Us Electrophysiology Equipment Market

Размер рынка в млрд долларов США

CAGR :

%

USD

5.08 Billion

USD

9.60 Billion

2024

2032

USD

5.08 Billion

USD

9.60 Billion

2024

2032

| 2025 –2032 | |

| USD 5.08 Billion | |

| USD 9.60 Billion | |

|

|

|

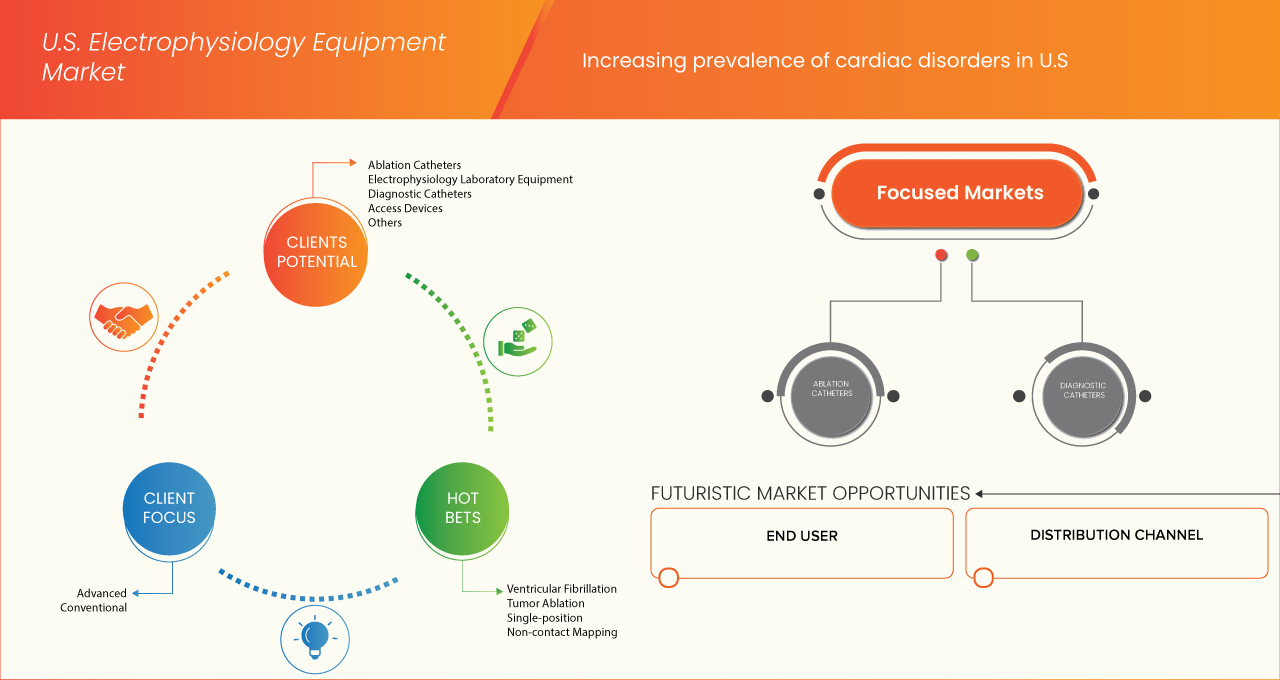

U.S. Electrophysiology Equipment Market, By Type (Ablation Catheters, Electrophysiology Laboratory Equipment, Diagnostic Catheters, Access Devices, and Others), Indication (Atrial Fibrillation, Atrial Flutter, Atrioventricular Nodal Reentry Tachycardia(AVNRT), Wolff-Parkinson-White Syndrome (WPW), and Others), Function (Advanced, Conventional, Cryoablation, and Others), Procedure (Ventricular Fibrillation, Tumor Ablation, Single-Position Non-Contact Mapping, Multipoint Electroanatomic Mapping for Simple Arrhythmias, Varicose Veins, and Others), End User (Hospitals, Ambulatory Surgical Centers, Diagnostic Centers, Cardiac Catheterization Laboratories, Speciality Clinics, and Others), Distribution Channel (Direct Tender and Retail Sales) – Industry Trends and Forecast to 2032

U.S. Electrophysiology Equipment Market Analysis

The history of Electrophysiology (EP) Equipment dates back to the mid-20th century, when advances in cardiology began to reveal the electrical nature of heart function. Initial developments included basic cardiac monitors and early pacemakers in the 1950s, which paved the way for more sophisticated devices. The 1960s and 1970s saw the introduction of electrocardiography (ECG) machines and the advent of catheter ablation techniques, allowing for targeted treatment of arrhythmias. Over the years, innovations such as three-dimensional mapping systems, advanced imaging techniques, and automated electrophysiology systems have significantly enhanced the precision and safety of procedures. By the late 1990s and into the 2000s, the integration of computer technology and improved understanding of cardiac anatomy led to the development of state-of-the-art EP labs equipped with specialized mapping and recording systems. Today, electrophysiology equipment continues to evolve, incorporating advanced technologies like artificial intelligence and minimally invasive approaches, thus transforming the management of cardiac arrhythmias and improving patient outcomes.

U.S. Electrophysiology Equipment Market Size

The U.S. electrophysiology equipment market is expected to reach USD 9.60 billion by 2032 from USD 5.08 billion in 2024, growing at a CAGR of 8.3% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

U.S. Electrophysiology Equipment Market Trends

“Increasing Adoption of Advanced Technologies”

One notable trend in the U.S. electrophysiology equipment market is the increasing adoption of advanced technologies such as 3D mapping systems and electrophysiology catheters, driven by the growing prevalence of cardiac arrhythmias and advancements in minimally invasive procedures. This shift is largely propelled by the demand for improved diagnostic accuracy and treatment efficacy, enabling healthcare providers to offer personalized and targeted therapies. Additionally, the integration of artificial intelligence and machine learning within these technologies is enhancing real-time data analysis and procedural outcomes, further driving market growth. As healthcare facilities continue to invest in state-of-the-art electrophysiology systems, this trend underscores a broader movement towards more specialized and technologically sophisticated cardiac care solutions in the U.S. healthcare landscape.

Report Scope and U.S. Electrophysiology Equipment Market Segmentation

|

Attributes |

U.S. Electrophysiology Equipment Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Johnsons & Johnsons(U.S.), Abbott(U.S.), Medtronic(Ireland), Boston Scientific Corporation(U.S.), and Koninklijke Philips N.V. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

U.S. Electrophysiology Equipment Market Definition

Electrophysiology equipment refers to a specialized set of medical devices and instruments used to diagnose and treat electrical activities of the heart, particularly in relation to arrhythmias and other cardiac disorders. This category includes tools such as electrophysiology catheters, which are inserted into the heart to record electrical signals; mapping systems, which visualize the electrical activity and help pinpoint areas of abnormal conduction; and ablation devices, which are employed to destroy or isolate problematic tissue responsible for irregular heart rhythms. With advancements in technology, electrophysiology equipment increasingly incorporates features like 3D mapping, remote navigation, and real-time data analysis, enhancing the precision and efficacy of cardiac procedures.

U.S. Electrophysiology Equipment Market Dynamics

Drivers

- Increasing Prevalence of Cardiac Disorders in U.S.

The increasing prevalence of cardiac disorders in the U.S., especially arrhythmias such as atrial fibrillation, heart block, and ventricular tachycardia, is a key driver for the electrophysiology equipment market. With rising rates of lifestyle-related conditions like hypertension, diabetes, and obesity, the incidence of heart rhythm disorders has surged in recent years. This growing burden on the healthcare system necessitates the use of advanced diagnostic and therapeutic tools, such as electrophysiology devices, to effectively diagnose, monitor, and treat these conditions. As more patients seek treatments like catheter ablation and other electrophysiology procedures to manage their conditions, the demand for high-performance EP equipment increases, driving both innovation and adoption within the market. This rise in demand for effective treatment options directly propels market growth, making the increasing prevalence of cardiac disorders a crucial driver for the electrophysiology equipment sector.

In October 2024, according to the article published by Centers for Disease Control and Prevention, Coronary heart disease (CHD), the most common heart condition, claimed 371,506 lives in 2022. Approximately 1 in 20 adults over 20 years old are affected by CHD, and 1 in 5 cardiovascular disease-related deaths occur in adults under 65. This high and rising prevalence of coronary artery disease significantly drives the demand for electrophysiology equipment used in diagnosis and treatment, fueling market growth

- Improved Healthcare Infrastructure

Расширение больниц, сотрудничество академических медицинских центров (AMC) с небольшими общественными больницами являются ключевыми факторами, движущими рынок электрофизиологического оборудования в США. Поскольку AMC и крупные сети больниц улучшают свои возможности и инвестируют в специализированную кардиологическую помощь, они устанавливают стандарт для передового лечения, часто делясь технологиями и опытом с небольшими общественными больницами. Такое сотрудничество обеспечивает более широкий доступ к передовым диагностическим и лечебным возможностям, включая электрофизиологические устройства. Закон о доступном медицинском обслуживании (ACA) еще больше способствовал этой тенденции, расширяя доступ к здравоохранению, особенно для малообеспеченных слоев населения. По мере того, как все больше пациентов получают доступ к передовой сердечно-сосудистой помощи, спрос на электрофизиологическое оборудование растет, стимулируя рост рынка и инновации в этом секторе.

Например-

В апреле 2024 года, согласно статье, опубликованной Американской кардиологической ассоциацией, Inc., ACA рассматривает расширение Medicaid, которое расширило доступ к первичной и профилактической помощи, что позволило улучшить диагностику и лечение кардиометаболических факторов риска, одновременно снизив катастрофические расходы на здравоохранение. Это также помогло сократить расовые различия в доступе к здравоохранению. Этот улучшенный доступ к медицинской помощи приводит к более высокому спросу на передовые методы лечения сердечно-сосудистых заболеваний и диагностические инструменты, что стимулирует внедрение электрофизиологического оборудования в медицинских учреждениях по всей территории США.

Возможности

- Растет число процедур катетерной абляции

Растущее число процедур катетерной абляции значительно создает возможности для рынка электрофизиологического оборудования в США за счет увеличения спроса на передовые диагностические и терапевтические устройства. Катетерная абляция, в основном используемая для лечения аритмий, таких как мерцательная аритмия и желудочковая тахикардия, является минимально инвазивной процедурой, которая имеет преимущества по сравнению с традиционными методами, такими как управление приемом лекарств или хирургические вмешательства. По мере того, как растет осведомленность о преимуществах катетерной абляции среди пациентов и поставщиков медицинских услуг, а также по мере того, как все больше медицинских учреждений внедряют эти технологии, растет спрос на электрофизиологическое оборудование, такое как катетеры, системы картирования и электрофизиологические анализаторы. Эта тенденция дополнительно поддерживается растущим старением населения, которое более подвержено сердечно-сосудистым заболеваниям, требующим таких вмешательств.

Например,

В июле 2023 года, согласно статье, опубликованной Национальной медицинской библиотекой, Катетерная абляция является быстро развивающейся областью и доказала свою эффективность для многих пациентов, страдающих от рецидивирующих аритмий. Катетерная абляция широко используется при многих предсердных аритмиях, процедура также связана с большим количеством серьезных осложнений, включая смерть, стеноз легочных вен, перфорацию пищевода, блокаду сердца, требующую кардиостимулятора, инсульт, повреждение диафрагмального нерва и осложнения сосудистого доступа.

- Увеличение финансирования сердечно-сосудистых исследований

Увеличение финансирования сердечно-сосудистых исследований представляет собой значительную возможность для рынка электрофизиологического оборудования США за счет ускорения инноваций и содействия разработке технологий следующего поколения. Поскольку исследовательские институты и частные компании получают большую финансовую поддержку, они могут выделять ресурсы на изучение новых электрофизиологических методов и усовершенствование конструкции оборудования. Это финансирование позволяет исследователям проводить комплексные исследования, которые могут привести к открытию новых терапевтических методов, улучшенных конструкций катетеров, сложных инструментов картирования и усовершенствованных технологий визуализации. Следовательно, внедрение этих инноваций помогает удовлетворить растущий спрос на эффективные и безопасные варианты лечения сердечных аритмий и других сердечно-сосудистых заболеваний, создавая благоприятную среду для расширения рынка.

Более того, увеличение финансирования сердечно-сосудистых исследований часто приводит к расширению сотрудничества между различными секторами, включая академические учреждения, поставщиков медицинских услуг и биофармацевтические компании. Такие партнерства могут обеспечить быстрый перевод результатов исследований в клинические приложения, что приводит к ускоренному улучшению электрофизиологического оборудования.

Ограничения/Проблемы

- Нехватка квалифицированных специалистов в США

Нехватка квалифицированных специалистов в сфере здравоохранения является критической проблемой для рынка США. Электрофизиологические процедуры, такие как катетерная абляция и картирование сердца, требуют высокоспециализированной подготовки, и все меньше практикующих специалистов обладают опытом для выполнения этих сложных вмешательств. По мере роста спроса на передовые электрофизиологические процедуры системы здравоохранения сталкиваются с трудностями в обучении и удержании квалифицированных специалистов, особенно в недостаточно обслуживаемых или сельских районах. Эта нехватка не только ограничивает возможности для выполнения этих процедур, но и снижает эффективность использования передового электрофизиологического оборудования. Следовательно, рост рынка ограничен, поскольку поставщики медицинских услуг изо всех сил пытаются удовлетворить растущий спрос на эти передовые решения для лечения заболеваний сердца.

Например,

В октябре 2024 года, согласно статье, опубликованной PRS Global, нехватка медицинских технологов будет значительной: почти половина медицинских лабораторий США сообщат о трудностях с заполнением вакансий, а уровень вакансий достигнет 20% в некоторых регионах (ASCLS, 2024). Этот дефицит влияет на работу передового электрофизиологического оборудования, поскольку квалифицированные специалисты необходимы для выполнения сложных процедур. Нехватка обученного персонала ограничивает эффективное использование и внедрение этих технологий, выступая в качестве сдерживающего фактора для роста рынка

- Альтернативы электрофизиологическим процедурам

Конкуренция со стороны альтернативных методов лечения существенно сдерживает рынок электрофизиологического оборудования в США. Поскольку неинвазивные методы лечения, такие как фармакологическое лечение, электрическая кардиоверсия и вмешательство в образ жизни, становятся все более распространенными для лечения нарушений сердечного ритма, спрос на инвазивные электрофизиологические процедуры, такие как катетерная абляция, снижается. Эти альтернативы предоставляют менее рискованные и недорогие варианты, ограничивая потребность в передовых электрофизиологических устройствах и замедляя рост рынка.

Например,

В мае 2024 года, согласно статье, опубликованной Heart Rhythm Society, катетерная абляция, включая термическую абляцию и абляцию импульсным полем (PFA), является эффективной нефармакологической альтернативой для лечения нарушений сердечного ритма. Как менее инвазивная процедура, она конкурирует с традиционными фармакологическими методами лечения, предлагая жизнеспособный вариант для пациентов, желающих принимать меньше лекарств. Предпочтение катетерной абляции по сравнению с постоянной лекарственной терапией ограничивает спрос на электрофизиологическое оборудование, выступая в качестве сдерживающего фактора для роста рынка.

Объем рынка электрофизиологического оборудования в США

Рынок сегментирован на шесть заметных сегментов на основе типа, показания, функции, процедуры, конечного пользователя и канала сбыта. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип

- Катетеры для абляции

- Радиочастотная абляция

- Криоабляция

- Электрическая абляция

- Лазер/Свет

- Ультразвуковая абляция

- Электрофизиологическое лабораторное оборудование

- Системы 3D-картографирования

- Системы регистрации электрофизиологии

- Системы внутрисердечной эхокардиографии (Ice)

- Электрофизиологические рентгеновские системы

- Электрофизиологические системы дистанционного управления

- Диагностические катетеры

- Катетеры для усовершенствованной диагностики

- Обычные диагностические катетеры

- Катетеры для ультразвуковой диагностики

- Устройства доступа

- Ножны

- Вводная часть

- Расширитель/Игла

- Комплект электродов пациента

- Другие

- Другие

Индикация

- Мерцательная аритмия

- Трепетание предсердий

- Атриовентрикулярная узловая реципрокная тахикардия (Avnrt)

- Синдром Вольфа-Паркинсона-Уайта (WPW)

- Другие

Функция

- Передовой

- Общепринятый

- Криоабляция

- Другие

Процедура

- Фибрилляция желудочков

- Абляция опухоли

- Однопозиционное бесконтактное картирование

- Многоточечное электроанатомическое картирование для простых аритмий

- Варикозное расширение вен

- Другие

Конечный пользователь

- Больницы

- Амбулаторные хирургические центры

- Диагностические центры

- Лаборатории катетеризации сердца

- Специализированные клиники

- Другие

Канал распространения

- Прямой тендер

- Розничные продажи

Доля рынка электрофизиологического оборудования в США

Конкурентная среда рынка содержит сведения о конкурентах. Включены сведения о компании, ее финансах, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, глобальном присутствии, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании приложений. Приведенные выше данные касаются только фокуса компаний на рынке.

Лидерами рынка электрофизиологического оборудования в США являются:

- Johnsons & Johnsons (США)

- Эбботт(США)

- Medtronic (Ирландия)

- Бостонская научная корпорация (США)

- Koninklijke Philips NV(США)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER FIVE FORCES

5 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF CARDIAC DISORDERS IN U.S.

6.1.2 IMPROVED HEALTHCARE INFRASTRUCTURE

6.1.3 INCREASE IN AGING POPULATION

6.2 RESTRAINTS

6.2.1 SHORTAGE OF SKILLED PROFESSIONALS IN U.S

6.2.2 ALTERNATIVES TO ELECTROPHYSIOLOGY PROCEDURES

6.3 OPPORTUNITIES

6.3.1 GROWING NUMBER OF CATHETER ABLATION PROCEDURES

6.3.2 INCREASED FUNDING FOR CARDIOVASCULAR RESEARCH

6.3.3 GROWING OF ARRHYTHMIA BURDEN

6.4 CHALLENGES

6.4.1 REGULATORY HURDLES INVOLVED IN THE APPROVALS OF THE PRODUCTS

6.4.2 HIGH COSTS OF THE EQUIPMENT

7 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 ABLATION CATHETERS

7.2.1 RADIOFREQUENCY ABLATION

7.2.2 CRYOABLATION

7.2.3 ELECTRICAL ABLATION

7.2.4 LASER/LIGHT

7.2.5 ULTRASOUND ABLATION

7.3 ELECTROPHYSIOLOGY LABORATORY EQUIPMENT

7.3.1 3D MAPPING SYSTEMS

7.3.2 ELECTROPHYSIOLOGY RECORDING SYSTEMS

7.3.3 INTRACARDIAC ECHOCARDIOGRAPHY (ICE) SYSTEMS

7.3.4 ELECTROPHYSIOLOGY X-RAY SYSTEMS

7.3.5 ELECTROPHYSIOLOGY REMOTE STEERING SYSTEMS

7.4 DIAGNOSTIC CATHETERS

7.4.1 ADVANCED DIAGNOSTIC CATHETERS

7.4.2 CONVENTIONAL DIAGNOSTIC CATHETERS

7.4.3 ULTRASOUND DIAGNOSTIC CATHETERS

7.5 ACCESS DEVICES

7.5.1 SHEATH

7.5.2 INTRODUCER

7.5.3 DILATOR/NEEDLE

7.5.4 PATIENT ELECTRODE KIT

7.5.5 OTHERS

7.6 OTHERS

8 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY PROCEDURE

8.1 OVERVIEW

8.2 VENTRICULAR FIBRILLATION

8.3 TUMOR ABLATION

8.4 SINGLE-POSITION NON-CONTACT MAPPING

8.5 MULTIPOINT ELECTROANATOMIC MAPPING FOR SIMPLE ARRHYTHMIAS

8.6 VARICOSE VEINS

8.7 OTHERS

9 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY INDICATION

9.1 OVERVIEW

9.2 ATRIAL FIBRILLATION

9.3 ATRIAL FLUTTER

9.4 ATRIOVENTRICULAR NODAL REENTRY TACHYCARDIA (AVNRT)

9.5 WOLFF-PARKINSON-WHITE SYNDROME (WPW)

9.6 OTHERS

10 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 ADVANCED

10.3 CONVENTIONAL

10.4 CRYOABLATION

10.5 OTHERS

11 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 AMBULATORY SURGICAL CENTERS

11.4 DIAGNOSTIC CENTERS

11.5 CARDIAC CATHETERIZATION LABORATORIES

11.6 SPECIALITY CLINICS

11.7 OTHERS

12 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

13 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 JOHNSON & JOHNSON SERVICES, INC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 ABBOTT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 MEDTRONIC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 BOSTON SCIENTIFIC CORPORATION(2024)

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 KONINKLIJKE PHILIPS N.V.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ANGIODYNAMICS

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ATRICURE, INC. (2024)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 BIOTRONIK SE & CO.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CATHVISION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATES

15.1 GENERAL ELECTRIC COMPANY

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 MICROPORT SCIENTIFIC CORPORATION

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 OLYMPUS CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 SIEMENS HEALTHCARE PRIVATE LIMITED

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 STRYKER

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 TELEFLEX INCORPORATED

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 THERMEDICAL, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

TABLE 1 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 2 U.S. ABLATION CATHETERS IN ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 3 U.S. ELECTROPHYSIOLOGY LABORATORY EQUIPMENT IN ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 4 U.S. DIAGNOSTIC CATHETERS IN ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 5 U.S. ACCESS DEVICES IN ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY PROCEDURE, 2018-2032 (USD MILLION)

TABLE 7 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY INDICATION, 2018-2032 (USD MILLION)

TABLE 8 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 9 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 10 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

Список рисунков

FIGURE 1 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: SEGMENTATION

FIGURE 11 FIVE SEGMENTS COMPRISE THE U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 INCREASING PREVALENCE OF CARDIAC DISORDERS IN U.S. IS DRIVING THE GROWTH OF THE U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET FROM 2025 TO 2032

FIGURE 15 THE ABLATION CATHETERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET IN 2025 AND 2032

FIGURE 16 DROC ANALYSIS

FIGURE 17 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY TYPE, 2024

FIGURE 18 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY TYPE, 2025-2032 (USD MILLION)

FIGURE 19 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 20 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY PROCEDURE, 2024

FIGURE 22 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY PROCEDURE, 2025-2032 (USD MILLION)

FIGURE 23 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY PROCEDURE, CAGR (2025-2032)

FIGURE 24 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY PROCEDURE, LIFELINE CURVE

FIGURE 25 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY INDICATION, 2024

FIGURE 26 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY INDICATION, 2025-2032 (USD MILLION)

FIGURE 27 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY INDICATION, CAGR (2025-2032)

FIGURE 28 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 29 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY FUNCTION, 2024

FIGURE 30 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY FUNCTION, 2025-2032 (USD MILLION)

FIGURE 31 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY FUNCTION, CAGR (2025-2032)

FIGURE 32 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY FUNCTION, LIFELINE CURVE

FIGURE 33 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY END USER, 2024

FIGURE 34 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 35 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY END USER, CAGR (2025-2032)

FIGURE 36 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 38 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 39 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 40 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: COMPANY SHARE 2024 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.