Romania Bake Off Bakery Products Market

市场规模(十亿美元)

CAGR :

%

| 2023 –2030 | |

| USD 875.53 Million | |

| USD 1,241.72 Million | |

|

|

|

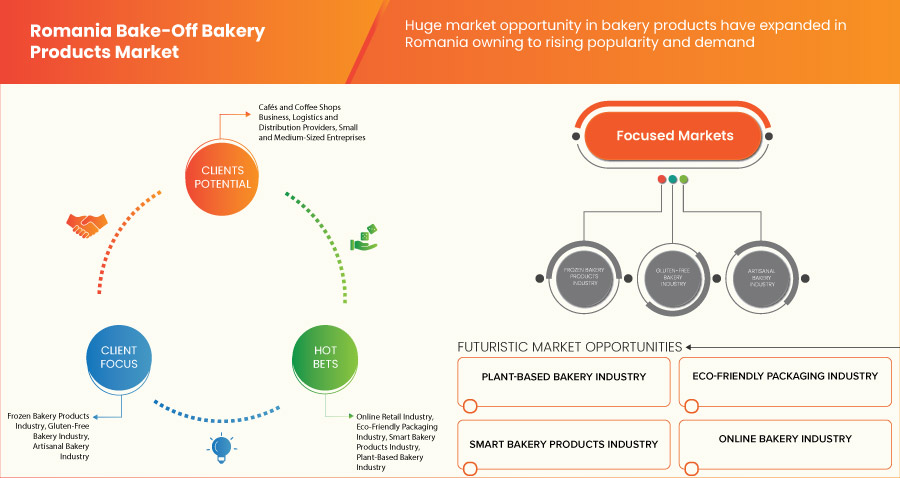

>罗马尼亚烘焙产品市场,按产品类型(面包、糕点、法式蛋糕、美式甜品等)、产品类别(冷冻、常温/常温、冷藏)、性质(传统和有机)、最终用户(家庭/零售和食品服务业)、分销渠道(线下零售和线上零售)划分 - 行业趋势和预测到 2030 年。

罗马尼亚烘焙产品市场分析及规模

健康和营养烘焙产品需求的不断增长、新口味和新产品的创新以及全国范围内在线营销和基于移动应用的配送服务的激增预计将推动市场增长。然而,原料成本的波动、保质期短以及政府对食品加工行业的严格监管预计将抑制市场增长。此外,有限的分销渠道和缺乏熟练工人预计将对市场增长构成挑战。然而,食品服务业的不断增长和网上购物的日益普及预计将为未来的市场增长提供丰厚的机会。

Data Bridge Market Research 分析称,罗马尼亚烘焙食品市场规模预计将从 2022 年的 8.7553 亿美元增至 2030 年的 12.4172 亿美元,在 2023 年至 2030 年的预测期内,复合年增长率为 4.7%。对健康营养烘焙产品的需求不断增长,预计将推动市场增长。罗马尼亚烘焙食品市场报告还全面涵盖了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021 (可定制为 2015-2020) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

产品类型(面包、糕点、法式蛋糕、美式甜品等)、产品类别(冷冻、常温/常温、冷藏)、性质(传统和有机)、最终用户(家庭/零售和食品服务业)、分销渠道(线下零售和线上零售) |

|

覆盖国家 |

国家(罗马尼亚) |

|

涵盖的市场参与者 |

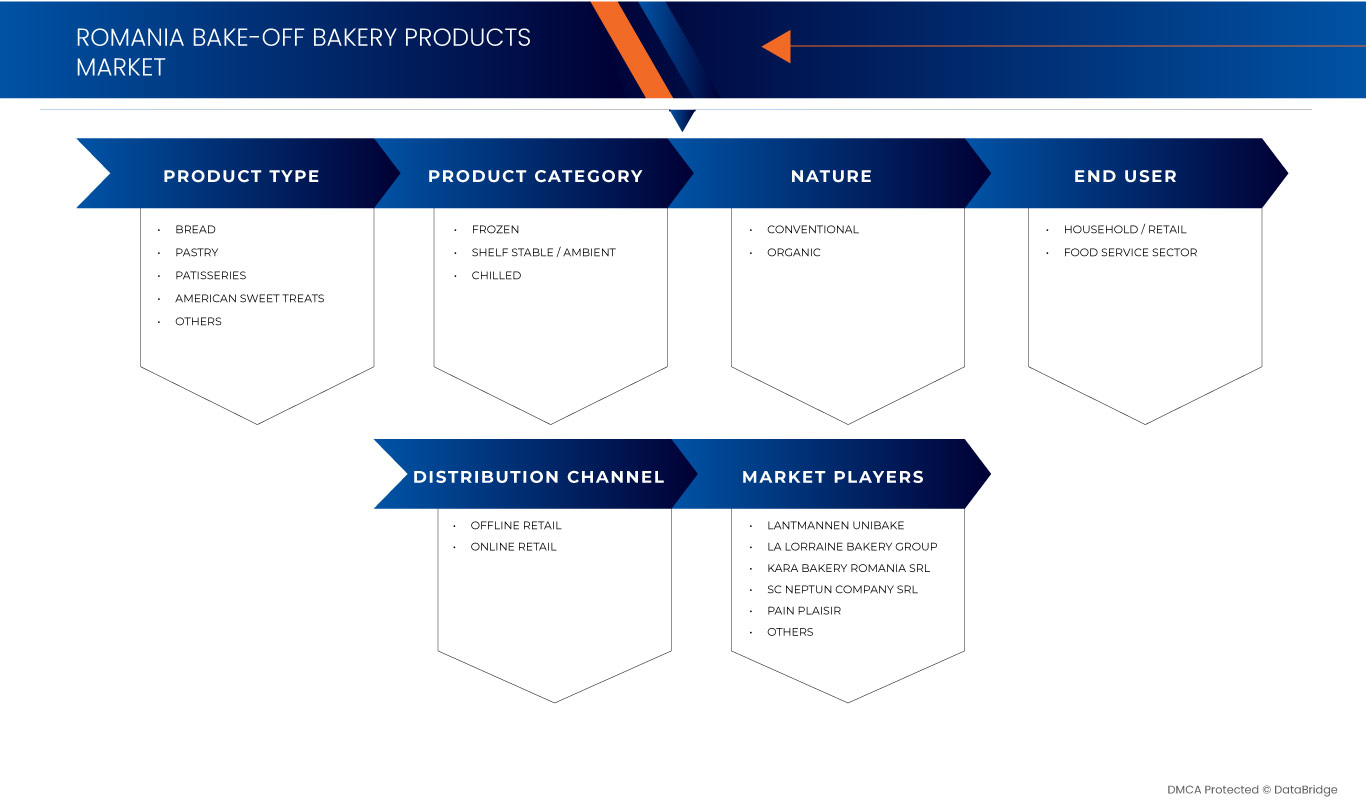

Lantmannen Unibake、La Lorraine Bakery Group、KARAMOLEGOS BAKERY ROMÂNIA SRL、SC Neptun Company SRL、Pain Plaisir、Panemar、Grain Trip Bakery SRL 和 Goodmills |

市场定义

罗马尼亚烘焙大赛面包店是罗马尼亚一家可爱的美食胜地,其灵感来自广受欢迎的烘焙比赛节目。这家美丽的面包店提供各种精美的烘焙食品,如手工面包、糕点、蛋糕和饼干, 均由专业面包师精心制作。罗马尼亚烘焙大赛面包店致力于质量和创新,不仅以其令人惊叹的美食刺激味蕾,还提供了温馨友好的氛围,让顾客可以享受新鲜出炉的美食。

烘焙烘焙产品是指在商业面包房中部分或全部制作完毕后,再运送至另一地点进行最终烘焙或重新加热的烘焙食品。这种方法为烘焙食品的销售和配送提供了更大的便利性和灵活性,同时保持了与新鲜烘焙食品相当的新鲜度和质量。面包和糕点等烘焙食品在面包房中部分烘焙或半烘焙,然后快速冷却,有时甚至冷冻以延长保质期。这些部分制作完毕的产品在需要时运送到零售店或食品服务设施。烘焙烘焙产品使企业能够向消费者提供多种烘焙食品选择,而无需进行大量的现场烘焙,使其成为各种希望提供新鲜美味烘焙食品的食品店的理想选择。

罗马尼亚烘焙大赛烘焙产品市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 对健康营养烘焙产品的需求不断增长

市场正在经历显著增长,这得益于对健康和营养烘焙食品的需求不断增长。罗马尼亚消费者的健康意识越来越强,他们越来越意识到均衡饮食的重要性。消费者偏好的这种转变促使罗马尼亚的烘焙公司不断适应和创新,在烘焙领域提供各种更健康、更有营养的选择。这些产品通常以全麦、低糖和天然成分为特色,迎合了消费者对更健康的烘焙食品的需求。

- 不断创新,推出新口味和新产品

创新新口味和新产品的动力确实是市场增长的强大动力。随着消费者的口味越来越大胆和多样化,罗马尼亚的面包店正在利用这一趋势创造出各种独特而诱人的烘焙产品。这种创新不仅可以吸引消费者,还可以为差异化和市场增长创造机会。

通过推出新颖的口味、配料和产品形式,罗马尼亚的烘焙烘焙店可以满足不断变化的消费者口味和偏好。推出创意产品,例如采用异国情调配料的手工面包或限时季节性口味,可以激发消费者的兴趣并吸引新客户。此外,创新可以提高客户忠诚度,因为消费者更有可能回到始终提供新鲜诱人产品的烘焙店。总体而言,追求口味和产品的创新是推动市场向前发展的动力,推动销售并促进烘焙行业的竞争力。

机会

- 食品服务业蓬勃发展

罗马尼亚食品服务业的蓬勃发展为市场带来了巨大的机遇。随着消费者偏好的演变,餐厅、咖啡馆、酒店和餐饮服务对优质便捷的烘焙食品的需求日益增长。烘焙食品以新鲜和易于制作而闻名,完全符合食品服务行业的需求。为这些机构供货的面包店可以满足对各种烘焙食品(包括面包、糕点和特色食品)日益增长的需求,确保食品服务企业能够为客户提供有吸引力且多样化的菜单。

此外,食品服务业的扩张使烘焙烘焙企业能够与这些机构建立长期的合作伙伴关系和合同。通过提供始终如一的质量和定制解决方案,面包店可以成为餐馆和其他食品服务提供商值得信赖的供应商。这不仅可以开辟稳定的收入来源,还可以创造创新和合作的机会,以满足食品服务业的独特需求。总体而言,罗马尼亚不断发展的食品服务业为烘焙烘焙企业扩大市场占有率和增强产品以满足多样化和充满活力的客户群提供了一条有希望的途径。

克制/挑战

- 原料成本价格波动

原料成本波动是市场增长的重大制约因素。烘焙企业严重依赖面粉、糖、黄油和鸡蛋等一系列原材料,这些原料价格的任何波动都会直接影响其生产成本。当原料价格不可预测地上涨时,烘焙企业面临着维持产品稳定定价的挑战,这可能导致利润率下降或需要将增加的成本转嫁给消费者。这可能会导致消费者需求下降,尤其是在经济困难时期,并阻碍烘焙市场的增长。

最新动态

- 2022 年 9 月,GoodMills 推出了 Vitatex 纯素零食混合物,这是一种用于植物汉堡和肉丸以及咸味烘焙和零食馅料的预混料。该预混料由小麦蛋白制成,口感多汁,具有逼真的肉味,可以与水和油混合,然后塑形以便于使用。据 GoodMills 称,消费者想要更多植物基、纯素和素食产品,这种预混料让拥有小吃亭、小酒馆、食堂和其他食品服务提供商的面包师和屠夫可以改变他们的产品

- 2021 年 1 月,Lantmännen Unibake 在波兰投资,并扩大了其位于 Nowa Sol 的面包店的市场。该投资约为 4000 万欧元,旨在加速其在欧洲市场的增长。其中包括一条新的高速快餐生产线、零售包装设备以及现有建筑和仓储能力的扩建。该投资策略通过创造就业机会促进了增长。它还通过供应商和承包商创造了许多新的间接就业机会

罗马尼亚烘焙大赛烘焙产品市场范围

罗马尼亚烘焙食品市场根据产品类型、产品类别、性质、最终用户和分销渠道进行细分。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

产品类型

- 面包

- 糕点

- 糕点

- 美国甜品

- 其他的

根据产品类型,市场分为面包、糕点、法式蛋糕、美式甜食和其他。

产品类别

- 冰冻

- 常温/常温

- 冷藏

根据产品类别, 市场分为冷冻、保质/常温、冷藏。

自然

- 传统的

- 有机的

根据性质,市场分为传统市场和有机市场。

最终用户

- 家居/零售

- 食品服务业

根据最终用户,市场分为家庭/零售和食品服务业。

分销渠道

- 线下零售

- 网上零售

根据分销渠道,市场分为线下零售和线上零售。

竞争格局和罗马尼亚烘焙产品市场份额

罗马尼亚烘焙食品市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资和新市场计划。以上提供的数据点仅与公司对罗马尼亚烘焙食品市场的关注有关。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 PRODUCT TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRIVATE LABEL VS BRAND ANALYSIS

4.1.1 PRIVATE LABEL

4.1.2 BRAND

4.2 PROMOTIONAL ACTIVITIES

4.3 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.4 NEW PRODUCT LAUNCH STRATEGY

4.4.1 LINE EXTENSION

4.4.2 NEW PACKAGING

4.4.3 SUSTAINABLE PACKAGING

4.4.4 CONVENIENT PACKAGING

4.4.5 ATTRACTIVE PACKAGING

4.4.6 RELAUNCHING

4.4.7 NEW FORMULATION

4.5 CONSUMER LEVEL TRENDS

4.5.1 SHOPPING BEHAVIOUR

4.5.2 MEETING CONSUMER REQUIREMENTS

4.6 SUPPLY CHAIN ANALYSIS

4.7 FACTORS INFLUENCING PURCHASING DECISION

4.8 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.9 GROWTH STRATEGIES ADOPTED BY KEY PLAYERS

4.1 IMPACT OF ECONOMIC SLOW DOWN ON THE MARKET

4.10.1 IMPACT ON PRICE

4.10.2 IMPACT ON SUPPLY CHAIN

4.10.3 IMPACT ON SHIPMENT

4.10.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.11 BRAND OUTLOOK

4.12 PRICING ANALYSIS

4.13 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: REGULATIONS

4.13.1 JEL CLASSIFICATION: D18

4.14 FOOD LABELLING REGULATION IN ROMANIA – GENERAL ASPECTS

4.15 ECONOMIC OPERATOR’S OBLIGATIONS REGARDING FOOD LABELING

4.16 PENALTIES APPLICABLE TO INFRINGEMENTS OF FOOD LABELING PROVISIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR HEALTHY AND NUTRITIOUS BAKERY PRODUCTS

5.1.2 INCREASING INNOVATION WITH NEW FLAVOURS AND PRODUCTS IN BAKERY PRODUCTS

5.1.3 GROWING ONLINE MARKETING AND MOBILE APP-BASED DELIVERY SERVICES ACROSS THE COUNTRY

5.2 RESTRAINTS

5.2.1 PRICE FLUCTUATIONS IN THE COST OF INGREDIENTS

5.2.2 SHORT SHELF LIFE OF BAKERY PRODUCTS

5.2.3 SEVERE GOVERNMENT REGULATIONS RELATING TO FOOD PROCESSING INDUSTRY

5.3 OPPORTUNITIES

5.3.1 GROWING FOOD SERVICE SECTOR

5.3.2 INCREASING ACCEPTANCE OF ONLINE SHOPPING

5.4 CHALLENGES

5.4.1 LIMITED DISTRIBUTION CHANNELS

5.4.2 DEFICIENCY OF SKILLED WORKERS

6 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 BREAD

6.2.1 BY TYPE

6.2.1.1 WHITE

6.2.1.2 BROWN

6.2.2 BY FORM

6.2.2.1 LOAF BREAD

6.2.2.2 BAGUETTE

6.2.2.3 SMALL BREAD

6.3 PASTRY

6.3.1 BY CATEGORY

6.3.1.1 VIENNOISERIE

6.3.1.2 PUFF

6.3.1.3 DANISH

6.4 PATISSERIES

6.4.1 TARTS & PIES

6.4.2 CAKES

6.5 AMERICAN SWEET TREATS

6.5.1 COOKIES

6.5.2 MUFFINS

6.5.3 BROWNIES

6.5.4 DONUTS

6.5.5 OTHERS

6.6 OTHERS

7 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

7.1 OVERVIEW

7.2 FROZEN

7.3 SHELF STABLE / AMBIENT

7.4 CHILLED

8 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET, BY NATURE

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 ORGANIC

9 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET, BY END USER

9.1 OVERVIEW

9.2 HOUSEHOLD / RETAIL

9.3 FOOD SERVICE SECTOR

9.3.1 BY CATEGORY

9.3.1.1 RESTAURANTS

9.3.1.2 HOTELS

9.3.1.3 CAFES

9.3.1.4 COFFEE SHOPS

9.3.1.5 BAKERY CHAINS

9.3.1.6 OTHERS

10 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE RETAIL

10.2.1 BY TYPE

10.2.1.1 CONVENIENCE

10.2.1.2 SUPERMARKETS/HYPERMARKETS

10.2.1.3 SPECIALTY STORES

10.2.1.4 GROCERY STORES

10.2.1.5 OTHERS

10.3 ONLINE RETAIL

10.3.1 BY TYPE

10.3.1.1 E-COMMERCE WEBSITES

10.3.1.2 COMPANY OWNED WEBSITES

11 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ROMANIA

12 SWOT ANALYSIS

13 COMPANY PROFILING

13.1 LANTMANNEN UNIBAKE

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 LA LORRAINE BAKERY GROUP

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 KARAMOLEGOS BAKERY ROMÂNIA SRL

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT DEVELOPMENT

13.4 SC NEPTUN COMPANY SRL

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENT

13.5 PAIN PLAISIR

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENTS

13.6 GOODMILLS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 GRAIN TRIP BAKERY SRL

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCTS PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 PANEMAR

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 ROMANIA BREAD IN BAKE-OFF BAKERY PRODUCTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 ROMANIA BREAD IN BAKE-OFF BAKERY PRODUCTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 4 ROMANIA PASTRY IN BAKE-OFF BAKERY PRODUCTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 5 ROMANIA PATISSERIES IN BAKE-OFF BAKERY PRODUCTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 ROMANIA AMERICAN SWEET TREATS IN BAKE-OFF BAKERY PRODUCTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 8 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 9 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 10 ROMANIA FOOD SERVICE SECTOR IN BAKE-OFF BAKERY PRODUCTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 11 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 12 ROMANIA OFFLINE RETAIL IN BAKE-OFF BAKERY PRODUCTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 ROMANIA ONLINE RETAIL IN BAKE-OFF BAKERY PRODUCTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 ROMANIA BAKED-OFF BAKERY PRODUCTS MARKET: SEGMENTATION

FIGURE 2 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: DATA TRIANGULATION

FIGURE 3 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: DROC ANALYSIS

FIGURE 4 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: MULTIVARIATE MODELLING

FIGURE 11 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: PRODUCT TYPE TIMELINE CURVE

FIGURE 12 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: SEGMENTATION

FIGURE 13 INCREASING INNOVATION WITH NEW FLAVOURS IN BAKERY PRODUCT IS EXPECTED TO DRIVE ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 BREAD IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET IN 2023 TO 2030

FIGURE 15 VARIOUS PROMOTIONAL ACTIVITIES

FIGURE 16 CONSUMER SPENDING OF ROMANIA IN USD MILLION

FIGURE 17 SHOPPING BEHAVIOUR OF BAKERY PRODUCTS IN ROMANIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET

FIGURE 19 BREAD & BAKERY GOODS PRODUCTION IN ROMANIA (USD BILLION)

FIGURE 20 NEW FLAVOURS AND INGREDIENTS

FIGURE 21 FREQUENCY OF BUYING BREAD AND BAKERY PRODUCTS DURING THE PANDEMIC AS COMPARED TO THE PRE-COVID-19 PERIOD AS PER COUNTIES (BN: BISTRITA-NASAUD, BH: BIHOR, CJ: CLUJ, MM: MARAMURES, SM: SATU-MARE, SJ: SALAJ)

FIGURE 22 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: BY PRODUCT TYPE, 2022

FIGURE 23 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: BY PRODUCT CATEGORY, 2022

FIGURE 24 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: BY NATURE, 2022

FIGURE 25 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: BY END USER, 2022

FIGURE 26 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 27 ROMANIA BAKE-OFF BAKERY PRODUCTS MARKET: COMPANY SHARE 2022 (%)

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.