Us Padded Mailers Market

Размер рынка в млрд долларов США

CAGR :

%

USD

650.16 Million

USD

97,532.00 Million

2024

2032

USD

650.16 Million

USD

97,532.00 Million

2024

2032

| 2025 –2032 | |

| USD 650.16 Million | |

| USD 97,532.00 Million | |

|

|

|

|

Сегментация рынка конвертов с мягкой подкладкой в США по типу материала (крафт-бумага, полиэтилен и бумага на основе волокна), типу (самозапечатывающиеся, самоклеящиеся и запечатывающиеся), вместимости (менее 300 г, от 300 до 500 г, от 500 до 1000 г, от 1000 до 2000 г и более 2000 г), размеру (10 x 13 дюймов, 9 x 12 дюймов и 6 x 9 дюймов), каналу сбыта (супермаркеты/гипермаркеты, интернет-магазины, специализированные магазины и другие), применению (производство и складирование, книги и аудио-CD, ювелирные изделия, подарки, рамки, часы и сувениры, видеокассеты и другие) — тенденции отрасли и прогноз до 2032 года

Размер рынка почтовых рассылок с мягкой обложкой

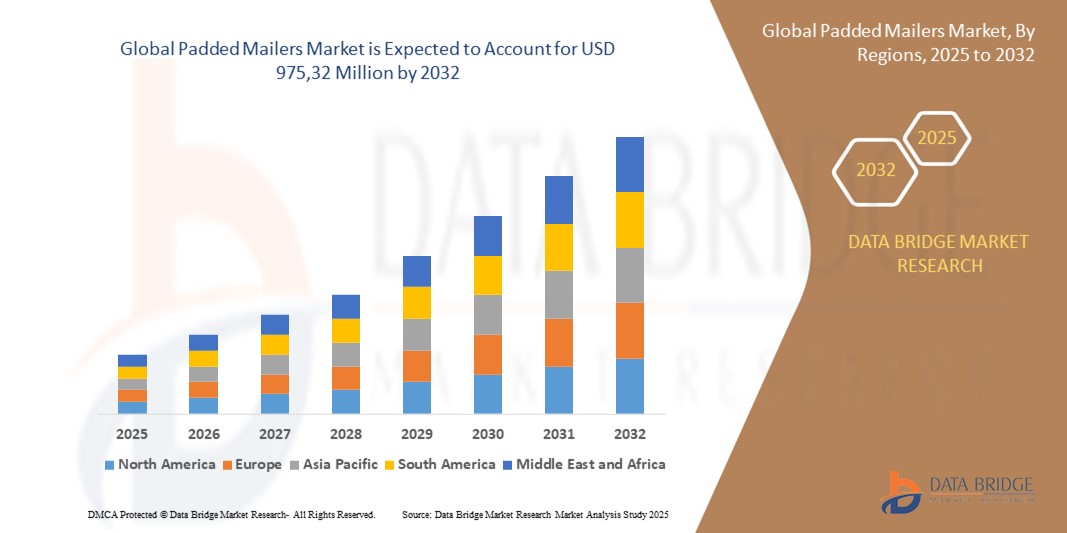

- Объем рынка почтовых конвертов в США в 2024 году оценивался в 650,16 млн долларов США , а к 2032 году , как ожидается, он достигнет 975,32 млн долларов США при среднегодовом темпе роста 5,2% в прогнозируемый период.

- Рост рынка во многом обусловлен быстрым развитием электронной коммерции и растущим спросом на легкие, экономичные и защитные упаковочные решения в различных отраслях, включая розничную торговлю, электронику и здравоохранение.

- Кроме того, растущая осведомленность об окружающей среде и давление со стороны регулирующих органов способствуют переходу на альтернативные варианты экологичной упаковки, побуждая производителей разрабатывать перерабатываемые и мягкие почтовые конверты на основе волокон, которые соответствуют целям экономики замкнутого цикла, тем самым ускоряя проникновение на рынок.

Анализ рынка почтовых рассылок с мягкой обложкой

- Мейлеры с мягкой подкладкой – это упаковочные конверты с мягкой подкладкой, предназначенные для защиты товаров во время транспортировки и снижения стоимости доставки благодаря своей лёгкости. Они широко используются для отправки небольших и средних товаров, таких как книги, электроника, ювелирные изделия и фармацевтические препараты, как в сегментах B2C, так и B2B.

- Растущий спрос на мягкие почтовые конверты в США обусловлен, прежде всего, ростом популярности интернет-торговли, повышенным вниманием к безопасности продукции при транспортировке и растущим предпочтением экологичных бумажных почтовых конвертов традиционным пластиковым аналогам.

- В 2024 году сегмент самоклеящихся конвертов занял лидирующие позиции на рынке, заняв 62% рынка благодаря удобству нанесения, минимальному времени подготовки и прочным клеевым свойствам, обеспечивающим надежную герметизацию. Самоклеящиеся конверты широко используются как в розничной торговле, так и в логистике для быстрой и эффективной упаковки.

Область применения отчета и сегментация рынка почтовых рассылок с мягкой обложкой

|

Атрибуты |

Ключевые данные о рынке мягких почтовых рассылок |

|

Охваченные сегменты |

|

|

Страны действия |

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка мягких почтовых конвертов

«Расширение электронной коммерции и инноваций в области устойчивой упаковки»

- Рынок мягких почтовых конвертов в США переживает бурный рост, обусловленный ростом электронной коммерции и потребностью в безопасной, легкой и экономичной упаковке для доставки широкого ассортимента продукции.

- Например, такие компании, как Sealed Air Corporation, PAC Worldwide Corporation и Pregis LLC, внедряют экологичные, перерабатываемые и биоразлагаемые почтовые конверты, чтобы удовлетворить растущий спрос потребителей и регулирующих органов на экологичные упаковочные решения.

- Интеграция современных материалов, таких как более тонкая, но прочная крафт-бумага и биопластик, усиливает защиту, снижает транспортные расходы и способствует достижению целей отрасли в области устойчивого развития.

- Внедрение технологий ускоряется: производители внедряют такие функции, как пломбы с защитой от несанкционированного вскрытия, водонепроницаемость, RFID и QR-коды для повышения безопасности, прослеживаемости и аналитики цепочки поставок.

- Рост числа услуг по подписке на почтовые отправления, брендов, работающих напрямую с потребителями, и увеличение числа международных перевозок стимулируют спрос на мягкие почтовые конверты, которые обеспечивают как защиту, так и возможности брендинга.

- В заключение следует отметить, что сочетание роста электронной коммерции, инноваций в области материалов и инициатив в области устойчивого развития позиционирует мягкие почтовые конверты как важнейший компонент будущего упаковки и логистики в США.

Динамика рынка мягких почтовых рассылок

Водитель

«Расширение электронной коммерции и прямой доставки»

- Бурный рост интернет-торговли и прямой доставки потребителю является основным драйвером рынка почтовых отправлений с мягкой подкладкой в США.

- Например, такие компании, как Amazon, Walmart и продавцы Shopify, все чаще используют мягкие почтовые конверты для эффективной, защищенной и экономичной доставки электроники, книг, одежды и мелких товаров.

- Удобство, малый вес и более низкие расходы на доставку конвертов с мягкой подкладкой делают их предпочтительным выбором как для крупных розничных торговцев, так и для малого бизнеса.

- Рост популярности персонализированного брендинга и индивидуальной упаковки побуждает бренды использовать почтовые конверты с мягкой подкладкой в качестве маркетингового инструмента, улучшая качество обслуживания клиентов и их лояльность.

- Расширение логистических сетей и улучшение доставки «последней мили» еще больше повышают спрос на универсальные и долговечные почтовые решения.

Сдержанность/Вызов

«Волатильность цен на сырье и инфраструктура переработки»

- Колебание цен на основные виды сырья, такие как крафт-бумага, полиэтилен и биопластик, может повлиять на себестоимость продукции и размер прибыли производителей почтовых конвертов с мягкой подкладкой.

- Например, такие компании, как Intertape Polymer Group и ProAmpac Holdings Inc., сталкиваются с трудностями при поиске экологически чистых и доступных материалов, сохраняя при этом качество и производительность продукции.

- Ограниченная инфраструктура переработки и несогласованные системы сбора в США могут препятствовать циркулярности мягких почтовых конвертов, особенно тех, которые изготовлены из смешанных материалов.

- Растущее давление со стороны регулирующих органов в отношении экологически чистой упаковки и расширенной ответственности производителей приводит к увеличению расходов на соблюдение требований и усложнению работы для производителей.

- Высокая конкуренция и чувствительность к ценам на рынке затрудняют для поставщиков поиск баланса между инновациями, устойчивым развитием и прибыльностью.

Объем рынка мягких почтовых рассылок

Рынок сегментирован по типу материала, производительности, размеру, каналу сбыта и области применения.

- По типу материала

В зависимости от типа материала рынок конвертов с пуговицами в США сегментируется на крафт-бумагу, полиэтилен и бумажные материалы. Крафт-бумага заняла лидирующие позиции на рынке, обеспечив наибольшую долю выручки в 2024 году благодаря своей пригодности к переработке, экономичности и широкой доступности. Её жёсткая внешняя поверхность в сочетании с амортизирующим внутренним слоем делает её предпочтительным выбором для лёгких и нехрупких товаров. Конверты с пуговицами из крафт-бумаги всё чаще выбирают экологически ответственные компании и платформы электронной коммерции, стремящиеся сократить использование пластика.

Прогнозируется, что сегмент упаковки на основе бумажного волокна будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено растущим спросом на экологичные и биоразлагаемые упаковочные решения. Эти конверты, часто изготавливаемые из переработанной бумажной массы или формованного бумажного волокна, обеспечивают надлежащую защиту и подходят для брендирования и персонализации, что делает их привлекательными для розничных продавцов, ориентированных на экологичность, и поставщиков премиальной продукции.

- По типу

По типу рынок сегментируется на самоклеящиеся и самоклеящиеся. На сегмент самоклеящихся материалов в 2024 году пришлась наибольшая доля – 62%, что обусловлено удобством применения, минимальным временем подготовки и прочными клеевыми свойствами, обеспечивающими надежную герметизацию. Самоклеящиеся конверты широко используются как в розничной торговле, так и в логистике для быстрой и эффективной упаковки.

Ожидается, что сегмент самоклеящихся и герметичных конвертов будет демонстрировать самые высокие среднегодовые темпы роста в период с 2025 по 2032 год, чему будут способствовать система контроля первого вскрытия и улучшенная защита от случайного вскрытия. Эти особенности делают самоклеящиеся и герметичные конверты подходящими для отправки дорогостоящих и чувствительных товаров, особенно в таких отраслях, как электроника, ювелирные изделия и фармацевтика.

- По вместимости

По вместимости рынок сегментируется на следующие категории: упаковка весом менее 300 г, от 300 до 500 г, от 500 до 1000 г, от 1000 до 2000 г и свыше 2000 г. Сегмент упаковки весом от 300 до 500 г занимал наибольшую долю рынка в 2024 году, поскольку он соответствует наиболее распространённым потребностям в упаковке в сфере электронной коммерции и доставки небольших посылок. Этот весовой диапазон идеально подходит для таких товаров, как книги, косметика и аксессуары, требующих мягкой защиты, но не превышающих стандартные почтовые ограничения по весу.

Ожидается, что сегмент посылок весом от 500 до 1000 г будет расти самыми быстрыми темпами в период с 2025 по 2032 год благодаря растущему спросу со стороны интернет-магазинов, доставляющих товары среднего веса. Эти почтовые отправления обеспечивают баланс между защитой, эффективностью доставки и стоимостью, что делает их привлекательными для растущего онлайн-бизнеса и сторонних логистических компаний.

- По размеру

По размеру рынок сегментирован на форматы 10 x 13 дюймов, 9 x 12 дюймов и 6 x 9 дюймов. В 2024 году сегмент формата 10 x 13 дюймов доминировал на рынке, что обусловлено его пригодностью для хранения документов большого объёма, каталогов, одежды и товаров среднего размера. Этот формат широко используется в розничной торговле, издательском деле и корпоративном секторе благодаря своей универсальности и вместительности.

Прогнозируется, что сегмент упаковки формата 6 x 9 дюймов будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено увеличением объёмов мелкой электроники, аксессуаров и предметов роскоши, отправляемых напрямую потребителям. Компактные конверты с мягкой подкладкой позволяют сэкономить на доставке, обеспечивая при этом надлежащую защиту и сокращая количество упаковочных отходов.

- По каналу распространения

По каналам сбыта рынок сегментируется на супермаркеты/гипермаркеты, интернет-магазины, специализированные магазины и другие. Сегмент электронной коммерции обеспечил наибольшую долю выручки в 2024 году благодаря росту онлайн-торговли и потребности в быстрой, удобной и экономичной закупке упаковки. Доступность онлайн широкого ассортимента форматов и материалов для почтовых упаковок, а также возможность оптовых закупок очень привлекательна для малого бизнеса и независимых продавцов.

Ожидается, что специализированные магазины будут расти самыми быстрыми темпами в период с 2025 по 2032 год, чему будет способствовать растущий спрос на фирменные, экологичные и высококачественные почтовые конверты с мягкой подкладкой. Эти магазины ориентированы на нишевые сегменты бизнеса, включая ремесленные бренды и поставщиков товаров премиум-класса, которые ищут индивидуальные упаковочные решения, соответствующие их фирменному стилю.

- По применению

По сфере применения рынок сегментируется на производство и складирование, книги и аудио-CD, ювелирные изделия, подарки, рамки, часы и сувениры, видеокассеты и другие. Сегмент книг и аудио-CD занимал наибольшую долю рынка в 2024 году благодаря сохраняющейся популярности физических носителей в сфере образования и развлечений. Издатели и розничные торговцы используют мягкие конверты для почтовой рассылки, обеспечивая экономичную и устойчивую к повреждениям упаковку этих носителей.

Сегмент ювелирных изделий, как ожидается, продемонстрирует самые быстрые темпы роста в период с 2025 по 2032 год благодаря растущей тенденции онлайн-покупок небольших, но дорогостоящих товаров. Мягкие конверты обеспечивают лёгкую и надёжную упаковку ювелирных изделий, минимизируя расходы на доставку и обеспечивая профессиональный процесс распаковки, что критически важно для удовлетворенности клиентов и восприятия бренда.

Региональный анализ рынка почтовых рассылок с мягкой обложкой

- США лидировали на рынке мягких почтовых конвертов с наибольшей долей выручки в 2024 году, что обусловлено доминированием сектора электронной коммерции, растущим спросом на легкую и экономичную упаковку и повсеместным переходом на экологически чистые материалы.

- Компании, работающие в сфере розничной торговли, электроники и средств личной гигиены, все чаще используют мягкие почтовые конверты для безопасной доставки товаров на последнем этапе, а предпочтение потребителями минимальной и перерабатываемой упаковки еще больше ускоряет рост рынка.

- Наличие налаженных логистических сетей и производителей упаковки также способствует крупномасштабному производству и инновациям в области технологий материалов по всей стране.

Доля рынка почтовых рассылок с мягкой обложкой

Лидерами отрасли производства мягких почтовых отправлений являются, в первую очередь, хорошо зарекомендовавшие себя компании, в том числе:

- Vereinigte Papierwarenfabriken GmbH (Германия)

- Sealed Air (США)

- Pregis LLC (США)

- ProAmpac (США)

- Intertape Polymer Group (Канада)

- Polycell Packaging Corp (Тайвань)

- Корпорация PAC Worldwide. (США)

- STOROPACK HANS REICHENECKER GMBH (Германия)

- abrisojiffy.com (Бельгия)

- Bravo Pack Inc (США)

- 3M (США)

- LPS Industries. (США)

- AP Packaging Corp. (США)

- Sonoco ThermoSafe (США)

- Смерфит Каппа (Ирландия)

- Сержант Смит (Великобритания)

Последние события на рынке конвертов с мягкой подкладкой в США

- В сентябре 2024 года компания Mondi, мировой лидер в производстве экологичной упаковки и бумаги, представила новые перерабатываемые защитные конверты Protective Mailers, полностью изготовленные из бумаги и разработанные совместно с Amazon. Ожидается, что этот запуск окажет значительное влияние на рынок почтовых конвертов с мягкой подкладкой, ускорив переход к экологичным альтернативам без пластика. Предлагая полностью перерабатываемое решение, исключающее необходимость использования пузырчатой пленки, инновационная разработка Mondi соответствует растущему спросу потребителей и регулирующих органов на экологичную упаковку для электронной коммерции, подкрепляя рыночную тенденцию к переходу к циклической экономике.

- В 2023 году CompanyBox открыла новую эру устойчивого развития на рынке мягких почтовых конвертов, выпустив полностью перерабатываемые и компостируемые почтовые конверты на бумажной основе с экологически чистыми чернилами на водной основе, ориентированные на потребителей, заботящихся об окружающей среде.

- В 2021 году компания Georgia-Pacific расширила свои мощности по производству бумажных конвертов с мягкой подложкой, пригодных для вторичной переработки, что соответствует растущему спросу на экологически безопасные решения для доставки на рынке конвертов с мягкой подложкой.

- В 2020 году компания PREGIS LLC произвела революцию на рынке мягких почтовых конвертов, представив систему упаковки в полиэтиленовые пакеты MAX-PRO 24, обеспечивающую повышенную производительность и снижение затрат на рабочую силу за счет автоматизированных настроек, что обещает увеличение доходов и продаж.

- В 2020 году компания Intertape Polymer Group отреагировала на меняющиеся потребности, выпустив новую линейку клейкой ленты для социального дистанцирования с повышенной прочностью, чтобы удовлетворить вызванный пандемией спрос на безопасные решения для транспортировки на рынке мягких почтовых конвертов.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.