Рынок управления рабочей силой в Северной Америке по предложению (решения и услуги), размеру организации (крупные предприятия, малые и средние предприятия), операционным системам (Windows, Android, iOS, LINUX и другие), модели развертывания (облачные и локальные), конечному пользователю ( банковское дело, финансовые услуги и страхование , автомобилестроение, телекоммуникации и ИТ, производство, здравоохранение, оборона и государственное управление, транспорт и логистика, потребительские товары и розничная торговля, решения в сфере энергетики и коммунальных услуг и другие) — отраслевые тенденции и прогноз до 2030 года.

Анализ и размер рынка управления персоналом в Северной Америке

Управление рабочей силой относится к процессам и инструментам, используемым организациями для оптимизации производительности и эффективности своих сотрудников. Рынок управления рабочей силой быстро растет, что обусловлено растущим внедрением облачных решений и потребностью предприятий в повышении своей операционной эффективности. Однако этот рынок также сталкивается с рядом ограничений, таких как нехватка квалифицированной рабочей силы и растущая сложность трудового законодательства и правил. В этом контексте важно понимать текущие тенденции и факторы, формирующие рынок управления рабочей силой, а также проблемы, с которыми сталкиваются организации в этой области.

Data Bridge Market Research анализирует, что рынок управления рабочей силой в Северной Америке, как ожидается, достигнет 3 574 810,79 тыс. долларов США к 2030 году, при среднегодовом темпе роста 10,1% в течение прогнозируемого периода. Отчет о рынке управления рабочей силой в Северной Америке также всесторонне охватывает анализ цен, патентный анализ и технологические достижения.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2023-2030 |

|

Базовый год |

2022 |

|

Исторические годы |

2021 (можно настроить на 2020-2016) |

|

Количественные единицы |

Доход в тыс. долл. США |

|

Охваченные сегменты |

Предложение (решения и услуги), размер организации (крупные предприятия, малые и средние предприятия), операционные системы (Windows, Android, iOS, LINUX и другие), модель развертывания (облачная и локальная), конечный пользователь (банковское дело, финансовые услуги и страхование, автомобилестроение, телекоммуникации и ИТ, производство, здравоохранение, оборона и государственное управление, транспорт и логистика, потребительские товары и розничная торговля, решения в сфере энергетики и коммунальных услуг и другие) |

|

Страны, охваченные |

США, Канада и Мексика. |

|

Охваченные участники рынка |

UKG Inc., Reflexis Systems, Inc., SAP, Verint Systems Inc., ADP, ATOSS Software AG, NICE, Workday, Inc., Visier, Inc., Ceridian HCM, Inc., Paylocity., Paycom Payroll LLC., Sumtotal Systems, LLC, Infor, Cegid Meta4, Ramco Systems, Replicon, IBM, INFORM Software, InVision AG, Oracle |

Определение рынка

Управление рабочей силой оптимизирует производительность сотрудников, гарантируя, что все ресурсы работают в нужное время и в нужном месте. Управление рабочей силой обычно включает прогнозирование, планирование, управление навыками, внутридневное управление, хронометраж и посещаемость. Программное обеспечение для управления рабочей силой часто интегрируется с приложениями HR от сторонних компаний и ключевыми технологиями HR, которые выступают в качестве ключевых хранилищ информации о занятости. Это помогает HR эффективно управлять сотрудниками для повышения производительности организации. Управление рабочей силой (WFM) эффективно выполняет требования к рабочей силе и устанавливает и управляет графиками сотрудников для выполнения определенной задачи на ежедневной и почасовой основе. Управление рабочей силой внедряет технологии IoT и AI , чтобы предложить улучшенные решения для управления человеческими ресурсами. Облачный сегмент процветает на рынке управления рабочей силой в Азиатско-Тихоокеанском регионе благодаря таким преимуществам, как неограниченная масштабируемость, контроль и различные приложения.

Динамика рынка управления персоналом в Северной Америке

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

ВОДИТЕЛИ

- Растущее внедрение Интернета вещей (IoT) и облачных решений для управления персоналом

Интернет вещей — одна из потенциальных технологий, которая может предоставить современные решения для современных рабочих мест, чтобы повысить рабочую культуру и оптимизировать использование ресурсов. Использование IoT и облачных технологий в управлении рабочей силой обеспечивает лучшую связь, навыки принятия решений и бесперебойную совместимость, а также развивает интеллектуальную рабочую культуру.

- Растущее проникновение аналитических решений и приложений для подключенных устройств

Аналитика рабочей силы объединяет программное обеспечение и методологию, которая применяет статистические модели к данным, связанным с работой, и позволяет организациям оптимизировать человеческие ресурсы. Такие технологии и аналитика развивались на протяжении многих лет и ежедневно развиваются с ростом спроса на рынке.

- Необходимость сокращения расходов, связанных с человеческими ресурсами

В современном бизнесе предприятия прилагают все усилия для повышения прибыли и расширения бизнеса на этом гиперконкурентном рынке, который постоянно оказывает давление на сокращение расходов и повышение прибыльности. Сокращение расходов, связанных с человеческими ресурсами, играет важную роль в повышении прибыльности предприятий.

ВОЗМОЖНОСТЬ

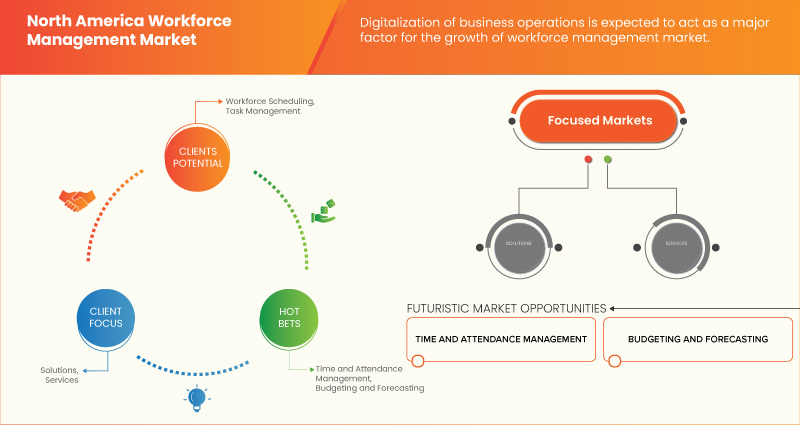

- Цифровизация бизнес-операций

Технологические достижения являются движущей силой промышленной революции с потенциальной трансформацией отраслей промышленности Северной Америки и значительным социальным, экономическим и экологическим воздействием, представляющим огромный потенциал роста. Самая большая возможность — это трансформация всех отраслей и предприятий путем улучшения производственных и бизнес-процессов, что увеличивает инвестиции в регион.

ОГРАНИЧЕНИЯ/ПРОБЛЕМЫ

- Недостаточная осведомленность об инструментах управления персоналом

Мир развивается вокруг цифровых технологий, и различные отрасли промышленности принимают технологические достижения для своего развития и трансформации. Технологический прогресс в любой отрасли сделал бизнес-операции простыми. Аналогичным образом, внедрение программного обеспечения и передовых технологий во всех отраслях промышленности повлияло на их производительность и эффективность .

- Высокие затраты, связанные с приобретением и внедрением решений по управлению персоналом

Управление рабочей силой — это общий термин для различных инструментов и механизмов, используемых организациями для работы с рабочей силой, от составления списков, составления графиков работы и перемещений для организаций, работающих посменно, до отслеживания рабочего времени и обеспечения подтверждения работы для удаленных или полевых работников. Эта классификация программирования часто объединяет финансы, бухгалтерский учет и другие HR-ответы, чтобы гарантировать более эффективное управление сотрудниками. В рабочей силе есть много элементов и устройств, которые часто пересекаются с HR-программированием.

Влияние COVID-19 на рынок управления персоналом в Северной Америке

Пандемия COVID-19 существенно повлияла на рынок управления рабочей силой, ускорив несколько существующих тенденций и создав новые проблемы для организаций. С внезапным переходом на удаленную работу и необходимостью поддержания непрерывности бизнеса компании быстро адаптировали свои стратегии и инструменты управления рабочей силой. Это привело к росту спроса на облачные решения, которые позволяют работать удаленно, и на такие технологии, как видеоконференции, инструменты совместной работы и платформы виртуального обучения. В то же время пандемия также подчеркнула важность управления рабочей силой для поддержания производительности и обеспечения вовлеченности сотрудников во время кризиса. По мере того, как мир движется к эпохе после пандемии, ожидается, что рынок управления рабочей силой продолжит развиваться, движимый потребностью в большей гибкости и маневренности в условиях неопределенности.

Последние события

- В марте 2022 года Ceridian HCM Inc. объявила, что Center Parcs UK & Ireland выбрала Dayforce для оптимизации рабочей силы, повышения вовлеченности сотрудников и усиления соответствия нормативным требованиям. Это сотрудничество поможет компании укрепить свои рыночные позиции в шести регионах Великобритании и Ирландии.

- В ноябре 2021 года Visier, Inc. объявила о разработке новой платформы как услуги (PaaS) Alpine Visier. Эти новые услуги помогают компании диверсифицировать предложения для клиентов и предоставлять надежное решение, которое привлекает новых клиентов для ускорения роста доходов.

Масштаб рынка управления персоналом в Северной Америке

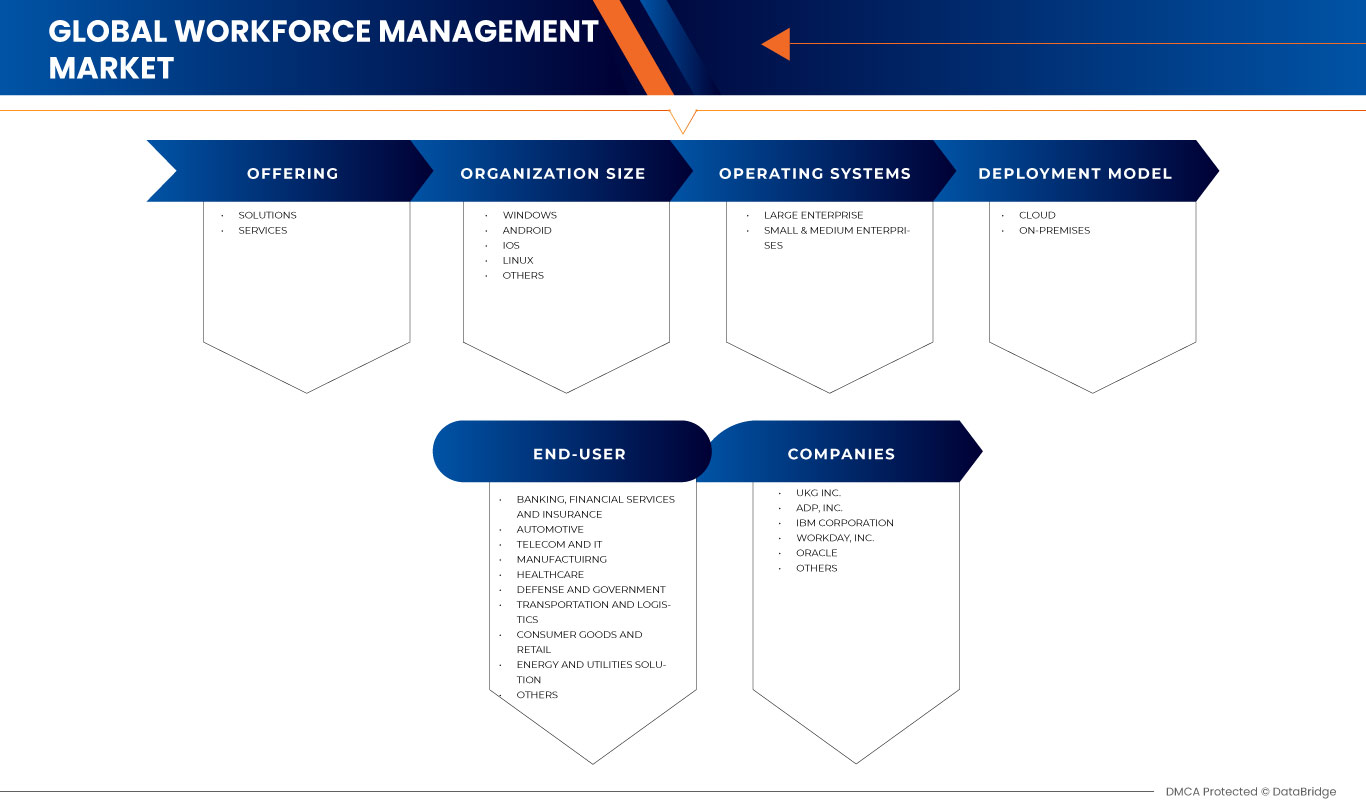

Рынок управления рабочей силой в Северной Америке сегментирован на основе предложения, размера организации, операционных систем, модели развертывания и конечного пользователя. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и информацию, которая поможет им принимать стратегические решения для определения основных рыночных приложений.

Предложение

- Решения

- Услуги

По принципу предложения рынок управления персоналом в Северной Америке сегментируется на решения и услуги.

Модель развертывания

- Облако

- Локально

На основе модели развертывания рынок управления персоналом в Северной Америке сегментируется на локальный и облачный.

Размер организации

- Крупное предприятие

- Малые и средние предприятия

В зависимости от размера организации рынок управления персоналом в Северной Америке сегментируется на крупные предприятия, а также малые и средние предприятия.

Операционные системы

- Окна

- андроид

- iOS

- ЛИНУКС

- Другие

По типу операционных систем рынок управления персоналом в Северной Америке сегментируется на Windows, Android, iOS, Linux и другие.

Конечный пользователь

- Банковское дело, финансовые услуги и страхование

- Автомобильный

- Телекоммуникации и ИТ

- Производство

- Здравоохранение

- Оборона и правительство

- Транспорт и логистика

- Потребительские товары и розничная торговля

- Решения в сфере энергетики и коммунальных услуг

- Другие

По признаку конечного пользователя рынок управления персоналом в Северной Америке сегментируется на банковское дело, финансовые услуги и страхование, автомобилестроение, телекоммуникации и ИТ, производство, здравоохранение, оборону и государственное управление, транспорт и логистику, потребительские товары и розничную торговлю, энергетику и коммунальные решения и другие.

Региональный анализ/инсайты рынка управления персоналом в Северной Америке

Проведен анализ рынка управления персоналом в Северной Америке, а также предоставлены сведения о размерах рынка и тенденциях по регионам, предложениям, размеру организации, операционным системам, модели развертывания и конечным пользователям, как указано выше.

В отчете о рынке управления персоналом в Северной Америке рассматриваются следующие страны: США, Канада и Мексика.

Ожидается, что США будут доминировать в регионе Северной Америки, поскольку у США крупнейшая экономика в мире, с высокодиверсифицированной рабочей силой, включающей работников из самых разных отраслей. Это создало значительный спрос на решения по управлению рабочей силой, поскольку компании стремятся управлять своими сотрудниками более эффективно и действенно.

В разделе отчета, посвященном региону, также приводятся отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции, анализ пяти сил Портера и тематические исследования, являются некоторыми указателями, используемыми для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных региона учитываются наличие и доступность брендов Северной Америки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговые пути.

Конкурентная среда и анализ доли рынка управления персоналом в Северной Америке

Конкурентная среда рынка управления рабочей силой в Северной Америке содержит сведения о конкуренте. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Северной Америке, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта и доминирование приложений. Вышеуказанные пункты данных относятся только к компаниям, сосредоточенным на рынке управления рабочей силой в Северной Америке.

Некоторые из основных игроков, работающих на рынке управления персоналом в Северной Америке: UKG Inc., Reflexis Systems, Inc., SAP, Verint Systems Inc., ADP, ATOSS Software AG, NICE, Workday, Inc., Visier, Inc., Ceridian HCM, Inc., Paylocity., Paycom Payroll LLC., Sumtotal Systems, LLC, Infor, Cegid Meta4, Ramco Systems, Replicon, IBM, INFORM Software, InVision AG и Oracle.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA WORKFORCE MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 OFFERING TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S ANALYSIS

4.2 REGULATORY FRAMEWORK

4.3 TECHNOLOGICAL TRENDS

4.4 PATENT ANALYSIS

4.5 CASE STUDY

4.6 VALUE CHAIN ANALYSIS

4.7 COMPANY COMPARATIVE ANALYSIS

4.7.1 UKG INC.:

4.7.2 SAP SE:

4.7.3 WORKDAY, INC.:

4.7.4 ADP, INC.:

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING ADOPTION OF THE INTERNET OF THINGS (IOT) AND CLOUD-BASED WORKFORCE MANAGEMENT SOLUTIONS

5.1.2 INCREASING PENETRATION OF ANALYTICAL SOLUTIONS AND CONNECTED DEVICES APPLICATIONS

5.1.3 NEED FOR REDUCTION OF EXPENSES RELATED TO HUMAN RESOURCE

5.2 RESTRAINTS

5.2.1 LACK OF AWARENESS ABOUT WORKFORCE MANAGEMENT TOOLS

5.2.2 COMPLEXITIES IN THE INTEGRATION OF DIFFERENT WORKFORCE MANAGEMENT TOOLS

5.3 OPPORTUNITIES

5.3.1 DIGITALIZATION OF BUSINESS OPERATIONS

5.3.2 INCREASE IN DEMAND FOR FLEXIBLE MANAGEMENT RESOURCES

5.3.3 UPSURGE IN THE ADOPTION OF ARTIFICIAL INTELLIGENCE IN BUSINESS OPERATIONS

5.4 CHALLENGES

5.4.1 HIGH COST ASSOCIATED WITH THE PURCHASE AND DEPLOYMENT OF WORKFORCE MANAGEMENT SOLUTIONS

5.4.2 RISING NEED FOR REGULAR DATA MONITORING AND DATA INPUT SYSTEMS IN THE WORKFORCE

6 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 TIME AND ATTENDANCE MANAGEMENT

6.2.2 LEAVE AND ABSENCE MANAGEMENT

6.2.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

6.2.4 WORKFORCE SCHEDULING

6.2.5 WORKFORCE ANALYTICS

6.2.6 BUDGETING AND FORECASTING

6.2.7 TASK MANAGEMENT

6.2.8 FATIGUE MANAGEMENT

6.2.9 OTHERS

6.3 SERVICES

6.3.1 CONSULTING

6.3.2 IMPLEMENTATION

6.3.3 TRAINING, SUPPORT AND MAINTENANCE

7 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE

7.1 OVERVIEW

7.2 LARGE ENTERPRISE

7.3 SMALL & MEDIUM ENTERPRISES

8 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS

8.1 OVERVIEW

8.2 WINDOWS

8.3 ANDROID

8.4 IOS

8.5 LINUX

8.6 OTHERS

9 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISES

10 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY END-USER

10.1 OVERVIEW

10.2 BANKING, FINANCIAL SERVICES AND INSURANCE

10.2.1 SOLUTIONS

10.2.1.1 TIME AND ATTENDANCE MANAGEMENT

10.2.1.2 LEAVE AND ABSENCE MANAGEMENT

10.2.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.2.1.4 WORKFORCE SCHEDULING

10.2.1.5 WORKFORCE ANALYTICS

10.2.1.6 BUDGETING AND FORECASTING

10.2.1.7 TASK MANAGEMENT

10.2.1.8 FATIGUE MANAGEMENT

10.2.1.9 OTHERS

10.2.2 SERVICES

10.2.2.1 CONSULTING

10.2.2.2 IMPLEMENTATION

10.2.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.3 AUTOMOTIVE

10.3.1 SOLUTIONS

10.3.1.1 TIME AND ATTENDANCE MANAGEMENT

10.3.1.2 LEAVE AND ABSENCE MANAGEMENT

10.3.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.3.1.4 WORKFORCE SCHEDULING

10.3.1.5 WORKFORCE ANALYTICS

10.3.1.6 BUDGETING AND FORECASTING

10.3.1.7 TASK MANAGEMENT

10.3.1.8 FATIGUE MANAGEMENT

10.3.1.9 OTHERS

10.3.2 SERVICES

10.3.2.1 CONSULTING

10.3.2.2 IMPLEMENTATION

10.3.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.4 TELECOM AND IT

10.4.1 SOLUTIONS

10.4.1.1 TIME AND ATTENDANCE MANAGEMENT

10.4.1.2 LEAVE AND ABSENCE MANAGEMENT

10.4.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.4.1.4 WORKFORCE SCHEDULING

10.4.1.5 WORKFORCE ANALYTICS

10.4.1.6 BUDGETING AND FORECASTING

10.4.1.7 TASK MANAGEMENT

10.4.1.8 FATIGUE MANAGEMENT

10.4.1.9 OTHERS

10.4.2 SERVICES

10.4.2.1 CONSULTING

10.4.2.2 IMPLEMENTATION

10.4.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.5 MANUFACTURING

10.5.1 SOLUTIONS

10.5.1.1 TIME AND ATTENDANCE MANAGEMENT

10.5.1.2 LEAVE AND ABSENCE MANAGEMENT

10.5.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.5.1.4 WORKFORCE SCHEDULING

10.5.1.5 WORKFORCE ANALYTICS

10.5.1.6 BUDGETING AND FORECASTING

10.5.1.7 TASK MANAGEMENT

10.5.1.8 FATIGUE MANAGEMENT

10.5.1.9 OTHERS

10.5.2 SERVICES

10.5.2.1 CONSULTING

10.5.2.2 IMPLEMENTATION

10.5.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.6 HEALTHCARE

10.6.1 SOLUTIONS

10.6.1.1 TIME AND ATTENDANCE MANAGEMENT

10.6.1.2 LEAVE AND ABSENCE MANAGEMENT

10.6.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.6.1.4 WORKFORCE SCHEDULING

10.6.1.5 WORKFORCE ANALYTICS

10.6.1.6 BUDGETING AND FORECASTING

10.6.1.7 TASK MANAGEMENT

10.6.1.8 FATIGUE MANAGEMENT

10.6.1.9 OTHERS

10.6.2 SERVICES

10.6.2.1 CONSULTING

10.6.2.2 IMPLEMENTATION

10.6.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.7 DEFENSE AND GOVERNMENT

10.7.1 SOLUTIONS

10.7.1.1 TIME AND ATTENDANCE MANAGEMENT

10.7.1.2 LEAVE AND ABSENCE MANAGEMENT

10.7.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.7.1.4 WORKFORCE SCHEDULING

10.7.1.5 WORKFORCE ANALYTICS

10.7.1.6 BUDGETING AND FORECASTING

10.7.1.7 TASK MANAGEMENT

10.7.1.8 FATIGUE MANAGEMENT

10.7.1.9 OTHERS

10.7.2 SERVICES

10.7.2.1 CONSULTING

10.7.2.2 IMPLEMENTATION

10.7.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.8 TRANSPORTATION AND LOGISTICS

10.8.1 SOLUTIONS

10.8.1.1 TIME AND ATTENDANCE MANAGEMENT

10.8.1.2 LEAVE AND ABSENCE MANAGEMENT

10.8.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.8.1.4 WORKFORCE SCHEDULING

10.8.1.5 WORKFORCE ANALYTICS

10.8.1.6 BUDGETING AND FORECASTING

10.8.1.7 TASK MANAGEMENT

10.8.1.8 FATIGUE MANAGEMENT

10.8.1.9 OTHERS

10.8.2 SERVICES

10.8.2.1 CONSULTING

10.8.2.2 IMPLEMENTATION

10.8.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.9 CONSUMER GOODS AND RETAIL

10.9.1 SOLUTIONS

10.9.1.1 TIME AND ATTENDANCE MANAGEMENT

10.9.1.2 LEAVE AND ABSENCE MANAGEMENT

10.9.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.9.1.4 WORKFORCE SCHEDULING

10.9.1.5 WORKFORCE ANALYTICS

10.9.1.6 BUDGETING AND FORECASTING

10.9.1.7 TASK MANAGEMENT

10.9.1.8 FATIGUE MANAGEMENT

10.9.1.9 OTHERS

10.9.2 SERVICES

10.9.2.1 CONSULTING

10.9.2.2 IMPLEMENTATION

10.9.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.1 ENERGY AND UTILITIES SOLUTIONS

10.10.1 SOLUTIONS

10.10.1.1 TIME AND ATTENDANCE MANAGEMENT

10.10.1.2 LEAVE AND ABSENCE MANAGEMENT

10.10.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.10.1.4 WORKFORCE SCHEDULING

10.10.1.5 WORKFORCE ANALYTICS

10.10.1.6 BUDGETING AND FORECASTING

10.10.1.7 TASK MANAGEMENT

10.10.1.8 FATIGUE MANAGEMENT

10.10.1.9 OTHERS

10.10.2 SERVICES

10.10.2.1 CONSULTING

10.10.2.2 IMPLEMENTATION

10.10.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.11 OTHERS

11 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 UKG INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 SOLUTION PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 ADP, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 IBM CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 WORKDAY, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 ORACLE

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SOLUTION PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ATOSS SOFTWARE AG

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SERVICES PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 CEGID META4

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 CERIDIAN HCM, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 SOLUTION PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 INFOR

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 INFORM SOFTWARE

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICE PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 INVISION AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 NICE

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SOLUTION PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 PAYCOM PAYROLL LLC

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 SOLUTION PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 PAYLOCITY

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 SOLUTION PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 QUINYX AB

14.15.1 COMPANY SNAPSHOT

14.15.2 SOLUTION PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 RAMCO SYSTEMS

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 REFLEXIS SYSTEMS, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 SERVICE PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 REPLICON

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICE PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 SAP SE

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 COMPANY SHARE ANALYSIS

14.19.4 PRODUCT PORTFOLIO

14.19.5 RECENT DEVELOPMENTS

14.2 SUMTOTAL SYSTEMS, LLC

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 VERINT SYSTEMS INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENTS

14.22 VISIER, INC.

14.22.1 COMPANY SNAPSHOT

14.22.2 SOLUTION PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Список таблиц

TABLE 1 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA LARGE ENTERPRISE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA SMALL & MEDIUM ENTERPRISES IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA WINDOWS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA ANDROID IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA IOS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA LINUX IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA CLOUD IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA ON-PREMISES IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA ENERGY AND UTILITIES SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA OTHERS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 77 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 79 NORTH AMERICA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 80 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 81 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 82 NORTH AMERICA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 83 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 84 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 85 NORTH AMERICA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 86 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 87 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 88 NORTH AMERICA ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 89 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 90 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 91 U.S. WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 92 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 93 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 94 U.S. WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 95 U.S. WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 96 U.S. WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 97 U.S. WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 98 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 99 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 100 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 101 U.S. AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 102 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 103 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 104 U.S. TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 105 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 106 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 107 U.S. MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 108 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 109 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 110 U.S. HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 111 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 112 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 113 U.S. DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 114 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 115 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 116 U.S. TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 117 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 118 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 119 U.S. CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 120 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 121 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 123 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 125 CANADA WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 126 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 127 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 128 CANADA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 129 CANADA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 130 CANADA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 131 CANADA WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 132 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 133 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 134 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 135 CANADA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 136 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 137 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 138 CANADA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 140 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 141 CANADA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 142 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 143 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 144 CANADA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 145 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 146 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 147 CANADA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 148 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 149 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 150 CANADA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 151 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 152 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 153 CANADA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 154 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 155 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 156 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 157 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 158 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 159 MEXICO WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 160 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 161 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 162 MEXICO WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 163 MEXICO WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 164 MEXICO WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 165 MEXICO WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 166 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 167 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 168 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 169 MEXICO AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 170 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 171 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 172 MEXICO TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 173 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 174 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 175 MEXICO MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 176 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 177 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 178 MEXICO HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 179 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 180 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 181 MEXICO DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 182 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 183 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 184 MEXICO TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 185 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 186 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 187 MEXICO CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 188 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 189 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 190 MEXICO ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 191 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 192 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

Список рисунков

FIGURE 1 NORTH AMERICA WORKFORCE MANAGEMENT MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: MULTIVARIATE MODELLING

FIGURE 11 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: OFFERING TIMELINE CURVE

FIGURE 12 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: SEGMENTATION

FIGURE 13 INCREASING PENETRATION OF ANALYTICAL SOLUTIONS AND CONNECTED DEVICES APPLICATIONSARE EXPECTED TO BE KEY DRIVERS FOR THE NORTH AMERICA WORKFORCE MANAGEMENT MARKET IN THE FORECAST PERIOD 2023 TO 2030

FIGURE 14 THE SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WORKFORCE MANAGEMENT MARKET FROM 2023 TO 2030

FIGURE 15 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF NORTH AMERICA WORKFORCE MANAGEMENT MARKET

FIGURE 17 ENTERPRISES USING IOT, 2021

FIGURE 18 EMPLOYMENT FOR THE AGE 20 TO 64

FIGURE 19 AI ADOPTION RATE AROUND THE WORLD

FIGURE 20 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY OFFERING, 2022

FIGURE 21 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 22 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY OPERATING SYSTEMS, 2022

FIGURE 23 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 24 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY END-USER, 2022

FIGURE 25 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: SNAPSHOT (2022)

FIGURE 26 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY COUNTRY (2022)

FIGURE 27 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY COUNTRY (2023-2030)

FIGURE 28 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY COUNTRY (2022-2030)

FIGURE 29 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY OFFERING (2023-2030)

FIGURE 30 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.