建築業是與建設、修理、翻新和維護基礎設施相關的生產和貿易的工業部門。建築業為國家社會經濟發展和經濟成長做出了貢獻。由於與其他行業的聯繫,建築業可以為經濟的其他領域(如製造業、物流業、貿易業和金融服務業)創造活動和就業機會。建築業成長的主要驅動力是都市化、人口成長、房屋市場和基礎設施。

建築業可以成為擴大聚氨酯泡沫市場的主要動力。由於新興經濟體的外國直接投資,建築相關活動正在增加。水泥、木材、玻璃、金屬和黏土是建築業最常使用的材料。聚氨酯用於建築領域,製造出強度高、重量輕、功能良好、經久耐用且適應性強的高性能產品。聚氨酯泡棉是一種柔性化學產品,可用於許多典型的建築應用,例如黏合、填充、密封和絕緣。它具有很高的隔熱和隔音性能,是水管隔熱、屋頂和牆壁粘合和密封,以及最重要的安裝窗戶和門框的完美產品。建築相關活動的成長以及聚氨酯泡沫在建築業的廣泛應用促進了聚氨酯泡沫市場的成長。

訪問完整報告@ https://www.databridgemarketresearch.com/reports/global-polyurethane-foam-market

Data Bridge Market Research 分析稱,全球聚氨酯泡沫市場預計將從 2024 年的 271.8 億美元增至 2032 年的 408.9 億美元,在 2025 年至 2032 年的預測期內,複合年增長率將達到 5.4%。

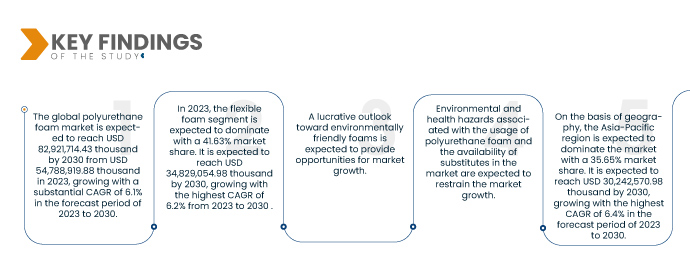

研究的主要發現

汽車和航空領域的接受度不斷提高

聚氨酯泡棉是一種聚合物材料,具有高抗拉強度、低重量、耐化學性、可加工性和機械特性,已用於各種應用。由於其獨特的性能,航空航天和汽車工業對輕質高性能材料的需求日益增長。在汽車行業中,汽車泡棉發揮著重要作用,因為它對從汽車座椅到地毯襯墊的乘客安全和舒適度起著重要作用。聚氨酯泡棉在汽車工業中用於製造裝飾件、座椅、頭枕、隔音材料和空調過濾器。這是因為泡沫是一種具有多種特性的材料,例如隔振、吸音和絕緣。開孔泡棉和閉孔泡棉均可用於現代汽車的汽車緩衝墊和座椅。目前汽車中使用的聚氨酯泡沫由於其耐用和極輕的特性,可以為車輛提供更長的行駛里程,從而進一步降低汽車的整體重量。因此,燃油效率得到提高並減少了對環境的影響。汽車領域的此類高端應用將推動聚氨酯泡沫市場的成長。

聚氨酯泡沫在航空航太工業的應用非常多樣化。它用於客艙壁、行李艙、天花板、盥洗室、駕駛艙墊以及艙室和艙段分隔器等結構件。這種泡沫可以保護飛機和機內乘客免受過度溫度波動的影響。航空航太泡沫密度也有助於防止空氣洩漏進出飛機,從而保持機艙壓力。它還可以作為隔音屏障,保護乘客免受飛機引擎高分貝噪音的影響。

報告範圍和市場細分

報告指標

|

細節

|

預測期

|

2025年至2032年

|

基準年

|

2024

|

歷史歲月

|

2023(可自訂為2017-2022)

|

定量單位

|

收入(十億美元)

|

涵蓋的領域

|

產品(軟質泡棉、硬質泡棉和噴塗泡棉)、類別(開孔泡棉和閉孔泡棉)、密度組成(低密度組成、中密度組成和高密度組成)、製程(模製泡棉、塊狀泡棉、噴塗和層壓)、終端用戶(寢具和家具、建築和施工、汽車、電子、包裝、鞋類等)

|

覆蓋國家

|

美國、加拿大、墨西哥、巴西、阿根廷、南美洲其他地區、德國、法國、英國、西班牙、義大利、波蘭、荷蘭、俄羅斯、土耳其、比利時、瑞典、瑞士、丹麥、芬蘭、挪威、歐洲其他地區、中國、日本、印度、韓國、台灣、澳洲、泰國、新加坡、菲律賓、馬來西亞、越南、紐西蘭、印尼、亞太地區其他地區、南非、沙烏地阿拉伯、聯合阿拉伯

|

涵蓋的市場參與者

|

漢高股份公司(德國)、聖哥班(法國)、亨斯邁國際有限公司(美國)、巴斯夫(德國)、井上株式會社(日本)

積水化學工業株式會社(日本)、Foamcraft, Inc.(美國)、DOW(美國)Rogers Corporation(美國)、Wisconsin Foam Products(美國)、UFP Technologies, Inc.(美國)、BASF SE(德國)、Sunpreeth Engineers(印度)、General Plastics Manufacturing Company, Incacturing Company, Inc.(美國)、ESALS P.T.A. LLC(美國)、Tirupati Foam Ltd.(印度)、Sheela Foam Ltd.(印度)、Henkel AG & Co. KGaA(德國)和 Recticel NV/SA(比利時)

|

報告涵蓋的數據點

|

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。

|

細分分析

全球聚氨酯泡棉市場根據產品、類別、密度組成、製程和最終用戶分為五個顯著的部分。

- 根據產品,市場分為軟質泡沫、硬質泡沫和噴塗泡沫

預計到 2025 年,軟質泡沫將佔據主導地位,市佔率達到 38.91%

2025 年,柔性泡棉預計將佔據市場主導地位,佔有 38.91% 的市場份額,因為它可應用於床上用品、家具、汽車內飾和包裝等各個領域

- 根據類別,市場分為開孔和閉孔

預計到 2025 年,開放式電池領域將佔據主導地位,市佔率達 70.85%

到 2025 年,開放式蜂巢板預計將佔據 70.85% 的市場份額,因為它具有出色的隔音性能,可廣泛應用於商業和住宅建築的隔音應用。

- 根據密度組成,市場分為低密度組成、中密度組成和高密度組成。到 2025 年,低密度成分部分預計將佔據市場主導地位,市佔率達到 49.42%。

- 根據工藝流程,市場分為模製泡棉、板坯泡棉、噴塗和層壓。預計到 2025 年,模塑泡棉市場將佔據主導地位,市佔率達 39.95%

- 根據最終用戶,市場細分為床上用品和家具、建築和施工、汽車、電子、包裝、鞋類等。 2025 年,床上用品和家具領域預計將佔據市場主導地位,市佔率達 32.30%

主要參與者

Data Bridge Market Research 分析了漢高股份公司(德國)、聖戈班(法國)、亨斯邁國際有限責任公司(美國)、巴斯夫(德國)和井上株式會社(日本)為主要市場參與者。

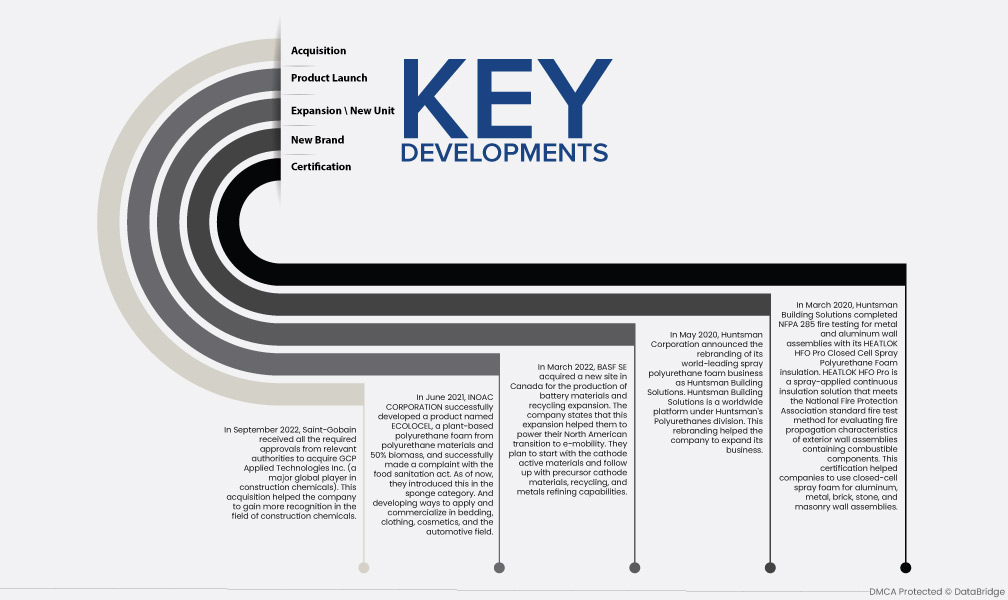

市場發展

- 2022年9月,聖戈班已獲得相關部門收購GCP Applied Technologies Inc.(全球主要建築化學品製造商)所需的所有批准。此次收購有助於公司在建築化學品領域獲得更多認可

- 2020年5月,亨斯邁集團宣布將其全球領先的噴塗聚氨酯泡沫業務更名為亨斯邁建築解決方案。亨斯邁建築解決方案是亨斯邁聚氨酯部門旗下的全球平台。此次品牌重塑幫助該公司擴大了聚氨酯泡沫業務

- 2021 年 3 月,亨斯邁建築解決方案公司使用其 HEATLOK HFO Pro 閉孔噴塗聚氨酯泡棉隔熱材料完成了金屬和鋁牆組件的 NFPA 285 防火測試。 HEATLOK HFO Pro 是一種噴塗式連續絕緣解決方案,符合美國國家消防協會標準防火測試方法,用於評估含有可燃組件的外牆組件的火災蔓延特性。此認證有助於公司將閉孔噴塗泡棉用於鋁、金屬、磚、石和磚石牆體組件。標誌著我們向快速成長的中亞和中東市場邁出了重要一步

- 2022年,巴斯夫在加拿大收購了一個新工廠,用於生產電池材料和擴大回收。該公司表示,此次擴張將有助於他們推動北美向電動車的轉型。他們計劃從陰極活性材料開始,然後再研究前體陰極材料、回收和金屬精煉能力。

區域分析

根據 Data Bridge 市場研究分析:

2025年,亞太聚氨酯泡沫市場預計將佔據主導地位

由於快速的城市化、智慧城市項目以及中國、印度和東南亞對商業和住宅建築的投資不斷增加,亞太聚氨酯泡沫市場預計將佔據主導地位。聚氨酯泡棉廣泛用於隔熱、屋頂和密封應用,使其成為建築領域的關鍵材料。

有關全球聚氨酯泡棉市場報告的更多詳細信息,請點擊此處 - https://www.databridgemarketresearch.com/reports/global-polyurethane-foam-market