>印度和欧洲仿制药注射市场,按治疗应用(肿瘤学、心血管疾病、传染病、疼痛管理、代谢紊乱(糖尿病)和免疫学紊乱)、生物仿制药(索马鲁肽、富马酸伊布替利特、依洛尤单抗、阿利罗尤单抗、阿尼芬净、度拉鲁肽、利西拉来肽、艾塞那肽、利拉鲁肽和阿达木单抗)、最终用户(直销分销商、药品批发商、药店、药房、集团采购组织(GPO)等)、分销渠道(药品批发商、合同制造商、药房连锁店、集团采购组织(GPO)等) - 行业趋势和预测到 2035 年。

印度和欧洲仿制注射剂市场分析及规模

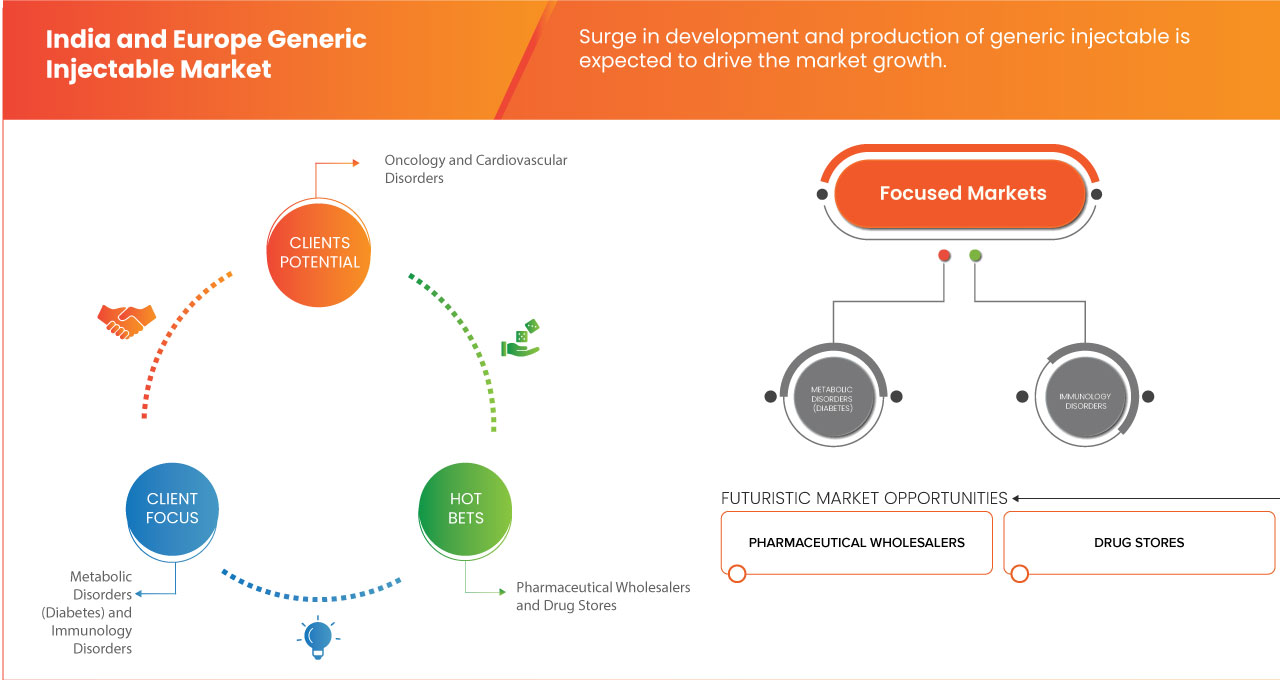

仿制注射剂比品牌注射剂更经济,为旨在控制成本而不影响质量的医疗保健系统提供了一种有吸引力的解决方案,推动了市场的增长。通过增加对合同研究制造的重视,市场增长的上升预计将为市场增长创造机会。

Data Bridge Market Research 分析称,在 2024 年至 2035 年的预测期内,印度和欧洲仿制注射剂市场将以 9.0% 的复合年增长率增长,预计到 2031 年将从 2023 年的 434.994 亿美元增至 1190.6377 亿美元。慢性病发病率的上升和仿制注射剂开发和生产的激增预计将推动市场扩张。

|

报告指标 |

细节 |

|

预测期 |

2024 至 2035 年 |

|

基准年 |

2023 |

|

历史性的一年 |

2022(可定制 2016-2021) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

治疗应用(肿瘤学、心血管疾病、传染病、疼痛管理、代谢紊乱(糖尿病)和免疫系统疾病)、生物仿制药(索马鲁肽、富马酸伊布替利特、依洛尤单抗、阿利罗尤单抗、阿尼芬净、度拉鲁肽、利西拉来肽、艾塞那肽、利拉鲁肽和阿达木单抗)、最终用户(直销分销商、药品批发商、药店、药房、集团采购组织 (GPO) 和其他)、分销渠道(药品批发商、合同制造商、药房连锁店、集团采购组织 (GPO) 和其他) |

|

覆盖国家/地区 |

印度和欧洲 |

|

涵盖的市场参与者 |

Cipla Inc.、Dr. Reddy's Laboratories Ltd、Sanofi、Viatris Inc.、Fresenius Kabi AG、Sandoz Group AG、GLENMARK PHARMACEUTICALS LTD、Gland Pharma Limited、Par Pharmaceutical 和 Sun Pharmaceutical Industries Ltd. 等 |

市场定义

“仿制注射剂”是指使用仿制药注射给药。这种给药方式之所以受到青睐,是因为它能够提供准确的剂量管理,并且在口服给药不可行或效果不佳时可作为备用。仿制注射给药对医疗保健至关重要,因为它提供了价格合理的替代品,同时又不牺牲治疗要求。

印度和欧洲仿制注射剂市场动态

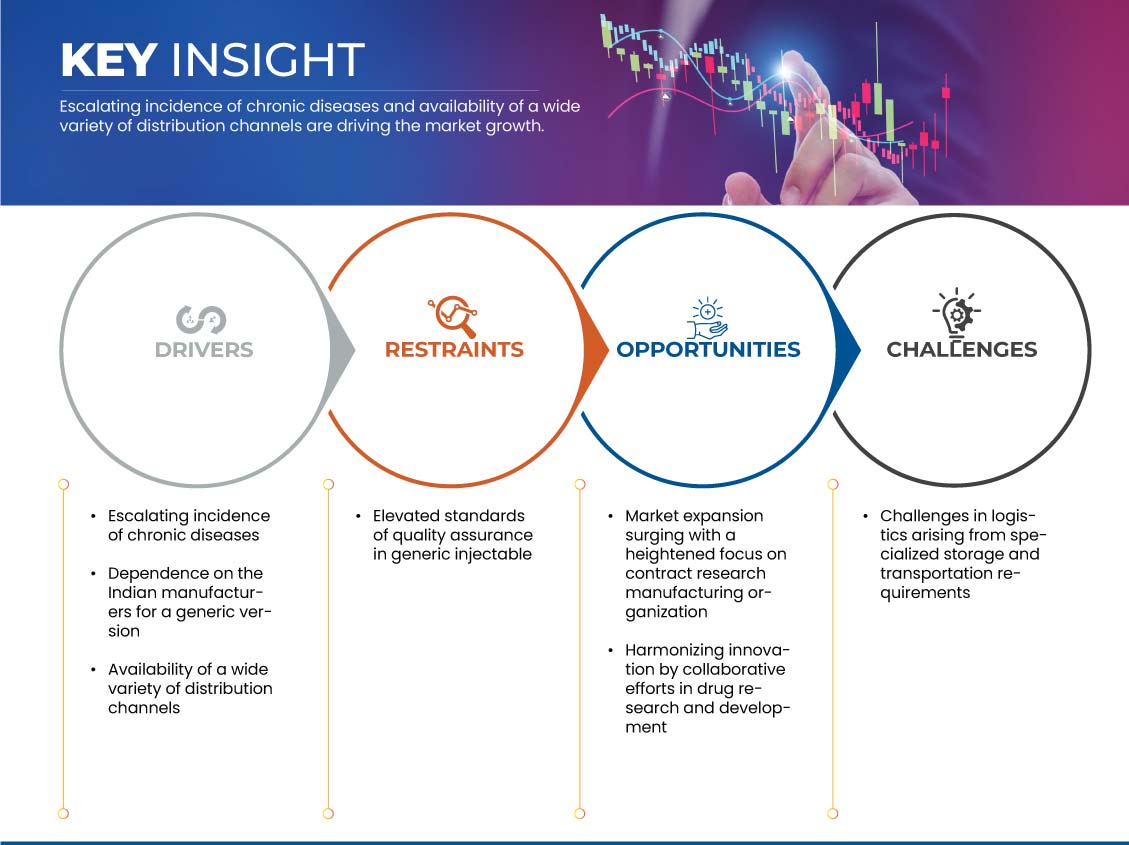

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 仿制注射剂的开发和生产激增

由于仿制注射剂的开发和生产不断增加,市场正在经历显著的增长。包括医疗保健越来越重视成本效益在内的多种因素推动了这一增长。

通用注射剂比品牌注射剂更经济,为旨在不影响质量的情况下管理成本的医疗保健系统提供了有吸引力的解决方案。

各种品牌注射药物专利到期进一步为仿制药开辟了道路,促进了良性竞争,扩大了医疗保健提供者的选择范围。欧洲的监管支持和有利环境在鼓励仿制药注射剂获得批准和进入市场方面发挥着关键作用。此外,对生物仿制药的需求不断增长,尤其是复杂生物注射剂的仿制药,极大地促进了仿制药注射剂开发前景的不断扩大。

- 慢性病发病率不断上升

慢性病的增多带来了对有针对性和高效治疗干预措施前所未有的需求。注射给药系统已成为应对这些持续健康挑战的复杂问题不可或缺的工具。慢性病的固有性质通常要求精确的剂量控制和持续的药物给药,而注射给药系统在这方面表现出色。随着全球医疗保健系统努力应对日益加重的慢性病负担,该市场通过提供可提高治疗效果、改善患者管理和提高治疗效果的解决方案而获得关注。

总之,市场的发展方向与其解决慢性病日益普遍所带来的复杂医疗保健需求的能力密切相关。市场巩固了其作为

机会

- 通过更加重视合同研究制造来促进市场增长

合同研究和制造组织 (CRMO) 在制药企业中越来越受欢迎,尤其是那些从事仿制药开发的企业。合同制造利用专业知识、改进流程并提高仿制药的产量。制药企业可以通过使用 CRMO 来管理生产,专注于其主要技能,包括营销、研究和法规遵从性。制药行业正在发生变化,随之而来的是,对药物发现和生产的效率、经济性和灵活性的需求也在增加。CRMO 或合同研究和制造组织在帮助仿制药生产商满足这些期望方面至关重要,因为它们提供专业服务。由于监管要求有限、药物研究程序日益复杂以及对创新制造技术的需求,制药企业正在将其运营的不同阶段外包。

限制/挑战

- 确保并维持高质量标准

注射剂制造中固有的严格质量控制流程要求在每个阶段都一丝不苟地关注细节。满足这些标准需要在技术、基础设施和熟练人员方面进行大量投资,这可能会导致生产成本上升。此外,严格的合规要求也可能延长新注射剂的上市时间。尽管存在这些挑战,但保持高品质的承诺对于保障患者安全和维护医疗实践的完整性至关重要。

尽管质量保证限制带来了挑战,但它仍然是一个关键方面,凸显了该行业对提供安全有效的注射药物的坚定承诺。这一承诺在确保全球患者的信任和健康方面发挥着根本作用。

- 专业化仓储和运输需求引发的物流

仿制药通常由多家制造商生产,因此配方和包装也各不相同。尽管仿制药的配方各异,但它们在储存和运输过程中更容易受到湿度和温度变化的影响。问题在于,某些仿制药,尤其是那些对稳定性有特定要求的仿制药,可能需要特定的储存设置来保持其有效性和安全性。

某些复杂配方和仿制药可能容易受到温度变化和光照的影响。如果储存不当,这些药物的完整性可能会受到损害,从而导致治疗效果降低,甚至在服用时出现安全问题。此外,批发商和分销商只是众多经常参与仿制药全球分销网络的中间商中的两个。暴露于不利的储存条件会给供应链的每个阶段带来风险。这在基础设施较不发达或运输温度调节不均衡的地区尤其重要。

最新动态

- 2024 年 1 月,Sun Pharmaceutical Industries Limited 与 Taro Pharmaceutical Industries Ltd. 正式签署最终合并协议。根据该协议,Sun Pharma 作为 Taro 的控股股东,将收购 Taro 所有已发行的普通股,但不包括 Sun Pharma 或其关联公司已持有的股份。收购价格为每股 43.00 美元(不含利息)。此次合并预计将创建一个更加强大和具有竞争力的实体,为 Sun Pharma 和 Taro Pharmaceutical Industries Ltd 带来潜在好处,例如提高市场占有率、提高运营效率和扩大能力

- 2023 年 11 月,费森尤斯卡比在欧盟推出了托珠单抗生物仿制药 Tyenne,该仿制药参考了 RoActemra(托珠单抗)。Tyenne 标志着欧洲首个用于治疗各种炎症和免疫疾病的托珠单抗生物仿制药。它将扩大其产品范围

- 2023 年 8 月,Aurobindo Pharma 获得美国食品药品监督管理局 (USFDA) 的最终批准,生产和商业化单剂量瓶装注射用盐酸万古霉素 USP,浓度为 1.25 克/瓶和 1.5 克/瓶。这些制剂与 Mylan Laboratories Ltd 生产的参比药物 (RLD) 注射用盐酸万古霉素 USP 具有生物等效性和治疗等效性

- 2023 年 6 月,雷迪博士实验室有限公司宣布成立新的专门部门“RGenX”,标志着其进入印度商业仿制药市场。雷迪博士认为,这将使患者以更实惠的价格获得更多产品选择。新合资企业将推进公司到 2030 年为超过 15 亿患者提供服务的目标。这有助于公司通过产品供应扩大业务

- 2023 年 12 月,Hikma Pharmaceuticals PLC 推出了盐酸苯肾上腺素注射液 USP,有 500mcg/5mL 和 1,000mcg/10mL 两种剂量。该产品目前在美国以即用型小瓶形式供应。其预期用途是提高因麻醉期间血管扩张而出现临床显著低血压的成年人的血压。这有助于该公司扩大其市场。

印度和欧洲通用注射剂市场范围

印度和欧洲仿制药注射剂市场分为三个显著的细分市场,基于治疗应用、最终用户、生物仿制药和分销渠道。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

治疗应用

- 肿瘤学

- 心血管疾病

- 传染病

- 疼痛管理

- 代谢紊乱(糖尿病)

- 免疫学疾病

根据治疗应用,市场分为肿瘤学、心血管疾病、传染病、疼痛管理、代谢紊乱(糖尿病)和免疫系统疾病。

生物仿制药

- 索马鲁肽

- 富马酸伊布替利特

- 依洛尤单抗

- 阿利库单抗

- 阿尼芬净

- 艾塞那肽

- 利西拉来肽

- 度拉鲁肽

- 阿达木单抗

根据生物仿制药,市场细分为索马鲁肽、富马酸伊布利特、依洛尤单抗、阿利罗尤单抗、阿尼芬净、艾塞那肽、利西拉来肽、度拉鲁肽和阿达木单抗。

最终用户

- 直销分销商

- 药品批发商

- 药店

- 药店

- 集团采购组织 (GPO)

- 其他的

根据最终用户,市场细分为直销分销商、医药批发商、药店、药房、集团采购组织(GPO)等。

分销渠道

- 药品批发商

- 合同制造商

- 药店连锁店

- 集团采购组织 (GPO)

- 其他的

根据分销渠道,市场分为医药批发商、合同制造商、药店连锁店、集团采购组织 (GPO) 等。

印度和欧洲通用注射剂市场区域分析/见解

对印度和欧洲仿制注射剂市场进行了分析,并按治疗应用、最终用户、生物仿制药和分销渠道提供了市场规模洞察和趋势。

本市场报告涵盖的国家/地区是印度和欧洲。

由于该地区注射仿制药分子的技术进步,欧洲有望主导印度和欧洲仿制药注射剂市场

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势、波特五力分析和案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了区域/国家品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

印度和欧洲仿制注射剂市场:竞争格局和份额分析

印度和欧洲仿制注射剂市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、区域业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对市场的关注有关。

印度和欧洲仿制注射剂市场的一些主要参与者包括 Cipla Inc.、Dr. Reddy's Laboratories Ltd、Sanofi、Viatris Inc.、Fresenius Kabi AG、Sandoz Group AG、GLENMARK PHARMACEUTICALS LTD、Gland Pharma Limited、Par Pharmaceutical 和 Sun Pharmaceutical Industries Ltd. 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA AND EUROPE GENERIC INJECTABLE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 INDIA MULTIVARIATE MODELLING

2.6 TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.1.1 EUROPE

4.1.2 INDIA

4.2 PORTER FIVE FORCED

4.2.1 EUROPE

4.2.2 INDIA

4.3 EPIDEMIOLOGY

5 EUROPE GENERIC INJECATBLE MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGE IN DEVELOPMENT AND PRODUCTION OF GENERIC INJECTABLE

5.1.2 PIONEERING PROGRESS FUELED BY TECHNOLOGICAL ADVANCEMENTS IN DRUG MOLECULES

5.1.3 SURGE OF GENERIC INJECTABLE MARKET AMIDST THE ESCALATING PREVALENCE OF CHRONIC DISEASES

5.2 RESTRAINTS

5.2.1 ENSURING AND MAINTAINING HIGH-QUALITY STANDARDS

5.2.2 ENSURING THE QUALIFICATION AND ETHICAL STANDARDS OF A CONTRACT MANUFACTURING ORGANIZATION (CMO)

5.2.3 NAVIGATING MARKET CHALLENGES IN THE DEVELOPMENT COSTS OF GENERIC INJECTABLE

5.3 OPPORTUNITIES

5.3.1 ASCENDANCE OF MARKET GROWTH THROUGH INCREASED EMPHASIS ON CONTRACT RESEARCH MANUFACTURING

5.3.2 SYNERGIZING INNOVATION THROUGH COLLABORATIVE DRUG RESEARCH AND DEVELOPMENT

5.3.3 EXPANSION IN MARKET GROWTH FUELED BY RISING PREFERENCE FOR GENERIC DRUGS OVER NOVEL ALTERNATIVES

5.3.4 EXPANDING HORIZONS PROPELLED BY GROWING PIPELINE OF INNOVATIVE PRODUCTS

5.4 CHALLENGES

5.4.1 LOGISTICAL CHALLENGES DUE TO SPECIALIZED STORAGE AND TRANSPORTATION NEEDS

6 INDIA GENERIC INJECATBLE MARKET OVERVIEW

6.1 DRIVERS

6.1.1 ESCALATING INCIDENCE OF CHRONIC DISEASES

6.1.2 DEPENDENCE ON THE INDIAN MANUFACTURERS FOR GENERIC VERSION

6.1.3 AVAILABILITY OF A WIDE VARIETY OF DISTRIBUTION CHANNELS

6.2 RESTRAINTS

6.2.1 ELEVATED STANDARDS OF QUALITY ASSURANCE IN GENERIC INJECTABLE

6.3 OPPORTUNITIES

6.3.1 MARKET EXPANSION SURGING WITH A HEIGHTENED FOCUS ON CONTRACT RESEARCH MANUFACTURING ORGANIZATION

6.3.2 HARMONIZING INNOVATION BY COLLABORATIVE EFFORTS IN DRUG RESEARCH AND DEVELOPMENT

6.3.3 MARKET GROWTH EXPANDS DUE TO INCREASING FAVOR FOR GENERIC DRUGS INSTEAD OF NOVEL ALTERNATIVES

6.3.4 GOVERNMENT DRIVE AND ADVOCACY FOR GENERIC MEDICATIONS

6.4 CHALLENGES

6.4.1 CHALLENGES IN LOGISTICS ARISING FROM SPECIALIZED STORAGE AND TRANSPORTATION REQUIREMENTS

7 INDIA & EUROPE INJECTABLE DRUG DELIVERY MARKET, BY THERAPEUTIC APPLICATION

7.1 OVERVIEW

7.2 ONCOLOGY

7.3 CARDIOVASCULAR DISORDERS

7.4 INFECTIOUS DISEASES

7.5 PAIN MANAGEMENT

7.6 METABOLIC DISORDERS (DIABETES)

7.7 IMMUNOLOGY DISORDERS

8 INDIA & EUROPE INJECTABLE DRUG DELIVERY MARKET, BY BIOSIMILAR DRUGS

8.1 OVERVIEW

8.2 SEMAGLUTIDE

8.3 IBUTILIDE FUMARATE

8.4 EVOLOCUMAB

8.5 ALIROCUMAB

8.6 ANIDULAFUNGIN

8.7 DULAGLUTIDE

8.8 LIXISENATIDE

8.9 EXENATIDE

8.1 LIRAGLUTIDE

8.11 ADALIMUMAB

9 INDIA & EUROPE INJECTABLE DRUG DELIVERY MARKET, BY END USER

9.1 OVERVIEW

9.2 DIRECT SALES DISTRIBUTORS

9.3 PHARMACEUTICAL WHOLESALERS

9.4 DRUG STORES

9.5 PHARMACY

9.6 GROUP PURCHASING ORGANIZATIONS (GPOS)

9.7 OTHERS

10 INDIA & EUROPE INJECTABLE DRUG DELIVERY MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 CONTRACT MANUFACTURERS

10.3 PHARMACEUTICAL WHOLESALERS

10.4 PHARMACY CHAINS

10.5 GROUP PURCHASING ORGANIZATIONS (GPOS)

10.6 OTHERS

11 INDIA AND EUROPE GENERIC INJECTABLE MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

11.2 COMPANY SHARE ANALYSIS: INDIA

12 SWOT ANALYSIS

12.1 CONTRACT MANUFACTURERS

12.2 MANUFACTURERS

12.3 DISTRIBUTORS

13 COMPANY PROFILE (CONTRACT MANUFACTURERS)

13.1 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 CARDINAL HEALTH

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 DIVI'S LABORATORIES LIMITED.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 DR. REDDY’S LABORATORIES LTD

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 FAREVA

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 HIKMA PHARMACEUTICALS PLC

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 INNOVEXIA LIFESCIENCES PVT LTD

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 MEDLOCK HEALTHCARE

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 RECIPHARM AB.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 SWISSCHEM

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 TEVA PHARMACEUTICAL INDUSTRIES LTD

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 VENUS PHARMA GMBH.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 ZYDUS GROUP

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

14 COMPANY PROFILES (DISTRIBUTORS)

14.1 AAH PHARMACEUTICALS LTD

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT DESCRIPTION

14.1.3 RECENT DEVELOPMENT

14.2 HENRY SCHEIN, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 MAWDSLEYS – BROOKS & CO. LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT DESCRIPTION

14.3.3 RECENT DEVELOPMENT

14.4 MEDLINE INDUSTRIES, LP.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENT

15 COMPANY PROFILES (GENERIC MANUFACTURERS)

15.1 FRESENIUS SE & CO. KGAA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 AMNEAL PHARMACEUTICALS LLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 SUN PHARMACEUTICAL INDUSTRIES LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 LUPIN.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 ZYDUS GROUP

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AUROBINDO PHARMA.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CIPLA INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CONCORD BIOTECH.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 DR. REDDY’S LABORATORIES LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 GLAND PHARMA LIMITED

15.10.1 COMPANY SNAPSHOT

15.10.2 SOURCE: COMPANY WEBSITE, ANNUAL REPORTS, AND SEC FILING

15.10.3 REVENUE ANALYSIS

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENT

15.11 GLENMARK PHARMACEUTICALS LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 HIKMA PHARMACEUTICALS PLC

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 INTAS PHARMACEUTICALS LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 PAR PHARMACEUTICAL.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SANDOZ GROUP AG

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 SANOFI

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 VIATRIS INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

18 REFERENCES

表格列表

TABLE 1 INDIA GENERIC INJECTABLE MARKET, BY THERAPEUTIC APPLICATION, 2022-2035 (USD MILLION)

TABLE 2 EUROPE GENERIC INJECTABLE MARKET, BY THERAPEUTIC APPLICATION, 2022-2035 (USD MILLION)

TABLE 3 EUROPE ONCOLOGY IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 4 EUROPE ONCOLOGY IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 5 EUROPE CARDIOVASCULAR DISORDERS IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 6 INDIA CARDIOVASCULAR DISORDERS IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 7 EUROPE INFECTIOUS DISEASES IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 8 INDIA INFECTIOUS DISEASES IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 9 EUROPE PAIN MANAGEMENT IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 10 INDIA PAIN MANAGEMENT IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 11 EUROPE METABOLIC DISORDERS (DIABETES) IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 12 INDIA METABOLIC DISORDERS (DIABETES) IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 13 EUROPE IMMUNOLOGY IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 14 INDIA IMMUNOLOGY IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 15 EUROPE GENERIC INJECTABLE MARKET, BY BIOSIMILAR DRUGS, 2022-2035 (USD MILLION)

TABLE 16 INDIA GENERIC INJECTABLE MARKET, BY BIOSIMILAR DRUGS, 2022-2035 (USD MILLION)

TABLE 17 EUROPE GENERIC INJECTABLE MARKET, BY END USER, 2022-2035 (USD MILLION)

TABLE 18 INDIA GENERIC INJECTABLE MARKET, BY END USER, 2022-2035 (USD MILLION)

TABLE 19 EUROPE GENERIC INJECTABLE MARKET, BY END USER, 2022-2035 (USD MILLION)

TABLE 20 INDIA GENERIC INJECTABLE MARKET, BY END USER, 2022-2035 (USD MILLION)

TABLE 21 EUROPE GENERIC INJECTABLE MARKET, BY DISTRIBUTION CHANNEL, 2022-2035 (USD MILLION)

TABLE 22 INDIA GENERIC INJECTABLE MARKET, BY DISTRIBUTION CHANNEL, 2022-2035 (USD MILLION)

图片列表

FIGURE 1 INDIA AND EUROPE GENERIC INJECTABLE MARKET: SEGMENTATION

FIGURE 2 INDIA AND EUROPE GENERIC INJECTABLE MARKET: DATA TRIANGULATION

FIGURE 3 INDIA GENERIC INJECTABLE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE GENERIC INJECTABLE MARKET: DROC ANALYSIS

FIGURE 5 INDIA GENERIC INJECTABLE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 6 EUROPE GENERIC INJECTABLE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 7 INDIA AND EUROPE GENERIC INJECTABLE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 EUROPE MULTIVARIATE MODELLING

FIGURE 9 INDIA AND EUROPE GENERIC INJECTABLE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 INDIA AND EUROPE GENERIC INJECTABLE MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 INDIA AND EUROPE GENERIC INJECTABLE MARKET: SEGMENTATION

FIGURE 12 ESCALATING INCIDENCE OF CHRONIC DISEASES AND SURGE IN THE DEVELOPMENT AND PRODUCTION OF GENERIC INJECTABLE IS DRIVING THE GROWTH OF THE INDIA GENERIC INJECTABLE MARKET IN THE FORECAST PERIOD OF 2024 TO 2035

FIGURE 13 SURGE IN DEVELOPMENT AND PRODUCTION OF GENERIC INJECTABLE DRUGS IS EXPECTED TO DRIVE THE EUROPEAN GENERIC INJECTABLE MARKET IN THE FORECAST PERIOD OF 2024 TO 2035

FIGURE 14 ONCOLOGY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA GENERIC INJECTABLE MARKET IN 2024 AND 2035

FIGURE 15 ONCOLOGY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE GENERIC INJECTABLE MARKET IN 2024 AND 2035

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE GENERIC INJECATBLE MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDIA GENERIC INJECATBLE MARKET

FIGURE 18 EUROPE GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, 2023

FIGURE 19 EUROPE GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, 2024-2035 (USD MILLION)

FIGURE 20 EUROPE GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, CAGR (2024-2035)

FIGURE 21 EUROPE GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, LIFELINE CURVE

FIGURE 22 INDIA GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, 2023

FIGURE 23 INDIA GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, 2024-2035 (USD MILLION)

FIGURE 24 INDIA GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, CAGR (2024-2035)

FIGURE 25 INDIA GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, LIFELINE CURVE

FIGURE 26 EUROPE GENERIC INJECTABLE MARKET: BY BIOSIMILAR DRUGS, 2023

FIGURE 27 EUROPE GENERIC INJECTABLE MARKET: BY BIOSIMILAR DRUGS, 2024-2035 (USD MILLION)

FIGURE 28 INDIA GENERIC INJECTABLE MARKET: BY BIOSIMILAR DRUGS, 2023

FIGURE 29 INDIA GENERIC INJECTABLE MARKET: BY BIOSIMILAR DRUGS, 2024-2035 (USD MILLION)

FIGURE 30 EUROPE GENERIC INJECTABLE MARKET: BY END USER, 2023

FIGURE 31 EUROPE GENERIC INJECTABLE MARKET: BY END USER, 2024-2035 (USD MILLION)

FIGURE 32 EUROPE GENERIC INJECTABLE MARKET: BY END USER, CAGR (2024-2035)

FIGURE 33 EUROPE GENERIC INJECTABLE MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 INDIA GENERIC INJECTABLE MARKET: BY END USER, 2023

FIGURE 35 INDIA GENERIC INJECTABLE MARKET: BY END USER, 2024-2035 (USD MILLION)

FIGURE 36 INDIA GENERIC INJECTABLE MARKET: BY END USER, CAGR (2024-2035)

FIGURE 37 INDIA GENERIC INJECTABLE MARKET: BY END USER, LIFELINE CURVE

FIGURE 38 EUROPE GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 39 EUROPE GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, 2024-2035 (USD MILLION)

FIGURE 40 EUROPE GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2035)

FIGURE 41 EUROPE GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 42 INDIA GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 43 INDIA GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, 2024-2035 (USD MILLION)

FIGURE 44 INDIA GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2035)

FIGURE 45 INDIA GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 46 EUROPE GENERIC INJECTABLE MARKET: COMPANY SHARE 2023 (%)

FIGURE 47 INDIA GENERIC INJECTABLE MARKET: COMPANY SHARE 2023 (%)

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.