Global Fdm Composite Large Size Tooling Market

市场规模(十亿美元)

CAGR :

%

| 2024 –2031 | |

| USD 334.80 Million | |

| USD 442.01 Million | |

|

|

|

>全球 FDM 复合材料大尺寸模具市场细分,按材料碳纤维、玻璃纤维、金属合金、硅橡胶等)、最终用户(航空航天和航空、汽车工业、可再生能源、电气和电子、建筑和施工、医疗等)– 行业趋势和预测到 2031 年。

全球 FDM 复合材料大尺寸模具市场分析

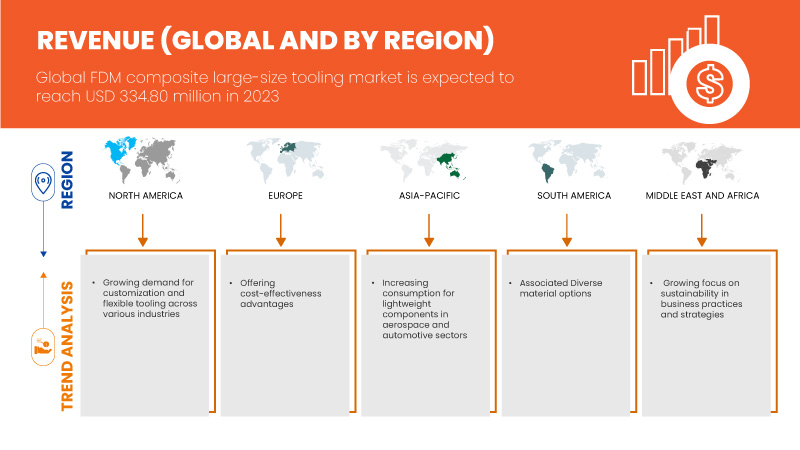

航空航天和汽车行业对轻型部件的消费不断增加,推动了市场的增长。商业实践和战略中对可持续性的日益关注为市场提供了机遇。此外,相关的多样化材料选择也推动了市场的增长。

全球 FDM 复合材料大尺寸模具市场规模

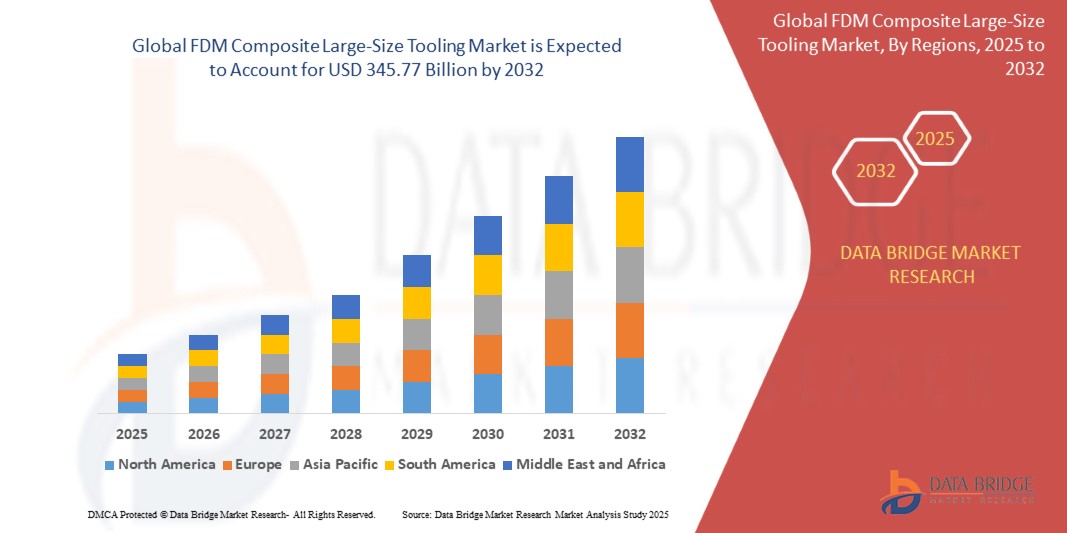

全球 FDM 复合材料大尺寸模具市场预计将从 2023 年的 3.348 亿美元增至 2031 年的 4.4201 亿美元,在 2024 年至 2031 年的预测期内,复合年增长率将达到 3.6%。

全球 FDM 复合材料大尺寸模具市场趋势

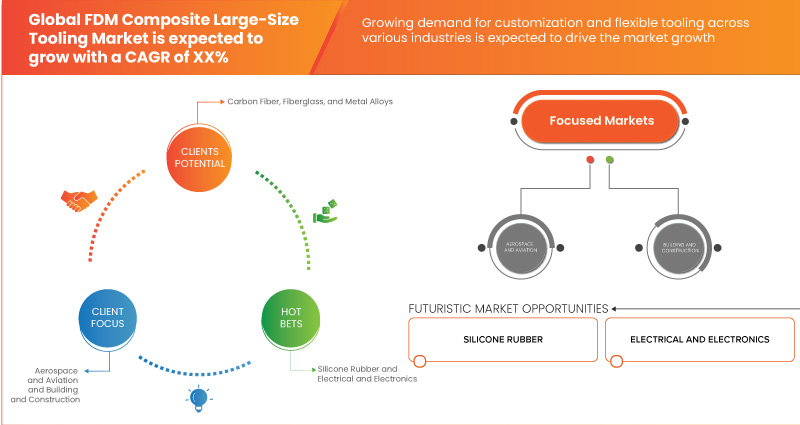

“各行业对定制和灵活工具的需求日益增长”

医疗保健、汽车和航空航天等各个行业对定制和灵活工具的需求不断增长,影响了全球 FDM 复合材料大尺寸工具市场。航空航天、汽车、消费品和医疗保健等行业对定制和复杂零件的需求不断增长。这些行业需要能够处理复杂几何形状和特定设计要求的工具解决方案。传统的制造方法往往在灵活性和速度方面不足,导致布里格斯汽车公司、特斯拉、凯迪拉克等汽车公司寻求提供更大适应性的替代方案。FDM 技术能够逐层创建复杂的形状和结构,提供了引人注目的解决方案。它允许快速原型设计和生产定制工具,这对于满足现代制造应用的各种需求至关重要,既适用于小型工具(例如医疗保健设备面标),也适用于大型工具(例如飞机的各个部件、定位控制台和车辆的车身结构)。这种灵活性对于需要频繁更改工具设计或涉及小批量、高混合生产的行业特别有益。

此外,大规模定制(根据个别客户规格定制产品)的趋势正在扩大 FDM 复合材料大尺寸模具的范围。随着企业努力提供个性化产品,对适应性强、可重构模具解决方案的需求不断增长。FDM 技术通过实现高精度和高效率的定制模具和工具生产来满足这一需求。快速迭代设计和生产小批量定制模具的能力支持了更加个性化的消费产品趋势。

报告范围和全球 FDM 复合大尺寸模具市场细分

|

报告指标 |

细节 |

|

分割 |

按材料分类-碳纤维、玻璃纤维、金属合金、硅橡胶等 按最终用户分类- 航空航天、汽车工业、可再生能源、电气电子、建筑、医疗等 |

|

覆盖国家 |

美国、加拿大、墨西哥、中国、日本、印度、韩国、新加坡、印度尼西亚、泰国、菲律宾、澳大利亚和新西兰、马来西亚、亚太其他地区、德国、意大利、英国、法国、西班牙、土耳其、俄罗斯、瑞士、比利时、荷兰、欧洲其他地区、巴西、阿根廷、南美洲其他地区、阿联酋、沙特阿拉伯、南非、科威特以及中东和非洲其他地区 |

|

主要市场参与者 |

Startasys(美国)、Airtech Advanced Materials Group(美国)和 Proto3000(加拿大) |

|

市场机会 |

|

|

增值数据信息集 |

除了对市场价值、增长率、细分、地理覆盖范围和主要参与者等市场情景的见解之外,Data Bridge Market Research 策划的市场报告还包括深入的专家分析、按地理位置表示的公司生产和产能、分销商和合作伙伴的网络布局、详细和更新的价格趋势分析以及供应链和需求的赤字分析。 |

全球 FDM 复合大尺寸模具市场定义

FDM 复合材料大尺寸模具是指使用熔融沉积成型 (FDM) 技术制造的用于生产大型部件的复合材料模具。FDM 是一种增材制造工艺,通过逐层挤压材料来构建部件。当与碳纤维或玻璃纤维增强聚合物等复合材料结合使用时,它可以增强模具的强度和耐用性。这种方法可以创建复杂的几何形状和结构,这些几何形状和结构通常重量轻但坚固耐用。FDM 复合材料大尺寸模具通常用于航空航天、汽车和制造业等需要高性能和高精度的行业。

全球 FDM 复合材料大尺寸模具市场动态

驱动程序

- 提供成本效益优势

熔融沉积成型 (FDM) 技术的成本效益是推动全球 FDM 复合材料大尺寸模具市场发展的重要因素。FDM 在经济性和效率方面的优势使其成为生产大型模具的有力选择,这反过来又影响了其在航空航天、汽车、医疗保健、消费品等各个行业的广泛采用。FDM 技术的主要成本效益之一是它能够通过减少材料浪费来降低生产成本。与通常涉及减材工艺的传统制造方法不同,FDM 是一种增材制造技术,其中材料逐层沉积。这种方法最大限度地减少了浪费,因为材料只在需要构建零件的地方使用。它通过快速生产原型和模具来节省成本。传统的模具方法可能耗时且昂贵,尤其是在需要多次迭代或定制设计时。FDM 创建和修改模具的快速周转时间允许更快的设计迭代和更短的开发周期。这种快速成型能力减少了与传统工具工艺相关的准备时间和成本,使其成为希望加快生产时间表的公司合适的选择。

- 航空航天和汽车行业对轻量化部件的消耗不断增加

航空航天和汽车行业越来越重视轻型部件,以提高性能、燃油效率和整体功能。对轻型部件的这种不断增长的需求极大地影响了全球 FDM 复合材料大尺寸模具市场,推动了先进制造技术的创新和采用。在航空航天领域,轻型部件对于提高燃油效率和降低运营成本至关重要。飞机制造商寻求具有高强度重量比的材料来降低飞机的总重量,这直接意味着降低油耗和增加有效载荷能力。碳纤维和玻璃纤维等复合材料因其优异的强度和轻质特性而被广泛使用。支持使用复合长丝的熔融沉积成型 (FDM) 技术越来越多地被用于生产可容纳这些先进材料的大尺寸模具。FDM 使用复合材料制造复杂、大型工具的能力与航空航天业对其部件的精密和轻量化特性的需求完美契合。同样,汽车行业正在转向轻型汽车,以提高燃油效率和减少排放。轻质部件(例如由先进复合材料制成的部件)在实现这些目标方面发挥着关键作用。将这些材料整合到汽车零部件和组件中需要专门的工具。FDM 技术提供了一种经济高效且灵活的解决方案,用于生产能够处理复合材料复杂性的大型工具。该技术允许快速原型设计和迭代设计更改,这在快节奏的汽车行业中至关重要,因为创新和上市时间至关重要。

例如,2024 年 6 月,根据 AIP Precision 上发表的一篇博客,FDM 技术因其设计自由度和减轻重量的能力而在航空航天领域制造复杂部件方面发挥着重要作用。这一优势支持生产复杂而轻巧的部件。

机会

- 商业实践和战略越来越注重可持续性

当前,全球环保意识不断增强,人们越来越倾向于采用环保制造实践,旨在减少浪费、降低碳排放、鼓励使用再生材料,这为全球 FDM 复合材料大尺寸模具市场提供了重要机遇。

FDM 技术使用热塑性聚合物逐层构建零件,非常适合利用这一趋势实现可持续发展。FDM 技术使用回收的热塑性材料,例如高密度聚乙烯 (HDPE)、聚乳酸 (PLA)、聚对苯二甲酸乙二醇酯 (PET)、聚丙烯 (PP) 和丙烯腈丁二烯苯乙烯 (ABS),为可持续发展创造了显著的机会。将这些废料转化为 3D 打印细丝,制造商可以显著减少对原始资源的依赖并减少垃圾填埋。这种回收策略不仅支持全球可持续发展目标,而且还带来经济效益,包括降低原材料费用和提高总体成本效率。

FDM 技术的进步通过将各种添加剂和填料整合到回收的长丝中,增强了这一机会。这些改进提高了 3D 打印部件的机械性能和性能,促进了高质量、耐用部件的生产,并促进了制造过程中的可持续性和资源效率。

例如,根据 Elsevier BV 发表的一篇文章,加入天然纤维、生物炭和其他先进材料可以显著提高 3D 打印部件的机械性能,有效解决与耐用性和性能相关的问题。这些创新使得能够制造出高质量、结构坚固的部件,满足各种工程应用的严格要求。

- 与智能工业4.0集成,增强智能技术应用

熔融沉积成型 (FDM) 打印机的数字化为通过智能增材制造推进复合材料模具提供了重大机遇。将智能技术集成到 FDM 工艺中可提高生产复杂模具组件的效率、精度和质量。FDM 中的智能技术可以持续监控打印过程并自动纠正缺陷,这对于精度至关重要的复合材料模具尤其重要。先进的监控系统可以主动检测和解决问题,减少材料浪费并提高模具组件的整体质量。此外,可以使用人工智能 (AI) 工具来处理这些数据并实时调整打印过程,确保一致的材料特性和层粘合。该闭环系统可以显著提高由 FDM 技术生产的大型复合材料工具的质量和可靠性,最大限度地减少内部空隙等缺陷并确保批次间的一致性。使用 FDM 技术生产大型航空航天部件的公司可以实施这种智能制造方法。集成人工智能驱动的预测性维护系统还可以预见潜在的设备故障,从而减少停机时间并保持高生产效率。通过发展成为闭环、可租赁性更高的大规模生产流程,FDM 技术可以实现先进制造业中大规模模具应用所需的精度和可靠性。

此外,将数字控制和反馈机制集成到 FDM 打印机中,可以生产具有详细设计和规格的复杂复合部件。这与向智能制造和工业的广泛转变相一致,将 FDM 技术定位为高性能复合工具发展的关键参与者。

限制/挑战

- 结构完整性不足影响性能和安全性

熔融沉积成型 (FDM) 复合材料大尺寸模具缺乏结构完整性,严重制约了全球 FDM 复合材料大尺寸模具市场的发展。这一问题影响模具解决方案的有效性和可靠性,影响其在医疗保健、消费品等各个行业的采用和性能。导致结构完整性问题的另一个方面是打印模具中可能存在空隙或间隙。FDM 技术(主要在生产大型部件时)有时会导致模具内部出现空隙或填充不完整,从而削弱其强度和稳定性。这些缺陷会导致承载能力下降,并增加变形或断裂的敏感性。此外,FDM 的低分辨率可能导致层粘合不充分,从而导致模具内出现薄弱点。粗糙纹理和可见层线等表面缺陷可能会损害功能和美观,而尺寸不准确会影响模具的配合度和性能。

此外,FDM 打印工具的后处理也会影响其结构完整性。通常需要使用打磨、机械加工或涂层等技术来实现最终规格和表面光洁度。后处理不充分会留下残余应力或缺陷,从而影响工具的整体强度和功能。

- 后处理要求对于最终产品至关重要

在全球 FDM 复合材料大尺寸模具市场中,后处理要求是一项重大挑战。虽然 FDM 技术具有许多优势,包括快速成型和经济高效的制造,但需要进行大量的后处理可能会削弱其中一些优势,尤其是在大尺寸模具应用中。

FDM 技术通过分层材料来构建零件,这可能会导致表面缺陷、可见的层线和残余应力,必须进行纠正才能达到质量标准。这对于复合材料模具来说尤其重要,因为高精度和耐用性至关重要。后处理步骤(包括打磨、机械加工和表面精加工)通常是必要的,以改进最终产品、增强其外观并改善其机械性能。这些额外的过程对于解决 FDM 打印过程的缺陷至关重要,可确保模具组件既能发挥作用,又符合严格的规格。

对于大型模具,后处理变得越来越复杂,需要使用各种资源。这些零件的尺寸通常需要额外的人工和专用设备,这会导致更高的生产时间和成本。此外,确保大型部件的质量一致性可能很困难,因为后处理的不一致可能会影响模具的整体性能和可靠性。

此外,精确的后处理要求使得保持通常与 FDM 技术相关的效率提升的任务变得复杂。后处理所花费的时间和费用可能会削弱快速生产的一些优势,尤其是对于大型和复杂的工具组件而言,精加工至关重要。

本市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入领域的机会、市场法规的变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新。如需获取更多市场信息,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您做出明智的市场决策,实现市场增长。

原材料短缺和运输延误的影响和当前市场状况

Data Bridge Market Research 提供高水平的市场分析,并通过考虑原材料短缺和运输延误的影响和当前市场环境来提供信息。这意味着评估战略可能性、制定有效的行动计划并协助企业做出重要决策。

除了标准报告外,我们还提供从预测的运输延迟、按区域划分的分销商映射、商品分析、生产分析、价格映射趋势、采购、类别绩效分析、供应链风险管理解决方案、高级基准测试等角度对采购层面的深入分析,以及其他采购和战略支持服务。

经济放缓对产品定价和供应的预期影响

当经济活动放缓时,行业开始受到影响。DBMR 提供的市场洞察报告和情报服务考虑了经济衰退对产品定价和可获得性的预测影响。借助这些,我们的客户通常可以领先竞争对手一步,预测他们的销售额和收入,并估算他们的盈亏支出。

全球 FDM 复合材料大尺寸模具市场范围

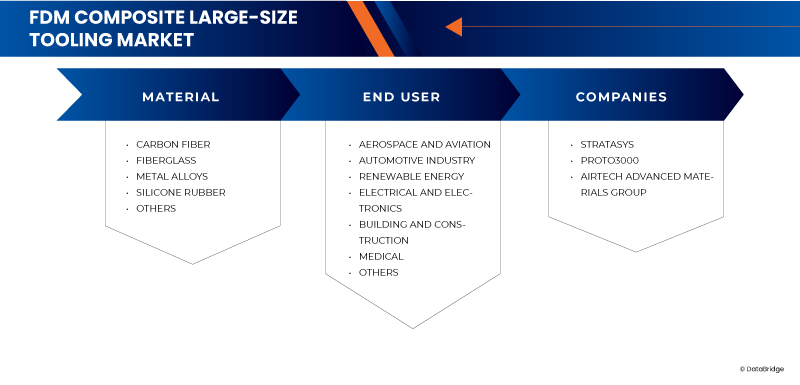

根据材料和最终用户,市场分为两个显著的部分。这些部分之间的增长将帮助您分析行业中微弱的增长部分,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

材料

- 碳纤维

- 玻璃纤维

- 金属合金

- 硅橡胶

- 其他的

终端用户

- 航空航天

- 汽车工业

- 可再生能源

- 电气和电子产品

- 建筑和施工

- 医疗的

- 其他的

全球 FDM 复合大尺寸模具市场区域分析

对市场进行了分析,并根据上述材料和最终用户提供了市场规模洞察和趋势。

市场覆盖的国家包括美国、加拿大、墨西哥、中国、日本、印度、韩国、新加坡、印度尼西亚、泰国、菲律宾、澳大利亚和新西兰、马来西亚、亚太其他地区、德国、意大利、英国、法国、西班牙、土耳其、俄罗斯、瑞士、比利时、荷兰、欧洲其他地区、巴西、阿根廷、南美洲其他地区、阿联酋、沙特阿拉伯、南非、科威特以及中东和非洲其他地区。

亚太地区将在全球 FDM 复合材料大尺寸模具 市场中占据主导地位并成为增长最快的地区,因为其拥有完善的基础设施、先进的加工技术以及与其他地区相比更高的行业投资水平,预计将进一步推动市场的增长。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化影响了市场的当前和未来趋势。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测单个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

全球 FDM 复合材料大尺寸模具市场份额

市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对市场的关注有关。

全球 FDM 复合大尺寸模具市场领导者包括:

- Startasys。(美国)

- Airtech 先进材料集团(美国)

- Proto3000(加拿大)

全球 FDM 复合材料大尺寸模具市场的最新发展

- 2024 年 7 月,Stratasys 凭借其在环境可持续性方面的领导地位,在 AMGTA 2024 年度峰会上获得了四项可持续发展表彰奖。这些奖项表彰了 Stratasys 保持 ISO 14001 EMS 认证、卓越的可持续发展报告、环境可持续性研究以及在全球范围内推进可持续制造实践,展示了其对正念制造方法的承诺

- 2024 年 6 月,Stratasys 和 AM Craft 宣布建立合作伙伴关系,以扩大经飞行认证的 3D 打印部件在航空领域的使用。Stratasys 对 AM Craft 进行了战略投资,该公司拥有 EASA 第 21G 部分生产组织批准,能够以经济高效的方式生产认证部件。此次合作旨在增强供应链解决方案并满足不断增长的行业需求

- 2023 年 12 月,Stratasys 凭借其基于 PolyJet 的 J5 DentaJet、J5 MediJet 和 J850 数字解剖 3D 打印机荣获医疗、牙科或医疗保健应用类别的 3D 打印行业奖。此外,Stratasys 在 2023 年颁奖典礼上获得了年度公司(企业)荣誉提名,Neo450 系列获得了年度企业 3D 打印机(聚合物)荣誉提名

- 2023 年 12 月,Stratasys Ltd. 与 NOCTI 合作推出首个熔融沉积成型 (FDM) 工艺认证,由 NOCTI 认证。该认证可确保学生和专业人士获得行业认可的增材制造技能。它还帮助学校获得资金来扩展其增材制造课程,为快速发展的领域培养下一代专家

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 BARGAINING POWER OF SUPPLIER

4.1.5 COMPETITIVE RIVALRY

4.2 PRODUCTION CONSUMPTION ANALYSIS

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 OVERVIEW

4.3.2 LOGISTIC COST SCENARIO

4.3.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR CUSTOMIZATION AND FLEXIBLE TOOLING ACROSS VARIOUS INDUSTRIES

6.1.2 OFFERING COST-EFFECTIVENESS ADVANTAGES

6.1.3 INCREASING CONSUMPTION FOR LIGHTWEIGHT COMPONENTS IN AEROSPACE AND AUTOMOTIVE SECTORS

6.1.4 ASSOCIATED DIVERSE MATERIAL OPTIONS

6.2 RESTRAINT

6.2.1 INSUFFICIENT STRUCTURAL INTEGRITY COMPROMISING PERFORMANCE AND SAFETY

6.3 OPPORTUNITIES

6.3.1 GROWING FOCUS ON SUSTAINABILITY IN BUSINESS PRACTICES AND STRATEGIES

6.3.2 INTEGRATION WITH SMART INDUSTRY 4.O FOR ENHANCED SMART TECHNOLOGY APPLICATIONS

6.4 CHALLENGES

6.4.1 POST-PROCESSING REQUIREMENTS ARE ESSENTIAL FOR FINALIZING THE PRODUCT

6.4.2 MATERIAL LIMITATIONS ASSOCIATED WITH FDM TECHNOLOGY

7 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 CARBON FIBER

7.3 FIBERGLASS

7.4 METAL ALLOYS

7.5 SILICONE RUBBER

7.6 OTHERS

8 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER

8.1 OVERVIEW

8.2 AEROSPACE AND AVIATION

8.3 AUTOMOTIVE INDUSTRY

8.4 RENEWABLE ENERGY

8.5 ELECTRICAL AND ELECTRONICS

8.6 BUILDING AND CONSTRUCTION

8.7 MEDICAL

8.8 OTHERS

9 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA-PACIFIC

9.2.1 CHINA

9.2.2 JAPAN

9.2.3 INDIA

9.2.4 SOUTH KOREA

9.2.5 SINGAPORE

9.2.6 INDONESIA

9.2.7 THAILAND

9.2.8 PHILIPPINES

9.2.9 AUSTRALIA & NEW ZEALAND

9.2.10 MALAYSIA

9.2.11 REST OF ASIA-PACIFIC

9.3 EUROPE

9.3.1 GERMANY

9.3.2 ITALY

9.3.3 U.K.

9.3.4 FRANCE

9.3.5 SPAIN

9.3.6 TURKEY

9.3.7 RUSSIA

9.3.8 SWITZERLAND

9.3.9 BELGIUM

9.3.10 NETHERLANDS

9.3.11 REST OF EUROPE

9.4 NORTH AMERICA

9.4.1 U.S.

9.4.2 CANADA

9.4.3 MEXICO

9.5 SOUTH AMERICA

9.5.1 BRAZIL

9.5.2 ARGENTINA

9.5.3 REST OF SOUTH AMERICA

9.6 MIDDLE EAST AND AFRICA

9.6.1 SOUTH AFRICA

9.6.2 SAUDI ARABIA

9.6.3 U.A.E.

9.6.4 KUWAIT

9.6.5 REST OF MIDDLE EAST AND AFRICA

10 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: EUROPE

10.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 STARTASYS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 AIRTECH ADVANCED MATERIALS GROUP

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT UPDATES

12.3 PROTO3000

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

表格列表

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 3 GLOBAL CARBON FIBER IN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 4 GLOBAL FIBERGLASS IN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 5 GLOBAL METAL ALLOYS IN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 6 GLOBAL SILICONE RUBBER IN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 7 GLOBAL OTHERS IN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER 2022-2031 (USD THOUSAND)

TABLE 9 GLOBAL AEROSPACE AND AVIATION IN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 GLOBAL AUTOMOTIVE INDUSTRY IN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 11 GLOBAL RENEWABLE ENERGY IN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 GLOBAL ELECTRICAL AND ELECTRONICS IN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 13 GLOBAL BUILDING AND CONSTRUCTION IN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 14 GLOBAL MEDICAL SEGMENT IN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 GLOBAL OTHERS IN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 16 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 20 CHINA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 21 CHINA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 22 JAPAN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 23 JAPAN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 24 INDIA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 25 INDIA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 26 SOUTH KOREA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 27 SOUTH KOREA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 28 SINGAPORE FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 29 SINGAPORE FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 30 INDONESIA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 31 INDONESIA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 32 THAILAND FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 33 THAILAND FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 34 PHILIPPINES FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 35 PHILIPPINES FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 36 AUSTRALIA & NEW ZEALAND FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 37 AUSTRALIA & NEW ZEALAND FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 38 MALAYSIA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 39 MALAYSIA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 40 REST OF ASIA-PACIFIC FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 41 EUROPE FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 42 EUROPE FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 43 EUROPE FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 44 GERMANY FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 45 GERMANY FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 46 ITALY FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 47 ITALY FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 48 U.K. FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 49 U.K. FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 50 FRANCE FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 51 FRANCE FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 52 SPAIN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 53 SPAIN FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 54 TURKEY FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 55 TURKEY FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 56 RUSSIA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 57 RUSSIA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 58 SWITZERLAND FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 59 SWITZERLAND FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 60 BELGIUM FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 61 BELGIUM FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 62 NETHERLANDS FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 63 NETHERLANDS FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 64 REST OF EUROPE FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 65 NORTH AMERICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 66 NORTH AMERICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 67 NORTH AMERICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 68 U.S. FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 69 U.S. FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 70 CANADA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 71 CANADA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 72 MEXICO FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 73 MEXICO FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 74 SOUTH AMERICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 75 SOUTH AMERICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 76 SOUTH AMERICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 77 BRAZIL FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 78 BRAZIL FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 79 ARGENTINA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 80 ARGENTINA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 81 REST OF SOUTH AMERICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 85 SOUTH AFRICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 86 SOUTH AFRICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 87 SAUDI ARABIA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 88 SAUDI ARABIA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 89 U.A.E. FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 90 U.A.E. FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 91 KUWAIT FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 92 KUWAIT FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2022-2031 (USD THOUSAND)

TABLE 93 REST OF MIDDLE EAST AND AFRICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

图片列表

FIGURE 1 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET

FIGURE 2 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET: SEGMENTATION

FIGURE 11 FIVE SEGMENTS COMPRISE THE GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL

FIGURE 12 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET: EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 ASIA PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 GROWING DEMAND FOR CUSTOMIZATION AND FLEXIBLE TOOLING ACROSS VARIOUS INDUSTRIES IS EXPECTED TO DRIVE THE GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET IN THE FORECAST PERIOD

FIGURE 16 THE CARBON FIBER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET IN 2024 AND 2031

FIGURE 17 ASIA PACIFIC IS THE FASTEST-GROWING MARKET FOR GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET IN THE FORECAST PERIOD

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 PRODUCTION CONSUMPTION ANALYSIS: GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET

FIGURE 21 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY MATERIAL, 2023

FIGURE 22 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET, BY END-USER, 2023

FIGURE 23 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET: SNAPSHOT (2023)

FIGURE 24 ASIA-PACIFIC FDM COMPOSITE LARGE-SIZE TOOLING MARKET: SNAPSHOT (2023)

FIGURE 25 EUROPE FDM COMPOSITE LARGE-SIZE TOOLING MARKET: SNAPSHOT (2023)2022

FIGURE 26 NORTH AMERICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET: SNAPSHOT

FIGURE 27 SOUTH AMERICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET: SNAPSHOT (2023)

FIGURE 28 MIDDLE EAST AND AFRICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET: SNAPSHOT (2023)

FIGURE 29 GLOBAL FDM COMPOSITE LARGE-SIZE TOOLING MARKET: COMPANY SHARE 2023 (%)

FIGURE 30 EUROPE FDM COMPOSITE LARGE-SIZE TOOLING MARKET: COMPANY SHARE 2023 (%)

FIGURE 31 ASIA-PACIFIC FDM COMPOSITE LARGE-SIZE TOOLING MARKET: COMPANY SHARE 2023 (%)

FIGURE 32 NORTH AMERICA FDM COMPOSITE LARGE-SIZE TOOLING MARKET: COMPANY SHARE 2023 (%)

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.