亚太临床试验用品市场,按服务(储存、制造、包装和标签及分销)、临床阶段(第三阶段、第二阶段、第四阶段、第一阶段)、治疗用途(肿瘤学、心血管疾病、皮肤病学、代谢紊乱、传染病、呼吸系统疾病、中枢神经系统和精神障碍、血液疾病、其他)、最终用户(合同研究组织、制药和生物技术公司)、行业趋势和预测到 2029 年。

市场分析与洞察:亚太临床试验用品市场

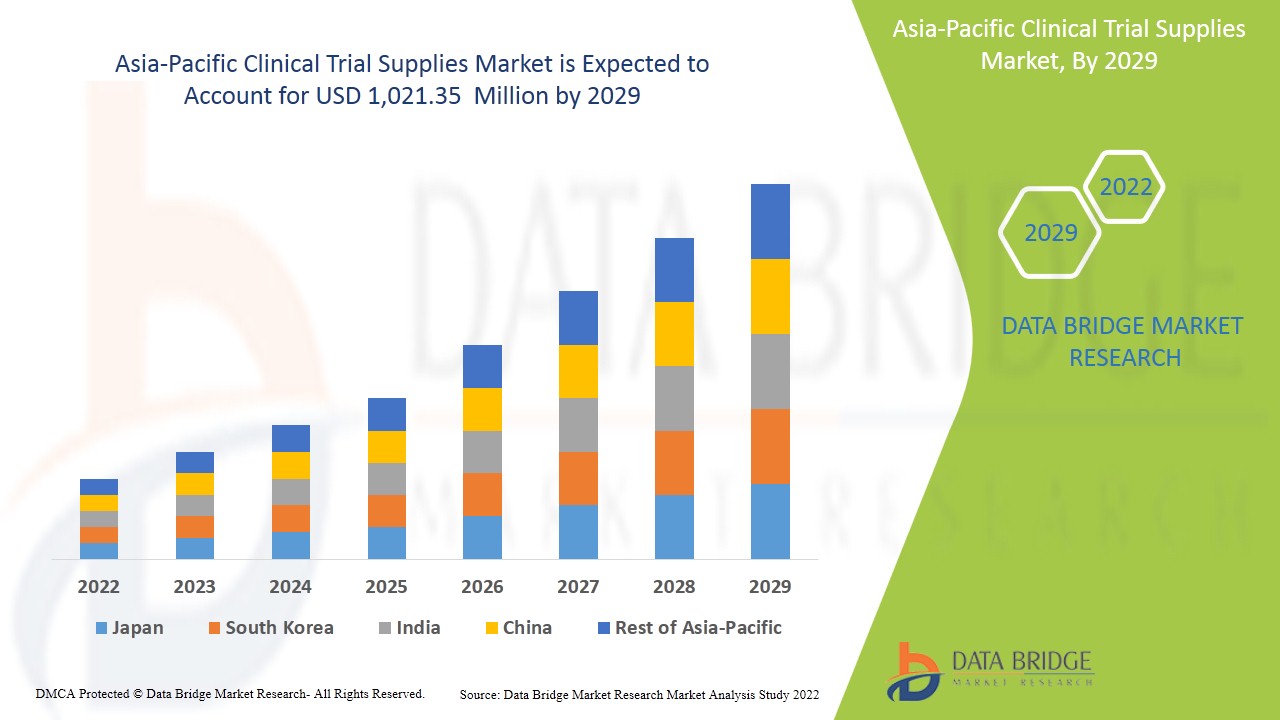

预计亚太临床试验用品市场将在 2022 年至 2029 年的预测期内实现市场增长。Data Bridge Market Research 分析,在 2022 年至 2029 年的预测期内,该市场将以 9.2% 的复合年增长率增长,预计到 2029 年将达到 10.2135 亿美元。推动临床试验用品市场增长的主要因素是全球临床试验需求的增加、疾病发病率的增加、政府对研发的投资以及个性化医疗等新疗法的开发,从而引领临床试验用品市场在未来增长。

临床试验是一项研究,旨在确定医疗策略、治疗或设备是否安全、有效且对人类有用。这些研究有助于确定哪种医疗方法最适合某些疾病。临床试验为医疗保健决策提供了最佳数据。

临床试验的目的是研究严格的科学标准。这些标准保护患者并有助于产生可靠的研究结果。

临床试验是药物开发的最后一个阶段,这是一个漫长而细致的研究过程,由科学家或研究人员针对特定疾病(无论是药物还是医疗器械)进行。药物开发过程通常始于实验室,科学家首先在实验室中开发和测试与疾病治疗相关的新想法。

亚太临床试验用品市场报告提供了市场份额、新发展和产品线分析、国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报,我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按服务(存储、制造、包装和标签及分销)、临床阶段(第三阶段、第二阶段、第四阶段、第一阶段)、治疗用途(肿瘤学、心血管疾病、皮肤病学、代谢紊乱、传染病、呼吸系统疾病、中枢神经系统和精神障碍、血液疾病、其他)、按最终用户(合同研究组织、制药和生物技术公司) |

|

覆盖国家 |

北美洲的美国、加拿大和墨西哥、欧洲的德国、法国、英国、荷兰、瑞士、比利时、俄罗斯、意大利、西班牙、土耳其、欧洲其他地区、亚太地区 (APAC) 的中国、日本、印度、韩国、新加坡、马来西亚、澳大利亚、泰国、印度尼西亚、菲律宾、亚太地区 (APAC) 的其他地区、中东和非洲 (MEA) 的其他地区、南美洲的巴西、阿根廷和南美洲其他地区。 |

|

涵盖的市场参与者 |

Movianto(美国)、Sharp(美国)、Thermo Fisher Scientific Inc.(美国)、Catalent, Inc(美国)、PCI Pharma Services(美国)、Almac Group(英国)、PAREXEL International Corporation(美国)、Bionical Ltd.(英国)、Alium Medical Limited(英国)、Myonex(英国)、Clinigen Group plc(英国)、Ancillare, LP(美国)、SIRO Clinpharm(印度)CLINICAL SUPPLIES MANAGEMENT HOLDINGS, INC.(美国)Biocair(英国)等。 |

临床试验用品市场动态

驱动程序

- 全球临床试验需求不断增长

仅在北美、欧洲和亚洲等发展中国家,临床试验需求就增长了82%。这些药物在临床试验后才能上市,因此所有公司大多根据药物或设备机器的类型进行临床试验。因此,临床试验将成为治疗市场增长率扩大的主要驱动力。

- 慢性病发病率上升

由于人口快速增长和感染率上升,全球范围内慢性病的发病率居高不下。这些疾病在药物研发的临床试验领域发挥着重要作用。药物必须通过所有标准的临床阶段才能供人类使用。因此,为了治疗人类的这些慢性病,药物必须是安全的。

- 政府研发资金投入

仪器、人力、研究人员受到伤害时的医疗管理、保险、运输、伦理委员会费用、数据处理和其他消耗品是临床试验的主要成本。临床试验是对疾病预防和治疗方案的评估,将进一步促进治疗市场的增长。

机会

- 新兴国家新药研发试验增多

药物疗效临床试验是开发用于治疗疾病的药物在投放市场供人类使用之前的主要关键。此外,新药在销售和分销之前必须符合许可证延期和国际标准。疾病的流行率和发病率的增加以及患者数量的增加是导致过去一段时间发展中国家药物开发临床试验趋势出现的因素。

此外,新兴市场(中国、巴西、俄罗斯、印度和南非)的政府也在改革公共医疗体系,提供更便捷的医疗服务。这两个因素的协同作用意味着新兴市场的市场发展将更加自由,临床研究创新也将更加活跃。

限制/挑战

药物不良反应是指在正常使用条件下,药物在人体中可能产生的不良或有害影响。药物不良反应通常表现为黄疸、贫血、皮疹,导致白细胞计数减少、肾脏受损、神经损伤,从而导致视力或听力受损。

许多不良反应可通过临床测试阶段的体检确定。因此,在临床试验期间报告不良反应是供应市场的主要制约因素。尽管生物制剂和新药的开发投入了大量的时间和成本,但据估计,较低的审批时间和药物审批率给市场带来了最大的挑战,这可能会阻碍市场的增长。

本临床试验用品市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入来源、市场法规变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新等方面的机会。如需了解有关临床试验用品市场的更多信息,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您做出明智的市场决策,实现市场增长。

近期发展

- 2022 年 2 月,Catalent Inc. 宣布该公司已扩大了在中国的临床用品温控存储和配送能力。这导致临床供应量增加,以优化开发、上市和针对不同病症的更好治疗,以及二次包装能力

亚太临床试验用品市场范围

亚太临床试验用品市场根据服务、临床阶段、治疗用途和最终用户进行分类。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

服务

- 制造业

- 分配

- 贮存

- 包装和标签

根据服务,亚太临床试验用品市场分为制造、分销、储存以及包装和标签。

临床阶段

- 第一阶段

- 第二阶段

- 第三阶段

- 第四阶段

根据临床阶段,亚太临床试验用品市场分为 I 期、II 期、III 期和 IV 期。

治疗用途

- 肿瘤学

- 中枢神经系统

- 精神障碍

- 心血管疾病

- 传染病

- 呼吸系统疾病

- 血液疾病

- 皮肤科

- 其他的

根据治疗用途,亚太临床试验用品市场细分为肿瘤学、中枢神经系统和精神疾病、心血管疾病、传染病、呼吸系统疾病、代谢紊乱、血液疾病、皮肤病学等。

最终用户

- 合同研究组织

- 制药和生物技术公司

根据最终用户,亚太临床试验用品市场分为合同研究组织和制药和生物技术公司。

临床试验用品市场区域分析/见解

亚太临床试验用品市场进一步细分为日本、中国、韩国、印度、澳大利亚、新加坡、印度尼西亚、泰国、马来西亚、菲律宾和亚太其他地区等主要国家。

印度在市场份额和市场收入方面占据亚太临床试验用品市场的主导地位,并将在 2022-2029 年的预测期内继续保持主导地位。这是由于该地区患者人数不断增加、医疗保健领域的投资不断增加以及政府支持不断增加

报告的国家部分还提供了影响单个市场因素和市场法规变化,这些因素和变化会影响市场的当前和未来趋势。新车和替换车销售、国家人口统计数据和进出口关税等数据点是预测单个国家市场情况的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了全球品牌的存在和可用性以及它们因本土和国内品牌的激烈竞争而面临的挑战以及销售渠道的影响。

竞争格局和亚太临床试验用品市场份额分析

亚太临床试验用品市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用主导地位、技术生命线曲线。以上提供的数据点仅与公司对临床试验用品市场的关注有关。

亚太临床试验用品市场的主要知名参与者包括 Movianto(美国)、Sharp(美国)、Thermo Fisher Scientific Inc.(美国)、Catalent, Inc(美国)、PCI Pharma Services(美国)、Almac Group(英国)、PAREXEL International Corporation(美国)、Bionical Ltd.(英国)、Alium Medical Limited(英国)、MYODERM(英国)、Clinigen Group plc(英国)、Ancillare, LP(美国)、SIRO Clinpharm(印度)、CLINICAL SUPPLIES MANAGEMENT HOLDINGS, INC.(美国)、Biocair(英国)等。

研究方法:亚太临床试验用品市场

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、全球与区域和供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES

5 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: REGULATORY SCENARIO

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR CLINICAL TRIALS WORLDWIDE

6.1.2 INCREASING INCIDENCE OF CHRONIC DISEASES

6.1.3 GOVERNMENT FUNDS IN R&D INVESTMENTS

6.1.4 ADVANCEMENT OF TECHNOLOGY IN CLINICAL TRIALS SUPPLIES

6.2 RESTRAINTS

6.2.1 ADVERSE EFFECTS OF CLINICAL TRIALS

6.2.2 TRANSPORTATION ISSUE IN CLINICAL TRIAL SUPPLIES

6.2.3 HIGH COST ASSOCIATED WITH THE CLINICAL TRIALS

6.3 OPPORTUNITIES

6.3.1 INCREASING NEW DRUG DEVELOPMENT TRIALS IN EMERGING COUNTRIES

6.3.2 INCREASING DEMAND FOR INNOVATIVE SOLUTIONS IN CLINICAL TRIALS SERVICES

6.3.3 EVOLUTION IN SUPPLY CHAIN MANAGEMENT FOR CLINICAL TRIALS

6.4 CHALLENGES

6.4.1 LOWER PROCEDURE TIME OF CLINICAL TRIALS APPROVAL

6.4.2 LACK OF SKILLED PERSON TO OPERATE DEVICES DURING CLINICAL TRIALS

7 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES

7.1 OVERVIEW

7.2 STORAGE

7.3 MANUFACTURING

7.4 PACKAGING AND LABELLING

7.5 DISTRIBUTION

8 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASES

8.1 OVERVIEW

8.2 PHASE III

8.3 PHASE II

8.4 PHASE IV

8.5 PHASE I

9 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE

9.1 OVERVIEW

9.2 ONCOLOGY

9.3 CARDIOVASCULAR DISEASES

9.4 DERMATOLOGY

9.5 METABOLIC DISORDERS

9.6 INFECTIOUS DISEASES

9.7 RESPIRATORY DISEASES

9.8 CNS AND MENTAL DISORDERS

9.9 BLOOD DISORDERS

9.1 OTHERS

10 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY END USER

10.1 OVERVIEW

10.2 CONTRACT RESEARCH ORGANIZATIONS

10.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

11 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 AUSTRALIA

11.1.6 THAILAND

11.1.7 MALAYSIA

11.1.8 SINGAPORE

11.1.9 INDONESIA

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.1.5.1 PARTNERSHIP

14.2 ALMAC GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 CATALENT INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SERVICE PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.3.5.1 SERVICE EXPANSION

14.4 CLINIGEN GROUP PLC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.4.5.1 PARTNERSHIP

14.5 MOVIANTO

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 SERVICE PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.5.4.1 ACQUISITION

14.6 PCI PHARMA SERVICES

14.6.1 COMPANY SNAPSHOT

14.6.2 SERVICE PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 SHARP

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICE PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 ALIUM MEDICAL LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 SERVICE PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ANCILLARE, LP

14.9.1 COMPANY SNAPSHOT

14.9.2 SERVICE PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 BIOCAIR

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICE PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 BIONICAL LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 SERVICE PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.11.3.1 SERVICE LAUNCH

14.12 CLINICAL SUPPLIES MANAGEMENT HOLDINGS,INC

14.12.1 COMPANY SNAPSHOT

14.12.2 SERVICE PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 KLIFO

14.13.1 COMPANY SNAPSHOT

14.13.2 SERVICE PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.13.3.1 ACQUISTION

14.14 MYONEX

14.14.1 COMPANY SNAPSHOT

14.14.2 SERVICE PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 PAREXEL INTERNATIONAL CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 SERVICE PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.15.3.1 COLLABORATION

14.16 SIRO CLINPHARM PRIVATE LIMITED

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICE PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 LOCATIONS OF REGISTERED STUDIES

TABLE 2 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC STORAGE IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC MANUFACTURING IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC PACKAGING AND LABELLING IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC DISTRIBUTION IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC PHASE III IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC PHASE II IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC PHASE IV IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC PHASE I IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC ONCOLOGY IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC CARDIOVASCULAR DISEASES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC DERMATOLOGY IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC METABOLIC DISORDERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC INFECTIOUS DISEASES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC RESPIRATORY DISEASES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC CNS AND MENTAL DISORDERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC BLOOD DISORDERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC OTHERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 CHINA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 31 CHINA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 32 CHINA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 33 CHINA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 JAPAN CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 35 JAPAN CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 36 JAPAN CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 37 JAPAN CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 INDIA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 39 INDIA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 40 INDIA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 41 INDIA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 SOUTH KOREA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 43 SOUTH KOREA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 44 SOUTH KOREA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH KOREA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 AUSTRALIA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 47 AUSTRALIA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 48 AUSTRALIA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 49 AUSTRALIA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 THAILAND CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 51 THAILAND CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 52 THAILAND CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 53 THAILAND CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 MALAYSIA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 55 MALAYSIA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 56 MALAYSIA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 57 MALAYSIA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 58 SINGAPORE CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 59 SINGAPORE CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 60 SINGAPORE CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 61 SINGAPORE CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 INDONESIA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 63 INDONESIA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 64 INDONESIA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 65 INDONESIA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 PHILIPPINES CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 67 PHILIPPINES CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 68 PHILIPPINES CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 69 PHILIPPINES CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 REST OF ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 ASIA PACIFIC CLINICAL TRIAL SUPLLIES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC CLINICAL TRIAL SUPLLIES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 RISING DEMAND FOR CLINICAL TRIALS WORLDWIDE AND INCREASING INCIDENCES OF DISEASES IS DRIVING THE ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 STORAGE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET

FIGURE 14 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, 2021

FIGURE 15 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, 2021

FIGURE 19 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, 2021

FIGURE 23 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY END USER, 2021

FIGURE 27 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: SNAPSHOT (2021)

FIGURE 31 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY COUNTRY (2021)

FIGURE 32 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES (2022-2029)

FIGURE 35 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。