不斷增加的創傷和骨折病例極大地推動了拉丁美洲、北美、非洲和歐洲的骨合成設備市場的發展。道路交通事故、運動傷害和跌倒的發生率不斷上升,加上人口老化加劇,容易患骨質疏鬆症和骨折,這都推動了對先進骨合成設備的需求。在這些地區,修復和穩定骨折的外科手術激增,需要使用鋼板、螺絲和髓內釘,以促進市場成長。醫療技術的進步和對改善患者治療效果的日益關注進一步推動了這些設備的採用,使骨合成市場成為這些地區醫療保健系統的重要組成部分。創傷病例的增加導致骨折盛行率上升,這反過來又增加了對有效可靠的骨合成解決方案的需求,推動了市場創新和投資,以滿足對這些基本醫療設備日益增長的需求。

老年族群中骨關節炎盛行率的上升成為拉丁美洲、北美、非洲和歐洲骨合成設備市場發展的重要驅動力。隨著老年人口的增長,骨關節炎(一種常導致嚴重關節疼痛和活動障礙的退化性關節疾病)的發生率也在增加。這種情況通常需要進行關節置換和骨骼復位等外科手術,而這又需要使用骨合成裝置(如板、螺絲和桿)來穩定和支撐受影響的骨骼和關節。骨關節炎病例的激增導致對這些外科手術的需求增加,推動了骨合成設備的市場。此外,醫療技術的進步、手術技術的改進以及對提高老年患者生活品質的日益重視進一步推動了這些設備的採用。因此,隨著這些地區的醫療保健系統努力滿足患有骨關節炎的老齡人口日益增長的需求,骨合成設備市場正在經歷大幅增長。

此外,對微創骨合成技術的傾向成為拉丁美洲、北美、非洲和歐洲骨合成設備市場的重要推手。微創手術技術具有許多優點,包括縮短恢復時間、降低併發症風險和減少術後疼痛,對患者和醫療保健提供者都具有很大的吸引力。這種對微創手術的偏好導致了先進骨合成裝置的採用增加,例如髓內釘、鎖定板和生物可吸收植入物,這些裝置有助於更快癒合並改善患者預後。

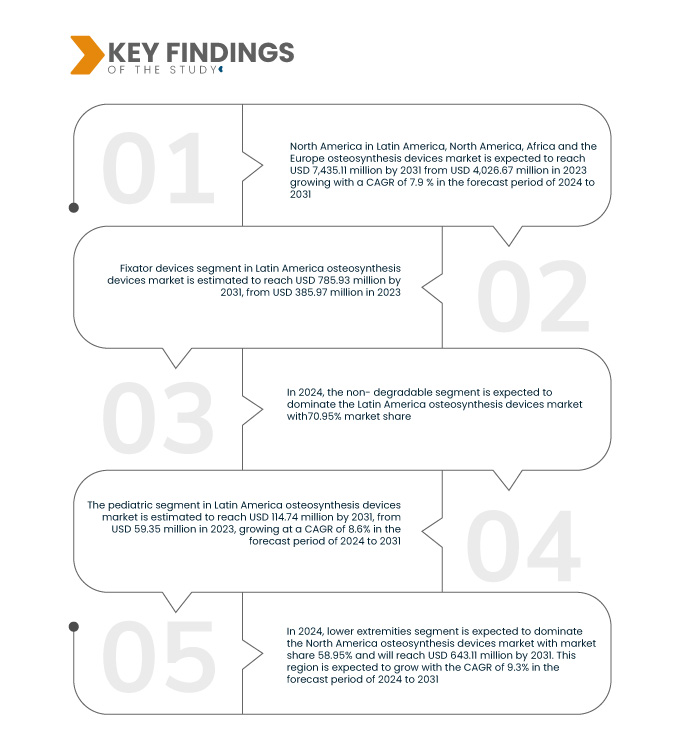

Data Bridge Market Research 分析,拉丁美洲、北美、非洲和歐洲骨科設備市場預計在 2024 年至 2031 年的預測期內以 7.9% 的複合年增長率增長,預計到 2031 年將從 2023 年的 40.2667 億美元增至 74.3512億美元,固定器械部分預計將推動市場成長,因為它們在治療複雜骨折方面的多功能性、微創性以及材料和設計的進步,可改善患者的治療效果並縮短恢復時間。

研究的主要發現

骨合成設備在市場定義中的作用不斷演變

在技術快速進步的推動下,骨合成設備在市場中的作用越來越活躍。這些裝置包括板、螺絲、桿和釘,對於在癒合過程中穩定和調整骨折至關重要。最近的創新,例如使用鈦和生物可吸收聚合物等生物相容性材料,正在提高設備性能和患者安全性。此外, 3D 列印和電腦輔助手術等技術正在推動開發更精確、更客製化的設備,以滿足個別患者的需求,從而提高治療效果。

全球人口老化也在擴大骨合成設備的需求方面發揮重要作用。隨著老年人口的增加,骨折和骨質疏鬆症相關疾病的發生率也在增加,因此這些設備對於有效的骨骼修復和管理至關重要。此外,骨骼合成裝置不再侷限於創傷病例;它們的應用範圍越來越廣泛,包括脊椎融合、骨骼畸形矯正手術,甚至是骨腫瘤的治療。此次擴展拓寬了市場並增加了這些設備在骨科和重建手術中的相關性。

另一個重要趨勢是向微創手術技術的轉變。這一趨勢正在推動更小、更複雜的骨合成裝置的發展,這些裝置可以以更少的手術創傷植入,從而縮短恢復時間並改善患者的治療效果。隨著醫療保健提供者和患者尋求侵入性較小的選擇,對這些先進設備的需求預計會增長。縮短恢復時間和改善整體患者體驗的重點正在重塑市場並指導未來的創新。

最後,骨合成設備市場受到滿足嚴格監管標準和確保長期安全性和有效性的需求的影響。製造商面臨越來越大的創新壓力,同時也要遵守複雜的監管要求,這可能會影響新設備推向市場的速度。儘管存在這些挑戰,但由於醫療保健需求不斷增長和製造商之間競爭加劇,全球骨合成設備市場仍在成長。這種競爭格局鼓勵進一步創新,並推動骨骼穩定和修復領域更有效、以患者為中心的解決方案的發展。

報告範圍和市場細分

報告指標

|

細節

|

預測期

|

2024-2031

|

基準年

|

2023

|

歷史性的一年

|

2022(可自訂為 2016 - 2021)

|

定量單位

|

收入(百萬美元)

|

涵蓋的領域

|

產品類型(固定器、骨骼生長刺激器等)、材質(不可降解和可降解)、骨折類型(髕骨、脛骨及腓骨、脊椎、髖骨及骨盆、鎖骨、肩胛骨及肱骨、股骨、橈骨或尺骨及兩者、腕骨、胸骨、肋骨、顱骨和麵骨)、部位(下肢和上肢)、病患類型(成人、老年人和兒童)、最終使用者(醫院、骨科診所、門診手術中心、創傷中心等)、分銷管道(直銷和第三方分銷商)

|

覆蓋國家

|

美國、加拿大、墨西哥、德國、法國、英國、義大利、西班牙、俄羅斯、荷蘭、瑞士、土耳其、比利時、丹麥、挪威、瑞典、波蘭、歐洲其他地區、巴西、阿根廷、哥倫比亞、秘魯、智利、薩爾瓦多、巴拿馬、宏都拉斯、玻利維亞、哥斯大黎加、厄瓜多、瓜地馬拉、巴拉圭、牙買加、千里達和多巴哥、委內瑞拉、多明尼加共和國、南非、埃及、阿爾及利亞、加納、肯亞、奈及利亞、蘇丹、烏幹達、坦尚尼亞、衣索比亞、剛果民主共和國、非洲其他地區

|

涵蓋的市場參與者

|

Smith & Nephew(歐洲)、Zimmer Biomet(美國)、Olympus Corporation(日本)、樂普醫療科技(北京)有限公司(中國)、Precision Spine, Inc.(美國)、微創醫療科學有限公司(中國)、B. Braun Medical Ltd(歐洲)、Stryker(美國)、Globus Medicaltech(美國)、MedtronC(美國)。 Inc.(美國)、Normmed Medical(土耳其)、Medartis AG(歐洲)、Orthofix Medical Inc.(美國)和OssaTechnics(歐洲)

|

報告涵蓋的數據點

|

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、按地理位置代表的公司生產和產能、分銷商和合作夥伴的網絡佈局、詳細和更新的價格趨勢分析以及供應鏈和需求的缺口分析

|

細分分析

拉丁美洲、北美、非洲和歐洲骨科設備市場分為七個值得注意的細分市場,基於產品類型(固定器設備、骨骼生長刺激器等)、材料(不可降解和可降解)、骨折類型(髕骨、脛骨和腓骨、脊柱、髖骨和骨盆、鎖骨、肩胛骨和肱骨、股骨、橈骨或尺骨及兩者、腕骨、胸骨、肋骨、顱骨和麵骨)、部位(下肢和上肢)、患者類型(成人、老年和兒童)、最終用戶(醫院、骨科診所、門診手術中心、創傷中心等)、渠道(直銷和第三方分銷商)

- 根據產品類型,市場細分為固定器、骨骼生長刺激器和其他

2024 年,固定器設備產品和服務部分預計將佔據市場主導地位

到 2024 年,固定器械領域預計將佔據市場主導地位,市場份額達到 73.75%,這得益於其在治療複雜骨折方面的多功能性、微創性以及材料和設計的進步,可改善患者的治療效果並縮短恢復時間。

- 根據材料,市場分為不可降解和可降解

2024 年,術前護理類型預計將佔據市場主導地位

到 2024 年,不可降解材料預計將佔據市場主導地位,市佔率達到 69.47%,這得益於其耐用性、長期骨固定的可靠性以及減少的切除手術需求。這些裝置提供穩定的固定,且不會隨著時間的推移而發生腐蝕或降解的風險,使其成為從創傷手術到重建手術等各種骨科應用的理想選擇。

- 依骨折類型,市場分為髕骨、脛骨和腓骨、脊椎、髖骨和骨盆、鎖骨、肩胛骨、肱骨、股骨、橈骨或尺骨及兩者、腕骨、胸骨、肋骨、顱骨和顏面骨。預計 2024 年髕骨市場將佔據主導地位,市佔率為 24.63%

- 根據部位,市場分為下肢和上肢。預計到 2024 年,下肢市場將佔據主導地位,市佔率將達到 58.95%

- 根據患者類型,市場分為成人、老年和兒童。預計到 2024 年,下肢市場將佔據主導地位,市佔率將達到 55.28%

- 根據最終用戶,市場細分為醫院、骨科診所、門診手術中心、創傷中心和其他。到 2024 年,醫院部門預計將佔據市場主導地位,市佔率達到 46.35%

- 根據分銷管道,市場分為直銷和第三方分銷商。預計到 2024 年,直銷領域將佔據主導地位,市佔率達 61.75%

主要參與者

Data Bridge Market Research 將以下公司視為骨合成設備市場的主要參與者,包括 Zimmer Biomet(美國)、Stryker(美國)、Globus Medical(美國)、B. Braun Medical Ltd.(歐洲)和 Smith & Nephew(歐洲)。

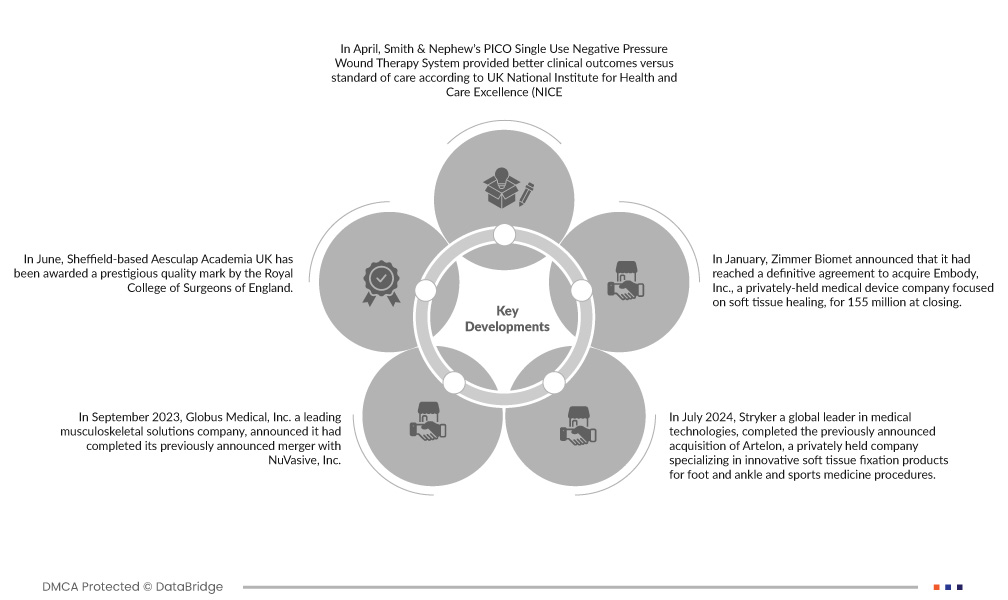

市場開發

- 今年 4 月,英國國家健康與臨床優化研究所 (NICE) 表示,史密斯和侄子的 PICO 拋棄式負壓傷口治療系統比標準治療提供了更好的臨床效果。因此,NICE 再次確認其指導意見保持不變,即對於手術部位感染風險高的患者,應考慮將 PICOs NPWT 作為閉合手術切口的選項。主要高風險因素包括高體重指數 (BMI)、糖尿病、腎功能不全和吸煙等

- 2023 年 9 月,領先的肌肉骨骼解決方案公司 Globus Medical, Inc. 宣布已完成先前宣布的與 NuVasive, Inc. 的合併。合併後的公司將為外科醫生和患者提供最全面的肌肉骨骼手術解決方案和支援技術,以影響護理連續性

- 2023 年 7 月,領先的肌肉骨骼解決方案公司 Globus Medical, Inc. 宣布推出 MARVEL 生長棒系統,該系統專為早發性脊柱側彎的兒科患者設計,旨在透過微創牽引獲得併維持矯正,同時促進生長

- 2024 年 6 月,醫療技術全球領導者史賽克 (Stryker) 宣布簽署最終協議,收購 Artelon 的所有已發行和流通股,Artelon 是一家私人控股公司,專門生產用於足踝和運動醫學手術的創新軟組織固定產品。此次收購增強了史賽克在軟組織固定領域的產品供應能力,並凸顯了史賽克致力於為韌帶和肌腱重建提供差異化解決方案的承諾。

- 今年 1 月,Zimmer Biomet 宣布已達成最終協議,以 1.55 億美元收購專注於軟組織癒合的私人控股醫療器材公司 Embody, Inc.。此次收購包括 Embody 的完整膠原蛋白生物整合解決方案組合,用於支持最具挑戰性的骨科軟組織損傷的癒合——包括用於肌腱癒合的 TAPESTRY 生物整合植入物和 TAPESTRY RC,後者是首批用於肩袖修復的關節鏡植入系統之一。此次收購將有助於該公司擴大產品組合和業務。

- 今年 1 月,微創手術技術和手術技能教育領域的全球領導者 Arthrex 推出了一個以患者為中心的新資源網站 TheNanoExperience.com,重點介紹了奈米關節鏡的科學性和優勢。奈米關節鏡是一種現代、微創的骨科手術,可以快速恢復活動能力並減輕疼痛。

- 今年 1 月,微創手術技術的全球領導者 Arthrex 宣布其 ACL TightRope 植入物已獲得美國食品藥物管理局 (FDA) 的兒科適應症批准。 TightRope 植入物用於骨科損傷的外科治療,是第一個也是唯一一個獲準用於兒科的前十字韌帶 (ACL) 損傷固定裝置。

- 10月,主動癒合創新領域的全球領導者Bioventus在芝加哥舉行的北美脊椎學會(NASS)會議上展示了其全面的脊椎手術解決方案。此次活動標誌著 BoneScalpel Access 的全面推出

- 今年 2 月,Exactech 與 Statera Medical 建立了開創性合作關係,共同開發世界上首個智慧反向肩部植入物。這項創新合作旨在將先進技術融入骨科解決方案,提高手術精確度和病患治療效果。透過將 Exactech 在關節置換方面的專業知識與 Statera Medical 在醫療器材開發方面的創新方法相結合,此次合作有望透過增強的功能和以患者為中心的設計重新定義肩部手術的標準

- 今年 4 月,全球醫療技術領導者美敦力公司宣布,美國食品藥物管理局 (FDA) 已批准 Inceptiv v 閉環可充電脊髓刺激器 (SCS) 用於治療慢性疼痛。 Inceptiv 是第一款提供閉環功能的美敦力 SCS 設備,可感知脊髓沿線的生物訊號並自動即時調整刺激,使治療與日常生活動作保持協調。

有關拉丁美洲、北美、非洲和歐洲骨合成設備市場的更多詳細信息,請點擊此處 - https://www.databridgemarketresearch.com/reports/latin-america-north-america-africa-and-the-europe-osteochemistry-devices-market