERIENCE

FIGURE 16 THREE WAYS ARTIFICIAL INTELLIGENCE IS TRANSFORMING TREASURY

FIGURE 17 CYBER-ATTACKS INCIDENTS ACROSS INDUSTRIES FROM 2016 TO 2021

FIGURE 18 CYBER-ATTACKS INCIDENTS BY COUNTRY AND REGION IN 2020

FIGURE 19 TREASURY DEPARTMENT CURRENTLY USING

FIGURE 20 ANALYTICS ADOPTION BY SECTOR, FROM THE YEAR 2019 TO 2021 AT INDIAN FIRMS

FIGURE 21 ASIA PACIFIC TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM, 2022

FIGURE 22 ASIA PACIFIC TREASURY SOFTWARE MARKET: BY APPLICATION, 2022

FIGURE 23 ASIA PACIFIC TREASURY SOFTWARE MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 24 ASIA PACIFIC TREASURY SOFTWARE MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 25 ASIA PACIFIC TREASURY SOFTWARE MARKET: BY VERTICAL, 2022

FIGURE 26 ASIA-PACIFIC TREASURY SOFTWARE MARKET: SNAPSHOT (2022)

FIGURE 27 ASIA-PACIFIC TREASURY SOFTWARE MARKET: BY COUNTRY (2022)

FIGURE 28 ASIA-PACIFIC TREASURY SOFTWARE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 ASIA-PACIFIC TREASURY SOFTWARE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 ASIA-PACIFIC TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM (2023 & 2030)

FIGURE 31 ASIA PACIFIC TREASURY SOFTWARE MARKET: COMPANY SHARE 2022(%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。