Global Amino Acids Premix For Feed Market

市场规模(十亿美元)

CAGR :

%

| 2022 –2029 | |

| USD 1.20 Billion | |

| USD 3.01 Billion | |

|

|

|

>全球饲料用氨基酸预混料市场按来源(植物基、动物基)、类型(L-赖氨酸、L-牛磺酸)、最终用途(反刍动物、家禽、猪、水产、马、医疗保健、动物饲料、食品工业和其他)、分销渠道(大卖场、药店、超市、网上商店)划分 - 行业趋势和预测至 2029 年

市场分析和规模

饲料预混料在改善饲料添加剂和饲料特性方面起着至关重要的作用。饲料预混料还可以增强动物的免疫系统和生殖系统,提高其新陈代谢,从而使动物受益。“预混料”一词是指维生素、微量矿物质、抗生素、饲料补充剂和稀释剂。

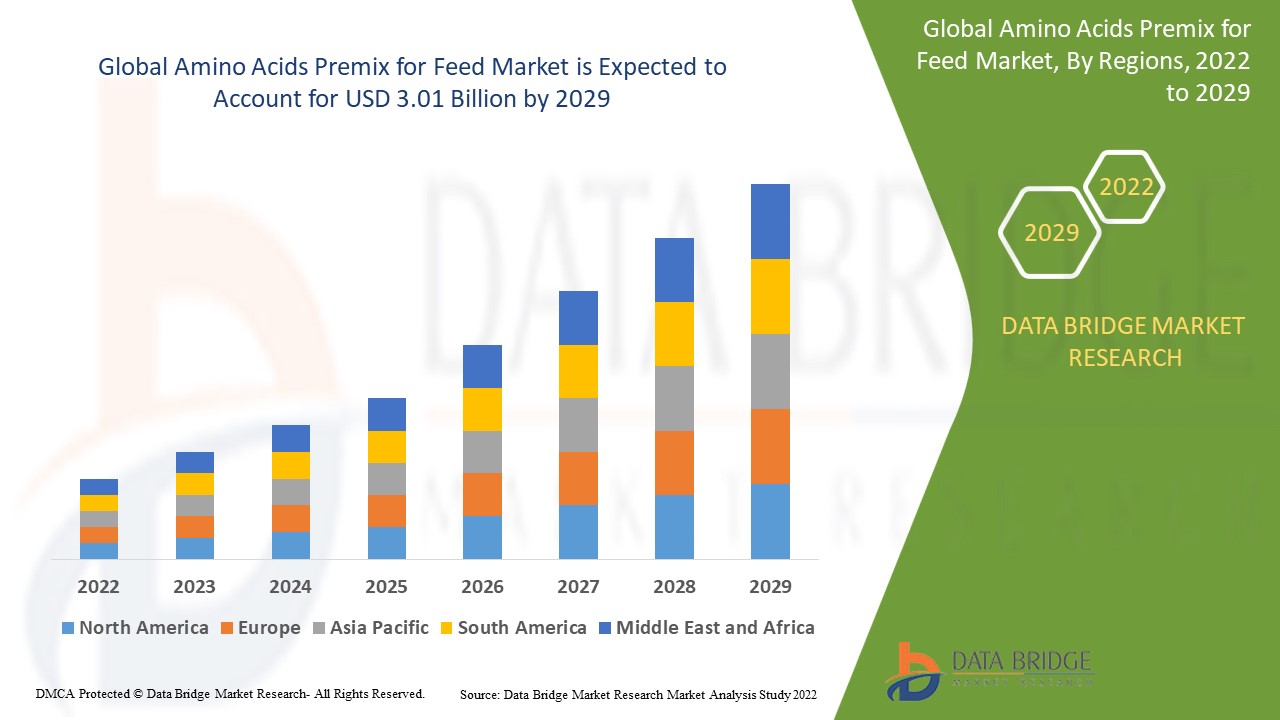

Data Bridge Market Research 分析,饲料用氨基酸预混料市场在 2021 年的价值为 12 亿美元,预计到 2029 年将达到 30.1 亿美元,在 2022 年至 2029 年的预测期内复合年增长率为 12.2%。

市场定义

氨基酸在健康营养,尤其是肠外营养中非常重要。氨基酸经常作为膳食补充剂用于动物饲料中。氨基酸用作动物饲料可提高代谢率,并为牛、肉鸡和猪等动物提供营养。此外,饲料氨基酸有助于动物的健康、繁殖和哺乳。

报告范围和市场细分

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(单位:十亿美元)、销量(单位:台)、定价(美元) |

|

涵盖的领域 |

来源(植物性、动物性)、类型(L-赖氨酸、L-牛磺酸)最终用途(反刍动物、家禽、猪、水产、马、医疗保健、动物饲料和其他)、分销渠道(大卖场、药店、超市、网上商店) |

|

覆盖国家 |

美国、加拿大、北美的墨西哥、德国、波兰、爱尔兰、意大利、英国、法国、西班牙、荷兰、比利时、瑞士、土耳其、俄罗斯、欧洲其他地区(欧洲)、日本、中国、印度、韩国、新西兰、越南、澳大利亚、新加坡、马来西亚、泰国、印度尼西亚、菲律宾、亚太地区(APAC)其他地区(亚太地区)、巴西、阿根廷、智利、南美洲其他地区(南美洲)、阿联酋、沙特阿拉伯、埃及、科威特、南非、中东和非洲(MEA)其他地区(中东和非洲(MEA)) |

|

涵盖的市场参与者 |

Dow (US), BASF SE (Germany), Chr. Hansen Holding A/S (Denmark), DSM (Netherlands), DuPont (US), Evonik Industries AG (Germany), NOVUS INTERNATIONAL (USA), Alltech (US), Associated British Foods plc (UK), Charoen Pokphand Foods PCL (Thailand), Cargill, Incorporated (US), Nutreco (Netherlands), ForFarmers. (Netherlands), De Heus Animal Nutrition (Netherlands), Land O'Lakes (US), Kent Nutrition Group (US), J. D. HEISKELL & CO. (US), Perdue Farms (US), SunOpta (Canada), Scratch and Peck Feeds (US), De Heus Animal Nutrition (Netherlands), MEGAMIX (Russia), Agrofeed (Hungary) |

|

Opportunities |

|

Amino Acids Premix for Feed Market Dynamics

Drivers

- Growing focus on the animal health

Increased emphasis on animal health will also drive market growth. Increased cattle farming is likely to increase demand for amino acids premix for feed. Humans' increasing demand for animal-based products will drive up market demand. Proponents of natural growth are expected to be active in the market as their momentum grows. Increasing consumer responsiveness of the benefits of using feed additives to reduce disease has fuelled the market's demand.

- Increasing demand for organic meat

Food safety concerns have increased the demand for high-quality amino acids premix for feed to ensure meat safety. Another factor driving the growth of the amino acids premix for feed market is the growing awareness among farm owners of maintaining a healthy animal-based diet. As a result, they are transitioning from standard amino acids premix for feed to functional and premium variants that help improve the animals' immunity against enzootic diseases while also lowering the risk of metabolic disorders, acidosis, injuries, and infections.

Furthermore, an increase in demand for organic meat from developed-country consumers and the implementation of new animal rearing practises and the maintenance of high farming standards have created a positive outlook for the industry.

Opportunity

Increasing meat consumption in developing economies such as China, India, and Brazil is expected to drive global demand for the product. Australia is a major pork exporting region and is expected to drive product demand over the forecast period.

Restraints

High raw material prices and a rising number of restrictions and regulatory bans will serve as market restraints on the expansion of amino acids premix for feed. Less product awareness will restrain further challenging the growth of the amino acids premix for feed market during the forecast period.

This amino acids premix for feed market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the amino acids premix for feed market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Amino Acids Premix for Feed Market

Agriculture and food production have been identified as critical sectors during the COVID-19 situation. As a result, farmers have continued to ensure that farm animals receive high-quality nutrition in order to feed an increasing number of global consumers. However, the supply chain disruption has become the most significant factor affecting the amino acids premix for feed market. China is a major producer and exporter of amino acids premix for feed, and it stockpiled significant amounts of product during the emergence of the COVID-19 situation while businesses were closed for the lunar new year, which was enough for 2-3 months’ supply. Furthermore, logistics issues have hampered the supply of containers and vessels and the transport of certain micro-ingredients.

Recent Development

- De Heus acquired Coppens Diervoeding, a feed manufacturing company based in the Netherlands that specializes in the pig farming sector, in July 2021. This acquisition enabled the company to double its production capacity and strengthen its regional presence by 400k.

- ADM opened a new livestock feed plant in Ha Nam province, Vietnam, in November 2019. The new facility adds to ADM's growing list of investments in Vietnam, becoming the company's fifth plant dedicated to animal nutrition in the country.

- In October 2021, Cargill and BASF announced a partnership in the animal nutrition business, bringing additional markets and research and development capabilities to the companies' current feed enzymes distribution agreements. This partnership contributed in the development, manufacture, marketing, and sale of customer-focused enzyme products and solutions for animals, especially pigs.

Global Amino Acids Premix for Feed Market Scope

The amino acids premix for feed market is segmented on the basis of source, type, end-user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Source

- Plant Based

- Animal Based

Type

- L-lysine

- L-taurine

- Others

End-User

- Animal Feed

- Swine

- Poultry

- Cattle

- Food Industry

- Healthcare

Distribution channel

- Hypermarket

- Pharmacy Stores

- Supermarket

- Online Stores

Amino Acids Premix for Feed Market Regional Analysis/Insights

The amino acids premix for feed market is analysed and market size insights and trends are provided by country, source, type, end user and distribution channel as referenced above.

The countries covered in the amino acids premix for feed market report are U.S., Canada, Mexico in North America, Germany, Poland, Ireland, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Chile, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Egypt, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Asia-Pacific is the most important pork consumption and production market, accounting for roughly half of global output. The global region is the largest market for amino acids premix for feed products due to the high consumption of pork meat. South East Asia is the world's largest pork producer and exporter. Since ancient times, pork meat has been consumed in the region and is the most popular meat due to its high fat content and flavour. China is the largest pork producer's market, followed by Vietnam, Thailand, South Korea, Japan, and the Philippines. Japan, South Korea, and Taiwan are saturated pork consumption markets, while Vietnam and the Philippines are emerging markets.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Amino Acids Premix for Feed Market Share Analysis

The amino acids premix for feed market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to amino acids premix for feed market.

饲料用氨基酸预混料市场的一些主要参与者包括:

- 嘉吉公司(美国)

- 陶氏(美国)

- 巴斯夫公司(德国)

- Chr. Hansen Holding A/S(丹麦)

- 帝斯曼(荷兰)

- 杜邦(美国)

- 赢创工业集团 (德国)

- NOVUS INTERNATIONAL(美国)

- Alltech (美国)

- 英国联合食品有限公司 (英国)

- 正大食品 PCL(泰国)

- Nutreco (荷兰)

- ForFarmers。(荷兰)

- De Heus Animal Nutrition(荷兰)

- Land O'Lakes(美国)

- 肯特营养集团(美国)

- JD HEISKELL & CO.(美国)

- Perdue Farms(美国)

- SunOpta(加拿大)

- Scratch Peck 饲料(美国)

- De Heus Animal Nutrition(荷兰)

- MEGAMIX(俄罗斯)

- Agrofeed(匈牙利)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

可定制

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.