亚太针刺活检市场,按针类型(环钻活检针、Klima 胸骨针、Salah 针抽吸针、Jamshidi 针及其他针)、人体工程学(锐针、钝针、Quincke 针、Chiba 针、Franseen 针及其他针)、程序(细针抽吸活检、芯针活检、真空辅助活检、图像引导活检)、采样部位(肌肉、骨骼及其他器官)、效用(一次性和可重复使用)、应用(肿瘤、感染、炎症及其他)划分 - 行业趋势和预测至 2029 年。

亚太针吸活检市场分析及规模

预计针吸活检市场将在预测期内出现显著增长。针吸活检市场的扩张与全球癌症病例的发病率成正比。这将提高针吸活检的接受度,从而推动市场发展。快速的创新和技术进步影响着针吸活检市场,产品开发不断进行,以提高手术期间和手术后的患者的舒适度并减少创伤。这个市场需求极大,预计在预测期内将出现巨大增长。

Data Bridge Market Research 分析了 2022-2029 年预测期内针刺活检市场的增长率。2021 年市场价值为 1.8 亿美元。除了市场价值、增长率、细分市场、地理覆盖范围、市场参与者和市场情景等市场洞察外,Data Bridge Market Research 团队策划的市场报告还包括深入的专家分析、患者流行病学、管道分析、定价分析和监管框架。

亚太针吸活检市场范围和细分

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制为 2014 - 2019) |

|

定量单位 |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

针类型(环钻活检针、Klima 胸骨针、Salah 针抽吸针、Jamshidi 针及其他针)、人体工程学(尖针、钝针、Quincke 针、Chiba 针、Franseen 针及其他针)、操作(细针抽吸活检、芯针活检、真空辅助活检、图像引导活检)、取样部位(肌肉、骨骼及其他器官)、效用(一次性和可重复使用)、应用(肿瘤、感染、炎症及其他) |

|

覆盖国家 |

日本、中国、韩国、印度、澳大利亚、新加坡、泰国、马来西亚、印度尼西亚、菲律宾、亚太地区其他地区 |

|

涵盖的市场参与者 |

波士顿科学公司(美国)、Hologic 公司(美国)、ST. STONE MEDICAL DEVICES PVT. LTD(印度)、AprioMed AB(瑞典)、Amecath(埃及)、Cardinal Health(美国)、BD(美国)、Merit Medical Systems(美国)、Swastik Enterprise(印度)、B. Braun SE(德国) |

|

市场机会 |

|

市场定义

A needle biopsy is an image-guided or ultrasound procedure that is used to obtain a sample of cells from the human body for laboratory or diagnostic testing, particularly of the tumour. The common needle biopsy procedures include fine-needle aspiration biopsy and Core Needle Biopsy. A needle biopsy comes in place whenever there is an abnormal lump or when the imaging scans show abnormalities in the body. It is gaining enormous importance to physicians and doctors and is expected to have a huge growth in the forecast period.

Needle Biopsy Market Dynamics

Drivers

- Increasing Cancer Cases

Incidence of cancer cases is directly helping expand the needle biopsy market globally. According to the WHO, in 2030, deaths caused because of cancer are expected to reach 13 billion worldwide. A rapid growth in the incidence of cancer across the globe is expected to increase the number of patients undergoing biopsies. This will consequently increase the adoption of needle-based biopsy guns, driving market growth.

- Increased Elderly Population

Cancer is thought to be an age-related disease, as per the researchers. According to several studies, people over the age of 50 are more prone to cervical, breast, and prostate cancer. During the projected period, this is expected to boost the market.

Opportunities

- Clinical Research and Reimbursement

The several advanced innovations of needle biopsy, promising clinical studies, and better reimbursement policies are expected to provide substantial growth opportunities for the needle biopsy market from 2022 to 2029.

- Advanced Technologies

Adopting technologies such as using artificial intelligence in the needle biopsy market is creating an opportunity for the growth of the same. For instance, Freenome, an AI genomics business based in the United States, announced in October 2018 that it is working on developing blood tests that utilize AI to detect the body's early-warning indications of cancer. The company released preliminary evidence in R&D in October 2018 for applying machine learning to detect colorectal cancer in its early stages.

Restraints/Challenges

- Lack of skilled professionals

The lack of qualified personnel who cannot use these systems could curb the growth of the Asia-Pacific needle biopsy market over a forecast period.

- High Cost

The high cost of these treatment processes can impede the growth of the needle biopsy market even though the disease incidence is high.

这份亚太针吸活检市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入领域的机会、市场法规的变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新。如需了解有关亚太针吸活检市场的更多信息,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您做出明智的市场决策,实现市场增长。

COVID-19 对亚太针刺活检市场的影响

COVID-19 造成了一场重大的公共卫生危机,几乎影响了所有行业,其长期后果预计将在预测期内影响行业增长。

在后疫情时代,由于癌症的流行与当前情况无关,因此针刺活检市场有望大幅增长。此外,由于医院和研究机构的新冠肺炎感染病例较少,因此人们将再次关注癌症病例。

最新动态

- 2021 年 1 月,Hologic, Inc 以 6400 万美元收购了 SOMATEX Medical Technologies GmbH。此举旨在提供一系列用于乳腺癌治疗的新型解决方案。Hologic, Inc 将能够扩大乳腺癌标志物组合。

亚太针吸活检市场范围

亚太地区针刺活检市场根据针类型、程序、取样部位和应用进行细分。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

针型

- 环钻活检针

- 气候胸骨针

- 萨拉赫针 抽吸针

- 贾姆希迪针

- 其他的

程序

- 细针穿刺活检

- 芯针活检

- 真空辅助活检

- 图像引导活检

示例站点

- 肌肉

- 骨骼

- 其他器官

应用

- 瘤

- 感染

- 炎

- 其他的

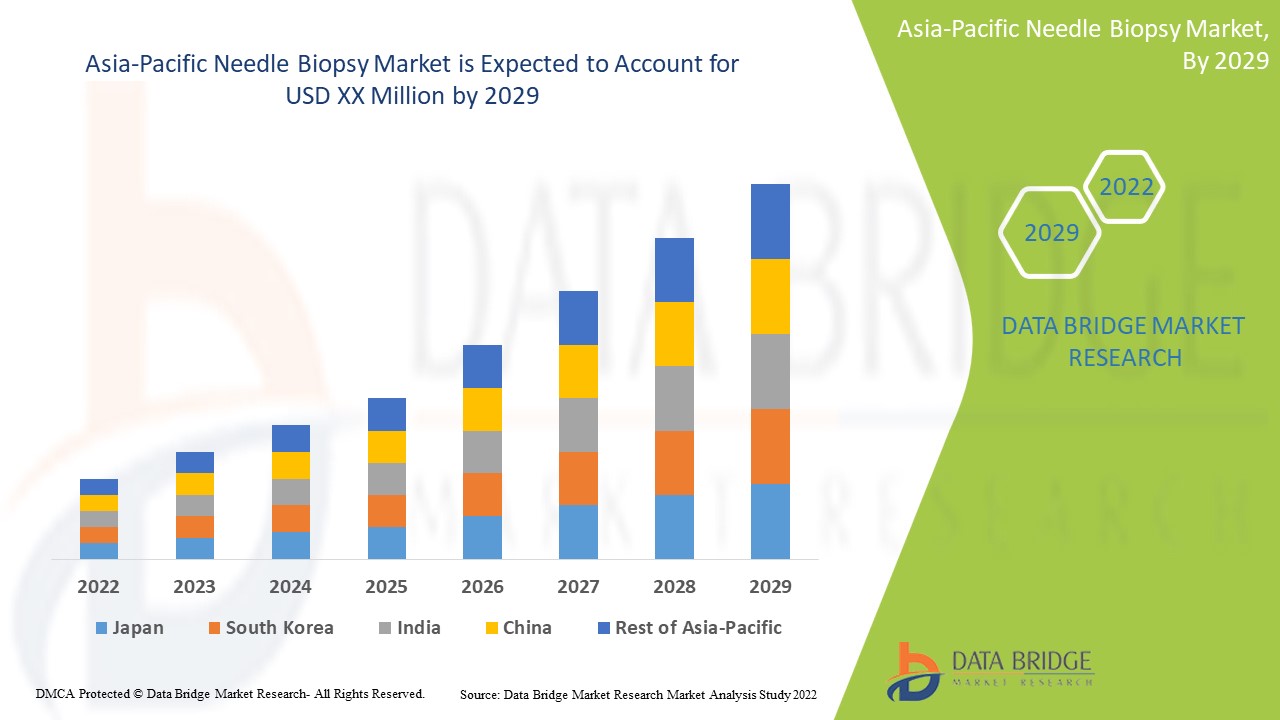

亚太地区针刺活检市场区域分析/见解

对亚太针刺活检市场进行了分析,并根据上述针头类型、程序、采样部位和应用提供了市场规模洞察和趋势。

亚太针刺活检市场的主要国家包括日本、中国、韩国、印度、澳大利亚、新加坡、泰国、马来西亚、印度尼西亚、菲律宾和亚太其他地区。

由于中国人们对癌症治疗的认识度较高且针刺活检的报销情况良好,预计中国将主导亚太针刺活检市场。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和国内市场监管变化。此外,在提供国家数据预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的激烈竞争或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

竞争格局和亚太针刺活检市场份额分析

亚太针吸活检市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对亚太针吸活检市场的关注有关。

亚太地区针刺活检市场的主要参与者包括:

- 波士顿科学公司 (美国)

- Hologic, Inc.(美国)

- ST. STONE MEDICAL DEVICES PVT. LTD.(印度)

- AprioMed AB(美国)

- Amecath(埃及)

- 康德乐 (美国)

- BD(美国)

- Merit Medical Systems(美国)

- Swastik Enterprise(印度)

- B. Braun SE(德国)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of THE Asia-Pacific needle biopsy market

- Currency and pricing

- LIMITATIONs

- MARKETS COVERED

- Asia-Pacific needle biopsy market: SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- MULTIVARIATE MODELLING

- end user LIFELINE CURVE

- DBMR MARKET POSITION GRID

- VENDOR SHARE ANALYSIS

- MARKET procedure COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- Asia-Pacific needle biopsy market: regulations

- REGULATIONS IN CHINA

- MEDICAL DEVICE INSTRUCTIONS FOR LABELLING IN CHINA:

- REGULATIONS IN JAPAN

- REGUALTION IN INDIA

- Market Overview

- drivers

- INCREASED PREVALENCE OF BREAST AND LUNG CANCER

- SURGE IN DEMAND FOR MINIMALLY INVASIVE SURGERIES

- GOVERNMENT INITIATIVES TO SPREAD AWARENESS ABOUT LUNG AND BREAST CANCER

- TECHNOLOGICAL ADVANCEMENT IN NEEDLE BIOPSY

- RESTRAINTS

- RISING COST OF THE NEEDLE BIOPSY

- RAPID DEVELOPMENT OF ULTRASENSITIVE IMAGING TECHNOLOGIES SUCH AS MAGNETIC RESONANCE IMAGING

- RISK OF INFECTION RELATED TO BIOPSY PROCEDURES

- COMPLEXITY IN NEEDLE BIOPSY

- OPPORTUNITIES

- STRATEGIC INITIATIVEs BY THE MARKET PLAYERS

- RISE IN HEALTHCARE EXPENDITURE AND DISPOSABLE INCOME

- INCREASE IN RESEARCH AND DEVELOPMENT ACTIVITIES

- HUGE MARKET POTENTIAL IN DEVELOPING COUNTRIES

- CHALLENGES

- STRINGENT RULES AND REGULATIONS

- rise in competition between market players

- limitations or complications of needle biopsy

- Impact of COVID-19 Pandemic on the Asia-Pacific needle biopsy market

- Price Impact

- Asia-pacific needle biopsy market, By needle type

- overview

- trephine biopsy needles

- reusable

- disposable

- salah needle aspiration needle

- klima sternal needle

- jamshidi needle

- others

- Asia-Pacific needle biopsy market, By ergonomics

- overview

- sharp

- blunt

- chiba

- franseen

- quincke

- others

- Asia-Pacific needle biopsy market, By PROCEDURE

- overview

- fine-needle aspiration biopsy

- core needle biopsy

- image-guided biopsy

- vacuum assisted biopsy

- Asia-Pacific needle biopsy market, By sample site

- overview

- bones

- muscles

- other organs

- BREAST

- liver

- lungs

- others

- Asia-Pacific needle biopsy market, By utility

- overview

- disposable

- reusable

- Asia-Pacific needle biopsy market, By application

- overview

- tumor

- carcinoma

- sarcoma

- blastoma

- germ cell tumor

- others

- infection

- INFLAMMATION

- others

- Asia-Pacific needle biopsy market, By end user

- overview

- hospitals

- diagnostic centers

- biopsy labs

- Ambulatory surgical centers

- Academic and research organization

- others

- Asia-Pacific needle biopsy market, By distribution channel

- overview

- direct tender

- retail sales

- ASIA-PACIFIC NEEDLE BIOPSY MARKET, BY COUNTRY

- China

- India

- Japan

- AUSTRALIA

- South Korea

- Singapore

- Malaysia

- thailand

- indonesia

- philippines

- Rest of Asia-Pacific

- company share analysis: Asia-Pacific

- boston scientific corporation

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- HOLOGIC, INC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- product portfolio

- RECENT DEVELOPMENTS

- BD

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- B. BRAUN MELSUNGEN AG

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- product Portfolio

- RECENT DEVELOPMENTs

- cook

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- amecath

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- APRIOMED, AB

- COMPANY SNAPSHOT

- product portfolio

- RECENT DEVELOPMENT

- ARGON MEDICAL

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Cardinal Health

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- HAKKO CO., LTD.

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- merit medical systems

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ST. STONE MEDICAL DEVICES PVT. LTD.

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

表格列表

TABLE 1 Asia-Pacific needle biopsy market, By needle type, 2019-2028 (USD million)

TABLE 2 ASIA-PACIFIC trephine biopsy needles in needle biopsy market, By needle type, 2019-2028 (USD million)

TABLE 3 Asia-Pacific needle biopsy market, By ergonomics, 2019-2028 (USD million)

TABLE 4 Asia-Pacific needle biopsy market, By procedure, 2019-2028 (USD million)

TABLE 5 Asia-Pacific needle biopsy market, By sample site, 2019-2028 (USD million)

TABLE 6 ASIA-PACIFIC other organs IN needle biopsy market, By sample site, 2019-2028 (USD million)

TABLE 7 Asia-Pacific needle biopsy market, By utility, 2019-2028 (USD million)

TABLE 8 Asia-Pacific needle biopsy market, By application, 2019-2028 (USD million)

TABLE 9 ASIA-PACIFIC tumor in needle biopsy market, By application, 2019-2028 (USD million)

TABLE 10 Asia-Pacific needle biopsy market, By end user, 2019-2028 (USD million)

TABLE 11 Asia-Pacific needle biopsy market, By distribution channel, 2019-2028 (USD million)

TABLE 12 Asia-Pacific needle biopsy MARKET, By COUNTRY, 2021-2028 (USD million)

TABLE 13 Asia-Pacific Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 14 Asia-Pacific trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 15 asia-Pacific Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 16 Asia-Pacific Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 17 Asia-Pacific Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 18 Asia-Pacific other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 19 Asia-Pacific Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 20 Asia-Pacific Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 21 Asia-Pacific tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 22 Asia-Pacific Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 23 Asia-Pacific Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 24 China Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 25 China trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 26 China Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 27 China Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 28 china Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 29 china other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 30 China Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 31 China Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 32 China tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 33 China Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 34 China Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 35 India Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 36 India trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 37 India Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 38 India Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 39 India Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 40 India other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 41 India Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 42 India Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 43 India tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 44 India Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 45 India Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 46 Japan Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 47 Japan trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 48 Japan Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 49 Japan Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 50 Japan Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 51 Japan other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 52 Japan Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 53 Japan Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 54 Japan tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 55 Japan Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 56 Japan Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 57 Australia Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 58 Australia trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 59 Australia Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 60 Australia Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 61 Australia Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 62 Australia other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 63 Australia Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 64 Australia Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 65 Australia tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 66 Australia Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 67 Australia Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 68 South Korea Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 69 South Korea trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 70 South Korea Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 71 South Korea Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 72 South Korea Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 73 South Korea other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 74 South Korea Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 75 South Korea Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 76 South Korea tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 77 South Korea Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 78 South Korea Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 79 Singapore Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 80 Singapore trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 81 Singapore Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 82 Singapore Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 83 Singapore Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 84 Singapore other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 85 Singapore Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 86 Singapore Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 87 Singapore tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 88 Singapore Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 89 Singapore Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 90 Malaysia Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 91 Malaysia trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 92 Malaysia Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 93 Malaysia Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 94 Malaysia Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 95 Malaysia other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 96 Malaysia Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 97 Malaysia Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 98 Malaysia tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 99 Malaysia Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 100 Malaysia Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 101 Thailand Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 102 Thailand trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 103 Thailand Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 104 Thailand Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 105 Thailand Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 106 Thailand other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 107 Thailand Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 108 Thailand Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 109 Thailand tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 110 Thailand Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 111 Thailand Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 112 Indonesia Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 113 Indonesia trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 114 Indonesia Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 115 Indonesia Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 116 Indonesia Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 117 Indonesia other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 118 Indonesia Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 119 Indonesia Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 120 Indonesia tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 121 Indonesia Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 122 Indonesia Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 123 Philippines Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 124 Philippines trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 125 Philippines Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 126 Philippines Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 127 Philippines Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 128 Philippines other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 129 Philippines Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 130 Philippines Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 131 Philippines tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 132 Philippines Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 133 Philippines Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 134 rest of asia-pacific Needle biopsy Market, By needle type, 2019-2028 (USD Million)

图片列表

FIGURE 1 Asia-Pacific needle biopsy market: segmentation

FIGURE 2 Asia-Pacific needle biopsy market: data triangulation

FIGURE 3 ASIA-PACIFIC NEEDLE BIOPSY MARKET: DROC ANALYSIS

FIGURE 4 Asia-Pacific needle biopsy market: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 Asia-Pacific needle biopsy market: COMPANY RESEARCH ANALYSIS

FIGURE 6 Asia-Pacific needle biopsy market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Asia-Pacific needle biopsy market: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC NEEDLE BIOPSY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 Asia-Pacific needle biopsy market: MARKET procedure OVERAGE GRID

FIGURE 10 ASIA-PACIFIC NEEDLE BIOPSY MARKET: SEGMENTATION

FIGURE 11 rising prevalence of breast and lung cancer, INCREASE in demand of minimally invasive surgeries, and presence of healthcare reimbursement is expected to drive the Asia-Pacific needle biopsy market in the forecast period of 2021 to 2028

FIGURE 12 TREPHINE BIOPSY NEEDLE SEGMENT is expected to account for the largest share of the Asia-Pacific needle biopsy market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPRTUNITIES AND CHALLENGES OF ASIA-PACIFIC NEEDLE BIOPSY MARKET

FIGURE 14 COMPARISON OF PREVALENCE OF BREAST CANCER IN EUROPE, INDIA AND IN THE U.S.

FIGURE 15 PREVALENCE OF LUNG CANCER IN VARIOUS COUNTRIES, WITH HUNGARY BEING THE HIGHEST PREVALENCE RATE IN WOMEN AND MEN

FIGURE 16 Asia-Pacific needle biopsy market: By needle type, 2020

FIGURE 17 Asia-Pacific needle biopsy market: By needle type, 2021-2028 (USD million)

FIGURE 18 Asia-Pacific needle biopsy market: By needle type, CAGR (2021-2028)

FIGURE 19 Asia-Pacific needle biopsy market: By needle type, LIFELINE CURVE

FIGURE 20 Asia-Pacific needle biopsy market: By ERGONOMICS, 2020

FIGURE 21 Asia-Pacific needle biopsy market: By ERGONOMICS, 2021-2028 (USD million)

FIGURE 22 Asia-Pacific needle biopsy market: By ERGONOMICS, CAGR (2021-2028)

FIGURE 23 Asia-Pacific needle biopsy market: By ERGONOMICS, LIFELINE CURVE

FIGURE 24 Asia-Pacific needle biopsy market: By procedure, 2020

FIGURE 25 Asia-Pacific needle biopsy market: By procedure, 2021-2028 (USD million)

FIGURE 26 Asia-Pacific needle biopsy market: By procedure, CAGR (2021-2028)

FIGURE 27 Asia-Pacific needle biopsy market: By procedure, LIFELINE CURVE

FIGURE 28 Asia-Pacific needle biopsy market: By sample site, 2020

FIGURE 29 Asia-Pacific needle biopsy market: By sample site, 2021-2028 (USD million)

FIGURE 30 Asia-Pacific needle biopsy market: By sample site, CAGR (2021-2028)

FIGURE 31 Asia-Pacific needle biopsy market: By sample site, LIFELINE CURVE

FIGURE 32 Asia-Pacific needle biopsy market: By utility, 2020

FIGURE 33 Asia-Pacific needle biopsy market: By utility, 2021-2028 (USD million)

FIGURE 34 Asia-Pacific needle biopsy market: By utility, CAGR (2021-2028)

FIGURE 35 Asia-Pacific needle biopsy market: By utility, LIFELINE CURVE

FIGURE 36 Asia-Pacific needle biopsy market: By application, 2020

FIGURE 37 Asia-Pacific needle biopsy market: By application, 2021-2028 (USD million)

FIGURE 38 Asia-Pacific needle biopsy market: By application, CAGR (2021-2028)

FIGURE 39 Asia-Pacific needle biopsy market: By application, LIFELINE CURVE

FIGURE 40 Asia-Pacific needle biopsy market: By end user, 2020

FIGURE 41 Asia-Pacific needle biopsy market: By end user, 2021-2028 (USD million)

FIGURE 42 Asia-Pacific needle biopsy market: By end user, CAGR (2021-2028)

FIGURE 43 Asia-Pacific needle biopsy market: By end user, LIFELINE CURVE

FIGURE 44 Asia-Pacific needle biopsy market: By distribution channel, 2020

FIGURE 45 Asia-Pacific needle biopsy market: By distribution channel, 2021-2028 (USD million)

FIGURE 46 Asia-Pacific needle biopsy market: By distribution channel, CAGR (2021-2028)

FIGURE 47 Asia-Pacific needle biopsy market: By distribution channel, LIFELINE CURVE

FIGURE 48 Asia-Pacific needle biopsy MARKET: SNAPSHOT (2020)

FIGURE 49 Asia-Pacific needle biopsy MARKET: BY COUNTRY (2020)

FIGURE 50 Asia-Pacific needle biopsy MARKET: BY COUNTRY (2021 & 2028)

FIGURE 51 Asia-Pacific needle biopsy MARKET: BY COUNTRY (2020 & 2028)

FIGURE 52 Asia-Pacific needle biopsy MARKET: BY needle type (2021-2028)

FIGURE 53 Asia-Pacific needle biopsy market: company share 2020 (%)

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.